XM vs City Index: Which One Is Best?

We compared XM to City Index based on the fees the broker charge, trading platforms, regulation and features offered. Our findings were that City Index had the edge over XM in 2025 with the full detailed analysis below.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 10:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers the 10 most important trading factors between XM and City Index. City Index has lower spreads and fees compared to XM, making it more cost-effective for traders. XM offers a better trading platform experience with the availability of cTrader, which City Index does not provide.

City Index provides a superior overall trading experience, with lower spreads and faster market order speeds. XM Trading offers a wider range of account types, including Micro, Standard, and XM Zero, compared to City Index’s Standard and Premium. City Index is regulated by the Financial Conduct Authority (FCA), offering stronger trust and regulation compared to XM’s regulation.

1. Lowest Spreads And Fees – City Index

XM offers four account types distinguished by lot sizes and pricing: micro-lots with no commission, standard lots with spread-only costs, and commission-based pricing. City Index offers no commission trading.

To assess the trading costs between these two brokers, use the City Index vs XM calculator below. You can adjust currency pairs, lot sizes, and base currency to determine which broker offers better rates across various markets.

XM Spreads

| XM | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | All-in Cost EUR/USD - Active | EUR/USD Standard Account |

|---|---|---|---|---|---|---|---|---|---|---|

| MyFxBook | 0.20 | 0.10 | 0.10 | 0.40 | 0.60 | 0.40 | 1.10 | 1.10 | N/A | N/A |

| BrokerChooser | 0.10 | 0.10 | 0.20 | 0.40 | 0.50 | N/A | N/A | N/A | N/A | N/A |

| ForexBrokers.com | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| CompareForexBrokers | 0.26 | 0.10 | 0.10 | 0.20 | 0.10 | 0.50 | 0.30 | 0.40 | N/A | N/A |

| XM | 0.70 | 0.70 | 0.60 | 0.90 | 1.20 | 1.00 | 1.00 | 1.50 | N/A | N/A |

| Consensus | 0.32 | 0.25 | 0.25 | 0.48 | 0.60 | 0.63 | 0.80 | 1.00 | N/A | N/A |

City Index Spreads

| City Index | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | All-in Cost EUR/USD - Active | EUR/USD Standard Account |

|---|---|---|---|---|---|---|---|---|---|---|

| MyFxBook | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| BrokerChooser | 1.10 | 1.30 | 2.00 | 1.10 | 2.10 | N/A | N/A | N/A | N/A | N/A |

| ForexBrokers.com | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 1.40 | 0.74 |

| CompareForexBrokers | 0.32 | 0.18 | 0.50 | 0.30 | 0.30 | 0.39 | 0.39 | 0.70 | N/A | N/A |

| City Index | 0.03 | 0.01 | 0.26 | 0.48 | 0.15 | 0.24 | 0.02 | 0.45 | N/A | N/A |

| Consensus | 0.48 | 0.50 | 0.92 | 0.63 | 0.85 | 0.32 | 0.21 | 0.58 | 1.40 | 0.74 |

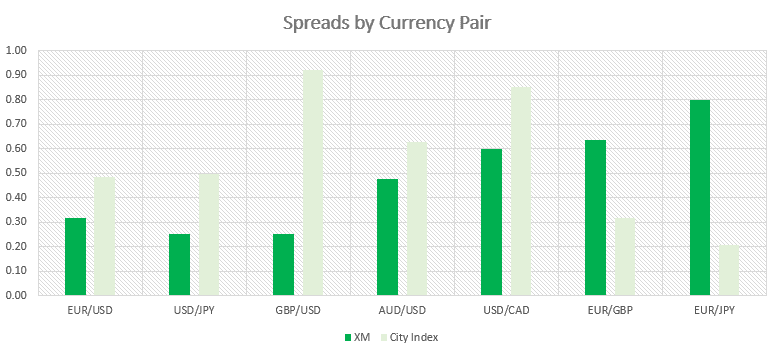

The graph below shows just the consensus data with City Index having the lower spreads for the EUR/GBP and EUR/JPY but XM has lower spreads for all other major currency pairs.

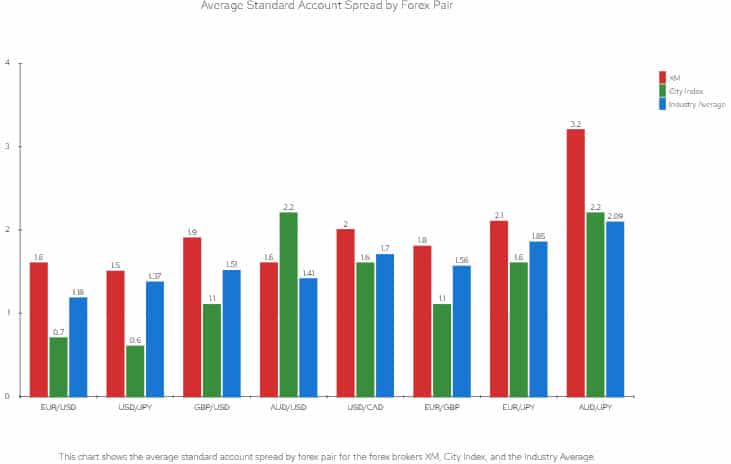

Standard Account Spreads

XM offers a spread of 2.0 for EUR/USD, higher than the industry average of 1.2. This trend continues across the board, with XM’s spreads consistently higher than the industry average. It might seem minor but can add up over time and many trades.

City Index offers a spread of 0.7 for EUR/USD, significantly lower than the industry average. They consistently offer lower spreads across all forex pairs than the industry average. All other things being equal, trading with City Index could result in lower costs over time.

| XM Spreads | City Index Spreads | Industry Average | |

|---|---|---|---|

| Overall Average | 2.39 | 1.45 | 1.7 |

| EUR/USD | 2 | 0.7 | 1.2 |

| USD/JPY | 2.5 | 0.6 | 1.5 |

| GBP/USD | 1.3 | 1.6 | 1.6 |

| AUD/USD | 2.4 | 2.2 | 1.6 |

| USD/CAD | 2.3 | 1.6 | 1.9 |

| EUR/GBP | 2.4 | 1.1 | 1.5 |

| EUR/JPY | 3.2 | 1.6 | 2.1 |

| AUD/JPY | 3 | 2.2 | 2.3 |

Standard Account Analysis Updated December 2025[1]December 2025 Published And Tested Data

In conclusion, City Index is the more cost-effective option if we’re purely looking at spreads. However, it’s important to remember that spreads are just one factor when choosing a forex broker. Other factors, such as customer service, trading platforms, and overall trading experience, should also be considered.

Commission Rates

City Index charges lower Lowest Commission Brokers, which can add up to substantial savings over time, especially for active traders.

Our Lowest Spreads and Fees Verdict

While both brokers offer competitive trading costs, City Index comes out on top due to its lower commission rates and fewer miscellaneous fees.

View City Index ReviewVisit City Index

*Your capital is at risk ‘68% of retail CFD accounts lose money’

2. Better Trading Platforms – XM

XM offers both MetaTrader 4 and 5, while City Index only has MT4 but has TradingView. While City Index does not offer cTrader, XM does.

| Trading Platform | XM | City Index |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | No |

| cTrader | No | No |

| TradingView | No | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

Social And Copy Trading

Both brokers offer social and copy trading features, allowing traders to follow and copy the trades of experienced traders.

VPS and Other Trading Tools

Both brokers offer VPS and other trading tools to enhance the trading experience.

Our Better Trading Platform Verdict

Both brokers offer a wide range of trading platforms and tools, but XM Trading has a slight edge due to its offering of cTrader.

*Your capital is at risk ‘75.99% of retail CFD accounts lose money’

3. Superior Accounts And Features – XM

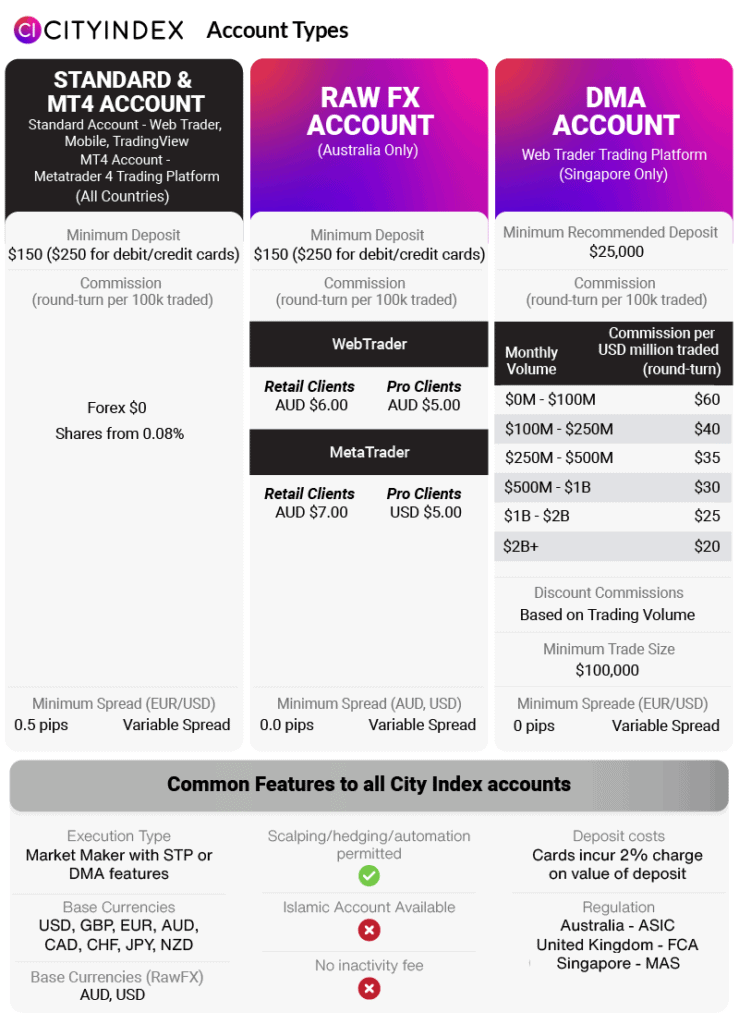

XM Trading offers three main account types: Micro, Standard, and XM Zero. City Index, on the other hand, offers two main account types: Standard and Premium.

XM Account Types

| XM Account | Micro account | Standard Account | Zero Account | Ultra Low Account |

|---|---|---|---|---|

| Restrictions | Available with all branches | Available with all branches | UK and Europe only | Australia and select countries only |

| Minimum Spread | 1 pip | 1 pip | 0.1 pips | 0.6 pips |

| Commission | Commission-free | Commission-free | $3.5 per side, per 100k traded | Commission-free |

| Contract size | 1 Lot = 1000 | 1 Lot = 100,000 | 1 Lot = 100,000 | Standard Ultra: 1 Lot = 100,000 Micro Ultra: 1 Lot = 1000 |

| Minimum trade volume | 0.01 Lots (MT4) 0.1 Lots (MT5) | 0.01 Lots (MT4) 0.1 Lots (MT5) | 0.01 Lots | Standard Ultra: 0.01 Lots Micro Ultra: 0.1 Lots |

| Lot restriction per ticket | 100 Lots | 50 Lots | 50 Lots | Standard Ultra: 50 Lots Micro Ultra: 100 Lots |

| Islamic account | Optional | Optional | Optional | Optional |

City Index Account Types

| XM | City Index | |

|---|---|---|

| Standard Account | Yes | No |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | No |

| Active Traders | No | No |

| Spread Betting (UK) | No | Yes |

Our Superior Accounts and Features Verdict

XM Trading wins this category due to its more comprehensive range of the Best Brokers for Micro Trading.

*Your capital is at risk ‘75.99% of retail CFD accounts lose money’

4. Best Trading Experience – City Index

City Index uses a market-maker pricing model through its proprietary dealing desk. XM provides traders in the UK and Europe with a competitive edge with its ECN spreads.

Our tests revealed that City Index has a slightly faster market order speed compared to XM.

| Broker | Overall Speed Ranking | LO Rank | Limit Order Speed (ms) | MO Rank | Market Order Speed (ms) |

|---|---|---|---|---|---|

| XM | 19 | 13 | 148 | 18 | 184 |

| City Index | 6 | 6 | 95 | 7 | 131 |

Our Best Trading Experience and Ease Verdict

Based on our findings and tests, City Index offers a slightly better overall trading experience due to its lower spreads and faster market order speed.

View City Index ReviewVisit City Index

*Your capital is at risk ‘68% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – City Index

Both brokers are similarly trustworthy in regulation, reputation, and reviews, with City Index scoring 64 and XM scoring 58.

City Index Trust Score

XM Trust Score

Regulation

XM Trading is regulated by the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC). City Index is regulated by the Financial Conduct Authority (FCA), the Monetary Authority of Singapore (MAS), and the Australian Securities and Investments Commission (ASIC).

| XM | City Index | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) CYSEC (Cyprus) | ASIC (Australia) FCA (UK) MAS (Singapore) |

| Tier 2 Regulation | DFSA (Dubai) | |

| Tier 3 Regulation | FSC-BZ |

Reputation

XM has been around since 2009 with headquarters in Belize City. City Index has more years in the industry, as their operations started in 1983 in London, UK.

A quite popular broker, XM has around 673,000 monthly hits on Google. Despite being around longer, City Index has only a 12,100 monthly search volume.

Reviews

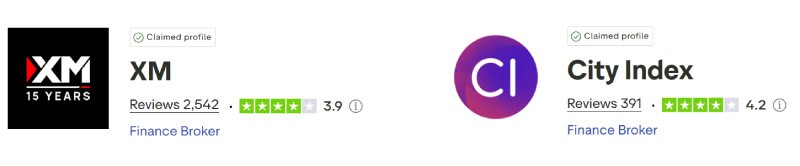

While popular, XM only has a 3.9 out of 5 score on TrustPilot from over 2,500 reviews. Alternatively, City Index has a slightly higher TrustPilot score of 4.2 from about 400 users.

Our Stronger Trust and Regulation Verdict

Both brokers are well-regulated, but City Index has a slight edge as it’s among the FCA Regulated Brokers, with the FCA being considered one of the strictest regulatory bodies in the world.

View City Index ReviewVisit City Index

*Your capital is at risk ‘68% of retail CFD accounts lose money’

6. Most Popular Broker – XM

XM gets searched on Google more than City Index. On average, XM sees around 723,000 branded searches each month, while City Index gets about 9,900 — that’s 98% fewer.

| Country | XM | City Index |

|---|---|---|

| United States | 74,000 | 390 |

| Thailand | 74,000 | 40 |

| Japan | 74,000 | 90 |

| India | 60,500 | 590 |

| South Africa | 33,100 | 90 |

| Malaysia | 27,100 | 110 |

| Indonesia | 27,100 | 90 |

| Egypt | 22,200 | 20 |

| Brazil | 18,100 | 40 |

| Vietnam | 18,100 | 40 |

| Colombia | 18,100 | 20 |

| Morocco | 18,100 | 20 |

| France | 14,800 | 70 |

| Germany | 14,800 | 140 |

| Mexico | 14,800 | 10 |

| Philippines | 12,100 | 30 |

| Pakistan | 12,100 | 40 |

| Uzbekistan | 12,100 | 10 |

| Italy | 9,900 | 50 |

| Turkey | 9,900 | 50 |

| United Kingdom | 8,100 | 4,400 |

| Algeria | 8,100 | 10 |

| Cambodia | 6,600 | 10 |

| Spain | 5,400 | 50 |

| Peru | 5,400 | 10 |

| Canada | 5,400 | 50 |

| Taiwan | 5,400 | 50 |

| Bangladesh | 5,400 | 20 |

| Kenya | 5,400 | 30 |

| Netherlands | 4,400 | 40 |

| Saudi Arabia | 4,400 | 20 |

| Ecuador | 4,400 | 10 |

| Nigeria | 4,400 | 70 |

| Singapore | 4,400 | 720 |

| Sri Lanka | 4,400 | 10 |

| Poland | 3,600 | 90 |

| United Arab Emirates | 3,600 | 40 |

| Chile | 2,900 | 10 |

| Jordan | 2,900 | 10 |

| Australia | 2,900 | 1,000 |

| Venezuela | 2,900 | 10 |

| Greece | 2,900 | 20 |

| Switzerland | 2,400 | 30 |

| Argentina | 2,400 | 10 |

| Dominican Republic | 2,400 | 10 |

| Portugal | 1,900 | 30 |

| Austria | 1,900 | 10 |

| Cyprus | 1,900 | 20 |

| Ghana | 1,900 | 10 |

| Botswana | 1,900 | 10 |

| Bolivia | 1,600 | 10 |

| Mongolia | 1,600 | 10 |

| Sweden | 1,300 | 40 |

| Hong Kong | 1,300 | 40 |

| Ethiopia | 1,300 | 10 |

| Uganda | 1,000 | 10 |

| Costa Rica | 880 | 10 |

| Tanzania | 880 | 10 |

| Ireland | 590 | 30 |

| Panama | 590 | 10 |

| New Zealand | 480 | 10 |

| Mauritius | 260 | 10 |

74,000 1st | |

390 2nd | |

74,000 3rd | |

90 4th | |

60,500 5th | |

590 6th | |

27,100 7th | |

110 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with XM receiving 15,630,000 visits vs. 216,000 for City Index.

Our Most Popular Broker Verdict

XM is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘75.99% of retail CFD accounts lose money’

7. CFD Product Range And Financial Markets – City Index

XM offers a diverse range of more than 1,250 CFD trading products, including forex, shares, indices, and commodities. With City Index, traders have access to over 4,600 markets spanning forex, stocks, indices, cryptocurrencies, and more.

Our own testing didn’t reveal any broker that could outperform these two in terms of product range.

| CFDs | XM | City Index |

|---|---|---|

| Forex Pairs | 55 | 84 |

| Indices | 14 | 20 |

| Commodities | 2 Metals 5 Energies 8 Softs | 4 Metals 8 Energies 18 Softs |

| Stocks | 1261 | 4500+ |

| Bonds | No | 11 |

| Cryptocurrency | No | 25+ |

| Futures | No | No |

| Options | No | No |

City Index not only offers a wider range of shares CFDs but also provides options for trading in cryptocurrencies and bonds, which are not available with XM. XM, however, has a decent range of Forex and commodities CFDs, making it a strong contender in this category.

Our Top Product Range and CFD Markets Verdict

City Index takes the lead in offering a more comprehensive range of CFDs and markets, especially with its extensive shares of CFDs and additional trading options like cryptocurrencies and bonds.

View City Index ReviewVisit City Index

*Your capital is at risk ‘68% of retail CFD accounts lose money’

8. Superior Educational Resources – City Index

XM provides a comprehensive educational section on its website, including webinars, video tutorials, and articles. City Index, on the other hand, offers a well-structured educational portal with trading guides, webinars, and market analysis. Our own testing also provided some valuable insights into the educational features of both brokers.

- XM offers webinars that cover a wide range of topics, suitable for traders of all levels.

- City Index provides detailed trading guides that are especially useful for beginners.

- XM has a rich library of video tutorials that cover both basic and advanced trading strategies.

- City Index offers market analysis reports that can help traders make informed decisions.

- Both brokers provide demo accounts, allowing traders to practice without risking real money.

- Our tests gave City Index a score of 8.5 and XM a score of 7.5 in terms of educational resources.

City Index’s educational portal is not only well-structured but also covers a wide range of topics, making it suitable for both beginners and experienced traders. XM, although strong in its educational items, lacks the depth and variety that City Index provides.

Our Superior Educational Resources Verdict

Based on our testing, City Index offers superior educational resources with a score of 8.5 compared to XM’s 7.5.

View City Index ReviewVisit City Index

*Your capital is at risk ‘68% of retail CFD accounts lose money’

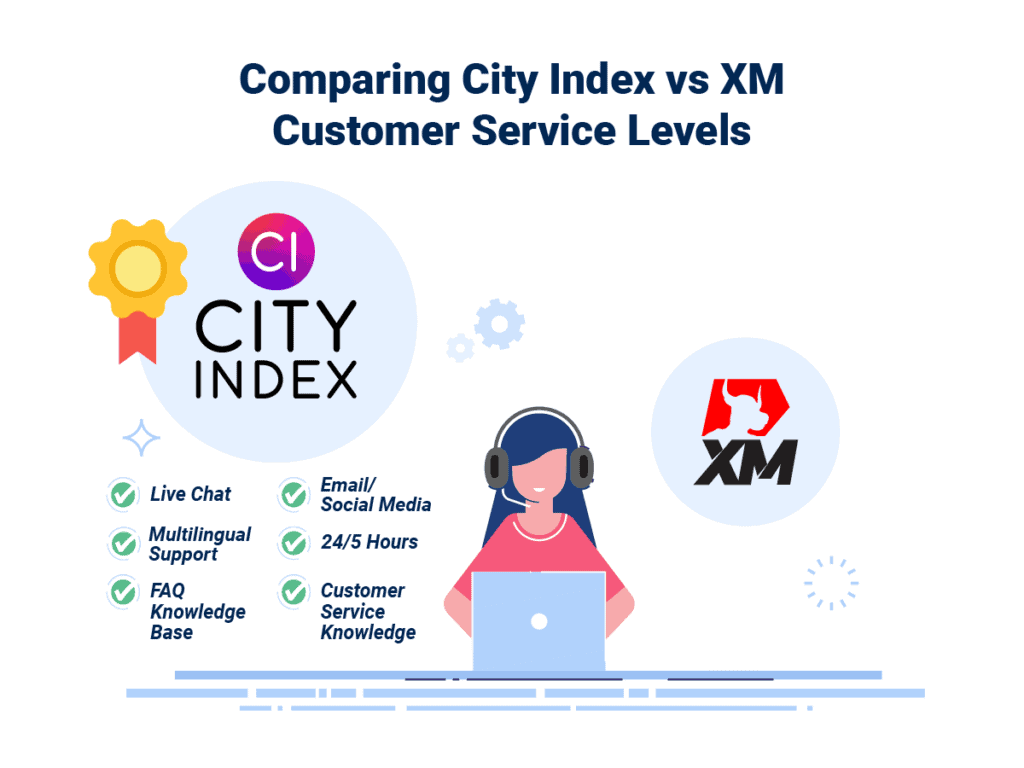

9. Better Customer Service – City Index

XM customer service is available 24/7 via live chat, and email, while City Index is on 24/5 through live chat, email, and messenger.

City Index has a slight edge due to its excellent customer service knowledge and FAQ knowledge base.

| Feature | XM | City Index |

|---|---|---|

| Live chat | 24/7 | 24/5 |

| Customer Service Knowledge | Good | Excellent |

| FAQ Knowledge Base | Average | Excellent |

| Email/Social Media | Email Messenger | |

| Multilingual Support | Yes | Yes |

Our Superior Customer Service Verdict

City Index wins this category due to its superior customer service.

View City Index ReviewVisit City Index

*Your capital is at risk ‘68% of retail CFD accounts lose money’

10. Better Funding Options – XM

XM offers a variety of funding options, including credit/debit cards, electronic wallets, and bank wire transfers. City Index provides fewer options but focuses on the most commonly used methods like credit/debit cards and bank transfers.

| Funding Option | XM | City Index |

|---|---|---|

| Credit Card | ✅ | ✅ |

| Debit Card | ✅ | ✅ |

| Bank Transfer | ✅ | ✅ |

| PayPal | ❌ | ✅ |

| Skrill | ✅ | ❌ |

| Neteller | ✅ | ❌ |

| Crypto | ✅ | ✅ |

As you can see, XM offers a broader range of funding options, including several e-wallets like Skrill and Neteller, which are not available with City Index. City Index, however, offers the most commonly used methods, making it easier for traders who prefer traditional funding options.

Our Better Funding Options Verdict

Based on our testing, XM offers better funding options due to its wider variety of available methods.

*Your capital is at risk ‘75.99% of retail CFD accounts lose money’

11. Lower Minimum Deposit – City Index

City Index has a lower minimum deposit of $0 vs $5 from XM. However, the $0 requirement is limited to bank transfers in some regions.

Refer to the table below for City Index’s deposit requirements.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $150 |

| Paypal | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $150 |

| Bank Wire | £0 Minimum Deposit | $0 Minimum Deposit | €0 Minimum Deposit | $150 |

| Skrill | N/A | N/A | N/A | N/A |

In contrast, XM offers a straightforward minimum deposit amount across the board.

| Minimum Deposit | GBP | USD | EUR | AUD |

|---|---|---|---|---|

| Credit Card / Debit Card | £5 | $5 | €5 | $5 |

| Bank Wire | £5 | $5 | €5 | $5 |

| Electronic Wallets | £5 | $5 | €5 | $5 |

Our Lower Minimum Deposit Verdict

City Index wins with its $0 deposit requirement. Since both brokers offer traders a low entry point, we believe either is a winner. The winner overall will have to do well in the other areas.

View City Index ReviewVisit City Index

*Your capital is at risk ‘68% of retail CFD accounts lose money’

So Is City Index or XM The Best Broker?

City Index is the winner because it excels in more categories, including spreads and fees, trading experience, regulation, product range, and educational resources. The table below summarises the key information leading to this verdict.

| Criteria | XM | City Index |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ❌ | ✅ |

| Superior Accounts And Features | ❌ | ✅ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ❌ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ✅ | ❌ |

| Superior Customer Service | ✅ | ❌ |

| Better Funding Options | ❌ | ✅ |

| Lower Minimum Deposit | ✅ | ❌ |

City Index: Best For Beginner Traders

City Index is better for beginner traders due to its no minimum deposit and more educational resources.

City Index: Best For Experienced Traders

City Index is the best choice for experienced traders because of its advanced trading platforms, competitive spreads, and strict regulation.

FAQs Comparing XM Vs City Index

Does City Index or XM Have Lower Costs?

City Index has lower costs when it comes to spreads and fees. For example, the average spread for EUR/USD is 0.7 with City Index, compared to 1.6 with XM. Lower spreads can significantly reduce your trading costs over time. For more information on low-cost brokers, you can visit this Lowest Commission Brokers page.

Which Broker Is Better For MetaTrader 4?

Both City Index and XM offer MetaTrader 4, but XM provides a more user-friendly experience with additional features. XM’s MetaTrader 4 platform is known for its advanced charting tools and a wider range of indicators. For a comprehensive list of the best MetaTrader 4 brokers, check out this best MT4 brokers page.

Which Broker Offers Social Trading?

City Index offers social trading through its TradingView platform, which is known for its social trading features. TradingView allows you to follow other traders, view their strategies, and even copy their trades. For more on social trading platforms, you can refer to this best social trading platforms page.

Does Either Broker Offer Spread Betting?

City Index offers spread betting, but XM does not. Spread betting is available with City Index for UK residents only. For more details on spread betting brokers, you can visit this best spread betting broker for beginners page.

What Broker is Superior For Australian Forex Traders?

In my opinion, XM is the superior broker for Australian Forex traders. Both brokers are ASIC regulated, but XM offers a lower minimum deposit and more flexible account options. For a more comprehensive list of brokers suitable for Australian traders, check out this Best Forex Brokers In Australia page.

What Broker is Superior For UK Forex Traders?

For UK Forex traders, I believe City Index is the superior choice. Both brokers are FCA regulated, but City Index was founded in the UK and offers a more comprehensive range of CFD markets. For more information on the best brokers for UK traders, you can refer to this Best Forex Brokers In UK page.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert