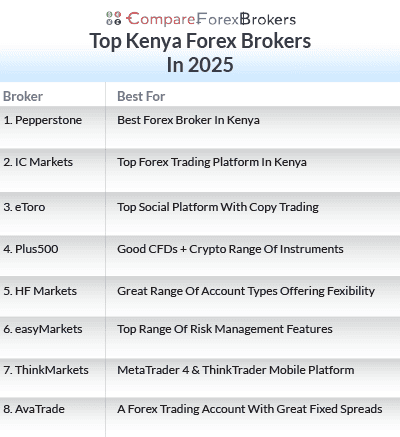

Best Forex Brokers in Kenya

Kenyan Forex traders should choose a locally CMA-regulated Forex Broker that has an international reach, low spreads, and the best Forex trading platforms. The list below shows the top forex brokers in Kenya based on their criteria.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

We recommend the forex brokers below for Kenyan traders

- Pepperstone - Best Forex Broker In Kenya

- IC Markets - Top Forex Trading Platform In Kenya

- eToro - Top Social Platform With Copy Trading

- Plus500 - Good CFDs + Crypto Range Of Instruments

- HF Markets - Great Range Of Account Types Offering Fexibility

- easyMarkets - Top Range Of Risk Management Features

- ThinkMarkets - MetaTrader 4 & ThinkTrader Mobile Platform

- AvaTrade - A Forex Trading Account With Great Fixed Spreads

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.30 | 0.20 | $3.50 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

61 |

ASIC, CySEC, MAS FCA, FMA, DFSA EFSA, FSA, FSCA |

- | - | - | - | 1.2 | 1.7 | 1.1 |

|

|

|

140ms | $100 | 65 | 18 | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

46 |

FCA, FSCA, CYSEC DFSA, CMA, FSA-S |

- | - | - | $3.00 | 1.4 | 1.6 | 1.6 |

|

|

|

$0 | 38+ | 19+ |

|

|||

Read review ›

Read review ›

|

52 |

ASIC, CySEC FSA-S, FSC-BVI |

- | - | - | - | 0.8 | 1.3 | 1.5 |

|

|

|

155ms |

$200 (Standard) $3,000 (Premium) $10,000 (VIP) |

62+ | 17+ | 30:1 | 500:1 |

|

What Are The Best Forex Brokers In Kenya?

Choosing a forex broker has many factors, particularly for traders based in Kenya. You want a broker that does a lot of things well or has a particular competitive advantage in one area. Trading factors to consider include trading platforms, forex spreads and account types. Below, I provided a list of the best forex brokers in Kenya.

1. Pepperstone - Best Forex Broker In Kenya

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.4

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why I Recommend Pepperstone

Pepperstone stands out as my top forex broker in Kenya. The tests conducted by our analyst, Ross Collins, found you can enjoy low currency spreads, reaching 0 pips on major pairs like EUR/USD and AUD/USD, 100% of of the time (outside rollover). This is all thanks to competitive pricing through the broker’s STP-style execution and ECN connections.

According to research, Pepperstone’s average spreads are 1.22 pips on EUR/USD for the Standard account (commission-free) and 0.1 pips for the Razor account. This affirms the broker’s excellence in the broader forex market.

Pros & Cons

- No minimum deposit on their Raw account.

- Very good execution speeds.

- All popular third-party trading platforms are available.

- They are regulated by the CMA.

- Their educational materials could be better.

- They don’t offer a fixed spread account.

- They don’t have their own trading platform.

Broker Details

The Best Forex Broker In Kenya

Pepperstone is my top pick for the best forex brokers in Kenya and the most trusted online forex trading provider. Our team at CompareForexBrokers conducted a rating process based on four elements:

- Wide range of currency pairs (92 major, minor and exotic pairs)

- Fair trading fees (tight spreads and low commissions)

- High leverage of 500:1

- A low minimum deposit of $200

Headquartered in Melbourne, Australia, Pepperstone is a multi-licenced forex broker that provide Kenyan traders access to the forex market. I found that they are one of only three brokers and the only international forex broker to hold a non-dealing Foreign Exchange Broker permit and be CMA licenced with the Capital Markets Authority of Kenya (CMA).

This makes Pepperstone the best choice for Kenyan traders in my books, offering global standard trading conditions legally if you are trading in Kenya.

- Pepperstone Markets Kenya Limited | Company No.PVT-PJU7Q8K | CMA Licence No.128 – based in Nairobi

As an international forex brokerage firm, Pepperstone complies with the rules imposed by the world’s top-tier regulatory bodies, including:

As an international forex brokerage firm, Pepperstone complies with the rules imposed by the world’s top-tier regulatory bodies, including:

- Capital Markets Authority (CMA) in Kenya.

- Australian Securities and Investments Commission (ASIC) in Australia

- The Financial Conduct Authority (FCA) in the UK

- Cyprus Securities and Exchange Commission (CySEC) in Europe

- The Dubai Financial Services Authority (DFSA) in Dubai

Pepperstone Spreads

As a Kenyan resident, you can start trade forex with Pepperstone, offering 92 currency pairs with currency spreads that can go as low as 0 pips on EUR/USD, AUD/USD or GBP/USD. The broker can offer competitive spreads because of its price engine, which connects to various liquidity providers using STP-style execution to achieve ECN pricing.

However, the average spread across Pepperstone’s Standard account (with zero commission trading) is 0.77 pips on EUR/USD. By comparison, the average spread on the Razor account is 0.17 pips on EUR/USD.

For a complete forex spread comparison (using ECN accounts) of the reviewed forex brokers, have a look at the table below:

Avg. spreads are taken from each broker's website and updated monthly. Last update on 06/01/2025

As a trader in Kenya, you have to pay a commission on every CFD trade. But this should be not a point of worry because the commission charged by Pepperstone is competitive. When I compared them to other CFD brokers, the Australian-based broker cam on the top of my list. The minimum commission starts from:

- USD 0.02 per share when you trade CFD stocks

- USD 3.50 per one standard lot per side

To learn which account type is right for you view our page on Pepperstone Account Types.

Note* The below graph ranks Kenyan CFD brokers in terms of total commission costs.

Note* Choose from our list of lowest spread forex brokers, which are a perfect fit for day traders and scalpers.

Pepperstone has high-leverage

Pepperstone is one of the leading forex brokers with high leverage: 500:1 for currency trading. However, forex traders from Kenya can all access different financial instruments in the form of Contract for Difference (CFDs) with a maximum leverage of:

Pepperstone is one of the leading forex brokers with high leverage: 500:1 for currency trading. However, forex traders from Kenya can all access different financial instruments in the form of Contract for Difference (CFDs) with a maximum leverage of:

- 200:1 leverage for index trading

- 500:1 leverage for commodity trading

- 100:1 leverage for currency index trading

- 20:1 leverage for shares trading

- 5:1 leverage for cryptocurrency trading

Note* Leverage in forex allows Kenyan traders to control larger sums of money with relatively low investments. Risk warning: leverage is a double-edged sword as it can magnify both your profits and your losses.

Pepperstone Has A Low Minimum Deposit

Forex traders can open a live trading account with a minimum deposit of only $200 in Kenya. This minimum deposit is not enforced so a deposit might not be necessary to open your account. Still, you will still need to meet margin requirements to open a position.

After testing the broker, I discovered that Pepperstone offers a wide range of funding and withdrawal options including:

- Credit card and debit card (Visa and MasterCard)

- Bank transfer

- Electronic wallets like POLi, BPAY, PayPal, NETELLER, Skrill, M-Pesa, and Union Pay

Deposits and withdrawal transactions are secure because Pepperstone uses advanced encryption technology. Moreover, it’s great that forex payment methods come with no additional costs and are free of charge — that’s a great value you’ll be getting in there.

My Verdict On Pepperstone

Pepperstone Markets Kenya Limited holds CMA Licence No. 128, making them locally regulated and renowned for their stellar global reputation. In my honest opinion, they are a trustworthy forex broker offering competitive trading costs, leading customer support, fast trade execution, and other advanced trading features.

Finally, as a Pepperstone customer, you can choose your preferred method of payment from a wide-array of selection, along with low minimum deposits.

2. IC Markets - Top Forex Trading Platform In Kenya

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why I Recommend IC Markets

I recommend IC Markets because the broker offers one of the lowest spreads, as confirmed by our own tests. The tests done by our analyst Ross Collins found that for the Raw spreads, IC Markets charged a mere 0.32 pips for the EUR/USD.

Another reason I appreciate IC Markets is that they give you the maximum flexibility to choose from four powerful trading platforms namely MetaTrader 4, MetaTrader 5, cTrader and TradingView.

Pros & Cons

- Very tight spreads.

- Low commission.

- Wide range of third-party trading platforms.

- Excellent range of markets.

- Execution speeds could be better

- Not regulated by the CMA

- They are licensed by very few regulators

- Their educational materials are not extensive.

Broker Details

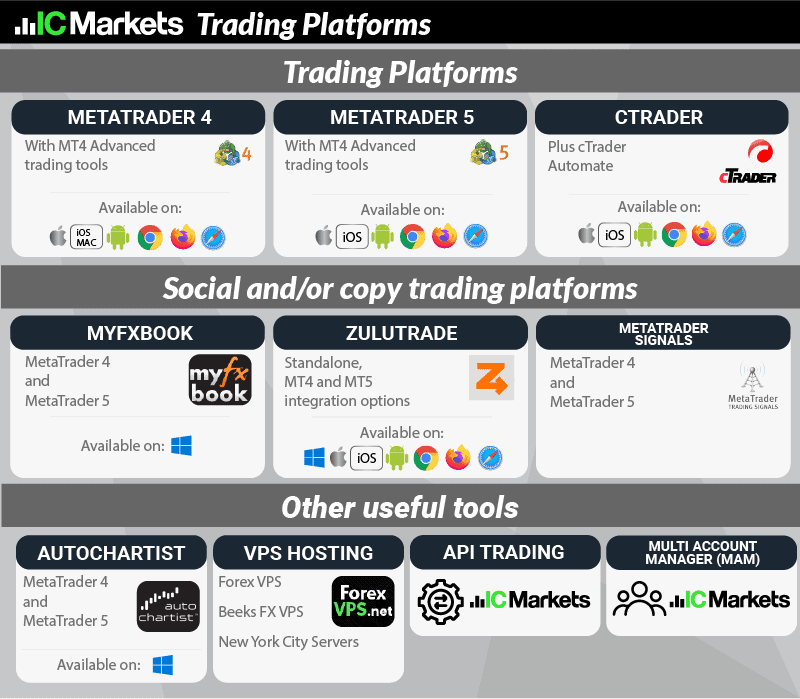

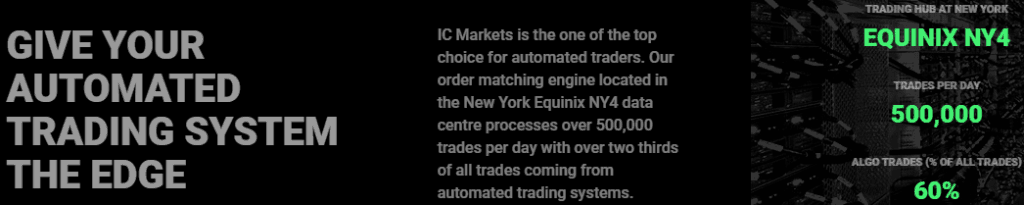

My assessment found that IC Markets has the best range of trading platforms for beginner to expert CFD traders. Among the best brokers I had the chance to review, IC Markets is the one I highly recommend for Forex traders in Kenya, especially if you prefer using powerful trading platforms:

- MetaTrader 4

- MetaTrader 5

- cTrader

- TradingView

The Broker That Has The Best Trading Platforms In Kenya

IC Markets is the trading name of International Capital Markets Pty Ltd, a financial services provider licenced and regulated by the Australian Securities and Investments Commission (ASIC). In Europe, IC Markets operates as IC Markets (EU) Ltd, an entity regulated by the Cyprus Securities and Exchange Commission (CySEC).

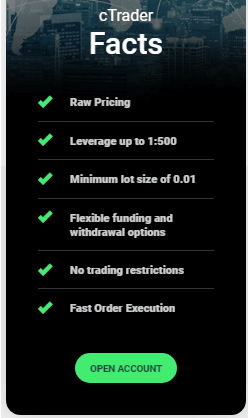

cTrader

cTrader

With the unique design, exquisite user interface, and advanced functionality, IC Markets’ cTrader offers high-speed performance combined with deep liquidity in 64 currency pairs and 16 major Stock Indices. The platform is available in both desktop and web-based versions, and you can also use the app for mobile trading, providing maximum versatility.

cTrader By IC Markets

Based on my findings, one advantage of the cTrader software solution is that it allows for currency trading with ultra-low spreads. If you are a Kenya-based client, you can trade EUR/USD with spreads of as low as 0.0 pips during the European and the US trading sessions, while the average spread on the pair is 0.1 pips.

Since the broker’s cTrader server is located in the LD5 IBX Equinix Data Centre (London) and is cross-connected to IC Markets and its liquidity providers, you can enjoy low latency and ultra-fast order execution. I found that the broker’s cTrader server has less than 1ms latency to VPS providers that are either collocated in the LD5 IBX data centre, or via dedicated lines to other data centres. I see this as a huge advantage when scalping or trading in high-frequency.

Another advantage of IC Markets’ cTrader is the full depth of market (DoM), which presents all executable prices derived directly from the broker’s price aggregator. For every single currency pair, you can view the available volumes for each price level at any time.

Moreover, IC Markets places no restrictions on limit orders. This means you’ll be able to place Stop Loss and Take Profit orders at the closest pip distance possible from the current market price.

Other key features of IC Markets’ cTrader include:

- Real-time Forex and CFD price quotes

- Minimum lot size of 0.01 and no maximum

- Multiple order types

- Flexible options for deposits and withdrawals

- Detachable charts

- One-click trading

- Expanded symbol display

- Smart Stop Out – based on a more advanced algorithm, it ensures maximum protection for clients’ trading accounts. In case your margin level drops below the Smart Stop Out level, your active positions will be closed partially until the margin level is restored above the Smart Stop Out level. I would like to note that Smart Stop Out will only close what is necessary from your largest position to restore your margin level.

Last but not least, I will mention the commission associated with trading on the broker’s cTrader platform – $3.00 per side for every 1 Standard lot traded.

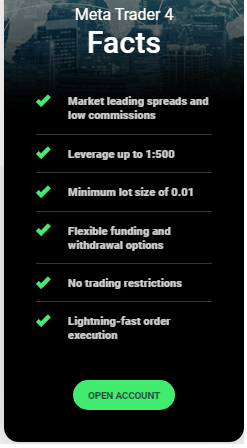

MetaTrader 4

The most popular trading platform, especially with Forex trading, has several distinctive features:

The most popular trading platform, especially with Forex trading, has several distinctive features:

- Forex leverage of up to 1:500

- Raw pricing that allows no dealing desk execution and no requotes, suitable for scalpers, high-volume traders or clients using Expert Advisors. Spreads start from 0.0 pips on major currency pairs

- MetaTrader 4 server located in the Equinix NY4 data centre that ensures low latency and ultra-fast order execution

- Standard and Raw Spread trading accounts available

- No restrictions on limit orders

- No limits on trade sizes, with the minimum lot size being 0.01

- Hedging is allowed due to the no “first in first out” rule with IC Markets

- Flexible options for deposits and withdrawals (Credit or Debit Cards, Skrill, Neteller, bank wire transfer among others)

- Available in a desktop app, web trader, and mobile application

MT4 Raw Spread trading account, offered by IC Markets, charges $7.00 round-trip for each standard lot in addition to the spread.

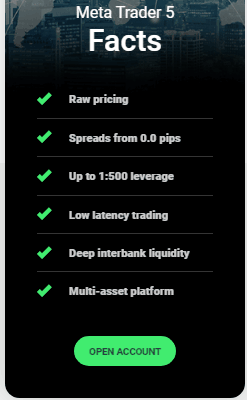

MetaTrader 5

The broker’s MetaTrader 5 software solution offers advanced charting technology and sophisticated tools for order management, allowing better control of trading positions.

For Kenya-based traders, you can take advantage of:

- Multiple tradable asset classes – Foreign Exchange, Shares, Stock Indices, Commodities, Bonds, Cryptocurrencies

- MetaTrader 5 servers located in the Equinix NY4 data centre that ensures low latency and ultra-fast order execution

- Raw pricing that allows No Dealing Desk Brokers execution and no requotes

- Market Depth that discloses the entire range of available prices directly from the broker’s up to 25 top-tier liquidity providers

- No restrictions on limit orders

- No limits on trade size

- Position Hedging

- Flexible options for deposits and withdrawals

Trading Accounts Offered By IC Markets

Like Pepperstone, IC Markets offers two accounts:

- Spread Only Account = Standard Account

- Spread + Commission Account = Raw Spread account

Low-fee forex trading in Kenya aligns with the raw spread account, but as a beginner trader, you may prefer the simplicity of the Standard account. You can view the details about the types of accounts on the IC Markets Raw Spread Vs Standard Accounts comparison page.

My Verdict On IC Markets

In my best forex broker in Kenya review, IC Markets offers the most powerful selection of trading platforms. Pepperstone came in second place in my scoring system, but IC Markets scored more points due to the fact that the broker offers a greater diverse range of tradable CFDs that also include bonds and futures.

3. eToro - Top Social Platform With Copy Trading

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro

Minimum Deposit

$50

Why I Recommend eToro

eToro emerged as the top FX broker for copy trading in my reviews. The broker offers a vast active trader base of 30 million users, meaning you will have no shortage in quality signal providers to follow and copy.

My recommendation centres on eToro’s CopyTrader and Smart Portfolios features, which use AI technology to help you find the best traders to copy or build the best-performing signal providers into an index.

Pros & Cons

- A large community of users.

- No management fees or hidden costs.

- Kenya-based traders can copy up to 100 traders simultaneously.

- Offers a popular investor program for those who want to sell their expertise.

- High minimum deposit of USD 500.

- Is suitable for automated copy trading but does not offer algorithmic trading.

- The trader you copy may not be skilled enough.

Broker Details

The Broker With The Best Social Trading Platform

Among the brokers I reviewed, eToro is the best FX broker for copy trading. They allow Kenyan traders to earn money by following, copying, and mirroring more experienced traders. Over the years, eToro has become famous for its best social trading platform. Currently, they have an active trader base of over 3,000,000 people.

As a global Forex brokerage, eToro is multi-regulated in the following jurisdictions:

- eToro’s European operations are authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC)

- Operations in the United Kingdom are authorized and regulated by the Financial Conduct Authority (FCA)

- Operations in Australia are authorized and regulated by the Australian Securities and Investments Commission (ASIC)

- Operations in the USA are authorized and regulated by the National Futures Association (NFA)

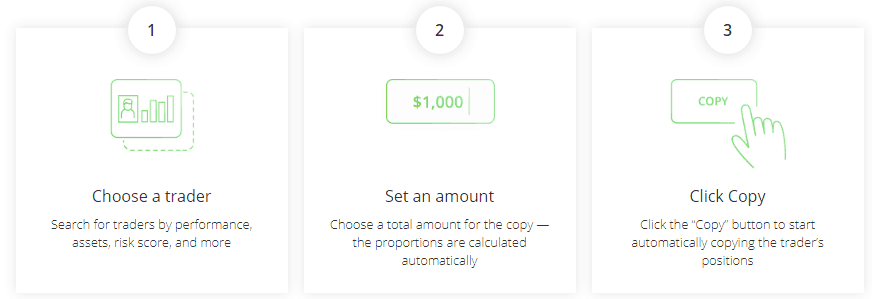

eToro Allows Copy Trading With As Little As $200

I recommend eToro’s CopyTrader feature for these main reasons:

- Beginners can start earning a passive income as long as you trading strategies allow you to profit consistently

- Experienced traders with proven strategies can earn an extra income every month by joining the broker’s Popular Investor Program

With eToro’s CopyTrader, you will get the chance to search through the broker’s vast customer base by using parameters such as risk score, return, location, number of copiers or preferred market segments. This makes it easy for beginner traders to find a trader suiting their trading objectives and connect with them.

I want to take note that CopyTrader allows eToro clients not just to replicate the trading activity of top traders, but you can also join a global community of people with a shared interest – online Forex trading.

I find copying the portfolio performance of a leading trader quite effortless. If you are a novice trader, you simply need to allocate a part of your available trading account balance to the trader you’ve chosen to copy.

To access the broker’s CopyTrader feature, you are required to deposit at least $200 into your eToro trading account. Deposits in a different currency than USD will be converted at the current exchange rate and incur a conversion fee.

Kenya-based retail traders can pick from several account funding options:

- Bank wire transfer – 4-7 business days of processing time, no maximum deposit limit,

- Skrill – instant processing, the maximum deposit is $10,000,

- Paypal – instant processing, the maximum deposit is $10,000,

- Neteller – instant processing, the maximum deposit is $10,000,

- Debit or Credit Card by Visa or MasterCard – instant processing, the maximum deposit is $40,000.

The minimum amount required for every copied position is $1. Copy trading does not incur any management fees or other hidden costs.

My Verdict On eToro

Overall, eToro has claimed the first spot in my star scoring system for having a large social investment network, small account opening, and financial markets available for trading. Join the best forex social trading platform by clicking the button below.

4. Plus500 - Good CFDs + Crypto Range Of Instruments

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.3

AUD/USD = 1.4

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Why I Recommend Plus500

I recommend Plus500 because they are a globally regulated provider offering CFD products that cover wide range of markets, along with superior risk management tools.

The broker is also among the handful of CFD providers that have a guaranteed negative balance protection policy. Under which, you, as a retail investor, cannot lose greater amounts than the initial deposit.

With this risk management tool in place, you will feel more secure when trading with CFDs on leverage.

Pros & Cons

- Excellent 24/7 customer support

- Good range to cryptos and indices.

- Minimum deposit of $100.

- Several funding options.

- No raw spread account.

- Does not offer MT4, MT5, cTrader or TradingView.

- The spreads can be quite high.

Broker Details

The Broker That Has A Great Range Of CFDs & Cryptocurrencies

With conviction, I can say that Plus500 is the best online provider for trading CFDs and cryptocurrency trading. For over a decade, this global CFD provider has specialised in helping clients trade in a range of markets. It’s also an advantage that the broker is authorized and regulated in several jurisdictions, including:

- Australia – by the ASIC

- New Zealand – by the Financial Markets Authority (FMA)

- South Africa – by the Financial Sector Conduct Authority (FSCA)

- European Union – by the Cyprus-based CySEC

- United Kingdom – by the FCA

- Singapore – by the Monetary Authority of Singapore (MAS)

CFD And Forex Trading With Plus500

As a globally regulated provider, Plus500 offers CFD products covering a wide range of markets, along with superior risk management tools. They are also among the handful of Forex brokers that have a guaranteed negative balance protection policy, under which retail investor accounts cannot lose greater amounts than the initial deposit.

With this risk management tool in place, Kenya-based retail clients get greater security when trading with high-risk, complex instruments like Contracts for Difference (CFDs) on leverage.

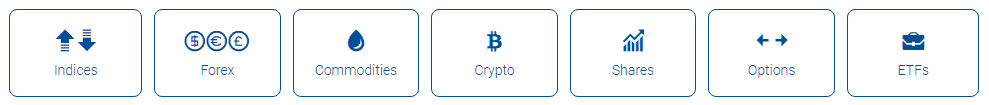

Plus500 offers CFDs on over 2,000 financial instruments grouped in several asset classes as follows:

- Foreign Exchange – 71 major, minor and exotic currency pairs traded with a maximum leverage of 1:300. Clients can trade majors such as EUR/USD with variable spreads of as low as 0.6 pips and minors such as GBP/JPY with variable spreads of as low as 2.8 pips

- Indices – 26 major and minor Stock Indices and 6 Sector Indices traded with a maximum leverage of 1:100. Clients can trade the benchmark S&P 500 Index with spreads of as low as 0.8 points and the NYSE FANG+ Index, which encompasses 10 next-generation tech giants such as Facebook, Apple or Netflix, with spreads of as low as 1.32 points

- Equities – over 500 global Shares traded with a maximum leverage of 1:300 and fixed spreads of $0.95 on Tesla Inc, $2.01 on Amazon.com Inc and EUR 0.03 on Deutsche Lufthansa AG. Clients will be charged no fees when opening or closing a position

- Commodities – 22 Soft Commodities, Metals and Energies traded with a maximum leverage of 1:150 and variable spreads of as low as $0.10 on US Crude Oil and $4.2 on Gold. On the other hand, Coffee CFDs are traded with a fixed spread of $0.20

- Exchange-Traded Funds (ETFs) – 95 contracts traded with a maximum leverage of 1:100 and fixed spreads of 0.17 points on PowerShares QQQ Trust and 0.14 points on Vanguard Real Estate (VNQ)

- Options – Options CFD contracts on Equities, Currency Pairs, Indices and Commodities traded with a maximum leverage of 1:10

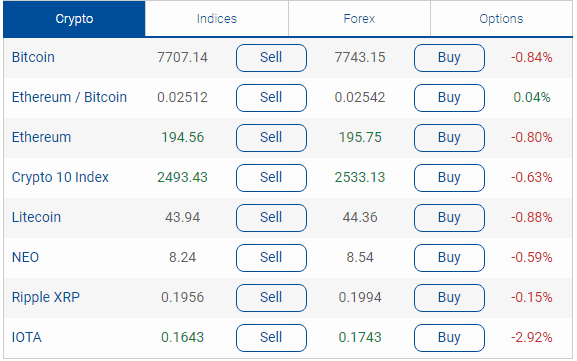

Plus500 Cryptocurrency Trading

Plus500 offers 12 cryptocurrencies traded with a maximum leverage of 1:30 and fixed spreads of 36.01 points on Bitcoin and 1.19 points on Ethereum. Additionally, they offer CFDs on the popular Crypto 10 Index traded with a fixed spread of 39.7 points.

The broker’s retail investor account has access to the following cryptocurrencies: Bitcoin, Ethereum / Bitcoin, Ethereum, Crypto 10 Index, Litecoin, NEO, Ripple XRP, IOTA, Stellar, EOS, Bitcoin Cash ABC, Cardano, Tron and Monero.

Trading cryptocurrency CFDs have several advantages for the Kenya-based traders:

- Speculate on the price movement in both directions: buying and selling cryptocurrencies

- No crypto exchange account required

- No crypto wallet requirement

- Available to trade cryptocurrencies over the weekend 24/7

- Advanced risk management tools

Final Words – Best Online Brokers For CFD Trading And Cryptocurrency

Overall, Pluss500 is the world’s biggest CFD provider that enables clients from Kenya and other African countries to speculate on the price movement in the biggest financial markets in the world. Grab your free demo trading account by clicking the button below.

5. HFM - Great Range Of Account Types Offering Fexibility

Forex Panel Score

Average Spread

EUR/USD = 0.6

GBP/USD = 0.7

AUD/USD = 0.1

Trading Platforms

MT4, MT5, HFM App

Minimum Deposit

$0

Why I Recommend HFM

I recommend HF Markets because the broker offers the widest range of account types I encountered so far. There are 4 main types of accounts available, designed to suit different preferences (risk appetite, trade size, level of funding, etc.) of retail customers.

I appreciate that the Premium Account allows for flexibility in position sizing and is suitable if you are a trader with experience. You can operate with up to 60 Standard lots for each position, while the minimum trade size is 0.01 lot.

Pros & Cons

- Raw spreads are quite tight.

- Decent commission of $3 per side.

- Numerous bonus offers and discounts.

- Offers a dedicated social trading account type.

- Standard spreads are relatively expensive.

- Only offers MT4 and MT5, does not offer cTrader or TradingView.

- Does not accept PayPal.

Broker Details

The Broker With A Great Trading Account Range

HF Markets is a global award-winning Forex and CFD broker, licenced and regulated by some of the most reputable regulatory bodies around the world.

HF Markets and Hot Forex are trading names of the HF Markets Group, the parent company of:

- HF Markets (Europe) Ltd, which falls under the regulation of Cyprus-based CySEC

- HF Markets (UK) Ltd, regulated by the FCA

- HF Markets SA (PTY) Ltd, regulated by South Africa’s FSCA

- HF Markets (DIFC) Ltd, regulated by the Dubai Financial Services Authority (DFSA)

- HF Markets (Seychelles) Ltd, regulated by the Seychelles Financial Services Authority (FSA)

- HF Markets Ltd, regulated by the Financial Services Commission of the Republic of Mauritius

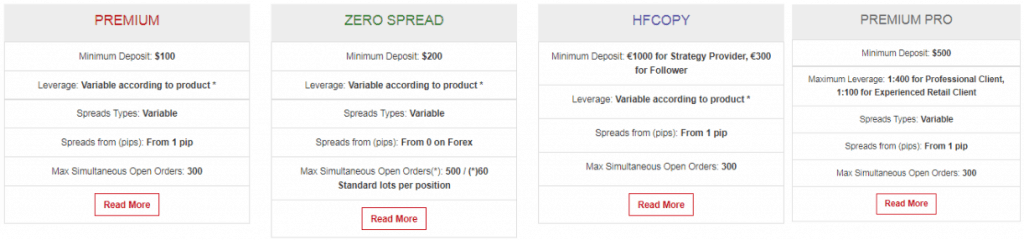

Hot Forex Offers The Widest Range Of Account Types For Kenyan Clients

Among the best Forex brokers I recommend to Kenyan traders, Hot Forex offers the widest range of account types. There are 4 main types of accounts available for your taking, designed to suit different preferences, risk appetite, trade size, level of funding, etc.

- Premium accounts

- Zero Spread account

- HFcopy account

- Premium Pro account

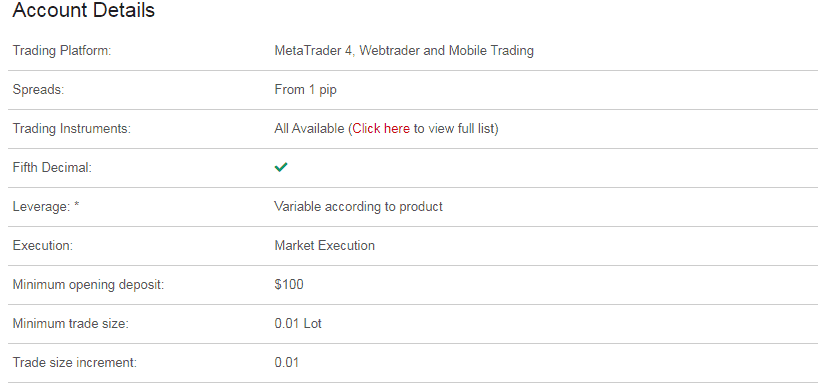

HF Markets Premium Account

The Premium Account allows for flexibility in position sizing and is suitable for retail clients with experience. You can operate with up to 60 Standard lots for each position, while the minimum trade size is 0.01 lot. More account details can be seen in the table below.

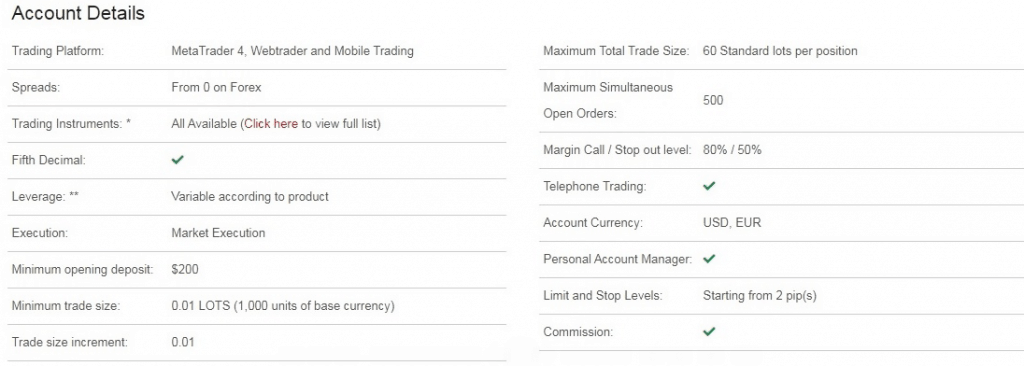

HF Markets Zero Spread Account

I found that the ZERO Spread Account allows for low-cost ECN-style Forex trading with a minimum deposit of $200. I see this working best for high-volume traders, scalpers, and traders who use Expert Advisors. It also helps that Kenya-based clients can trade with ultra-tight spreads, starting from 0.0 pips on EUR/USD, with no hidden markups. More account details are presented below.

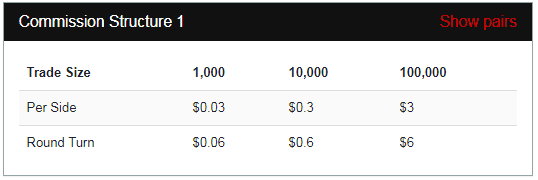

The ZERO Spread Account offered by Hot Forex, features a transparent commission-based structure, with commissions starting from $0.03 per side for 1 Micro lot when trading major currency pairs (AUD/USD, EUR/USD, GBP/USD, USD/CAD, USD/CHF, USDJPY).

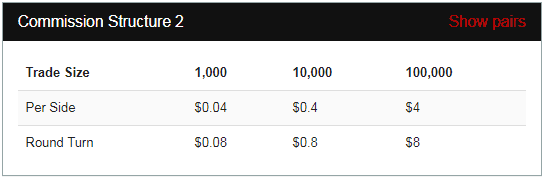

For minor and exotic pairs (AUD/CAD, EUR/CHF, GBP/NZD, USD/SEK, USD/PLN etc), the commissions charged start from $0.04 per side for 1 Micro lot.

For minor and exotic pairs (AUD/CAD, EUR/CHF, GBP/NZD, USD/SEK, USD/PLN etc), the commissions charged start from $0.04 per side for 1 Micro lot.

HFCopy Account

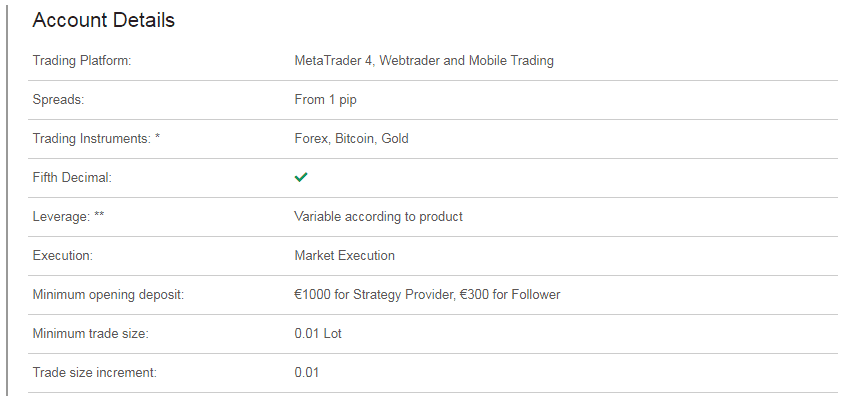

The HFcopy Account offers similar parameters to the Premium Account. The only difference I noted is that the HFcopy Account is suitable for Strategy Providers and Followers who have become part of HFcopy, a leading community of traders.

Strategy Providers can build their inventory of Followers and will be paid a performance fee of up to 35%. At the same time, Followers can copy the trading activity of the Strategy Providers they have chosen to follow.

More HFcopy Account details can be seen below.

HF Martkets Premium Pro Account

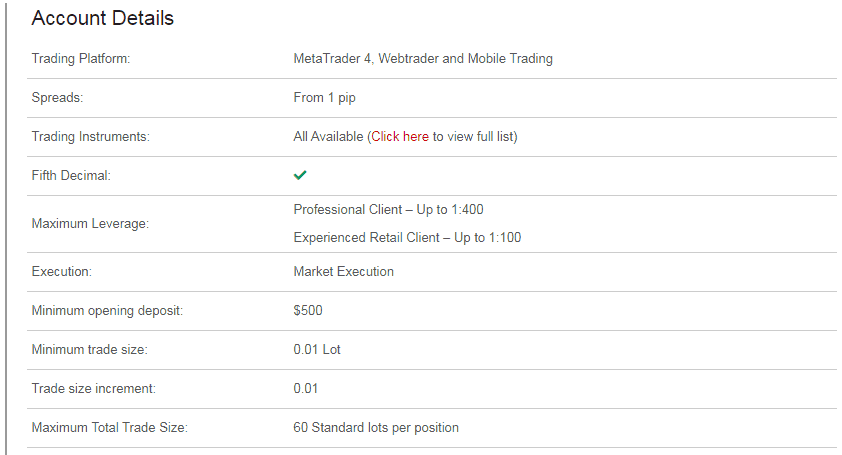

The Premium Pro Account is designed to suit the financial objectives of traders categorized either as Experienced Retail Clients or as Professional Clients.

Experienced Retail Clients are considered those that meet certain criteria, including requisite experience (specific trading activities conducted over the last 24 months), deep knowledge of derivative instruments (proven work experience or training in the field as well as appropriate professional certificates) and, last but not least, their country of residence in Poland.

Meanwhile, Professional Clients are considered to be investors with vast knowledge and experience who can assess and manage their own risk. They also meet certain criteria, including professional experience in the financial services industry of at least 1 year, financial instrument portfolio with more than €500,000 in value and trading experience (40 trades of significant size placed over the past 1 year).

The details of the Premium Pro Account, offered by Hot Forex, can be seen below.

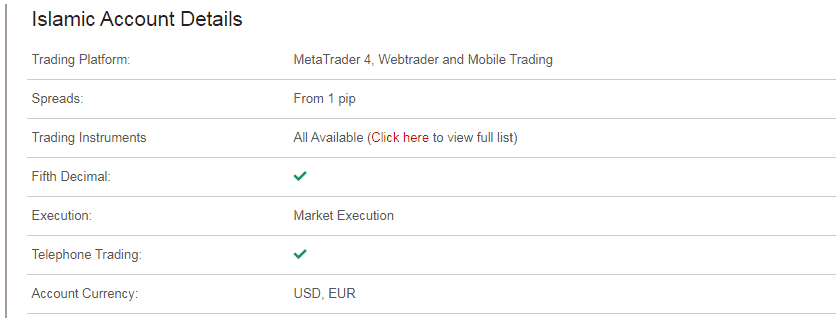

HF Markets Islamic Account

The broker also offers an Islamic Account, which doesn’t charge for swap or rollover fees when you hold active positions overnight. It is worth noting that this is only available to customers of the Muslim faith. The Islamic Account can replicate the trading conditions either of a Premium Account or of a Zero Spread Account.

6. easyMarkets - Top Range Of Risk Management Features

Forex Panel Score

Average Spread

N/A

Trading Platforms

MT4, MT5, TradingView, easyMarkets Trading

Minimum Deposit

$200

Why I Recommend easyMarkets

I like easyMarkets for their innovative risk management tools such as dealCancellation and the Freeze Rate tool.

From my observation, the dealCancellation option allows you to cancel a losing position for a certain fee within a particular time period (1, 3, or 6 hours). Honestly, this can save you during major economic or political events when market volatility may heighten and cause sudden swings in spreads.

I found that spreads with easyMarkets are wider but they are fixed. Also, they include a guaranteed stop loss, meaning you never need to worry about slippage.

Pros & Cons

- Excellent risk management tools.

- Great customer support with a dedicated account manager.

- No slippage guarantee with the easyMarkets platform

- Has a free demo account.

- Spread is higher but fixed

- Minimum deposit of $200.

- No raw spread account.

Broker Details

The Broker That Has Unique Risk Management Features

Forex trading using leverage carries a high degree of risk, and this is the reason why risk management tools to mitigate that risk can be very useful. easyMarkets offers solutions that help you manage risk.

Using the trading name of Easy Forex Trading Ltd, an entity headquartered in Limassol, Cyprus, this broker is regulated by the CySEC. Moreover, the company fully complies with the regulatory framework of the European Securities and Markets Authority (ESMA).

easyMarkets Offers Unique Tools To Trade Forex

When signing up with easyMarkets, Kenya-based clients will be able to access unique risk trading tools, aimed to improving overall experience and bolstering confidence. One such tool is the deal cancellation option.

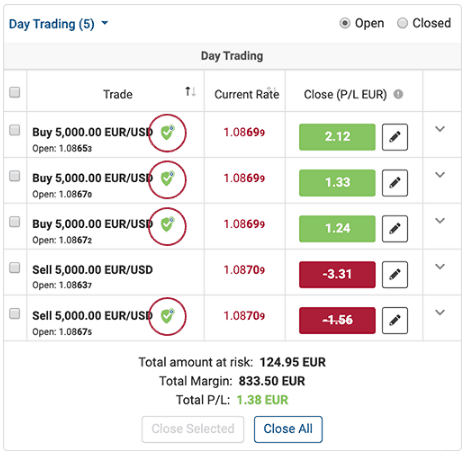

dealCancellation Tool

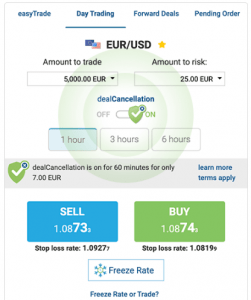

easyMarkets dealCancellation is an innovative tool that allows you to cancel a losing position for a certain fee within a particular period (1, 3, or 6 hours). This can be used quite efficiently during major economic or political events when some brokerages increase margins, as well as in other cases, like when market volatility heightens.

When you open a new position, you can activate dealCancellation by clicking on the shield icon (as visualized below). After which, you will be able select the duration when the feature will be active – 1, 3, or 6 hours.

In the Open Trades Report section, you can view which positions have the deal cancellation feature activated.

Note* In case the market moves against your position, you can simply cancel the deal within the selected time window, in exchange for a certain fee.

Note* In case the market moves against your position, you can simply cancel the deal within the selected time window, in exchange for a certain fee.

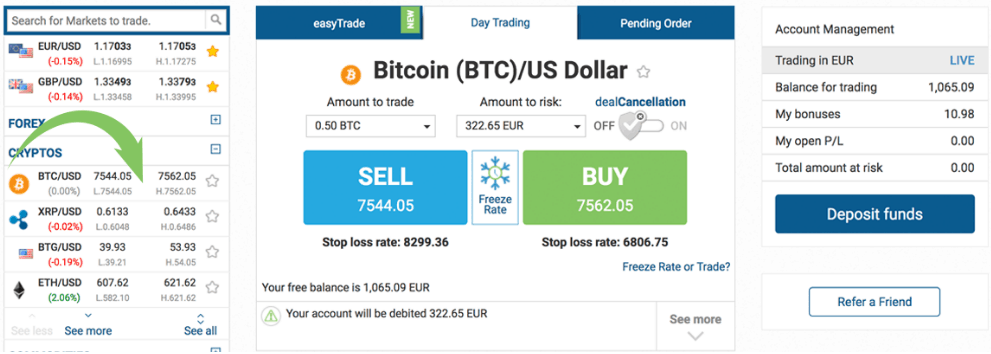

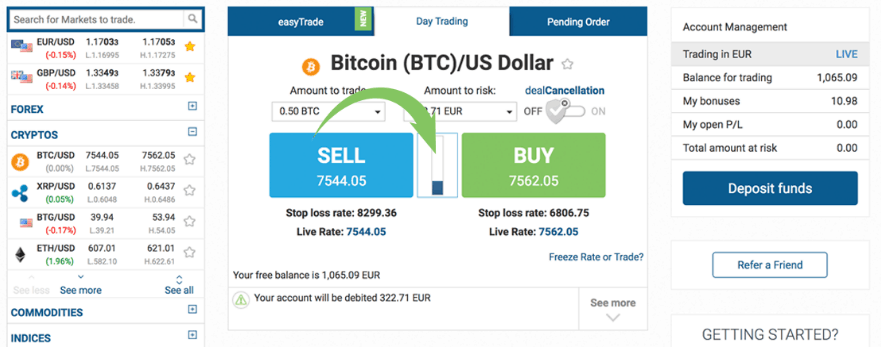

Freeze Rate Tool

This is another unique feature, offered by easyMarkets, which enables you to freeze the current price quote on your screen. Then, you will be granted several seconds to perform a trade.

This a tool can be quite useful when trading Forex, especially before announcements by central banks or politicians, as well as before volatility-inducing macroeconomic reports (GDP, Non-Farm Payrolls, Core PCE Inflation) are released. The Freeze Rate can also be valuable when trading Cryptocurrencies, a market segment characterized by extreme volatility.

To use the Freeze Rate, you should first select a trading instrument, as visualized below.

You have a 3-second time window to Sell or to Buy the instrument. The freeze duration will be visualized by a bar.

Other Risk Management Features Offered By easyMarkets

Since trading CFDs on leverage may result in a rapid loss of capital, having a set of tools to minimize risk is essential. With easyMarkets, Kenya-based retail clients can take advantage of:

- Free Guaranteed Stop Loss – sets an absolute limit on potential losses. A losing position will be closed at the specified “Stop Loss” price level with 100% certainty,

- Zero Slippage – the broker’s proprietary platform ensures that no unintended losses or gains can occur as a result of higher volatility and trade orders will be filled at the specified price level,

- Fixed Spreads – spreads offered on financial instruments remain stable, regardless of market liquidity and volatility,

- Negative Balance Protection

7. ThinkMarkets - MetaTrader 4 & ThinkTrader Mobile Platform

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.3

AUD/USD = 0.2

Trading Platforms

MT4, MT5, TradingView, ThinkTrader

Minimum Deposit

$0

Why I Recommend ThinkMarkets

I recommend ThinkMarkets for their outstanding mobile trading app, ThinkTrader Mobile. Some of the notable features I took notes of are: Quad Screen Display for monitoring four real-time charts simultaneously, an Innovative Analysis suite with over 80 indicators, 50 drawing tools, and 14 chart types.

Our analyst, Ross Collins, tested ThinkMarkets ThinkZero account for raw spreads. He found they averaged 0.46 pips for EUR/USD and have commissions of $3.50, making them a solid broker to go for.

Pros & Cons

- Decent average spreads.

- Apart from their mobile trading app, ThinkMarkets also offers MT4 and MT5.

- They provide decent 24/7 customer support with a dedicated account manager.

- No minimum deposit for their Standard account.

- High $500 minimum deposit for ThinkZero account.

- Very slow execution speed according to our test.

- Not regulated by the CMA.

Broker Details

My in-depth comparison of the best MetaTrader 4 brokers in Kenya revealed that ThinkMarkets is the most trusted MT4 broker. With more than a decade of business experience, they are a multi-regulated global Forex broker, recognized for having innovative software solution for mobile trading.

ThinkMarkets complies with strict regulatory standards in several jurisdictions, including:

- Australia – the ASIC

- United Kingdom – the FCA

- South Africa – the FSCA

I recommend this broker to Kenya-based retail traders for their unique mobile trading platform and amazing MetaTrader 4 solution.

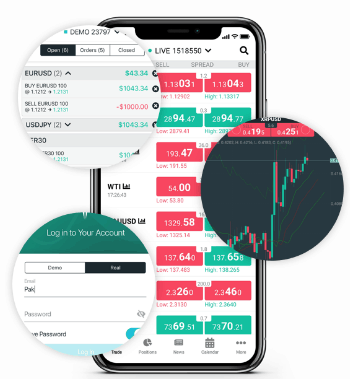

ThinkTrader – Best Mobile Trading Platforms On The Market

What makes ThinkTrader Mobile unique is a set of distinctive features such as:

- Quad Screen Display – 4 real-time charts can be monitored at once on any iOS and Android-based device

- Innovative Analysis – a full suite of technical analysis tools (over 80 indicators, 50 drawing tools and 14 chart types)

- Multi Deal Closure – all active positions in a given instrument can be closed instantly and without effort

- Multitouch Functionality – a given area on the chart can be dragged and highlighted so that traders can instantly determine the exact number of pips it represents

- Cloud-based Alerts – all the required market information can be obtained when traders need it without being logged in to their trading account

- Cutting-edge TrendRisk Scanner

- Customizable trading history reports

- Real-time news from FX Wire Pro

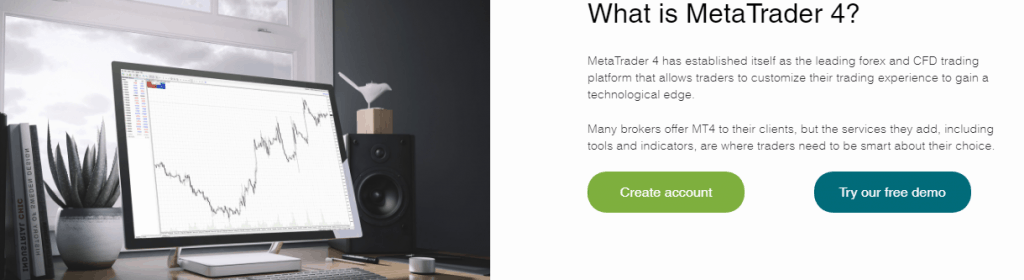

MetaTrader 4 Offered By ThinkMarkets

ThinkMarkets’ MetaTrader 4 software solution grants retail clients access to:

- A wide range of technical indicators, including Autochartist

- Instant order execution as the MT4 servers are located in the London LD5 data centre and the Equinix data centre in Hong Kong

- Zero Forex spread accounts, starting from 0.0 pips on EUR/USD. The broker’s ThinkZero Account allows for ECN-style trading with a commission of $3.5 per side, per 1 Standard lot

- Free Demo Account with USD 10,000 in virtual trading funds

- Free VPS service that allows Expert Advisors to run during power outages

- Free MT4 trading guides

- Risk management features such as Negative Balance Protection

Final Words – Best MetaTrader 4 Broker In Kenya

ThinkMarkets has established a name as the best MT4 broker in Kenya. The broker’s infrastructure uses advanced technological solutions with servers located in the world’s biggest financial hubs, London and Hong Kong.

Additionally, the award-winning mobile trading App ThinkTrader offers a full charting solution available on iPhone and Android devices. Snag your free demo account by clicking the button below.

8. AvaTrade - A Forex Trading Account With Great Fixed Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why I Recommend AvaTrade

I recommend AvaTrade for offering low fixed-spread accounts. For me, fixed spreads can fit certain trading strategies better than variable spreads because they are more transparent and more effective for news trading. This makes AvaTrade a good choice for scalping and day traders.

Pros & Cons

- Tight and transparent fixed spreads.

- Provides a dedicated account manager.

- Licensed by reputed tier-1 regulators.

- Several trading platforms to choose from.

- Minimum deposit of $100.

- No commission-based account.

- Does not offer customer support on weekends.

Broker Details

A Forex Trading Account With Great Fixed Spreads

AvaTrade is the best Kenyan forex broker with fixed spread accounts. Fixed spreads are better than variable spreads because they allow Kenyan traders to reduce trading costs, they are more transparent and more effective for news trading. AvaTrade is a globally recognized Forex broker, regulated on five continents by reputable regulatory bodies such as:

- Australia’s ASIC

- South Africa’s FSCA

- British Virgin Islands Financial Services Commission

- The Central Bank of Ireland

- The Abu Dhabi Global Markets (ADGM) Financial Regulatory Services Authority (FRSA)

- Japan’s FSA.

Among the best Forex brokers in Kenya I reviewed, AvaTrade offers the lowest possible fixed Forex spreads.

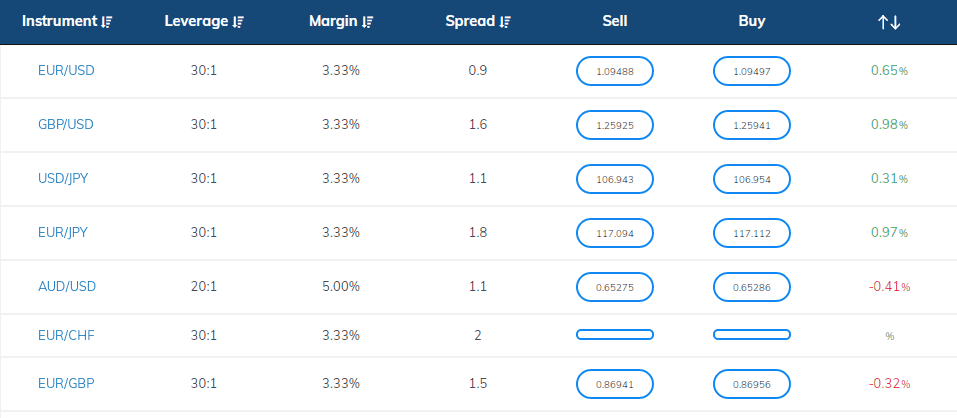

AvaTrade Fixed Spreads

Retail clients in Kenya can access the Forex market through AvaTrade’s MetaTrader 4 and MetaTrader 5 platforms. The broker offers 55 major, minor and exotic currency pairs, trading with a maximum leverage of 1:400 (for professional traders only) and with fixed spreads that start from 0.6 pips (for professional traders only) on EUR/USD.

Our team of experts conducted a full comparison of the fixed spread forex brokers in Kenya. The second best option is Go Markets, followed by easyMarkets.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 06/01/2025

As a retail trader, you can trade Forex with leverage of up to 1:30, fixed spreads of as low as 0.9 pips on EUR/USD and a minimum deposit of $100. The table below presents trading conditions for some of the most popular Forex pairs.

Final Words – Best Fixed Spread Forex Broker

Overall, AvaTrade is the best Forex broker in Kenya with spreads that remain stable in all market conditions. You can start forex trading with fixed spreads on 55 currency pairs. AvaTrade’s referral program will award you a deposit bonus of $250 for every client you refer to them.

Ask an Expert

What are the best times to trade forex in Kenya?

The New York Markets open at 4pm in Kenyan time, while the London market opens at midday in Kenya. These are good times to consider trading but any time of day or night will do as Forex markets have trading 24 hours a day.

Is online trading taxable in Kenya?

Yes, Profits above KES 24,000 for each month are considered taxable by the Kenya Revenue Authority. Currently Forex profits are taxed at 25%.