Best Forex Broker For Scalping

Forex scalping has particular trading requirements, so forex traders can get the most from their scalping strategy on the forex market. Traders should choose a trading platform from a forex broker that has fast execution with low costs.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

The top forex brokers with great scalping software list is:

- Eightcap - Top Broker for Scalping Crypto

- FP Markets - Best For Broker Scalping Overall

- BlackBull Markets - Fastest Broker for Scalping

- IC Markets - Good Futures Trading For Day Traders

- Pepperstone - Top Choice For Scalping With MT4

- HF Markets - Great AI Trading Software For Scalping

- FxPro - Good Scalping Conditions With cTrader

- FXTM - Highest Leverage For High Volume Trading

- AvaTrade - Top Choice For Fixed Spread Trading

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

96 |

ASIC ,FCA, CySEC |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.10 | 0.50 | 0.30 | $3.00 | 1.20 | 1.50 | 1.40 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

95 | FMA, FSA-S | 0.14 | 0.43 | 0.30 | $3.00 | 1.10 | 1.40 | 1.20 |

|

|

|

72ms | $0 | 72 | 9 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.20 | 0.10 | $3.50 | 1.10 | 1.20 | 1.10 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

46 |

FCA, FSCA, CYSEC DFSA, CMA, FSA-S |

- | - | - | $3.00 | 1.4 | 1.6 | 1.6 |

|

|

|

$0 | 38+ | 19+ |

|

|||

Read review ›

Read review ›

|

59 |

FCA, FSCA CySEC, SCB, FSCM |

0.45 | 0.52 | 0.57 | $3.50 | 1.46 | 1.76 | 2.06 |

|

|

|

151ms | $100 | 69 | 28 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

62 |

FCA, FSCA, CySEC FSCM, CMA |

0.1 | 2 | 0.5 | $4.00 | 2.1 | 2.5 | 2.1 |

|

|

|

160ms | $10 | 58 | - | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

68 |

ASIC, FSCA CBI, KNF, CIRO ADGM, FSC-BVI |

Cross | Cross | Cross | Cross | 0.9 | 1.3 | 1.1 |

|

|

|

160ms | $100 | 55 | 27 | 30:1 | 400:1 |

|

What Is The Best Trading Platform For Scalping?

Scalping requires a broker with low fees, an advanced trading platform and fast execution speeds. With this in mind we matched these primary criterea to the list below and then alligned different trading needs to the most suitable broker.

1. Eightcap - The Best Forex Broker For Scalping

Forex Panel Score

Average Spread

EUR/USD = 0.06

GBP/USD = 0.73

AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap for Scalping Cryptocurrencies

We highly recommend Eightcap as the best TradingView broker for scalping because of its low ECN-like spreads and unique, tailored TradingView experience for UK traders.

I found Eightcap’s low spreads, particularly on its Raw Account, kept my trading costs low, which is vital when you’re using a high-frequency, scalping trading strategy. Coupled with TradingView’s easy access to advanced tools and charting options for real-time analysis and execution added to my smooth trading experience as a scalper.

Pros & Cons

- Extensive Range of Cryptocurrency CFDs

- Competitive Spreads

- Advanced Trading Platforms

- Strong Regulatory Framework

- Can be hard to navigate for Beginners

- $100 Minimum Deposit Requirement

- Regional Restrictions on Cryptocurrency Trading for European and UK traders

Broker Details

Eightcap stands out to me with some of the lowest spreads in the market, which is important for scalping strategies. While the broker only supports TradingView in the UK, I was pleased that it offers useful market analysis and insight tools alongside the platform’s already superior charting capabilities.

Additionally, Eightcap is highly trustworthy, being regulated by some of the A-level top-tier regulatory bodies across the globe such as Australia’s ASIC and the UK’s FCA. However, trading restrictions by the FCA mean that UK traders won’t have access to cryptocurrency trading.

Low RAW Spreads for Scalping

As an ECN, no-dealing desk broker, Eightcp offers both a Standard Account (commission-free) and a Raw Account (commission-based). To obtain the lowest possible spreads as a scalper from my testing, I highly recommend the broker’s Raw Account.

Based on my published analysis of spreads across 40 leading brokers, Eightcap’s Raw Account delivers highly competitive rates, with an average spread of 0.06 pips on the EUR/USD, the lowest I’ve encountered.

During my own testing, I found that Eightcap averaged 0.20 pips for EUR/USD, which is lower than the 0.26 pips average I observed across 20 other top brokers. While the difference of 0.06 pips per trade may seem small, it can add up significantly over time, which is vital when you’re using a short-term trading strategy like scalping.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Top TradingView Platform Experience

While Eightcap doesn’t offer either MT4 or MT5, the broker is the only dedicated TradingView broker in the UK, which is a powerful platform in its own right, particularly for scalping.

For a start, I appreciated the ease with which I could set up alerts on categories like price levels, indicators, and custom indicators simply by clicking on the charts I was using. You can also trade with over 15 customisable chart types, including Kagi, Renko, and Point & Figure.

Adding to its TradingView platform experience, I found Eightcap Labs offered plenty of helpful e-Books and guides on trading fundamentals, trading strategies, and overall platform and tools, including an insightful piece on utilising the Zig Zag indicator, on TradingView. These additional resources refined my trading and helped me identify trading opportunities while I was scalping.

Our Final Verdict on Eightcap

Eightcap is our preferred TradingView broker for scalping due to its competitive spreads, charting features and market insights.

Unfortunately, as a UK trader you can’t capitalise on Eightcap’s extensive range of nearly 100 cryptocurrencies given the regulatory restrictions imposed by the FCA. Another downside I found is that UK traders don’t have access to either of the popular MetaTrader platforms, limiting your trading options to TradingView.

However, the firm’s strong regulatory framework adds an extra layer of security and my overall platform experience combined with its low RAW spreads more than makes up for Eightcap’s regional restrictions in the UK.

2. FP Markets - Top Low Spread Broker

Forex Panel Score

Average Spread

EUR/USD = 1.1

GBP/USD = 1.3

AUD/USD = 1.3

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

FP Markets stands out as our top pick for a low-spread broker and has consistently been one of our favourite brokers for many years now.

The firm’s hallmark of providing consistently tight spreads has often been a fantastic option when we’re focused on running scalping strategies. The tight spreads ensure that we can execute our trades efficiently and cost-effectively.

The platform’s competitive pricing model, coupled with minimal slippage, fosters an ideal trading environment for those engaged in high-frequency trading activities.

Pros & Cons

- Tight spreads

- Fast execution

- Over 33 account funding options

- High leverage

- No inactivity fee

- Withdrawal fees

- May requote prices and cause delays

- Spread may widen during volatile market conditions

- Lacks trading platform diversity

Broker Details

1. LOW SPREADS AND COSTS

FP Markets can offer tight spreads as they source prices from multiple tier-one liquidity providers. This allows Forex traders who employ scalping to take advantage of spreads starting from 0.0 pips using the FP Markets Raw Spread account. The RAW spread accounts average spread on major currency pairs such as EUR/USD of 0.1 pips most of the time, which is one of the best available from brokers worldwide.

FP Markets can offer tight spreads as they source prices from multiple tier-one liquidity providers. This allows Forex traders who employ scalping to take advantage of spreads starting from 0.0 pips using the FP Markets Raw Spread account. The RAW spread accounts average spread on major currency pairs such as EUR/USD of 0.1 pips most of the time, which is one of the best available from brokers worldwide.

Below are the spreads of the range of Forex brokers who advertise their average spread on their website. This table is updated monthly.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Commissions when trading with FP Markets is $3.00 side / $6.00 round turn. These commissions are in line with commission charges from other brokers making them suitable for high-volume traders. Scalpers can place orders between the spread due to no minimum order distance and a freeze level of 0. All orders, including Stop-Loss orders, can be placed at any distance from the current market price.

2. ECN TRADING ENVIRONMENT

FP Markets’ raw pricing along with a MetaTrader server located in the Equinix NY data centre gives STP / ECN style trading conditions. The main advantage of brokers that use STP / ECN style conditions can be summarized by low latency and minimized probability for slippage, no dealing desk, no re-quotes, and fast order execution.

MetaTrader 5 offers Depth of Market, which allows traders to visualize the entire range of available prices derived directly from its liquidity providers. This ensures complete transparency of all liquidity for any currency at any moment.

3. STRONG FOREX REGULATION

FP Markets complies with strict regulatory standards by some of the most reputable Forex authorities worldwide. FP Markets is regulated in Australia by the Australian Securities and Investments Commission (ASIC) and in Europe by the Cyprus Securities and Exchange Commission (CySEC).

“Raw Spreads + Fast Speed + Reduced Slippage = FP Markets”

SUMMARY OF WHY FP MARKETS IS THE TOP LOW-SPREAD BROKER

Based on our thorough testing, FP Markets has emerged as our top choice if you’re seeking a low-spread broker.

The firm distinguishes itself with its consistently tight spreads across its wide range of trading products..

Our long-time experience with the broker has shown us it’s an exceptional option for scalping strategies. The competitive pricing model and minimal slippage create a conducive environment for high-frequency trading where you have to minimise your trading costs and fees.

3. Blackbull Markets - Fastest Broker for Scalping

Forex Panel Score

Average Spread

EUR/USD = 0.23

GBP/USD = 0.72

AUD/USD = 0.65

Trading Platforms

MT4, MT5, cTrader, TradingView, BlackBull Social, BlackBull Shares, BlackBull Trade

Minimum Deposit

$0

Why We Recommend BlackBull Markets

We found BlackBull Markets to have the fastest execution speeds, making it an ideal choice for scalping strategies that rely on speed and efficiency. With advanced technology and strategically placed servers, BlackBull Markets achieved an average limit order speed of 72 milliseconds, which is 44.6% faster than the industry average of 130 milliseconds. For market orders, their speed was 90 milliseconds, 36.2% quicker than the industry average of 141 milliseconds.

Overall, BlackBull Markets offers competitive spreads, low commission fees, and a commitment to providing the fastest trade executions, creating a superior platform for scalpers.

Pros & Cons

- Ultra-fast execution speeds

- Low spreads starting from 0.1 pips

- No minimum deposit required

- Wide range of trading platforms and instruments.

- High leverage options

- A $5 withdrawal fee applies to all withdrawal methods.

- ECN Institutional Account requires a high minimum deposit of $20,000.

- Limited educational resources for beginners.

Broker Details

METATRADER 4 & 5

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are widely loved in the forex industry for their advanced trading features, customizability, and user-friendly interface. BlackBull Markets supports both platforms, allowing traders to leverage their robust analytical tools, expert advisors (EAs) for automated trading, and one-click trading capabilities.

Both platforms are designed to cater to the needs of scalpers with features like rapid order execution, a comprehensive set of technical analysis tools, and the ability to access deep liquidity pools for better price execution.

ADVANTAGES OF TRADING WITH BLACKBULL MARKETS

For scalpers, speed is of the essence, and BlackBull Markets excels in this area with some of the fastest execution speeds in the industry. Traders can benefit from:

- ECN Prime Account with spreads starting from 0.1 pips.

- Ultra-fast order execution, with an average limit order speed of 72 milliseconds.

- Direct access to liquidity providers, ensuring minimal slippage and optimal entry and exit points.

- Availability of VPS (Virtual Private Server) services to further reduce latency.

BlackBull Markets is not just fast; it’s designed for the demanding requirements of scalping, making it our top recommendation for traders looking to execute this strategy.

LOW SPREADS AND COMPETITIVE COMMISSIONS

BlackBull Markets offers some of the lowest spreads and commissions in the industry. With the ECN Prime Account, traders enjoy spreads from as low as 0.1 pips plus a commission of $3.00 per side per 100k traded. These cost-effective trading conditions are ideal for scalpers, who benefit from narrow spreads and low trading costs.

Below is a comparison of spreads across various brokers, illustrating BlackBull Markets’ competitive edge:

FASTEST EXECUTION FOR SCALPING

BlackBull Markets’ commitment to ultra-fast execution is unmatched. With servers located in major financial hubs like New York and London, you’ll experience rapid order execution no matter where on the globe you’re located. The broker’s advanced infrastructure minimizes latency, ensuring that orders are executed at the best possible prices with minimal delay.

DIVERSE TRADING PLATFORMS AND INSTRUMENTS

If you’re a scalper or day trader, you’ll have specific needs for your trading platform, and BlackBull Markets meets these with a wide range of trading platforms (MT4, MT5, cTrader, and TradingView) and instruments. Whether trading forex, commodities, indices, or shares, BlackBull Markets offers the tools and assets scalpers are looking for.

SUMMARY OF WHY BLACKBULL MARKETS IS THE BEST FOR ULTRA-FAST SCALPING

BlackBull Markets stands out to us as the premier broker for scalpers seeking the fastest execution speeds in 2025. Its combination of low spreads, competitive commissions, and ultra-fast execution makes it our top pick for traders employing scalping strategies. With no minimum deposit required and a comprehensive range of trading platforms and instruments, BlackBull Markets is ideally suited for scalpers looking for efficiency and performance.

4. IC Markets - Ideal STP & ECN Trading For Scalping

Forex Panel Score

Average Spread

EUR/USD = 0.62

GBP/USD = 0.83

AUD/USD = 0.77

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

We highly suggest using IC Markets if you’re looking to trade futures CFDs due to the firm’s ultra-low latency, tight spreads, and unique range of futures CFDs.

We were quite surprised to learn that with IC Markets, we had access to trade the CBOE VIX index, Brent Crude Futures, ICE Dollar Index futures and even WTI Crude Oil futures. These are all serious products that you wouldn’t often find at retail-focused brokers.

The ability to trade the VIX index, or the ICE dollar index opens the door for us to trade some more sophisticated strategies, and we’d highly recommend this option to advanced and experienced traders.

Pros & Cons

- Advanced analytics

- Discounts for active traders

- Educational materials

- Tight spreads

- Low-quality educational materials

- High minimum deposit

- Withdrawal fees

- Slow live chat support

Broker Details

IC Markets is particularly good for scalping because it has ultra-low latency and fast execution. Trading is available with MetaTrader 4, MetaTrader 5, cTrader and TradingView

This enables you to enter and exit trades quickly to capture small price movements and gain more profits. Trading is available with MetaTrader 4, MetaTrader 5, cTrader and TradingView.

Apart from futures, IC Markets also provides the following instruments:

- Forex

- Commodities

- Indices

- Stocks

- Cryptocurrencies

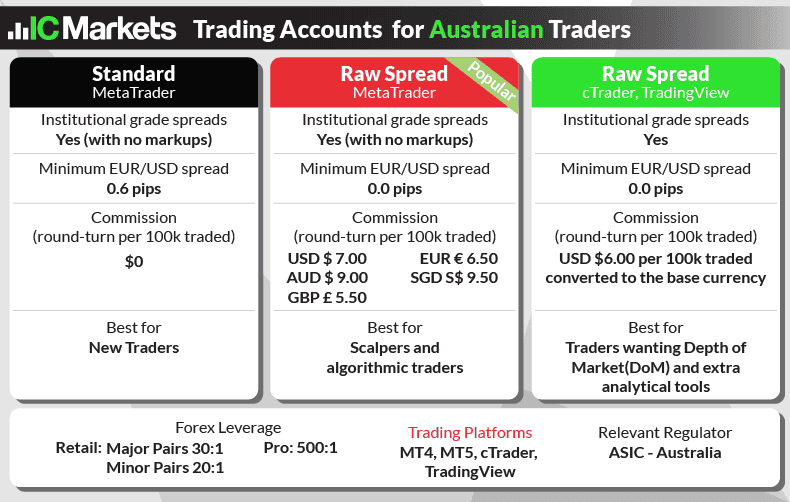

There are three accounts to choose from:

- Standard Meta Trader: Best for new traders

Average EUR/USD spread: 0.62 pips - Raw Spread MetaTrader: Best for scalpers and algorithmic traders. Average EUR/USD spread: 0.02 pips

- Raw Spread cTrader: Best for traders wanting Depth of Market (DoM) and extra analytical tools

SUMMARY OF WHY WE RECOMMEND IC MARKETS FOR TRADING FUTURES

IC Markets is our stand-out pick for trading futures CFDs, distinguished by its ultra-low latency, competitive tight spreads, and unique assortment of futures CFDs not commonly offered by retail-focused brokers.

We were impressed to find we had access to premium products such as the CBOE VIX index, Brent Crude Futures, ICE Dollar Index futures, and WTI Crude Oil futures, showcasing IC Markets as an impressive broker for engaging in some more sophisticated trading strategies.

This wide range of offerings, combined with allowing access to our favourite trading platforms, positions IC Markets as our top choice for advanced and experienced traders looking to expand their trading strategies with futures CFDs.

5. Pepperstone - Top Choice For Scalping With MT4

Forex Panel Score

Average Spread

EUR/USD = 1.12

GBP/USD = 1.69

AUD/USD = 1.22

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

Pepperstone stands out to us as the optimal broker for automated scalping with MetaTrader 4, thanks to its ECN pricing model and direct access to a wide network of top-tier liquidity providers. With that level of technology setup, we found that Pepperstone provided ultra-tight spreads, such as an average of just 1.12 pips on EUR/USD.

We were impressed to find the inclusion of 28 Smart Trader Tools specifically for MT4 enhances the precision and efficiency of scalping strategies, complemented by commission discounts for high-volume traders which can significantly lower trading costs. Furthermore, Pepperstone offers lightning-fast order execution speeds (orders filled in less than 77ms) that can be highly useful for automated high-frequency trading strategies.

Pros & Cons

- Inclusion of 28 Smart Trader Tools for MT4

- Commission discounts for high-volume traders

- No inactivity fee

- Extremely narrow average spreads

- Higher leverage comes with greater risks

- Potential for occasional slippage

- Lacks specialist risk management tools

- Withdrawal fees

Broker Details

We like that Pepperstone offers additional Expert Advisors for free that enhance your MetaTrader 4 experience by adding much-needed account and trade management tools to the platform.

One plugin we like and think it’s a must-use for scalping is the “Mini-Terminal” EA. This EA improves the default MT4 one-click trading feature by adding a default stop-loss, take profit, and trailing stop-loss order. These orders get added to each instant execution (instead of manually adding them after executing – which we can easily forget), ensuring your risk management is consistently implemented.

We also like that it shows how many lots you have open within the terminal, helping you keep track of scaling a position or how much exposure you have.

RAW pricing accounts offered by brokers like Pepperstone tend to offer spreads from zero-pips, which can boost your profit margins as a scalper, so we tested to see if Pepperstone offered this.

Our analyst, Ross Collins, used the MetaTrader 4 platform to track the RAW spread pricing on EUR/USD over 24 hours and compared it with 15 other brokers. He found that Pepperstone offered EUR/USD at 0.0 pips 100% of the time, way better than the industry average of 94%.

| Zero Spread Testing | |

|---|---|

| Broker | Time At Minimum Spread |

| Pepperstone | 100% |

| City Index | 100% |

| Fusion Markets | 98.55% |

| ThinkMarkets | 97.93% |

| IC Markets | 97.83% |

| TMGM | 97.83% |

| FP Markets | 97.83% |

| Eightcap | 97.83% |

| Admirals | 95.60% |

| Blueberry Markets | 94.20% |

| GO Markets | 87.68% |

| BlackBull Markets | 86.96% |

SUMMARY OF WHY PEPPERSTONE IS THE BEST METATRADER 4 SCALPING BROKER

Our team highly recommend Pepperstone as the best broker for automated scalping with MT4 due to its ECN pricing model, ultra-tight spreads (average 1.12 pips on EUR/USD), and lightning-fast execution speeds (less than 77ms). The inclusion of 28 Smart Trader Tools and commission discounts for high-volume traders can also offer substantial benefits for many traders.

6. HFM (Formerly HotForex) - Great AI Trading Software For Scalping

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.9

AUD/USD = 1.8

Trading Platforms

MT4, MT5, HFM App

Minimum Deposit

$100

Why We Recommend HFM

Our team carried out a full test of HFM (Formerly HotForex) — we found it to be a highly reliable and efficient broker for scalping. We found their cent account interesting as not many brokers offer this type of account.

HFM (Formerly HotForex) is equipped with advanced trading technology. This will provide you with low latency and high liquidity — two things necessary for successful scalping. Trading is available via MetaTrader 4, and MetaTrader 5 along with their proprietary platform called HFM Platform. We recommend scalpers use Expert Advisors for automation.

Pros & Cons

- Low spreads

- Educational resources

- Multiple trading platforms

- Fast execution

- Few account currencies

- Customer support closed on weekends

- Account features dependent on your location

- Account availability dependent on your location

Broker Details

While testing the HF Markets account, we liked the range of available tools, including AutoChartist and their AI-powered advanced insights tool. This AI tool piqued our interest because it collected millions of articles about the markets and provided a real-time sentiment analysis based on this data.

In particular, we thought the real-time volatility tool was impressive as it gave you a daily snapshot of where the volatility is rising or lowering. This tool lets you find the most likely to move assets and improve your chances of scalping a profit.

HF Markets also impressed us with its educational resources, consisting of 12 courses ranging from beginners to trading strategies. In fact, the trading strategies courses were excellent compared to other brokers we tested, as HF Markets gave step-by-step videos on strategies like their Fractal strategy.

Other brokers gloss over trading basics and offer limited and mostly useless trading strategies. So, the fact that HF Markets provided something different is a bonus, especially if you have just started trading.

The broker offers average RAW spreads from 0.1 pips on EUR/USD, which is decent and below the industry average of 0.22 based on our tests.

7. FxPro - Good Scalping Conditions With cTrader

Forex Panel Score

Average Spread

EUR/USD = 1.32

GBP/USD = 1.7

AUD/USD = 1.95

Trading Platforms

MT4, MT5, cTrader, FxPro Trading Platform

Minimum Deposit

$100

Why We Recommend FxPro

FxPro stands out to us as a top cTrader broker, offering a variety of instruments and account options. You can also trade with MetaTrader 4, MetaTrader 5 and FxPro Trading Platform.

What we like the most about FxPro is the cTrader platform. It provides lightning-fast execution and tight spreads. And, if you use the FxPro Trading Platform, you can trade 10 currency pairs using fixed spreads and instant execution.

Pros & Cons

- A diverse range of instruments

- Tight spreads

- Fixed spread available

- Excellent customer support

- Could be more competitively priced

- Limited currency pairs

- High trading fees for stock CFDs

- Inactivity fee

Broker Details

We think the cTrader platform pairs nicely with FxPro as it is a no-dealing desk (NDD) broker, meaning FxPro passes your orders straight to the liquidity provider. This gives you tighter spreads, averaging 0.32 pips on EUR/USD with a commission of $3.50 per lot when using the cTrader platform compared to FxPro’s platform, which averaged 1.32 pips (but was commission-free) in our tests.

While testing the cTrader platform, we found that the platform had 65+ trading indicators and 11 chart types, including tick, renko, or range charts. What stood out for us is the Depth of Market tool, which shows you all the pending orders at each price level that the liquidity provider offers.

We like this because it gives you access to raw market data that you can use to find supply and demand zones, giving your scalps better accuracy. The platform also has one-click trading that can help boost your execution timings, which is a bonus.

The broker has a decent selection of markets, which includes 69 forex pairs, 2000+ stocks, 19 indices, 11 commodities and 30 crypto markets available through cTrader.

8. FXTM - Highest Leverage For High Volume Trading

Forex Panel Score

Average Spread

EUR/USD = 1.9

GBP/USD = 2

AUD/USD = 2

Trading Platforms

MT4, MT5

Minimum Deposit

$10

Why We Recommend FXTM

We were impressed by FXTM’s high leverage ratios. A high leverage is ideal for scalping

as it allows you to control larger positions with a smaller amount of capital, therefore amplifying potential profits from small price movements.

Pros & Cons

- Educational resources

- 30+ languages supported

- A diverse range of instruments

- Tight spreads

- Fast execution speeds

- FXTM Trader is not available on all accounts

- Does not support cryptocurrencies

- Inactivity fee

- Withdrawal fee

Broker Details

What interested us when reviewing FXTM was it offered high leverage on its trading accounts. Higher leverage is helpful if you are successful and want to take on more risk or if you have low funds and want more exposure for less margin.

We opened an account to test the leverage available, and during the signup process, the broker allows you to choose the leverage ratio for the account, which can be from 1:25 to 1:2000.

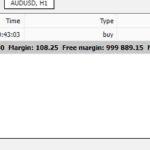

We confirmed this leverage by opening a demo account and placing a trade on the EUR/USD, which would offer the full 1:1000 leverage.

As you can see, the broker allowed us to execute the trade at the 1:1000 ratio, meaning we only had to fund $108.25. This is interesting as most brokers have max leverage of 1:30, which their regulators set, like the Financial Conduct Authority or Australian Securities and Investments Commission.

What also stood out with FXTM in our tests is how low their average RAW spreads were, averaging 0.32 pips for EUR/USD, which is lower than the industry average, which was 0.49 pips.

9. AvaTrade - Top Choice For Fixed Spread Trading

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

After conducting in-depth testing of AvaTrade, we’ve concluded that this broker is our top choice for fixed spread trading. We found that when comparing a collection of major brokers that offer fixed spreads, that Avatrade came out on top for providing the tightest spreads, therefore making it a fantastic choice for scalpers.

Apart from the tight spreads, Avatrade offers a wide range of instruments, some of our favourite charting platforms and quality customer support, so overall we found it to firm to be a great quality broker.

Pros & Cons

- Commission-Free Trading

- Fixed Spreads

- Wide Range of Instruments

- Advanced Trading Platforms

- Wider Spreads on Fixed Accounts

- High Inactivity Fees

- Slow Withdrawal Process

- Geographic Restrictions on Certain Accounts

Broker Details

AvaTrade has earned its place as our top pick when it comes to fixed spread trading, which can be highly useful for traders who want to control the predictability of their trading costs. With its commission-free trading framework, AvaTrade provides tight fixed spreads across a variety of CFDs, including a comprehensive selection of 55 forex pairs, commodities, indices, and even bonds, making it particularly appealing for forex and metals options trading.

The AvaOptions mobile platform was a standout feature for us, and we could see ourselves using it as a risk management tool in the future.

AvaTrades’s commitment to accessibility is evident through the integration of popular platforms like MetaTrader 4 and MetaTrader 5, accommodating a wide range of trading strategies and styles.

Regulated in multiple jurisdictions, including Europe, the UK, Australia, the UAE, and South Africa, we feel very safe with the idea of keeping funds with the broker. The minimum deposit is a manageable $100, and there are no deposit or withdrawal fees and support for credit card transactions. All up, AvaTrade as quite an attractive option for traders focusing on fixed spread advantages.

Summary of why AvaTrade is our top choice for Fixed Spread Trading

AvaTrade earns our standout recommendation if you’re looking to trade with fixed spreads. Its ability to offer the tightest fixed spreads while offering a diverse range of trading instruments, access to preferred charting platforms for thorough analysis, and commendable customer support make it a great brokerage option.

Ask an Expert

Is scalping harder than day trading?

Scalping and day trading are two different styles of trading…both are hard in their own right, the key is how committed you are to being the best trader you can be.

How long does scalping last?

As short as you like

Nice article… but I wonder – I’m not very experienced with scalping and I just started my account in FP Markets, is it possible to make a good profit with scalping considering all the broker fees?

It is possible to make good profits by scalping especially if trading with high leverage but here are risks involved and it take a long time to develop the right skills to be successful, even experienced traders can make losses from time to time.

Is scalping great for a beginner in forex trading?

No, scalping is best for experiences traders as micro movements in the spread can affect the a scalpers trading strategy.