IG Group vs eToro 2025

IG is one of the most trusted brokers worldwide, while eToro is a specialist broker focusing on its social trading niche. While these are very different CFD brokers, we compared them based on spread, trading platform and features.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

trading spread bets and CFDs with this provider

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Pro 2: 250:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 10:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

How Do eToro Vs IG Group Compare?

Our full comparison covers the 10 most important trading factors to consider when choosing between IG and eToro.

- IG requires a minimum deposit of $450, while eToro’s minimum deposit ranges from $50-$200, depending on the region.

- IG offers a broader range of financial instruments, including options and interest rates, whereas eToro excels in the range of cryptocurrencies available.

- IG provides access to MetaTrader 4 and other advanced platforms, while eToro lacks MetaTrader support but offers unique social trading features.

- Both platforms charge inactivity fees, but eToro also charges a $5 withdrawal fee, which IG does not.

- IG is regulated by multiple Tier-1 authorities, offering additional protections like negative balance protection, while eToro is regulated by ASIC and CySEC.

1. Lowest Spreads And Fees – IG Group

Trading costs and all types of fees are important considerations when choosing a forex broker, as they can have a significant impact on your overall profitability. Taking a closer look at the tests we ran and research collected across eToro and IG Markets, there are differences in the costs and fees associated with trading on each platform, and it mostly comes down to how you trade.

The table below makes it immediately obvious where some of the key differences are.

| eToro | IG | |

|---|---|---|

| Average Spread | 4.2 pips | Standard - min 0.6 pips (avg 1.6 pips) |

| Commission round-turn per 100,000 | None | None |

| Inactivity fees | Yes. USD 10 per month after 12 months | Yes. EUR 10 per month after 12 months |

| Minimum deposit | 50 USD | None |

| Withdrawal fees | USD 5 per withdrawal | None |

eToro offers a no-commission account, which can be attractive for traders looking to minimise their trading costs. However, it’s worth noting that eToro sets its minimum spreads higher than other comparable brokers who do charge a commission. Our tests revealed a standard average spread of 4.2 pips for eToro, which is significantly higher than IG’s average spread of 1.6 pips.

In addition to higher spreads, eToro also charges a withdrawal fee of USD 5 per transaction. This can be a disadvantage for traders who need to withdraw funds frequently or in smaller amounts.

On the other hand, IG offers competitive trading costs and fees, with no minimum deposit and no withdrawal fees. IG charges a standard minimum spread of 0.6 pips (with an average spread of 1.6 pips), which is significantly lower than eToro’s average spread.

Another factor to consider when it comes to trading costs is inactivity fees. Both eToro and IG charge inactivity fees of USD 10 or EUR 10 per month after 12 months of inactivity, respectively. While this may not be a concern for active traders, it’s worth noting for those who may not trade frequently.

Our Lowest Spreads and Fees Verdict

Overall, in terms of trading costs and fees, IG emerges as the more cost-effective option. With no minimum deposit or withdrawal fees and lower average spreads compared to eToro, IG is a great choice for traders looking to minimise their trading costs.

Ross Collins, our Chief Technology Researcher, tested the spreads for 20 standard accounts to see which broker has the best average spreads. While we’re yet to test IG and eToro in this particular case, we found that IC Markets came out on top with an average spread of 1.03 pips.

Just keep in mind that 1.03 pips is the average across 6 major currency pairs; it is lower for EUR/USD.

*Your capital is at risk ‘69% of retail CFD accounts lose money’

2. Better Trading Platform – Tie

| Trading Platform | IG Group | eToro |

|---|---|---|

| MetaTrader 4 | Yes | No |

| MetaTrader 5 | No | No |

| cTrader | No | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

It’s great when our trading platform provides a suite of useful features, but there are certain options that feel like must-haves, and if the basics aren’t there, gaps can quickly become obvious.

eToro’s lack of access to Metatrader can make their trading tools feel incomplete. IG offers access to both its proprietary trading platforms as well as MetaTrader 4, ProRealTime (good for charts and automation) and L2 Dealer (for DMA trading), giving traders more flexibility and options to tailor their trading experience to their specific needs and workflow.

eToro lets you social trade using MT4 signals (assuming you’re using that platform). Automation is also available via expert advisors (EAs) and the ProRealTime Trading Platform provides a type of automation, copying other trades.

Our Better Trading Platform Verdict

Ultimately, it comes down to your bespoke needs as a trader. While IG Group may have the edge in terms of offering a more robust set of features and tools, eToro’s social trading capabilities make it an appealing choice for many traders.

*Your capital is at risk ‘61% of retail CFD accounts lose money’

3. Superior Accounts And Features – IG Group

Both eToro and IG stand out as good choices if you are a beginner trader. Both platforms offer no-commission accounts (aka Standard accounts), which is a convenient option for users who want to try their hand at trading without the complexity of commission fees, Lowest Commission Brokers.

We looked into the type of trading execution the brokers offer, and we found that both use a market marker execution model, which means the broker is the counterparty to your trades. IG appears to use a price-matching model where spreads are aggregated among a large pool of liquidity providers, which is in line with the spreads being offered in the market. eToro doesn’t explain how they source their spreads, but they will be wider since there are costs involved with paying the signal providers for copy trading. On the plus side, you won’t get slippage when you copy a signal provider.

We tried opening an account with eToro, and to do so, you will need to make a minimum deposit of USD50. When we tried to open an account with IG, there was no requirement to make a deposit. We could even start using a demo account without providing funding details.

eToro is known for its social trading feature that allows users to copy the trades of other successful traders. This feature can be helpful for new traders who want to gain insights and learn the ropes from like-minded traders.

IG offers a broader range of educational resources, including webinars, online courses, and trading guides. It’s better known for its access to institutional and credentialed experts rather than the grassroots social wisdom of crowds that eToro cultivates.

We found eToro and IG Markets both excellent platforms for beginner traders and useful for many experienced traders with complex workflows. We determined this by testing each broker from the perspective of both personas.

| eToro | IG | |

|---|---|---|

| Market Maker | Yes | Yes |

| Dealing Desk | Yes | Yes |

| Execution Type | Market Maker with STP price matching. Uses Market Execution | Market Maker or DMA |

| Demo Account | Yes with 100k of virtual funds that does not expire | Yes |

| Standard Account | Yes | Standard Account |

| Commission Account | No | DMA Account (pro traders only) |

| Fixed-spread Account | No | No |

| Swap-free Account | On request | No |

| # of Base Currencies | USD only (but portfolio values can be displayed in 8 currencies) | 5 |

| Maximum Forex Leverage | 1:30 to 1:500 | 1:30 or 1:500 |

eToro and IG Markets offer no-commission accounts, a wide range of trading instruments, and user-friendly interfaces. If you want lower, tighter spreads, then consider a broker with an ECN account. With spreads from 0.0 pips, you will save even when you pay a commission on top of the spread.

| IG Group | eToro | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | No |

| Swap Free Account | No | Yes |

| Active Traders | No | No |

| Spread Betting (UK) | Yes | No |

When it comes to choosing a forex broker, costs are a significant consideration for traders of all levels. Both eToro and IG offer commission-free trading accounts, which is especially useful for traders wanting a simple cost structure (like beginners and discretionary traders). However, there are noteworthy differences in the spreads offered by the two platforms, which can have a significant impact on the overall trading costs, depending on the type of use.

IG’s standard average spread of 1.6 pips is a definitive advantage over eToro’s standard spread of 4.2 pips. This difference can add up to a significant amount, especially for high-frequency traders who place many trades daily.

In addition to the spreads, there are other costs to consider when choosing your forex broker, including overnight fees, account fees, and withdrawal fees. Both eToro and IG have competitive fees in these areas, but traders should be aware of the complete stack of costs before choosing a broker.

Our Superior Accounts and Features Verdict

Overall, while both eToro and IG Group have their advantages and disadvantages, we prefer IG Group’s slightly lower overall trading costs.

*Your capital is at risk ‘69% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – IG Group

When it comes to the trading experience, both IG and eToro have their merits. IG’s platform is incredibly intuitive, and the availability of MetaTrader 4 adds a layer of familiarity for many traders. On the other hand, eToro’s social trading features are a game-changer, especially for beginners who can learn from other traders in real time.

- IG’s user interface is clean and easy to navigate, making it straightforward for both beginners and experienced traders.

- eToro’s CopyTrader feature allows you to automatically copy the trades of successful traders, simplifying the trading process.

- IG offers a demo account with $10,000 in virtual funds, allowing you to practise without any financial risk.

- eToro’s platform is web-based and doesn’t require any downloads, making it accessible from any device.

However, it’s worth noting that neither platform made it to the top spots in our own testing for categories like “Best MT4” or “Best for Beginners”. Both have room for improvement in different aspects, such as spreads and customer service.

Our Best Trading Experience and Ease Verdict

Based on our analysis and testing, IG Group offers a more comprehensive and intuitive trading experience, especially for those familiar with MetaTrader 4.

*Your capital is at risk ‘69% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – IG Group

IG Group Trust Score

eToro Trust Score

Trading with a regulated broker is an essential aspect of mitigating risk when trading online. As mentioned earlier, trading carries inherent risks, but the risk of losing your funds to fraud or broker insolvency can be significantly reduced by working with a broker who has a Tier-1 regulatory licence.

You can significantly reduce the risk associated with trading online by choosing a broker licensed by a Tier 1 regulator, such as the UK’s Financial Conduct Authority or the Commodities Futures Trading Commission and National Futures Association in the US. These regulatory bodies impose stringent requirements on brokers and other financial service providers to safeguard customer funds and prevent fraudulent activities.

| eToro | IG Group | |

|---|---|---|

| Tier 1 regulators* | ASIC (Australia) CYSEC (Cyprus) FCA (UK) | ASIC (Australia) FCA (UK) BaFin (Germany) FINMA (Switzerland) NFA/CFTC (USA) CYSEC (Cyprus) MAS (Singapore) FMA (New Zealand) |

| Tier 2 regulators | MFSA (Europe) ADGM (UAE) GFSC (Gilbraltar) | JFSA (Japan) DFSA (Dubai) |

| Tier 3 regulators | FSA-S (Seychelles) | BMA (Bermuda) FSCA (South Africa) |

| Negative Balance Protection | Yes | Yes |

| Trust Score | 63/100 | 95/100 |

eToro holds licences from the Australian Securities & Investment Commission (ASIC) and the Cyprus Securities Exchange Commission (CySEC). ASIC is responsible for regulating Australia’s financial services sector and enforcing laws to protect consumers, investors, and creditors. Similarly, CySEC regulates the financial markets in Cyprus but is suitable if you are based anywhere in the EU territory, ensuring the fair and transparent operation of the industry.

On the other hand, IG is licensed by several Tier-1 regulators, including the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, the National Futures Association (NFA), and the North American Derivatives Exchange (NADEX). The FCA is considered one of the most stringent regulators in the world and requires brokers to meet strict financial requirements and abide by strict rules and regulations.

In addition to its Tier-1 licences, IG also provides Negative Balance Protection, which means that clients will not lose more than their account balance, even in the event of extreme market volatility or unexpected price gaps.

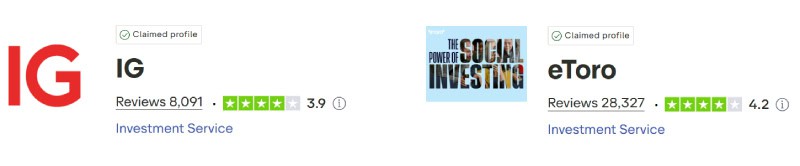

Reviews

eToro boasts a 4.2 out of 5 rating from over 28,000 reviews, reflecting strong user satisfaction. IG Markets holds a slightly lower score of 3.9 out of 5, based on around 8,000 reviews. eToro shines with volume and user-friendly features, while IG Markets appeals to more experienced traders seeking depth and reliability.

Our Stronger Trust and Regulation Verdict

Overall, while both eToro and IG Group have Tier-1 regulators backing them up, IG has a more extensive regulatory presence and offers additional protections for some types of accounts. Therefore, in terms of risk, IG Group may be the better choice for traders who prioritise safety and security, with eToro a close runner-up.

*Your capital is at risk ‘69% of retail CFD accounts lose money’

6. Most Popular Broker – eToro

eToro gets searched on Google more than IG Group. On average, eToro sees around 823,000 branded searches each month, while IG Group gets about 97,080 — that’s 88% fewer.

| Country | IG Group | eToro |

|---|---|---|

| United Kingdom | 2,900 | 135,000 |

| France | 14,800 | 110,000 |

| Italy | 8,100 | 110,000 |

| Germany | 5,400 | 74,000 |

| Spain | 110 | 60,500 |

| United States | 2,900 | 33,100 |

| Australia | 6,600 | 27,100 |

| Netherlands | 480 | 18,100 |

| Colombia | 70 | 14,800 |

| United Arab Emirates | 260 | 14,800 |

| Mexico | 90 | 12,100 |

| Switzerland | 320 | 12,100 |

| India | 4,400 | 9,900 |

| Malaysia | 480 | 9,900 |

| Poland | 90 | 9,900 |

| Peru | 50 | 9,900 |

| Taiwan | 480 | 8,100 |

| Philippines | 90 | 8,100 |

| Argentina | 50 | 8,100 |

| Portugal | 320 | 8,100 |

| Austria | 480 | 8,100 |

| Ireland | 90 | 8,100 |

| Greece | 140 | 6,600 |

| Brazil | 170 | 5,400 |

| Chile | 50 | 5,400 |

| Sweden | 3,600 | 4,400 |

| Canada | 320 | 3,600 |

| Morocco | 260 | 3,600 |

| Singapore | 1,000 | 3,600 |

| South Africa | 2,400 | 2,900 |

| Thailand | 320 | 2,900 |

| Indonesia | 110 | 2,900 |

| Pakistan | 1,000 | 2,900 |

| Vietnam | 260 | 2,900 |

| Nigeria | 90 | 2,900 |

| Ecuador | 20 | 2,900 |

| Turkey | 320 | 2,400 |

| Bolivia | 10 | 2,400 |

| Cyprus | 70 | 1,900 |

| Dominican Republic | 30 | 1,900 |

| New Zealand | 170 | 1,900 |

| Costa Rica | 10 | 1,900 |

| Japan | 140 | 1,600 |

| Hong Kong | 5,400 | 1,600 |

| Egypt | 50 | 1,600 |

| Venezuela | 10 | 1,300 |

| Saudi Arabia | 1,000 | 1,300 |

| Algeria | 90 | 1,300 |

| Kenya | 90 | 1,000 |

| Bangladesh | 50 | 1,000 |

| Jordan | 20 | 1,000 |

| Cambodia | 30 | 880 |

| Ghana | 20 | 480 |

| Sri Lanka | 40 | 390 |

| Panama | 10 | 390 |

| Uganda | 10 | 260 |

| Uzbekistan | 10 | 260 |

| Ethiopia | 10 | 260 |

| Mauritius | 30 | 260 |

| Tanzania | 20 | 210 |

| Botswana | 20 | 70 |

| Mongolia | 10 | 70 |

2,900 1st | |

135,000 2nd | |

8,100 3rd | |

110,000 4th | |

110 5th | |

60,500 6th | |

6,600 7th | |

27,100 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with eToro receiving 51,160,000 visits vs. 9,438,000 for IG Group.

Our Most Popular Broker Verdict

eToro is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘61% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – Tie

When it comes to available trading instruments, both eToro and IG offer a comprehensive selection of products and markets, including forex, commodities, stocks, and cryptocurrencies. However, there are differences in the range and variety of products available on each platform.

| eToro | IG | |

|---|---|---|

| Forex trading | 49 | 110 |

| Cryptocurrency trading | 79 Cryptos 14 crosses | 13,000+ |

| Share CFD trading | 3,000+ (across 15 global exchanges) | 13 plus Crypto10 Index |

| Commodities CFD trading | 26 hard and softs | 11 Metals 7 Energies 23 Softs |

| ETF CFD trading | 300+ | 2000+ |

| Indices CFD trading | 20 | 130 |

| Bonds/Treasuries CFD trading | 0 | 14 |

| Real Stocks | Yes (selected countries) | In selected markets (i.a Australia, UK) |

| Other Products | Customer Index Baskets | Spread Betting Options Trading Furtures Trading Binary Trading Interest Rates Sectors |

Both eToro and IG have something for every type of investor, but eToro consistently outperformed IG in terms of the breadth of markets available.

One area where eToro outperforms IG is in the range of cryptocurrencies available. With 79 pairs and 14 crosses, eToro is a top choice for crypto enthusiasts looking to trade in this market.

On the other hand, IG offers a more diverse range of products across different asset classes, including forex, stocks, commodities, and bonds. IG also offers a wider range of markets, including some hard-to-find products such as options and interest rates. This can be an advantage for traders who want to access a wider range of products and markets.

When it comes to traceable products, both eToro and IG offer a range of products that can be easily tracked, including stocks, commodities, and ETFs. This is an important consideration for traders who want to monitor their investments closely and make informed decisions based on market trends and data.

Our Top Product Range and CFD Markets Verdict

Overall, both eToro and IG Group offer a comprehensive range of products and markets, but the choice will depend on individual trading preferences and goals. Traders need to consider which platform more sufficiently captures the basket of currencies or assets they wish to trade.

*Your capital is at risk ‘61% of retail CFD accounts lose money’

8. Superior Educational Resources – IG Group

When it comes to educational resources, both IG and eToro have a lot to offer, but they approach trader education differently. IG has a comprehensive education section that includes webinars, video tutorials, and articles aimed at both beginners and experienced traders.

- IG offers a wide range of webinars that cover various trading topics.

- eToro provides an interactive trading academy with courses and quizzes.

- IG’s video tutorials are in-depth and cover a variety of trading strategies.

- eToro offers a ‘Daily Market Review’ to keep traders updated on market conditions.

- IG provides articles that delve into complex trading topics.

- eToro has a vibrant community where traders can discuss strategies and tips.

eToro, on the other hand, leans more towards social learning. Their platform allows you to engage with other traders, ask questions, and even copy their trades. This makes it a great place for beginners to start their trading journey.

Our Superior Educational Resources Verdict

Based on our team’s scoring, IG Group offers superior educational resources, particularly for traders looking for in-depth tutorials and a wide range of topics.

*Your capital is at risk ‘69% of retail CFD accounts lose money’

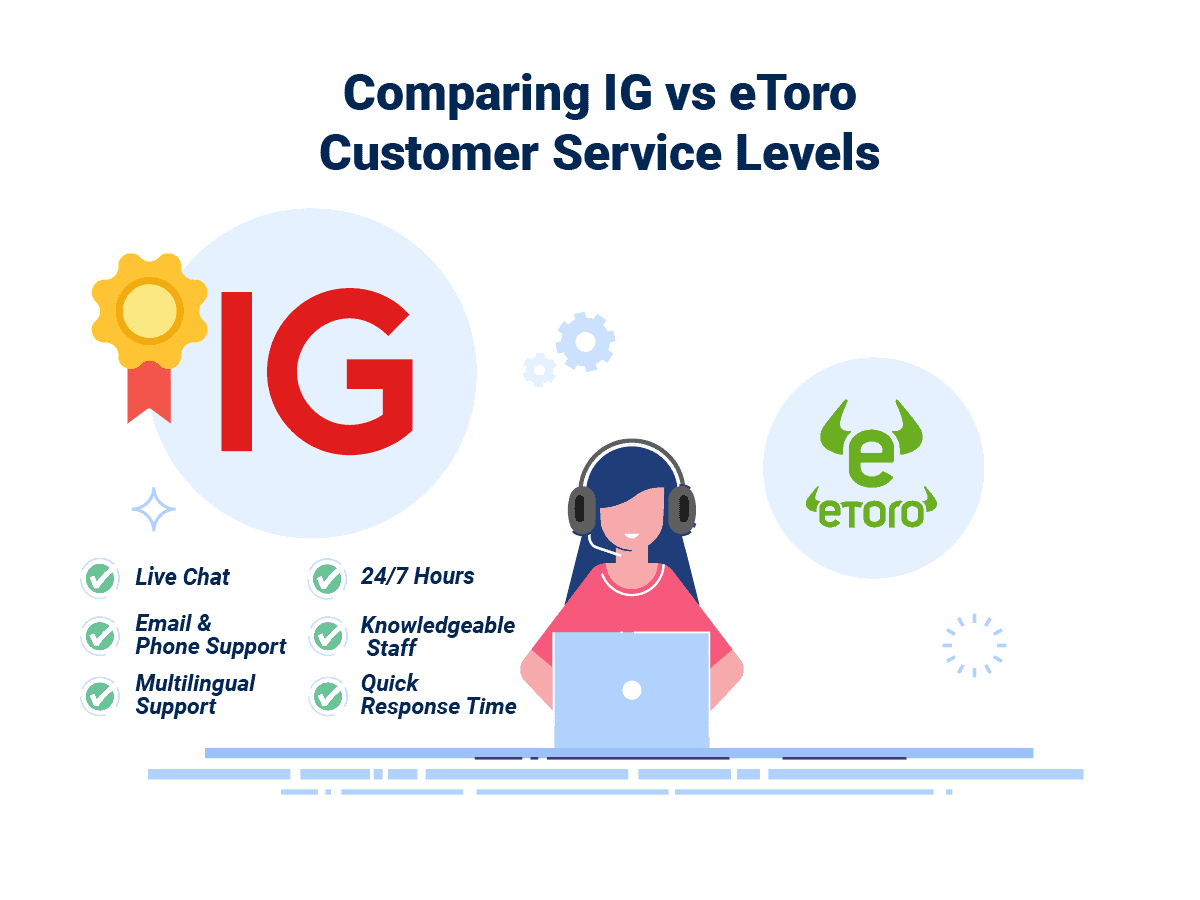

9. Superior Customer Service – IG Group

Customer service is a crucial aspect of any trading platform, and both IG and eToro have their strengths and weaknesses in this department. IG offers 24/5 customer support through various channels, including phone, email, and live chat. Their response time is generally quick, and the support team is knowledgeable.

eToro also provides 24/5 customer support but mainly through live chat and ticket systems. While their response time is decent, it’s not as fast as IG’s. Additionally, eToro offers support in multiple languages, which can be a significant advantage for non-English speakers.

| Feature | IG Group | eToro |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

In terms of additional support tools, IG offers webinars and a comprehensive FAQ section. eToro, on the other hand, has a community forum where traders can discuss various topics and seek advice.

Our Superior Customer Service Verdict

Based on our team’s scoring, IG Group edges out eToro in customer service, particularly in terms of response time and the variety of support channels available.

*Your capital is at risk ‘69% of retail CFD accounts lose money’

10. Better Funding Options – IG Group

Funding options are a significant consideration when choosing a trading platform. IG offers a variety of methods, including bank transfers, credit/debit cards, and even PayPal. The platform also doesn’t charge any deposit fees, which is a plus for many traders.

eToro also provides multiple funding options, such as credit/debit cards, bank transfers, and e-wallets like Skrill and Neteller. However, eToro does charge a $5 withdrawal fee, which can add up over time if you frequently move funds in and out of your account.

| Funding Methods | IG Group | eToro |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | Yes |

| Skrill | No | Yes |

| Neteller | No | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | Yes |

| POLi / bPay | Yes | Yes |

| Klarna | No | Yes |

Our Better Funding Options Verdict

Based on our team’s scoring, IG Group offers better funding options, particularly due to the absence of withdrawal fees and the inclusion of PayPal as a funding method.

*Your capital is at risk ‘69% of retail CFD accounts lose money’

11. Lower Minimum Deposit – eToro

When it comes to trading, especially for beginners, the minimum deposit requirement can be a significant factor in choosing a broker. IG and eToro are two brokers that have made it easier for traders to get started by offering low minimum deposit requirements. IG allows traders to start with a CFD account that has no minimum deposit, while eToro requires a minimum deposit of $50 for its standard account.

| Broker | Minimum Deposit | Recommended Deposit |

| IG Group | $0 | $100 |

| eToro | $50 | $200 |

For traders who are looking to engage in Direct Market Access (DMA), IG sets the bar at $450. This is considerably higher than the standard account but offers more features and capabilities. eToro, on the other hand, maintains its $50 minimum deposit across its offerings, making it a more straightforward choice for traders who prefer simplicity.

| Trader is a redident in: | Minimum First Deposit (USD) |

| Australia, United Kingdom, Germany, Malaysia, Singapore, Thailand, Ireland, Spain, Sweden | $50 |

| France, Poland, Slovakia, Belgium, Czech Republic | $100 |

| Eligible countries outside of the list | $200 |

| New Zealand | $1,000 |

| Israel | $10,000 |

| Uniited States | $10 |

Our Lower Minimum Deposit Verdict

When it comes to lower minimum deposits, eToro takes the lead with a flat $50 requirement for its standard account, making it more accessible for traders who are just starting out.

*Your capital is at risk ‘61% of retail CFD accounts lose money’

Our Final Verdict On Which Broker Is The Best: IG Group or eToro?

IG is the winner because it consistently outperforms eToro in most of the key areas that matter to traders. The table below summarises the key information leading to this verdict.

| Criteria | IG Group | eToro |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ✅ | ✅ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ❌ |

| Top Product Range And CFD Markets | ✅ | ✅ |

| Superior Educational Resources | ✅ | ❌ |

| Superior Customer Service | ✅ | ❌ |

| Better Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ❌ | ✅ |

Best For Beginner Traders

For beginner traders, eToro is the better choice due to its lower minimum deposit requirement and user-friendly interface.

Best For Experienced Traders

For experienced traders, IG is the superior option, offering a wide range of features, lower spreads, and robust customer service.

FAQs Comparing IG Group Vs eToro

Does eToro or IG Group Have Lower Costs?

IG has lower costs compared to eToro. IG offers spreads as low as 0.6 pips on major currency pairs like EUR/USD. eToro’s spreads start at 1 pip for the same pair. For more information on low-cost brokers, you can visit this comprehensive guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

When it comes to MetaTrader 4, IG is the clear winner. IG offers full support for MetaTrader 4, including custom indicators and automated trading strategies. If you’re keen on using MT4, check out this list of the best MT4 brokers.

Which Broker Offers Social Trading?

For social trading, eToro takes the lead. eToro’s CopyTrader feature allows you to automatically copy the trades of successful traders. To explore more about social trading platforms, you can refer to this guide on the best copy trading platforms.

Does Either Broker Offer Spread Betting?

IG offers spread betting, while eToro does not. IG provides a robust platform for spread betting across various markets. For a deeper dive into spread betting options, explore this list of top UK spread betting brokers.

What Broker is Superior For Australian Forex Traders?

In my opinion, IG stands out for Australian Forex traders. Both IG and eToro are regulated by ASIC, but IG, founded in the UK, has a longer history compared to eToro, which is based overseas. For more Australian Forex insights, check out this comprehensive review of the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK Forex traders, I’d have to give the nod to IG. Both brokers are FCA regulated, but IG, being UK-founded, has a deeper understanding of the local market compared to eToro, which is based overseas. For more UK-specific trading information, consult this guide to the Best Forex Brokers In UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert