Lowest Commission Forex Brokers

Brokerage for ECN-style forex accounts is based on spreads and commissions with the latter the primary trading cost. We compared the best trading accounts based on brokerage to determine the lowest commission forex broker.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Our February 2026 analysis found the best low commission forex brokers are:

- Fusion Markets - The Lowest Commission Forex Broker Overall

- Pepperstone - Zero Spread Broker With Low Commissions

- GO Markets - Lowest Commission For European Traders

- FP Markets - Low Commission and Spread For Scalping

- Eightcap - Low Commission With Automation Trading Platforms

- AvaTrade - No Commission Standard Account For Day Trading

- City Index - Low Commission of $2.50 With RAW FX Account

- IC Markets - 0 Pip Spreads Plus Low FX Commissions

What is the lowest commission forex broker?

Fusion Markets offers the lowest commission forex broker, charging $2.25 per side ($4.50 round turn) with a 79ms execution speed. With RAW spreads from 0.14 pips on EUR/USD across 84 currency pairs, Fusion Markets provides ECN execution with no minimum deposit. We also shortlisted other low commission brokers based on their round-turn costs and spread transparency.

1. Fusion Markets - The Lowest Commission Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.14 GBP/USD = 0.1 AUD/USD = 0.13

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

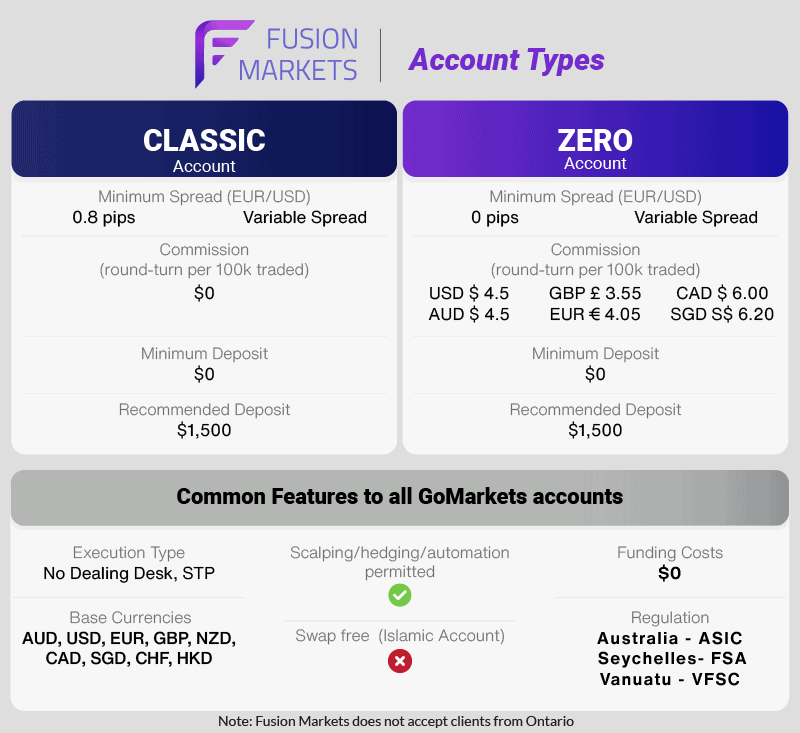

Why We Recommend Fusion Markets

We recommend Fusion Markets because they offer the lowest commission rate of any forex broker at $2.25 per side. They also offer the 3rd lowest average spreads through their RAW account including 0.09 EUR/USD spread and 0.14 for AUD/USD spread.

Our testing showed the broker also offered one of the technology stacks with a fast execution speed of 79 ms for limit orders (the industry average of 129.7ms).

Pros & Cons

- Lowest forex commissions

- Some of the lowest forex spreads

- No fees for funding or withdrawals

- Supports both MetaTrader 4 and 5

- Regulated by ASIC

- No sign-up bonus

- Very limited educational resources

- No Islamic-compliant trading account

- No cent accounts

Broker Details

Fusion Markets offer the lowest commission for two of the most common base currencies with AUD 2.25 and USD $2.25 per side ($4.50 round-turn). This is 53% lower than the industry average of the US Dollar base currency and 48% lower for the Australian Dollar base currency.

| Broker | USD | AUD |

|---|---|---|

| Fusion Markets | $2.25 | $2.25 |

| London Capital Group | $2.25 | N/A |

| CMC Markets | $2.50 | $2.50 |

| Fair Markets | $2.50 | $2.50 |

| Go Markets | $2.50 | $3.00 |

| City Index | $2.50 | $3.50 |

| Tickmill | $3.00 | N/A |

| DNA Markets | $3.00 | $2.50 |

| VT Markets | $3.00 | $3.00 |

| Vantage FX | $3.00 | $3.00 |

| FIBO Group | $3.00 | $3.00 |

| Admirals | $3.00 | $4.00 |

| Blackbull Markets | $3.00 | $4.50 |

| FP Markets | $3.00 | N/A |

| ATC Brokers | $3.00 | N/A |

| HF Markets | $3.00 | N/A |

| MultiBank Group | $3.00 | N/A |

| Tradersway | $3.00 | N/A |

| FlowBank | $3.25 | $3.25 |

| Pepperstone | $3.50 | $3.50 |

| EightCap | $3.50 | $3.50 |

| Axi | $3.50 | $3.50 |

| ThinkMarkets | $3.50 | $3.50 |

| Global Prime | $3.50 | $3.50 |

| Blueberry Markets | $3.50 | $3.50 |

| TMGM | $3.50 | $3.50 |

| IC Markets | $3.50 | $4.50 |

| FxPro | $3.50 | N/A |

| Exness | $3.50 | N/A |

| LQDFX | $3.50 | N/A |

| OctaFx | $3.50 | N/A |

| XM | $3.50 | N/A |

| FXCM | $4.00 | $4.00 |

| XTB | $4.00 | N/A |

| FXTM | $4.00 | N/A |

| HYCM | $4.00 | N/A |

| Blackwell Global | $4.50 | N/A |

| Dukascopy | $5.00 | N/A |

| AMarkets | $5.00 | N/A |

| BD Swiss | $5.00 | N/A |

| Axiory Nano | $6.00 | N/A |

| IG | $6.00 | N/A |

During our tests, we found Fusion Markets to deliver tight RAW spreads, averaging 0.09 pips on the highly liquid EUR/USD pair. Such competitive spreads and cheap commissions translate to substantial cost savings on every trade you make.

With a live account, you can access Fusion Market’s full suite of trading platforms, including the industry-leading MetaTrader 4, MT5, and cTrader. This choice allows you to select the platform that best fits your trading style, whether you focus on technical analysis, automated trading, or multi-asset trading.

We like the cTrader platform as it combines the best of MetaTrader 5 and TradingView with an excellent charting package featuring 67 indicators, plus advanced tools with Direct Market Access.

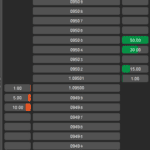

Notably, cTrader’s Depth of Market feature stood out, enabling you to analyse real-time liquidity provider’s order flow data, a powerful tool for identifying potential trade opportunities and managing risk effectively.

2. Pepperstone - Zero Spreads and Low Commission With MT4

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.3 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

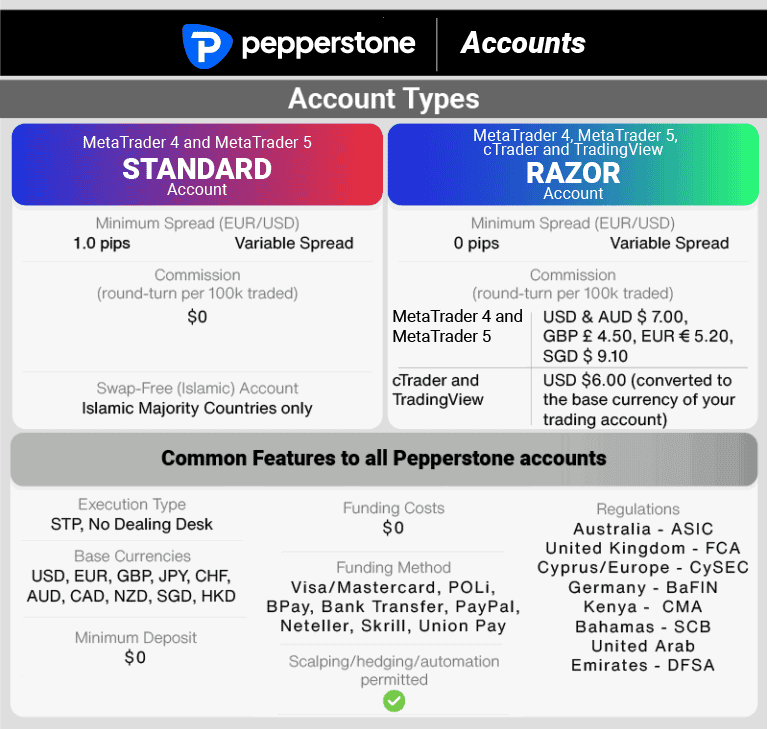

We like Pepperstone as they have no-dealing which allows the broker to offer spreads of 1.12 pips on average for the EUR/USD pair alongside low commissions to reduce trading costs. We also like the choice of 4 trading platforms MT4, MT5, cTrader and TradingView.

During our testing, Pepperstone stayed at the minimum spread of 0 pips 100% of the time outside the rollover period. This 24-hour 0f spread capability makes it one of the most reliable forex brokers in our opinion.

Pros & Cons

- Works with MT4, MT5, cTrader and Tradingview

- No minimum deposit

- Best customer service

- Low spreads

- 90-day limit on the demo account

- Lacks an in-house trading platform

- Demo account is limited to one month

Broker Details

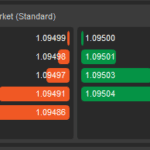

While opening our RAW account, we noticed that Pepperstone offered its spreads from 0.0 pips. So, we tasked our analyst, Ross Collins, to determine whether this is true and how frequently they are available. Ross found that Pepperstone provide 0.0 pip spreads on its major currency pairs 100% of the time, delivering on their advertised spreads, which is excellent.

| Zero Spread Testing | |

|---|---|

| Broker | Time At Minimum Spread |

| Pepperstone | 100% |

| City Index | 100% |

| Fusion Markets | 98.55% |

| ThinkMarkets | 97.93% |

| IC Markets | 97.83% |

| FP Markets | 97.83% |

| Eightcap | 97.83% |

| Admirals | 95.60% |

| GO Markets | 87.68% |

| BlackBull Markets | 86.96% |

| GO Markets | 87.68% |

Zero spreads allow you to execute trades at the true market price without the added cost of the bid-ask spread. This reduces your trading expenses, particularly for high-frequency traders and scalpers who rely on capturing small price movements. The ability to trade without the spread margin means you’ll get the best prices from the liquidity provider and eliminates the extra spread costs.

Furthermore, Pepperstone’s low commissions of $3.50 per lot traded complement the zero-spread offering, ensuring your trading costs remain competitive. This helps keep your trading costs fixed to the commission, giving you transparent and predictable trading costs – even during turbulent markets.

Surprisingly, Pepperstone offers many trading platforms for a low-cost broker, including MetaTrader 4, TradingView, MetaTrader 5, and cTrader. While testing the MT4 platform with Pepperstone, we liked the inclusion of the Mini-Terminal EA, which enhances the platform’s functionality by allowing you to set default stop-loss and take-profit levels. This feature streamlines your trading process, reducing the risk of potential mistakes and improving your overall trading experience.

3. GO Markets - Lowest Commission Europe Broker

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.2 AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, Go Markets Trading App

Minimum Deposit

$200

Why We Recommend GO Markets

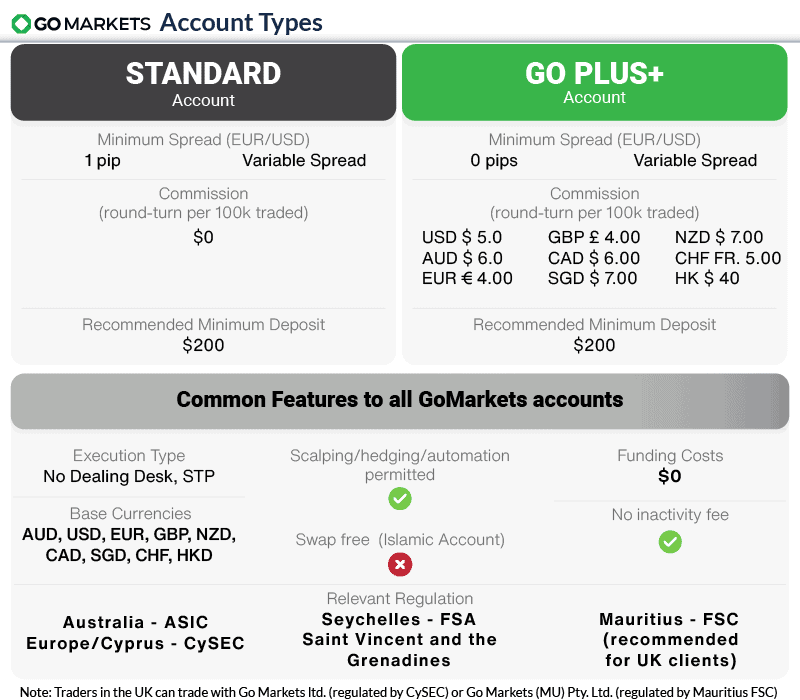

The GO+ Account has the lowest commission of £2.00 for the GBP base currency and €2.00 for the Euro base currency account . For European traders, this is the lowest rate for the two most common base currencies chosen by individuals.

Pros & Cons

- Offers a wide range of payment options

- Works with nine different base currencies

- Regulated by ASIC, CySEC, and FSA

- Decent variety of cryptocurrency assets

- Does not have deposit fees

- Do not offer an Islamic account

- Slightly limited selection of currency pairs

- Online support chat is not the best

- Doesn’t work with cent accounts

Broker Details

As the table below shows, both Go Markets and Tickmill have the lowest commission when a trader opens a Euro of British Pound account. We recommend though Go Markets based on their lowest average spreads and superior trading platform.

| Broker | GBP | EUR |

|---|---|---|

| Go Markets | £2.00 | € 2.00 |

| Tickmill | £2.00 | € 2.00 |

| VT Markets | £2.00 | € 2.50 |

| Vantage FX | £2.00 | € 2.50 |

| DNA Markets | £2.25 | € 2.50 |

| FP Markets | £2.25 | € 2.75 |

| Pepperstone | £2.25 | € 2.60 |

| EightCap | £2.25 | € 2.75 |

| Axi | £2.25 | € 3.25 |

| Admirals | £2.40 | € 2.60 |

| CMC Markets | £2.50 | € 2.50 |

| FlowBank | £2.50 | € 2.50 |

| ThinkMarkets | £2.50 | € 3.00 |

| IC Markets | £2.50 | € 2.75 |

| Global Prime | £2.70 | € 3.10 |

| XTB | £3 | € 3.50 |

| FIBO Group | £3.00 | € 3.00 |

| Dukascopy | £3.50 | € 4.00 |

| AMarkets | N/A | € 5.00 |

The extensive range of markets available at GO Markets is also noteworthy. We found that they offer 49 forex pairs, 1200+ share CFDs, 16 indices, five commodities, and 14 crypto markets. A range of markets like this is ideal if you are an experienced trader seeking volatility; you can easily switch between the markets within your GO+ Account.

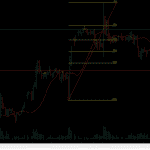

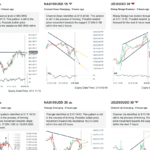

We were able to test the GO+ Account on MetaTrader 5, which has an excellent charting package with 38+ indicators, three chart types, and a range of drawing tools, including Fibonacci Retracement tools. The broker also offers MetaTrader 4 and cTrader for free, which are good alternatives to MT5.

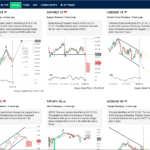

With our GO+ Account, we gained access to popular trading tools, including Autochartist and Trading Central. These excellent services use technical analysis and price action to analyse multiple assets for potential trading opportunities. We believe these tools can help give you insights and identify trading setups during the day, increasing your chances of finding potentially profitable trades.

If you are a beginner, we like that these platforms give a professional market commentary and show you the technical analysis for each idea, which can help reduce your learning curve.

4. FP Markets - Low Commission and Spread For Scalping

Forex Panel Score

Average Spread

EUR/USD = 0.14 GBP/USD = 0.39 AUD/USD = 0.31

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

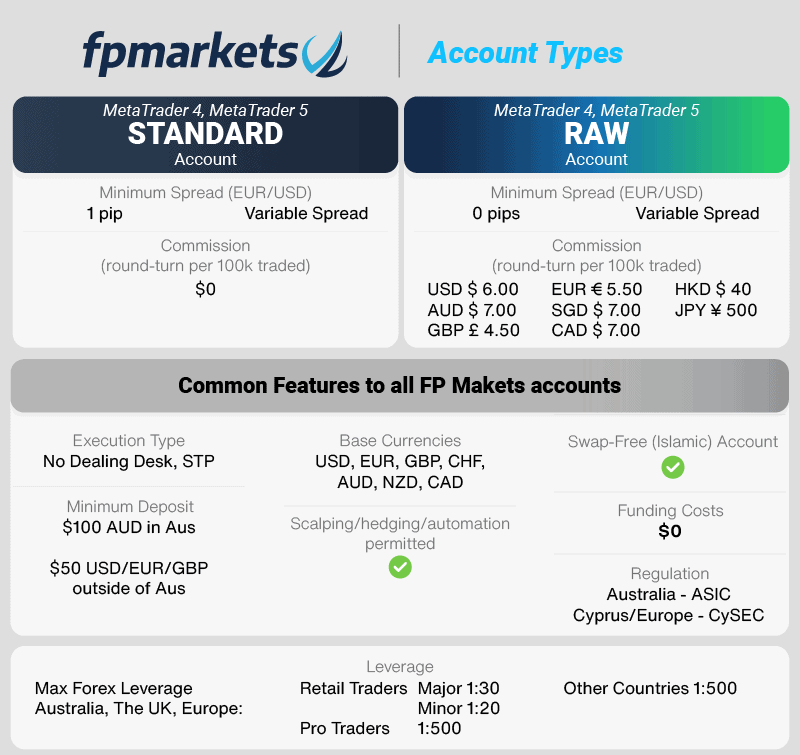

FP Markets offers ECN trading accounts which come with extremely tight spreads (an average of 0.1 pip for EUR/USD) and low commissions of $3.50 round turn. In our opinion, these trading conditions make FP Market the ideal forex broker for scalpers.

In addition to this, its support for popular trading platforms like MT4, MT5, cTrader and TradingView makes it an even more desirable choice for experienced traders like us.

Pros & Cons

- ECN pricing with its RAW account

- Offers a swap-free Islamic account

- 0 pips minimum spread for EUR/USD

- 63 unique forex trading pairs

- Regulated in Australia, Europe, and the UK

- The mobile app still needs more work

- Lacks of 3rd party copy trading functionality

- cTrader is not available in Australia

- $100 minimum deposit for the standard account

Broker Details

We think FP Markets’ low commissions and tight spreads make it an attractive choice for scalpers. The $3.00 per lot traded commission on their RAW account is $0.50 lower than the industry average, and these savings can add up significantly, especially for high-frequency traders.

The competitive spreads on major currency pairs, averaging 0.1 pips on EUR/USD in our tests, combined with the broker’s No Dealing Desk (NDD) model, ensure you receive the most competitive pricing without any markup. This level of pricing transparency is crucial for scalpers, as even the slightest deviation can impact potential profits.

Interestingly, our analyst Ross Collins found that FP Markets achieved an impressive average market order execution speed of 96 ms, one of the fastest we tested out if the ASIC-regulated brokers. We think this is particularly important for scalpers, as fast execution speeds are essential when capturing quick market movements during the day.

| Market Order Rank | Broker | Market Order Speed |

|---|---|---|

| 1 | Fusion Markets | 77 |

| 2 | FP Markets | 96 |

| 3 | Pepperstone | 100 |

| 4 | FXCM | 123 |

| 5 | TMGM | 129 |

| 6 | City Index | 131 |

| 7 | Eightcap | 139 |

| 8 | IG | 141 |

| 9 | Markets.com | 141 |

| 10 | GO Markets | 145 |

| 11 | IC Markets | 153 |

| 12 | easyMarkets | 155 |

| 13 | Axi | 164 |

| 14 | CMC Markets | 180 |

| 15 | Admiral Markets | 182 |

| 16 | XM | 184 |

| 17 | ThinkMarkets | 248 |

FP Markets offers MetaTrader 4, MetaTrader 5, cTrader and TradingView as its platforms, and we believe both are excellent scalping choices. MetaTrader 4 has a decent choice of 30+ technical indicators with nine timeframes (e.g. tick charts, 1-minute and higher), but what stood out for us was its one-click trading feature.

The ability to execute orders instantly with a single click, combined with the broker’s rapid execution times, allows you to take advantage of short-term price movements more effectively. This level of responsiveness is critical for scalping strategies, where even milliseconds can make a difference.

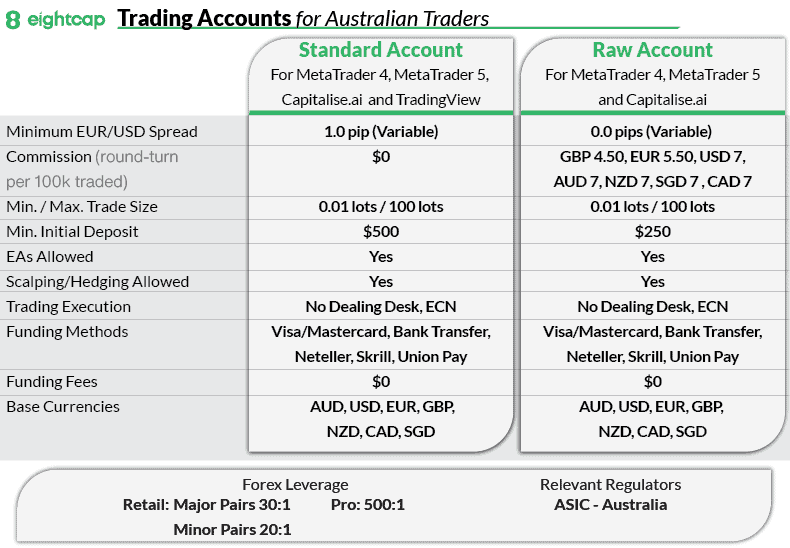

5. Eightcap - Low Commission With Automation Trading Platforms

Forex Panel Score

Average Spread

EUR/USD = 0.06 GBP/USD = 0.1 AUD/USD = 0.2

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

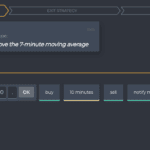

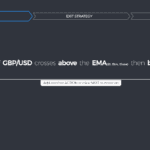

The world is moving towards AI and software automation, and the Eightcap automation features take full advantage of that. Its low commission of AU $3.50 is made even better with its Expert Advisors (EAs) and Capitalise.ai service. These automation tools are useful for trading the 56 Forex pairs and 95 crypto Eightcap offers.

EAs allow for the creation of custom automation bots when using MetaTrader 4 or MetaTrader 5 trading platform. Capitalise.ai is unique in it allows you to create algorithms to automate your trading without using any code. A good automation script ensures you never miss a trading opportunity.

Pros & Cons

- Has a Good Trustpilot score

- No deposit or withdrawal fees

- Allows you to use an Islamic account

- Supports 95 cryptocurrency assets

- Provides the best trade automation features

- Supports only 56 forex trading pairs

- MT4 & 5 are unsupported in the UK

- Cryptocurrencies are unavailable in Europe & UK

- Requires customer service call for an Islamic account

Broker Details

When we opened our Eightcap RAW account, we received access to various tools for automating our trades, including MetaTrader 4’s Expert Advisors (EAs) and Capitalise.ai.

Capitalise.ai stood out as a no-code solution for automating our strategies without writing a single line of code. We like the simplified approach of simply telling the AI our strategy, including entry and exit conditions and letting the platform generate the strategy instantly. Thanks to their interactive tutorials, the platform was easy to use, and we could set up our first strategy within minutes of signing up.

One standout feature of Capitalise.ai is the ability to automate strategies across all of Eightcap’s trading products, including 56 currency pairs, 586 shares, 16 indices, eight commodities, and 95 crypto markets. This flexibility is particularly valuable for crypto traders, as the platform allows you to automate crypto strategies, capitalising on the market’s unique opportunities and volatility.

In our tests, Eightcap’s RAW account offered tight spreads, averaging 0.2 pips, which is on par with some of the best offerings in the industry. While the spreads are near zero, Eightcap charges a commission of $3.50 per lot traded.

Although not the lowest, this commission rate is competitive, especially with Eightcap’s excellent suite of automation tools, making it a solid choice for traders who prefer to automate their trading strategies.

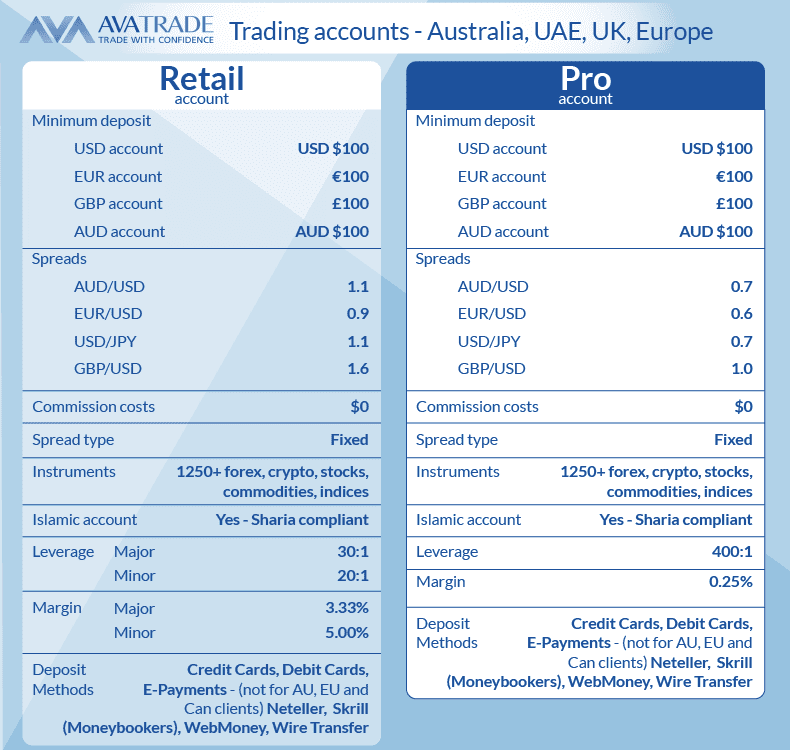

6. AvaTrade - No Commission Standard Account For Day Trading

Forex Panel Score

Average Spread

EUR/USD = 0.8 GBP/USD = 1.2 AUD/USD = 0.9

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

AvaTrade is a market maker but what makes them unique is that they allow day trading and scalping and they have fixed spreads. In short, they operate like a no-dealing desk broker rather than a market maker who often places trading restrictions to prevent making losing trades. There are no commissions with AvaTrade so the spread is wider but you can trade using MetaTrader 4 and MetaTrader 5.

AvaTrade doesn’t have a commission but instead offers fixed spreads of 0.9 for the EUR/USD pair meaning they are stable during time of volatility.

Pros & Cons

- Regulated in 13 different jurisdictions worldwide

- 4.6-star rating on Trustpilot

- AvaOptions app for options trading

- Easy and fast account opening process

- Commission-free trading

- High inactivity fees

- Withdrawals can take up to 3 days

- A minimum deposit fee of 100 USD

Broker Details

For day traders or those looking to profit from volatile markets, we believe AvaTrade is an excellent choice thanks to its Standard account, which offers fixed spreads with no commissions. Our tests with AvaTrade’s Standard account found the spreads competitive, with 0.9 pips on EUR/USD.

| Broker | EUR/USD Effective Spread (Commission + Avg. Spread*) | Variable or Fixed |

|---|---|---|

| Fusion Markets | $5.16 ($2.25 per lot + 0.16) | Variable |

| FP Markets | $6.20 ($3.00 per lot + 0.20) | Variable |

| City Index | $6.22 ($3.00 per lot + 0.22) | Variable |

| GO Markets | $6.59 ($3.00 per lot + 0.59) | Variable |

| Pepperstone | $7.19 ($3.50 per lot + 0.19) | Variable |

| IC Markets | $7.19 ($3.50 per lot + 0.19) | Variable |

| Eightcap | $7.20 ($3.50 per lot + 0.20) | Variable |

| AvaTrade | $9.00 ($0 Commission + 0.90) | Fixed |

While this spread may appear wider than others in the industry, it’s important to remember that AvaTrade does not charge additional commissions. This fixed spread pricing can benefit day traders, ensuring that spreads remain consistent regardless of market volatility or price spikes.

We think this consistency can help mitigate the impact of unexpected costs during periods of heightened market activity, ultimately saving you money.

One feature we appreciate with the AvaTrade Standard account is the access to multiple platforms, including MT4, MT5, Web Trader, AvaTradeGO, and AvaTrade Options.

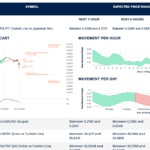

The AvaTradeGO mobile app platform stood out to us, as it incorporates an impressive market sentiment feature conveniently displayed alongside the current market you’re analysing. These sentiment tools can provide valuable insights into the overall sentiment of AvaTrade’s clients, potentially helping you gauge the market’s potential direction.

For instance, if over 58% of traders believe GBP/USD will fall, this information can help verify trends, especially for day traders who rely on capitalising on short-term price movements.

7. City Index - Low Commission of $2.50 With RAW FX Account

Forex Panel Score

Average Spread

EUR/USD = 0.7 GBP/USD = 1.1 AUD/USD = 0.5

Trading Platforms

MT4, TradingView, City Index WebTrader

Minimum Deposit

$0

Why We Recommend City Index

City Index offers a commission rate of just $2.50 USD or $3.50 AUD when using their RAW FX Account. We tested the spreads with the RAW FX account and found the USD/EUR currency pair averaged 0.25 pips beating out all brokers except Fushion Markets. With low commission costs and low spreads, City Index will save you on trading costs. with this level of consistency.

Pros & Cons

- Extremely tight spread

- Good for scalping

- No deposit or withdrawal fees

- Has a feature-rich mobile app

- Has a minimum deposit of $150

- Charges a $15 monthly inactivity fee

- No social/copy trading data

- No Islamic account

Broker Details

We appreciate City Index’s RAW FX Account, which offers one of the lowest commissions in the industry at just $2.50 per lot traded. This account grants you access to City Index’s tightest spreads in Australia, starting from 0.0 pips on forex pairs and gold markets. However, it’s important to note that these tight spreads do not apply to other markets like indices and share CFDs.

During testing, our analyst, Ross Collins, monitored the average RAW spreads on major markets and calculated an overall average for the major currency pairs. Out of the 15 brokers tested, City Index secured the second position, averaging 0.25 pips across its major pairs, closely following Fusion Markets at 0.22 pips.

| Broker | Combined for major pairs we tested |

|---|---|

| Fusion Markets | 0.22 |

| City Index | 0.25 |

| IC Markets | 0.32 |

| TMGM | 0.32 |

| Pepperstone | 0.36 |

| FP Markets | 0.41 |

| Blueberry Markets | 0.43 |

| GO Markets | 0.46 |

| ThinkMarkets | 0.46 |

| Tickmill | 0.47 |

| Eightcap | 0.5 |

| Axi | 0.73 |

| CMC Markets | 0.73 |

| Admirals | 0.79 |

| BlackBull Markets | 0.94 |

This test proves that City Index offers one of the lowest spreads when trading major currency pairs. This is excellent because it translates to lower trading costs, potentially allowing you to maximise profits.

One feature we liked about City Index is the free access to a decent range of trading tools, including the Performance Analytics tool. This tool acts as a performance coach, tracking your trading results and providing real-time feedback, such as your best times to trade, most profitable markets, and more.

This kind of analysis is helpful, as it allows you to identify your strengths and weaknesses, allowing you to double down on what’s working and avoid decisions that aren’t.

Your capital is at risk ‘69% of retail CFD accounts lose money with City Index’

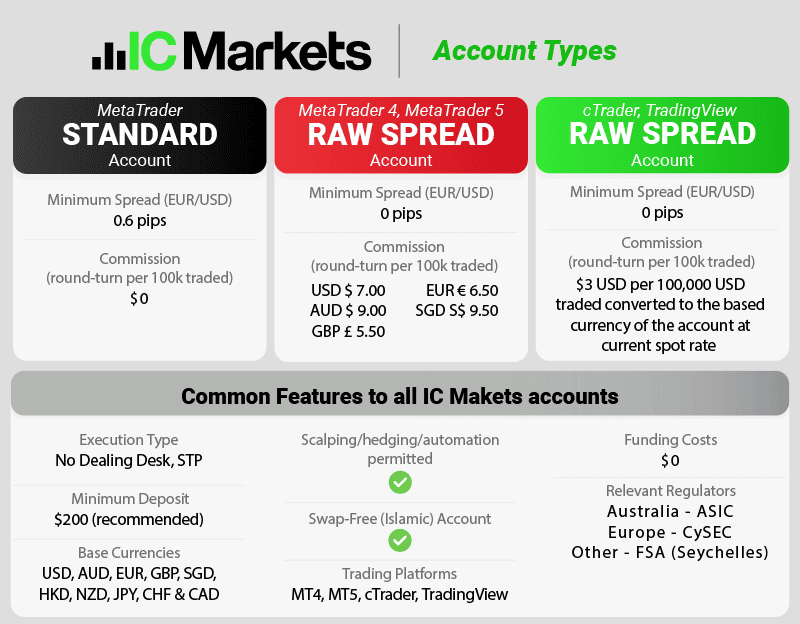

8. IC Markets - 0 Pip Spreads Plus Low FX Commissions

Forex Panel Score

Average Spread

EUR/USD = 0.01 GBP/USD = 0.04 AUD/USD = 0.02

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

We recommend IC Markets because of the low spreads and zero spreads they offer. Commission costs of $4.50 AUD and $3.50 USD per lot sideways are in line with the average but where the broker most shines is their low spreads.

With the IC Markets RAW spread account the broker publishes an average 0.2 pips spread for EUR/USD which is the best in the markets and they finished 3rd in our tests with an average spread of 0.32. We also tested how often the broker has zero pips spreads and the answer is 97.83% of the time outside the rollover period.

Pros & Cons

- Supports 61+ trading pairs

- Works with MT4, MT5, and cTrader

- Commission of just AU$3.50

- Regulated by ASIC and CySEC

- No investor protection for non-EU retail traders

- Lacks proper educational material

- Customer support could be better

- Limited in-house research data

Broker Details

During our testing, we found that IC Markets offered 0.0 pip spreads on its RAW account 97.83% of the time. This means you’ll be paying just the commission when you enter the trade, which is excellent because it minimises the upfront costs associated with each trade, potentially maximising your profits.

| Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY | Grand Total |

|---|---|---|---|---|---|---|---|

| IC Markets | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% | 97.83% |

Speaking of commissions, IC Markets is competitive, with theirs being $3.50 per lot traded, which is in line with the industry average. However, when you have spreads at 0.0 pips, you’d happily pay this commission, as you can execute trades at the true market price without the additional spread cost.

We think the MetaTrader 5 platform pairs nicely with IC Markets, as the broker allows you to utilise all of MT5’s features, such as the depth of market tools. This feature visually represents the liquidity provider’s order book, displaying the available buy and sell orders at different price levels. This allows you to gauge market sentiment using raw data from other traders and make better trading decisions based on where there is more buying or selling pressure.

While exploring MT5, we found that it provided a decent choice of 38+ indicators by default and over 20+ drawing tools, offering more choice than MetaTrader 4. IC Markets doesn’t just offer MT5; they also provide MT4 for those who prefer the classic interface, cTrader, and TradingView, a popular choice for traders focusing on technical analysis.

This diverse range of platform options ensures you can choose the platform that best suits your trading style and preferences

Ask an Expert

Fusion Markets based on your analysis seems to have the lowest spreads but I’m not based in Australia. Can I still trade with them?

Yes of course you can. While traders in Australia are regulated by ASIC, Traders outside Australia are regulated by the Vanuatu Financial Services Commission (VFSC). One benefit of trading outside Australia is that the maximum leverage for forex pairs is 1:500. Traders in Australia are restricted to 1:30.

Which broker is the cheapest overall?

Based on an analysis Ross, our Head of Research, conducted recently using Spread Monitor, IC Markets and CMC Markets were the two brokers that came out on top most consistently. IC Markets’ avg. spread

across all majors was about about 1.02 pips. CMCs was around 1.09 pips on avg. Obviously there are other factors to consider when working out the very cheapest, but looking at spreads which is a trader’s main cost is the best way to analyse it.

Can you trade forex with no fees at all?

Not really, while you might be able to trade with 0 pip spreads, you will still need to pay commission fees. The only way to trade with no fees is by using a demo account using virtual money.

If I’m mostly trading small lot sizes, will low commissions really make a big difference for me?

Yes because the commission scales based on your trade sizes. Trading a micro-lot will cost $0.035 per trade, and still gives you access to tighter spreads. In general, with brokers like Fusion Markets, their commission based accounts are cheaper than the spread-only accounts.

Are there any hidden conditions or restrictions for getting the lowest commission rates?

You need to look at each broker individually. Most brokers have a RAW account with a set commission which is what most clients will use but some brokers have discount commissions for high volume traders (sometimes called active account) or reduce commission if your account can meet higher minimum deposits.