FXCM vs OANDA: Which One Is Best?

In this review, we looked at how the Forex broker OANDA and FXCM compare. Both have their own trading platform plus MT4 and TradingView, along with (mostly) no commissions. See our findings in this OANDA vs FXCM battle.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 33:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors to help you make an informed decision between OANDA and FXCM. Here are five key differences:

- OANDA offers a wider range of forex pairs with 68, compared to FXCM’s 42.

- FXCM excels in share CFD trading, offering 219 options, while OANDA doesn’t offer any.

- Both brokers are heavily regulated, but OANDA extends its services to the US market.

- OANDA has a more comprehensive educational suite, suitable for traders of all experience levels.

- FXCM has a slightly higher average spread for EUR/USD at 1.3, compared to OANDA’s 1.2.

1. Lowest Spreads And Fees – Tie

The CompareForexBrokers team wanted to see how the two brokers compared when it came to spread costs, so we went and tested. For this exercise, we tested 6 major currency pairs over a 24-hour period (AUD/USD, EUR/USD, GBP/USD, USD/CAD, USD/CHF and USD/JPY) and then averaged the spread across the currency pairs.

The below table shows our test results for the no commission, standard account spreads for each broker. Our findings show that FXCM averaged 1.47 pips over the 6 tested pairs, which equates to a cost of $13.49 per lot. OANDA didn’t fare as well, with an average of 1.54 pips or a cost $14.23 per lot.

| Broker | Spread (6 Majors combined) | GBPUSD | USDCAD | AUDUSD | EURUSD | USDCHF | USDJPY |

|---|---|---|---|---|---|---|---|

| FXCM | 1.47 | 1.39 | 1.96 | 1.31 | 0.93 | 1.84 | 1.38 |

| OANDA | 1.54 | 1.86 | 1.75 | 1 | 1.06 | 2 | 1.55 |

Of course, if we had chosen different currency pairs or tested on a different date, the results might have been different. For example, our tests suggest OANDA is a better choice than FXCM for AUD/USD (far superior) and USD/CAD currency pairs.

Interestingly, our tests captured OANDA as having lower minimum spreads and lower average minimum spreads as well. So to us, if you time your order, OANDA can be a better choice. To achieve this, your best bet is to use some sort of automation, which is possible with both brokers.

| Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY |

|---|---|---|---|---|---|---|

| FXCM | 1 | 0.7 | 0.7 | 1.4 | 0.7 | 0.7 |

| OANDA | 0.7 | 0.6 | 0.9 | 0.8 | 0.8 | 0.6 |

| Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY |

|---|---|---|---|---|---|---|

| FXCM | 1 | 0.71 | 0.75 | 1.44 | 1.04 | 0.74 |

| OANDA | 0.73 | 0.66 | 1.12 | 1.04 | 1.2 | 0.77 |

We haven’t tested each broker’s commission-based accounts. In Australia, FXCM doesn’t have this type of account, but they do have such an account for their clients in the UK, and it’s called their active trader account. This account has tiered commissions and is best for high-volume traders.

Like FXCM, OANDA has a commission account called their Cores spread account, and it is available in Australia, Singapore and the US. This account has a fixed rather than a tiered commission for each lot, this being $7.00 per lot, which in our experience, is the standard amount most brokers charge.

| FXCM | OANDA | |

|---|---|---|

| Promoted Spread (EUR/USD) | Not provided | Standard - Avg 0.6 pips Core Pricing - Avg 0.1 pips |

| CompareForexBroker Tested Spreads (EUR/USD) | Standard: Avg 0.93 pips | Standard Avg 1.06 pips |

| Commission per 100,000 Round-turn | Active traders (not Australia, Canada) - $5.00 min volume $150M-500M | Core Pricing (AU, SG) - AUD 7, USD 7, SGD 7. Core Pricing (US) USD $10 |

| Inactivity fees | Yes 50 units after 12 months of inactivity | Yes $10 per month after 12 months |

| Active Trader Discount | Yes | In the US only |

| Minimum deposit | $300 to open, $50 per deposit | None |

| Deposit or Withdrawal fees | Only International bank transfer | Only International bank transfer |

| Our Cost Score | 6 | 4 |

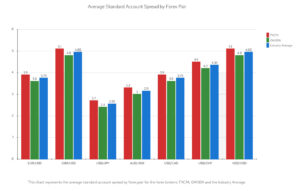

Standard Account Spreads

Looking at the average standard account spreads for the forex pairs, we can see some interesting patterns. For the EUR/USD pair, FXCM has an average spread of 1.3, while OANDA has a slightly lower spread of 1.2. This trend continues across the other forex pairs, with OANDA consistently offering slightly lower spreads than FXCM.

| Forex Pair | FXCM | OANDA | Industry Average |

|---|---|---|---|

| EUR/USD | 1.3 | 1.2 | 1.25 |

| GBP/USD | 1.7 | 1.6 | 1.65 |

| USD/JPY | 0.9 | 0.8 | 0.85 |

| AUD/USD | 1.1 | 1.0 | 1.05 |

| USD/CAD | 1.3 | 1.2 | 1.25 |

| USD/CHF | 1.5 | 1.4 | 1.45 |

| NZD/USD | 1.7 | 1.6 | 1.65 |

Standard Account Analysis Updated July 2025[1]July 2025 Published And Tested Data

However, when we compare these spreads to the industry average, we find that both FXCM and OANDA are offering competitive rates. For example, the industry average spread for the EUR/USD pair is 1.25, which is higher than OANDA’s spread and only slightly lower than FXCM’s. This pattern is consistent across all the forex pairs we analysed.

Based on this data, I would argue that OANDA is the cheaper option in terms of spreads. However, it’s important to remember that spreads are just one aspect of the cost of trading. Other factors, such as commission fees and account types, can also impact the overall cost. Therefore, while OANDA may have lower spreads, this does not necessarily mean it is the cheaper option overall.

Our Lowest Spreads and Fees Verdict

FXCM and OANDA have carefully constructed trading costs – the Cost Score between the two is a tie with scores of 6 each. We elected to focus our comparison on the no-commission account since the is the most popular option retail traders are likely to use, which we assume our readers will be. FXCM won on this, but OANDA does have lower minimum deposits and inactivity fees, which allowed them to gain ground.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

2. Better Trading Platform – FXCM

We found that FXCM and OANDA are close in this category, but FXCM edged out OANDA. Both offer modern platforms and tools.

FXCM offers its proprietary Trading Station platform, MetaTrader 4, and TradingView. These platforms support algorithmic trading and provide advanced charting tools.

Also satisfactory was FXCMs web trading platform; we appreciated that it is highly customisable and user-friendly. The platform offered us a wide range of order types and features a great search function. However, it lacks two-step authentication, which is an essential security feature.

OANDA also supports the widely popular MetaTrader 4 (MT4) platform but has its own trading platform called OANDA Trade Web and OANDA Trade Mobile. We thought the outstanding feature of the web version is that it comes with TradingView for advanced charting and a guaranteed stop loss, but we were disappointed it is not available for the web.

Desktop Platforms were equally acceptable for both FXCM and OANDA. FXCM desktop version stood out more because of their Trading Station. For us, one of its main highlights is the Marketscope 2.0 charting tool, which offers powerful charting capabilities that run parallel to the main platform window. Trading Station is a strong competitor to MetaTrader and features complex back-testing options, such as accounting for potential historical slippage and trading costs.

Neither broker supports social trading, however, it is still possible by using MetaTrader’s Trading Signals, to have the ability to copy trades of successful traders.

| Trading Platform | FXCM | OANDA |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | No | No |

| cTrader | No | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

Our Better Trading Platform Verdict

On paper, FXCM and OANDA have similar offerings to clients. We gave FXCM a Trading Platform score of 7 and OANDA a 6 because of FXCM’s Marketscope 2.0 charting tool. It is advanced and efficient, making trading a breeze for us.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

3. Superior Accounts And Features – OANDA

- FXCM offers a unique account type for high-volume traders in the UK called the Active Trader account, which features tiered commissions.

- OANDA provides a Cores Spread account with a fixed commission of $7 per lot, available in Australia, Singapore, and the US.

- Both brokers offer maximum leverage allowed by regulators, but FXCM allows up to 1:200 for Pro Accounts, while OANDA caps at 1:100.

- FXCM charges an inactivity fee of 50 units after 12 months, whereas OANDA charges $10 per month after 12 months of inactivity.

- OANDA has a zero initial deposit requirement, making it more accessible for beginners, while FXCM requires a $300 initial deposit.

| FXCM | OANDA | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | No |

| Active Traders | Yes | No |

| Spread Betting (UK) | Yes | Yes |

Our Superior Accounts and Features Verdict

OANDA offers a more flexible and accessible range of account types, especially for beginners and those looking for fixed commissions.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – FXCM

FXCM and OANDA are market maker brokers. Due to their stellar reputations, they get by well. A market maker facilitates the process required to provide liquidity for trading pairs on centralised exchanges. In the forex industry, market makers often have a bad reputation because some brokers display worse bid/ask prices than ECN brokers.

In our case, though, we found that FXCM and OANDA provided consistent low spreads without manipulation, so you shouldn’t concern yourself if the broker has a dealing desk or not.

Both brokers have the maximum leverage allowed by regulators. In the case of Australia, Europe, and The United Kingdom, this is 1:30 for major pairs and 1:20 for minor and exotic pairs. If you qualify for a Pro Account or are trading from an emerging market, then leverage up to 1:100 is available with OANDA and 1:200 with FXCM. While we think high leverage can be useful, keep in mind it can lead to outsized losses, so it is best left to professionals.

On the subject of leverage, it helps if you can reduce the risk of slippage; for this reason, execution speed can make a difference. We tested the Execution Speeds of FXCM and found they have an average execution speed of 108 ms for Limit Orders and 123 ms for Market Orders. This places them 6th of the 20 Forex brokers we test.

| FXCM | OANDA | |

|---|---|---|

| Execution Type | FXCM Enhanced Execution - Market Maker matched to best prices in liquidity pool (with Market Execution) | Market Maker (with Market Execution) |

| Demo Account | Yes | Yes |

| Standard Account | Standard | Standard |

| Commission Account | In UK/ EU with Active Trader | Yes |

| Fixed-spread Account | No | No |

| Swap-free Account | On request | On request |

| # of Base Currencies | 9 | 5 |

| Maximum Forex Leverage | 1:30 or 1:200 | 1:30 or 1:100 |

| Execution Speed | Limit Order 108 Market Order 123 | N/A |

| Our Ease Of Account Opening Score (out of 15) | 8 | 8 |

| Our Overall Trading Experience Score | 7 | 6 |

Our Best Trading Experience and Ease Verdict

FXCM and OANDA are both market-maker brokers with identical leverage offerings. As traders, we desire as many base currencies as possible and a sufficient range of leverage. Both are closely matched, but we chose FXCM as our favoured broker in the Trading Experience category, so we gave them a score of 7 and OANDA a 6.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – Tie

FXCM Trust Score

OANDA Trust Score

FXCM is regulated in three Tier-1 jurisdictions, making it a safe and low-risk choice for trading forex and CFDs. The broker is authorised by the following Tier-1 regulators: Australian Securities & Investment Commission (ASIC), Financial Conduct Authority (FCA), and Investment Industry Regulatory Organisation of Canada (IIROC) via Friedberg Direct.

OANDA is also regulated by these financial regulatory bodies but is also able to offer trading to clients in the US as they are regulated by the National Futures Association (NFA) and the Commodities Futures Trading Commission (CFTC) in the USA.

Despite both brokers being highly regulated, we found the brokers are not spotlessly clean. OANDA was fined $20,000 by the NFA in 2021 and $500,000 by the CFTC for regulatory breaches in 2020.

FXCM was fined $2 million in 2011 for slippage malpractice and $7 million by US regulators in 201, which saw them exit the US market.

When choosing a broker, the most important detail is to check the broker is regulated in the country you are resident in. So, if you are in Australia, it is best the broker has ASIC regulation.

| FXCM | City Index | |

|---|---|---|

| Tier 1 regulators* | ASIC (Australia) FCA (UK) CYSEC (Cyprus) CIRO (CANADA) BaFin (Germany) | ASIC (Australia) FCA (UK) MAS (Singapore) |

| Tier 2 regulators* | FSCA (South Africa) ISA (Israel) | |

| Tier 3 regulators* | ||

| Negative Balance Protection | Yes | Yes |

| Guaranteed Stop Loss | No | With OANDA Trade |

| Trust Score | 8 | 8 |

Our Stronger Trust and Regulation Verdict

We gave FXCM and OANDA both a score of 8 as they are heavily regulated and hold positive reputations within the forex trading industry.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

6. Most Popular Broker – OANDA

OANDA gets searched on Google more than FXCM. On average, OANDA sees around 550,000 branded searches each month, while FXCM gets about 40,500 — that’s 92% fewer.

| Country | FXCM | OANDA |

|---|---|---|

| United States | 2,900 | 49,500 |

| United Kingdom | 2,900 | 33,100 |

| India | 2,900 | 33,100 |

| France | 1,600 | 22,200 |

| Japan | 1,300 | 12,100 |

| Australia | 1,300 | 6,600 |

| Malaysia | 1,300 | 6,600 |

| Germany | 1,000 | 40,500 |

| South Africa | 1,000 | 12,100 |

| Colombia | 1,000 | 9,900 |

| Thailand | 1,000 | 4,400 |

| Indonesia | 1,000 | 2,900 |

| Pakistan | 1,000 | 2,400 |

| Canada | 880 | 12,100 |

| Nigeria | 880 | 6,600 |

| Vietnam | 880 | 2,400 |

| Italy | 720 | 18,100 |

| Spain | 590 | 22,200 |

| Taiwan | 590 | 2,900 |

| Singapore | 480 | 9,900 |

| United Arab Emirates | 480 | 6,600 |

| Mexico | 480 | 6,600 |

| Brazil | 480 | 6,600 |

| Turkey | 480 | 4,400 |

| Hong Kong | 480 | 4,400 |

| Morocco | 480 | 1,900 |

| Philippines | 390 | 9,900 |

| Netherlands | 390 | 6,600 |

| Egypt | 390 | 2,900 |

| Venezuela | 390 | 880 |

| Argentina | 320 | 4,400 |

| Poland | 320 | 3,600 |

| Kenya | 260 | 4,400 |

| Saudi Arabia | 260 | 2,400 |

| Bangladesh | 260 | 2,400 |

| Algeria | 260 | 1,600 |

| Peru | 210 | 2,400 |

| Greece | 210 | 2,400 |

| Chile | 210 | 1,600 |

| Switzerland | 170 | 22,200 |

| Sweden | 170 | 4,400 |

| Ecuador | 170 | 1,000 |

| Cambodia | 170 | 590 |

| Cyprus | 140 | 4,400 |

| Dominican Republic | 140 | 1,300 |

| Portugal | 110 | 9,900 |

| Austria | 110 | 5,400 |

| Ghana | 110 | 2,900 |

| Sri Lanka | 110 | 1,300 |

| Bolivia | 110 | 720 |

| Tanzania | 90 | 1,600 |

| Uganda | 90 | 1,300 |

| Ireland | 70 | 2,900 |

| New Zealand | 70 | 1,600 |

| Jordan | 70 | 1,600 |

| Ethiopia | 70 | 880 |

| Uzbekistan | 70 | 390 |

| Panama | 50 | 1,000 |

| Botswana | 50 | 480 |

| Mongolia | 50 | 70 |

| Mauritius | 40 | 2,400 |

| Costa Rica | 30 | 1,000 |

2024 Monthly Searches For Each Brand

FXCM - US

FXCM - US

|

2,900

1st

|

OANDA - US

OANDA - US

|

49,500

2nd

|

FXCM - UK

FXCM - UK

|

2,900

3rd

|

OANDA - UK

OANDA - UK

|

33,100

4th

|

FXCM - France

FXCM - France

|

1,600

5th

|

OANDA - France

OANDA - France

|

22,200

6th

|

FXCM - Australia

FXCM - Australia

|

1,300

7th

|

OANDA - Australia

OANDA - Australia

|

6,600

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with OANDA receiving 4,647,000 visits vs. 365,000 for FXCM.

Our Most Popular Broker Verdict

OANDA is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – FXCM

OANDA beats FXCM with more forex pairs to choose from, 68 versus 42. But FXCM has far more in the category of share CFD trading at 219 to OANDAs 0. We found it surprising that OANDA doesn’t have shares trading with CFDs, not just because most forex brokers offer this, but because OANDA is such a major global broker.

We consider both brokers a toss-up with commodities as they have virtually equal offerings. Oanda gave us the edge to choose more bonds and treasuries, which we really liked.

On the other hand, FXCM flipped the score by offering 7 cryptocurrencies versus OANDA’s 4. In today’s markets, we find the more cryptos to trade, the better because there is a growing demand for crypto trading.

Should you be based in the UK, both brokers offer spread betting as an alternative to CFD trading.

| FXCM | OANDA | |

|---|---|---|

| Forex trading | 42 | 68 |

| Cryptocurrency trading | 7 | 4 |

| Share CFD trading | 219 | 0 |

| Commodities CFD trading | 3 Metals 5 Energies 3 Softs | 3 Metals (Gold and Silver x 10 other currencies) 3 Energies 4 Softs |

| ETF CFD trading | 0 | 0 |

| Indices CFD trading | 16 | 15 |

| Bonds/Treasuries CFD trading | 1 | 5 |

| Real Stocks | No | No |

| Other Products | Spread Betting | Spread Betting |

| Our Products Score | 7 | 6 |

Our Top Product Range and CFD Markets Verdict

Although FXCM has fewer forex pairs to trade, we feel they deserve a higher Tradable Products score than OANDA primarily because of OANDA’s lack of shares to choose from. OANDA is no slouch with 68 forex pairs, and we note that as a positive. But again, we feel that brokers today need to offer shares trading. We gave FXCM a score of 7 and OANDA a 6.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

8. Superior Educational Resources – Tie

FXCM’s in-house education is above average, primarily consisting of articles, videos, and content produced for its YouTube channel. The learning centre offers us two comprehensive guides and a vast library of nearly 200 articles covering topics such as trading tips, strategies, charting, and indicators. FXCM also offers a selection of articles broken down by experience level, catering to beginner, intermediate, and advanced traders.

OANDA offers us a well-structured education suite suitable for different levels of experience, and its market analysis is detailed and comprehensive, thanks to the in-house analysts and third-party provider, Market Pulse.

OANDA provides a variety of educational materials, including getting-started guides, tools and strategies, and capital management resources. Additionally, OANDA hosts frequent webinars covering various trading topics and maintains an archive of past webinars for on-demand viewing.

Our Superior Educational Resources Verdict

We thought FXCM and OANDA matched up well on education and research.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

9. Superior Customer Service – FXCM

When it comes to customer service, both OANDA and FXCM have their merits. OANDA offers 24/5 customer support through live chat, email, and phone, catering to traders around the globe. FXCM, on the other hand, provides a similar level of support but stands out with its educational webinars and market analysis updates.

In terms of accessibility and response time, OANDA’s live chat is generally quicker, while FXCM offers more in-depth responses. Below is a table summarising the key customer service features of each broker:

| Feature | OANDA | FXCM |

|---|---|---|

| Support Availability | 24/5 | 24/5 |

| Contact Methods | Live Chat, Email, Phone | Live Chat, Email, Phone |

| Educational Webinars | No | Yes |

| Market Analysis | Yes | Yes |

| Response Time | Quick | Moderate |

| In-depth Responses | Moderate | Yes |

Our Superior Customer Service Verdict

Based on our analysis, FXCM offers a slightly more comprehensive customer service experience, particularly with its educational webinars and in-depth responses.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

10. Better Funding Options – OANDA

When it comes to funding options, both OANDA and FXCM offer a variety of methods to suit different trader needs. OANDA provides the convenience of multiple payment options, including credit/debit cards, bank transfers, and PayPal. FXCM, on the other hand, also accepts credit/debit cards and bank transfers but adds the option of Skrill for traders who prefer e-wallets.

Here’s a table summarising the available funding options for each broker:

| Funding Option | Credit/Debit Card | Bank Transfer | PayPal | Skrill | Neteller | WebMoney | UnionPay | FasaPay | Bitcoin |

|---|---|---|---|---|---|---|---|---|---|

| OANDA | ✅ | ✅ | ✅ | ❌ | ❌ | ❌ | ❌ | ❌ | ❌ |

| FXCM | ✅ | ✅ | ❌ | ✅ | ❌ | ❌ | ❌ | ❌ | ❌ |

Our Better Funding Options Verdict

OANDA offers a slightly more versatile range of funding options, including PayPal, making it more convenient for a broader spectrum of traders.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

11. Lower Minimum Deposit – OANDA

OANDA has a lower minimum deposit requirement of $0 vs $50 from FXCM. Having said that, if you use cards or Trustly as your payment option, both channels require at least $25 or equivalent.

You will find more details in the table below.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £25 Minimum Deposit | $25 Minimum Deposit | €25 Minimum Deposit | $25 |

| Bank Wire | £0 Minimum Deposit | $0 Minimum Deposit | €0 Minimum Deposit | $0 |

| Trustly | £25 Minimum Deposit | $25 Minimum Deposit | €25 Minimum Deposit | $25 |

| Paypal | N/A | N/A | N/A | N/A |

Unlike OANDA, FXCM has a fixed minimum deposit amount for its traders.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

| Bank Wire | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

| Skrill | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

| Neteller | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

Our Lower Minimum Deposit Verdict

OANDA clearly takes the lead by offering a $0 minimum deposit despite its varying minimum amounts.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

So Is OANDA or FXCM The Best Broker?

FXCM is the winner because it excels in a greater number of categories, particularly in trading platforms, customer service, and product range. Below is a table that summarises the key information leading to this verdict.

| Criteria | OANDA | FXCM |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ✅ |

| Better Trading Platform | ❌ | ✅ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience And Ease | ❌ | ✅ |

| Stronger Trust And Regulation | ✅ | ✅ |

| Top Product Range And CFD Markets | ❌ | ✅ |

| Superior Educational Resources | ✅ | ✅ |

| Superior Customer Service | ❌ | ✅ |

| Better Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ✅ | ❌ |

OANDA: Best For Beginner Traders

OANDA is better suited for beginner traders due to its lower minimum deposit and more straightforward account features.

FXCM: Best For Experienced Traders

FXCM is the better choice for experienced traders, offering a superior trading platform and a wider range of products.

FAQs Comparing FXCM Vs OANDA

Does OANDA or FXCM Have Lower Costs?

It’s a tie between OANDA and FXCM when it comes to lower costs. Both brokers offer competitive spreads, but the exact numbers can vary based on the trading pair and market conditions. For example, OANDA has an average spread for EUR/USD at 1.2, while FXCM’s is slightly higher at 1.3. For more information on low-cost trading, you can visit this comprehensive Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

FXCM is the better choice for MetaTrader 4 users. The broker provides a seamless experience with additional plugins and a user-friendly interface. If you’re keen on using MT4, you might want to check out this list of the best MT4 brokers.

Which Broker Offers Social Trading?

Neither OANDA nor FXCM offer social or copy trading at this time. If social trading is a key factor for you, you may need to look at other brokers. For more options, you can explore this list of the best social trading platforms.

Does Either Broker Offer Spread Betting?

FXCM offers spread betting, while OANDA does not. Spread betting with FXCM is available for UK residents and provides a tax-efficient way to trade. For more details on spread betting, you can check out this comprehensive guide for the best spread betting brokers.

What Broker is Superior For Australian Forex Traders?

In my opinion, OANDA is the superior choice for Australian Forex traders. Both OANDA and FXCM are ASIC regulated, but OANDA has a more comprehensive offering for the Australian market. If you’re an Aussie trader, you might find this list of the Best Forex Brokers In Australia useful for more options.

What Broker is Superior For UK Forex Traders?

From my perspective, FXCM is the better option for UK Forex traders. Both brokers are FCA regulated, but FXCM offers spread betting, which is a tax-efficient way to trade in the UK. For more information on the Best Forex Brokers In UK, you can visit this comprehensive list of the Best Forex Brokers In UK.

Please note: The information above is based on FXCM Australia and OANDA; most information should apply globally, but there may be differences (especially in Canada and the USA).

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert