Pepperstone MT4 vs MT5 Comparison

Pepperstone clients can choose between the MetaTrader 4 or MetaTrader 5 platform with MT4 more suited to forex traders with MT5 being more CFD trading focused. Compare Pepperstone MT4 vs MT5 options factoring in automation, functionality and charting facilities.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Our team tested key features of the MT4 and MT5 trading platforms offered by leading forex broker Pepperstone. Both platforms had advantages and drawbacks, but one clear winner emerged when we tallied the results.

MT4 vs MT5 Selection Logic When Opening A Pepperstone Account

A well-regarded Australian retail trading broker, Pepperstone regularly tops our rankings across various categories. Likewise, the MetaTrader 4 and MetaTrader 5 platforms have become synonymous with day trading in recent years, particularly amongst those who specialise in forex and contracts for difference (CFDs).

At Compare Forex Brokers, we wanted to know what happens when you combine one of the best brokers with the best platforms. Would Pepperstone allow the platforms to operate at full capacity, with all features included? (Not quite.) Would one better fit the broker’s trading products or specific strategies? (Absolutely.)

Below, is our head-to-head matchup of Pepperstone’s MT4 and MT5 offerings and our final verdict.

The overall rating is based on review by our experts

Pepperstone Commissions: MT4 vs MT5

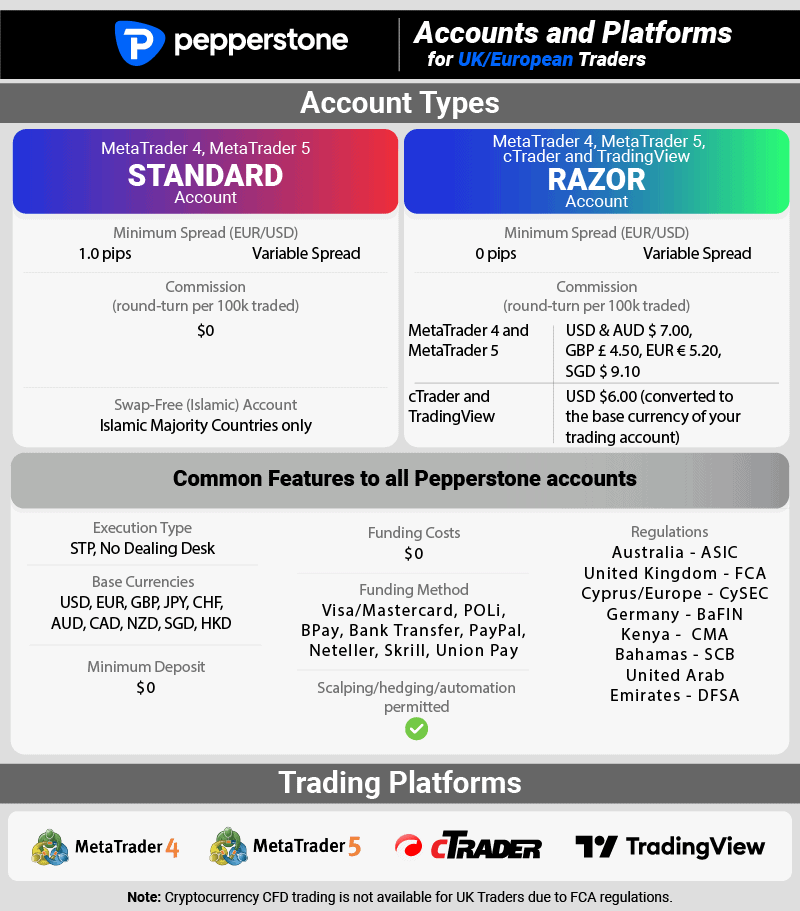

Because they directly impact profitability, many traders focus first on spreads commissions when choosing a broker or trading platform. Some brokers calculate commissions as a percentage of the value of your trade, while others charge a flat fee per round-turn lot. Pepperstone falls into the latter category, with commissions ranging from USD 3.50 to GBP 2.25 for the Pepperstone Account Types.

Read our full comparison of Pepperstone Razor and Standard accounts

For traders who prefer to trade without paying broker commissions, Pepperstone offers a Standard account. Keep in mind, however, that commission-free accounts typically offer wider spreads, and Pepperstone is no exception. While the Razor account offers spreads as tight as 0.0 pips, the Standard account starts at 0.6 pips.

Pepperstone MT4 Commissions

Traders who opt for Pepperstone’s Standard account with MetaTrader 4 need to factor in a fixed minimum spread of 1.0 pip for major currency pairs. Though not always the cheapest, we recommend this account type for beginners still learning how to calculate trading costs.

Razor account holders trading with MetaTrader 4 pay a flat commission for every round-turn trade. Amounts vary depending on the base currency of your account:

- £2.25

- $3.50

- €2.60

- ₣3.30

| What We like | What We Don’t |

|---|---|

| Straightforward commission structure | Micro lots rounded up in some cases |

| Competitive average raw spread | |

| Lower-than-average trading costs |

Pepperstone MT5 Commissions

Fortunately for the review team at Compare Forex Brokers, Pepperstone likes to keep things simple. Commissions and spreads for Standard and Razor accounts running MetaTrader 5 are identical to those for MetaTrader 4.

To recap: that means a minimum spread of 1.0 pip for major currency pairs if you trade via a Standard account and commissions equal to approximately £2.25 per round turn lot for the Razor account. (Actual commissions may vary slightly depending on the base currency of your account.

| What We Like | What We Don’t |

|---|---|

| Straightforward commission structure | Micro lots rounded up in some cases |

| Competitive average raw spread | |

| Lower-than-average trading costs |

How We Tested

We compared Pepperstone spreads and commissions against those of 37 other Tier-1 regulated brokers and assigned point values based on: complexity of fee structure; average variable spread; average raw spread; and overall commission cost per round-turn trade.

Our Winner: Tie

With – literally – identical spreads and commissions for the MetaTrader 4 and MetaTrader 5 platforms, we have no choice but to call this one a draw.

Pepperstone Leverage: MT4 vs MT5

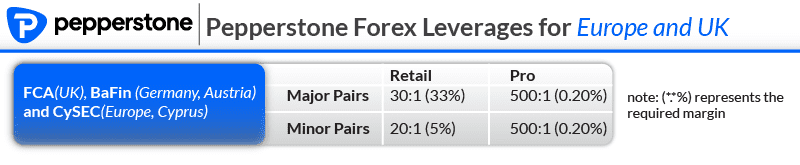

Leverage, sometimes also known as trading on margin, allows traders to magnify the size of their positions by borrowing from the broker. This can lead to exponentially higher profits when you read the market correctly – and equally sizable losses when you get it wrong.

The UK’s Financial Conduct Authority (FCA) caps leverage for retail traders at 30:1 for major pairs and 20:1 for minors. In practical terms, that means that, for every £1 in your account, you can trade up to £30 (£20, if you’re trading a minor pair). Professionals have significantly more with which to play, with permissible margins of up to 500:1.

Always think twice before using leverage in a trade unless you’re sure you can cover any losses if the market moves against you. Likewise, don’t trade on margin if you can’t afford to lose the total value of the position. (Anything else is just gambling, plain and simple.)

Pepperstone MT4 Leverage

Regardless of your account type, if you trade forex with MetaTrader 4, you’ll have access to the maximum Pepperstone leverage allowed by the FCA: 30:1 for major currency pairs and 20:1 for minor currency pairs.

If you have a portfolio valued at more than €500,000, experience as a professional trader and have made at least 10 ‘significant’ transactions in the last quarter, you may qualify for a Professional account with Pepperstone. In that case, you’ll have access to leverage as high as 500:1.

| What We Like | What We Don’t |

|---|---|

| Maximum leverage allowed by the FCA | Strict requirements to qualify as a ‘Professional’ trader |

Pepperstone MT5 Leverage

Whether you trade forex with a Razor or Standard account, Pepperstone’s UK clients using MetaTrader 5 can trade on margin at rates of 30:1 for major currency pairs and 20:1 for minor pairs. That’s the maximum allowed by the FCA.

MetaTrader 5 users can also qualify as Professional clients, provided they can offer proof of a portfolio valued at more than €500,000, experience as a professional trader and 10 significant transactions in the most recent quarter. Meet those requirements? Pepperstone will give you margins as high as 500:1.

| What We Like | What We Don’t |

|---|---|

| Maximum leverage allowed by the FCA | Strict requirements to qualify as a ‘Professional’ trader |

How We Tested

We compared the margin rates offered by Pepperstone for each account type and platform against the maximum permitted by the FCA.

Our Winner: Tie

As with commissions, we can’t justify anything other than a tie. Both MetaTrader 4 and MetaTrader 5 users benefit from Pepperstone’s decision to offer as much leverage as allowed by law.

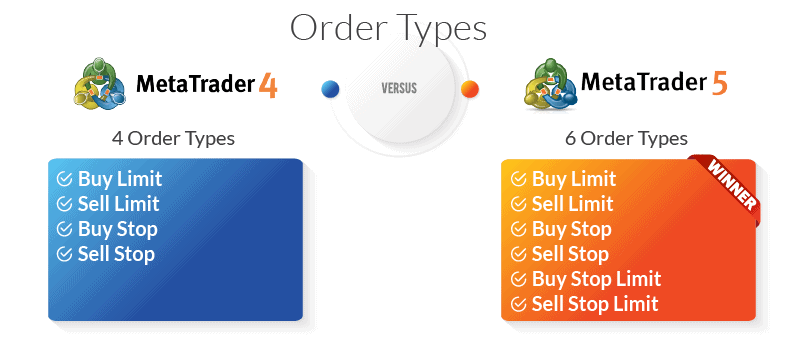

Pepperstone Order Types: MT4 vs MT5

Before diving into the particulars of which platform offers what order types, let’s take a moment to review orders in general. In simplest terms, an order is your request to the broker to buy or sell if specific criteria are met. The number and characteristics of those criteria, however, allow for sophisticated trading strategies.

- Market orders. An order to buy or sell immediately. Guaranteed execution, but no guarantee of the price.

- Pending orders. An order to buy or sell at a specific price or better.

- Buy Limit

- Buy-Stop Limit

- Sell Limit

- Sell-Stop Limit

- Stop orders. An order to close a position if the price falls below a certain level, or sell if it rises beyond a pre-set threshold.

- Trailing-Stop

- Stop-Loss

- Take-Profit

Regardless of your trading style or strategy, the more pending and stop order options a platform offers, the better. Combining limits and stops controls your exposure and maximises your profits, particularly if you trade on margin.

Pepperstone MT4 Order Types

In addition to market orders, forex traders using the MT4 platform can opt for four different types of pending orders:

- Buy Limit

- Sell Limit

- Buy Stop

- Sell Stop

| What We Like | What We Don’t |

|---|---|

| Sufficient pending order types to manage risk | No Stop-Limit orders |

| No Stop-Loss order | |

| No Take-Profit order | |

| No Trailing-Stop order |

Pepperstone MT5 Order Types

MetaTrader 5 includes standard market orders, as well as two more pending order types than MT4:

- Buy Limit

- Sell Limit

- Buy Stop

- Sell Stop

- Buy Stop Limit

- Sell Stop Limit

| What We Like | What We Don’t |

|---|---|

| Full range of limit and stop orders to limit risk and maximize profit | No Trailing-Stop order |

| Stop-Loss order available | |

| Take-Profit order available |

How We Tested

Our team reviewed the Pepperstone website, noted the order types listed and then tested each using our own accounts to confirm availability. In each case, we found that the broker accurately represented the availability of market and pending orders for the MetaTrader 4 and MetaTrader 5 platforms.

Our Winner Is MetaTrader 5

In this case, MetaTrader5’s additional pending order types clearly pushed it to the top spot. The more risk management tools the better, in our opinion. Because all the technical indicators and advanced charting in the world can’t save your capital if you misread the market.

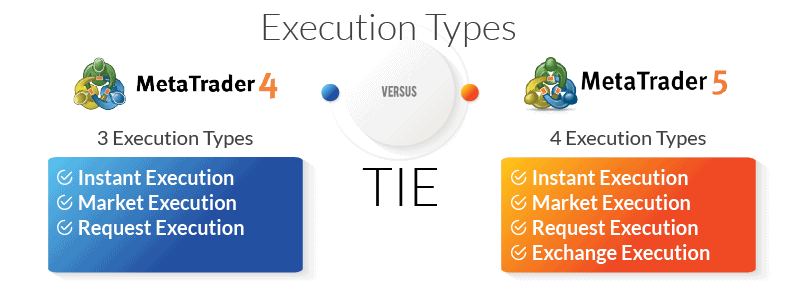

Pepperstone Execution Types: MT4 vs MT5

After order types, execution methods play the most significant role in the success of your trading strategy. A platform with a broader range of execution types gives you more options when coordinating your trades. Note that, if you intend to trade more than forex, you’ll want as many order types as possible to accommodate the particularities of different markets.

- Instant Execution. The platform fills an order at the exact price quoted by the broker.

- Market Execution. The platform fills an order at the current market price based on aggregated liquidity sources. (Traders may experience slippage using this execution type.)

- Request Execution. The platform fills an order at a price pre-agreed by the trader and the brokerage.

- Exchange Execution. The platform fills an order directly on an exchange at the current market price as calculated based on depth of market data.

Learn more about Pepperstone ECN order execution system

Pepperstone MT4 Execution Types

Despite the fact that MetaTrader 4 can handle up to three different types of execution, Pepperstone offers only one: Market. In practical terms, that leaves Pepperstone clients at greater risk of slippage and gapping. Pepperstone claims deep liquidity and ultra-fast processing offer sufficient protection, but we have our doubts.

Because MetaTrader 4 does not offer Exchange execution, you’re limited in the number of products you can trade. If you’re interested in more than forex or CFDs, this isn’t the platform for you.

| What We Like | What We Don’t |

|---|---|

| Deep liquidity to minimise gaps and slippage | No Instant execution |

| No Request execution | |

| Only suitable for forex trading |

Pepperstone MT5 Execution Types

Despite the fact that MetaTrader 5 includes an Exchange execution type that allows traders to fill orders directly on exchanges, Pepperstone limits clients to Market execution. According to the broker, this reduces risk to traders and strengthens the overall market by giving account holders access to deep liquidity. This may be the case, however we also note that limiting traders to Market execution also works to a broker’s advantage.

| What We Like | What We Don’t |

|---|---|

| Deep liquidity to minimise gaps and slippage | No Instant execution |

| No Request execution | |

| No Exchange execution |

How We Tested

We confirmed the available execution types with Pepperstone customer support and compared against the options provided in our own accounts:

Our Winner: Tie

Pepperstone subjects MetaTrader 4 and 5 users to identical limitations when it comes to executing orders. It’s Market execution or nothing.

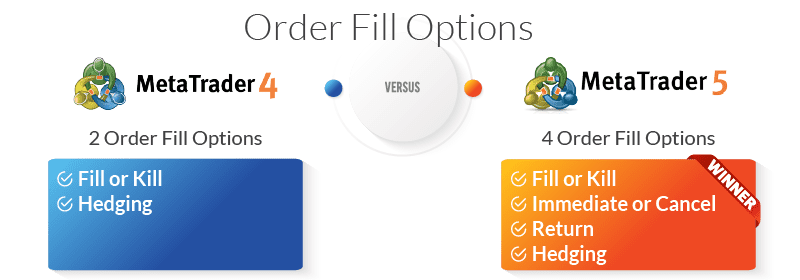

Pepperstone Order Fill Options

If you want to control how your trading platform executes your order, you’ll need a range of different fill options. Specifically, you’ll want access to partial order fills. As the name implies, a partial fill allows you to fulfil a portion of your order if market conditions match your criteria, but stop short if conditions change.

- Fill or Kill orders. The order must be filled immediately in its entirety or else cancelled.

- Immediate or Cancel orders. Similar to a Fill or Kill order, but allows for partial fills. If the broker cannot fill the order immediately, it fills as much as possible and cancels the remainder.

- Return orders. Another type of partial fill order, a Return order allows the broker to fill a portion of an order while retaining the remainder for later execution when market conditions meet the trader’s parameters again.

- Hedging. Hedging orders allow traders to place simultaneous long and short positions on the same instrument to exploit market volatility.

Pepperstone MT4 Order Fill Options

Trading forex or CFDs with Pepperstone on MetaTrader 4? Prepare yourself emotionally for an all-or-nothing approach: the broker offers only Fill or Kill.

| What We Like | What We Don’t |

|---|---|

| Ability to fill an order | No partial fill options |

| No Hedging |

Pepperstone MT5 Order Fill Options

In addition to Fill or Kill, MetaTrader 5 users have access to one partial fill option: Immediate or Cancel.

| What We Like | What We Don’t |

|---|---|

| Option for partial fills with Immediate or Cancel | No Returns |

| No Hedging |

How We Tested

We spoke to Pepperstone customer support to confirm that the order fill options we found – and didn’t find – in our own accounts matched against the broker’s offering:

![]()

Our Winner: MetaTrader 5

Ona partial fill order doesn’t seem sufficient to put the platform over the top, but given Pepperstone’s restrictions, it does the trick.

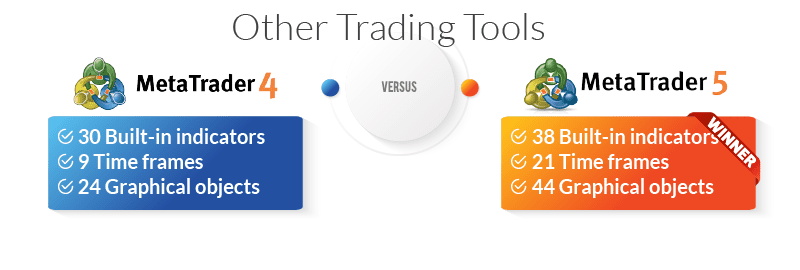

Pepperstone Technical Analysis: MT4 vs MT5:

The cornerstone of just about any successful trading strategy, including automated and algorithmic trading, technical analysis refers to the idea that identifying patterns in past market movements allows you to predict future market behaviour.

Pepperstone MT4 Technical Analysis

Pepperstone clients who opt for MetaTrader 4 face no restrictions on the platform’s available technical analysis tools. That means access to:

- 30 technical indicators

- 9 timeframes

- 24 graphical objects

Additionally, Pepperstone offers MT4 users access to AutoChartist, an advanced analytical program designed to identify complex patterns like Fibonacci retracements. Traders also have access to the Smart Trader suite of tools to manage automated technical trading.

| What We Like | What We Don’t |

|---|---|

| All the basics for technical analysis | Notably fewer timeframes and graphical objects than MT5 |

| Access to AutoChartist | |

| Access to Smart Trader Tools |

Pepperstone MT5 Technical Analysis

While MetaQuotes is always careful to say that MT5 shouldn’t be viewed as an upgrade to MT4, that’s difficult to swallow given the scope of its technical analysis tools. With almost double the number of timeframes and graphical objects, MT5 just packs more analytical punch:

- 38 technical indicators

- 21 timeframes

- 44 graphical objects

Pepperstone does not offer access to AutoChartist to MT5 traders, however the Smart Trader Tools for automation are available.

| What We Like | What We Don’t |

|---|---|

| Powerful technical analysis tools for advanced trading | No access to AutoChartist |

| Access to Smart Trader Tools |

How We Tested

We analysed the performance of the EUR/USD over three 15-minute periods using each platform’s available tools and offered predictions based on our findings. After comparing our predictions to actual market performance, we found that the additional tools available through MT5 enhanced the accuracy of our bets.

Our Winner: MetaTrader 5

Did we mention that the newer platform has almost double the number of graphical objects? Even without the added bonus of AutoChartist, the capabilities of MT5 put it far and away ahead of MT4. (That said, if you’re just starting out, you may find MetaTrader 5 more overwhelming than helpful.)

Automated Trading: MT4 vs MT5

Call it the rise of the robots. Automated trading refers to the use of algorithms, also known as Expert Advisers or ‘bots’, to scan the market and place orders on your behalf when specific conditions arise. Bots work best when paired with custom indicators, a charting tool that allows a trader to modify parameters within charts to generate trading signals for the bot to follow.

1. MT4 Automated Trading

Beyond the 1,700 EAs and 2,100 technical indicators available for purchase on the official MetaQuotes Market, Pepperstone clients using MT4 have access to additional software tools: Capitalise.ai, DupliTrade and MyFxBook.

A no-code automation solution, Capitalise.ai transforms your natural-language description of your strategy into executable instructions. Once connected to MT4, Capitalise.ai shares converts the commands into orders and executes them on your behalf when market conditions match your parameters.

Similarly, MyFxBook contains many of the tools you need to create sophisticated automations, as well as a bustling community. Connect with fellow traders, compare notes and follow those whose strategies you’d like to emulate.

Finally, copy traders have access to DupliTrade, which automatically copies the moves of expert traders to your MT4 account.

| What We Like | What We Don’t |

|---|---|

| Extensive selection of bots and indicators available for purchase | Incompatibility between MT4 and MT5 programming languages |

| Access to Capitalise.ai | |

| Social trading through MyFxBook | |

| Copy trading through DupliTrade |

2. MT5 Automated Trading

As you might expect given its more recent vintage, MetaTrader 5 doesn’t offer nearly the number of bots or custom indicators as its older sibling. The combined total of bots and custom indicators available for purchase? Just over 2,000.

Moreover, Pepperstone does not offer Capitalise.ai or DupliTrade integrations for the platform. That means no copy trading and a long slog through the MQL5 coding language if you want to write your own bot. On the bright side, you can always share your frustration with fellow traders on MyFxBook – the only MT5 integration Pepperstone offers.

| What We Like | What We Don’t |

|---|---|

| Growing collection of bots and custom indicators | Incompatibility between MT4 and MT5 programming languages |

| Social trading through MyFxBook | No Capitalise.ai |

| No DupliTrade | |

| Far fewer MQL5 tools |

How We Tested

We provided the technical team with two different trading strategies and asked them to automate each using a Pepperstone MT4 and a Pepperstone MT5 account.

Automated Trading Winner: MT4

Age has its perks. After nearly two decades dominating the forex and CFD trading landscape, MetaTrader 4 enjoys significantly greater name-recognition and market share than the much-younger MT5. Pepperstone clearly understands its client base, and goes the extra mile with additional integrations that make automated trading accessible to MT4 users of all skill levels.

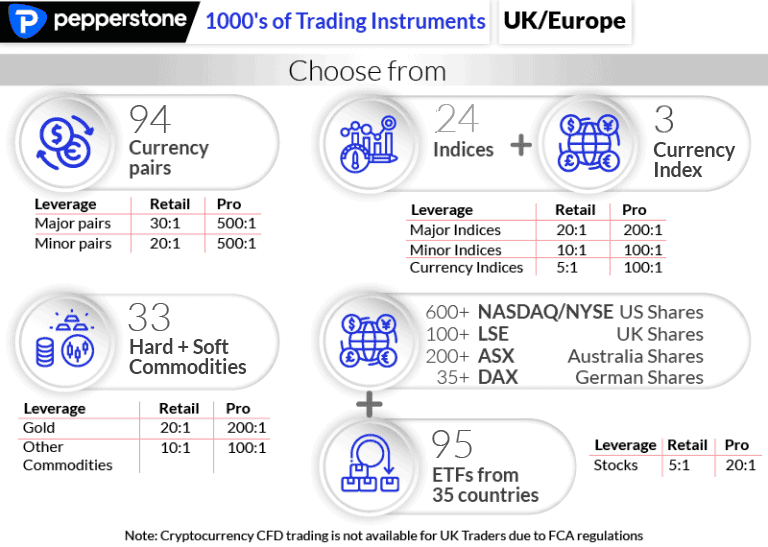

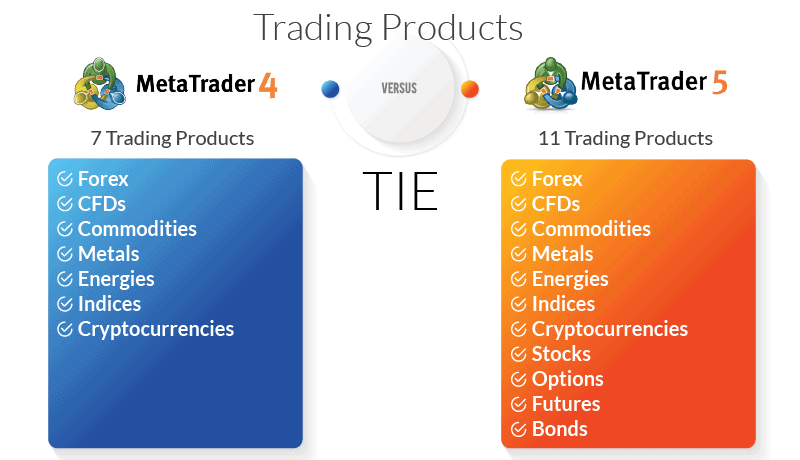

Pepperstone Trading Products: MT4 vs MT5

Pepperstone prides itself on the number of trading instruments and markets it offers, and rightly so. Of the 38 brokers we’ve reviewed in 2026, only one scored higher in the ‘Range of Markets’ category and it topped the rankings for the Best Brokers for Gold CFD Trading.

When evaluating the broker’s MT4 and MT5 offering, we looked for the platform most able to accommodate the breadth of trading products available.

Pepperstone MT4 Trading Products

Initially designed exclusively for forex and CFD trading, MetaTrader 4 has expanded to include commodities, metals, energies and indices. Pepperstone clients can trade all of these products, making the platform perfectly suitable for anyone uninterested in centralised exchanges.

- Forex

- CFDs

- Commodities

- Metals

- Energies

- Indices

- Cryptocurrencies (only for Professional clients in the UK)

- MT4 Spread Betting (UK only)

| What We Like | What We Don’t |

|---|---|

| Solid range of trading products | No exchange-traded funds (ETFs) |

| Well-suited to forex and CFDs | No shares, options, futures or bonds |

| Spread betting | Limited availability of crypto |

Pepperstone MT5 Trading Products

In addition to all the trading products available on MetaTrader 4, Pepperstone clients who opt for MetaTrader 5 can expand their portfolios to include exchange-traded assets.

- Forex

- CFDs

- Commodities

- Metals

- Energies

- Indices

- Cryptocurrencies (only for Professional clients in the UK)

- Stocks

- Options

- Futures

- Bonds

- Spread Betting (UK only)

| What We Like | What We Don’t |

|---|---|

| Extensive range of trading products | Limited availability of crypto |

| ETFs | |

| Shares, options, bonds and futures | |

| Spread betting |

How We Tested

We compared the available instruments to trade on each platform with our UK-based Pepperstone-trading accounts.

Our Winner: MetaTrader 5

Ultimately, MT4’s specialisation in the forex and CFD markets held it back. For Pepperstone clients wanting to add diversity to their portfolios or take advantage of the full range of products the broker offers, MT5 is the clear winner.

Pepperstone MetaTrader 4 vs MetaTrader 5: Our Verdict

The question of what qualifies as the ‘best’ trading platform will always have an element of subjectivity. Many, many factors influence which tools, interfaces and features work for one trader and not another, even when they use the same strategies.

For our – literal – money, however, the best trading platform for Pepperstone clients is MT5. Additional order types, as well as the option for partial execution combine with a comprehensive selection of tradable products to give it the top spot.

FAQs

Below, some of the most commonly asked questions about Pepperstone and its trading platforms pulled from the comments section of CompareForexBrokers.com.

What is MetaTrader 4? What is MetaTrader 5?

Developed by the MetaQuotes corporation, MetaTrader 4 and MetaTrader 5 are the two most popular platforms for retail trading available today. MT4 boasts more than 16 million users, but more brokerages offer MT5.

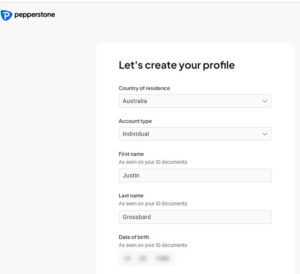

How Do I Open a Pepperstone Account?

Pepperstone admirably balances caution and efficiency in the account opening process. At no point did we experience unnecessary delays or feel burdened by documentation requirements. At the same time, we appreciate the clear commitment to applying Anti-money Laundering and Know Your Customer protocols.

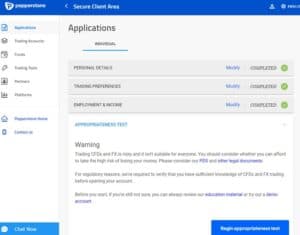

Step 1

After clicking any one of the blue buttons labelled ‘Start Trading’ on the Pepperstone website, you’ll receive a prompt to enter basic biographical information and create a profile. The broker uses this to verify your identity, so it’s important to enter accurate data.

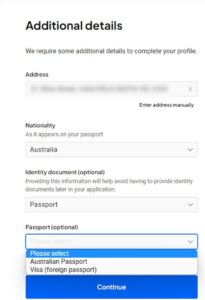

Step 2

Once you’ve created your profile, you’ll need to provide a copy of a government-issued ID document. Note that, while providing a copy of your ID at this stage is technically options, Pepperstone won’t be able to complete onboarding without them.

Step 3

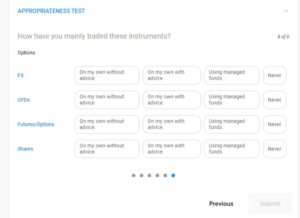

Next, Pepperstone asks you to complete an appropriateness test to assess your level of experience and overall suitability for retail trading. Answer honestly and don’t try to ‘game’ the quiz! (Almost everyone passes, anyway.)

You’ll be asked to share information about your prior experience, if any, trading forex, CFDs and other financial instruments.

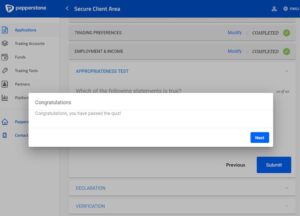

Provided you meet the criteria for income, experience and trading preferences, you’ll receive a confirmation message that you’ve passed.

Step 4

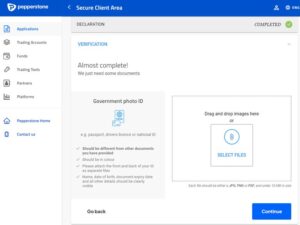

Remember how we said you would, eventually, need to share a copy of your government-issued ID to complete the account opening process? If you haven’t uploaded one already, the moment has arrived.

Who Regulates Pepperstone?

The Financial Conduct Authority oversees Pepperstone’s activities in the UK. We consider Pepperstone among the safest and most trustworthy brokers due to multiple Tier-1 licences, including:

Can I Open a Demo Account with Pepperstone?

Yes. If you’re curious about the Pepperstone trading experience but not ready to commit capital, you can open a demo account valid for 30 days to test out the broker.

Does Pepperstone Require a Minimum Deposit?

No. Pepperstone does not require a minimum deposit to begin trading.

Risk Warning and Disclaimer

Forex trading can entail a high level of risk. The same market volatility and leverage that propel significant profits can also lead to catastrophic loss. Beginner traders are advised to start trading using a free demo account from a trusted brokerage licensed by the UK’s Financial Conduct Authority (FCA) to better understand their trading needs before putting money into the financial markets.

CompareForexBrokers.com provide educational reviews of online trading products and services, including brokerages, trading platforms and trading tools. CompareForexBrokers.com is not an investment adviser, financial adviser or other financial services professional and does not offer investment advice. None of the content published on this page or elsewhere on CompareForexBrokers.com should be construed as investment advice or an inducement to MetaTrader.

Is MT5 better than MT4?

Both platforms are popular for different reasons. MT4 was designed for forex trading, while MT5 is a multi-asset platform that offers both centralised and non-centralised markets, including shares. Click here to view the best MT4 brokers, or here for the best MT5 brokers.

Is cTrader better than MT5?

cTrader and MetaTrader 5 (MT5) are both top platforms offering different trading tools and features. cTrader is predominately a forex trading platform, while MT5 provides access to both non-centralised and centralised financial markets including forex and shares.

What is the key differences between MT4 and MT5?

The main difference between the two MetaQuotes platforms is MetaTrader 4 (MT4) was created mainly for forex trading, while MetaTrader (MT5) is a multi-asset trading platform with both centralised and decentralised markets. Most US traders opt for the best forex brokers in USA platform.

Both MT4 and MT5 have Expert Advisors (EAs) for automated trading, yet MT5’s backtesting features can test multiple currency pairs at a time, while MT4 is restricted to single currency backtesting. When writing EAs, you use the MQL4 programming language on MT4 and MQL5 on MT5.

Additionally, MT5 offers a larger selection of advanced charting tools, with more timeframes, technical indicators and graphical objects for technical analysis.

What is MetaTrader 4? What is MetaTrader 5?

Developed by the MetaQuotes corporation, MetaTrader 4 and MetaTrader 5 are the two most popular platforms for retail trading available today. MT4 boasts more than 16 million users, but more brokerages offer MT5.

About Pepperstone: Minimum Deposits, Demo Accounts, etc.

Pepperstone was established in Australia but is regulated by multiple financial authorities around the globe. Depending on where you reside and the investor protections you want, you can sign up to one of the following Pepperstone Limited subsidiaries:

- The Australian Securities and Investments Commission (ASIC),

- The Financial Conduct Authority (FCA), United Kingdom

- The Cyprus Securities and Exchange Commission (CySEC), Europe

- The Dubai Financial Services Authority (DFSA), United Arab Emirates

- The Securities Commission of the Bahamas (SCB), Global

- The Federal Financial Supervisory Authority of Germany (BaFin)

- The Capital Markets Authority (CMA), Kenya

Regardless of the subsidiary you sign up to, the broker offers two trading account types with different pricing structures. The broker’s Razor Account offers ECN-style commission spreads, while the Standard Account provides access to commission-free trading and spreads. You can view the Pepperstone razor vs standard table to compare the two MetaTrader accounts Pepperstone offers.

Additional features available to all Pepperstone clients using MT4 and MT5 include:

- No minimum deposit, although $200 is recommended.

- The potential to earn rebates through Pepperstone’s Active Trader program.

- Desktop and WebTrader platforms with advanced trading tools and add-on features.

- Mobile apps for trading on the go are available for both Android and iOS devices.

- A range of payment methods to make deposits and withdrawals, including credit cards and e-wallet systems like NETELLER and Skrill.

- Educational resources with trading platform tutorials, articles and webinars.

- Free demo accounts to help you practice trading complex instruments like CFDs and forex.

Disclaimer

Pepperstone UK is no longer able to offer retail investor accounts access to cryptocurrency markets. The FCA recently changed UK forex trading regulation banning retail traders from trading crypto products.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Can I have MT4 and MT5 at the same time?

In theory, it is possible. If you wish to run the desktop version of MT4 and MT5 at the same time on the one computer, you may need install the file for each platform version in a different directory on your PC or laptop and save the file in separate destination folder. When doing the installation, make sure you do not install the file to the default location otherwise MT4 and MT5 will be in the same directory.

How many people use Pepperstone?

Pepepperstone says they are trusted by 400,000 clients worldwide.

What leverage does Pepperstone MT4 use?

This depends on what country you are trading from and what product you are trading with. In the UK, Australia, Europe and UAE – major Forex pairs can be up to 1:30 for retail traders. Other regions or for Professional traders they can be up to 1:500.

If you decide to switch from MT4 to MT5 (or vice versa), how seamless is that process at Pepperstone (account migration, data, EAs)?

Switching your account should be seamless but your issues will be when you use Expert Advisors as they are no compatible between each platform as they use a different language.