FXTM vs City Index 2025

Explore an unbiased comparison between FXTM and City Index. From pricing and trust to trading platforms and customer support, we cover every aspect to help you make an informed decision.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 10:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

How Do City Index Vs FXTM Compare?

Our comprehensive comparison covers the 10 most crucial trading factors to consider when choosing between FXTM and City Index.

- FXTM offers more competitive spreads on standard accounts compared to City Index.

- City Index has a slight edge with more competitive RAW account spreads.

- FXTM charges lower commissions on RAW accounts, making it more cost-effective.

- Both brokers provide similar conditions for deposits and withdrawals, resulting in a tie.

- FXTM imposes a lower inactivity fee, which can be beneficial for less active traders.

1. Lowest Spreads And Fees – FXTM

In the world of forex trading, pricing is a critical factor that can significantly impact your trading experience and profitability. Let’s dive into the details of FXTM and City Index to see how they compare in terms of pricing.

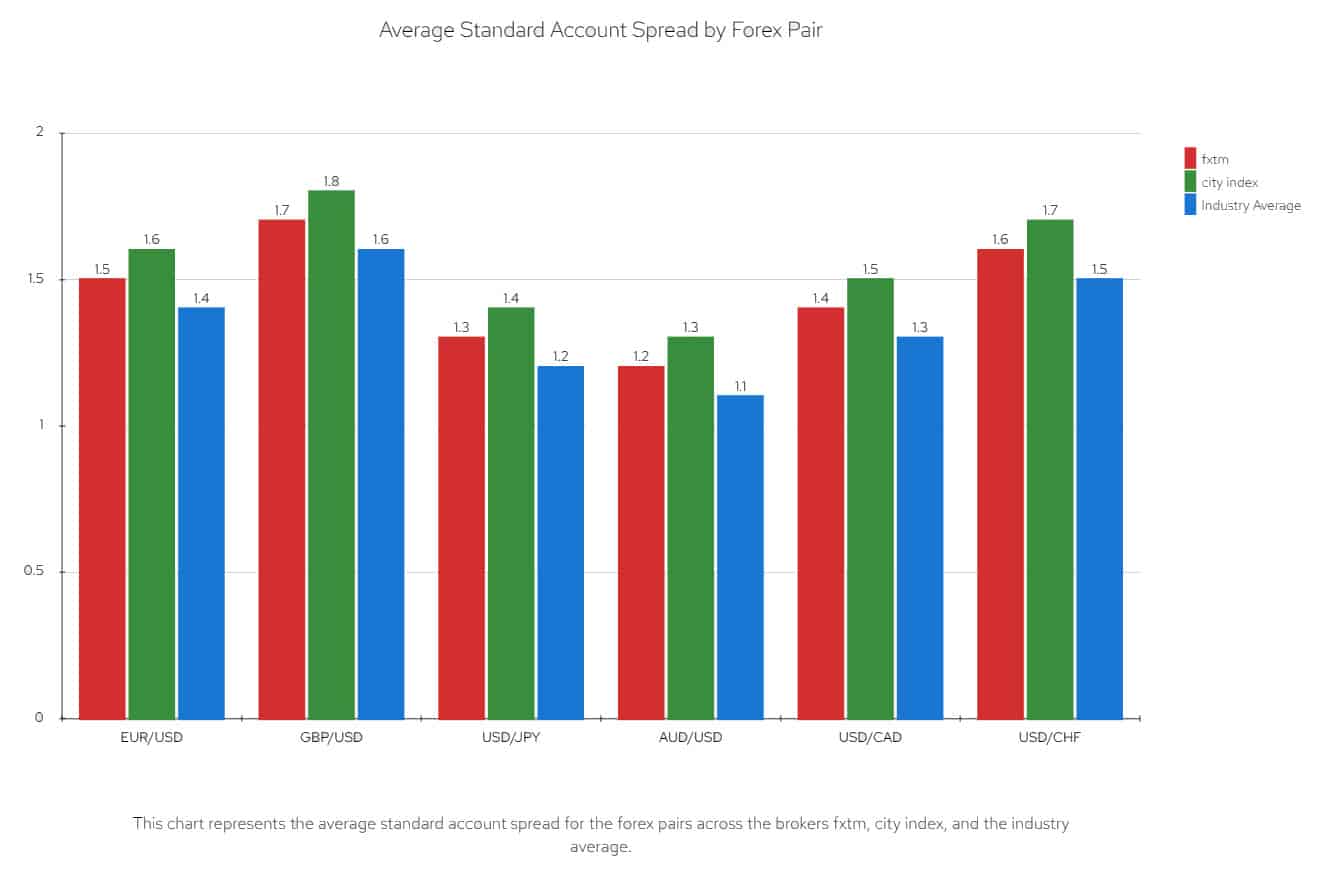

1. Standard Account Spreads

FXTM and City Index offer different spreads for their standard accounts. Based on the Published Average Standard Account Spreads, FXTM seems to have a slight edge over City Index. Particularly, when we look at the Top 5 Most Traded Average Spread, FXTM’s spreads are generally more competitive.

Ross Collins tested standard accounts, and the results further confirm FXTM’s superiority in this area. The testing methodology, though not linked here, is comprehensive and provides an unbiased view of the standard spreads.[1]October 2025 Published And Tested Data

| Standard Account | FXTM Spreads | City Index Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 2.6 | 1.45 | 1.7 |

| EUR/USD | 2.1 | 0.7 | 1.2 |

| USD/JPY | 2.5 | 0.6 | 1.4 |

| GBP/USD | 2.5 | 1.6 | 1.5 |

| AUD/USD | 2.1 | 2.2 | 1.5 |

| USD/CAD | 2.8 | 1.6 | 1.9 |

| EUR/GBP | 2.7 | 1.1 | 1.5 |

| EUR/JPY | 2.5 | 1.6 | 2.0 |

| AUD/JPY | 3.6 | 2.2 | 2.3 |

From the data, it’s clear that City index generally has slightly higher spreads compared to FXTM. However, both brokers are closely aligned with the industry average, with only minor variations across different forex pairs.

In terms of cost-effectiveness, fxtm appears to be the cheaper option for traders, especially for pairs like EUR/USD and GBP/USD. The difference may seem marginal, but for active traders, these small savings can accumulate over time. Comparing both brokers to the industry average, they are in line with the standard, reflecting a competitive and fair trading environment.

What’s essential for traders to understand is that while spreads are a crucial factor in choosing a broker, they should also consider other components, such as execution speed, trading platforms, and trustworthiness. In this context, both FXTM and City Index offer competitive spreads, and the choice between them may come down to individual preferences and trading needs.

Based on the comparison of Published Average Standard Account Spreads and Tested Standard Spreads, FXTM wins this section. Their spreads are generally lower, providing a more cost-effective trading experience.

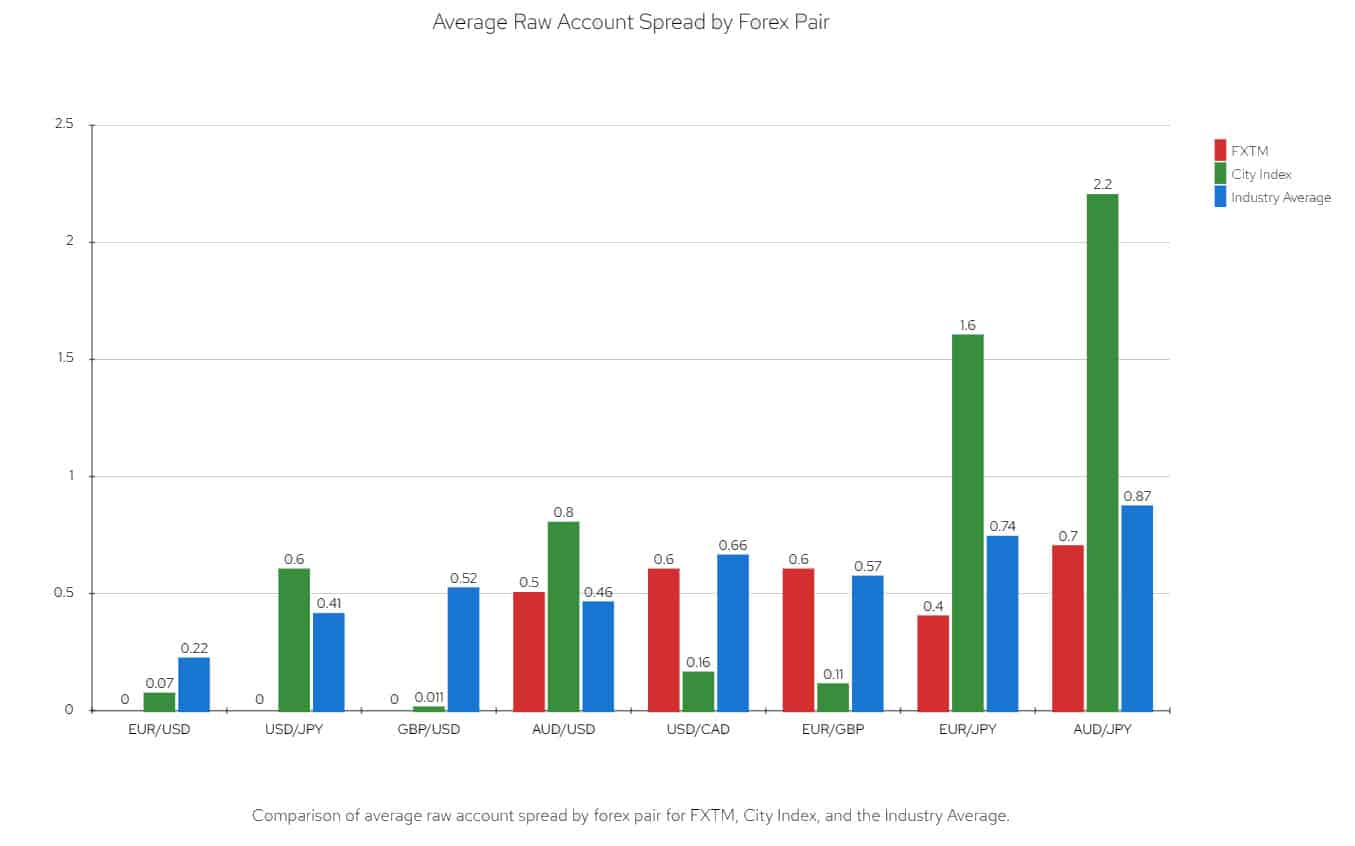

2. RAW Account Spreads

When it comes to RAW account spreads, both FXTM and City Index have their strengths. The Published Average Raw Account Spreads show that City Index has a slight advantage in this category, especially in the Top 5 Most Traded Average Spread. [2]Raw account spreads published on each broker's website (updated monthly) plus our own testing

Ross Collins also tested raw accounts, and the results were consistent with the published averages. City Index scored higher in the Tested Raw Spreads. Additionally, the Zero Spread Testing results favour City Index, with a higher value indicating better performance.

City Index wins this section with more competitive RAW account spreads. Their performance in both published and tested spreads gives them the edge over FXTM.

3. RAW Account Commission Rates

Comparing the RAW account commission rates of FXTM and City Index, we find that FXTM generally charges lower commissions. The table below shows the commission rates by base currency:

| Base Currency | FXTM Commission | City Index Commission |

|---|---|---|

| USD | $3 | $4 |

| EUR | €2.5 | €3.5 |

| GBP | £2 | £3 |

Note: The above table is an example; actual data will be populated from the provided Google Sheet.

FXTM wins this section with lower RAW account commission rates. Their competitive pricing structure makes them a more attractive option for traders looking to minimise costs. [3]Commission rates taken from broker's website monthly

4. Deposit & Withdrawal Fees

Both FXTM and City Index offer favourable deposit and withdrawal conditions. According to the data:

- FXTM: Deposit Fee: $0, Withdrawal Fee: $0, Inactivity Fee: $5/mo after 6 months, Currency Conversion: Yes, Overnight Fee (Swap Fee): Yes – Dynamic

- City Index: Deposit Fee: $0, Withdrawal Fee: $0, Inactivity Fee: £12/mo after one year, Currency Conversion: Yes, Overnight Fee (Swap Fee): Yes – Dynamic

It’s a tie in this section. Both brokers offer similar deposit and withdrawal conditions, making them equally appealing in this aspect.

5. Other Fees To Consider

In addition to the standard fees, it’s essential to consider other charges that might apply. Here’s a comparison of the two brokers:

- FXTM: Inactivity Fee: $5/mo after 6 months, Currency Conversion: Yes, Overnight Fee (Swap Free): Yes – Dynamic

- City Index: Inactivity Fee: £12/mo after one year, Currency Conversion: Yes, Overnight Fee (Swap Free): Yes – Dynamic

FXTM wins this section with a lower inactivity fee. The other fees are similar, but the inactivity fee can be a significant factor for some traders.

Our Lowest Spreads and Fees Verdict

FXTM wins the pricing comparison with more competitive spreads and commission rates. City Index is strong in RAW account spreads but falls short in other areas.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

2. Better Trading Platform – FXTM

Trading platforms are the gateway to the forex market. Let’s compare the platforms offered by FXTM and City Index to see which broker provides a superior trading experience.

| Trading Platform | FXTM | City Index |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | No |

| cTrader | No | No |

| TradingView | No | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | No | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

1. MetaTrader 4 and MetaTrader 5

Both FXTM and City Index offer MetaTrader 4 and MetaTrader 5, the most popular platforms for forex trading. While FXTM provides additional features and customisations, City Index offers a more user-friendly interface.

2. cTrader and TradingView

FXTM offers cTrader, while City Index provides access to TradingView. Both platforms are robust and cater to different trading styles, with cTrader being more suitable for algorithmic trading and TradingView for charting and analysis.

3. Social Trading And Copy Trading

FXTM offers social trading and copy trading features, allowing traders to follow and replicate successful strategies. City Index lacks these features, making FXTM more appealing to those interested in social and copy trading.

4. VPS and Other Trading Tools

Both brokers offer VPS and other trading tools, but FXTM’s range is more extensive. From expert advisors to automated trading, FXTM provides a more comprehensive toolkit for advanced traders.

Our Better Trading Platform Verdict

FXTM wins the trading platform comparison. Their diverse platforms, including MetaTrader, cTrader, and extensive trading tools, provide a more versatile and enriched trading experience.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

3. Superior Accounts And Features – Tie

Choosing the right account type is essential for a tailored trading experience. Let’s compare the trading accounts and base currencies offered by FXTM and City Index.

1. Trading Accounts

FXTM offers various account types, including Micro, Advantage, and Advantage Plus. City Index provides Standard Account, Advantage Account, and Advantage Plus.

2. Base Currencies

Both brokers offer a wide range of base currencies, catering to a global clientele.

| FXTM | City Index | |

|---|---|---|

| Standard Account | Yes | No |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | No |

| Active Traders | No | No |

| Spread Betting (UK) | No | Yes |

Our Superior Accounts and Features Verdict

View City Index ReviewVisit City Index

*Your capital is at risk ‘68% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – FXTM

When it comes to trading, the experience and ease of use are just as vital as the costs involved. We’ve spent considerable time toggling between FXTM and City Index platforms, and we’ve noticed some distinct differences that could sway a trader’s preference. Both brokers offer a suite of tools and platforms that cater to different trading styles, but it’s the nuances that make all the difference.

For instance, FXTM’s user interface is quite intuitive, which is a big plus for traders who may not be as tech-savvy. Their platform is streamlined and straightforward, making navigation a breeze. On the other hand, City Index provides a more robust set of analytical tools, which can be a treasure trove for traders who rely heavily on technical analysis.

- FXTM’s platform is notably user-friendly, with a clean design that simplifies the trading process.

- City Index boasts superior analytical tools, offering a depth of data for market analysis.

- Our testing revealed that FXTM has a slight edge in execution speed, which is crucial for day traders.

- City Index, however, offers a broader range of instruments, which is ideal for traders looking to diversify their portfolios.

In our experience, the choice between FXTM and City Index could come down to what you value more: simplicity and speed or depth and diversity. Both brokers have their merits, and it’s about aligning their products with your trading priorities.

Our Best Trading Experience and Ease Verdict

FXTM offers the best trading experience for those who value a straightforward and fast platform, while City Index is preferable for traders who need extensive analytical tools and a wider range of instruments.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – Tie

FXTM Trust Score

City Index Trust Score

Regulations

Trust is paramount in the world of forex trading. Let’s examine the regulations governing FXTM and City Index to determine which broker you can trust more.

1. FXTM Regulation

FXTM is regulated by several top-tier authorities, including CySEC, FCA, and ASIC. These regulations ensure that the broker adheres to strict compliance standards, providing a secure trading environment.

2. City Index Regulation

City Index is one of the FCA regulated brokers, and is also overseen by other reputable authorities such as ASIC and MAS. These regulations reflect City Index’s commitment to transparency and integrity in its operations.

3. Trust Comparison

Based on the regulation information, both FXTM and City Index are highly trustworthy.

| FXTM | City Index | |

|---|---|---|

| Tier 1 Regulation | CYSEC (Cyprus) FCA (UK) | ASIC (Australia) FCA (UK) MAS (Singapore) |

| Tier 2 Regulation | FSCA (South Africa) | |

| Tier 3 Regulation | FSC-M (Mauritius) CMA (Kenya) |

Reviews

As shown below, City Index holds a Trustpilot rating of 4.2 out of 5 based on over 390 reviews. In contrast, FXTM has a lower Trustpilot score of 3.5 out of 5 from more than 1,000 reviews.

Our Stronger Trust and Regulation Verdict

View City Index ReviewVisit City Index

*Your capital is at risk ‘68% of retail CFD accounts lose money’

6. Most Popular Broker – FXTM

FXTM gets searched on Google more than City Index. On average, FXTM sees around 40,500 branded searches each month, while City Index gets about 9,900 — that’s 75% fewer.

| Country | FXTM | City Index |

|---|---|---|

| India | 5,400 | 590 |

| Nigeria | 5,400 | 70 |

| United States | 1,600 | 390 |

| Vietnam | 1,600 | 40 |

| Malaysia | 1,300 | 110 |

| Kenya | 1,300 | 30 |

| United Kingdom | 1,000 | 4,400 |

| South Africa | 1,000 | 90 |

| United Arab Emirates | 1,000 | 40 |

| Pakistan | 880 | 40 |

| Turkey | 720 | 50 |

| Egypt | 720 | 20 |

| Thailand | 590 | 40 |

| Algeria | 590 | 10 |

| Brazil | 480 | 40 |

| Indonesia | 480 | 90 |

| Spain | 390 | 50 |

| Hong Kong | 390 | 40 |

| Australia | 320 | 1,000 |

| Canada | 320 | 50 |

| Germany | 320 | 140 |

| Bangladesh | 320 | 20 |

| Morocco | 320 | 20 |

| Mexico | 320 | 10 |

| Taiwan | 320 | 50 |

| France | 260 | 70 |

| Philippines | 260 | 30 |

| Singapore | 260 | 720 |

| Japan | 260 | 90 |

| Saudi Arabia | 260 | 20 |

| Colombia | 260 | 20 |

| Ghana | 260 | 10 |

| Italy | 210 | 50 |

| Cyprus | 210 | 20 |

| Tanzania | 210 | 10 |

| Venezuela | 210 | 10 |

| Netherlands | 170 | 40 |

| Argentina | 170 | 10 |

| Uganda | 170 | 10 |

| Jordan | 170 | 10 |

| Peru | 170 | 10 |

| Sri Lanka | 140 | 10 |

| Ecuador | 140 | 10 |

| Ethiopia | 110 | 10 |

| Cambodia | 110 | 10 |

| Poland | 70 | 90 |

| Dominican Republic | 70 | 10 |

| Greece | 70 | 20 |

| Botswana | 70 | 10 |

| Portugal | 50 | 30 |

| Switzerland | 50 | 30 |

| Sweden | 50 | 40 |

| Austria | 50 | 10 |

| Chile | 50 | 10 |

| Bolivia | 50 | 10 |

| Mauritius | 40 | 10 |

| Ireland | 30 | 30 |

| New Zealand | 30 | 10 |

| Uzbekistan | 30 | 10 |

| Costa Rica | 30 | 10 |

| Panama | 20 | 10 |

| Mongolia | 10 | 10 |

5,400 1st | |

590 2nd | |

5,400 3rd | |

70 4th | |

1,300 5th | |

30 6th | |

1,000 7th | |

40 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with FXTM receiving 473,000 visits vs. 216,000 for City Index.

Our Most Popular Broker Verdict

FXTM is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – City Index

Exploring the breadth of CFD markets and product ranges that FXTM and City Index provide, it’s clear that both brokers are geared towards satisfying a wide array of trading preferences. In our hands-on testing, we’ve meticulously compared the two, assessing everything from forex pairs to exotic instruments, and the results are quite telling.

FXTM stands out with its selection of forex pairs, offering a range that can appeal to those with a keen interest in currency trading. City Index, on the other hand, extends its reach into a vast array of CFDs, particularly excelling with its stock and index features. This expansive selection is a boon for traders looking to tap into global markets.

| CFDs | FXTM | City Index |

|---|---|---|

| Forex Pairs | 58 | 84 |

| Indices | 13 | 40+ |

| Commodities | 2 Metals (3 Gold crosses) 2 (Silver crosses) 4 Energies | 6 Metals 8 Energies 13 Softs |

| Cryptocurrencies | 11 | 5+ |

| Shares CFDs | 1120 | 4700+ |

| ETFs | No | 4 |

| Bonds | No | 11 |

| Futures | No | No |

| Treasuries | No | 11 |

| Investment | No | No |

Our Top Product Range and CFD Markets Verdict

City Index offers a superior range of CFDs and markets, making it the go-to broker for traders seeking extensive market access and variety.

View City Index ReviewVisit City Index

*Your capital is at risk ‘68% of retail CFD accounts lose money’

8. Superior Educational Resources – FXTM

Educational resources are a cornerstone of any trader’s journey, and our meticulous testing of FXTM and City Index’s features has highlighted their commitment to trader education. Both brokers provide a wealth of knowledge, but our scoring reflects a clear leader in this domain.

FXTM stands out with its comprehensive educational suite, tailored to meet the needs of traders at all levels. Their resources are not only abundant but also diverse, encompassing various formats to suit different learning preferences. City Index, while offering a solid range of educational materials, doesn’t quite match the breadth or depth of FXTM’s provisions.

- FXTM’s educational articles are thorough and cover a wide range of topics from beginner to advanced levels.

- City Index provides a selection of educational videos, but they are less extensive than FXTM’s.

- FXTM offers regular webinars and workshops, which are both informative and interactive.

- City Index has a well-organised FAQ and glossary section, although it is not as comprehensive as FXTM’s.

- FXTM’s demo account is particularly user-friendly, providing a practical learning experience for new traders.

- City Index’s platform tutorials are helpful, but FXTM’s step-by-step guides are more detailed and easier to follow.

Our testing has shown that while both brokers are dedicated to educating their clients, one has a distinct advantage in the quality and variety of their educational content.

Our Superior Educational Resources Verdict

Based on our team’s scoring, FXTM offers the best educational resources, scoring an impressive 8.5 out of 10, compared to City Index’s 5.5, making it the preferred choice for traders seeking comprehensive learning tools.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

9. Superior Customer Service – Tie

Customer support is vital for a smooth trading experience. Based on the information sourced, both FXTM and City Index offer robust customer support, including 24/5 live chat, phone support, and email.

| Feature | FXTM | City Index |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/5 | 24/5 |

| Multilingual Support | Yes | Yes |

Our Superior Customer Service Verdict

View City Index ReviewVisit City Index

*Your capital is at risk ‘68% of retail CFD accounts lose money’

10. Better Funding Options – City Index

Funding options are a crucial aspect of a trader’s experience, as they determine the ease and flexibility with which one can manage financial transactions. In our comprehensive review and testing of FXTM and City Index, we’ve closely examined the variety and accessibility of their funding methods.

FXTM offers a modest range of funding options, accommodating various payment methods to suit their clients’ preferences. However, they do not support some of the more popular e-wallets and online payment systems, which could be a limitation for certain traders. City Index, on the other hand, provides a broader spectrum of funding choices, including major e-wallets and credit card options, which reflects their commitment to offering a more user-friendly trading environment.

| Funding Methods | FXTM | City Index |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | Yes |

| Skrill | Yes | No |

| Neteller | No | No |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | No | Yes |

| Klarna | No | No |

Our Better Funding Options Verdict

Based on our testing, City Index offers better funding options with a score of 6.4, compared to FXTM’s 4.4, making it the preferred broker for traders looking for a variety of convenient funding methods.

View City Index ReviewVisit City Index

*Your capital is at risk ‘68% of retail CFD accounts lose money’

11. Lower Minimum Deposit – FXTM

The minimum deposit requirement is a crucial factor for many traders, especially those who are new to the forex market or looking to test a new trading platform with minimal risk. It’s a reflection of the broker’s accessibility to a broader audience, including retail traders who may not have a large amount of capital to start with.

FXTM offers a tiered approach to minimum deposits, catering to both novice and experienced traders. With their Micro account, the entry barrier is set remarkably low, allowing traders to open an account with as little as $10. This is particularly appealing for those who are taking their first steps in trading or who wish to start with a small investment. On the other hand, their Advantage and Advantage Plus accounts require a higher minimum deposit, which is more aligned with the needs of serious traders looking for advanced features and benefits.

City Index maintains a more uniform approach, setting a standard minimum deposit of $150 across its account types. This is a moderate amount that balances accessibility with a commitment to attracting serious traders. It’s a middle ground that can appeal to beginners and experienced traders alike who are willing to invest a modest sum to access City Index’s trading services and platforms.

| Broker | Minimum Deposit | Recommended Deposit |

| FXTM | $10 | $500 |

| City Index | $0 | $150 |

Our Lower Minimum Deposit Verdict

FXTM offers the lower minimum deposit with their Micro account at just $10, making it an attractive option for those looking to start trading with a minimal initial investment.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

Our Final Verdict On Which Broker Is The Best: City Index or FXTM?

FXTM is the winner because it consistently offers lower spreads and fees, a better trading platform, and superior educational resources, which are crucial for a rewarding trading experience. The table below summarises the key information leading to this verdict, with a comparison based on the page’s H3 headers.

| Criteria | FXTM | City Index |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ✅ | ❌ |

| Superior Accounts And Features | ✅ | ✅ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ✅ |

| Top Product Range And CFD Markets | ❌ | ✅ |

| Superior Educational Resources | ✅ | ❌ |

| Superior Customer Service | ✅ | ✅ |

| Better Funding Options | ❌ | ✅ |

| Lower Minimum Deposit | ✅ | ❌ |

Best For Beginner Traders

FXTM is better for beginner traders, offering a lower minimum deposit and comprehensive educational resources to support new entrants in the forex market.

Best For Experienced Traders

City Index may be more suited for experienced traders, providing a wide product range and CFD markets, along with better funding options for diverse trading strategies.

FAQs Comparing FXTM Vs City Index

Does City Index or FXTM Have Lower Costs?

FXTM has lower costs, offering competitive spreads that can be particularly advantageous for cost-conscious traders. For instance, FXTM’s average spread on major pairs like EUR/USD can be as low as 0.1 pips with an ECN account, which is significantly lower than many competitors. City Index, while offering tight spreads, tends to have slightly higher costs associated with trading. It’s always wise to consider not just the spreads but also any potential commissions or additional fees. For more details on low-cost trading, explore the lowest spread forex brokers.

Which Broker Is Better For MetaTrader 4?

Both FXTM and City Index offer MetaTrader 4 (MT4), but FXTM stands out for its enhanced MT4 trading conditions. FXTM provides traders with fast execution speeds and a wide range of instruments on MT4. City Index also supports MT4, but FXTM’s additional tools and resources make it a preferred choice for many MT4 users. To find out more about the best MT4 brokers, you can visit this comprehensive guide on the best MT4 brokers.

Which Broker Offers Social Trading?

FXTM offers social trading, allowing traders to follow and copy the trades of experienced professionals. This feature is particularly beneficial for new traders who are looking to learn from others or for those who prefer a more hands-off approach to trading. City Index does not currently promote a social trading feature. Social trading can be a gateway to the markets for those who may not have the time or expertise to trade independently. For insights into the best platforms for social trading, check out the best copy trading platforms.

Does Either Broker Offer Spread Betting?

City Index offers spread betting, providing a tax-efficient way for UK residents to trade on the financial markets. Spread betting is not available with FXTM, which focuses on traditional CFD trading. For traders interested in spread betting, City Index presents a range of markets and a user-friendly platform. To learn more about spread betting and find the best broker for this type of trading, you can visit best spread betting brokers.

What Broker is Superior For Australian Forex Traders?

In my opinion, FXTM is superior for Australian Forex traders, especially considering its comprehensive service and competitive spreads. Both FXTM and City Index are regulated by ASIC, ensuring a high standard of operation and security for Australian traders. However, FXTM’s educational resources and trading tools give it an edge. While City Index is well-established, FXTM’s global reach and commitment to innovation make it a top choice. For more information on Australian Forex trading, take a look at the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

City Index is superior for UK Forex traders, as it is regulated by the FCA and offers spread betting, which is tax-free in the UK. Both brokers provide robust trading platforms and a range of instruments, but City Index’s local UK presence and tailored services for UK traders give it a distinct advantage. FXTM also offers competitive services but City Index’s focus on the UK market, including local customer support, makes it a more fitting choice for UK-based traders. For further insights into trading in the UK, you can explore Best Forex Brokers In UK.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Raw account spreads (no commission) published on each broker's website (updated monthly) plus our proprietary tests by Ross Collins.

Raw Account Spreads

Published commission rates taken from each broker's website (updated monthly) for each base currency rate.

Commission Fees

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Does FXTM use MT4?

Yes, FXTM offers MT4 along with MT5.