easyMarkets vs Plus500: Which One Is Best?

In this review of easyMarkets and Plus500, we can see how closely both brokers compete for the top spot in the industry. However, it’s clear which one excels in terms of features and platform. Ultimately, the decision is yours to make. We’ll leave it all up to you.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

$3,000 (Premium)

$10,000 (VIP)

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors between easyMarkets and Plus500.

- easyMarkets is tailored for beginners with fixed spreads and risk management tools.

- easyMarkets’ minimum deposit starts at $200 for a standard account.

- Plus500 suits intermediate traders with over 100 technical indicators.

- Plus500 offers a broader range of CFD features and derivatives.

- Plus500 requires a deposit of only $100.

1. Lowest Spreads And Fees – Plus500

As we go through this review for easyMarkets and Plus500, we can see that the prior’s spreads are fixed, while the latter offer fixed or dynamic spreads depending on the currency pair.

| Standard Account | easyMarkets Spreads | Plus500 Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.83 | 1.75 | 1.6 |

| EUR/USD | 0.8 | 1.2 | 1.2 |

| USD/JPY | 1.5 | 2 | 1.4 |

| GBP/USD | 1.3 | 1.7 | 1.6 |

| AUD/USD | 1.5 | 1.1 | 1.5 |

| USD/CAD | 2.3 | 2 | 1.8 |

| EUR/GBP | 2 | 1.5 | 1.5 |

| EUR/JPY | 2.2 | 2.5 | 1.9 |

| AUD/JPY | 3 | 2 | 2.1 |

Looking at the spreads, you will notice that the Plus500 offers are narrower than easyMarkets. The spread difference reflects what each broker offers as part of their service. easyMarkets offers free inclusions for their client, such as risk management tools, which are paid for through the wider spread. Plus500 charges a premium for some of its features.

You will also notice that the spreads for easyMarkets MT4 accounts are narrower than those of their custom forex trading platform. This is because the MT4 platform does not have many exclusive risk management tools easyMarkets offer, such as free guaranteed stop loss, no slippage guarantee, dealCancellation, Inside Viewer, and Freeze Rate.

Fixed vs Dynamic Spreads

easyMarkets don’t or rarely change their fixed spreads, no matter how volatile the condition might be. This feature allows traders to plan their trading strategies around a spread before executing a trade.

easyMarkets held their fixed prices through one of the more dramatic economic events in recent memory. In 2015, the Swiss National Bank surprised the market by announcing they would stop pegging the Swiss Franc against the Euro, which resulted in a drop of 2000 pips for the CHF/EUR currency pair. Despite this, easyMarkets did not change their spreads.

Volatile spreads, on the other hand, are subject to market liquidity and conditions of the market. So, while variable spreads may generally be narrower than fixed spreads, the fluctuating nature means spreads may be wider than our table shows.

To make trading fees easier to understand, we created a calculator. Select your currency, trade size, and pair to get the fee.

Additional Costs

| Costs | easyMarkets | Plus500 |

|---|---|---|

| Rolling/Overnight Fees | None (included in spread) | Yes |

| Inactivity Fees | No | Yes |

| Guaranteed Stop Order | No (Included in spreads) | Yes |

| dealCancellation | Yes | Not offered |

| Maximum monthly withdrawals penalty | No | Yes |

| Deposit and withdrawal fees | No | Limited (ie. Incoming and outgoing bank transfers from your bank account to Plus500 account. ) |

It is important to note that neither broker charges commissions, while easyMarkets include most of their “hidden” costs in their spread, which are fixed. Plus500 has a few changes that will be applied after you make your purchase.

In this portion, it is safe to say that if you are after the narrowest spreads, choose Plus500. But, the complementary features easyMarkets offers mean this broker is well worth considering. easyMarkets features are very good if you are a risk-averse trader or are trading in a volatile market.

Our Lowest Spreads and Fees Verdict

Plus500 outpaces the rival here due to their lowest spreads and fees.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

2. Better Trading Platforms – Plus500

Brokers who offer better trading platforms mean they provide traders with advance tools and faster execution that comes with performance that is absolutely reliable. In this section, we will see which one offers better trading platforms.

easyMarkets Trading Platforms

This broker offers a choice of 2 platforms. This is their custom platform and MetaTrader 4.

| Trading Platform | easyMarkets | Plus500 |

|---|---|---|

| MetaTrader 4 | Yes | No |

| MetaTrader 5 | Yes | No |

| cTrader | No | No |

| TradingView | Yes | No |

| Copy Trading | Yes | No |

| Proprietary Platform | Yes | Yes |

easyMarkets proprietary offers all the standard tools one expects when trading. This platform, which is available via web and mobile, includes excellent features for new and intermediate traders. The platform offers the following key benefits:

- Access to easyMarkets risk management features such as dealCancellation and Freeze Rate.

- Trading tickets for easy switching between different trading categories, such as forwards or vanilla options.

- Access to 200+ trading instruments via the main trading screen

- Good range of analytical tools

- Easy-to-navigate interface

- Zero slippage

- Integrated news and charts

MetaTrader 4 by Metaquotes is the world’s most popular trading platform and the platform we like to recommend. Mt4 is built for both beginner and advanced traders and has a few features easyMarkets proprietary platform does not offer but also is missing a few features. MT4.

Features MT4 offers that easyMarkets own platform does not:

- Expert Advisors / Robots to automate your trading

- MultiTerminal so you can see more information on different terminals

- Excellent range of graphs and charts

Features easyMarkets proprietary platform offers that MT4 does not

- dealCancellation

- Vanilla options and forward deals

- Integrated news and charts

- No slippage guarantee

Plus500 Trading Platforms

Plus500 only offer their custom platform. They do not offer platforms like MetaTrader or cTrader, which many brokers offer. The Plus500 platform does have one unique feature, in addition to being able to use the platform via web browsers. Mobile and tablet users can also access their platform via their Apple Watch. The platform is specifically designed to operate seamlessly across different operating systems and interfaces (i.e. mobiles, tablets), which will appeal to you if you wish to be mobile.

The platform’s interface makes it easy for users to see all the information they need for different trading derivatives. It is also designed so you can easily use their risk management tools when you need them.

If you like to test your trading strategies before putting them into practice, the Plus500 platform has a great feature that allows for an easy switch between live and demo accounts.

We can surmise that both easyMarkets trading platforms and the Plus500 platform offer several benefits that other platforms do not offer. It is best to consider your trading needs when choosing a platform. For example, if you need risk management features, then easyMarkets proprietary platform might be ideal.

If you desire integration between different platform interfaces and operating systems, then Plus500 might be best. MetaTrader 4 is widely available, allowing users to switch brokers while still using the same platform.

Our Better Trading Platform Verdict

Plus500 platform outperforms in this category owing to their better trading platforms.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

3. Superior Accounts And Features – easyMarkets

For brokers having superior accounts and features are reputable and reliable. They provide flexibility, advanced tools, and better trading conditions, thus giving traders an overall trading experience.

With this portion, we will lay out all the details regarding these features offered from brokers.

easyMarkets Accounts

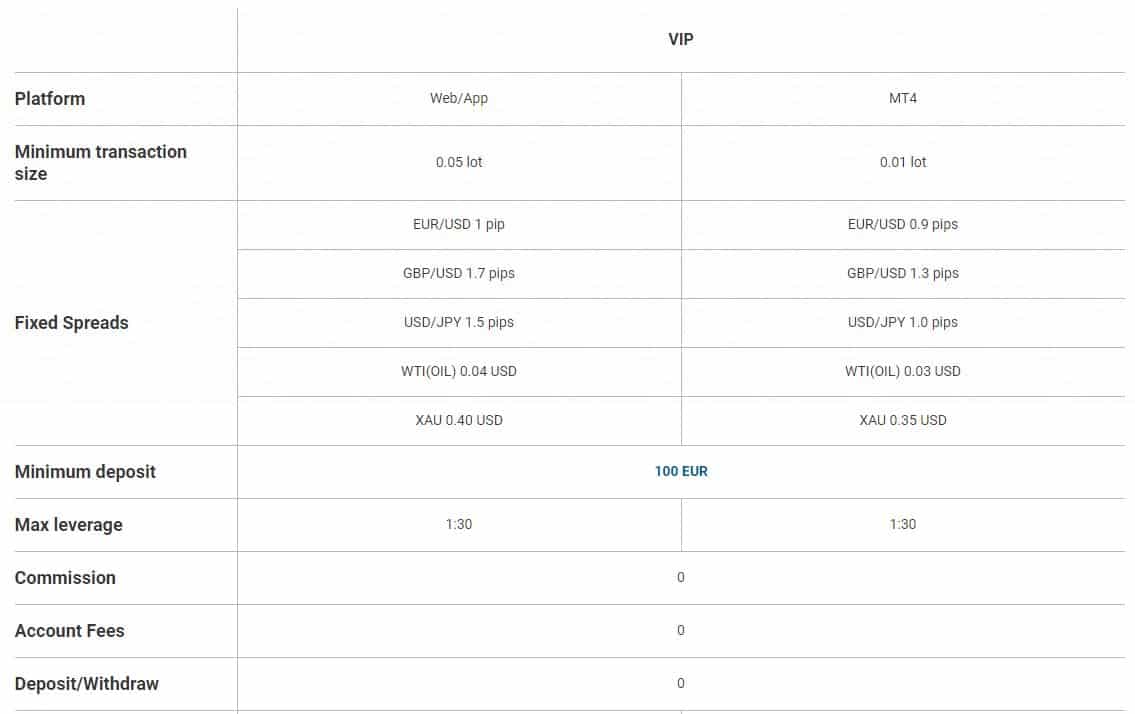

Clients in Australia and all other countries outside Europe and the UK can choose from 3 types of accounts. The VIP account has a higher minimum deposit but offers tighter spreads. The standard account has a lower minimum deposit but wider spreads.

Clients from Australia and other eligible countries can access the leverage of 200:1 with the easyMarkets platforms and 400:1 with MT4. Traders in Australia receive ASIC protection, and traders in most other countries receive the Financial Services Authority of Seychelles (FSA) protection.

| easyMarkets | Plus500 | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | No | No |

| Swap Free Account | No | No |

| Active Traders | Yes | No |

| Spread Betting (UK) | No | No |

For the best value, we recommend the VIP if you have the funds to meet the minimum deposit requirement.

easyMarkets clients in the UK and Europe only have one account available. This is the VIP account. To open an account, only 100 euros is required.

With The easyMarkets Platform, You Will Get:

- Free guaranteed negative balance protection

- Free guaranteed stop-loss and take-profit

- Deal cancellation

- Freeze rate

- No slippage

- Fixed spreads

With The MT4 Platform, You Will Get:

- Margin call when equity or used margin is 70%

- Deal stop out when equity or used margin is 50%

- Expert Advisors

Plus500 Accounts

Plus500 keeps things simple when choosing a trading account, as they only offer one account. The account offers traders the following:

- Commission-free trading

- 32 supported languages

- Negative balance protection

- Free close profit or close at loss rates

- Free Trailing stops

- Guaranteed Stops (premium included in spread)

- Free email and push notifications for important market events

- Alerts on price movements and trader sentiments

- Regional regulation

- Plus500CY (Cyprus)

- Europe – Cyprus Securities and Exchange Commission – CySEC

- Leverage for Retails clients – 30:1 for major currency pairs and 20:1 for minor currency pairs

- Leverage for Professional clients – 300:1

- Europe – Cyprus Securities and Exchange Commission – CySEC

- Plus500AU (Australia)

- Australia + South Africa + New Zealand + plus clients that don’t apply to any FCA, MAS, CySEC

- Leverage of 500:1

- Australia + South Africa + New Zealand + plus clients that don’t apply to any FCA, MAS, CySEC

- Plus500UK (United Kingdom)

- United Kingdom

- Leverage for Retails clients – 30:1 for major currency pairs and 20:1 for minor currency pairs

- Leverage for Professional Clients – 300:1

- United Kingdom

- Plus500SG (Singapore)

- Singapore

- Leverage of 20:1

- Singapore

- Plus500CY (Cyprus)

Note: Clients in the UK and Europe who wish to increase leverage by applying for a professional account will need to show the broker that they have a financial portfolio of at least 500,000 euros and have carried out at least 10 major transactions per quarter over the past 12 months.

Our Superior Accounts and Features Verdict

easyMarkets excels in this area owing to their superior accounts and features.

4. Best Trading Experience – Plus500

We will evaluate in this section who among these brokers offer the best trading experience. Remember that a broker should have, among other features, a user friendly platform, low fees and security.

Here’s what we’ve observed in our hands-on evaluation:

- Limit Order Speed: Plus500 consistently executed our limit orders more rapidly, giving us the edge we needed in fast-moving markets.

- Market Order Execution: Plus500 also took the lead in market order execution, a critical factor for us when timing is everything.

- Account Setup: Both platforms allowed us to set up standard accounts with relative ease, though Plus500 streamlined the process a bit more to our liking.

- Support and Service: The dedicated account manager at easyMarkets was a highlight, but Plus500’s overall efficiency resonated with our need for speed and simplicity.

We have observed through these details that Plus500 emerges as the broker that offers the best trading experience for us. Their swift execution and intuitive setup process gave them a decisive advantage in our books

Our Best Trading Experience and Ease Verdict

Plus500 ranks highest in this category due to their best trading experience.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

5. Stronger Trust and Regulation – Plus500

This portion of our review is so vital. So vital that it ensures traders a secure and transparent trading environment. Here’s the layout of our observation.

Plus500 Trust Score

easyMarkets Trust Score

Regulations Europe And The UK

Traders in the UK and Europe are regulated by CySEC. To abide by leverage requirements. Major forex pairs for retail traders are restricted to 30:1 and 20:1 for minor currency pairs. This can be increased if you qualify as a professional trader.

When we speak of trust and regulation, clearly, Plus500 takes the lead. Traders in the UK and Europe are regulated by CySEC, ensuring a high standard of oversight and protection. The leverage requirements set by this regulatory body are stringent, with major forex pairs for retail traders restricted to 30:1 and 20:1 for minor currency pairs. But for those who qualify as professional traders, this can be increased, offering more flexibility.

Both easyMarkets and Plus500 are renowned for their risk management features. While easyMarkets includes many of their risk management tools within their spreads, Plus500 offers these features as optional, allowing traders to tailor their experience. Notable features both brokers provide include Guaranteed Negative Balance Protection and Guaranteed Stop Loss/Take Profit. However, easyMarkets goes a step further with unique features like Price Freeze, dealCancellation, and a no-slippage guarantee.

| easyMarkets | Plus500 | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) | ASIC (Australia) FCA (UK) CYSEC (Cyprus) FMA (New Zealand) MAS (Singapore) |

| Tier 2 Regulation | DFSA (Dubai) EFSRA |

|

| Tier 3 Regulation | FSC-BVI FSA-S (Seychelles) | FSA-S (Seychelles) FSCA (South Africa) |

We can safely say that while both brokers have potent regulatory frameworks and risk management tools, Plus500 edges out with its CySEC regulation and a more flexible approach to risk management features.

Our Stronger Trust and Regulation Verdict

Plus500 outshines in this portion thanks to having stronger trust and regulation.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

6. Most Popular Broker – Plus500

Plus500 gets searched on Google about twice as often as easyMarkets. On average, Plus500 sees around 270,000 branded searches each month, while easyMarkets gets about 49,500 — that’s 81% fewer.

| Country | easyMarkets | Plus500 |

|---|---|---|

| Italy | 18,100 | 22,200 |

| Germany | 590 | 18,100 |

| United Kingdom | 390 | 14,800 |

| Spain | 390 | 9,900 |

| Australia | 2,400 | 8,100 |

| Netherlands | 170 | 8,100 |

| Poland | 320 | 8,100 |

| United States | 1,900 | 5,400 |

| South Africa | 720 | 5,400 |

| Switzerland | 110 | 5,400 |

| Portugal | 70 | 4,400 |

| United Arab Emirates | 210 | 4,400 |

| Greece | 390 | 4,400 |

| Sweden | 110 | 2,900 |

| Austria | 110 | 2,900 |

| Mexico | 320 | 2,900 |

| Hong Kong | 170 | 2,400 |

| France | 1,000 | 1,900 |

| Singapore | 210 | 1,900 |

| Argentina | 170 | 1,600 |

| Taiwan | 90 | 1,300 |

| New Zealand | 140 | 1,300 |

| Colombia | 320 | 1,300 |

| India | 1,600 | 1,000 |

| Cyprus | 590 | 880 |

| Saudi Arabia | 170 | 720 |

| Malaysia | 880 | 720 |

| Turkey | 140 | 720 |

| Ireland | 50 | 720 |

| Chile | 90 | 590 |

| Japan | 1,000 | 390 |

| Egypt | 590 | 390 |

| Pakistan | 480 | 320 |

| Canada | 210 | 320 |

| Thailand | 140 | 320 |

| Brazil | 3,600 | 320 |

| Indonesia | 480 | 320 |

| Nigeria | 390 | 320 |

| Morocco | 170 | 210 |

| Vietnam | 590 | 170 |

| Philippines | 480 | 170 |

| Algeria | 210 | 170 |

| Bangladesh | 260 | 170 |

| Dominican Republic | 70 | 140 |

| Jordan | 50 | 140 |

| Costa Rica | 90 | 140 |

| Cambodia | 140 | 110 |

| Peru | 140 | 90 |

| Panama | 70 | 90 |

| Venezuela | 40 | 90 |

| Kenya | 260 | 70 |

| Ghana | 70 | 70 |

| Uzbekistan | 390 | 70 |

| Sri Lanka | 90 | 40 |

| Ecuador | 50 | 40 |

| Tanzania | 50 | 30 |

| Uganda | 40 | 30 |

| Ethiopia | 30 | 30 |

| Botswana | 50 | 20 |

| Bolivia | 20 | 20 |

| Mauritius | 10 | 10 |

| Mongolia | 10 | 10 |

2024 Monthly Searches For Each Brand

easyMarkets - Italy

easyMarkets - Italy

|

18,100

1st

|

Plus500 - Italy

Plus500 - Italy

|

22,200

2nd

|

easyMarkets - UK

easyMarkets - UK

|

390

3rd

|

Plus500 - UK

Plus500 - UK

|

14,800

4th

|

easyMarkets - Australia

easyMarkets - Australia

|

2,400

5th

|

Plus500 - Australia

Plus500 - Australia

|

8,100

6th

|

easyMarkets - US

easyMarkets - US

|

1,900

7th

|

Plus500 - US

Plus500 - US

|

5,400

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with Plus500 receiving 6,888,000 visits vs. 296,000 for easyMarkets.

Our Most Popular Broker Verdict

Plus500 is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

7. CFD Product Range And Financial Markets – Plus500

Traders will have better opportunity to diversify their portfolio while they can easily manage financial risks effectively. In this section, we will compile and collate and lay out in front you each and every details these information.

easyMarkets offers over 200 trading CFDs instruments. Markets available for trade include:

- 64 Forex pairs

- 27 Shares CFD

- 3 Cryptocurrencies – Bitcoin, Ripple, Ethereum

- 21 Metals combinations among Gold, Silver, Platinum, Palladium and Copper

- 7 Soft commodities

- 5 Energy products

- 15 Indices

With easyMarkets, you can trade 4 different ways. These are CFDs, Options, Forwards and easyTrade.

Plus500 offers a far more comprehensive range of derivatives than easyMarkets.

Instruments available with Plus500 include:

- 13 Cryptocurrencies plus 1 Crypto index. Cryptos include Bitcoin, Bitcoin Cash, Ethereum, Litecoin, NEO, Ripple, Stellar, EOS, Cardano, Tron and Monero. 10 of these are combined to make up the Crypto Index.

- 67 indices, including country and sector indices, including cannabis indices.

- 17 commodities

- 1800+ Shares CFD

- Options

- ETFs

| CFDs | easyMarkets | Plus500 |

|---|---|---|

| Forex Pairs | 242 | 65 |

| Indices | 14 | 65 |

| Commodities | 5 Metals 5 Energies 7 Softs | 5 Metals 7 Energies 10 Softs |

| Cryptocurrencies | 3 | 28 |

| Shares | 60 | 11,000+ |

| ETFs | No | 97 |

| Bonds/Treasuries | No | No |

| Other Products(Options,Futures) | No | No |

Evidently, Plus500 offers more CFD features when it comes to trading different asset classes or derivatives than easyMarkets. We recommend Plus500 if you need to trade a wide range of different CFDs.

Our Top Product Range and CFD Markets Verdict

Plus500 stands out in this category thanks to their CFD product range and financial markets.

Note: Traders from the UK with Plus500UK (United Kingdom) will not be able to trade cryptocurrencies as FCA does not allow this derivate to be offered for trade.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

8. Superior Educational Resources – easyMarkets

When traders explore deep into the business of trading, having access to comprehensive educational resources can make all the difference. Clearly, both easyMarkets and Plus500 understand this and have made significant efforts to equip their users with the necessary tools and knowledge. Here’s a breakdown of what each broker offers:

- easyMarkets:

- Provides a range of educational tools tailored for beginners.

- Offers webinars, eBooks, and video tutorials to enhance learning.

- Features a dedicated ‘Learn Centre’ with articles and insights.

- Plus500:

- Focuses on providing a user-friendly platform for self-directed learning.

- Offers a range of articles and tutorials for traders of all levels.

- Features a ‘Trader’s Guide’ section with in-depth insights.

From our own testing, it’s evident that both brokers have invested in educational resources. But the depth and breadth of these resources vary. easyMarkets seems to have a more structured approach, with a dedicated learning centre and a variety of formats. In contrast, Plus500 offers a more streamlined experience, focusing on self-directed learning. We can definitely say easyMarkets offers a more comprehensive set of educational resources, making it the preferred choice for traders looking to expand their knowledge.

Our Superior Educational Resources Verdict

easyMarkets takes the lead in this section as a result of their superior educational resources.

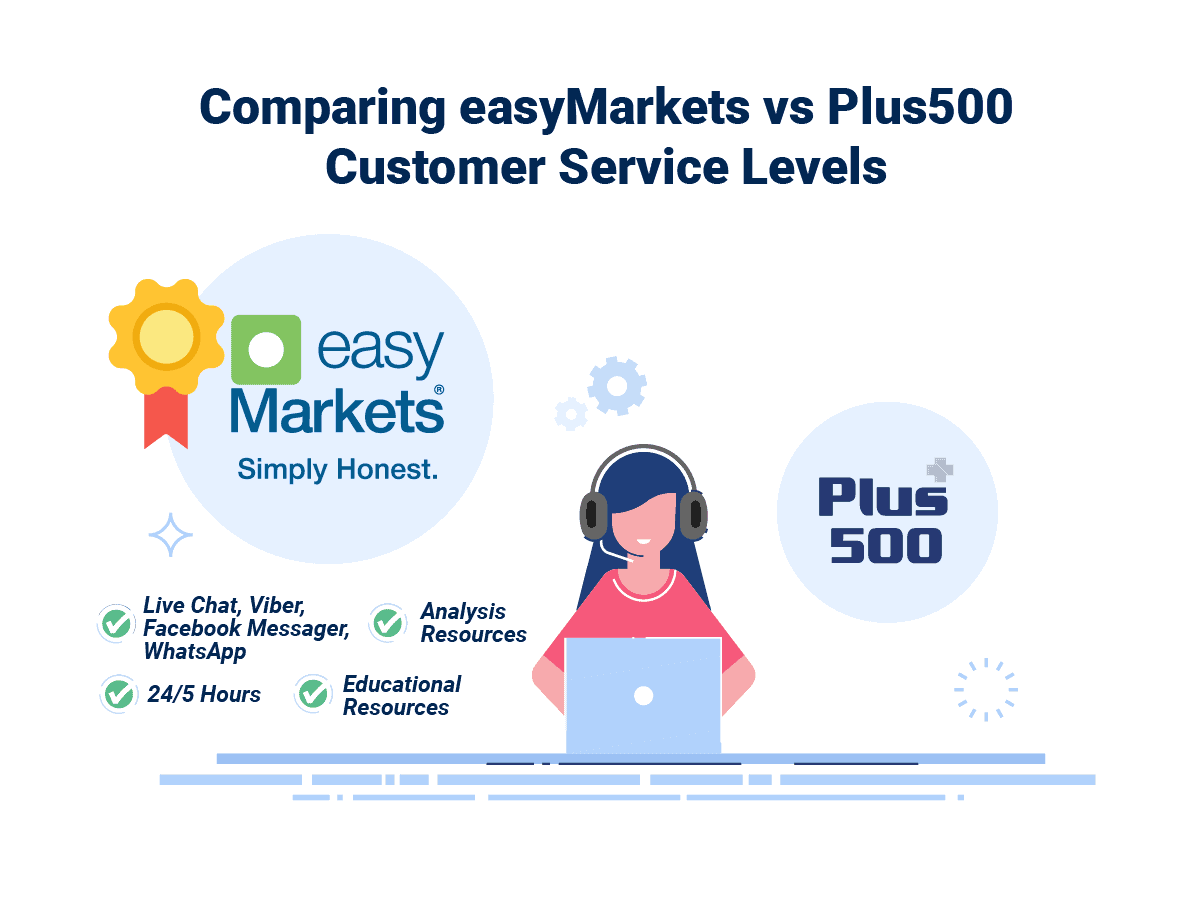

9. Better Customer Service – easyMarkets

Every businesses and establishments need to have the best customer service in their services. Having good customer services enhances the overall trading experience for traders, as it builds trust and confidence at the same time. Here, we will explain further each brokers customer service features.

easyMarkets Customer Support

This broker has 24/5 customer support starting at 8 am each Monday AEST time. easyMarkets have their support teams located in Sydney and Cyprus and are available via Messenger (Facebook), Viber and WhatsApp in addition to the traditional methods of contact methods.

easyMarkets Customer Service

The easyMarkets range of educational resources is solid. Educational features include:

- Get Starting – This section found on their website is a series of videos that covers all the fundamentals you need to know for trading with easyMarkets

- Discover – This video series explains everything you need to know about the main trading instruments available with easyMarkets.

- Free eBooks – If you prefer to learn by reading, easyMarkets offers eBooks you can download that cover a wide range of information about trading and easyMarkets trading platforms

- Knowledge Base – This feature explains the main topics in a simple and straightforward manner

- FAQ – Here you will find all your questions answered

easyMarkets services also include in-depth market analysis resources. These include:

- Market News – These are feeds of events on the market throughout the world.

- Trading Charts – These are charts that will help you predict future trading movements

- Currency Rates – here, you can find all the latest currency exchange rates around the world

- Financial Calendars – This feature advises on changes in policies that may impact the markets of your trades

- Forex News – This is a blog covering major news that will affect Forex

easyMarkets also offers a demo account. With the demo account, you get $15,000 of virtual funds and access to the most easyMarkets features, such as guaranteed protections and dealCancellation.

Plus500

This broker is unusual in that their support features are more limited when we compare with other brokers. For example, although Plus500 offers 24/7 live chat and email support, there is no phone support.

Plus500 also don’t offer much in the way of trading education. This is interesting, given it is a standard feature many other online brokers offer. This doesn’t mean Plus500 is an inferior product. It just means they assume you will use other resources freely available on the web when researching.

This broker, however, does offer one of the better demo accounts. While most brokers offer time limits or fund limits for their demo accounts, Plus500 has no access or limit restrictions.

| Feature | easyMarkets | Plus500 |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/5 | 24/7 |

| Multilingual Support | Yes | No |

Evidently, our recommendation goes out to easyMarkets. They provide s a wide range of contact options for customer support. Not only is their support better, but they have more services. easyMarkets offers all the educational tools you will need to help you trade successfully and have a great experience with easyMarkets.

Our Superior Customer Service Verdict

easyMarkets dominates this category in light of their better customer service.

10. More Funding Options – easyMarkets

As we explore more about online trading, the ease and variety of funding options play a pivotal role. Traders need flexibility in depositing and withdrawing funds; the more options a broker provides, the better. Both easyMarkets and Plus500 have recognised this need and offer a range of funding methods to cater to their diverse clientele. From our analysis, we’ve gathered insights into the funding options each broker offers.

easyMarkets provides a straightforward approach to funding, ensuring that traders can deposit and withdraw funds with ease. They offer a variety of methods, from traditional bank transfers to modern e-wallet solutions. On the other hand, Plus500, while offering a range of funding options, places a strong emphasis on security, ensuring that each transaction is protected.

Funding Options Table:

| Funding Option | easyMarkets | Plus500 |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | Yes |

| Skrill | Yes | Yes |

| Neteller | No | No |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Our Better Funding Options Verdict

easyMarkets secures the top spot here by the reason of having more funding options.

11. Lower Minimum Deposit – easyMarkets

For many traders, especially those just starting out, the minimum deposit requirement can be a significant factor in choosing a broker. It’s not just about the amount but also about the flexibility and accessibility it offers. A lower minimum deposit can be a sign of a broker’s commitment to cater to traders of all levels, from beginners to professionals. Both easyMarkets and Plus500 have set their minimum deposit thresholds, but how do they compare?

easyMarkets, known for its user-friendly approach, has always aimed to make trading accessible to the masses. Their minimum deposit reflects this ethos, ensuring that even those with a limited budget can start trading. Plus500, on the other hand, while being a major player in the industry, has its own set of criteria when it comes to minimum deposits, balancing between security and accessibility.

Minimum Deposit Table:

| Broker | Minimum Deposit | Recommended Deposit |

|---|---|---|

| easyMarkets | $200 | - |

| Plus500 | $100 | $100 |

In conjecture, when it comes to a lower minimum deposit, easyMarkets takes the lead with a requirement of just $100, making it a more accessible choice for traders on a budget.

Our Lower Minimum Deposit Verdict

easyMarkets takes the lead with their lower minimum deposit.

So is easyMarkets or Plus500 The Best Broker?

In this portion, we give our final analysis that Plus500 is the winner because of its holistic approach to trading, offering a blend of beginner-friendly tools and advanced features for seasoned traders.

The table below summarises the key information leading to this verdict:

| Categories | Plus500 | easyMarkets |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | Yes | No |

| Superior Accounts And Features | No | Yes |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | Yes | No |

| Top Product Range And CFD Markets | Yes | No |

| Superior Educational Resources | No | Yes |

| Superior Customer Service | No | Yes |

| Better Funding Options | No | Yes |

| Lower Minimum Deposit | No | Yes |

easyMarkets: Best For Beginner Traders

easyMarkets stands out as the go-to broker for those new to trading, offering a plethora of educational resources and a user-friendly platform.

Plus500: Best For Experienced Traders

While both brokers cater well to experienced traders, Plus500 offers a slightly more advanced platform and a broader range of CFD markets, making it the top choice for seasoned professionals.

FAQs Comparing easyMarkets Vs Plus500

Does Plus500 or easyMarkets Have Lower Costs?

easyMarkets generally offers lower costs compared to Plus500. For instance, easyMarkets provides a fixed spread of 0.70 for EUR/USD, whereas Plus500 offers a standard spread of 1.70 for the same pair. This difference in spread can significantly impact trading costs over time. For a more detailed comparison of broker spreads, you can explore the lowest spread forex brokers in the UK.

Which Broker Is Better For MetaTrader 4?

Both Plus500 and easyMarkets offer support for MetaTrader 4, but easyMarkets is particularly tailored for MT4 users with its range of features and tools. MetaTrader 4 is a popular choice among traders for its user-friendly interface and advanced charting capabilities. For those keen on exploring more about MT4 brokers, you can look into this comprehensive overview of the best MT4 brokers.

Which Broker Offers Social Trading?

easyMarkets offers social trading features, allowing traders to follow and copy the trades of professionals. Social trading has gained popularity as it provides an opportunity for less experienced traders to benefit from the strategies of seasoned professionals. For those interested in diving deeper into social trading platforms, here’s a detailed guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither Plus500 nor easyMarkets offer spread betting as a primary feature. Spread betting is a unique form of trading popular in the UK and offers tax benefits for traders. If you’re interested in brokers that provide spread betting, you can explore this comprehensive list of the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

For Australian Forex traders, easyMarkets stands out as the top choice. Founded in Australia and regulated by ASIC, it offers a high level of trust and security. While Plus500 is a strong international broker with a significant presence in Australia, easyMarkets’ local roots and ASIC regulation give it an edge. For more insights on Australian Forex brokers, check out this detailed guide on the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I believe Plus500 stands out as the superior choice. Being FCA-regulated, Plus500 ensures a high level of security and trust for UK-based traders. easyMarkets, while offering a solid platform, is not primarily UK-focused. The FCA regulation of Plus500 ensures adherence to stringent standards, making it a reliable choice for UK traders. For more insights on the best platforms for UK traders, here’s a comprehensive overview of the Best Forex Brokers In UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Are all of the spreads I get on EasyMarkets fixed spreads?

Yes, easyMarkets is a fixed spread broker. The broker has a reputation for keeping spreads fixed no matter how volatile market conditions are or how low liquidity is.

Is my money safe with Plus500?

Yes, absolutely. Plus500 is licenced and overseen by major financial regulators bodies such as ASIC (for Australia), FMA (for New Zealand), FSCA (for South Africa), FCA (for the UK), CySEC (EU), MAS (for Singapore) and FSA based in Seychelles for the rest of the world. These bodies have measures in place to ensure your funds are safe, measures include segregated accounts for your funds.