IC Markets vs IG: Which One Is Best?

With a large market share in the forex broker space, both IC Markets and IG Group (IG) offer the leading forex trading platforms and customer support. Let’s have a closer look at both brokers.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Pro 2: 250:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 10:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are five key differences between IC Markets and IG Group:

- IG offers more currency pairs, with 91, compared to IC Markets’ 63.

- IC Markets provides both lower spreads and higher leverage than IG.

- IC Markets primarily uses popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), while IG primarily uses their proprietary software.

- IG offers a broader range of trading instruments, including over 8,500 shares from various stock markets.

- IC Markets offers leverage of 500:1 under the Seychelles Financial Services Authority (FSA), while IG’s leverage varies based on the client’s location and regulatory jurisdiction.

1. Lowest Spreads And Fees – IC Markets

When comparing the spreads of the brokers, it is important to understand the reason each account has different spreads. We will look at each account one by one to identify the fundamental differences between each trading account.

| Spreads | EUR/USD | USD/JPY | AUD/USD | GBP/USD |

|---|---|---|---|---|

| IG Markets (Standard) | 0.75 | 0.76 | 0.76 | 1.117 |

| IC Markets (Standard) | 1.1 | 1.2 | 1.2 | 1.4 |

| IG Markets (Forex Direct) | 0.263 | 0.292 | 0.512 | 0.992 |

| IC Markets (Raw Spread) | 0.1 | 0.2 | 0.2 | 0.4 |

The below forex brokerage calculator compared IC Markets to IG Group (IG) for their lowest brokerage accounts (forex direct vs raw spread account). It shows the significant savings between the two accounts. Just note the forex direct account offered by IG only offers the USD base currency.

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

IC Markets Fees

IC Markets Raw spreads account offers the narrowest spreads through ECN pricing. IC Markets uses ECN-style execution to bring you the best spreads.

Electronic Data Communication (ECN) networks allow you to execute your orders directly with liquidity providers. Removing the ‘middleman’ or dealing desk between yourself (the trader) and providers means spreads are a true reflection of the market price.

To keep the spreads ‘raw’, IC Markets (and other ECN brokers) charge a commission for each trade you execute when using an ECN account instead of re-quoting the spread. IC Markets charges a $7.00 (round trip) commission for every 100,000 units (standard lots) you trade.

Narrow spreads encourage the trader to trade higher volumes, which means IC Markets can earn more in commission. A wider spread means costs for traders are higher, which means lower volumes traded. With this in mind, brokers have little motivation for a broker to manipulate spreads. IC Markets are the issuer of their own products, so they are not a 100% true ECN broker, but as they have No Dealing Desk Brokers or requotes, prices can be said to be ECN in the spread.

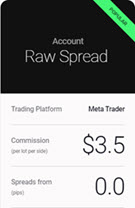

Features Of The RAW Spread Account:

- ECN Pricing

- Choice of trading platforms – MetaTrader 4, MetaTrader 5, cTrader

- Commission USD$3.5 side-trip, USD$7.0 round trip per standard lot

- Expert Advisors (EAs)

- Australian Investment and Securities Commission Regulation (ASIC, Australia), Cyprus Securities and Exchange Commission (CySEC, Europe) and Financial Services Authority (FSA, Seychelles) regulation.

- Leverage 500:1 (FSA) and 30:1 (ASIC, CySEC)

- IC Markets Minimum Deposit is $200 to start trading

- Currencies accepted: AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD, CHF (wire transfer only)

Note: an Islamic account that complies with Sharia law is available for Muslim traders who comply. This account is the same as the account of the RAW spread but has no swap fee (also called overnight rates or holding fees).

IC Markets Standard Account

You will notice the spreads on this account are 1 pip wider than the Raw Spread account. This is because the broker has widened the spread. This 1 pip in the spread replaces the commission you see in the Raw Spread account.

We recommend selecting the IC Markets Raw Spreads account over the Standard account. Commission costs of USD$7 round-turn are less than 1 pip, which is $10. You can learn more on the IC Markets Raw Spread Vs Standard Accounts page.

Features Of Standard Account:

- ECN + STP pricing. ECN spreads + 1 pip (1 pip = USD$10)

- No commission

- Choice of MT4, MT5 platforms

- Leverage of up to 500:1 (offshore, FSA) and 30:1 (ASIC, CySEC)

- Expert Advisors

- Minimum Deposit $200 to start trading

IG Fees

IG offers 2 broad types of accounts. Leveraged trading account for trading CFD instruments and Non-Leverage trading for trading Shares.

If you wish to trade any of the following contracts for difference (CFDs):

- Forex

- Indices

- Cryptocurrencies (Not UK)

- Commodities

- Shares CFDs

- Bonds

- ETFs

- Options

- Interest rates

Then, you will need a leveraged (CFD) account. Within the Leveraged CFD account, you can select from two account types.

IG Limited Risk Account

This account is for clients who are new to forex trading. The account protects your investments by including a guaranteed stop-loss with all your positions. This can help protect your investments until you become comfortable trading derivatives. As all trades include a small premium, they will have wider spreads than with the standard account. You will be able to upgrade to a standard account once you have completed 10 trades, or you can request from your personal account manager for an upgrade.

Standard Account – Market Maker

With this account, IG operates as a market maker. This means when you execute a trade, you are dealing directly with IG. When you open your position, IG will act as the seller. When you sell, IG will act as the buyer. In short, IG takes the other side of all your trades. As there is a dealing desk, spreads are wider than with an ECN pricing account.

Despite taking the opposite side of your trade, IG uses data sourced from liquidity providers to keep prices ‘real’. While the spreads are wider than the IC Markets Raw Spread account, there is no commission charge. This means the IG Standard account is competitive with the IC Markets Raw Spread account.

Minimum spreads are as follows:

- AUD / USD: Min 0.6 Avg 0.75

- USD / JPY: Min 0.7 Avg 0.89

- EUR / USD: Min 0.6 Avg 0.75

- GBP / USD Min 0.9 Avg 1.34

IG Forex Direct Trading

If you want lower spreads, then you can consider the Forex Direct account, which uses Direct Market Access (DMA) execution technology. This is similar to ECN, but the broker has individual contracts with each liquidity provider in the liquidity pool. This is different from ECN, where the brokers have no contracts as you are connected to anonymous ECN networks. DMA pricing is similar to ECN.

This account is not available to all traders. To qualify, you must meet the following conditions:

Traders In The UK And Europe (With IG UK)

- The Financial Conduct Authority (FCA) only allows professional traders to trade DMA.

- To qualify as a professional trader, you must meet one of 2 of 3 conditions:

- Have 500,000 euros in your cash portfolio

- Average 10 trades per quarter over the last 12 months

- Be a finance professional

Traders Outside The UK And Europe

- You will need a CFD account Standard account)

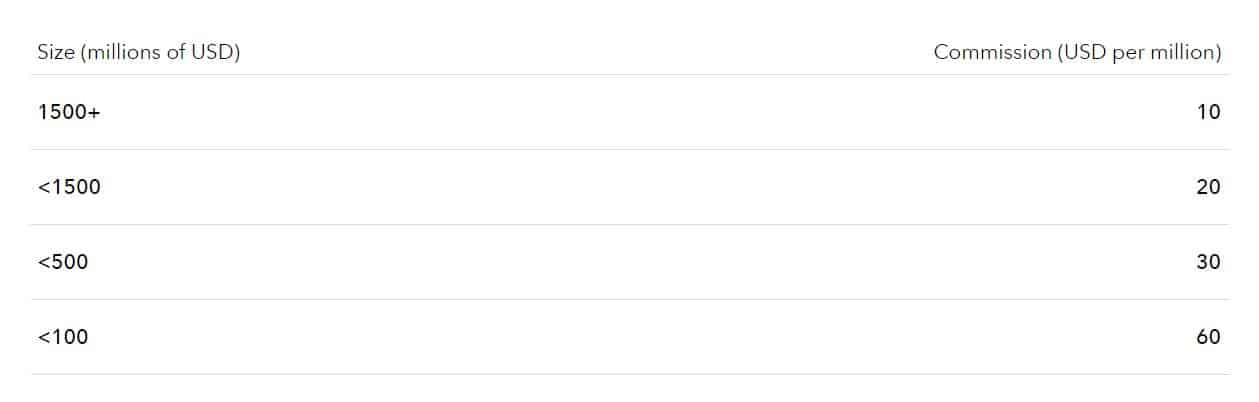

DMA Costs

As spreads are not widened, DMA traders will pay a commission. The commission is as follows:

AVG DMA Spreads

AVG DMA Spreads

- AUD/USD: 0.295

- EUR/USD: 01.65

- GBP/USD: 0.589

- USD/JPY 0.242

Our Lowest Spreads and Fees Verdict

Our analysis found the IC Markets Raw Spread account has the lowest fees. This is because their ECN-style trading environment achieves consistently lower spreads on the most traded currency pairs. While the IG Standard account is competitive, the total fees incurred when trading in our 2025 evaluation were constantly higher.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

2. Better Trading Platform – IC Markets

IG primarily uses their propriety software, while IC Markets uses the most popular platforms used by most brokers. This makes it an interesting comparison for which option is best for traders.

| Trading Platform | IC Markets | IG |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | No |

| cTrader | Yes | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

IC Trading Platform

The following trading platforms are available with IC Markets. MetaTrader 4 (MT4), MetaTrader 5 (MT5) and cTrader. IG also offer MT4 (along with their proprietary platforms).

MT4, MT5 and cTrader are the most popular trading platforms worldwide and are available as desktop and WebTrader platforms, as well as mobile trading apps for iOS and Android devices.

MetaTrader 4

This trading software or platform has long been the most popular trading platform for both traders and brokers. Continual upgrades mean the platform becomes one of the most ‘complete’ trading platforms available, making it popular with FX brokers. MT4 makes trading easy for those new to trading but also offers sophisticated features for traders requiring more in-depth information. While it is true many other products nowadays offer similar features, MT4 continues to be the best as they consistently offer new features.

Key features of note on MT4 include charts and indicators, expert advisors (i.e. trading automation) and the ability to customise your trading screens.

MetaTrader 5

This platform is an upgrade on MetaTrader 4. While it is true that MetaTrader 4 continues to be far more popular than MetaTrader 5, slowly but surely, MetaTrader 5 is catching up. MetaTrader 5 uptake has been slow because when MetaTrader was released in 2010, it was built to be compliant with USA trading regulations.

USA trade regulation doesn’t allow hedging or F.I.F.O style trading. MetaQuest assumed that the rest of the world would follow the USA with these regulatory requirements. This error has since been rectified, and MetaTrader 5 now allows netting (F.I.F.O) and hedging systems, meaning this meets USA and international regulatory requirements. So, although MT4 remains the chosen platform, there is now little reason to choose MT4 over MT5.

MetaTrader 5 is an improvement over MT4 as it allows better trading through central exchanges. This makes the platform a better choice as it is now better built to allow for trading of all types of asset classes, including shares, commodities and indices.

Other benefits include faster processing (which can help reduce slippage) as it is a 64-bit multithreaded platform that can handle up to 4 GB (an upgrade on MT4, which uses 32-but, mono threading with a 2 GB limit, more charts and indicators). Lastly, MT5 is better built for backtesting as it is using MQL5, which should assist with the easier creation of expert advisors.

| MetaTrader 4 | MetaTrader 5 | |

|---|---|---|

| Programming Language (for expert advisors) | MQL4 | MQL5 |

| Number of orders executable | 3 | 4 |

| Number of pending orders available | 4 | 6 |

| Number of indicators | 30 | 38 |

| Number of Analytical tools | 33 | 44 |

| Order Fill Policy | Fill or Kill | Fill or Kill Immediate or Cancel Return |

| General availability | Common | Growing |

| Hedging | Yes | Yes (since 2016) |

| Timeframes | 9 | 21 |

| Threading | 32bit / 2GB | 64 Bit / 4Gb |

| Speed / Stability | Fast / Stable | Faster / More Stable |

| CFD Trading | Decentralised | All (Decentralised and trading exchanges) |

| Depth of Market | No | Yes |

| Strategy Tester | Single Threaded | Multi-threaded + Multi-Currency + Real Ticks |

Additional MetaTrader Features

If you use MetaTrader with IC Markets, you will also get access to their MT4 Advanced Trader tools. This is a series of 20 additional trade execution and management tools that will make your trading experience even better.

cTrader Trading Platform

This platform is another very popular, readily accessible free platform available for traders. Choosing cTrader over MetaTrader is simply a case of personal preference. All platforms offer many of the same key features. However, many prefer the cTrader interface.

Some of the main features of cTrader are Level II pricing, Detachable charts, a dedicated platform for trading automation and 26 timeframes. cTrader, however, is only for forex trading, not CFD or cryptocurrency trading.

IG Trading Platforms

There are different trading tools available with IG. It is important to understand each platform serves a different purpose and, therefore, will serve the needs of different traders.

The first table shows that ‘Web-based’, ‘mobile apps’ and ‘Tablet apps’ are IG proprietary platforms. This platform is an IG award-winning platform and contains all the standard tools traders will want access to. It is worth noting that the Tablet is only built for iPads and that you can only trade directly from charts if using the web platform.

Below are some of the custom platforms that IG offers:

- L2 dealer is only for DMA traders, which means you will need a Forex Direct account. This means you would need to meet IG requirements to qualify as a ‘Professional Trader’.

- ProRealTime is a platform in its own right and its key feature is the high availability of charts and indicators you might not find elsewhere. There is, however, a $40 cost per month, and it is only available for web browsers.

- MetaTrader 4 is the same as MetaTrader 4 that IC Markets offers; however, it is only available as a download. To access this platform, you need to be using the IG web-based platform.

Our Better Trading Platform Verdict

IG gives you an extensive range of platform choices to choose from. We, however, don’t find these platforms interesting enough to choose over the MetaTrader options available with IC Markets.

If you choose MetaTrader with IC Markets, you can access the platform on your phone, tablet or the web. MetaTrader 4 is a great option, as many brokers offer this platform. However, we are recommending MetaTrader 5. While not as many brokers offer this as MetaTrader 4, it is still relatively common and offers all the MT4 features and more.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

3. Superior Accounts And Features – IC Markets

Both IC Markets and IG have distinct accounts tailored to different trading needs. IC Markets is renowned for its Raw Spreads account, which offers the narrowest spreads through ECN pricing. This ECN-style execution ensures that traders get the best spreads, reflecting the true market price.

To maintain these ‘raw’ spreads, IC Markets charges a commission for each trade executed on the ECN account. They also offer a Standard Account, where spreads are wider by 1 pip compared to the Raw Spreads account, replacing the commission seen in the latter.

On the other hand, IG provides two primary types of accounts: the Leveraged trading account for CFD instruments and the Non-Leveraged trading account for trading shares. Their Limited Risk Account is designed for newcomers to forex trading, ensuring investments are protected with a guaranteed stop-loss for all positions.

The Standard Account operates with IG as a market maker, meaning they take the opposite side of all your trades. Despite this, IG ensures that prices remain ‘real’ by sourcing data from liquidity providers. For traders seeking lower spreads, IG offers the Forex Direct account, which employs Direct Market Access (DMA) execution technology akin to ECN.

| IC Markets | IG Group | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | No |

| Active Traders | Yes | No |

| Spread Betting (UK) | No | Yes |

Our Superior Accounts and Features Verdict

While both brokers offer unique features in their accounts, IC Markets stands out with its Raw Spreads account, providing traders with a more transparent and cost-effective trading environment.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – IC Markets

Having dived deep into both IC Markets and IG, we’ve come to appreciate the unique trading experiences each offers. IC Markets, for instance, boasts its MT5 platform, which our testing confirmed as one of the best out there. The intuitive interface, combined with a vast array of tools, makes it a top choice for traders who prioritise efficiency and ease of use.

- IC Markets’ MT5 platform is a standout, offering a seamless trading experience.

- IG, on the other hand, provides a strong proprietary platform tailored to both beginners and seasoned traders.

- Our tests highlighted IC Markets’ Standard Account as one of the best, especially for traders who prefer a straightforward trading environment.

- IG’s platform, while different, offers a comprehensive suite of tools, ensuring traders have everything they need at their fingertips.

Our Best Trading Experience and Ease Verdict

Now, after spending considerable time on both platforms, we must say it’s a close call. Both brokers have their strengths, but if we had to pick one for the sheer ease of use and overall trading experience, we’d lean towards IC Markets. Their MT5 platform and Standard Account offerings are hard to beat.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – Tie

IC Markets Trust Score

IG Group Trust Score

When trading, we always prefer brokers that offer higher leverage limits. Leverage means you don’t need high levels of capital to achieve large returns on your FX trading. While we always recommend being aware of the risks when trading with leverage, leverage can be necessary to achieve significant returns. This is because currency movements, most of the time, are only incremental. It is only in extreme events, such as a political crisis, that current movements can be drastic.

IC Markets offers leverage of 500:1 to clients that fall under the jurisdiction of the Seychelles Financial Services Authority (FSA). For those that fall under the Cyprus Securities and Exchange Commission in Cyprus (CySEC) or Australian Securities and Investments Commission (ASIC), leverage for forex pairs is capped at 30:1.

Likewise, IG’s forex leverage varies depending on the regulation that applies to the territory their client is based on.

- UK, Europe, Australia (ASIC) and New Zealand (FMA) entities offer a maximum leverage of 30:1

- Dubai (DFSA) and US (CTFC, NFA) branches offer 50:1

- Singapore (MAS) caps leverage at 20:1

- Japan (JFSA) limits leverage to 25:1

| IC Markets | IG Group | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) | ASIC (Australia) FCA (UK) BaFin (Germany) FINMA (Switzerland) NFA/CFTC (USA) CYSEC (Cyprus) MAS (Singapore) FMA (New Zealand) |

| Tier 2 Regulation | JFSA (Japan) DFSA (Dubai) |

|

| Tier 3 Regulation | FSA-S (Seychelles) SCB (Bahamas) | BMA (Bermuda) FSCA (South Africa) |

Our Stronger Trust and Regulation Verdict

IC Markets has the highest leverage, although it should be noted that in some regions (e.g. ASIC), the regulator sets the leverage allowed for retail clients. When it comes to professional clients, on the other hand, IC Markets has a higher leverage offering.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

6. Most Popular Broker – IC Markets

IC Markets gets searched on Google more than IG Group. On average, IC Markets sees around 246,000 branded searches each month, while IG Group gets about 97,080 — that’s 60% fewer.

| Country | IC Markets | IG Group |

|---|---|---|

| United Kingdom | 33,100 | 2,900 |

| South Africa | 9,900 | 2,400 |

| India | 8,100 | 4,400 |

| Vietnam | 8,100 | 260 |

| Thailand | 8,100 | 320 |

| Australia | 6,600 | 6,600 |

| United States | 6,600 | 2,900 |

| Spain | 6,600 | 110 |

| Germany | 5,400 | 5,400 |

| Pakistan | 5,400 | 1,000 |

| Brazil | 4,400 | 170 |

| France | 4,400 | 14,800 |

| United Arab Emirates | 4,400 | 260 |

| Morocco | 4,400 | 260 |

| Italy | 3,600 | 8,100 |

| Malaysia | 3,600 | 480 |

| Indonesia | 3,600 | 110 |

| Nigeria | 3,600 | 90 |

| Colombia | 3,600 | 70 |

| Singapore | 3,600 | 1,000 |

| Poland | 2,900 | 90 |

| Sri Lanka | 2,900 | 40 |

| Philippines | 2,400 | 90 |

| Mexico | 2,400 | 90 |

| Kenya | 2,400 | 90 |

| Canada | 2,400 | 320 |

| Algeria | 2,400 | 90 |

| Hong Kong | 2,400 | 5,400 |

| Netherlands | 2,400 | 480 |

| Bangladesh | 1,900 | 50 |

| Saudi Arabia | 1,900 | 1,000 |

| Egypt | 1,600 | 50 |

| Peru | 1,600 | 50 |

| Switzerland | 1,600 | 320 |

| Japan | 1,300 | 140 |

| Argentina | 1,300 | 50 |

| Turkey | 1,300 | 320 |

| Sweden | 1,300 | 3,600 |

| Uzbekistan | 1,000 | 10 |

| Taiwan | 1,000 | 480 |

| Dominican Republic | 1,000 | 30 |

| Portugal | 1,000 | 320 |

| Ecuador | 1,000 | 20 |

| Cyprus | 880 | 70 |

| Ghana | 880 | 20 |

| Ireland | 880 | 90 |

| Greece | 720 | 140 |

| Austria | 720 | 480 |

| Chile | 720 | 50 |

| Venezuela | 720 | 10 |

| Uganda | 720 | 10 |

| Ethiopia | 720 | 10 |

| Mongolia | 720 | 10 |

| Jordan | 590 | 20 |

| Mauritius | 480 | 30 |

| Costa Rica | 390 | 10 |

| Tanzania | 320 | 20 |

| Panama | 260 | 10 |

| Botswana | 260 | 20 |

| Bolivia | 260 | 10 |

| New Zealand | 210 | 170 |

| Cambodia | 170 | 30 |

2024 Monthly Searches For Each Brand

IC Markets - UK

IC Markets - UK

|

33,100

1st

|

IG Group - UK

IG Group - UK

|

2,900

2nd

|

IC Markets - Australia

IC Markets - Australia

|

6,600

3rd

|

IG Group - Australia

IG Group - Australia

|

6,600

4th

|

IC Markets - US

IC Markets - US

|

6,600

5th

|

IG Group - US

IG Group - US

|

2,900

6th

|

IC Markets - Thailand

IC Markets - Thailand

|

8,100

7th

|

IG Group - Thailand

IG Group - Thailand

|

320

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with IC Markets receiving 2,425,000 visits vs. 9,438,000 for IG Group.

Our Most Popular Broker Verdict

IC Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – IG Group

While both brokers are international, the fact that IG comes from the UK, while IC Markets started in Australia, has made for different products being available.

IC Markets CFDs

This broker offers a solid collection of different asset classes for trade. While IG offers a far more extensive range of trading options, IC Markets offers most of the standard CFDs most people will look to trade with.

These CFDs include 17 different indices, 19 different commodities plus spot and futures CFDs, 120+ stocks from the ASX, Nasdaq and NYSE (provided you are using MT5). 6 different Bonds, 4 Global futures and 10 of the most popular cryptocurrencies, including Bitcoin, Ripple, Dash, Ethereum and Bitcoin Cash.

IC Markets do not charge a commission when trading bonds and indices.

IG CFDs

If you’re looking for a broker that offers an all-in-one CFDs trading portfolio, then IG might be the right broker for you. IG’s range of derivatives covers just about any assets you might want to consider for trading. Trading options include over 8,500 shares from the Australian and international stock markets, over 31 global indices, 26 different commodities and all the major cryptocurrencies.

Please note: The Financial Conduct Authority (FCA) in the UK recently changed regulations banning retail traders from accessing or trading cryptocurrency markets. To trade crypto with IG, you will need to sign up with an IG branch outside the UK.

IG also offers other assets not commonly on offer with other brokers; these include options, interest rates, bonds, exchange-traded products (ETP), exchange-traded funds (ETF) and initial public offerings (IPOs).

If purchasing shares, then IG allows you to purchase shares with lower commissions for the first weeks of trading while you build your confidence. After this period, it is 0.08% commission per side with a minimum charge of $7. To purchase shares, you will need a non-leveraged trading account.

If you are an IG client in the UK, you can also do spread betting. This is very similar to CFD trading, where you don’t own the underlying product but instead bet on the direction the instrument will move. It is popular with traders in the UK as there can be tax savings on your profits.

Our Top Product Range and CFD Markets Verdict

IG offers a superior range of derivatives to trade and some investment products. IC Markets offers all of the most traded products, but based on the sheer range of trading instruments, IG is the winner in this category.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

8. Superior Educational Resources – IG Group

When it comes to educational resources, both IC Markets and IG have invested significantly to ensure traders, both new and experienced, have access to top-notch learning materials. IC Markets offers a comprehensive educational section on its website, which includes webinars, video tutorials, and trading guides. These resources are designed to help traders understand the nuances of the forex market and develop effective trading strategies.

- IC Markets’ webinars are insightful, covering a range of topics from basic to advanced.

- Their video tutorials are well-structured, making complex topics easy to grasp.

- IG, on the other hand, boasts an expansive education portal with detailed articles and interactive quizzes.

- Their webinars are hosted by industry experts, offering deep insights into market trends.

- IG’s video library is vast, covering everything from platform tutorials to advanced trading techniques.

- Additionally, IG offers face-to-face seminars in select cities, providing traders with an opportunity to interact with experts and fellow traders.

Our Superior Educational Resources Verdict

While both brokers offer commendable educational resources, based on our testing and the depth of materials available, IG takes the lead in providing a more comprehensive and interactive learning experience for traders.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

9. Superior Customer Service – IG Group

We looked into what support methods are available for traders, how easy they were to use (e.g. wait times) and the level of knowledge of the individuals in testing. Customer survey reports from third parties were also considered.

IG Customer Service Levels

You can reach out to IG for support via Email, Live chat, phone and Twitter. Customer support is available 7 days a week. However, the hours are more limited on Saturdays.

The broker has a decent collection of tools that can assist you when trading for any issues or information you may need. These include glossaries, forums, user guides and FAQs. The most notable feature is their ‘IG Academy’. This education series is made of 9 different trading courses covering forex and CFD trading. Here, you will find booklets, webinars and mobile apps as different means to relay trade information.

| Feature | IC Markets | IG Group |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/7 |

| Multilingual Support | Yes | Yes |

IC Markets Customer Service Levels

You can contact the IC Markets support team 24/7 through live chat, email, or call back. They also provide FAQs in their help centre, where you can find possible answers to your questions.

IC Markets offers an extensive range of educational resources that will provide you with all the trading information you may need. This includes information on the advantages of Forex and CFD trading, video tutorials on how to use MetaTrader 4 and Web TV, which is recorded daily from the New York Stock Exchange discussing trade ideas in short video format.

They also have a devoted webpage that provides an educational overview. When you choose this page, you are taken to a page they call an ‘Information Hub for the Serious Trader’. This site includes information on different types of analysis and trading data and a range of other topics, such as risk management. You can also find links to all the past webinars they have hosted about different trading topics here.

Our Superior Customer Service Verdict

While both brokers provide good customer support and service, we like the IG range of education tools as they are more comprehensive.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

10. Better Funding Options – IC Markets

IC Markets have no fees when it comes to making a deposit or making a withdrawal with any of their funding methods. This is across the standard and RAW of IC Markets Account Types. The range of methods you can use for funding is quite broad. Funding methods include Credit cards and Debit Cards (Visa and MasterCard), Skrill, NETELLER, PayPal, BPAY, POLi, UnionPay and FasaPay.

IG, on the other hand, has individual charges for various funding methods. You will find they have a 1% fee when using Visa and 0.5% when using MasterCard. PayPal also has a 1% fee. All these methods have a minimum of $500 when making a deposit. BPAY and Bank Transfer are free and have no minimum deposit.

| Funding Option | IC Markets | IG Group |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | Yes |

| Skrill | Yes | No |

| Neteller | Yes | No |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Our Better Funding Options Verdict

IC Markets offers more funding options than IG and has no fees.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

11. Lower Minimum Deposit – IG Group

IG Group has a lower minimum deposit of $0 vs IC Markets’ $200. However, the $0 minimum by IG only applies to bank transfers and you may need to pay as much as €300 (for EUR traders).

Below, you can find IG’s various minimum deposits.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £250 Minimum Deposit | $50 Minimum Deposit | €300 Minimum Deposit | $100 |

| Paypal | £250 Minimum Deposit | $50 Minimum Deposit | €300 Minimum Deposit | $100 |

| Bank Wire | £0 Minimum Deposit | $250 Minimum Deposit | €0 Minimum Deposit | $0 |

| Skrill | N/A | N/A | N/A | N/A |

On the other hand, IC Markets’ minimum applies globally, as seen in the table below.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Paypal | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Bank Wire | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Skrill | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

To conclude, here are the brokers’ required and recommended amounts:

| Minimum Deposit | Recommended Deposit | |

| IC Markets | $200 | $200 |

| IG | $0 | $100 |

Our Lower Minimum Deposit Verdict

IG wins with its $0 minimum deposit requirement. However, one drawback could be its higher minimum of €300 (against IC Markets’ fixed 200 equivalent), especially for traders who mainly use PayPal and cards.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

Is IC Markets or IG The Best Broker?

IC Markets is the winner because it offers a more comprehensive range of services, superior educational resources, and a more user-friendly trading experience. The table below summarises the key information leading to this verdict:

| Criteria | IC Markets | IG Group |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platforms | Yes | No |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience | Yes | No |

| Stronger Trust And Regulation | Yes | Yes |

| CFD Product Range And Financial Markets | No | Yes |

| Superior Educational Resources | No | Yes |

| Better Customer Service | No | Yes |

| More Funding Options | Yes | No |

| Lower Minimum Deposit | Yes | No |

IG Group: Best For Beginner Traders

For those just starting out in the trading world, IG Group offers a more structured and comprehensive educational platform, making it the ideal choice for beginner traders.

IC Markets: Best For Experienced Traders

For seasoned traders looking for advanced tools and a wider range of services, IC Markets stands out with its diverse offerings and competitive spreads.

FAQs Comparing IC Markets Vs IG Group

Does IG Group or IC Markets Have Lower Costs?

When it comes to costs, IC Markets generally offers lower spreads and fees. Their average spread for major pairs like EUR/USD is often below 1 pip. On the other hand, IG also offers competitive spreads, especially on their Forex Direct account. For a detailed breakdown, you can check out this comprehensive Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both IC Markets and IG support MetaTrader 4, but IC Markets is often preferred by traders for its seamless MT4 integration. They offer advanced tools and plugins specifically designed for MT4 users. If you’re keen on exploring more about the best MT4 brokers, this list of top MT4 brokers might be of interest.

Which Broker Offers Social Trading?

In terms of social trading, IG has a more established platform. They offer a feature-rich social trading experience, allowing traders to follow and copy the strategies of professionals. IC Markets, while not as prominent in the social trading scene, does provide options for traders interested in copy trading. For a deeper dive into the world of social trading, here’s a comprehensive review of the best social trading platforms.

Does Either Broker Offer Spread Betting?

Yes, IG offers spread betting services. Spread betting is a popular trading method in the UK, allowing traders to speculate on price movements without owning the underlying asset. IG’s platform provides a user-friendly experience for spread betting enthusiasts. For those looking to explore more about this trading method, here’s a detailed guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, IC Markets stands out for Australian forex traders. Not only is IC Markets ASIC regulated, but it’s also an Australian-founded broker, giving it a home advantage in understanding the local market dynamics. IG, while also ASIC regulated, is originally from overseas. Both brokers offer competitive services, but there’s a certain comfort in trading with a broker that originates from your home country. If you’re keen to explore more about the Australian forex market, this comprehensive list of the Best Forex Brokers In Australia might be of interest.

What Broker is Superior For UK Forex Traders?

For UK traders, I’d personally lean towards IG. IG is FCA regulated and has a strong presence in the UK market. While IC Markets offers competitive services, it’s originally from Australia. IG’s deep understanding of the UK market dynamics, combined with its FCA regulation, makes it a top choice for many UK traders. For a deeper dive into the UK forex market, here’s a detailed review of the Best Forex Brokers In UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

How much do I need to start trading with IC Markets?

You don’t need fund to open an account through IC Markets do recommend starting with $200. To make a trade, you will need enough funds to cover margin requirements.