CMC Markets vs IC Markets 2025

Comparing CMC Markets and IC Markets reveals strong features on both sides. CMC offers a vast range of instruments, while IC Markets excels with tight spreads and fast execution on MT4, MT5, and cTrader. In this review, IC Markets dominates.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 16:1

Minor Pairs 10:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers the 10 most important trading factors between CMC Markets and IC Markets. Here are nine key differences:

- CMC Markets is a market maker offering fixed commission-free spreads.

- CMC Markets offers spreads of 1.20 pips

- IC Markets offers three popular trading platforms: MT4, MT5, and cTrader.

1. Lowest Spreads And Fees – IC Markets

IC Markets and CMC Markets both shine but cater to different needs. IC Markets, an NDD broker, excels with ultra-tight spreads (as low as 0.1 pips on EUR/USD) and flexibility between commission-free or low-commission accounts. Meanwhile, CMC Markets simplifies pricing with fixed, commission-free spreads, appealing to those seeking ease. Founded in 2007 (Australia) and 1989 (UK) respectively, both provide robust platforms and tools. Whether you prioritise cost-efficiency or simplicity, understanding their pricing and features will help you choose the right trading partner.

Spreads

IC Markets provides exceptionally low spreads, boasting a EUR/USD spread of just 0.02, in stark contrast to CMC Markets’ 0.5 and well below the industry average of 0.28. For the AUD/USD pair, IC Markets offers a spread of 0.03, while CMC Markets presents a spread of 0.6, against an industry norm of 0.45. Overall, IC Markets maintains an impressive average spread of 0.29, substantially lower than CMC Markets’ average of 0.93 and the industry average of 0.72.

| RAW Account | CMC Markets Spreads | IC Markets Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 0.93 | 0.29 | 0.72 |

| EUR/USD | 0.5 | 0.02 | 0.28 |

| USD/JPY | 0.8 | 0.14 | 0.44 |

| GBP/USD | 0.9 | 0.23 | 0.54 |

| AUD/USD | 0.6 | 0.03 | 0.45 |

| USD/CAD | 1.3 | 0.25 | 0.61 |

| EUR/GBP | 0.7 | 0.27 | 0.55 |

| EUR/JPY | 1.2 | 0.3 | 0.74 |

| AUD/JPY | 1.2 | 0.5 | 0.93 |

| USD/SGD | 1.2 | 0.85 | 1.97 |

Commission Levels

IC Markets imposes a commission fee of $3.50 per lot, which is higher than CMC Markets’ more competitive fee of $2.50 per lot. Notably, CMC Markets distinguishes itself with a $0 minimum deposit requirement, in contrast to IC Markets’ $200 minimum. For recommended deposits, CMC Markets advises a $100 investment, while IC Markets recommends $200. Furthermore, both brokers provide SWAP-free accounts, catering to traders who prefer interest-free trading.

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| CMC Markets | $2.50 | $2.50 | £2.50 | €2.50 |

| IC Markets | $3.50 | $4.50 | £2.50 | €2.75 |

Standard Account Fees

IC Markets offers competitive standard account fees, charging just 0.62 for EUR/USD and 0.77 for AUD/USD. In comparison, CMC Markets imposes considerably higher fees, at 1.12 for EUR/USD and 1.64 for AUD/USD. This stark contrast underscores IC Markets’ advantage for traders looking to minimize their trading expenses.

|

Standard Account Spreads

|

|||||

|---|---|---|---|---|---|

|

1.12 | 1.64 | 1.30 | 1.30 | 1.38 |

|

0.82 | 0.83 | 1.27 | 1.03 | 0.94 |

|

1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

|

1.20 | 0.90 | 1.50 | 1.80 | 1.80 |

|

1.50 | 1.50 | 1.60 | 1.80 | 1.80 |

|

1.20 | 1.40 | 1.40 | 1.50 | 1.40 |

|

1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

|

1.46 | 2.06 | 1.52 | 1.76 | 1.59 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Our Lowest Spreads and Fees Verdict

Our dedicated team of experts surmises that IC Markets takes the cake in this niche due to their lowest spreads and fees.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

2. Better Trading Platform – IC Markets

IC Markets and CMC Markets excel in forex trading with advanced, user-friendly platforms featuring real-time data, fast execution, and tools for automated and social trading. IC Markets, founded in 2007 (Australia), offers low spreads and diverse instruments, while CMC Markets, established in 1989 (UK), provides extensive tools and tradeable options. Both deliver strong security and technology, enabling efficient, informed trading for beginners and pros alike.

| Trading Platform | CMC Markets | IC Markets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | No | Yes |

| cTrader | No | Yes |

| TradingView | No | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

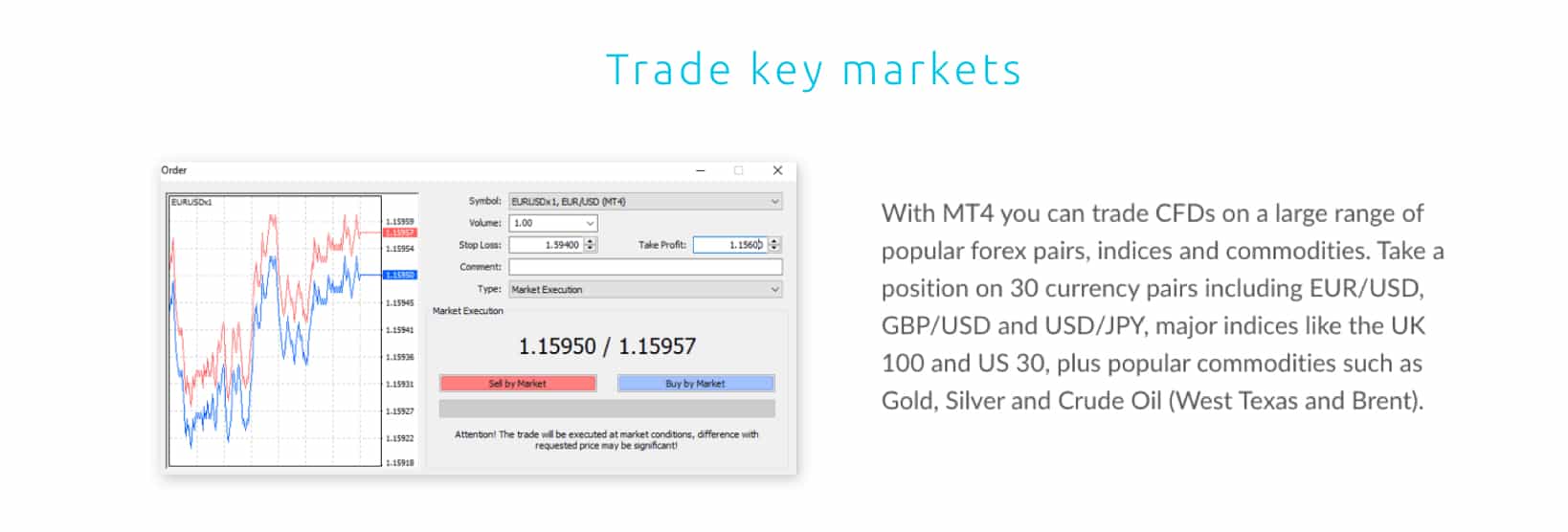

MetaTrader

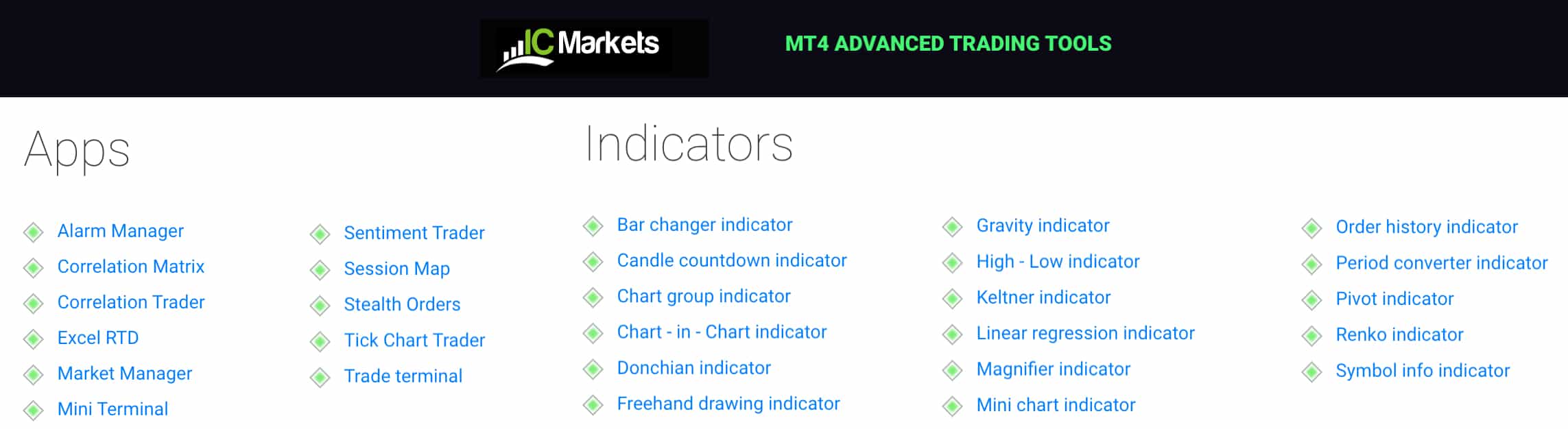

IC Markets and CMC Markets both provide access to MetaTrader 4 (MT4), the world’s leading trading platform. MT4 boasts an array of sophisticated trading tools, such as the MQL4 programming language, single-thread, single-currency backtesting, 30 built-in technical indicators, 31 graphical objects, and 9 customizable timeframes. Both brokers permit hedging and support Expert Advisors for automated trading strategies. However, CMC Markets limits MT4 functionality to commodities, indices, and forex, while IC Markets enhances the platform with its Advanced Trading Tools, offering traders even more capabilities.

Advanced Platforms

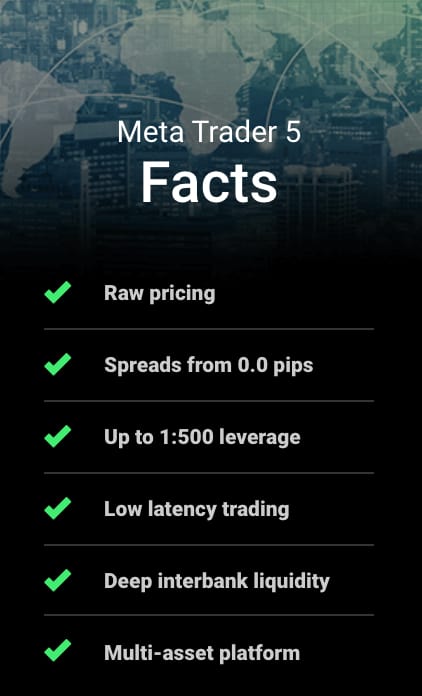

IC Markets offers users access to an array of advanced trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. MT5 boasts a rich set of features such as the MQL5 programming language, multi-threaded and multi-currency backtesting, 38 built-in technical indicators, 44 graphical objects, 21 timeframes, an economic calendar, and Level 2 Depth of Market. On the other hand, cTrader caters to those interested in automating their trading strategies through cBots utilizing the C# programming language. This platform includes 70 built-in technical indicators, 54 timeframes, scalping and hedging capabilities, and Level 2 market depth. Additionally, CMC Markets presents its proprietary Next Generation platform, granting access to over 9,500 financial instruments along with an impressive collection of 115+ technical indicators, 70 chart patterns, and 12 chart types.

Copy Trading

Both brokers provide mobile trading apps compatible with iOS and Android, enabling users to monitor markets and execute trades wherever they are. IC Markets supports MT4, MT5, and cTrader on mobile devices, whereas CMC Markets features its Next Generation platform alongside MT4 for mobile trading. For those looking to utilize MetaTrader 5, IC Markets is highly recommended due to its access to Expert Advisor capabilities, sophisticated charting tools, and an extensive range of products.

IC Markets and CMC Markets provide competitive trading conditions and advanced platforms suitable for various types of traders. IC Markets features the advanced MetaTrader 5 platform and an additional cTrader option, which may appeal to experienced traders. CMC Markets is noted for its comprehensive Next Generation platform and a wide range of tradeable instruments. The decision between these brokers will depend on personal trading preferences and requirements.

Our Better Trading Platform Verdict

IC Markets ranks the highest in this niche thanks to its better trading platform.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

3. Superior Accounts And Features – IC Markets

IC Markets and CMC Markets provide various account options tailored to different trading styles, including competitive spreads, low commissions, and advanced tools. They offer demo accounts for practice, automated trading, and social trading. With strong customer support and diverse financial instruments, both brokers enhance the trading experience for satisfaction and confidence.

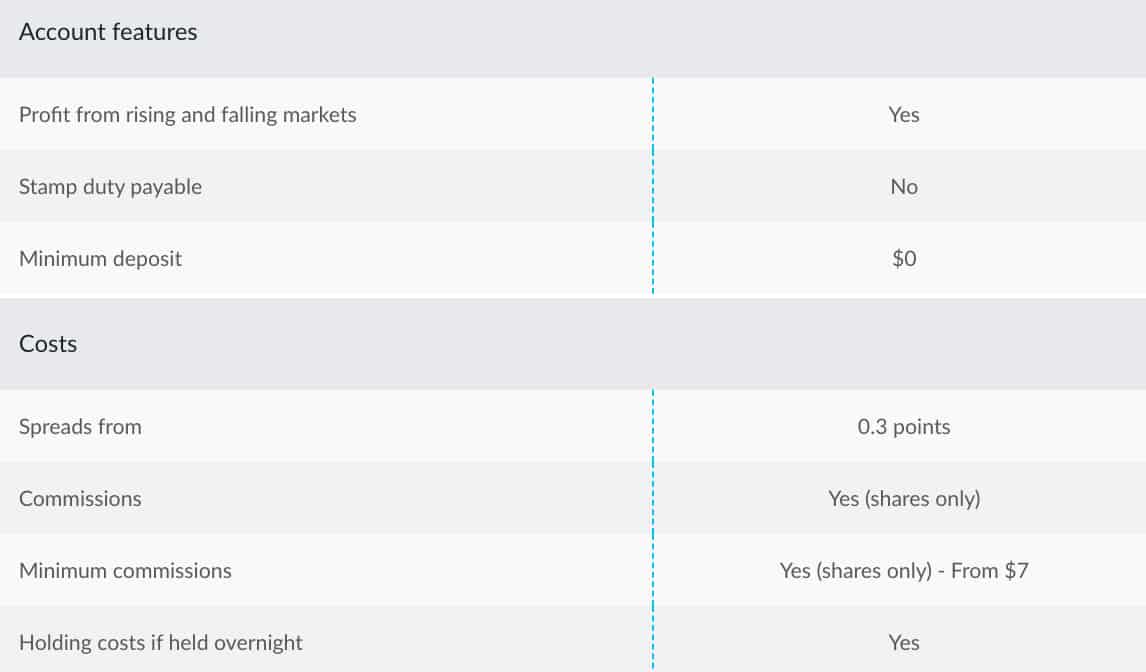

CMC Markets is a market maker broker that provides two types of accounts: a CFD trading account available worldwide and a spread betting account specifically for the UK and Ireland. The CFD trading account features a straightforward pricing structure, making it suitable for traders at all experience levels, particularly beginners. Commission costs are incorporated into the spread, so there are no additional flat-rate commission fees. However, high-volume traders may seek ECN-style pricing for tighter spreads and flat-rate commission fees, which CMC Markets does not offer due to its market maker model. Standard Account: simplifies fees for those new to trading

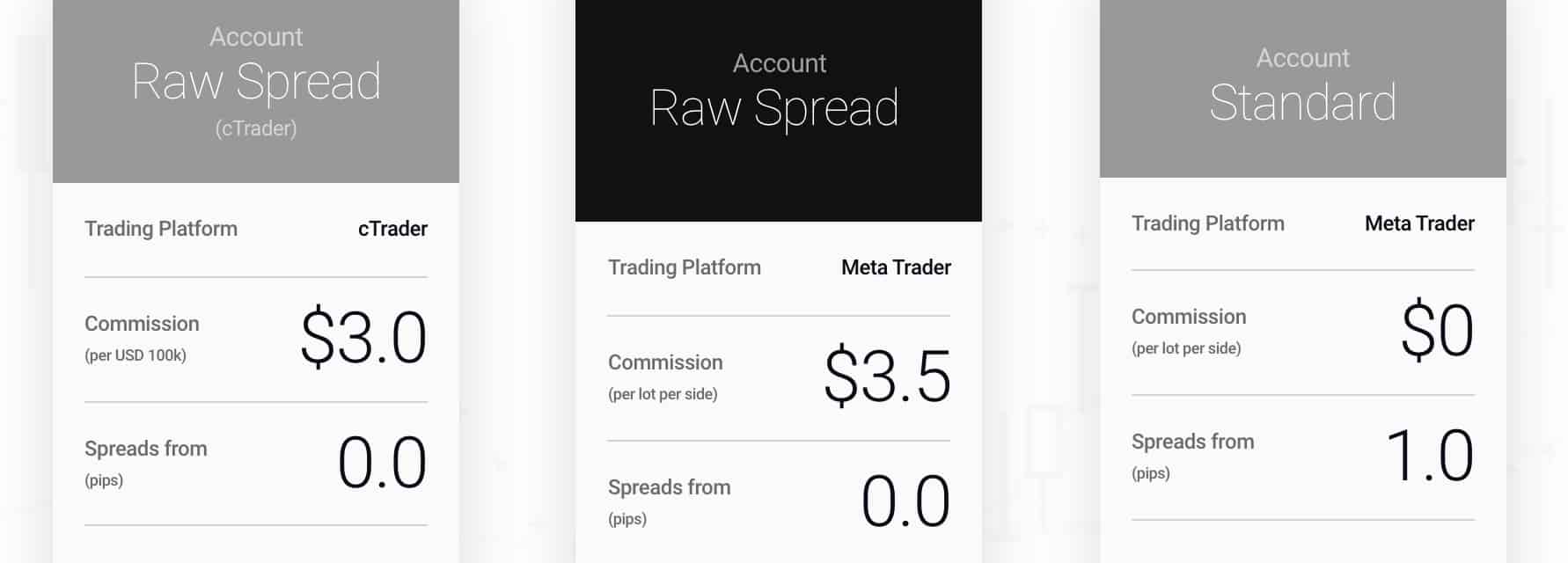

- Raw Account – MetaTrader: suitable for Expert Advisors and scalpers

- Raw Account – cTrader: suited to day trading and scalping

On the other hand, IC Markets has a commission-free standard account with wider spreads that include commission charges. It also offers two raw account types with ECN-like pricing, which provide access to institutional-grade spreads as low as 0.0 pips along with flat-rate commission fees. MetaTrader users face a $7 round-turn commission fee per 100k traded, while cTrader users benefit from lower trading costs of $6. The standard account is designed to simplify fees for new traders, whereas the raw accounts are aimed at Expert Advisors, scalpers, and day traders.

Additionally, IC Markets offers Islamic accounts with a swap-free fee structure in compliance with Sharia law. These accounts incur flat-rate swap fees instead of overnight financing fees represented as interest. Both the Standard and Raw accounts come in swap-free versions, with overnight financing fees varying from $5 to $30 depending on the forex pair, and fees increasing on Fridays. Current forex trading trends indicate bearish pressure on EUR/USD due to trade war concerns, while GBP/USD exhibits bullish momentum. The AUD/USD faces challenges related to Fed rate expectations, and the USD maintains a strong position.

| CMC Markets | IC Markets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | No | Yes |

| Swap Free Account | No | Yes |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | Yes | No |

Our Superior Accounts and Features Verdict

IC Markets, eventually, steals the show in this niche this is due to their superior accounts and features.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – IC Markets

IC Markets and CMC Markets offer top platforms, fast execution, and competitive spreads for all traders. A user-friendly interface, access to learning resources, and advanced tools are essential. With strong customer support and innovative features, these brokers help traders make informed decisions and improve their strategies, enhancing the overall trading journey.

Both CMC Markets and IC Markets have distinct strengths in their trading experiences and usability. CMC Markets is noted for its intuitive interface, which may be beneficial for beginners due to its straightforward navigation and design. This user-friendly approach can help reduce the learning curve for those new to trading.

However, based on our testing and the data from the spreadsheet:

- IC Markets is recognised for having the best MT5 platform.

- Their standard account is also highly recommended.

- IC Markets ties with Eightcap to offer the lowest spreads.

- The execution speed, although not the fastest, is commendable and ensures minimal slippage.

In contrast, IC Markets is known for its advanced MT5 platform, which offers a variety of features and functionalities. The standard account from IC Markets is recognized for its competitive spreads and execution speed, resulting in minimal slippage. Along with Eightcap, IC Markets provides some of the lowest spreads, appealing to traders looking for cost-effective solutions. While CMC Markets is more user-friendly, IC Markets offers a more varied trading experience with its platform options and pricing.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| CMC Markets | 138ms | 18/36 | 180ms | 26/36 |

| IC Markets | 134ms | 16/36 | 153ms | 22/36 |

Our Best Trading Experience and Ease Verdict

Based on our team’s analysis and testing, IC Markets rises above the other due to their best trading experience and ease.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – CMC Markets

In forex trading, trust and regulation are crucial. Brokers like IC Markets and CMC Markets excel here, operating under strict regulations that ensure fund safety and transparency. A well-regulated broker protects traders from fraud, boosts confidence, and promotes active trading. Strong oversight enhances a broker’s reputation, attracting serious traders. This review examines how IC Markets and CMC Markets maintain high regulatory standards and their importance for your trading experience.

CMC Markets Trust Score

IC Markets Trust Score

When it comes to trust scores, comparing these two brokers can be quite daunting. CMC Markets stands out with an impressive trust score of 91, far surpassing IC Markets. However, trust scores alone aren’t enough to make a decision. We must also consider factors such as features, platforms, services, and user-friendliness to make a well-rounded evaluation.

When selecting a forex broker, factors such as trust and regulation are important. Both CMC Markets and IC Markets are regulated by reputable financial authorities, which contributes to their reliability and transparency. CMC Markets is regulated by several financial authorities, including the Monetary Authority of Singapore (MAS), the Australian Securities and Investments Commission (ASIC), the Financial Markets Authority (FMA) in New Zealand, the Financial Conduct Authority (FCA) in the UK, the Investment Industry Regulatory Organization of Canada (IIROC), and the Federal Financial Supervisory Authority (BaFin) in Germany and Austria. This comprehensive regulatory framework ensures that CMC Markets follows strict operational standards, providing a secure trading environment for clients.

IC Markets, located in Sydney, is regulated by ASIC, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Services Authority of Seychelles (FSA). While IC Markets also has significant regulatory oversight, it is important to recognize that regulations and investor protections can vary by jurisdiction. For example, clients of the European IC Markets subsidiary benefit from negative balance protection as required by CySEC, whereas this protection is not a requirement of ASIC in Australia. When comparing the regulatory frameworks of CMC Markets and IC Markets, CMC Markets is notable for its regulation by multiple leading financial authorities and its listing on the London Stock Exchange, which adds to its transparency and reliability.

| CMC Markets | IC Markets | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) BaFin (Germany) FMA (New Zealand) CIRO (CANADA) MAS (Singapore) | ASIC (Australia) CYSEC (Cyprus) |

| Tier 2 Regulation | DFSA (Dubai) | |

| Tier 3 Regulation | FSA-S (Seychelles) SCB (Bahamas) |

Our Stronger Trust and Regulation Verdict

Without any doubt, CMC Markets ranks highest in this category owing to their stronger trust and regulation.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

6. Most Popular Broker – IC Markets

IC Markets gets searched on Google more than CMC Markets. On average, IC Markets sees around 246,000 branded searches each month, while CMC Markets gets about 90,500 — that’s 63% fewer.

| Country | CMC Markets | IC Markets |

|---|---|---|

| United Kingdom | 9,900 | 33,100 |

| South Africa | 720 | 9,900 |

| India | 1,300 | 8,100 |

| Thailand | 210 | 8,100 |

| Vietnam | 210 | 8,100 |

| Spain | 3,600 | 6,600 |

| United States | 4,400 | 6,600 |

| Australia | 49,500 | 6,600 |

| Germany | 3,600 | 5,400 |

| Pakistan | 320 | 5,400 |

| France | 720 | 4,400 |

| Brazil | 140 | 4,400 |

| United Arab Emirates | 390 | 4,400 |

| Morocco | 110 | 4,400 |

| Italy | 880 | 3,600 |

| Singapore | 2,400 | 3,600 |

| Colombia | 50 | 3,600 |

| Malaysia | 480 | 3,600 |

| Indonesia | 480 | 3,600 |

| Nigeria | 720 | 3,600 |

| Poland | 1,600 | 2,900 |

| Sri Lanka | 70 | 2,900 |

| Netherlands | 320 | 2,400 |

| Mexico | 90 | 2,400 |

| Hong Kong | 390 | 2,400 |

| Algeria | 90 | 2,400 |

| Canada | 4,400 | 2,400 |

| Philippines | 260 | 2,400 |

| Kenya | 170 | 2,400 |

| Saudi Arabia | 90 | 1,900 |

| Bangladesh | 110 | 1,900 |

| Peru | 40 | 1,600 |

| Switzerland | 210 | 1,600 |

| Egypt | 90 | 1,600 |

| Turkey | 260 | 1,300 |

| Argentina | 50 | 1,300 |

| Japan | 210 | 1,300 |

| Sweden | 590 | 1,300 |

| Portugal | 140 | 1,000 |

| Ecuador | 20 | 1,000 |

| Taiwan | 140 | 1,000 |

| Dominican Republic | 20 | 1,000 |

| Uzbekistan | 30 | 1,000 |

| Ireland | 390 | 880 |

| Cyprus | 170 | 880 |

| Ghana | 70 | 880 |

| Greece | 140 | 720 |

| Chile | 30 | 720 |

| Venezuela | 30 | 720 |

| Austria | 390 | 720 |

| Ethiopia | 40 | 720 |

| Uganda | 50 | 720 |

| Mongolia | 10 | 720 |

| Jordan | 30 | 590 |

| Mauritius | 20 | 480 |

| Costa Rica | 30 | 390 |

| Tanzania | 30 | 320 |

| Bolivia | 10 | 260 |

| Panama | 50 | 260 |

| Botswana | 30 | 260 |

| New Zealand | 1,900 | 210 |

| Cambodia | 50 | 170 |

2024 Monthly Searches For Each Brand

IC Markets - UK

IC Markets - UK

|

33,100

1st

|

CMC Markets - UK

CMC Markets - UK

|

9,900

2nd

|

IC Markets - India

IC Markets - India

|

8,100

3rd

|

CMC Markets - India

CMC Markets - India

|

1,300

4th

|

IC Markets - Australia

IC Markets - Australia

|

6,600

5th

|

CMC Markets - Australia

CMC Markets - Australia

|

49,500

6th

|

IC Markets - Thailand

IC Markets - Thailand

|

8,100

7th

|

CMC Markets - Thailand

CMC Markets - Thailand

|

210

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with IC Markets receiving 2,425,000 visits vs. 1,747,000 for CMC Markets.

Our Most Popular Broker Verdict

IC Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – CMC Markets

IC Markets and CMC Markets provide extensive CFD options, including forex, commodities, indices, and cryptocurrencies. This variety allows for better portfolio diversification and adaptability to market conditions, benefiting both short-term and long-term traders. Access to numerous financial instruments enhances strategy refinement, risk management, and the ability to capitalize on global trends.

IC Markets and CMC Markets each provide distinct advantages to retail forex traders, with CMC Markets offering an extensive range of 348 forex pairs along with market access to a myriad of assets tailored for diverse investment strategies. Their platform allows traders to explore a variety of CFDs, boasting access to thousands of products across multiple asset classes. While IC Markets may not have the same breadth as CMC Markets, it presents significant opportunities with several trading instruments including forex, commodities, indices, and cryptocurrencies that cater to a wide spectrum of trading strategies.

When engaging in trading with IC Markets, users can utilize popular platforms such as MetaTrader 4, MetaTrader 5, or cTrader. This access facilitates trading across 17 indices, over 10 cryptocurrencies, more than 19 commodities, 6+ bonds, and 4 futures. Notably, MetaTrader 5 users can diversify their portfolios with over 120 stock options. In contrast, CMC Markets enhances its offering with a comprehensive suite of financial instruments, including approximately 9,500 total products which encompass 9,405 shares and ETFs, 116 indices, 110 commodities, 51 treasuries, and 12 cryptocurrencies, further solidifying their position in the retail trading space:

- 9405 Shares and Exchanged Traded Funds (ETFs)

- 116 Indices

- 110 Commodities

- 51 Treasuries

- 12 Cryptos

For traders interested in the growing cryptocurrency sector, both IC Markets and CMC Markets provide extensive product selections for cryptocurrency CFDs. CMC Markets, in addition to individual cryptocurrencies, features exclusive cryptocurrency indices such as the All Crypto Index, Major Crypto Index, and Emerging Crypto Index. However, it’s essential to note that due to regulatory changes implemented by the FCA in 2021, CMC Markets Plc UK is no longer able to offer cryptocurrency trading to its UK clients, which may impact the product availability for those within that jurisdiction. As the forex market evolves, traders should remain informed on trends involving EUR, AUD, USD, and GBP as global economic conditions fluctuate.

As well as individual Cryptos, those trading with CMC Markets gain access to the broker’s unique range of Cryptocurrency Indices.

- All Crypto Index

- Major Crypto Index

- Emerging Crypto Index

Note: 2021 changes in policies by the FCA of the UK means CMC Markets Plc UK can no longer offer cryptocurrency trading to clients.

| CFDs | CMC Markets | IC Markets |

|---|---|---|

| Forex Pairs | 338 | 61 |

| Indices | 82 | 25 |

| Commodities | 124 | 4 Metals (Gold vs 6 currencies) (Silver vs 3 currencies) 8 Softs 5 Energies |

| Cryptocurrencies | 19 | 23 |

| Share CFDs | 10000+ | 2100+ |

| ETFs | 11265 | No |

| Bonds | 55 | 9 |

| Futures | Yes | Yes |

| Treasuries | 55 | 9 |

| Investments | Yes | Yes |

Our Top Product Range and CFD Markets Verdict

Again, CMC Markets come up trumps in this category thanks to their top product range and CFD markets.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

8. Superior Educational Resources – CMC Markets

Top brokers like IC Markets and CMC Markets provide extensive educational resources, including webinars, articles, and video tutorials, to help traders enhance their skills. Access to quality education boosts confidence and fosters growth, making it essential when choosing a broker.

Both CMC Markets and IC Markets recognize this and have invested significantly in their educational resources. CMC Markets offers a comprehensive suite of educational tools, including webinars, video tutorials, and market analysis. Their platform also features a ‘News and Analysis’ section, providing traders with up-to-date market insights and expert commentary. This extensive educational support ensures that traders are well-equipped to make informed decisions in the dynamic forex market.

IC Markets, on the other hand, also boasts a robust educational platform. They provide a detailed educational section on their website, offering webinars, video tutorials, and trading guides. Their ‘Market Analysis’ section is regularly updated with expert insights, and they have a ‘Trading Info’ section covering essential trading topics. Additionally, IC Markets offers a dedicated ‘Forex 101’ section for beginners and advanced trading tools and analysis for more experienced traders. This comprehensive educational support helps traders at all levels enhance their trading skills and knowledge.

IC Markets, on the other hand, also offers a robust educational platform. Based on our testing:

- IC Markets provides a detailed educational section on its website.

- They offer webinars, video tutorials, and trading guides.

- Their ‘Market Analysis’ section is updated regularly with expert insights.

- IC Markets also provides a ‘Trading Info’ section, which covers essential trading topics.

- They have a dedicated ‘Forex 101’ section for beginners.

- Their platform also features advanced trading tools and analysis for more experienced traders.

Our Superior Educational Resources Verdict

CMC Markets brings home the gold in this field thanks to their superior educational resources.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

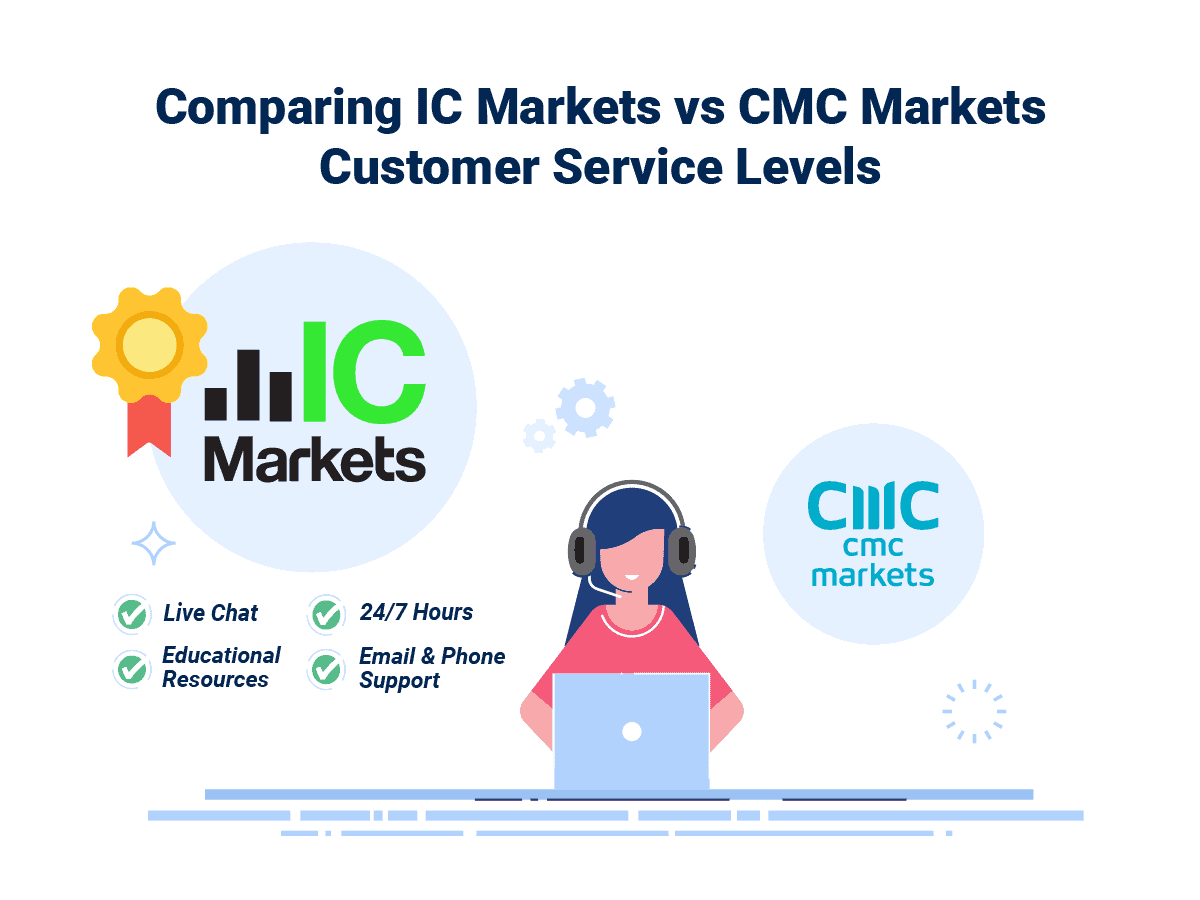

9. Superior Customer Service – IC Markets

IC Markets and CMC Markets prioritize quick, reliable support through 24/7 live chat, phone, and email. A responsive team fosters trust, and multilingual support helps all traders, boosting satisfaction and enabling successful trading.

Both CMC Markets and IC Markets provide customer support through phone, email, and live chat. CMC Markets offers support 24 hours a day from Monday to Friday, while IC Markets provides 24/7 customer support. This continuous availability allows traders to seek assistance at any time. Each broker also presents various educational resources, including demo accounts, webinars, platform tutorials, and articles, suitable for both new and experienced traders.

- Demo accounts

- Webinars

- Platform tutorials

- Articles and blogs

Additionally, CMC Markets and IC Markets offer a wide range of educational materials that cover subjects such as risk management and market analysis. These resources aim to enhance traders’ skills and knowledge, enabling them to make informed decisions in the forex market. IC Markets features a detailed trading essentials section, updated market analyses, and a ‘Forex 101’ section for beginners. CMC Markets similarly provides a collection of educational tools, including a ‘News and Analysis’ section with expert commentary and market insights.

| Minimum Deposit | Recommended Deposit | |

| CMC Markets | $0 | $100 |

| IC Markets | $200 | $200 |

Our Superior Customer Service Verdict

Undoubtedly, IC Markets is on top of the world right now this is due to its superior customer service.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

10. Better Funding Options – A Tie

IC Markets and CMC Markets provide various deposit and withdrawal methods like bank transfers, credit/debit cards, and e-wallets such as PayPal and Skrill. Some even accept cryptocurrencies. Low or no transaction fees allow for easy account management, enhancing the trading experience by minimizing transaction concerns.

Both CMC Markets and IC Markets provide a variety of deposit and withdrawal options, facilitating fund management for traders. Most of these methods are available at no cost, including credit cards, debit cards, e-wallets, and internet banking. IC Markets allows deposits and withdrawals using Visa, Mastercard, PayPal, Neteller, Skrill, FasaPay, POLi, Bpay, Bitcoin Wallet, wire transfer, bank transfer, broker-to-broker transfer, as well as Thai and Vietnamese internet banking. However, international bank transfers incur a fee of AUD 20. In comparison, CMC Markets offers free deposits through electronic wallets, debit/credit cards, and bank transfers, though it charges a £15 fee for same-day withdrawals and international bank transfers.>

- Debit and credit card: Visa and Mastercard

- e-Wallet: PayPal, Neteller, Skrill, FasaPay, POLi, Bpay and Bitcoin Wallet

- Internet Banking: Wire transfer, bank transfer, broker-to-broker transfer, Thai Internet banking and Vietnamese Internet banking

To initiate trading, IC Markets requires a minimum deposit of $200, while CMC Markets does not have an initial minimum deposit requirement. Both brokers provide accounts in multiple currencies: IC Markets supports USD, AUD, NZD, GBP, EUR, CHF, CAD, HKD, SGD, and JPY, while CMC Markets supports AUD, SGD, EUR, USD, NZD, CAD, GBP, NOK, PLN, and SEK, offering traders the flexibility to choose a base currency that meets their preferences.

- IC Markets: USD, AUD, NZD, GBP, EUR, CHF, CAD, HKD, SGD and JPY

- CMC Markets: AUD, SGD, EUR, USD, NZD, CAD, GBP, NOK, PLN and SEK

| Funding Option | CMC Markets | IC Markets |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | Yes |

| Skrill | No | Yes |

| Neteller | No | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Our Better Funding Options Verdict

It’s a stalemate for both IC Markets and CMC Markets in this niche this is due to their better funding options.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

11. Lower Minimum Deposit – A Tie

IC Markets and CMC Markets offer flexible deposit options, allowing traders to gain experience and refine strategies without significant risk. This inclusivity fosters a learning-friendly environment for skill development and effective risk management.

When starting a forex trading journey, the initial deposit requirement is an important consideration, particularly for new traders. CMC Markets and IC Markets have established accessible minimum deposit requirements. CMC Markets does not require an initial minimum deposit, which could be appealing for those wanting to start with a minimal investment. IC Markets, in comparison, has a minimum deposit requirement of $200, which is still relatively low for many traders.

Here’s a quick comparison of the minimum deposit amounts for both brokers:

| Minimum Deposit | Recommended Deposit | |

| CMC Markets | $0 | $100 |

| IC Markets | $200 | $200 |

While a lower minimum deposit can be attractive, it is also important to evaluate other factors such as the broker’s reputation, trading platform, and customer support. CMC Markets is regulated by several respected financial authorities, including the FCA, ASIC, and MAS, indicating a high level of trustworthiness. IC Markets is also well-regulated, with oversight from ASIC, CySEC, and the FSA. Both brokers provide strong trading platforms, with CMC Markets offering an intuitive interface suited for beginners, and IC Markets being recognized for its MT5 platform and competitive spreads.

Our Lower Minimum Deposit Verdict

Once again, it’s a deadlock for both CMC Markets and IC Markets by the reason of their lower minimum deposit.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

Our Final Verdict On Which Broker Is The Best: IC Markets or CMC Markets?

IC Markets dominates this category in light of their comprehensive educational platform and diverse product range. The table below summarises the key information leading to this verdict:

| Categories | CMC Markets | IC Markets |

|---|---|---|

| Lowest Spreads And Fees | No | Yes |

| Better Trading Platform | No | Yes |

| Superior Accounts And Features | No | Yes |

| Best Trading Experience And Ease | No | Yes |

| Stronger Trust And Regulation | Yes | No |

| Top Product Range And CFD Markets | Yes | No |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | No | Yes |

| Better Funding Options | Yes | Yes |

| Lower Minimum Deposit | Yes | Yes |

CMC Markets: Best For Beginner Traders

CMC Markets is better suited for beginner traders due to its user-friendly interface and extensive educational resources.

IC Markets: Best For Experienced Traders

IC Markets is the preferred choice for experienced traders because of its advanced trading platforms and competitive pricing.

FAQs Comparing CMC Markets Vs IC Markets

Does IC Markets or CMC Markets Have Lower Costs?

IC Markets generally offers lower costs compared to CMC Markets. They are renowned for their competitive spreads, with some pairs even going as low as 0.1 pips. CMC Markets, while competitive, tends to have slightly higher spreads on average. For a more detailed comparison of broker costs, you can refer to this comprehensive Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both IC Markets and CMC Markets support MetaTrader 4, but IC Markets is often preferred by traders for its advanced MT4 features and seamless integration. Their platform offers a range of customisable tools and indicators, enhancing the trading experience. For traders specifically looking for the best MT4 experience, this list of top MT4 brokers can provide more insights.

Which Broker Offers Social Trading?

IC Markets offers social trading features, allowing traders to copy strategies from experienced traders. CMC Markets, on the other hand, does not have a dedicated social trading platform. Social trading can be a game-changer, especially for beginners who are still learning the ropes. For those interested in exploring this further, here’s a comprehensive review of the best social trading platforms.

Does Either Broker Offer Spread Betting?

CMC Markets offers spread betting services, allowing traders from the UK and Ireland to take advantage of tax benefits associated with this form of trading. IC Markets, on the other hand, does not provide spread betting. Spread betting can be a lucrative trading strategy when done right, especially considering its tax implications. For those interested in diving deeper into spread betting, this comprehensive guide on the best spread betting brokers in the UK can be a great starting point.

What Broker is Superior For Australian Forex Traders?

In my opinion, IC Markets stands out as the superior choice for Australian forex traders. Founded in Sydney, IC Markets is ASIC regulated, ensuring a high level of trust and adherence to stringent regulatory standards. CMC Markets, while also offering services in Australia, is originally based overseas. IC Markets’ deep roots in Australia and its commitment to providing top-notch services tailored to the Australian market make it a preferred choice. For a broader perspective on the best brokers in Australia, you can check out this list of the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK forex traders, I believe CMC Markets has the edge. Being FCA regulated and having a strong presence in the UK, CMC Markets offers services tailored to the needs of UK traders. IC Markets, while also catering to UK traders, is not originally founded in the UK. The FCA regulation ensures that CMC Markets adheres to the highest standards of conduct and offers robust investor protection. For more insights on the Best Forex Brokers In UK, here’s a comprehensive review of the Best Forex Brokers In UK.

Article Sources

No commission account spread proprietary testing data and published website spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Is my money safe with IC Markets?

Yes, IC Markets is a regulated broker meaning your funds are always kept in segregated bank accounts.