Exness vs IC Markets 2024

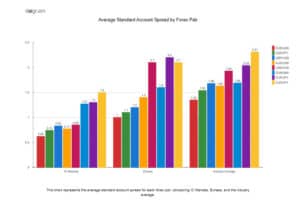

We explored Exness and IC Markets to find each Forex broker’s key trading features such as trading costs, forex platforms and financial regulators, to help you determine the right broker for your needs.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site. For more information, visit our About Us page.

Ask an Expert