Pepperstone Commission Guide

Pepperstone applies commission in two ways, the Razor account has spreads plus a commission of $7.00 per lot with MT4 while the Standard account includes commissions in the spread. Read about the Pepperstone commissions

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

No matter what account you choose to open as an online trader, understanding the commission involved is an important part of crunching your numbers and making Forex trading decisions that work for you and your budget. Pepperstone has two trading accounts including the Standard Account and Razor Account.

This page looks at the commission costs of each Pepperstone account type.

Pepperstone Razor Account Commissions

Pepperstone spreads are as low as 0.0 pips for major pairs such as EUR/USD, it is possible the only trading cost you pay will be the commissions (and in some cases holding costs). These commission costs will vary depending on the trading platform you use, the number of lots you trade with and the nominated currency of your account.

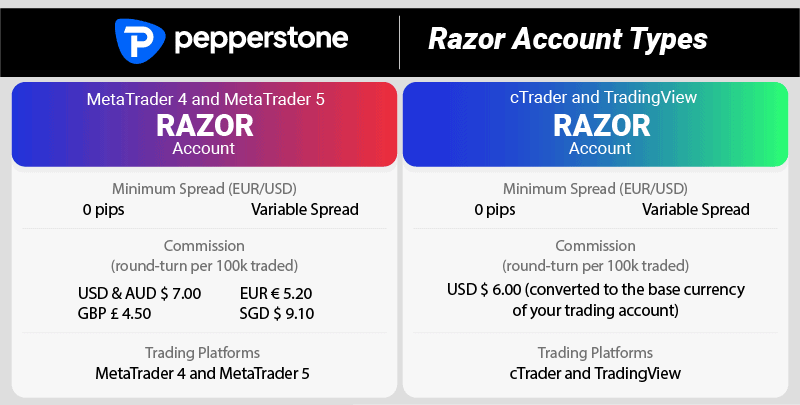

When choosing this account, you will need to decide between two types of Razor accounts. The difference between the two comes down to the trading platforms and the commissions these platforms apply.

As the table below shows, these fees are competitive and align with the industry average.

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| Pepperstone Commission Rate | $3.50 | $3.50 | £2.25 | €2.60 |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

Key Features Of the Razor Account

- Forex spreads from 0.0 pips + commission for each lot traded

- Spreads are more ECN-like (that a standard account) since quotes are more true market rates (i.e. those provided by liquidity providers)

- Choice of MetaTrader 4 or 5, cTrader and TradingView trading platforms

- Pepperstone Leverage is up to 30:1 or 500:1 (depending on regulatory jurisdictions)

- Best for advanced traders, day traders, scalpers, high-volume and high-frequency traders.

By using STP execution with no dealing desk, spreads can be kept low, which allows for the Pepperstone ECN-like pricing.

Snapshot of Razor Account Commissions

If your nominated account currency is USD and you are using a MetaTrader trading platform, your commission costs will be USD $7.00 round-turn for each 100,000 (standard lot) you trade. Commission costs will vary for MetaTrader accounts with other account currencies and for trades with smaller lot sizes.

Commission with the cTrader and TradingView trading platforms consists of USD $6.00 round-turn for each 100,000 lot. This is then converted to the nominated currency of your trading account using the exchange rate available at the time of the conversion.

Only Forex and share CFD products have commission costs. If you wish to trade other products, such as ETFs, Indices or Best Brokers for Gold CFD Trading you will not need to worry about commission fees.

Razor Commissions With MetaTrader

Given how commissions differ between trading platforms, account currency and lot size, in this section we take a deep dive into how commission costs are applied. Commissions MetaTrader 4 and MT5 Deep-Dive – Account Currency Matters

To keep spreads low and help the broker avoid wider spreads, a commission is paid.

If you trade with MetaTrader 4 or MetaTrader 5 trading platforms, you pay USD $7.00 round-turn for each standard (100,000) lot you trade. This USD $7.00 is the total amount after opening your trading position (USD $3.50) and exiting the trade (USD $3.50). Read the full Pepperstone MT4 vs MT5 comparison.

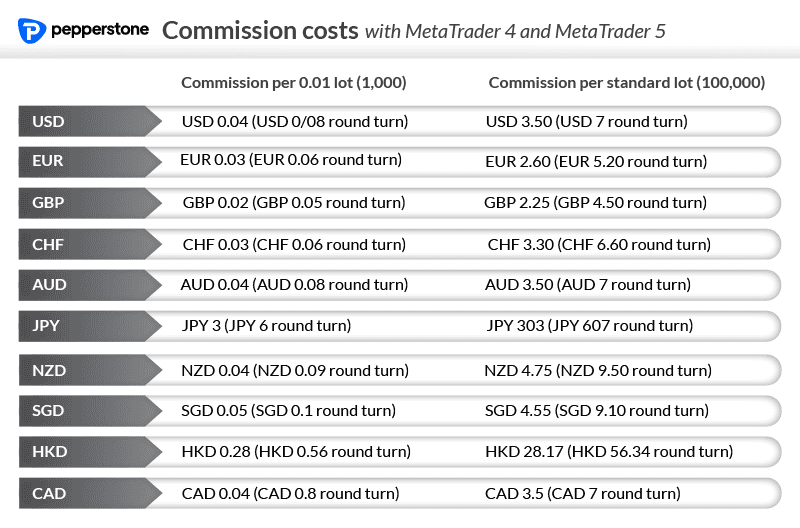

As a rule, commission costs are generally quoted using USD, however, the currency you pay actually depends on the nominated currency of your trading account. Trading accounts in AUD have a commission of AUD 7.00 round turn per lot and trading accounts in GBP have a commission of GBP £4.50. Pepperstone allows you to choose from 10 different types of currencies for your trading account – USD, AUD, EUR, GBP, CHF, JPY, NZD, SGD, CAD and HKD

When signing up for a trading account with Pepperstone, you need to nominate an account currency. If you’re located in Australia and using an Australian bank account to transfer your funds, then using the AUD is a logical choice. For those in the UK, it would be logical to nominate GBP as your account currency.

You don’t have to choose the same currency as your bank account but it will result in conversion fees when you deposit or withdraw funds from your trading account.

Razor Commission using cTrader and TradingView

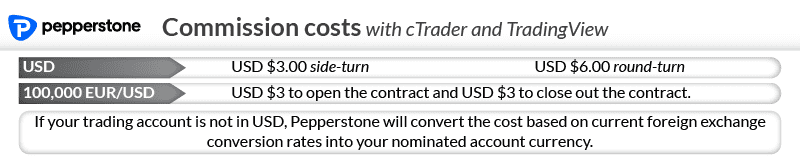

If you use the cTrader or TradingView trading platforms, you pay USD $6 for each lot (round-turn) converted into your base currency using current foreign exchange conversion rates.

Commission and Trading Lots Size

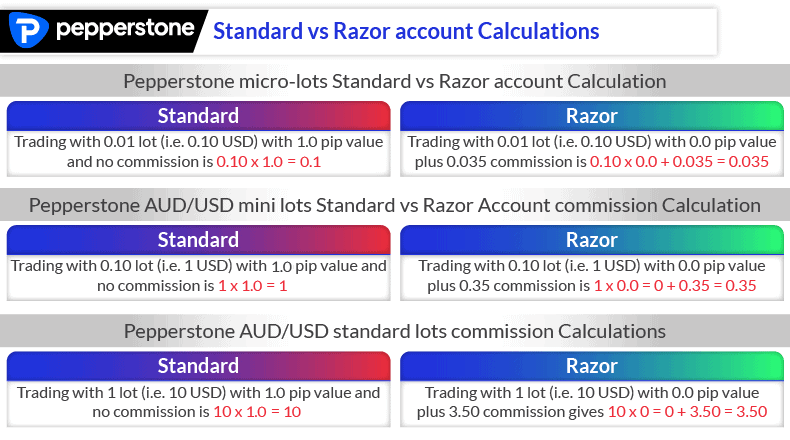

Pepperstone allows trading with 3 types of lot sizes. On this page, we quote using standard lots which is the equivalent of 100,000 units of the base currency. However, the broker also allows trading with smaller lots, these being micro lots (1,00 units) and mini lots (10,000).

The ability to trade with different lot types gives you added flexibility with your trading sizes. This is especially helpful for conservative traders who may want to limit the risk they take on by using less of their own funds. It is also helpful for those with fewer funds available to trade with.

Since micro and mini lot sizes are smaller, it is only right that the broker charges a smaller commission. Pepperstone applies a straight pro-rata conversion for mini lots. If the commission is $3.50 for a standard lot, you can expect to pay 35c for a mini lot (0.1).

If trading with micro-lots, a not-quite pro-rata conversion is applied. As an example EUR/USD commission of $3.50 will convert to 0.04c for micro lots.

Razor Account Round Up

With commissions of $7.00 round-turn per lot, commissions with Pepperstone follow industry standards. Nearly all ECN-style brokers have exactly the same commissions, there are some brokers that charge more but there are some brokers that charge less. For more info, visit our GO Markets Review and Fusion Markets Review. We have previously written about the Lowest Commission Brokers.

While the Razor Account does have commission costs, the spread is very low which more than makes up for the added commissions. In fact, Pepperstone is one of the Lowest Spread Forex Brokers for this style of account.

To help you choose between the Pepperstone Razor account and the Pepperstone Standard account, let’s look at the commission on the Pepperstone Standard account – a good account for beginner traders.

Pepperstone Standard Account Commissions

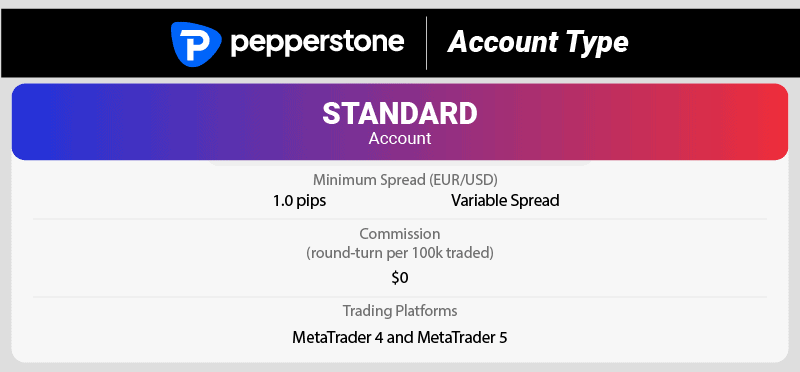

The Pepperstone Standard account has $0 commission and a mark-up of 1.0 pips. By offering the simplicity of commission that is built into the spread, the Pepperstone Standard account is a perfect choice for beginner traders, globally.

Standard Account – key features

- Forex spreads from 1.0 pips

- No commission costs (commission included in the spread)

- Choice of MetaTrader 4 or 5 trading platforms

- Can use Capitalise.ai with MetaTrader 4 for automation

- Best for beginner traders, discretionary traders, long term traders

Snapshot of Pepperstone Standard Account

Spreads with the Standard account are wider than the Razor account, since the broker’s commissions, or trading costs, are included with the spread. Despite this, spreads are still low being just 1.0 pips per lot. Like with the Razor account, one can choose between standard, micro and mini lots.

You can choose between MetaTrader 4 and MetaTrader 5 trading platforms and, if you choose MetaTrader 4, you can automate by integrating Capitalise.ai with the platform.

Pepperstone Standard Account Commissions Deep-Dive

As already established, the Pepperstone standard account has no commission costs. In reality, this isn’t exactly true – it just means the broker has incorporated the commissions into the spread.

When comparing minimum spreads with Pepperstone Razor Account and Standard Account, it appears they widen the spread by a flat 1.0 pips for major and minor pairs.

Raw Account Spreads

| Pepperstone | Tested RAW Spreads | Tested Industry Average |

|---|---|---|

| EUR/USD | 0.19 | 0.27 |

| USD/JPY | 0.36 | 0.48 |

| GBP/USD | 0.41 | 0.54 |

| AUD/USD | 0.19 | 0.42 |

| USD/CAD | 0.61 | 0.62 |

| USD/CHF | 0.39 | 0.71 |

Standard Account Spreads

| Pepperstone | Tested Standard Spreads | Tested Industry Average |

|---|---|---|

| EUR/USD | 1.21 | 1.11 |

| USD/JPY | 1.55 | 1.49 |

| GBP/USD | 1.50 | 1.50 |

| AUD/USD | 1.24 | 1.28 |

| USD/CAD | 1.60 | 1.67 |

| USD/CHF | 1.67 | 1.86 |

The Standard account can be used with either the MetaTrader (MT4 or MT5) platforms. If using MetaTrader 4, Capitalise.ai is available, which is among the Automatic Trading Platforms.

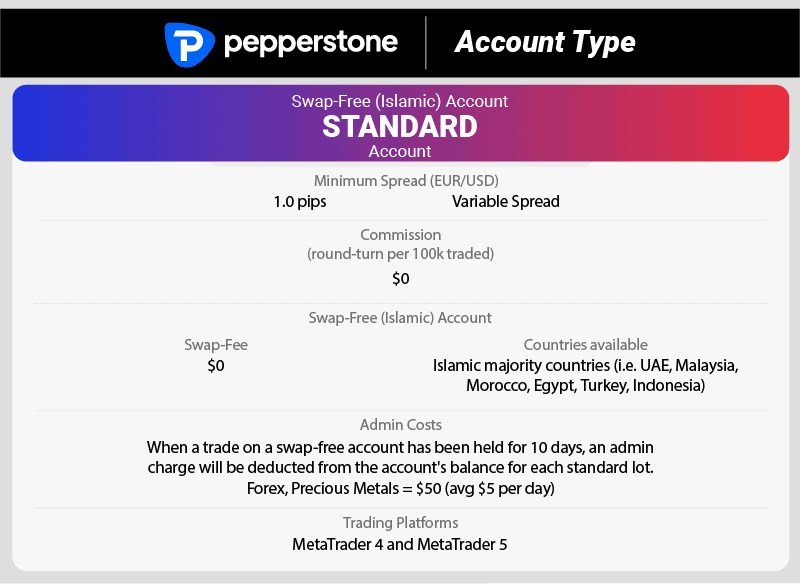

Swap-Free (Islamic) Account

For Islamic traders who abide by Shariah law, there is also a swap-free account. This account is only available to traders in Muslim-majority countries such as the United Arab Emirates, Morocco, Malaysia and Indonesia.

The Islamic account is the same as the Standard account but without swap fees. Instead of overnight fees, you pay an administration fee. This administration fee is charged every 11th day (10th overnight) that you hold an open position. Major pairs cost USD $50, that average to about USD $5 per day.

Choosing Between Razor Vs Standard Accounts

Our team made a full guide to help choose between the Pepperstone Razor vs Standard accounts. In summary, if we assume that Pepperstone marks up the spread with the standard account by 1.0 pips, then we can say the Razor account will be cheaper.

Remember that the cost with a standard account is with the spread only, while a Razor account has spreads + commission. So, if we apply the minimum spread for each account type, then this is the result:

Standard Account

- 1.0 pips which converts to $6.00 for each lot to open a trading position

Razor Account

- 0.0 pips + $3.50, which converts to $3.50 for each lot to open a trading position.

While the Razor account is cheaper when compared to the standard account, the difference is of most significance to high-volume or high-frequency traders, as the totals will add up over time.

Before you go looking for a broker with a no-commission account and lower spreads, keep in mind that 1.0 pips are very low for a standard account. You won’t find many brokers with tighter spreads, regardless if they are Market Maker Brokers or a no-dealing desk broker.

It’s important to note that the cost with a standard account is with the spread only, while a Razor account has spreads + commission.

You can also improve your knowledge of Pepperstone’s minimum deposits required across both main accounts – the Pepperstone Standard and Pepperstone Razor accounts – as well as Pepperstone deposit information by reading our detailed explanation of Pepperstone minimum deposit requirements.

How do Pepperstone commissions compare to other brokers

The table below compares the commission charged by 16 different brokers for like-for-like trading accounts. As can be seen, The vast majority of brokers charge the standard USD$7.00 per standard lot. So it would be fair to conclude that commissions with Pepperstone on their Razor account are fair and what one would expect from a broker you can trust.

There are a few brokers that do have slightly lower commissions, examples of these are GO Markets and Fusion Markets. If you are a high-volume trader and your goal is to save on commission costs, then these brokers may be worth considering. Just be sure the spreads match or better those of Pepperstone and the broker hasn’t sacrificed other features.

Some brokers have tiered commission. This means the more you trade the lower the commission costs will be. Low-volume traders may end up paying more while high-volume traders will likely save in the long run.

| Commission | Side-ways (Standard lot) | Round-turn (Standard lot) |

| Pepperstone | USD 3.50 | USD $7.00 |

| IC Markets | USD $3.50 | USD $7.00 |

| FxPro (with cTrader only) | USD$3.50 | USD$7.00 |

| Think Markets | USD$3.50 | USD$7.00 |

| OANDA | USD$3.50 | USD$7.00 |

| XM (Europe only) | USD$3.50 | USD$7.00 |

| BlackBull Markets | USD$3.50 | USD$7.00 |

| Eightcap | USD$3.50 | USD$7.00 |

| Axi | USD$3.50 | USD$7.00 |

| FP Markets | USD$3.00 | USD$6.00 |

| Go Markets | USD$2.50 | USD$5.00 |

| Fusion Markets | USD$2.25 | USD$4.50 |

| IG (DMA) | Tiered | Tiered |

| Admirals | Tiered | Tiered |

| Interactive Brokers | Tiered | Tiered |

| FXTM | Tiered | Tiered |

Verdict On Pepperstone Commission Rates

Our analysis comparing Pepperstone to other forex brokers shows the broker is competitive when it comes to commission rates and combined with their spreads makes their brokerage one of the lowest worldwide. This is why our 2026 analysis showed the broker was the Best Forex Brokers In Australia and and a top FCA Regulated Brokers winner. There is a more comprehensive Pepperstone Review that looks at other attributes of the broker from the trading platforms to execution speeds.

FAQ

What type of commission plans are available in pepperstone?

Pepperstone offer two types of commission plans when trading Forex. The Razor account has a spread plus commission plan, while the Standard account has a spread-only commission plan. The Razor account has a spread cost plus commission. and has two options – a MetaTrader 4 or MetaTrader 5 account for which you pay USD 7.00 (AUD 7.00, EUR 5.20, GBP 4.50) per lot round-turn and the cTrader or TradingView account. This account has a cost of $6 USD per lot converted to your account currency. The other option is a no-commission account which includes the commission in the spread.

What are the fees associated with trading on pepperstone?

The main fee you pay when trading with Pepperstone is the spread however there are other fees you may encounter. These fees include commission fees such as those found with the Razor when trading Forex and when trading CFD shares and ETFs. The other main fee to note is the overnight fee (sometimes called rolling costs or holding costs). Pepperstone fortunately does not charge an inactivity fee or fee to make a deposit or withdrawals unless it is an international bank transfer.

What currencies can you hold in your pepperstone account?

Pepperstone allows you to choose between the following currencies when creating your account – USD, EUR, GBP. CHF, AUD, JPY, NZD, SGD, HKD, CAD. Choosing the right account type matter as this is what you will pay your commission costs in with the Razor account and avoids costs associated with currency conversion.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.