IC Markets Review Of 2026

IC Markets is one of the largest forex brokers, featuring the most popular trading platforms and tier-1 ASIC and CySEC regulation. I recommend the broker for low-fee trading, as it provides the lowest Standard account spreads of any broker worldwide.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

IC Markets Summary

| 🗺️ Tier 1 Regulation | ASIC, CySEC |

| 🗺️ Tier 3 Regulation | FSA, SCB |

| 💰 EUR/USD Spread | Raw = 0.02 pips : Standard 0.82 |

| 📊 Trading Platforms | MT4, MT5, cTrader, TradingView |

| 💰 Minimum Deposit | USD $200 |

| 🎮 Demo Account | Yes (Unlimited) |

| 🛍️ Primary Markets | Forex, Shares CFDs, Commodities, Indices, Crypto |

Why Choose IC Markets

Fees are my primary reason for recommending IC Markets. Their standard account offers the lowest spreads (both spread-only and commission-based) of any forex broker I have tested worldwide. These low fees are available across all their trading platforms, including MT4, MT5, cTrader, and TradingView. The main tradable markets are forex, shares, indices, and crypto as a CFD.

While these are strong features, I found their 24/7 customer support live chat to be slow. During testing, I experienced a 12-minute wait during peak hours, which is not ideal. It’s also important to note that UK traders are onboarded through IC Markets’ Mauritius entity (IC Trading), as the broker does not hold FCA regulation. This means higher leverage is available, but with weaker regulatory protections.

IC Markets Pros And Cons

- Lowest standard account spreads

- Fast execution speeds

- All major trading platforms offered

- No proprietary mobile app

- Limited market analysis

- Lacking educatiotional material

The overall rating is based on review by our experts

Trading Fees

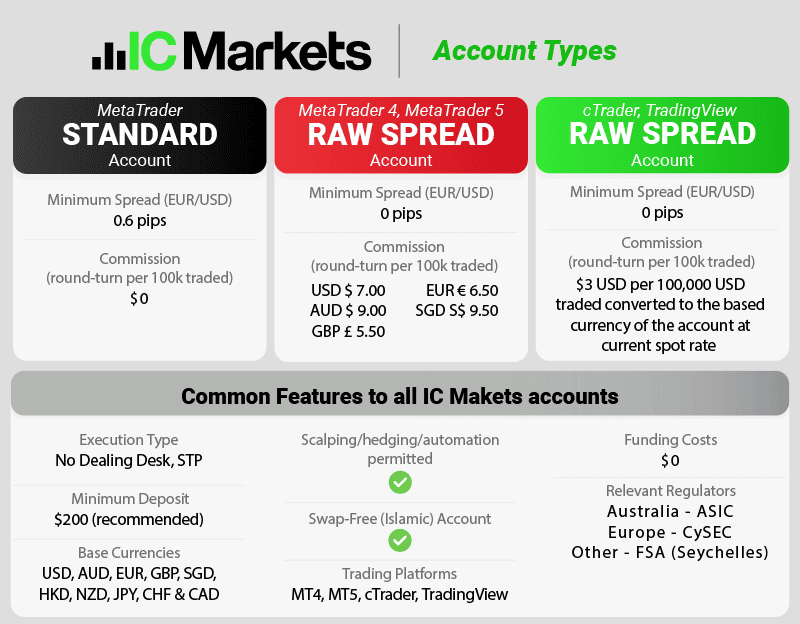

IC Markets provides two distinct pricing options: the Standard Account with no commission and spreads starting from 0.6 pips, and the Raw Account featuring spreads from 0.0 pips plus a commission fee.

- Standard Account: Ideal for beginners, offering straightforward pricing with no commission fees.

- Raw Account: Suited for experienced traders, as well as high volume, and algorithmic traders, due to its lower spreads and commission-based structure.

To assess IC Markets’ competitiveness, we tested their spreads against industry averages and conducted live comparisons with top brokers.

1. Raw Account Spreads

IC Markets’ Raw Account boasts some of the industry’s lowest spreads, with the EUR/USD averaging an impressive 0.02 pips. This is about 80% lower than Pepperstone’s Raw trading spread of 0.10 pips for the same pair.

Raw Forex Spread Comparison | |||||

|---|---|---|---|---|---|

| 0.01 | 0.02 | 0.50 | 0.27 | 0.30 |

| 0.06 | 0.20 | 0.10 | 0.10 | 0.20 |

| 0.14 | 0.31 | 0.62 | 0.39 | 0.75 |

| 0.10 | 0.10 | 0.90 | 0.30 | 1.30 |

| 0.10 | 0.20 | 0.60 | 0.30 | 1.00 |

| 0.90 | 0.13 | 0.17 | 0.14 | 0.14 |

| 0.10 | 0.20 | 0.50 | 0.30 | 0.20 |

| 0.16 | 0.29 | 1.50 | 0.54 | 0.68 |

| 0.80 | 0.40 | 1.30 | 0.50 | 0.90 |

| 0.10 | 0.50 | 0.70 | 0.60 | 0.40 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

IC Markets offers Raw spreads that are significantly tighter than the industry average, as shown in the table below.

| Raw Account Spreads | IC Markets | Average Spread |

|---|---|---|

| Overall | 0.29 | 0.74 |

| EUR/USD | 0.02 | 0.21 |

| USD/JPY | 0.14 | 0.39 |

| GBP/USD | 0.23 | 0.48 |

| AUD/USD | 0.03 | 0.39 |

| USD/CAD | 0.25 | 0.53 |

| EUR/GBP | 0.27 | 0.55 |

| EUR/JPY | 0.3 | 0.74 |

| AUD/JPY | 0.5 | 1.07 |

| USD/SGD | 0.85 | 2.34 |

View the comparison table of IC Markets Raw Spread Vs Standard Accounts to find the right account for your needs.

2. Raw Account Commission Rate

As an IC Markets Raw spread account holder, you pay a commission fee of $3.50 per lot of 100k traded.

The rate is higher than the industry average for the AUD, USD, and GBP base currencies. However, if your account’s base currency is EUR, IC Markets’ fees are slightly more competitive than brokers like Pepperstone.

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| IC Markets Commission Rate | $3.50 | $4.50 | £2.50 | €2.75 |

| Industry Average Rate | $3.45 | $3.29 | £2.44 | €2.91 |

To see how IC Markets’ trading costs stack up against competitors like Pepperstone and Eightcap, you can use our Fee Comparison tooll. Try out different base currencies, trade sizes, and currency pairs with the tool.

You learn more about their fees in our comprehensive review of IC Markets Spreads and Fees.

Commission Rebates

This year, IC Markets has introduced a new ‘Raw Trader Plus’ program, designed to reward high-volume traders.

As a member of Raw Trader Plus, you’ll receive rebates on your trading commissions, as well as exclusive benefits like VPS hosting and dedicated client support.

The Raw Trader Plus program offers three tiers of commission rebates, which are automatically refunded daily if you meet specific criteria. Reaching tier 3 can result in significant savings, reducing your effective commission rate to just $1 per lot.

| Raw Trader Plus Rebates | Commission Rebate (per lot) | Trading Volume Requirement (closed lots) | Effective Commission For Raw Trader Plus Members |

|---|---|---|---|

| Tier 1 | $1.50 | 100 | $2 |

| Tier 2 | $2.25 | >1,000 | $1.75 |

| Tier3 | $2.50 | 2,000 | $1 |

To retain your Raw Trader Plus membership, you must consistently meet the volume requirements over a 3-month period.

Use the calculator below to compare IC Markets’ trading costs with competitors such as Pepperstone, Eightcap and CMC Markets, adjusting for trade size, currency pair, and base currency.

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

3. Standard Account Fees

I found that IC Markets’ Standard Account offers some of the best no-commission spreads in the industry, with the EUR/USD averaging just 0.82 pips. This is nearly 50% lower than Pepperstone’s 1.1 pip spread on the same pair. For the AUD/USD pair, IC Markets maintains a tight spread of 0.83 pips, while the USD/CAD pair averages a competitive 1.05 pips.

The table below illustrates that IC Markets consistently offers low spreads across a wide range of major currency pairs, reinforcing their position as a leading broker for commission-free spreads.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| IC Markets Average Spread | 0.82 | 0.94 | 1.03 | 0.83 | 1.05 | 1.27 | 1.3 | 1.5 |

| Industry Average Spread | 1.2 | 1.5 | 1.6 | 1.5 | 1.8 | 1.6 | 1.9 | 2.1 |

4. Swap-Free Account Fees

For CFD traders who need to adhere to Sharia Law, IC Markets provides an Islamic Account option. This is available on both Raw and Standard pricing structures.

These accounts feature the same spreads as their conventional counterparts, but replace interest-based swap rates with a flat rate administrative fee. The changed fee structure ensures compliance with Islamic finance practices.

You can find out more about the Swap Free Islamic Accounts.

My Recommendation for Traders For Choosing an Account Type

For Beginners: Start with the Standard Account – I used this account for my first year of trading, and really appreciated the no-commission structure and 0.6 pip spreads. The MT4 platform’s simplicity helped me focus on learning price action without clutter.

For Experts: The Raw Account is unmatched – During the 2026 Fed rate announcement, I executed 50+ lots on USD/JPY with zero slippage, thanks to the broker’s 50+ liquidity providers. Pair it with cTrader’s Level II data for institutional-grade precision.

5. Other Fees

IC Markets doesn’t charge hidden fees as many brokers do. This means:

- $0 Deposit Fee

- $0 Withdrawal Fee

- $0 Inactivity Fee

Verdict On IC Markets Fees

IC Markets excels with highly competitive spreads. This means you get low-cost trading on the commission-free Standard Account and on the commission-based Raw Account.

Overall, I gave IC Markets a 9.5/10 for Trading Costs. This was due to its industry-leading spreads and fee transparency. I applied a 2.5x weighting to this score as I calculated the overall grade for the broker.

Execution Speeds

IC Markets excels in delivering ultra-fast execution speeds. This is a critical factor for scalpers, high-frequency traders, and algorithmic strategies.

IC Markets trading servers include the Equinix NY4 (New York) and LD5 (London) data centres. These serve the MetaTrader and cTrader platforms, respectively. This is great for ensuring proximity to global liquidity hubs, while also minimising latency.

| Broker | Execution Type | Overall Speed Ranking | Limit Order Speed (ms) | Market Order Speed (ms) |

|---|---|---|---|---|

| Blackbull Markets | ECN | 1 | 72 | 90 |

| Fusion Markets | ECN | 2 | 79 | 77 |

| Pepperstone | ECN | 3 | 77 | 100 |

| OANDA | Market Maker | 4 | 86 | 84 |

| Octafx | ECN | 5 | 81 | 91 |

| Exness | Market Maker | 6 | 92 | 88 |

| Blueberry Markets | ECN | 7 | 88 | 94 |

| FOREX.com | Market Maker | 8 | 98 | 88 |

| Global Prime | ECN | 9 | 88 | 98 |

| Tickmill | ECN | 10 | 91 | 112 |

| TMGM | ECN | 11 | 94 | 129 |

| City Index | Market Maker | 12 | 95 | 131 |

| Trading.com | Market Maker | 13 | 98 | 138 |

| FBS | ECN | 14 | 135 | 118 |

| Axi | ECN | 15 | 90 | 164 |

| Eightcap | ECN | 16 | 143 | 139 |

| IC Markets | ECN | 17 | 134 | 153 |

| FxPro | ECN | 18 | 151 | 138 |

| Go Markets | ECN | 19 | 144 | 145 |

| ATC Brokers | ECN | 35 | 238 | 241 |

Trading Platforms

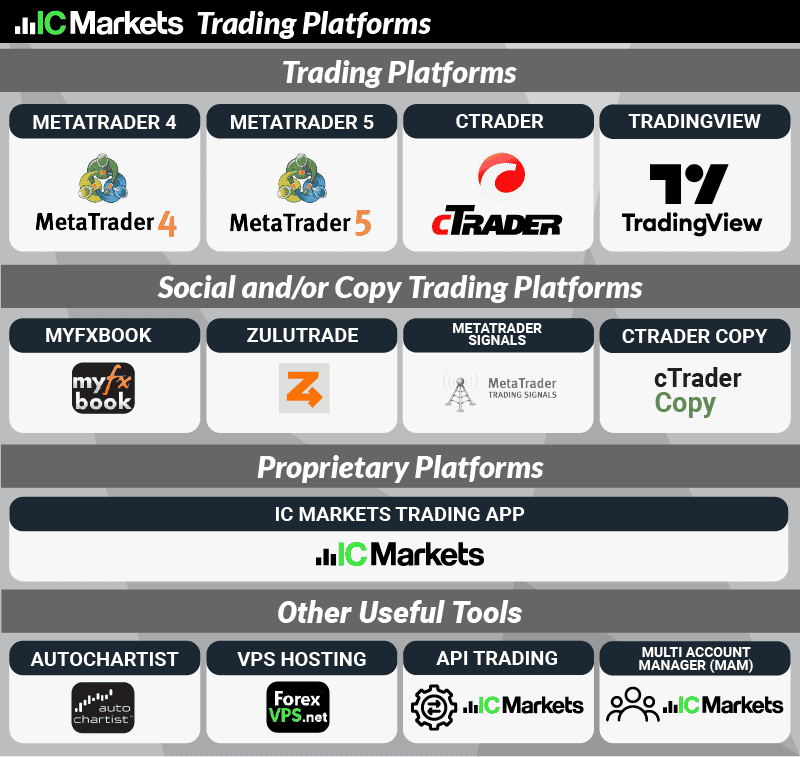

IC Markets offers a suite of trading platform options. These options include MetaTrader 4, MetaTrader 5, cTrader, TradingView, and the broker’s proprietary software.

| Trading Plaform | Available With IC Markets |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | Yes |

| TradingView | Yes |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector, so you can work out what trading software best matches your needs.

The short 5-step questionnaire helps you determine your most suitable forex platform. Once done, I recommend you read the relevant section on IC Markets, to see how the broker performs on that specific software.

IC Markets offers the four most popular forex trading platforms worldwide. These are MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView. There’s also a new share trading platform.

- MetaTrader 4 (MT4): Best for automated trading strategies, with Expert Advisors and extensive customisation.

- MetaTrader 5 (MT5): A multi-asset platform with improved technical tools.

- cTrader: Provides an ECN-like forex trading environment with advanced charting tools.

- TradingView: User-friendly interface offering advanced trading solutions.

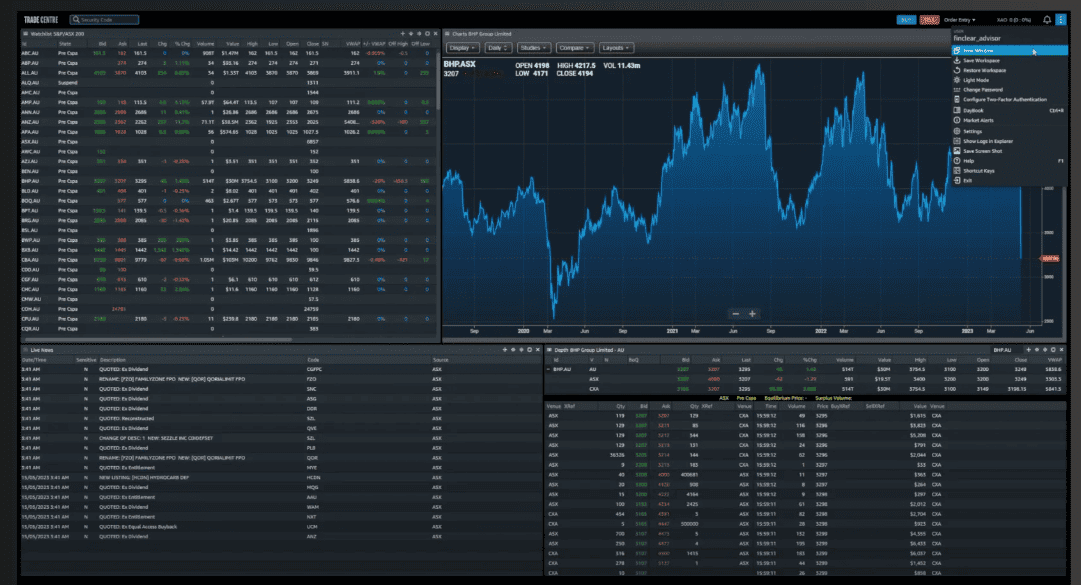

- FinClear: Share trading platform that provides direct access to trade in a wide range of ASX-listed companies.

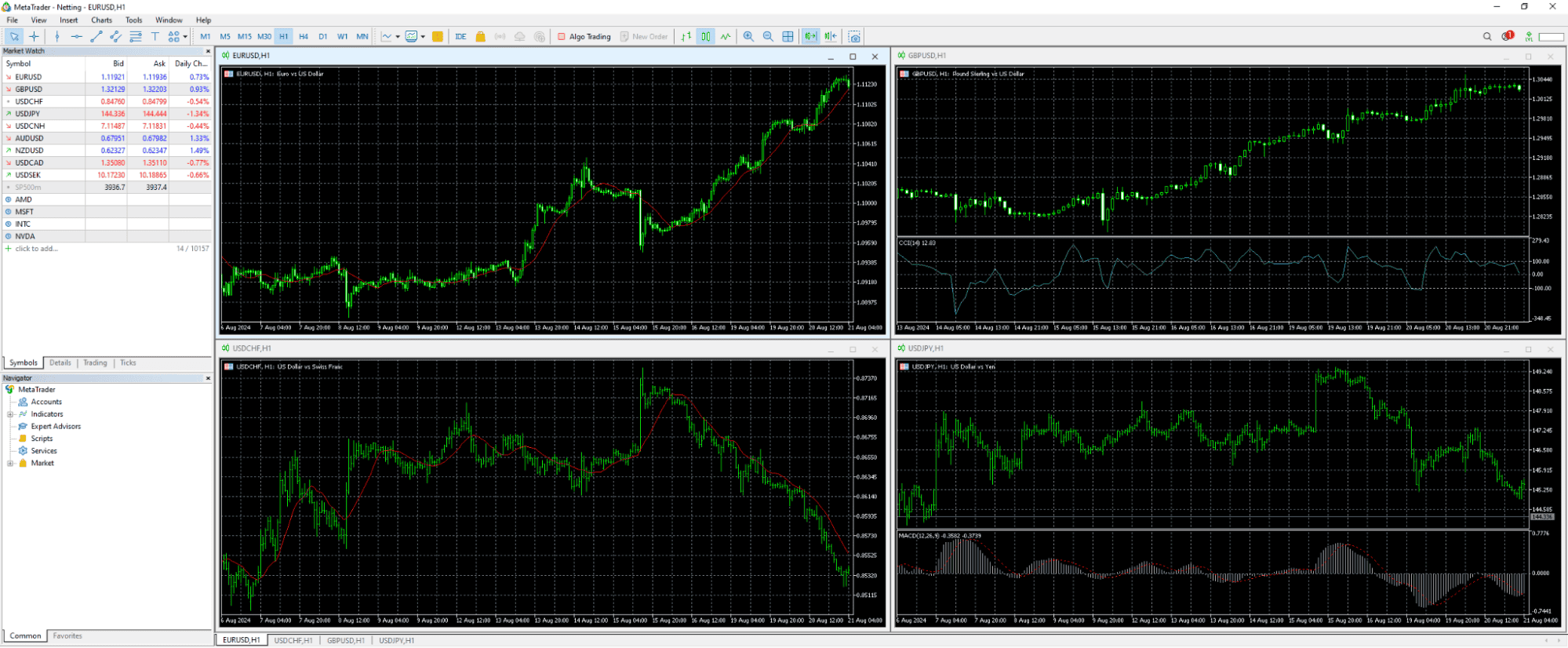

MetaTrader 4

From my experience as a forex-focused trader, MT4 remains a decent platform for anyone who values simplicity and reliability. Its uncluttered interface allowed me to execute trades swiftly, even during periods of high volatility.

The Expert Advisors (EAs) ecosystem is unparalleled – I easily automated strategies using the MQL4 code, and accessed thousands of free EAs from the MetaTrader Marketplace.

Key Differences vs. MT5:

- Asset Focus: MT4 supports forex and CFDs only – no stock trading.

- Technical Tools: 30 built-in indicators vs. MT5’s 80+.

- Timeframes: 9 timeframes vs. 21 on MT5. MT4 should be sufficient for most scalpers/swing traders.

- No Economic Calendar: Unlike MT5, MT4 lacks integrated macroeconomic data.

Best For:

- New Traders: Intuitive design reduces learning curves.

- Forex Scalpers: Lightning-fast order execution (under 30ms).

- EA Developers: Vast library of pre-built algorithms.

MetaTrader 5

MT5 is my top pick for traders diversifying beyond forex. The platform’s multi-asset capabilities let me seamlessly switch between forex, shares, and commodities. The built-in economic calendar and Depth of Market (DOM) feature were game-changers for fundamental analysis.

One of the main differences is if you prefer trading across both centralized and decentralized exchanges – this is not possible on MT4.

Key Upgrades vs. MT4:

- Asset Classes: Stocks, bonds, futures, and crypto CFDs.

- Technical Tools: 80+ indicators, 21 timeframes, and advanced charting tools like Renko bars.

- MQL5 Language: Faster back-testing and more complex EAs.

Best For:

- Multi-Asset Traders: Ideal for portfolios that combine forex, stocks, and commodities.

- Algorithmic Traders: Enhanced coding flexibility with MQL5.

- Data-Driven Traders: Integrated economic insights that reduce third-party tool dependency.

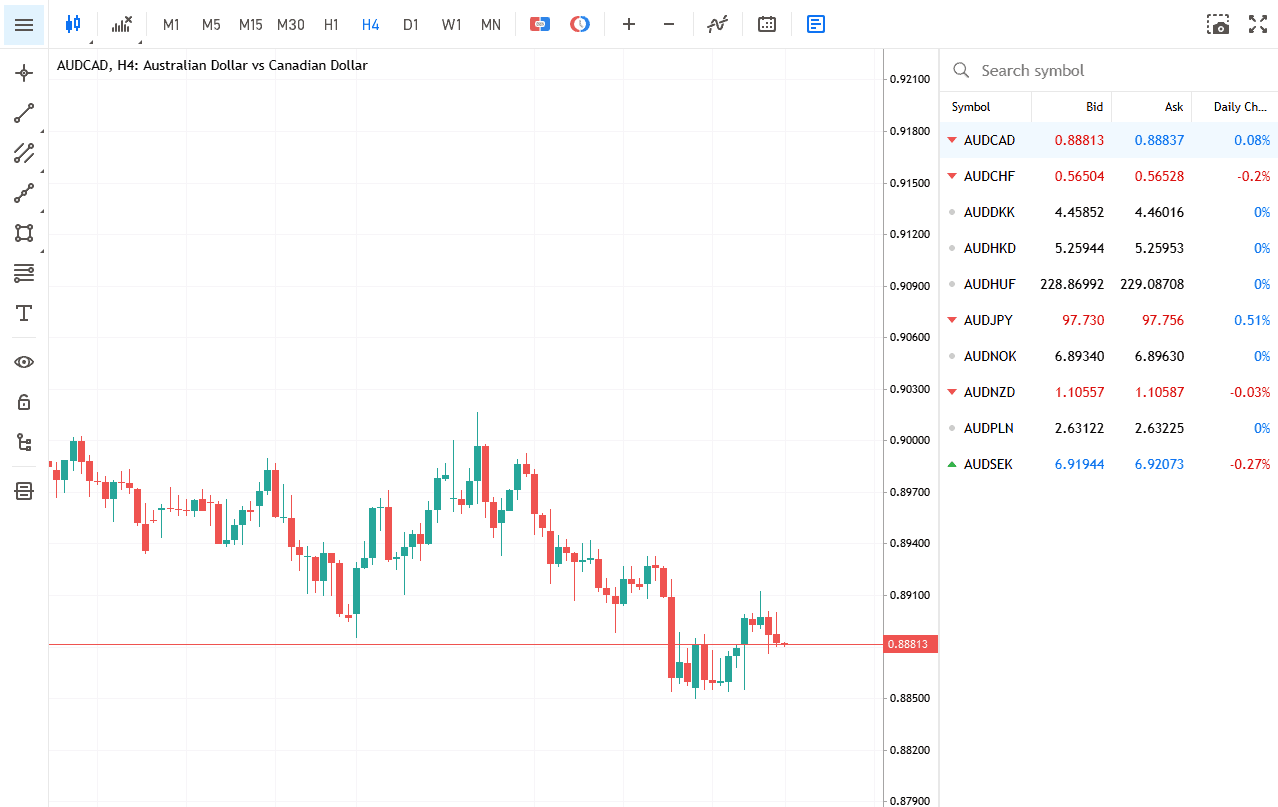

cTrader

As an algorithmic trader and scalper, I found that cTrader was ideal for my daily trades. The platform’s ECN-like execution and cAlgo automation tools are unmatched. Even if I use small timeframes to get precise entries, I can still rely on the fast speed to time my trades perfectly.

The platform’s transparency – allowing you to see Level II pricing – helped me refine my entries/exits. I particularly appreciated the back-testing feature, which let me to simulate strategies using historical tick data.

Unique Advantages:

- Detachable Charts: Custom workspace layouts improved my multitasking.

- C# Automation: More robust than MQL4/MQL5 for complex algorithms.

- No Dealing Desk: Direct liquidity access minimises requotes.

Best For:

- Professional Traders: Institutional-grade tools and transparency.

- Scalpers: cTrader is amazing if you are a scalper, due to its lightning execution speed.

- Algorithmic Developers: C# integration for high-frequency strategies.

- Price Action Traders: Level II data and heatmaps enhance decision-making.

If you prefer trading on shorter timeframes, then responsive software is really important for your bottom line. You need your market or limit trades to execute exactly when you want them to, and the software is going to help you make sure of that.

TradingView

I personally use TradingView for cross-market analysis and charting in conjunction with other trading platforms. For me, the charts and indicators are TradingView’s biggest strengths – you can chart and use custom indicators to an extent that’s just not possible with other platforms.

However, I actually tend to use other platforms for the trading itself. I keep TradingView for analysis and charting.

Beyond this, TradingView’s social trading features are great for newer traders, as you can gather good ideas for possible trading strategies. A word of warning here, though – actually copying other traders and being profitable is not so straightforward.

The platform has 100+ pre-built indicators (e.g., Ichimoku Cloud, Elliott Wave) by default. I was pleased to discover they are all incredibly easy to access. However, I found TradingView’s order execution slightly slower than that of MT5 or cTrader.

Standout Features:

- Community Ideas: Collaborate with 90M+ users to spot trends.

- Cross-Device Sync: Seamlessly switch between desktop and mobile.

- No Coding Required: Drag-and-drop strategy builder for quick testing.

Best For:

- Visual Learners: Intuitive charts with minimal setup.

- Market Analysis and Charting due to the large number of timeframes/indicators.

- Social Traders: Leverage crowd-sourced insights.

- Long-Term Investors: Advanced charting for macro trends.

Overall, I’d suggest that new IC Markets traders use TradingView for price analysis and charting, as it is intuitive and offers a gentle learning curve.

FinClear (IC Markets Share Trading Platform)

FinClear is an Australian financial services company specialising in execution and clearing services for equity markets.

Here are some core features of FinClear:

- Specifically designed for direct share trading, not CFDs.

- Utilises advanced technology stack for fast, flexible, and reliable service.

- Employs microservices architecture for independent operation and easy updates.

- Offers a user-friendly interface, accessible on various devices.

- Ensures security and efficiency with bank-grade encryption and 2FA.

Along with IC Markets, FinClear provides execution and settlement for the IC Markets share trading service.

Mobile Trading Apps

IC Markets provides mobile trading apps for all four of its forex platforms (MT4, MT5, cTrader, and TradingView), as well as on the share trading platform.

These apps are designed for both iOS and Android devices, offering you the flexibility to manage your trades on the go.

The mobile versions retain the core functionalities of their desktop counterparts, including real-time quotes, charting tools, and order management features.

My Verdict on IC Markets Trading Platforms

I give the broker a 9/10 score in the trading platform category. This high score is due to a highly versatile platform suite, which includes MT4, MT5, cTrader, and TradingView – four of the very best platforms in the industry.

Trading Experience

IC Markets’ forex trading platforms use Equinix servers, providing fast order execution speeds. The cTrader platform uses the LD5 server in London, while MT4 and MT5 use the NY4 data centre in New York.

| Trading Platform | Server | Coding Language |

|---|---|---|

| MetaTrader 4 | NY4 Data Centre | MQL4 |

| MetaTrader 5 | NY4 Data Centre | MQL5 |

| cTrader | LD5 Data Centre | cAlgo |

The broker also has direct access to interbank price feeds from over 50 banks and institutional liquidity providers. This means you can expect ultra-tight spreads and minimal slippage when forex trading – perfect for scalpers and traders who enjoy hedging the forex market.

My Verdict on Trading Experience

We’ve rated IC Markets as one of the best Australian forex brokers. The fast servers and excellent infrastructure both minimise latency, greatly improving the experience.

With fast execution and platform diversity, I give IC Markets a score of 8.5/10. All of this has a strong impact on day-to-day trading efficiency.

Is IC Markets Safe?

Yes, IC Markets is a safe broker with a reputation rating of 8/10. I had to mark it down in the regulation category, however. While you do get strong oversight from ASIC/CySEC, it’s let down a little by weaker protections from offshore entities like Mauritius.

1. Regulation

IC Markets is regulated by two Tier-1 financial authorities and two Tier-3 regulators.

| IC Markets | Regulator |

|---|---|

| Tier-1 | ASIC (Australia) - Australian Securities and Investments Commission CySEC (Cyprus) - Cyprus Securities and Exchange Commission |

| Tier-2 | X |

| Tier-3 | FSA (Seychelles) - Financial Services Authority SCB (Bahamas) - Securities Commission of The Bahamas |

For traders outside of Australia and the EU, IC Markets is licensed by the SCB (Bahamas) and the FSA (Seychelles). While these are reputable groups, they are not in the top two tiers, and you should be aware that offshore financial authorities offer fewer protections than CySEC or ASIC.

Please note: As of 2026, IC Markets uses different entities for regulatory purposes depending on your location. For example, UK clients and some EU clients are onboarded through their Mauritius-based entity; the FSC-regulated IC Trading.

Some EU clients may still be covered by CySEC regulation, but all UK clients will fall under the the protection of Mauritius’ FSC. This is because IC Markets lacks FCA (UK) regulation.

2. Reputation

IC Markets was established in 2007 in Melbourne, Australia. With over 246,000 monthly Google searches, the broker is one of the most frequently searched-for online.

Having over 180,000 active clients and 500,000 trades executed daily, IC Markets generated an impressive USD 1.64 trillion in trading volume in April 2024, firmly establishing itself as one of the world’s largest brokers. Notably, 60% of these trades were driven by algorithmic trading.

When it comes to Google searches, IC Markets attracts approximately 246,000 monthly searches, ranking it as the 11th most popular forex broker among the 65 brokers we analyzed. Data from Similarweb in February 2025 tells a similar story, placing IC Markets as the 13th most visited broker globally, with 2,425,000 total visits.

| Country | 2025 Monthly Searches |

|---|---|

| United Kingdom | 33,100 |

| India | 8,100 |

| South Africa | 8,100 |

| Australia | 6,600 |

| Thailand | 6,600 |

| United States | 6,600 |

| Germany | 5,400 |

| Indonesia | 5,400 |

| Spain | 5,400 |

| United Arab Emirates | 5,400 |

| Vietnam | 5,400 |

| Malaysia | 4,400 |

| Singapore | 4,400 |

| France | 4,400 |

| Pakistan | 4,400 |

| Morocco | 4,400 |

| Colombia | 3,600 |

| Italy | 3,600 |

| Mexico | 2,900 |

| Nigeria | 2,900 |

| Sri Lanka | 2,900 |

| Kenya | 2,400 |

| Hong Kong | 2,400 |

| Philippines | 2,400 |

| Netherlands | 2,400 |

| Poland | 2,400 |

| Canada | 2,400 |

| Saudi Arabia | 2,400 |

| Brazil | 1,900 |

| Algeria | 1,900 |

| Bangladesh | 1,900 |

| Turkey | 1,600 |

| Peru | 1,600 |

| Taiwan | 1,600 |

| Japan | 1,600 |

| Egypt | 1,600 |

| Switzerland | 1,600 |

| Argentina | 1,300 |

| Sweden | 1,300 |

| Ecuador | 1,000 |

| Dominican Republic | 1,000 |

| Uzbekistan | 1,000 |

| Chile | 880 |

| Portugal | 880 |

| Cyprus | 880 |

| Venezuela | 880 |

| Ghana | 880 |

| Uganda | 720 |

| Ireland | 720 |

| Greece | 720 |

| Mongolia | 590 |

| Austria | 590 |

| Jordan | 590 |

| Ethiopia | 480 |

| Mauritius | 480 |

| Costa Rica | 390 |

| Tanzania | 320 |

| Bolivia | 260 |

| Panama | 260 |

| Cambodia | 260 |

| Uruguay | 260 |

| New Zealand | 210 |

| Botswana | 170 |

33,100 1st | |

8,100 2nd | |

8,100 3rd | |

6,600 4th | |

6,600 5th | |

6,600 6th | |

5,400 7th | |

5,400 8th | |

5,400 9th | |

5,400 10th |

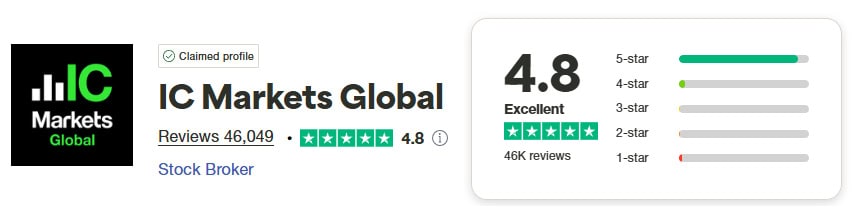

3. Reviews

The broker has an excellent TrustPilot score of 4.8 out of 5 stars. Of the broker’s 46,000 reviews, 91% of customers gave IC Markets 5 stars, showing an incredibly high level of client satisfaction.

Verdict On IC Markets Safety

IC Markets is a reliable broker, backed by regulation from respected authorities like ASIC and CySEC, and a strong reputation established since 2007. IC Markets’ excellent TrustPilot score and strong online presence underscore its high client satisfaction and trustworthiness.

Deposit and Withdrawal

IC Markets is a relatively accessible broker, with a low minimum deposit and a range of fee-free funding methods.

What is the minimum deposit at IC Markets?

IC Markets requires an initial minimum deposit of USD $200 (or equivalent) when you open a trading account.

Account Base Currencies

IC Markets offer 10 base currencies including the AUD, USD, EUR, GBP, SGD, JPY, CHF, NZD, CAD to HKD.

Deposit Options and Fees

IC Markets offers up to 19 fee-free funding methods. The payment methods available depend on the IC Markets subsidiary you are registered with as shown below but include e-wallets like PayPal and Neteller, as well credit/debit cards and bank transfers.

| Payment Method by Location | Australia (ASIC Regulated) | Europe (CySEC & BaFin Regulated) | International (FSA & SCB Regulated) |

|---|---|---|---|

| Visa Debit/Credit Card | ✓ | ✓ | ✓ |

| Mastercard Debit/Credit Card | ✓ | ✓ | ✓ |

| Bank Transfer | ✓ | ✓ | ✓ |

| Union Pay | ☓ | ☓ | ✓ |

| PayPal | ☓ | ✓ | ✓ |

| Neteller | ✓ | ✓ | ✓ |

| Skrill | ✓ | ✓ | ✓ |

| RapidPay | ✓ | ✓ | ✓ |

| POLi / BPay | ✓ | ☓ | ✓ |

| Klarna | ✓ | ✓ | ✓ |

| Cryptocurrency | ☓ | ☓ | ☓ |

| Thai Internet Banking | ✓ | ☓ | ✓ |

| Vietnamese Internet Banking | ✓ | ☓ | ✓ |

| Broker to Broker | ✓ | ☓ | ✓ |

Withdrawal Options and Fees

IC Markets also charges no withdrawal fees, although certain banks may charge $20 AUD for international bank transfers.

- PayPal/NETELLER/Skrill = Instant

- Domestic Wire Transfer = 1 working day

- Credit Cards and Debit Cards = 3 – 5 working days

It should be noted your withdrawals will be sent to your deposit account – so the withdrawal and deposit methods need to be the same.

View our detailed IC Markets Minimum Deposit page for more details on deposit methods, requirements and fees.

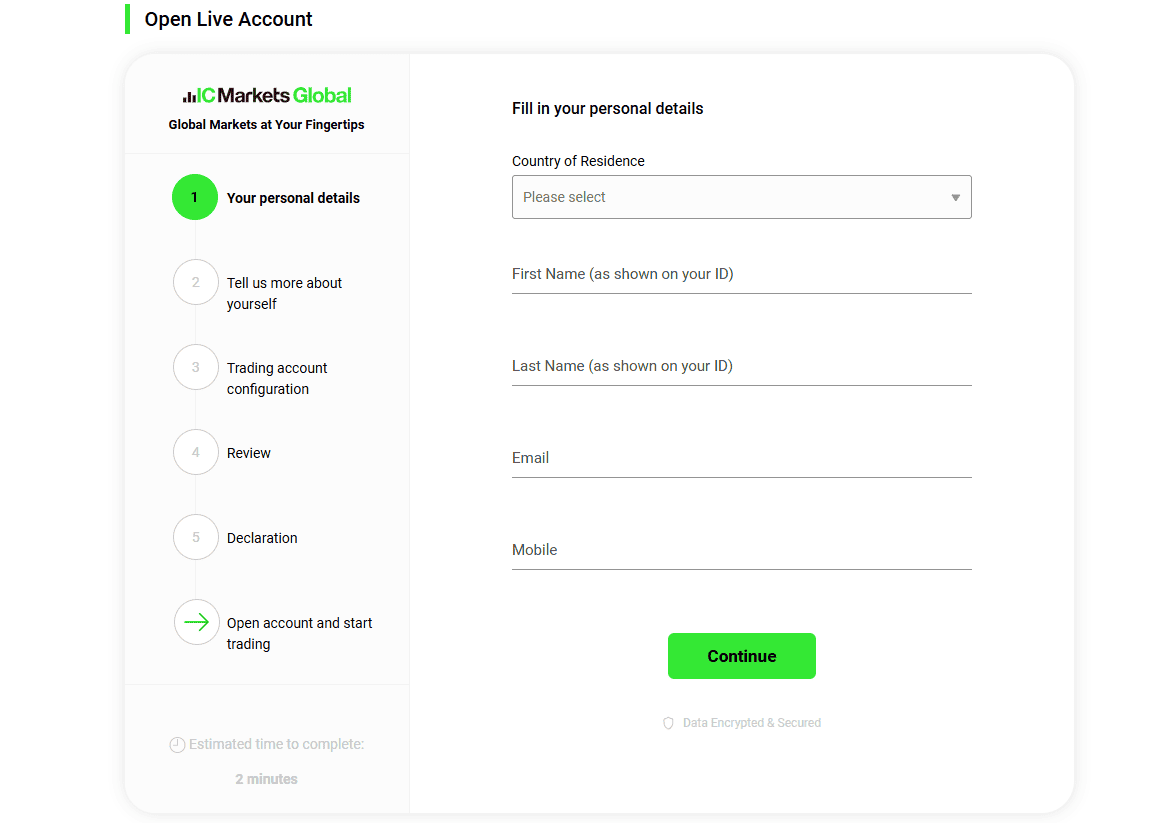

Ease To Open An Account

Opening an account with IC Markets is straightforward and efficient. In my evaluation, I found a clear process – I submitted my personal information, took an appropriateness test, and got my ID and residence verified.

IC Markets scored 84.4% in our account opening test. I think this is a fair reflection of their commitment to a smooth and compliant onboarding experience.

My Verdict on IC Markets Funding

During my testing of IC Markets, I found the process went very smoothly. I was able to top up my account in just a few minutes. Their withdrawal methods were also satisfactory with plenty of options – although these do vary depending on your exact location.

For these reasons and due to the fee-free deposits/withdrawals, I give funding a score 9.0/10. Withdrawals are generally fast, although some methods are faster than others.

Product Range

IC Markets offers a number of CFD trading instruments, such as forex, indices, commodities, stocks, bonds, futures, and cryptocurrency. In terms of execution method, IC counts itself among the no dealing desk brokers.

The broker now also provides a share trading facility specifically for Australian residents. This new service allows investment in over 2,000 Australian listed companies, with a straightforward flat fee structure and no monthly charges.

CFDs

- Forex

61 major, minor and currency pairs with tight spreads as low as 0.0 pips plus commission, or 1.0 pip commission-free. - Indices

Gain exposure to 25 of the largest indices around the world. You can trade index CFDs on all three trading platforms with no commission fees. - Commodities

Trade CFDs across agriculture, metals and energy markets, predicting the USD’s performance against various commodities. Over 24 commodities can be traded as both spot and futures CFDs. - Stocks

You can trade over 2100 major stocks as CFDs. This is only available through the MetaTrader 5 (MT5) trading platform. The shares available are across the NYSE, Nasdaq and the Australian Stock Exchange. - Bonds

You can speculate on more than 12 bonds, including those from the UK, Japan, USA and Europe. IC charges no commission fees when you are trading CFDs derived from bonds. - Cryptocurrency

CFD traders can speculate on 18 different cryptocurrency CFDs pairs including Bitcoin, Ethereum, Litecoin to Ripple. If you are looking to trade crypto, Eightcap provides the better range, with 250 coins. - Futures

You can trade 4+ global futures CFDs with no commission fees. This includes both the ICE Dollar Index and the CBOE VIX Index. You must have the MT4 platform to trade futures with this CFD broker.

Share Trading

IC Markets has recently expanded its services to include a dedicated share trading facility, exclusively designed for Australian residents. This facility grants access to over 2,200 Australian listed companies, covering a wide spectrum. I found everyone from small and mid-cap to blue-chip stocks listed here.

This service differs from IC Markets’ Share CFD offering. When trading share CFDs, you speculate on the price movements of shares without owning them, whereas the new share trading facility enables the actual purchase of company shares.

When engaging in direct stock trading, investors benefit from a transparent fee structure. You’ll pay only a flat trading fee of $7.70 for transactions up to $100,000, without incurring any monthly or activity charges.

Our Verdict On IC Markets Product Range

IC Markets presents a comprehensive range of tradable markets. These include a wide array of CFDs in forex, indices, commodities, and more. There’s also a new share trading facility for Australian residents.

For their great trading options range and amazing CFD and forex offerings, I give IC Markets a score of 9/10. I did make some slight deductions due to a lack of diversity in more niche markets, like crypto.

Customer Service

IC offers 24/7 customer support via live chat, email, phone, and social media.

Local customer support is available from their Sydney office at Level 6 309 Kent Street Sydney, NSW 2000.

CFD traders can reach them through different channels like email, Skype or phone. I was impressed that their Sydney response time is under 15 minutes, and more complex issues are resolved within a day.

Live chat customer service is also available 24 hours a day, 7 days a week. The company is dedicated to providing a high-quality educational centre (video journals and articles) that is great for those who have no previous knowledge of trading forex and CFDs.

The broker is one of the leaders in this category. During my tests, I found Pepperstone is one of the few FX brokers that has won more awards for customer support than IC Markets.

My Verdict on IC Markets Customer Service Levels

IC Markets excels in customer support, offering 24/7 assistance through various channels including live chat, email, and phone. All of this is complemented by a very responsive local team in Sydney.

For these reasons, I give IC Markets a customer service score of 9.0/10. This reflects their 24/7 support, and fast response during my testing of their chat support.

Research and Education

Trading Central LogoIC offers various research tools and support when forex trading, including:

Trading Central LogoIC offers various research tools and support when forex trading, including:

- A blog offering fundamental and technical analysis

- Content from 3rd parties including Trading Central

- An economic calendar

- Myfxbook news headlines

- ZuluTrade social copy trading

- FX Blue LLP Advanced Trading Tools

Outside these features, my IC Markets review didn’t find many advanced research options. I’d like to have seen some news headlines features and pattern-recognition tools.

IC Your Trade

IC Markets has launched a podcast series discussing current events and the opportunities and issues that affect the markets. The data is analysed by experts to provide valuable insights for traders as they make informed decisions.

Verdict on quality of education and research offered

IC Markets provides a range of research tools, including analysis, economic calendars, podcasts and social copy trading. But I found it lacks some of the advanced research features offered by other brokers.

For these reasons, I gave IC Markets 8.5/10 for education and research. I had to deduct a few points, as I couldn’t find any more advanced resources, such as webinars. There were some useful resources in languages like Spanish on the IC Markets YouTube channel, however.

Final Verdict on IC Markets

In my view, IC Markets is the best broker for traders looking for low spreads and fees. My review of IC Markets found the broker’s EUR/USD spread averaged 0.82 pips, the lowest of any Standard account globally .

Supporting the MetaTrader 4, MetaTrader 5, cTrader, and TradingView forex trading platforms, the broker caters to all trading styles. I recommend it most for intermediate or expert traders.

In my weighted score, IC Markets earned an impressive 90/100 points overall. This is a direct reflection of IC Markets’ strengths in the costs, platforms, and trust categories. I balanced these scores against weaker categories, like education and market diversity.

A few points are docked for the slower support and lack of educational content, but the upside of low-cost trading more than makes up for this.

IC Markets FAQ's

Is IC Markets A Good Broker?

IC Markets is considered one of the best forex Bbokers in Europe as well as one of forex brokers in Australia.

It features tier 1 regulation through ASIC and CySEC, and our 2026 spread table shows that IC Markets displays the lowest spreads on the most traded forex pairs.

What Demo Account Does IC Markets Offer?

Yes, IC Markets offers demo accounts for MetaTrader 4, MetaTrader 5, cTrader, and TradingView. These demo accounts offer unrestricted virtual funds, but will expire after 30 days of inactivity.

You can open a maximum of 20 demo accounts with IC Markets.

What Leverage Does IC Markets Offer?

IC Markets offers leverage of up to 500:1 through its offshore FSA regulatory division in Seychelles.

Leverage varies across different assets. You can get up to 500:1 on forex, gold, and commodities, and 200:1 for indices, futures, and bonds. The maximum for shares is 20:1, and 5:1 for cryptocurrencies.

However, if you choose the broker’s ASIC-regulated Australian branch or the CySEC-regulated branch, maximum leverage is lower. Here, you’ll get maximums of 30:1 on major forex pairs, but only 2:1 on cryptocurrencies.

What is the Minimum Deposit at IC Markets?

The IC Markets minimum deposit is USD 200. or equivalent. If you open an account with an AUD base currency, for example, it’s $290. For the EUR base, it’s €195, while the British Pound currency base has a minimum of £160.

What is the Full Name of IC Markets?

IC Markets is the most common way to refer to the broker, although you might also see it represented as IC Markets Global, Raw Trading ltd, or International Capital Markets pty. There are also other IC Markets entities in the group, such as IC Trading and IC Funded.

Does IC Markets Offer Prop Trading

IC Markets started offering prop trading in 2026, through its IC Funded entity. We have a separate website called Prop-Firms, where you can read our exclusive IC Funded review.

About the Review

When writing IC Markets review, the CompareForexBrokers team meticulously follows our established methodology for assessing forex fees. This involved a rigorous comparison and analysis of published broker fee data, as well as hands-on testing in controlled environments. Each month, we gather and scrutinise the fee data published by various brokers, including IC Markets, and test these in real trading conditions using tools like the MT4 Spread Monitor.

This comprehensive approach ensures the review is grounded in actual data and real-world trading scenarios, providing a reliable and accurate assessment of IC Markets’ fees.

For a detailed understanding of our methodology, you can read our full Forex Fees methodology here.

IC Markets Alternatives

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Go to IC Markets Website

Visit Verdict

Verdict  Broker Fees

Broker Fees  Trading Platforms

Trading Platforms  Safety

Safety  Account Funding

Account Funding  Product Range

Product Range  Customer Support

Customer Support  Market Research

Market Research

Ask an Expert

Are IC Markets the cheapest broker?

There are various costs to consider when looking at brokers

1. Spreads – these are your largest cost. Generally, there are two types of accounts. Standard accounts and ECN pricing accounts. Standard accounts have wider spreads than ECN pricing accounts as they do not have a commission in addition to the spread. For this reason, the commission cost is included in the spread. IC Markets publish their average spreads for each type of account and we include a comparison of these spreads between brokers on this page Low spread brokers. Generally, IC Markets spreads compare very well with other brokers.

2. Commissions – if you choose a RAW or ECN pricing account, you must consider the commission costs. IC Markets commissions are generally in line with what you find with most brokers being $3.50 for each standard lot to open your position.

Should I trade with IC Markets or with Pepperstone?

Both brokers are excellent choices…we suggest you take a look at our Pepperstone Review and IC Markets vs Pepperstone pages to find out more.

IC MarketsI see that they use the excuse of AML to freeze your withdrawals, prevent deposits even though your bank is OK, excessive spread manipulation, trading against you, not putting your trades through to market and much more. Why they are cancelling being regulated by FCA UK completely what’s to hide? Why is seychelles just as good as not being regulated ?

Hi Yuur, there is some misinformation here. IC Markets is a no dealing desk broker that uses STP trading execution. This means all quotes are sourced from liquidity providers and the broker does not manipulate the prices. Also IC Markets have never been regulated by the FCA. Seychelles regulations is not as good as CySEC or ASIC regulation but it is acceptable if you can’t use a broker using the financial regulator for your country. Do however avoid any unregulated brokers.

Is IC Markets secure?

Yes, IC Markets is regulated by ASIC in Australia, CySEC for Europe and FSA based in Seychelles for all other countries. These financial regulators all require you keep your funds in a segragated trading accont.

Can I deposit $100 on IC Markets?

Yes, while IC Markets advertises a minimum deposit of $200, you can deposit as much or little as you need as this $200 is more of a recommendation.