FINMA regulated brokers

Forex traders in Switzerland should choose from this list FINMA regulated brokers. This review list the best forex brokers you can choose from that have FINMA regulation and the key features the brokers offer.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

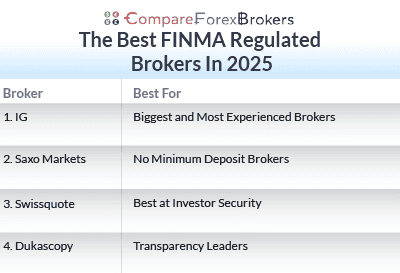

The Best FINMA Regulated Brokers for Swiss Traders

- IG Group - Biggest and Most Experienced Brokers

- Saxo Markets - No Minimum Deposit Brokers

- Swissquote - Best at Investor Security

- Dukascopy - Transparency Leaders

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

55 |

ASIC, FINMA FCA, MAS |

0.9 | 0.7 | 0.9 | - | 1.1 | 1.8 | 1.1 |

|

|

|

135ms | $2000 | 327 | 9 | 50:1 | 50:1 |

|

Read review ›

Read review ›

|

29 |

FCA, FINMA MAS, DFSA, MFSA |

1.7 | 1.6 | 1.7 | 2 | 1.7 | 2 | 1.6 |

|

|

|

170ms | $1000 | 80 | - | 30:1 | 400:1 |

|

What Are The Best FINMA Regulated Brokers?

FINMA (Financial Market Supervisory Authority) is Switzerland’s financial trading activity regulator. As a Swiss trader, choosing a Swiss-regulated broker is important for trust and authority. The following list contains the best FINMA-regulated brokers, based on a number of trading factors, relevant to Swiss traders.

1. IG Group - Biggest and Most Experienced Brokers

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

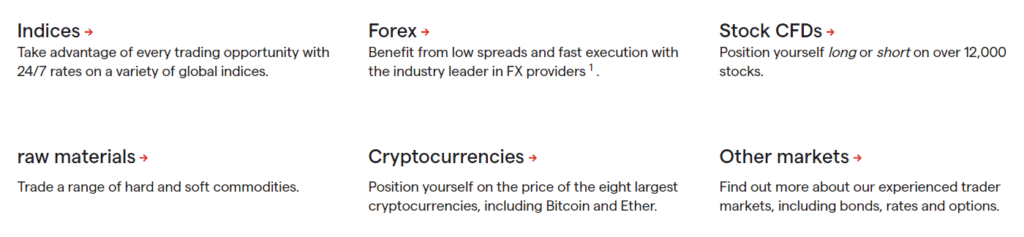

IG is the largest broker with numerous products like forex, CFDs, indices, cryptos, and shares, among others, boasting over 17,000 CFD markets.

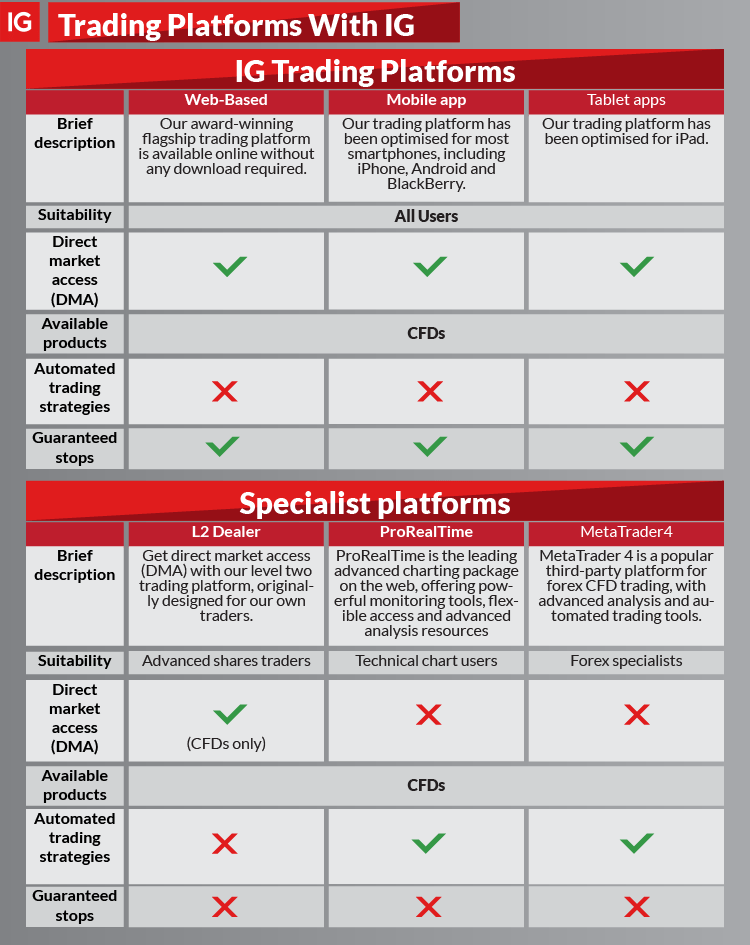

We like that you can choose from 4 trading platforms – IG Trading platforms, which has a guaranteed stop loss, ProRealTime for chart trading, MT4 to automate with EAs and L2 dealer for DMA trading.

With lots of products, choice of platforms and low spreads we think IG has something for everyone.

Pros & Cons

- Professional charting

- Negative balance feature

- Wide array of products

- Highly regulated

- Charges on inactive accounts

- Time lag in account opening

Broker Details

The Best FINMA Regulated Forex Broker

IG Bank (known as IG Markets in the rest of the world) is our top broker with FINMA regulation thanks to their low spreads with no commissions, excellent choice of trading platforms, and range of trading products.

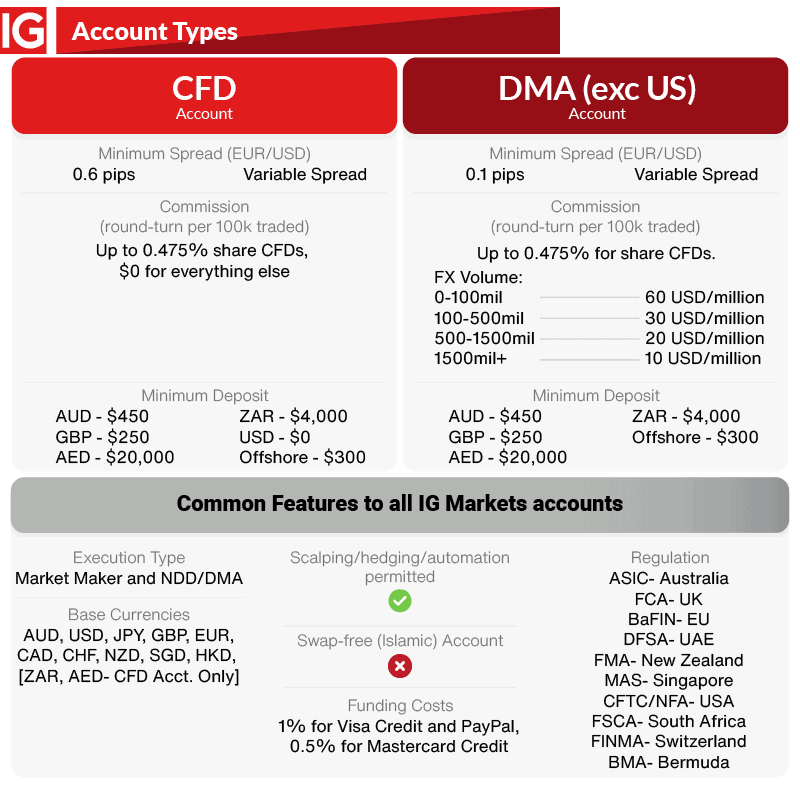

IG Has Low Spreads Without Commissions

As IG Bank is a market maker, spreads are all-inclusive, which means spreads come with no commission costs. While no dealing desk brokers may appear cheaper since they have tighter spreads, they have commission costs besides the spread. When this is factored in, IG Bank spread (which starts from 0.6 pips for the EUR/USD currency pair) is very competitive.

As a financial service provider and a forex broker, IG Bank offers its investors deep liquidity on the forex market and stock exchange as well as negative balance protection.

The below table highlights the major feature of the trading account most retail traders with IG Bank will use. Of particular note is the maximum leverage of 1:30 for forex trading. This is the maximum permitted for all brokers across Europe because of ESMA regulations.

The below table compiles the average spreads from brokers’ websites and is updated each month. IG markets offer some of the best spreads with no commissions from any broker. This makes IG one of the best choices of the brokers regulated FINMA.

On this list, you will notice Pepperstone, IC Markets and CMC Markets also have excellent spreads for their standard accounts. While these brokers are not regulated by FINMA, they are regulated by either the FCA in the UK or CySEC in Cyprus. Like FINMA, the FCA and CySEC fall under ESMA’s jurisdictions, which means brokers with these regulations are suitable across the entire European Economic Zone.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

IG Trading Products

IG offers the widest range of markets out of any broker on this list.

Traders can choose from major forex markets including 100 forex pairs consisting of:

- 16 Majors

- 8 Minors

- 18 Australasian Pairs

- 12 Scandinavian Pairs

- 17 Exotics

- 22 Emerging Forex Pairs

CFD trading products are not just limited to Forex. You can also trade Cryptocurrencies, Indices and Shares. You can also trade Daily and Weekly Future, Stock indices, and Share Options. Futures with Indices, Commodities, and Bonds are also available.

Other trading options include Bonds, Interest rates, and Sectors covering verticles such as Beverages, Banks, Media, and Food Producers.

IG Platforms

IG offers a wide range of platforms for you to choose from. Some of these platforms are third-party platforms and therefore might incur other fees.

IG Trading Platform

If you wish to have a choice of execution types, orders types and achieve IG’s fastest execution speed, then IG’s proprietary platform can be an appealing option.

With forex and shares, you can opt for forex direct or share DMA account, which means you can trade with a Direct Market Access (DMA) trading model instead of a dealing desk model. Using this model allows you to view the order books at the trading exchange. For this reason, the DMA is best for professional traders.

The IG trading platform also gives you a choice of advanced order types you won’t find with other platforms. For example, guaranteed stops are available, which means IG will close your position at the price you specify for a small premium. This means you don’t need to worry about unexpected losses because of slippage.

Lastly, the Trading Platform has an average execution speed of just 0.014 seconds. Faster execution speed helps reduce the likelihood of slippage which means you have a better chance of getting the price quoted.

MetaTrader 4 (MT4)

The world’s most popular forex trading platform is also another option for you to trade with. MetaQuotes originally designed the platform for forex traders but quickly developed into a multi-asset trading platform. Learn more about the <ahref=”https://www.compareforexbrokers.com/trading-platforms/best-mt4-brokers/”>best MT4 brokers.

Choose this platform over the IG Trading Platform if you want to be part of the MT4 trading community, which is one of the largest, or want to automate your trading with Expert Advisors.

MT4’s large community means you can find a wealth of resources to ensure you have the best trading experience. This means if you need help to master the platform, you can find it easily. If you are looking for custom indicators and signals, you can find this in the MT4 marketplace and you want to automate, you can a wealth of expert advisors.

ProRealTime

This platform is one of the best for advanced charting with powerful monitoring tools. If you trade based on technical analysis, then this is the platform for you. If you place less than 4 trades a month, there will be a 45 CHF fee, otherwise, it is free.

- We have listed its benefits below.

- Can trade all markets (apart from DMA)

- Advanced ProRealTime charts

- Automated trading strategies available

- It can import indicators from third parties

L2 Dealer

L2 Dealer is IG Bank’s Direct Market Access (DMA) platform. While DMA is available on the IG Trading platform, the key difference is that L2 Dealer is a specialist trading platform for level 2 trading.

- Watchlists and price alerts in real-time

- ProRealTime charting access

- Algorithmic trading, limits, market orders, and more

- Bloomberg & FIX API add-ons available

2. Saxo Markets - No Minimum Deposit Brokers

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 0.7

AUD/USD = 0.9

Trading Platforms

MT4, TradingView, SaxoTraderGo, SaxoTraderPro

Minimum Deposit

$0

Why We Recommend Saxo Markets

Coming into the industry with a banking background, Saxo Markets boasts an average spread of 1.20 pips for EUR/USD and 0.9 pips for AUD/USD average pair spread of 0.9.

Besides helping smaller accounts open multiple portfolios using its fractional shares feature, Saxo offers a variety of assets from CFDs to Stocks.

Pros & Cons

- $0 minimum deposit accounts

- Overall low trading fees

- Great CFD trading

- User friendly

- High minimum deposit in some regions

- Custody and future fees are exorbitant

- Not great for beginners

Broker Details

The Broker That Has A Great Range Of Trading Products

Saxo Bank (known as Saxo Markets in some other countries) is one of the larger brokers in the world with over 660,000 clients and 25+ years of experience in the industry.

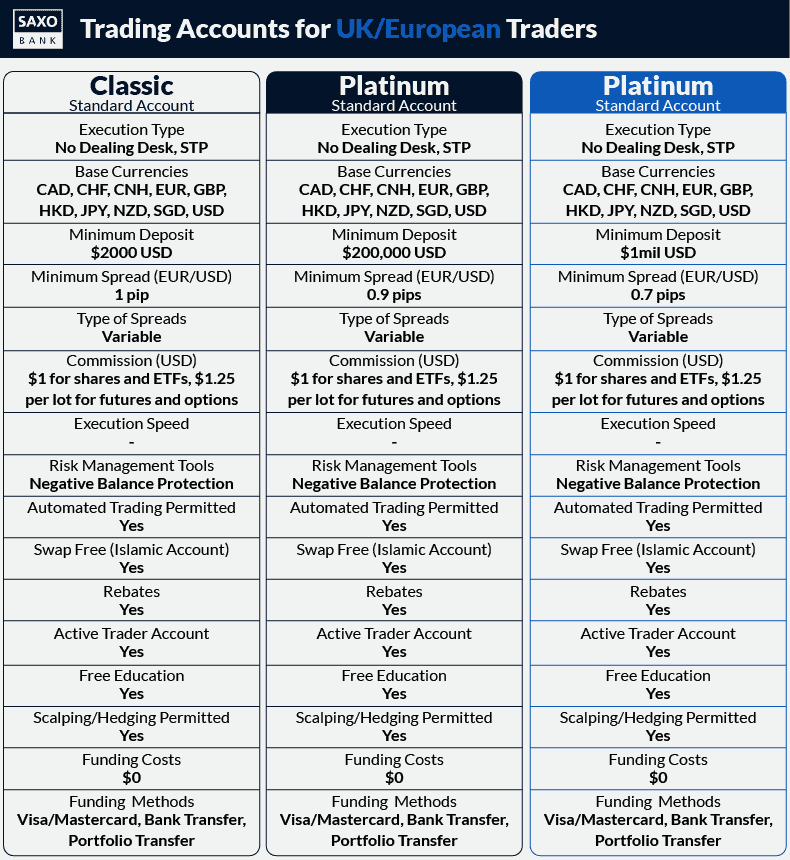

Saxo Bank Account Types

Saxo Bank offers their clients access to trading, investing and hedging across the full range of markets through 3 different account types: Classic, Platinum and VIP. The differences between the trading accounts are to do with initial funding amounts, spread differences, and support levels.

Classic Account

The Classic account is more suited to beginner traders as it has a lower entry barrier of only CHF 2,000. Most Saxo Bank clients will manage their trading activities from the Classic account. Additional features include 24/5 account support and access to the full range of CFD products, SaxoTraderGo and SaxoTraderPro trading platforms.

The trading cost for forex trading is built into an all-inclusive spread that starts from 2.0 pips on EUR/USD. Traders can enjoy commission-free trading across the full CFD product list. Under FINMA guidelines, the maximum leverage for trading forex is 30:1. On this account type, Saxo Bank offers a market-making execution model for all CFD products that are not traded on an exchange.

Platinum Account

Saxo Bank’s Platinum account comes with a higher minimum deposit of CHF 250,000. The Platinum account comes with the same features as the Classic account but, it additionally comes with 30% lower trading costs and customer support in your native language.

Through the Saxo Rewards program, traders can switch from the Classic account to the Platinum account if certain trading volume requirements are met.

The trading cost for the Platinum account is built into an all-inclusive spread that starts from 1.8 pips on EUR/USD, maximum leverage is set at 30:1 with a market-making execution model.

VIP Account

Saxo Bank’s VIP account is designed for institutional investors as it requires a minimum deposit of CHF 1 million. The VIP account has the same features as the Platinum account plus additional features like better prices, direct access 24/5 to Saxo Bank experts, 1:1 SaxoStrats access and invitations to exclusive events.

The VIP account has the lowest trading costs. The minimum spread on EUR/USD starts from 1.6 pips. Maximum leverage is set at 30:1 with a market-making execution model.

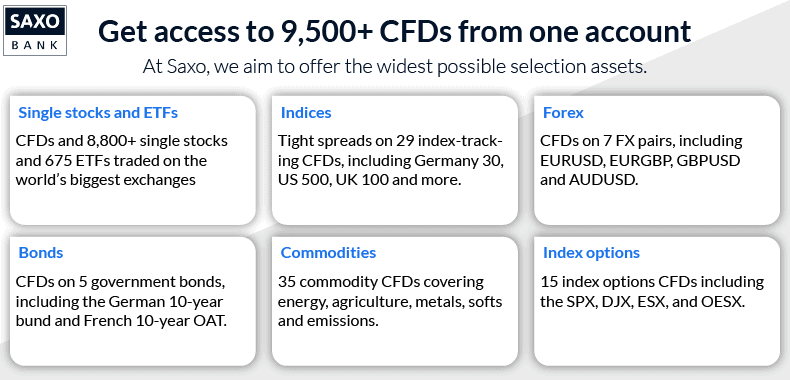

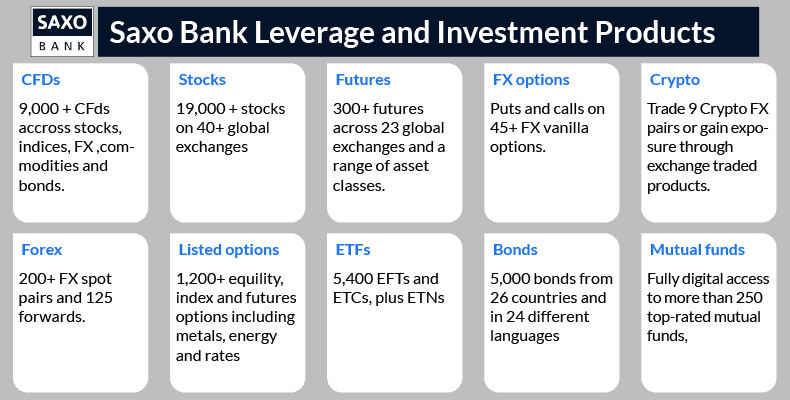

Saxo Bank CFD And Other Products

Saxo Bank offers access to a comprehensive list of CFD products that number over 40,000 financial markets. Asset selection at Saxo Bank is abundant and goes beyond CFDs to also spot trading and investment services.

With CFD trading, over 9000 CFD trading instruments are available. These include only 7 CFD forex pairs. If you want a more extensive range of forex pairs, you either need to trade forex spot, which has 200 pairs of major, minor and exotic pairs to choose from or find another broker.

Other CFDs, you can trade include 8,800+ stocks and 675 ETFS, 29 indices, 5 government bonds, 19 hard and soft commodities and 15 index options CFDs are available.

Additional leveraged products available for Forex traders include 182 forex pairs through spot trading, 140 forward contracts, 44 FX vanilla options and FX swaps.

If you wish to diversify and trade with other asset classes, then Saxo offers exposure to 9 crypto spot pairs like Bitcoin, Ethereum and Litecoin which can be traded against 3 major fiat currencies (USD, EUR and JPY).

Other spot options for trade include 16 precious metals, commodities, futures, options and ETFs. 200+ futures from 23 global exchanges, over 1,200 listed options

If you are looking for investment products, 19,000 stocks across 40 exchanges worldwide, 250 mutual funds, and 3000 ETFs and 5000+ bonds boost the remarkable list of financial instruments offered by Saxo Bank.

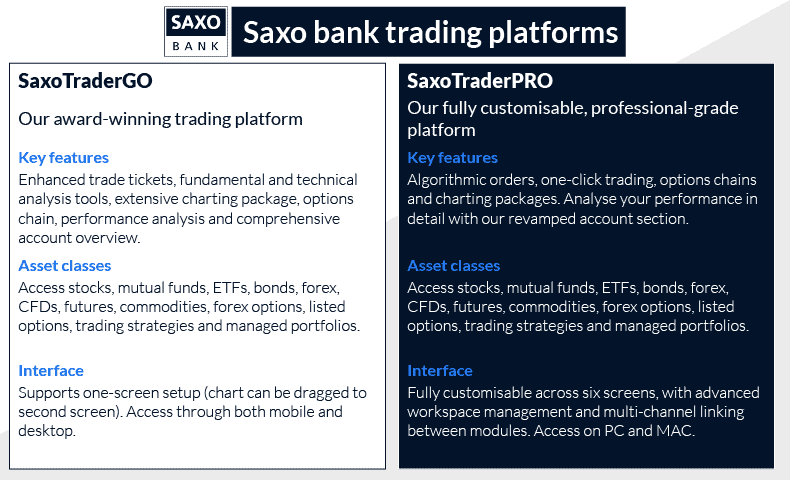

Saxo Bank Platforms

Saxo Bank offers you two different award-winning trading platforms. Both these platforms are available on a single Saxo account, giving you the opportunity to choose a platform that fits your needs. We have listed the features of these platforms below.

SaxoTraderGO

SaxoTraderGO is the award-winning proprietary platform Saxo Bank offers. This platform is the preferred trading platform for Saxo Bank clients and is available as web-based for desktop and as an app for mobiles.

One strength of the platforms is the charting. There are 49 technical indicators and 17 drawing tools. Some 7 bar types are available and charting time periods can be customised to your preference.

SaxoTraderGO offers a range of features as listed.

- Fundamental & technical analysis tools

- News and analysis from Saxo Bank experts

- Scalping and Hedging allowed

- Breakdown your portfolio performance and summary

SaxoTraderPRO

SaxoTraderPRO is the flagship desktop platform of the broker. Mostly, it is like SaxoTraderGo but has extra features to take trading to a professional level.

Among these features is that it can link the interface across six screens for a professional trading setup. It also offers level 2 order books or DMA trading and allows algorithmic trading.

Key features of SaxoTraderPro include:

- Advanced trade ticket for speed and productivity

- Place orders with level 2 prices (DMA Forex Brokers) with a subscription for the data

- Algorithmic ordering on major US, European and Asian markets

- Suit of over 50 technical indicators

3. Swissquote - Best at Investor Security

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.0

AUD/USD = 1.6

Trading Platforms

MT4, MT5, CFXD

Minimum Deposit

$1,000

Why We Recommend Swissquote

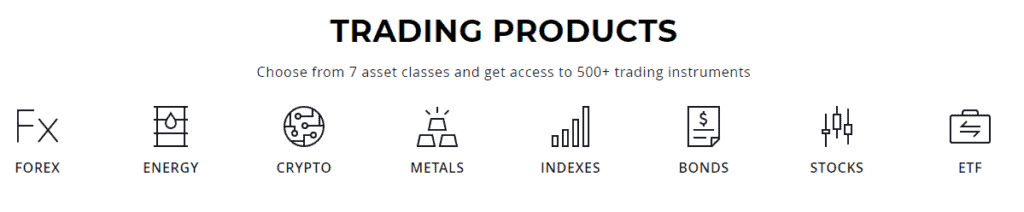

When it comes to providing security and reliability, Swissquote’s banking background gives it the upper hand. Offering numerous tradable assets, including more than 125 currency pairs, CFDs, bonds, options and futures, without commissions, Swissquote is an investor’s dreamland. Whatever your trading preferences are, the integration of MT4, MT5 and Advanced Trader (Swissqoute’s self-owned trading), will meet your needs.

Some drawbacks include exorbitant trading fees, expensive research fees and its unavailability in certain regions. Besides that, Swissquote is a great choice for investors.

Pros & Cons

- A wide variety of tradable assets

- Does not charge inactivity fee

- User-friendly platforms

- Exorbitant fees on bonds, stock and ETFs

- Expensive trading charges

- Is not globally accessible

Broker Details

The Broker With The Top Range Of Currency Pairs

SwissQuote is a market maker that allows you to trade over 3 million products from over 60 countries worldwide. Among these is 138 currency pairs, making it a good option if you are looking for uncommon currency pairs combinations.

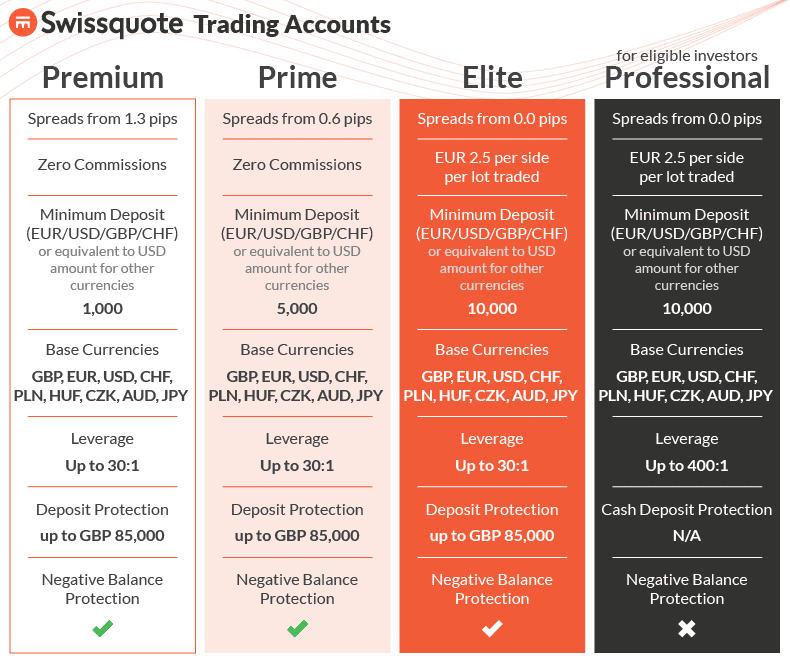

SwissQuote Account Types

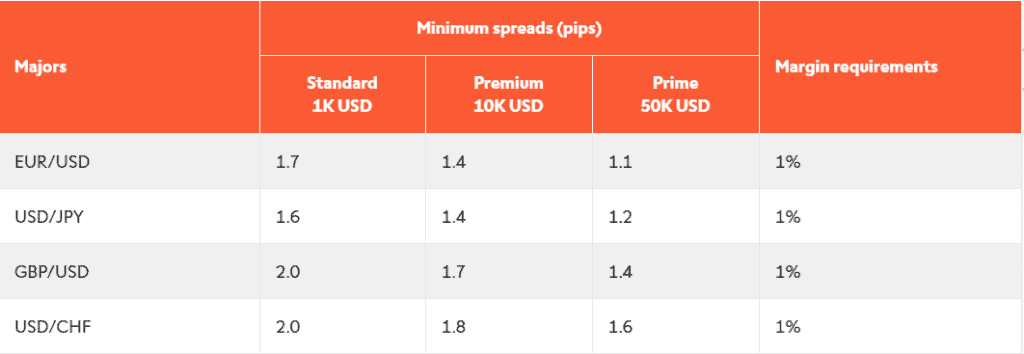

SwissQuote offers 3 different account types. Most retail traders will choose the standard account, as this account has the lowest minimum deposit of the options. At $1,000, many traders will consider this quite high compared to other brokers. Forex pairs start from 1.7 pips which are high compared to IG and other no commission accounts offered by Pepperstone, IC Markets, Markets.com suitable for traders in Switzerland.

If you want the best spreads Swissquote offer, then choose the Prime account. While spreads start from 1.1 pips, they are still higher than other brokers and with this; you need an eye-watering 50,000 in minimum deposits.

Regardless of which account you choose, you can trade the following:

- 76 Forex Pairs

- 8 Commodities

- 26 Indices

- 3 bonds

SwissQuote Spreads

As seen above, SwissQuote’s spreads depend on the account that you choose to trade on. SwissQuote’s pride itself on transparent pricing, which is why there are no commissions or hidden trading fees. Below we have listed some of their spreads for major forex pairs for all the accounts.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

SwissQuote’s Plugins

SwissQuote offers a range of different plugins and tools to assist your trading. Information in the financial markets is key, which is why SwissQuote offers 3 different tools to analyse the markets and show openings. All the plugins are only available for the MetaTrader platform.

Autochartist

Autochartist is a free tool offered to all SwissQuote clients. We have had our experts look into the many functions and benefits of Autochartist and we have listed them below.

- A premium market scanner to recognise market set-ups

- Volatility analysis for enhanced risk management

- Key event analysis for economic dates

- Perfect for beginners and expert traders

Trading Central

Trading central is a pattern recognition software for both the MT4 & MT5 platforms. Expert analysts from an award-winning market research firm built this plugin. We list some of its features below.

- Analyst views monitoring forex, stock indices, and commodities 24/7

- Scans the chart for 16 different candlestick patterns, looking for the best exit/entry points

- Adaptive divergence convergence to search for short-term trading signals

MetaTrader Master

We have coined the MetaTrader Master edition as the ultimate evolution of the MT4/Mt5 platforms. Some benefits of this tool are.

- Correlation matrix to show which instruments have a stronger correlation

- Better manage portfolio risk when working with several instruments

- Stealth Orders designed for scalpers to close all positions in one click

- Trade terminal to manage your entire account, and a mini terminal for individual positions

4. Dukascopy - Transparency Leaders

Forex Panel Score

Average Spread

EUR/USD = 0.28

GBP/USD = 0.92

AUD/USD = 1.07

Trading Platforms

MetaTrader 4

Minimum Deposit

$100

Why We Recommend Dukascopy

Dukascopy boasts various asset categories beyond forex and CFDs, not to mention its binary option offering on currency pairs. Dukascopy might not be the best option for trading and non-trading charges, but they have highly intuitive platforms and versatile account types to suit different trading activities.

We have to give them credit for having a well-rounded research and educational artillery and a customer support service that is always available. Besides the high cost of transactions, overall, Dukascopy is a great option.

Pros & Cons

- Numerous trading options

- Rich research tools

- Excellent customer service

- Offers different account types

- High trading and non-trading fees

- Some delays in withdrawal processes

- May not be best for beginners

Broker Details

The Broker That Has Great STP Or ECN Trading

DukasCopy is an online brokerage that has been regulated by FINMA since 2010. They offer a wide range of markets, including forex, metals, CFDs, bonds, and much more. DukasCopy is a little different from the previous two brokerage options, as they have a lower minimum deposit amount of $100. Similar to IG it means that you can trade without having to risk a large sum of money.

DukasCopy Spreads

DukasCopy operates under an ECN/STP trading model, meaning they have a small commission per trade of $35 per $1 million USD traded. Because of this execution-style, they have pretty low spreads going as low as 0.10 pips for the EUR/USD forex pair. While these are just their minimum spreads, we have collected and compared their average spreads to other brokerages.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

As you can see above, DukasCopy has reasonable spreads, but there are other brokers that have lower spreads.

DukasCopy Trading Platforms

DukasCopy has two different trading platforms to trade financial markets on. The first is their proprietary platform called JForex. The second platform option is the more popular MetaTrader 4 (MT4).

JForex

JForex is a free-to-use platform for DukasCopy traders. It comes with a wide range of features as listed below:

- Market depth with real-time level 2 pricing

- Slippage control

- Automated trading with JavaScript

- 250 indicators and chart studies

- Wide range of order types

MetaTrader 4 (MT4)

MT4 is the world’s most popular trading platform available with your DukasCopy account. We have listed some of its features below:

- Expert advisors (EAs) for automated trading

- Range of technical and fundamental analysis tools

- Easy-to-use trading orders

- Automated trading with MQL4 language

Ask an Expert