Hugo's Way vs Trader's Way 2026

Explore the key differences between Hugo’s Way and Trader’s Way, two popular forex brokers. Understand their trading costs, platforms, trust and regulation, account types, trading environment, customer service, and other trading factors to make an informed decision.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

How Do Trader’s Way Vs Hugo’s Way Compare?

Our full comparison covers the 10 most important trading factors. Here are five noticeable differences between Hugo’s Way and Trader’s Way:

- Hugo’s Way charges a commission of $5 per lot per side, while Trader’s Way charges $2.5 per lot per side.

- Hugo’s Way has a withdrawal fee of 2.5%, whereas Trader’s Way doesn’t charge any withdrawal fees.

- Both brokers offer MetaTrader 4 and 5, but only Trader’s Way offers cTrader.

- Hugo’s Way is registered in St. Vincent and the Grenadines, while Trader’s Way is registered in the Commonwealth of Dominica.

- Hugo’s Way requires a minimum deposit of $50 for a Live account, while Trader’s Way requires only $10.

1. Lowest Spreads And Fees: Trader’s Way

When it comes to trading costs, both brokers have their strengths and weaknesses. Let’s delve into the Lowest Commission Brokers to see how they compare.

Spreads

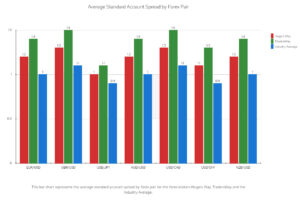

Looking at the data, we can see some interesting differences between the two forex brokers, Hugo’s Way and TradersWay.

Hugo’s Way has a slightly lower spread on the EUR/USD, AUD/USD, USD/CAD, and NZD/USD pairs. However, TradersWay offers a lower spread on the GBP/USD, USD/JPY, and USD/CHF pairs. It’s a close call, but overall, I’d say Hugo’s Way seems to be the cheaper option for most of the major pairs.

| Standard Account | Hugosway Spreads | Tradersway Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.76 | 2.53 | 1.7 |

| EUR/USD | 0.9 | 1.4 | 1.2 |

| USD/JPY | 1.5 | 1.6 | 1.5 |

| GBP/USD | 1.7 | 2.1 | 1.6 |

| AUD/USD | 1.3 | 2.5 | 1.6 |

| USD/CAD | 1.7 | 2.6 | 1.9 |

| EUR/GBP | 3.6 | 2.5 | 1.5 |

| EUR/JPY | 3.0 | 2.6 | 2.1 |

| AUD/JPY | 0.4 | 4.9 | 2.3 |

Standard Account Analysis Updated February 2026[1]February 2026 Published And Tested Data

But how do these brokers compare to the industry average? Well, both brokers offer competitive spreads, often lower than the industry average. This is good news for traders, as lower spreads mean lower trading costs.

Remember, the choice of a broker should not be based solely on spreads. Other factors, such as the trading environment, regulation, trading platforms, and customer service, are also important. But if you’re looking for a broker with low spreads, both Hugo’s Way and TradersWay are worth considering.

Commissions

Hugo’s Way charges a commission of $5 per lot per side, whereas Trader’s Way charges a commission of $2.5 per lot per side.

Deposit & Withdrawal Fees

Both brokers do not charge any deposit fees. However, Hugo’s Way charges a withdrawal fee of 2.5%, while Trader’s Way does not charge any withdrawal fees.

Other Fees

Neither broker charges inactivity fees or account maintenance fees.

Our Lowest Spreads and Fees Verdict

Trader’s Way wins this round due to its lower commission and absence of withdrawal fees.

Traders Way ReviewVisit Traders Way

2. Better Trading Platform: Trader’s Way

Both Hugo’s Way and Trader’s Way offer a range of trading platforms to cater to different trading styles and preferences. Let’s look at the Best cTrader Brokers to see how they compare.

| Trading Platform | Hugo's Way | Trader's Way |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | No | Yes |

| cTrader | No | Yes |

| TradingView | No | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | No | No |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

MetaTrader 4 and 5

Both brokers offer MetaTrader 4 and 5, the most popular trading platforms in the forex industry. These platforms are known for their advanced charting tools, automated trading capabilities, and extensive customizability.

cTrader and TradingView

While Hugo’s Way does not offer cTrader or TradingView, Trader’s Way offers cTrader, a platform known for its intuitive interface and advanced order capabilities.

Social And Copy Trading

Hugo’s Way offers social and copy trading through ZuluTrade and Myfxbook, allowing traders to copy the trades of successful traders. Trader’s Way does not offer social or copy trading.

VPS and Other Trading Tools

Both brokers offer VPS services for uninterrupted trading. They also offer various trading tools such as economic calendars, market news, and analysis.

Our Better Trading Platform Verdict

Trader’s Way wins this round due to its wider range of trading platforms.

3. Superior Accounts And Features: Trader’s Way

Hugo’s Way offers two types of accounts: a Demo account and a Live account. The Demo account allows traders to practice trading with virtual money, while the Live account requires a minimum deposit of $50 and offers leverage up to 1:500. Let’s look at the Best spread betting brokers to see how they compare.

Trader’s Way also offers two types of accounts: a Demo account and a Live account. The Demo account is for practice, while the Live account requires a minimum deposit of $10 and offers leverage up to 1:1000.

Our Superior Accounts and Features Verdict

Trader’s Way wins this round due to its lower minimum deposit requirement and higher leverage.

| Hugo's Way | Trader's Way | |

|---|---|---|

| Standard Account | No | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | No | No |

| Active Traders | No | No |

| Spread Betting (UK) | No | No |

4. Best Trading Experience And Ease: Trader’s Way

When it comes to the overall trading experience and ease of use, both Hugo’s Way and Trader’s Way have their unique offerings. From our own testing and the data we’ve gathered, it’s evident that the trading platforms play a significant role in enhancing the user experience. Hugo’s Way and Trader’s Way both offer MetaTrader 4 and 5, which are renowned for their user-friendly interfaces and advanced charting tools.

- Both brokers provide MetaTrader 4 and 5, ensuring familiarity for many traders.

- Trader’s Way offers cTrader, known for its intuitive interface and advanced order capabilities.

- Hugo’s Way offers social and copy trading through ZuluTrade and Myfxbook.

- Both brokers offer VPS services for uninterrupted trading, ensuring trades are executed without hitches.

Our Best Trading Experience and Ease Verdict

While both brokers offer robust platforms, Trader’s Way edges out slightly due to its inclusion of cTrader, providing traders with a more diverse trading experience.

5. Stronger Trust And Regulation: Tie

Stronger trust and regulation are essential for brokers, as they guarantee a secure and transparent trading environment.

Tradersway Trust Score

Hugo’s Way Trust Score

1. Regulations

Hugo’s Way is registered in St. Vincent and the Grenadines, while Trader’s Way is registered in the Commonwealth of Dominica. Neither broker is regulated by a tier-1 or tier-2 financial authority, which may raise concerns about their reliability and trustworthiness. Let’s look at the ASIC Regulated Brokers to see how they compare.

| Criteria | Hugo’s Way | Trader’s Way |

|---|---|---|

| Registered Country | St. Vincent and the Grenadines | Commonwealth of Dominica |

| Regulation | No tier-1 or tier-2 regulation | No tier-1 or tier-2 regulation |

2. Reputation

Hugo’s Way gets searched on Google more than Trader’s Way. On average, Trader’s Way sees around 4,400 branded searches each month, while Hugo’s Way gets about 6,600 — that’s 33% fewer.

| Country | Trader's Way | Hugo's Way |

|---|---|---|

| Colombia | 1,300 | 5,400 |

| Uzbekistan | 260 | 170 |

| India | 170 | 110 |

| Nigeria | 70 | 90 |

| Indonesia | 30 | 40 |

| Malaysia | 30 | 40 |

| Argentina | 320 | 30 |

| Germany | 320 | 30 |

| United Arab Emirates | 20 | 30 |

| Thailand | 50 | 30 |

| Peru | 260 | 30 |

| Vietnam | 30 | 30 |

| Brazil | 390 | 20 |

| Singapore | 90 | 20 |

| Hong Kong | 40 | 20 |

| Spain | 10 | 20 |

| Venezuela | 10 | 20 |

| Sri Lanka | 10 | 20 |

| Kenya | 30 | 20 |

| Turkey | 10 | 10 |

| Morocco | 10 | 10 |

| Philippines | 20 | 10 |

| Pakistan | 20 | 10 |

| Bangladesh | 10 | 10 |

| United States | 20 | 10 |

| Australia | 10 | 10 |

| Poland | 20 | 10 |

| Ethiopia | 10 | 10 |

| Ecuador | 20 | 10 |

| Saudi Arabia | 20 | 10 |

| United Kingdom | 10 | 10 |

| Taiwan | 10 | 10 |

| South Africa | 70 | 10 |

| Uruguay | 30 | 10 |

| Switzerland | 10 | 10 |

| Jordan | 20 | 10 |

| Algeria | 20 | 10 |

| Italy | 10 | 10 |

| Sweden | 10 | 10 |

| Mexico | 20 | 10 |

| Bolivia | 20 | 10 |

| Netherlands | 20 | 10 |

| Tanzania | 10 | 10 |

| Ireland | 10 | 10 |

| Cyprus | 10 | 10 |

| Canada | 10 | 10 |

| Portugal | 20 | 10 |

| Botswana | 10 | 10 |

| Greece | 10 | 10 |

| Austria | 10 | 10 |

| Chile | 10 | 10 |

| Ghana | 10 | 10 |

| New Zealand | 10 | 10 |

| France | 10 | 10 |

| Mauritius | 10 | 10 |

| Dominican Republic | 10 | 10 |

| Japan | 40 | 10 |

| Egypt | 10 | 10 |

| Panama | 10 | 10 |

| Uganda | 10 | 10 |

| Cambodia | 10 | 10 |

| Mongolia | 10 | 10 |

| Costa Rica | 10 | 10 |

1,300 1st | |

5,400 2nd | |

260 3rd | |

170 4th | |

70 5th | |

90 6th | |

30 7th | |

40 8th |

Similarweb shows a similar story when it comes to August 2025 website visits with Trader’s Way receiving 20,456 visits vs. 33,578 for Hugo’s Way.

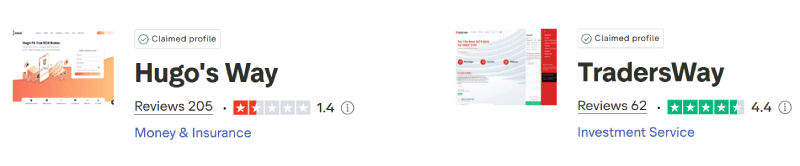

3. Reviews

As shown below, Hugo’s Way has a low Trustpilot rating of 1.4 out of 5, based on over 200 reviews. TradersWay holds a much stronger rating of 4.4 out of 5, from around 60 reviews. TradersWay is viewed far more favorably than Hugo’s Way on Trustpilot, with significantly better customer feedback and overall satisfaction. Hugo’s Way faces serious trust and reliability concerns among users.

Our Stronger Trust and Regulation Verdict

Neither broker wins this round due to the lack of regulation by a reputable financial authority.

6. Top Product Range And CFD Markets: Hugo’s Way

The range of CFDs, products, and markets a broker offers can be a pivotal factor in a trader’s decision-making process. After a thorough analysis of Hugo’s Way and Trader’s Way, combined with insights from our own testing, here’s a detailed comparison of their product offerings:

| CFDs | Hugo's Way | Trader's Way |

|---|---|---|

| Forex Pairs | 55 | 41 |

| Indices | 10 | 7 (MT4) |

| Commodities | 4 Metals 2 Energies | 2 Metals 2 Energies |

| Cryptocurrencies | 37 | 9 |

| Shares CFDs | 104 | No |

| ETFs | No | No |

| Bonds | No | No |

| Futures | No | No |

| Treasuries | No | No |

| Investment | No | No |

Hugo’s Way clearly stands out with its extensive range of Forex pairs, stocks, and cryptocurrencies CFDs. Their offering in metals and energies is also commendable.

Our Top Product Range and CFD Markets Verdict

Hugo’s Way offers a superior range of CFDs and markets, making it the top choice for traders seeking a comprehensive trading portfolio.

7. Superior Educational Resources: Hugo’s Way

When it comes to equipping traders with the knowledge they need to succeed, both Hugo’s Way and Trader’s Way have made significant efforts. Their educational resources are tailored to cater to both beginners and experienced traders. Let’s delve into what each broker offers:

- Hugo’s Way:

- Offers a comprehensive course on ‘Trading Basics’ which is an excellent introduction for beginners.

- Provides advanced trading strategies for seasoned traders, ensuring they can refine their skills.

- Webinars are frequently conducted, giving traders a chance to interact with experts.

- Tradersway:

- Emphasises on ‘Technical Analysis’, helping traders understand market movements.

- Their ‘Forex Glossary’ is a handy tool for those unfamiliar with trading jargon.

- Regularly updated blog posts ensure traders are kept abreast of the latest market news.

Our Superior Educational Resources Verdict

Based on our team’s ratings, Hugo’s Way slightly edges out with its diverse range of educational resources, making them the preferred choice for traders looking to expand their knowledge.

8. Superior Customer Service: Hugo’s Way

Both Hugo’s Way and Trader’s Way offer 24/7 customer service via live chat, email, and phone. However, Hugo’s Way has a reputation for its responsive and helpful customer service, while reviews for Trader’s Way’s customer service are mixed.

Our Superior Customer Service Verdict

Hugo’s Way wins this round due to its superior customer service.

| Feature | Hugo's Way | Trader's Way |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | No |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | No | Yes |

9. Better Funding Options: Trader’s Way

When it comes to funding options, both Hugo’s Way and Tradersway have made efforts to provide traders with a variety of methods to ensure smooth transactions. Funding your trading account is a crucial step, and the ease with which you can do so can significantly impact your trading experience. Both brokers offer popular methods like Bitcoin and VLoad, but there are some differences in terms of minimum deposit amounts and fees.

| Funding Option | Hugo's Way | Trader's Way |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | No |

| Skrill | No | Yes |

| Neteller | No | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | No | No |

| Klarna | No | No |

Our Better Funding Options Verdict

While both brokers offer similar funding options, Tradersway edges out with a lower minimum deposit requirement, making it slightly more accessible for traders looking to start with a smaller amount.

10. Lower Minimum Deposit: Trader’s Way

As mentioned earlier, Hugo’s Way requires a minimum deposit of $50, while Trader’s Way requires a minimum deposit of $10.

Our Lower Minimum Deposit Verdict

Trader’s Way wins this round due to its lower minimum deposit requirement and a wider range of trading instruments.

| | Minimum Deposit | Recommended Deposit |

| Hugo's Way | $10 | NA |

| Trader's Way | $0 | $10 |

Our Final Verdict On Which Broker Is The Best: Trader’s Way or Hugo’s Way?

Trader’s Way is the winner because of its comprehensive range of products, low spreads, and better funding options. The table below summarises the key information leading to this verdict:

| Criteria | Hugo's Way | Trader's Way |

|---|---|---|

| Lowest Spreads And Fees | ❌ | ✅ |

| Better Trading Platforms | ❌ | ✅ |

| Superior Accounts And Features | ❌ | ✅ |

| Best Trading Experience | ❌ | ✅ |

| Stronger Trust And Regulation | ✅ | ✅ |

| CFD Product Range And Financial Markets | ✅ | ❌ |

| Superior Educational Resources | ✅ | ❌ |

| Better Customer Service | ✅ | ❌ |

| More Funding Options | ❌ | ✅ |

| Lower Minimum Deposit | ❌ | ✅ |

Best For Beginner Traders

Hugo’s Way is the ideal choice for beginner traders due to its extensive educational resources and user-friendly platform.

Best For Experienced Traders

For seasoned traders, Trader’s Way stands out with its advanced trading platforms and superior customer service.

FAQs Comparing Hugo's Way Vs Trader's Way

Does Trader's Way or Hugo's Way Have Lower Costs?

Hugo’s Way generally offers more competitive rates. They have a reputation for providing traders with tight spreads, especially during peak trading hours. For a more detailed comparison of low-cost brokers, you can check out this comprehensive guide on lowest spread forex brokers in the UK.

Which Broker Is Better For MetaTrader 4?

Both Hugo’s Way and Trader’s Way support MetaTrader 4, making them suitable for traders familiar with this platform. MT4 is renowned for its user-friendly interface and advanced charting tools. If you’re keen on exploring more options, here’s a list of the Best MT4 Brokers in Canada.

Which Broker Offers Social Trading?

Hugo’s Way offers social trading through platforms like ZuluTrade and Myfxbook. Social trading allows traders to mimic the strategies of experienced traders, providing a unique way to diversify their portfolio. For those interested in exploring more about this trading style, here’s an in-depth review of the best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither Hugo’s Way nor Trader’s Way offers spread betting to their clients. Spread betting is a unique form of trading popular in the UK, allowing traders to bet on the direction of market movements without owning the underlying asset. If you’re interested in exploring spread betting further, here’s a guide to the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Trader’s Way is the superior choice for Australian forex traders. While both brokers offer competitive services, Trader’s Way stands out with its ASIC regulation, ensuring a higher level of trust and security for Australian traders. Hugo’s Way, on the other hand, is based overseas and lacks ASIC regulation. For a comprehensive list of top brokers in Australia, you can check out this list of the Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I personally believe Hugo’s Way offers a more comprehensive trading experience. While both brokers provide robust platforms and tools, Hugo’s Way is FCA regulated, ensuring a higher level of trust and security for UK traders. Trader’s Way, being based overseas, doesn’t hold the same level of regulatory oversight in the UK. For more insights on the best brokers in the UK, here’s a detailed review of the Forex Brokers In UK.

Article Sources

No commission account spread proprietary testing data and published website spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert