Plus500 vs eToro 2025

eToro is a forex broker with a social trading Platform to copy trade with the best traders. Plus500 is a CFD provider with its own CFD trading platform and risk management tools. Our experts review eToro vs Plus500 to find the best broker.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

How Do eToro Vs Plus500 Compare?

Our full comparison covers the 10 most important trading factors. Here are five noticeable differences between eToro and Plus500:

- eToro is a forex broker with a social trading platform, while Plus500 is a CFD provider with its own CFD trading platform.

- eToro offers variable spreads only, whereas Plus500 provides both variable and fixed spreads.

- Plus500’s average spread for EUR/USD is 0.7 pips, while eToro’s is 3.0 pips.

- eToro’s minimum deposit for CFD trading varies by method and region, while Plus500 requires a minimum deposit of $100.

- eToro charges an inactivity fee after 12 months of inactivity, while Plus500 charges after 3 months.

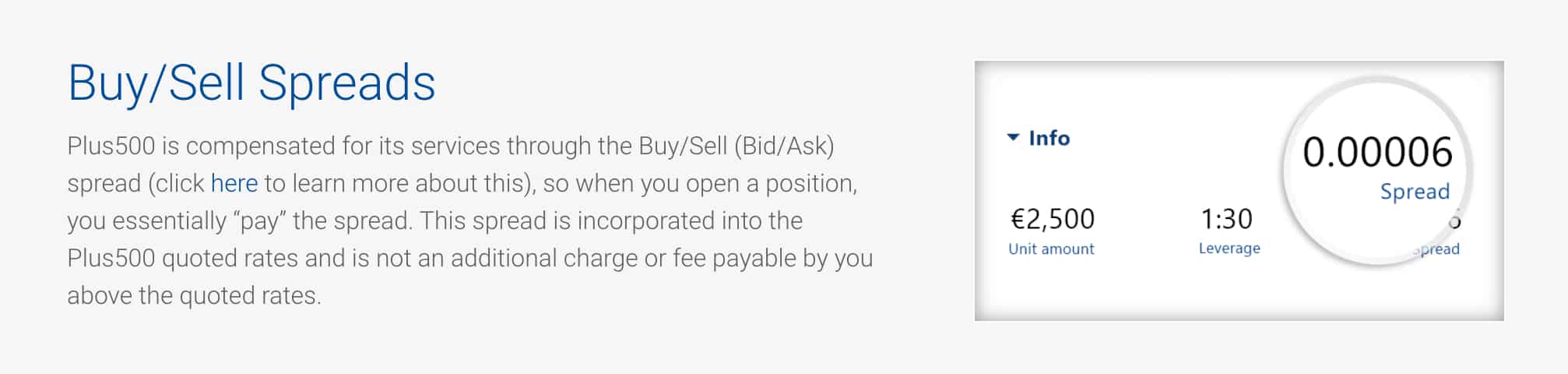

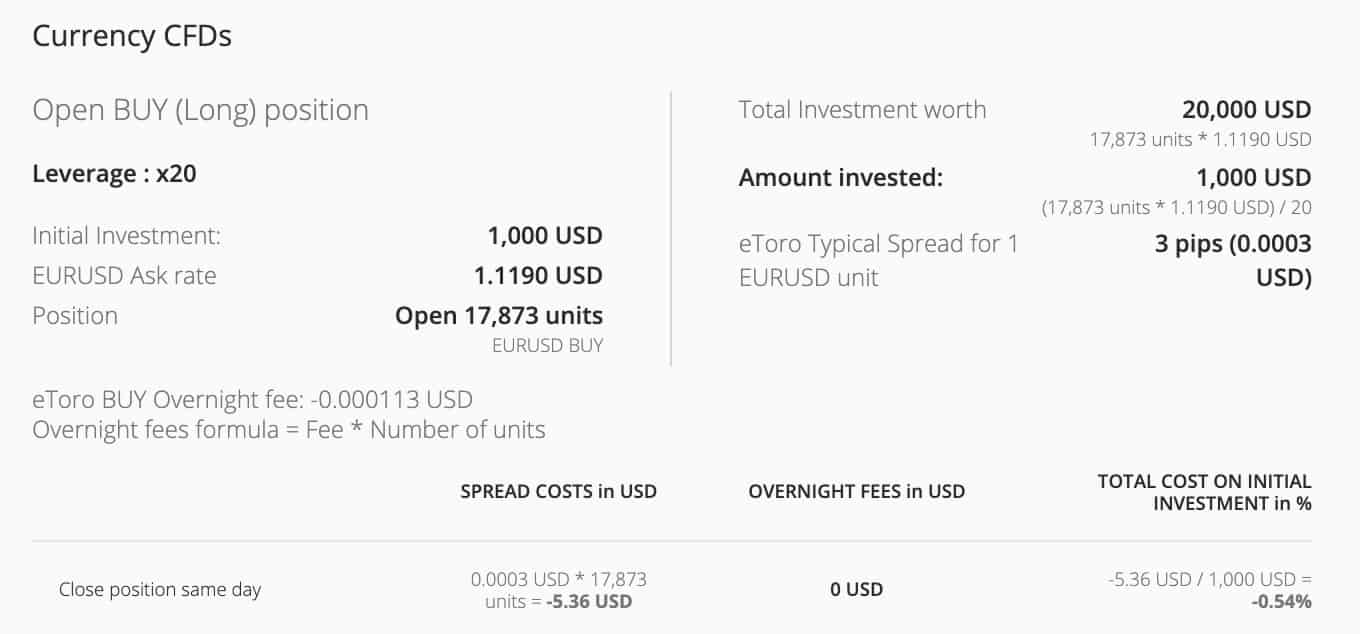

1. Lowest Spreads And Fees: Plus500

Plus500 and eToro are both market maker brokers that offer no commission forex trading on major and minor currency pairs. Market makers set their own bid-ask prices and act as the counterparty to your trade, using their own liquidity to fill orders. This compares to ECN brokers like IC Markets or NDD brokers like Pepperstone, which use multiple external liquidity providers to determine spreads and fill orders.

Although both market maker brokers charge no commission fees, Plus500 and eToro forex spreads and execution models vary slightly. Plus500 is a pure market maker and offers both variable and fixed spreads. Fixed spreads do not change with market and trading conditions (i.e. volatility, liquidity, financial market news, economic events, etc), while variable spreads fluctuate with market conditions.

eToro offers variable spreads only and utilises aspects of straight-through processing (STP) and no dealing desk (NDD) execution. This means that some trades are directly passed onto liquidity providers while orders are absorbed by eToro.

As market makers, both eToro and Plus500 only offer commission-free spreads, with no ECN spreads or account types available. When the two brokers’ average no commission spreads are compared, Plus500 is significantly more competitive. eToro minimum spread for the EUR/USD is 3.0 pips, while Plus500 offers an average spread of 0.7 pips for the EUR/USD.

Our Lowest Spreads and Fees Verdict

Both brokers are market makers that offer commission-free trading, but overall, Plus500 provides access to much lower spreads than eToro. Although Plus500 follows a traditional market maker brokerage model and eToro is a market maker that utilises STP/NDD execution, Plus500 offers much tighter forex spreads. For the EUR/USD Plus500 average is 0.7 pips, and eToro is over three times wider at 3 pips.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

2. Better Trading Platform: Tie

| Trading Platform | Plus500 | eToro |

|---|---|---|

| MetaTrader 4 | No | No |

| MetaTrader 5 | No | No |

| cTrader | No | No |

| TradingView | No | No |

| Copy Trading | No | Yes |

| Proprietary Platform | Yes | Yes |

Plu500 and eToro are CFD providers with a different focus. While Plus500 aims to ensure the simplest, most transparent trading conditions for retail clients on an easy-to-use CFD platform, eToro focuses on the social side of trading and its benefits for retail customers.

eToro has a well-designed, user-friendly web-based trading platform that provides higher security with a two-step login, executes trade orders at a reasonably fast speed and has a good search function. However, it does not offer much in terms of workspace or chart customisability.

On the other hand, Plus500’s trading platform has some notable features, such as trade alerts. Clients can receive real-time email, SMS and push notifications based on the following:

- Price – whether a particular trading instrument nears a certain Buy or Sell price level

- Change % (Daily or Hourly) – whether a particular trading instrument’s absolute price change (positive or negative) nears a certain level

- Traders’ Sentiments (Buyers % vs. Sellers %) – whether the percentage of Buyers or Sellers among Plus500 traders reaches a particular level

Meanwhile, eToro’s copy trading technology enables retail clients to automatically replicate the activity of top-performing traders without the need to pay management fees or other hidden costs. Clients are able to search through eToro’s vast active trader base (more than 3,000,000 traders) by using certain parameters such as return, risk score, number of copiers or preferred markets to trade.

Once a top-performing trader is located, clients can exactly copy his/her trading positions. We should note that every copied position has to be at least $1 in value.

At the same time, experienced traders with proven strategies are able to earn additional income each month by being followed and copied by other platform users. They can participate in eToro’s Popular Investor Program. When copied, traders will receive a fixed payment equal to 2% of their annual assets under management (the total amount allocated by other clients to copy trades).

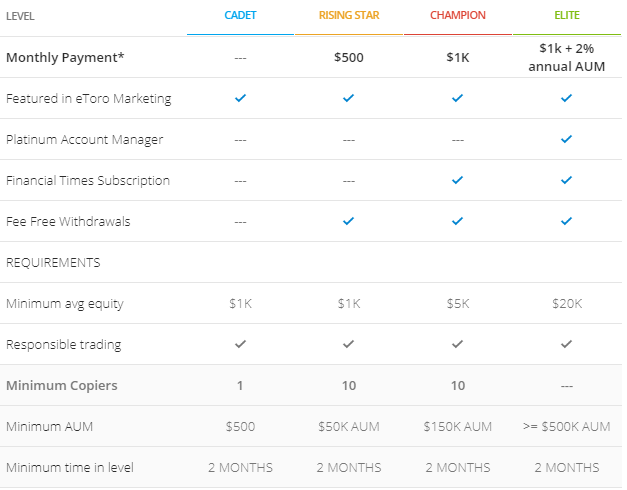

eToro’s Popular Investor Program includes four different levels that have their own specifications – Cadet, Rising Star, Champion and Elite.

Plus500 vs eToro: Mobile Trading Platform

Plus500 vs eToro: Mobile Trading Platform

Plus500’s Best Forex Trading Apps are compatible with both iOS and Android-based devices, as well as for Windows Phone. Plus500 trading App supports 31 languages and has the same features as the broker’s Webtrader. The most important tools and trading features include:

- Risk management tools such as Trailing Stop or Guaranteed Stop

- Real-time alerts such as Change % (Daily or Hourly)

- Traders’ Sentiments (Buyers % vs. Sellers %)

The broker’s mobile apps also feature a secure two-step login and biometric authentication.

eToro’s intuitive and innovative mobile trading app is also available for iOS and Android devices. It supports 21 languages and has the same functionalities as eToro’s web-based platform (Webtrader), including the following features:

- Virtual Portfolio

- TipRanks Research Tab

- One-Click Trading feature

eToro’s mobile apps also provide good touch interactions, with clients being able to access charts or open trades with a simple swipe to the left and to the right in their portfolio.

Our Better Trading Platform Verdict

We found the Plus500 trading platform to provide a better user experience for purely CFD trading. On the other hand, eToro offers a better experience for social trading. Finally, both trading platforms are designed with the tools and capabilities to serve the trading needs of CFD traders vs copy trading. We should note that both Forex brokers do not allow Hedging and Scalping on their platforms.

*Your capital is at risk ‘51% of retail CFD accounts lose money’

3. Superior Accounts And Features: Plus500

In this section, we compared the CFD account types offered by the two online brokers. Our team of experts will analyse for you the most important features so you can choose the right CFD account type.

Unlike other online brokers, Plus500 and eToro only offer a live trading account type for:

- Retail clients

- Professional clients (for EU residents that must comply with the ESMA restrictions)

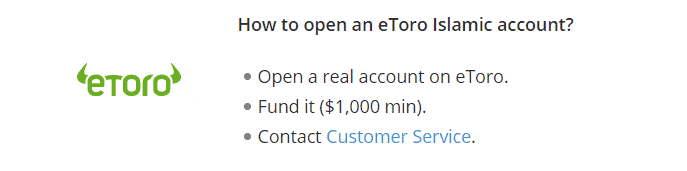

Additionally, you can open a free demo account that comes with zero risks. More, Muslim traders have the option to apply for a swap-free account that complies with Sharia law.

You can review the Plus500 vs eToro trading features in the comparison table below.

| Plus500 Account | eToro Account | |

|---|---|---|

| Range of Account Types | 1 | 1 |

| Minimum Deposit | $100 | $200 |

| Account Currencies | 10 Base currencies | USD Accounts Only |

| Deposit Methods | 5 Funding Options (Credit and Debit cards, PayPal, Skrill, Bank transfer) | 9 Funding Options (Credit Card, Skrill, Neteller, PayPal and Wire Transfers, etc.) |

| Spread Type | Fixed and Variable | Fixed |

| Lot Sizes Available | Micro, Mini, Standard | Micro, Mini, Standard |

| Maximum Leverage | 1:30 | 1:30 |

| Commission | 0% Commission | 0% Commission |

| Forex Pairs | 70 | 47 |

| CFD instruments | +2,000 | +2,000 |

| Trading Platforms | 1 Plus500 WebTrader | 1 eToro Platform |

| Swap Free Account | Yes | Yes |

| Expert Advisors | No | No |

| Scalping / Hedging | No | No |

| Guaranteed Stop Loss | Yes | No |

Note* The eToro Club membership program offers personalised VIP service for loyal clients. There are 5 different membership tiers (Silver, Gold, Platinum, Platinum+, and Diamond) that can unlock more competitive trading conditions and features.

eToro vs Plus500: Range Of CFD markets

Both online brokers offer an equal amount of financial instruments (+2,000 CFD instruments) across several asset classes, including currency pairs, indices, shares, ETFs, commodities, cryptocurrencies and options.

Trading CFDs can be done on:

- 7 different asset classes with the Plus500 trading account

- 6 different asset classes with the eToro trading account

Note* Options CFD trading is the only additional market that you can trade with Plus500, but not with eToro.

Note* Options CFD trading is the only additional market that you can trade with Plus500, but not with eToro.

Depending on your favourite market, traders have more tradable instruments with Plus500 if they want CFD trading in currencies, indices, commodities and options. For CFD trading in stocks, cryptocurrencies and ETFs, traders have more options with eToro.

For a side-by-side comparison of the eToro vs Plus500 range of CFD markets, please view the comparison table below.

| eToro | Plus500 | |

|---|---|---|

| Currency Pairs | 47 | 70 |

| Stocks | 2012 | 1668 |

| Indices | 13 | 30 |

| Commodities | 15 | 22 |

| Cryptocurrencies | 99 | 14 |

| ETFs | 153 | 95 |

| Options | None | 367 |

Note* The FCA ban on cryptocurrencies (Bitcoin, Ripple, Ethereum, etc.) prohibits FCA-regulated brokers from offering crypto assets to retail traders. Traders outside the UK can still enjoy trading digital currencies.

eToro vs Plus500: Inactivity Fees

eToro will start charging an inactivity fee of USD 10 per month if clients do not log in to their live accounts for 12 months.

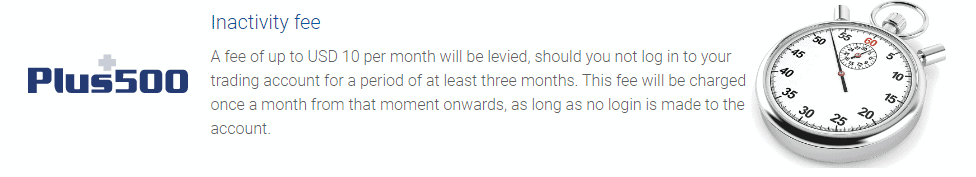

At the same time, Plus500 will charge an inactivity fee of up to USD 10 per month in case clients do not log in to their trading account for a period of at least 3 months.

Demo And Islamic Accounts

Both CFD providers allow practice trading risk-free with paper money. Plus500 allows clients to open and use a Demo Account for as long as they wish. It has USD 40,000 in virtual funds.

eToro also offers a free Demo Account, which comes with USD 100,000 in virtual funds. Since it mimics real market conditions, it is suitable for testing trading strategies with no risk of losing real money, as well as for testing the broker’s social trading feature.

Both brokers have a swap-free account option (Islamic Account) for clients of the Muslim faith.

| Plus500 | eToro | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | No | No |

| Swap Free Account | No | Yes |

| Active Traders | No | No |

| Spread Betting (UK) | No | No |

Our Superior Accounts and Features Verdict

Overall, Plus500 has a slight edge over eToro’s account features. Our team of FX experts has noted a lack of account type diversification. Both CFD brokers combine all their trading features into a single trading account that is suitable for all types of traders. Claim your free demo account by clicking the button below.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

4. Best Trading Experience And Ease: eToro

When it comes to the best trading experience and ease, both eToro and Plus500 have their unique offerings. From our analysis, eToro’s platform is designed with social trading in mind, allowing traders to follow and copy the trades of professionals.

This feature is especially beneficial for beginners who are still finding their footing in the trading world. Plus500, on the other hand, offers a straightforward and intuitive platform, making it easy for traders to navigate and execute trades.

- eToro’s CopyTrader feature allows users to mimic the trades of successful traders.

- Plus500’s platform is user-friendly with a clean interface, ideal for both beginners and experienced traders.

- eToro provides a vast array of educational resources, aiding traders in their journey.

- Plus500 offers a free demo account, allowing traders to practice without any financial risk.

From our own testing, we found that while many brokers excel in specific areas, the overall user experience is paramount. Factors like platform responsiveness, ease of use, and educational resources play a significant role in a trader’s journey.

Our Best Trading Experience and Ease Verdict

While both brokers offer commendable trading experiences, eToro edges out slightly due to its social trading features, making it more engaging and interactive for users.

*Your capital is at risk ‘51% of retail CFD accounts lose money’

5. Stronger Trust And Regulation: Tie

eToro Trust Score

Plus500 Trust Score

1. Regulation

Both Forex brokers comply with the strict regulatory standards of some of the most reputable Forex authorities across the globe. As such, both Plus500 and eToro can be considered safe.

eToro and its corporate arms are authorised to conduct online trading services business in the following jurisdictions:

- eToro (Europe) Ltd. is regulated by Cyprus-based CySEC

- eToro (UK) Ltd. is regulated by the UK Financial Conduct Authority (FCA)

- eToro AUS Capital Pty Ltd. is regulated by the Australian Securities and Investments Commission (ASIC)

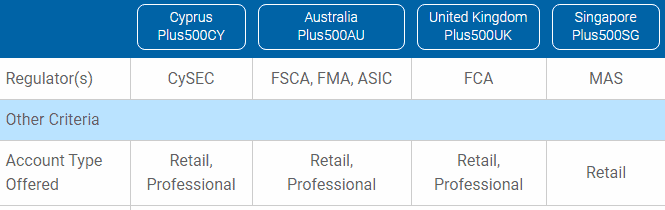

At the same time, Plus500 and its corporate arms are authorised to provide financial services in the following jurisdictions:

Plus500UK Ltd operates in the United Kingdom and falls under the regulation of the Financial Conduct Authority (FCA)

Plus500UK Ltd operates in the United Kingdom and falls under the regulation of the Financial Conduct Authority (FCA)- Plus500AU Pty Ltd operates in Australia and is regulated by the Australian Securities and Investments Commission (ASIC). The same company also falls under the regulation of New Zealand’s Financial Markets Authority (FMA) and of South Africa’s Financial Sector Conduct Authority (FSCA)

- Plus500CY Ltd operates in Europe and is regulated by the Cyprus Securities and Exchange Commission (CySEC)

- Plus500SEY Ltd is regulated by the Seychelles Financial Services Authority (FSA)

- Plus500SG Pte Ltd operates in Singapore and is regulated by the Monetary Authority of Singapore (MAS)

In addition, both Forex brokers ensure that they keep client funds fully segregated from their own corporate accounts, which minimises the risk of misuse.

| Plus500 | eToro | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) CYSEC (Cyprus) FMA (New Zealand) MAS (Singapore) | ASIC (Australia) CYSEC (Cyprus) FCA (UK) |

| Tier 2 Regulation | DFSA (Dubai) EFSRA | MFSA (Europe) ADGM (UAE) GFSC (Gilbraltar) |

| Tier 3 Regulation | FSA-S (Seychelles) FSCA (South Africa) | FSA-S (Seychelles) |

2. Reputation

eToro gets searched on Google more than Plus500. On average, eToro sees around 823,000 branded searches each month, while Plus500 gets about 201,000 — that’s 75% fewer.

| Country | Plus500 | eToro |

|---|---|---|

| Poland | 18,100 | 110,000 |

| India | 12,100 | 110,000 |

| Peru | 2,900 | 90,500 |

| Thailand | 14,800 | 74,000 |

| United Arab Emirates | 9,900 | 60,500 |

| Colombia | 6,600 | 40,500 |

| Brazil | 9,900 | 22,200 |

| Hong Kong | 6,600 | 18,100 |

| Pakistan | 6,600 | 18,100 |

| Indonesia | 1,000 | 14,800 |

| Vietnam | 2,400 | 12,100 |

| Ecuador | 210 | 12,100 |

| Sweden | 5,400 | 9,900 |

| Argentina | 1,300 | 9,900 |

| Mexico | 70 | 9,900 |

| Austria | 3,600 | 8,100 |

| Ghana | 2,400 | 8,100 |

| Greece | 720 | 8,100 |

| Canada | 3,600 | 6,600 |

| Netherlands | 2,900 | 5,400 |

| Italy | 1,300 | 5,400 |

| Spain | 1,000 | 5,400 |

| United States | 880 | 5,400 |

| Cyprus | 480 | 5,400 |

| Singapore | 320 | 5,400 |

| Malaysia | 260 | 5,400 |

| Philippines | 320 | 3,600 |

| Uzbekistan | 320 | 3,600 |

| Germany | 5,400 | 2,900 |

| Bangladesh | 1,600 | 2,900 |

| Nigeria | 260 | 2,900 |

| Turkey | 260 | 2,900 |

| Australia | 210 | 2,900 |

| Saudi Arabia | 210 | 2,900 |

| Tanzania | 50 | 2,900 |

| Portugal | 880 | 2,400 |

| Morocco | 140 | 2,400 |

| Mongolia | 1,900 | 1,900 |

| Panama | 880 | 1900 |

| Jordan | 480 | 1,900 |

| Algeria | 320 | 1,900 |

| Venezuela | 110 | 1,900 |

| United Kingdom | 2,900 | 1,600 |

| Taiwan | 480 | 1,600 |

| Bolivia | 320 | 1,600 |

| Sri Lanka | 90 | 1,600 |

| Dominican Republic | 70 | 1,600 |

| Egypt | 20 | 1,600 |

| Uruguay | 110 | 1,300 |

| Switzerland | 90 | 1,300 |

| South Africa | 70 | 1,000 |

| Cambodia | 90 | 880 |

| New Zealand | 70 | 720 |

| Botswana | 50 | 590 |

| Uganda | 90 | 480 |

| Ethiopia | 50 | 480 |

| Ireland | 40 | 390 |

| Chile | 20 | 260 |

| Japan | 20 | 260 |

| Kenya | 20 | 260 |

| Mauritius | 20 | 260 |

| France | 10 | 110 |

| Costa Rica | 50 | 70 |

110,000 1st | |

18,100 2nd | |

90,500 3rd | |

2,900 4th | |

60,500 5th | |

9,900 6th | |

22,200 7th | |

9,900 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with eToro receiving 45,400,000 visits vs. 6,096,000 for Plus500.

3. Reviews

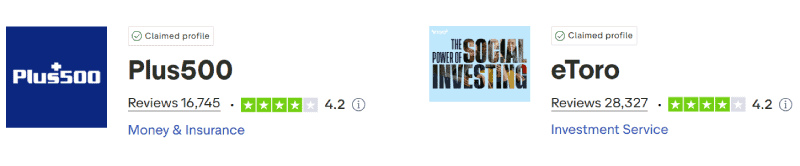

As shown below, Plus500 and eToro both enjoy solid reputations on Trustpilot, though their scores reflect different user bases. Plus500 holds a Trustpilot rating of 4.2 out of 5, based on more than 16,500 reviews. eToro has the same rating of 4.2 out of 5, but with over 28,000 reviews. Both platforms are well-rated, with eToro standing out slightly due to its larger review volume.

Our Stronger Trust and Regulation Verdict

Listed on the London Stock Exchange (LSE), Plus500 is regulated across over 6 forex regulatory authorities (3 global Tier-1 licenses and 3 global Tier-2 licenses). Plus500 complies with the local regulatory standards of each country it does business, which is why it gained more points in our star scoring system. Nevertheless, it’s also safe to trade with eToro, which has strong regulations.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

6. Top Product Range And CFD Markets: Tie

When it comes to the range of CFDs, products, and markets available, both eToro and Plus500 have a lot to offer. However, there are some key differences between the two that traders should be aware of.

Table: Comparison of eToro and Plus500’s Product Range and CFD Markets

| CFDs | Plus500 | eToro |

|---|---|---|

| Forex Pairs | 65 | 55 |

| Indices | 65 | 20 |

| Commodities | 5 Metals 7 Energies 10 Softs | 26 |

| Cryptocurrencies | 18 (+ Crypto 10) | 114+ |

| Shares CFDs | 11,000+ | 1209 NYSE 884 NASDAQ 117 FrankFurt 285 LSE 42 Madrid 49 Zurich 26 Oslo 49 Stockholm 23 Copenhagen 20 Helsingki 135 Hong Kong 3 Lisbon 15 Brussels 1 Saudi Arabia 35 Amsterdam |

| ETFs | 97 | 300 |

| Bonds | - | No |

| Futures | No | No |

| Treasuries | - | No |

| Investment | No | Yes (US only) |

Our Top Product Range and CFD Markets Verdict

While eToro offers a wider variety of stocks and ETFs, Plus500 excels in the number of Forex pairs and commodities. For traders looking for a diverse range of options, Plus500 might be the better choice. However, eToro’s platform is more user-friendly and offers a unique social trading feature.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

7. Superior Educational Resources: eToro

eToro:

- Social Trading Platform: eToro’s platform is designed with social trading in mind, allowing traders to follow and copy the trades of professionals. This feature is especially beneficial for beginners who are still finding their footing in the trading world.

- CopyTrader Feature: Allows users to mimic the trades of successful traders, providing a hands-on learning experience.

- Vast Array of Educational Resources: eToro provides a wide range of educational resources to aid traders in their journey.

- Virtual Portfolio: eToro offers a virtual portfolio feature, allowing traders to practice without any financial risk.

- TipRanks Research Tab: Provides insights and research to help traders make informed decisions.

- One-Click Trading Feature: Simplifies the trading process, making it more user-friendly for beginners.

Plus500:

- User-Friendly Platform: Plus500 offers a straightforward and intuitive platform, making it easy for traders to navigate and execute trades.

- Trade Alerts: Clients can receive real-time email, SMS, and push notifications based on various trading parameters.

- Risk Management Tools: Includes features such as Trailing Stop or Guaranteed Stop to help traders manage their risks.

- Real-Time Alerts: Provides alerts based on price changes, traders’ sentiments, and more.

- Demo Account: Plus500 allows practice trading risk-free with paper money, offering a platform to learn and practice.

- Secure Two-Step Login: Ensures higher security for traders.

Our Superior Educational Resources Verdict

Based on our team’s testing scores, eToro offers the best educational resources for traders.

*Your capital is at risk ‘51% of retail CFD accounts lose money’

8. Superior Customer Service: Plus500

Plus500 offers professional 24/7 customer support service via email or live chat in the majority of jurisdictions where it conducts business. The live chat service turned out to be quick and reliable, and we received relevant answers to our inquiries about trading and non-trading fees. The customer support team’s response by email was also timely (within an hour), and the information we were provided – was relevant.

Plus500 offers professional 24/7 customer support service via email or live chat in the majority of jurisdictions where it conducts business. The live chat service turned out to be quick and reliable, and we received relevant answers to our inquiries about trading and non-trading fees. The customer support team’s response by email was also timely (within an hour), and the information we were provided – was relevant.

Additionally, retail clients can also contact the broker’s support department through the WhatsApp messaging platform.

On the downside, Plus500 offers no client support over the phone.

In comparison, eToro offers 24/5 customer support service via live chat or a web-based ticketing system. With the latter, clients will receive an answer to their query via email.

We should note that the live chat link is not immediately found on the broker’s website. It turned out to be located below the FAQ in the “Help Center” section. Another circumstance we found inconvenient was that the chat function appeared offline too frequently.

Similar to Plus500, eToro does not offer client support over the phone, which is a drawback given nowadays’ relentless dynamics.

Our Superior Customer Service Verdict

Plus500 has a slight edge over eToro because its customer service is faster and open even on the weekends. Thanks to their superior customer support, Plus500 scored more points in this category, surpassing eToro.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

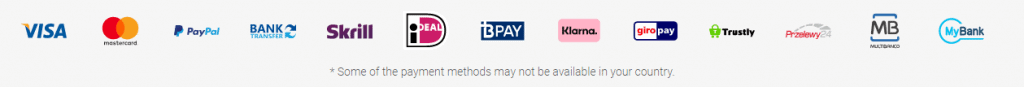

9. Better Funding Options: Plus500

Both brokers offer a range of account funding methods and will charge no fees on deposits. The most popular payment options include:

- Bank wire transfer

- Credit Card or Debit Card by Visa or Mastercard

- PayPal

- Skrill

Note* Plus500 offers 13 different payment options compared to eToro’s 9 different payment options.

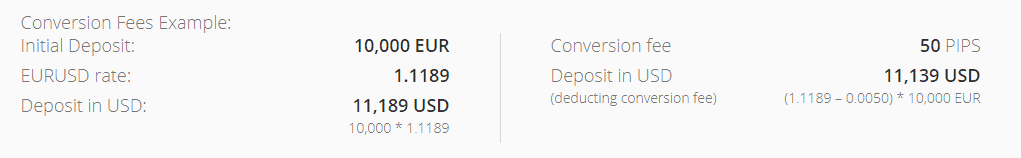

eToro also allows funding via Neteller, China UnionPay, RapidTransfer, Webmoney and Klarna/Sofort Banking. Despite that, the broker will not charge a deposit fee, there will be a conversion fee (as little as 50 pips) when clients deposit in base currencies (EUR, GBP, AUD, RMB, THB, IDR, MYR, VND, PHP) different from USD.

Wire transfer deposits are usually processed within a period of 4-7 business days, but there are no limitations for the maximum amount. On the other hand, deposits via Credit/Debit Cards and electronic wallets are instant, but there are limits for the maximum amount:

- For Credit/Debit Cards – $40,000

- For PayPal, Skrill and Neteller – $10,000

- For Klarna/Sofort Banking – $30,000

- For China UnionPay – $7,000

- For RapidTransfer – $5,500

eToro requires all deposits following the First Time Deposit to be at least $50, while for bank wire transfers the required minimum deposit is $500.

Profit Withdrawals

As far as withdrawals are concerned, Plus500 will charge no fees on the first five withdrawals made every month. Any subsequent withdrawals during the month will incur a $10 withdrawal fee. Plus500 has a minimum withdrawal amount requirement, which includes:

- $50 – for electronic wallets

- $100 – for bank wire transfers and Credit/Debit Cards

If clients withdraw lesser amounts than the above-mentioned, there will be a $10 fee.

In comparison, eToro will charge a $5 withdrawal fee and has a minimum withdrawal amount requirement of $30. Depending on the payment method used, clients will be able to receive their funds on average between 1-2 business days.

Our Better Funding Options Verdict

Both brokers eToro and Plus500 offer a good selection of payment gateways. There is no meaningful difference between the two brokers except for the small USD 5 withdrawal fee charged by eToro. This alone is the reason why Plus500 won this broker comparison category.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

10. Lower Minimum Deposit: eToro

When it comes to starting your trading journey, the initial deposit can be a significant factor. For many new traders, a lower minimum deposit can be an attractive feature, allowing them to dip their toes into the world of trading without committing a large sum of money upfront. Both eToro and Plus500 have set their minimum deposit thresholds to cater to a wide range of traders, from beginners to seasoned professionals.

Here’s a quick comparison of the minimum deposit amounts required by each broker:

| Broker | Minimum Deposit | Recommended Deposit |

| Plus500 | $100 | $100 |

| eToro | $50 | $200 |

The actual minimum deposit is more complicated than above and depends on where a trader lives in (their residency). We created the table below that shows the main regions and how eToro ranges from $10 to $10,000 for their minimum deposit requirement.

| Trader is a redident in: | Minimum First Deposit (USD) |

| Australia, United Kingdom, Germany, Malaysia, Singapore, Thailand, Ireland, Spain, Sweden | $50 |

| France, Poland, Slovakia, Belgium, Czech Republic | $100 |

| Eligible countries outside of the list | $200 |

| New Zealand | $1,000 |

| Israel | $10,000 |

| Uniited States | $10 |

It’s evident that while both brokers offer competitive minimum deposit amounts, there’s a clear difference between the two. eToro’s minimum deposit stands at a mere $50, making it more accessible for those who are cautious about investing a large sum from the get-go. On the other hand, Plus500’s minimum deposit is set at $100, which, while still reasonable, is double that of eToro’s.

Our Lower Minimum Deposit Verdict

eToro offers a lower minimum deposit, making it a more accessible option for new traders.

*Your capital is at risk ‘51% of retail CFD accounts lose money’

Our Final Verdict On Which Broker Is The Best: Plus500 or eToro?

eToro is the winner because it consistently outperforms Plus500 in several key areas, offering a more comprehensive trading experience for both beginners and seasoned traders. The table below summarises the key information leading to this verdict:

| Criteria | eToro | Plus500 |

|---|---|---|

| Lowest Spreads And Fees | ❌ | ✅ |

| Better Trading Platforms | ✅ | ✅ |

| Superior Accounts And Features | ❌ | ✅ |

| Best Trading Experience | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ✅ |

| CFD Product Range And Financial Markets | ✅ | ✅ |

| Superior Educational Resources | ✅ | ❌ |

| Better Customer Service | ❌ | ✅ |

| More Funding Options | ❌ | ✅ |

| Lower Minimum Deposit | ✅ | ❌ |

Best For Beginner Traders

eToro is the ideal choice for beginner traders due to its user-friendly platform and comprehensive educational resources.

Best For Experienced Traders

While both brokers cater to experienced traders, eToro offers a more diverse range of tools and features tailored to the needs of seasoned professionals.

FAQs Comparing eToro Vs Plus500

Does Plus500 or eToro Have Lower Costs?

eToro generally offers lower costs compared to Plus500. eToro’s spreads are competitive, especially for major currency pairs. For instance, the spread for EUR/USD can be as low as 1 pip. Plus500, on the other hand, might have slightly higher spreads for certain instruments. For a detailed comparison of broker costs, you can check out this Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Neither eToro nor Plus500 offers support for MetaTrader 4. Both brokers have developed their own proprietary platforms tailored to their clients’ needs. If you’re specifically looking for brokers that support MT4, you might want to explore this list of the best MT4 brokers.

Which Broker Offers Social Trading?

eToro is renowned for its social trading features, allowing traders to follow and copy the trades of professionals. This feature, known as CopyTrading, sets eToro apart from many other brokers. Plus500, on the other hand, does not offer social trading. If you’re interested in exploring more about social and copy trading platforms, here’s a comprehensive review of the best copy trading platforms.

Does Either Broker Offer Spread Betting?

Plus500 offers spread betting, allowing UK traders to take advantage of this tax-efficient way of trading. eToro, on the other hand, does not provide spread betting services. Spread betting can be a great way to capitalise on short-term market movements. If you’re interested in exploring more about this, here’s a comprehensive guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, eToro is a strong contender for Australian Forex traders. It’s ASIC regulated, ensuring a high level of trust and security for Australian traders. While Plus500 is also ASIC regulated, eToro has a slight edge due to its unique social trading features. Both brokers have a significant presence in Australia, but it’s worth noting that neither was originally founded in Australia. For a more detailed look into the best brokers for Australians, you can check out this list of the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I personally feel that Plus500 stands out. It’s FCA regulated, ensuring that UK traders are protected by stringent regulatory standards. eToro is also FCA regulated, but Plus500’s platform offers a more intuitive experience tailored to the needs of UK traders. Neither broker was originally founded in the UK, but both have established a strong foothold in the region. If you’re keen to explore more options, here’s a guide to the Best Forex Brokers In UK

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

can i trade spot commodities on Plus500 or eToro, or am i restricted to only CFD products?

You are limited to CFD products but if you are with eToro in the USA then you will trade proper cryptos and shares