FP Markets vs CMC Markets 2025

Our CMC Markets vs FP Markets forex broker comparison found one broker is a market maker with a large range of markets to trade, including 330 forex pairs, while the other is a no-dealing desk broker with tight spreads. Let’s have a closer look.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

spread betting and/or trading CFDs with this provider

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 16:1

Minor Pairs 10:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

How Do CMC Markets Vs FP Markets Compare?

Our full comparison covers the 10 most important trading factors. Here are five noticeable differences between FP Markets and CMC Markets:

- FP Markets operates using a no-dealing desk model with low spreads and STP execution, while CMC Markets operates using a market maker model.

- FP Markets offers an average spread generally lower than the industry average, especially for pairs like EUR/USD and AUD/USD.

- CMC Markets provides a vast 338 forex pairs, claiming to have more forex pairs than most competitors.

- FP Markets is regulated by ASIC (Australia) and CySEC (Cyprus), while CMC Markets is regulated by multiple top-tier regulators, including ASIC, FCA (UK), and MAS (Singapore).

- CMC Markets’ platform offering is limited to MT4 and a proprietary platform, whereas FP Markets offers multiple platforms, including MT4, MT5, and a proprietary trading app.

1. Lowest Spreads And Fees: CMC Markets

In our comparison between FP (aka First Prudential) Markets and CMC (aka Currency Management Corporation) Markets, we discuss the pros and cons you face trading with each broker to help you pick your next forex broker.

| Standard Account | FP Markets Spreads | CMC Markets Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.53 | 1.53 | 1.7 |

| EUR/USD | 1.2 | 1.3 | 1.2 |

| USD/JPY | 1.4 | 1.3 | 1.5 |

| GBP/USD | 1.50 | 1.50 | 1.6 |

| AUD/USD | 1.4 | 1.5 | 1.6 |

| USD/CAD | 1.50 | 1.50 | 1.9 |

| EUR/GBP | 1.4 | 1.5 | 1.5 |

| EUR/JPY | 1.9 | 1.7 | 2.1 |

| AUD/JPY | 1.90 | 1.90 | 2.3 |

Standard Account Analysis Updated November 2025[1]November 2025 Published And Tested Data

FP Markets is an Australian Forex broker established in 2005, that operates using a no dealing desk model meaning low spreads with STP execution. CMC Markets is one of the oldest brokers, having been founded in London in 1989. This broker operated using a market maker model.

When it comes to trading fees, one of the primary considerations for most traders is the spread. The spread is the difference between the bid and ask price of a trading instrument. Both FP Markets and CMC Markets have competitive spreads, but there are some differences to note:

- FP Markets: This broker operates using a no-dealing desk model, which typically means low spreads with Straight Through Processing (STP) execution. For popular pairs like EUR/USD or EUR/GBP, the typical spreads are 1.2 pips and 1.5 pips, respectively. They also offer a Raw Account where spreads start from 0.0 pips, with most brokers averaging 0.10 to 0.20 pips for the EUR/USD.

- CMC Markets: CMC Markets operates using a market maker model. They boast a vast offering of 338 different forex pairs. The minimum spread you can get with CMC Markets is 1.3 pips and a typical spread cost for the EUR/USD comes in at around 1.2 pips.

| | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| FP Markets | $3.00 | N/A | £2.25 | €2.75 |

| CMC Markets | $2.50 | $2.50 | £2.50 | €2.50 |

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.18 | 1.45 | 1.40 | 1.49 | 1.60 |

| 0.50 | 0.60 | 0.70 | 0.90 | 0.70 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.40 | 1.60 | 1.80 | 1.80 | 1.60 |

| 0.70 | 0.80 | 1.30 | 1.00 | 1.00 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.40 | 1.90 | 1.30 | 1.60 | 1.50 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 11/01/2025

Our Lowest Spreads and Fees Verdict

While both brokers offer competitive spreads, CMC Markets has a slight edge with a lower minimum spread.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

2. Better Trading Platform: FP Markets

CMC Markets has a slightly limited platform offering, with only MetaTrader 4 (MT4) plus a proprietary platform available. MT4 is one of the most popular Trading Platforms worldwide, packed full of everything you would need to trade better. MT4 is also renowned for the availability of Expert Advisors (EAs), which you can code (or simply download from someone else), to automatically trade for you.

| Trading Platform | FP Markets | CMC Markets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | No |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

The CMC Markets proprietary platform is the ‘Next Generation Platform’. The platform comes with a wide variety of features to make it simpler to use and more convenient. You can fully customise the platform to your own liking, making you more comfortable when trading.

FP Markets has a lot of platforms for you to choose between. Alongside MT4, they also offer MetaTrader 5 (MT5), a newer upgrade on MT4. On mobile (android/iOS), you can also use FP Markets’ trading app, allowing you constant access to the markets wherever you are.

On FP Markets, you also have the IRESS platform available but only to Australian traders. IRESS uses direct-market-access trading execution to give you the best prices, and you can go long or short on their global range of trading products. You have access to over 59 different technical indicators and over 50 drawing tools, allowing you to carefully conduct analysis into the instruments you trade. This platform is best for trading shares and Indices as the range of Forex and commodity products is limited.

Our Better Trading Platform Verdict

3. Superior Accounts And Features: Tie

Using a standard account means zero commissions, however, this means the bid-ask spread is artificially widened. Spreads are wider to cover brokerage fees.

We’ve compiled the average spreads for different brokers’ standard accounts into the following table for you to compare.

| FP Markets | CMC Markets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | No |

| Swap Free Account | Yes | No |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | No | Yes |

As you can see, we found that CMC Markets has a slight edge on standard spreads. While the minimum spread you can get is 0.7 pips, a typical spread cost would come in at around 1.2 pips for the EUR/USD.

Meanwhile, FP Markets have higher spreads all-round. The minimum spread with FP Markets is 1 pip, and typical spreads for popular pairs like the EUR/USD or EUR/GBP are at 1.3 pips and 2.2 pips.

In truth, if you want lower spreads for this kind of account, it may be better to consider another broker such as Pepperstone, IC Markets, which have spreads from 0.6 pips.

CMC Markets doesn’t have a minimum deposit to open an account. FP Markets does have a minimum deposit; however, this is only a recommendation. At the end of the day, you will need to make a deposit to commence trading, and this amount needs to meet the margin requirements to open a position.

If you have a need for swap-free trading to comply with Sharia law, then FP Markets is your only option.

Standard Account Spreads

Looking at the data, it’s clear that there are some differences in the standard account spreads between FP Markets, CMC Markets, and the industry average.

FP Markets has an average spread that is generally lower than the industry average, particularly for pairs like EUR/USD and AUD/USD. This suggests that FP Markets could be a more cost-effective choice for traders who frequently trade these pairs.

On the other hand, CMC Markets has a slightly higher average spread for most pairs compared to FP Markets. However, it’s worth noting that their spread for EUR/GBP is significantly lower than both FP Markets and the industry average. This could make CMC Markets a more attractive option for traders who focus on this particular pair.

Overall, I would argue that FP Markets offers a cheaper option for most forex pairs. However, the best choice will ultimately depend on which pairs you trade most frequently. It’s always important to consider the specifics of your own trading habits when choosing a broker.

What Are The STP-style Account Details And Spreads?

While standard accounts are commission-free with higher spreads, an STP-style or ‘raw’ account is the opposite. With this type of account, you get market-priced spreads, however, there will be a commission fee when you open and when you close your trading position.

CMC Markets doesn’t offer a raw account type when forex trading, so this section will focus only on FP Markets, the FP Markets RAW Account.

Spreads with the FP Markets’ Raw Account (like most good STP brokers) start from 0.0 pips. As you can see from the table above, most brokers average 0.10 to 0.20 pips for the EUR/USD.

Commission fees come in at $6.00 USD per standard lot with FP Markets, lower than the typical commission offered by other brokers. This represents the amount of commission you have to pay round-turn for a standard lot of 100k units.

Note: FP Markets also has an IRESS trading account for those using the IRESS Trading Platform. This platform is only available for Australian traders, and while you can trade forex, it is best for traders wanting to trade stocks since it has DMA trading.

Our Superior Accounts and Features Verdict

For the standard account, the broker with the lower brokerage fees is CMC Markets. They have slightly lower average spreads and a lower minimum spread at 0.7 pips wide; however, you may wish to consider some other brokers. When it comes to a true no dealing desk style account, FP Markets is an excellent choice, even when compared to other competing brokers.

4. Best Trading Experience And Ease: FP Markets

Having dived deep into both FP Markets and CMC Markets, I’ve noticed some distinct features that contribute to the overall trading experience. At FP Markets, the availability of multiple platforms, including MT4, MT5, and their proprietary trading app, ensures that traders have a variety of tools at their disposal. Their interface is user-friendly, and the seamless integration of platforms provides a smooth trading journey.

On the other hand, CMC Markets primarily offers MT4 and their ‘Next Generation Platform’. This proprietary platform is packed with features, making it both intuitive and efficient. It’s fully customisable, ensuring traders can set it up to their liking. From our own testing, here are some key points to consider:

- FP Markets: Recognised as the ‘Best CFD’ provider, indicating a strong emphasis on Contract for Difference trading.

- CMC Markets: Their vast offering of 338 forex pairs is unmatched, catering to diverse trading interests.

- Platform Diversity: FP Markets offers a broader range of platforms, catering to different trader preferences.

- User Experience: CMC’s ‘Next Generation Platform’ is tailored for a streamlined and efficient trading process.

| | Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank |

|---|---|---|---|---|

| FP Markets | 225ms | 31/36 | 96ms | 8/36 |

| CMC Markets | 138ms | 18/36 | 180ms | 26/36 |

Our Best Trading Experience and Ease Verdict

While both brokers offer commendable trading experiences, FP Markets edges out slightly due to its diverse platform offerings and recognition as the ‘Best CFD’ provider.

5. Stronger Trust And Regulation: Tie

CMC Markets Trust Score

FP Markets Trust Score

Broker’s Regulation

A broker is safely regulated if they have regulatory oversight in the region you are trading from.

FP Markets are regulated by two top-tier regulators. These are:

- The Australian Securities and Investments Commission (ASIC) in Australia

- The Cyprus Securities and Exchange Commission (CySEC), across the European Union

FP Markets also has a subsidiary operating out of St Vincent and the Grenadines. Clients outside Australia and the European Union have the option of signing up with this entity. While this entity is not regulated, it operates to the same standard as their ASIC and CySEC-regulated entities. Clients with this entity will be able to access leverage of 500:1, which is greater than the maximum 30:1 the Australian and Cyprus entities can offer.

CMC Markets are regulated by many more regulators compared to FP Markets. They have six top-tier regulators, who are:

- ASIC, in Australia

- The Financial Conduct Authority (FCA) in the United Kingdom

- The Federal Financial Supervisory Authority (BaFIN), in Germany

- The Investment Industry Regulatory Organization of Canada (IIROC) in Canada

- Financial Markets Authority (FMA) in New Zealand

- The Monetary Authority of Singapore (MAS) in Singapore

| FP Markets | CMC Markets | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) | ASIC (Australia) FCA (UK) BaFin (Germany) FMA (New Zealand) CIRO (CANADA) MAS (Singapore) |

| Tier 2 Regulation | DFSA (Dubai) | |

| Tier 3 Regulation | FSA-S (Seychelles) FSC-M (Mauritius) FSCA (South Africa) |

Reviews

As shown below, FP Markets holds a significantly higher Trustpilot score of 4.9/5 than CMC Markets’ 4.0/5, reflecting stronger overall customer satisfaction. The difference in scores suggests that FP Markets has built more consistent trust and loyalty among its users.

Our Stronger Trust and Regulation Verdict

To stay safe, we recommend trading with a broker regulated in the country you are trading from. As a result, if you are trading from Canada, New Zealand, or Singapore, you may be safer with CMC Markets.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

6. Most Popular Broker – CMC Markets

CMC Markets gets searched on Google more than FP Markets. On average, CMC Markets sees around 90,500 branded searches each month, while FP Markets gets about 49,500 — that’s 45% fewer.

| Country | FP Markets | CMC Markets |

|---|---|---|

| Australia | 1,900 | 49,500 |

| United Kingdom | 2,400 | 9,900 |

| United States | 1,600 | 4,400 |

| Canada | 1,600 | 4,400 |

| Germany | 1,300 | 3,600 |

| Spain | 1,600 | 3,600 |

| Singapore | 590 | 2,400 |

| New Zealand | 40 | 1,900 |

| Poland | 720 | 1,600 |

| India | 2,900 | 1,300 |

| Italy | 12,100 | 880 |

| France | 880 | 720 |

| South Africa | 2,400 | 720 |

| Nigeria | 590 | 720 |

| Sweden | 210 | 590 |

| Malaysia | 720 | 480 |

| Indonesia | 590 | 480 |

| United Arab Emirates | 480 | 390 |

| Austria | 170 | 390 |

| Hong Kong | 170 | 390 |

| Ireland | 90 | 390 |

| Netherlands | 480 | 320 |

| Pakistan | 1,300 | 320 |

| Turkey | 720 | 260 |

| Philippines | 390 | 260 |

| Thailand | 720 | 210 |

| Japan | 140 | 210 |

| Vietnam | 320 | 210 |

| Switzerland | 480 | 210 |

| Cyprus | 480 | 170 |

| Kenya | 590 | 170 |

| Brazil | 590 | 140 |

| Portugal | 210 | 140 |

| Greece | 1,900 | 140 |

| Taiwan | 210 | 140 |

| Morocco | 590 | 110 |

| Bangladesh | 720 | 110 |

| Saudi Arabia | 210 | 90 |

| Mexico | 170 | 90 |

| Egypt | 210 | 90 |

| Algeria | 210 | 90 |

| Ghana | 70 | 70 |

| Sri Lanka | 140 | 70 |

| Colombia | 260 | 50 |

| Argentina | 140 | 50 |

| Panama | 20 | 50 |

| Cambodia | 210 | 50 |

| Uganda | 70 | 50 |

| Peru | 70 | 40 |

| Ethiopia | 110 | 40 |

| Chile | 70 | 30 |

| Costa Rica | 20 | 30 |

| Uzbekistan | 70 | 30 |

| Venezuela | 110 | 30 |

| Jordan | 70 | 30 |

| Tanzania | 110 | 30 |

| Botswana | 50 | 30 |

| Mauritius | 20 | 20 |

| Ecuador | 70 | 20 |

| Dominican Republic | 70 | 20 |

| Bolivia | 30 | 10 |

| Mongolia | 10 | 10 |

1,900 1st | |

49,500 2nd | |

2,400 3rd | |

9,900 4th | |

1,600 5th | |

4,400 6th | |

590 7th | |

2,400 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with CMC Markets receiving 1,747,000 visits vs. 482,000 for FP Markets.

Our Most Popular Broker Verdict

CMC Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets: CMC Markets

Forex pairs are the most commonly traded CFD instrument, but there is also a wide range of other CFD products available. These include indices, crypto, shares and ETFs, as well as commodities.

| CFDs | FP Markets | CMC Markets |

|---|---|---|

| Forex Pairs | 63 | 338 |

| Indices | 19 | 82 |

| Commodities | 4 Metals (vs USD, AUD, EUR) 4 Energies 5 Softs | 124 |

| Cryptocurrencies | 12 | 19 |

| Shares CFDs | 10000+ (with IRESS) 814 (with MT5) | 10000+ |

| ETFs | 46 | 11265 |

| Bonds | 2 | 55 |

| Futures | No | Yes |

| Treasuries | 2 | 55 |

| Investment | No | Yes |

FP Markets makes 63 different forex pairs available to you. You can trade forex on 30:1 leverage as a retail trader in Australia, but if you are a pro trader or outside of Australia, you can get up to 500:1 leverage. There is also an impressive range of stocks available with FP Markets on the IRESS platform; you can trade over 10 thousand stocks.

CMC Markets advertises that they have more forex pairs than everyone else, and with 338 different forex pairs, they might just be right. As a top stockbroker, CMC Markets provides you with 9000 stocks to trade on markets ranging from the NYSE to the ASX and the LSE.

Our Top Product Range and CFD Markets Verdict

Both FP Markets and CMC Markets have an impressive range of currency pairs and stockbroking capabilities. However, we ultimately give the win to CMC Markets. Their 338 forex pairs available are incredible and simply unmatched, and you can be sure that any forex pair you’re looking to trade will be available.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

8. Superior Educational Resources: FP Markets

FP Markets:

- Webinars: Regularly hosts webinars covering various trading topics.

- E-books: Offers a range of e-books for traders of all levels.

- Tutorials: Provides video tutorials on platform usage and trading strategies.

- Market Analysis: Delivers daily market analysis to keep traders informed.

- Trading Tools: Equips traders with advanced tools for analysis and decision-making.

- Score: Based on our testing, FP Markets scored 8.5 for their educational resources.

CMC Markets:

- Webinars: Conducts webinars but less frequently compared to FP Markets.

- E-books: Limited range of e-books available for traders.

- Tutorials: Video tutorials mainly focus on platform navigation.

- Market Analysis: Offers weekly market analysis, less frequent than FP Markets.

- Trading Tools: Provides standard tools but lacks advanced features.

- Score: Based on our testing, CMC Markets scored 7.2 for their educational resources.

Our Superior Educational Resources Verdict

Based on our comprehensive testing, FP Markets offers superior educational resources compared to CMC Markets.

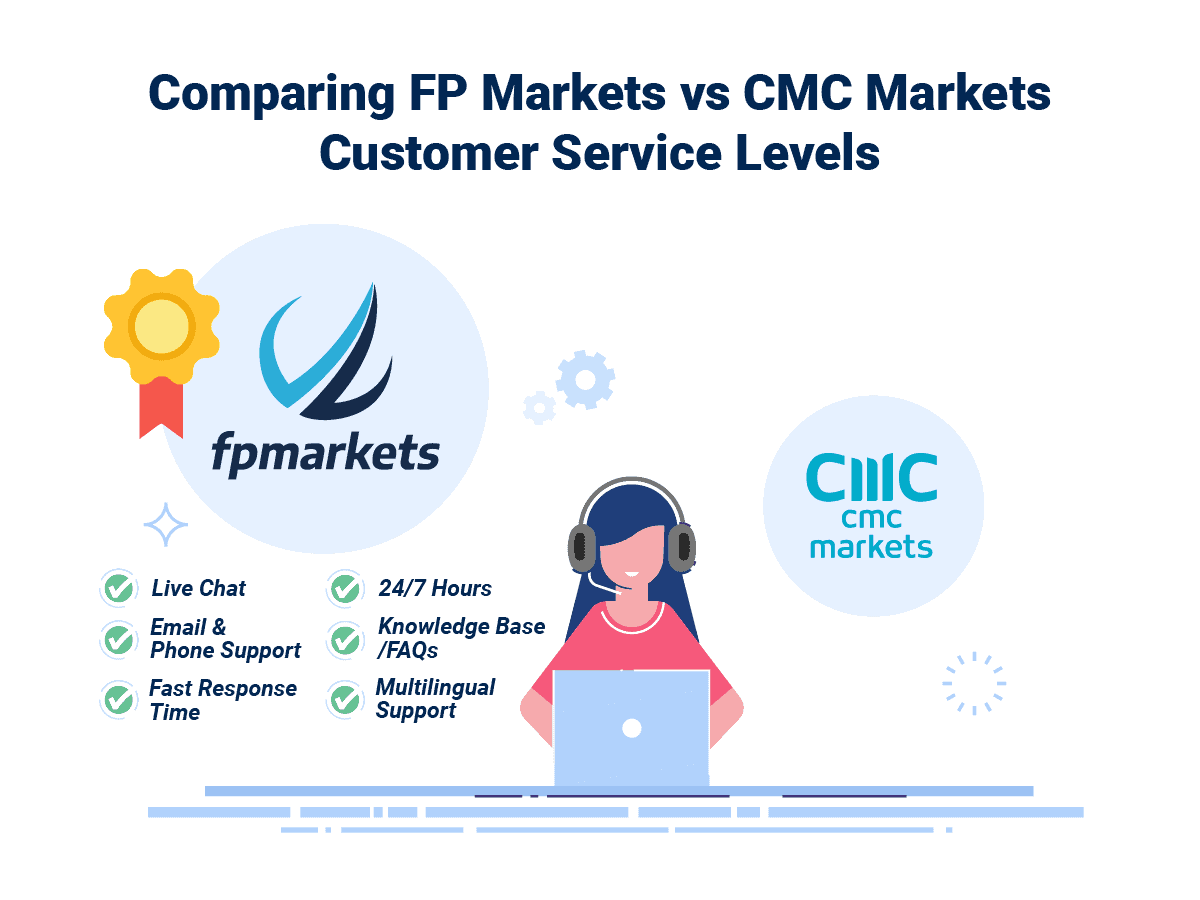

9. Superior Customer Service: FP Markets

In the world of online trading, customer service can make or break a trader’s experience. It’s not just about resolving issues but also about providing timely and accurate information. Both FP Markets and CMC Markets understand the importance of this and have invested in their customer support teams.

FP Markets prides itself on offering a multi-lingual support team available 24/5. They offer various channels of communication, including live chat, email, and phone support. Their response time is commendable, and the support team is well-trained to handle a wide range of queries.

CMC Markets, on the other hand, also offers 24/5 support with multiple contact options. Their team is knowledgeable and strives to provide solutions in a timely manner. However, based on our testing, there were slight delays in response times compared to FP Markets.

| Feature | FP Markets | CMC Markets |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

Our Superior Customer Service Verdict

Based on our comprehensive testing and the scores provided, FP Markets offers superior customer service compared to CMC Markets.

10. Better Funding Options: Tie

In the ever-evolving world of online trading, funding options play a pivotal role in ensuring seamless transactions for traders. Both FP Markets and CMC Markets have made significant strides in offering diverse and efficient funding methods to cater to their global clientele. While FP Markets boasts a wide array of funding options, CMC Markets is not far behind, ensuring that traders have multiple avenues to fund their accounts.

Our extensive testing and data analysis has revealed the various funding options available for both brokers. It’s evident that while some funding methods are universally accepted by both, there are distinct differences that traders should be aware of. The table below provides a comprehensive comparison of the funding options available for FP Markets and CMC Markets:

| Funding Option | FP Markets | CMC Markets |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | No |

| Skrill | Yes | No |

| Neteller | Yes | No |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

It’s crucial for traders to choose a broker that aligns with their preferred funding method, ensuring that they can capitalize on market opportunities without any hindrances. Both FP Markets and CMC Markets have showcased their commitment to providing traders with a plethora of funding options, but it’s always advisable to review the specifics before making a final decision.

Our Better Funding Options Verdict

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

11. Lower Minimum Deposit: CMC Markets

To be able to trade, you need to fund your trading account.

With FP Markets, you need a $100 AUD minimum deposit or $50 USD/EUR/GBP.

Funding methods range from a simple bank transfer to Visa/Mastercard credit cards or debit cards to e-wallets like Neteller, Skrill and PayPal. In Australia, you can also deposit via BPay or POLi.

CMC Markets has no minimum deposit, but remember that you need to meet the margin requirements if you intend on utilising leverage. You can deposit funds using many of the same methods as on FP Markets.

| | Minimum Deposit | Recommended Deposit |

| FP Markets | $100 | $100 |

| CMC Markets | $0 | $100 |

Our Lower Minimum Deposit Verdict

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

Is CMC Markets or FP Markets The Best Broker?

FP Markets is the winner because it excels in multiple categories, offering a comprehensive trading experience for its users. The table below summarises the key information leading to this verdict:

| Criteria | FP Markets | CMC Markets |

|---|---|---|

| Lowest Spreads And Fees | No | Yes |

| Better Trading Platform | Yes | No |

| Superior Accounts And Features | Yes | Yes |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | Yes | Yes |

| Top Product Range And CFD Markets | No | Yes |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | Yes | No |

| Better Funding Options | Yes | Yes |

| Lower Minimum Deposit | No | Yes |

CMC Markets: Best For Beginner Traders

For those just starting out in the trading world, CMC Markets offers a more user-friendly platform and resources tailored for beginners.

FP Markets: Best For Experienced Traders

For seasoned traders looking for advanced tools and features, FP Markets stands out as the preferred choice.

FAQs Comparing FP Markets Vs CMC Markets

Does CMC Markets or FP Markets Have Lower Costs?

CMC Markets generally offers lower costs when compared to FP Markets. For instance, CMC Markets boasts a minimum spread of 0.7 pips for the EUR/USD, which is slightly better than FP Markets. Traders are always on the lookout for brokers that offer competitive spreads, as it directly impacts their profitability. For a deeper dive into brokers with the most competitive commissions, explore our Lowest Commission Brokers page.

Which Broker Is Better For MetaTrader 4?

Both CMC Markets and FP Markets offer MetaTrader 4, but FP Markets stands out due to its diverse platform offerings and additional features tailored for MT4. MetaTrader 4 is a popular choice among traders globally, and having a broker that optimises its features is crucial. For a comprehensive analysis of top MT4 brokers, check out our best MT4 brokers review.

Which Broker Offers Social Trading?

FP Markets offers social trading features, allowing traders to copy the strategies of experienced traders. Social or copy trading has gained immense popularity as it allows novice traders to benefit from the expertise of seasoned professionals. If you’re keen on exploring platforms that excel in this domain, delve into our best copy trading platforms overview.

Does Either Broker Offer Spread Betting?

Neither CMC Markets nor FP Markets offer spread betting as a primary service. Spread betting is a popular form of trading in the UK, allowing traders to speculate on the price movement of financial instruments without owning the underlying asset. For those interested in spread betting, it’s essential to choose a broker that specialises in this area. You can explore our top spread betting brokers in the UK for more information.

What Broker is Superior For Australian Forex Traders?

In my opinion, FP Markets stands out as the superior choice for Australian forex traders. Founded in Australia and regulated by ASIC, FP Markets has a strong foothold in the Australian market. Their commitment to offering competitive spreads and a diverse range of trading platforms makes them a top choice. CMC Markets, while also offering services in Australia, is headquartered overseas. If you’re an Australian trader looking for a reliable broker, our guide on the Best Forex Brokers In Australia provides a comprehensive overview.

What Broker is Superior For UK Forex Traders?

For UK traders, I believe CMC Markets offers a more tailored experience. Being FCA regulated and having a significant presence in the UK, CMC Markets understands the unique needs of British traders. While FP Markets also offers services in the UK, they are primarily based overseas. CMC Markets’ robust platform offerings and commitment to transparency make them a top choice for UK traders. For a detailed look at the best brokers in the UK, check out our comprehensive review Best Forex Brokers In UK.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert