Best Copy Trading Platforms For Australia

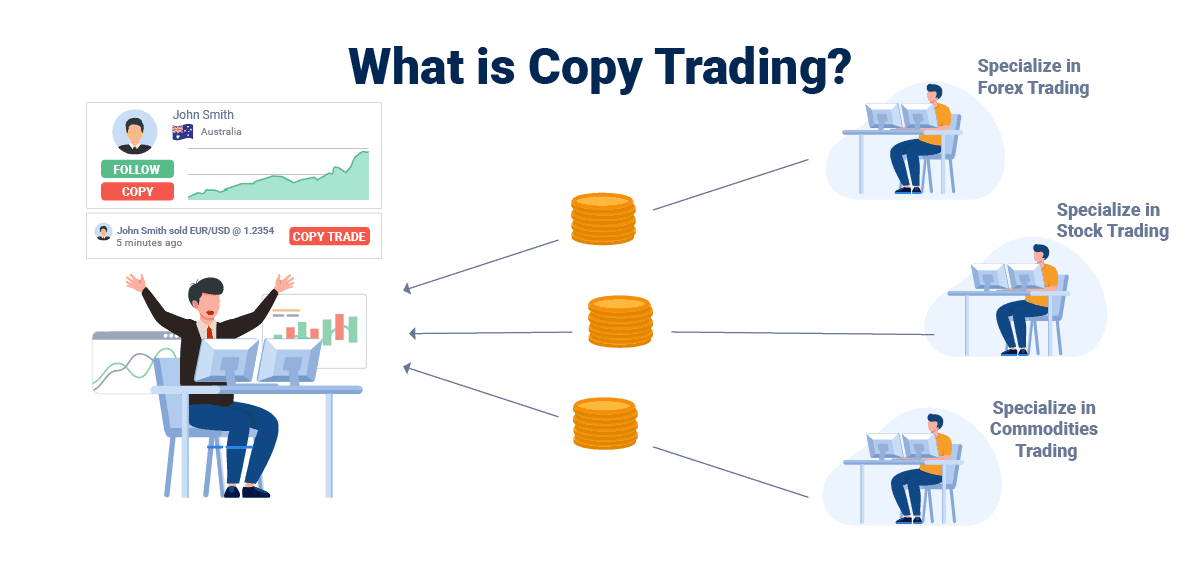

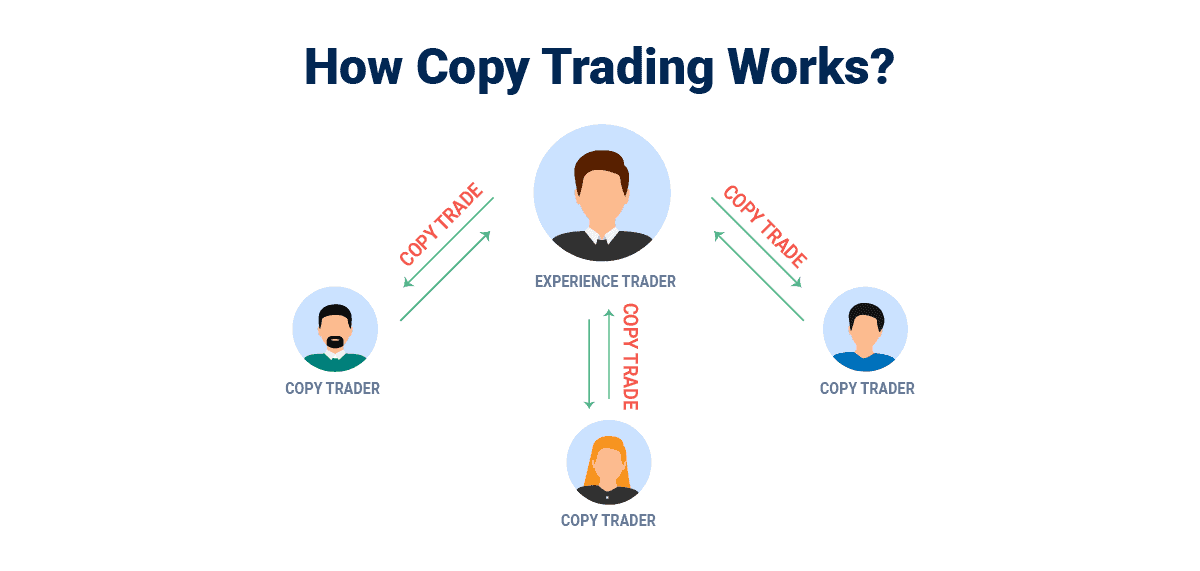

Copy trading platforms allow you to automatically copy other successful traders. Sometimes called social trading, find out the best platforms and the brokers that offer these platforms in our guide.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

The Brokers With The Best Copy Trading Platforms

- Pepperstone - Best Platforms For Copy Trading Overall

- eToro - Top Copy And Social Trading Platform

- IC Markets - Good Copy Trading With MetaTrader 4 And 5

- ZuluTrade - Great Custom Copy Trading Platform

- Darwinex - Best Copy Trading Platform And Broker

- MyFxBook - Best To Automate Copy Trading

- AvaTrade - Top Copy Trading Platforms Inc. Duplitrade

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.20 | 0.10 | $3.50 | 1.10 | 1.20 | 1.10 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

68 |

ASIC, FSCA CBI, KNF, CIRO ADGM, FSC-BVI |

Cross | Cross | Cross | Cross | 0.9 | 1.3 | 1.1 |

|

|

|

160ms | $100 | 55 | 27 | 30:1 | 400:1 |

|

What Are The Best Copy Trading Platforms?

Copy trading involves the ability to mirror another person’s trading strategies automatically. This is especially suited for beginners who aren’t confident traders. Therefore, we looked at each top Best Forex Brokers In Australia and then factored in the copy trading platform facilities suitable for all types of traders.

1. Pepperstone - Best Platforms For Copy Trading Overall

Forex Panel Score

Average Spread

EUR/USD = 1.10

GBP/USD = 1.40

AUD/USD = 1.20

Trading Platforms

MT4, MT5, cTrader,

TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

We liked the straightforward approach of Pepperstone when it comes to copy trading in Australia. Retail clients can tap into over 800 CFD instruments, enjoy speedy order execution at 30 ms, and take advantage of social trading with spreads kicking off at 0.0 pips. Moreover, they provide top-notch institutional market research, giving traders an edge. Not to forget, MyFxBook, DupliTrade, and MetaTrader signals are standout third-party services readily accessible to retail traders.

Pros & Cons

- Great copy trading software

- Tight forex spreads for all currencies

- Top customer service

- No proprietary apps offered

- Can only trade CFDs

- No physical stocks available

Broker Details

At Pepperstone, we’ve experienced the excellent platforms available for copy trading in Australia. As retail traders, we could select from 3 renowned third-party services: MetaTrader signals, DupliTrade, and MyFxBook. Engaging with Pepperstone allowed us to leverage social trading with spreads starting from 0.0 pips, rapid order execution at 30ms, access to over 800 CFD instruments, and invaluable access to institutional market research.

Established in 2010 in Melbourne, Australia, Pepperstone has rightfully earned its reputation as a prize-winning, multi-regulated CFD and Forex provider. They’re authorised to provide online trading services in several premier jurisdictions:

- Australia, where it operates as Pepperstone Australia, is regulated by the Australian Securities and Investments Commission (ASIC) and holds an Australian Financial Service Licence (AFSL),

- The United Kingdom, where it operates as Pepperstone UK, is regulated by the Financial Conduct Authority (FCA),

- The European Economic Area, where it operates as Pepperstone EU Limited, is regulated by the Cyprus Securities and Exchange Commission (CySEC),

- In Germany, Pepperstone is regulated by The Federal Financial Services Authority (BaFin)

- UAE, where it operates as Pepperstone AE, regulated by the Dubai Financial Services Authority (DFSA)

- In Kenya, Pepperstone is regulated by the Capital Markets Authority (CMA)

- Outside the listed countries and regions above, Pepperstone is regulated by the Securities Commission of the Bahamas (SC)

Based on our review, Pepperstone can be considered the best choice for Australian traders when it comes to Forex copy trading platforms.

| MyFxBook AutoTrade | MetaTrader Signals | DupliTrade | |

|---|---|---|---|

| Free Signals | ✔ | ✔ | ✘ |

| Paid Signals | ✘ | Weekly or Monthly Subscription fee | ✘ |

| Verified Track Record | ✔ | ✔ | ✔ |

| Trading History | ✔ | ✔ | ✔ |

| Social Network | ✔ | ✘ | ✘ |

| Minimum Deposit | $1,000 | ✘ | AUD $5,000 |

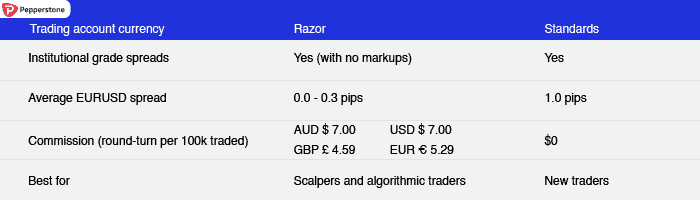

Pepperstone Has Great Spreads For Copy Traders

When settling on a copy trading platform, choosing a broker with low spreads is imperative. This ensures our trading costs are minimised with each transaction. With Pepperstone, we had the choice between two trading accounts:

- Standard Account – tight spreads from 1.0 pips with no commission costs

- Razor Account – Low spreads using STP and ECN pricing and commissions costs from $3.50 sideways for each lot.

Choosing Pepperstone as your forex broker guarantees some of the best spreads across brokers. The following table showcases the average spreads brokers display on their sites, updated at the start of each month. Pepperstone’s spreads consistently rank as some of the most competitive regardless of your preferred currency pair.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Forex Copy Trading Options For Australian Traders

The brokerage offers some of the best social trading platforms, which enable Australian customers to access trading strategies from top traders across the globe. Those platforms include:

- Myfxbook AutoTrade

- DupliTrade

- MetaTrader Signals (MT4 + MT5)

1) Myfxbook AutoTrade

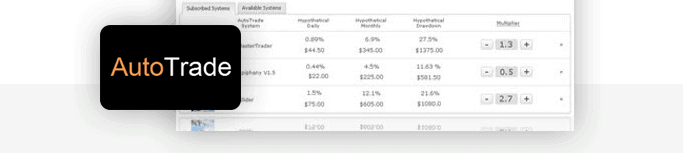

AutoTrade, designed by Myfxbook, lets traders like us emulate trades, capitalising on premier trading systems without incurring performance/management fees or needing any software.

Getting set up is a straightforward process:

- First, new Australian customers need to create a live trading account with Pepperstone (Standard or Razor).

- Second, sign up for AutoTrade on the Myfxbook website.

- And third, link your Pepperstone account to Myfxbook AutoTrade.

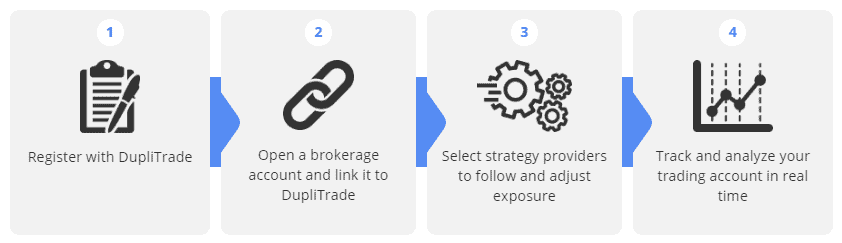

2) DupliTrade

DupliTrade, a renowned trading strategy marketplace, offers signals from expert traders. This gives traders with limited experience, like some of us, the chance to familiarise themselves with advanced trading methods. To utilise DupliTrade, a minimum deposit of AUD 5,000 is required. After this, you can commence automated trading based on signals directly on your MetaTrader 4 account.

3) MetaTrader Signals

Lastly, those of us based in Australia can tap into countless trading strategies and real-time signals using MetaTrader 4’s in-built copy trading feature – MetaTrader Signals. We found Pepperstone’s MT4 platform to be among the finest offered by ASIC-regulated brokerages, attributing to:

- Pepperstone’s raw pricing (ultra-thin spreads on over 180 trading instruments), deep liquidity and exceptional order execution (under 30 ms)

- No dealing desk execution with no re-quotes

- The platform’s comprehensive technical analysis suite (85 pre-installed indicators plus 28 additional Smart Trader tools)

- The platform’s multiple chart setups and flexible order types

- Access to the powerful Autochartist tool

- The platform’s support of Expert Advisors

- No deposit or withdrawal fees for all account funding options available, and 10 base currencies supported (AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD)

- Pepperstone’s award-winning, professional, 24/5 customer support service

Beyond the basic features of copy trading, MetaTrader signals users can have greater control and flexibility over the copied trades. For example, the MetaTrader platform allows taking control of the take profit and stop-loss orders. Not all mirror trading platforms support this functionality.

Disclaimer: We should note that Pepperstone will have no control over trading signals generated via these third-party social trading platforms, and signals should not be considered investment advice.

Bottom Line – Best Copy Trading Platforms

In summary, Pepperstone grants a streamlined avenue for novice traders to engage with elite copy trading platforms. For those seeking a passive forex market income, MetaTrader 4 is the ideal solution. DupliTrade stands out as the ultimate tool to emulate seasoned traders, and MyFxBook is a cost-free copy trading alternative.

2. eToro - Top Copy And Social Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 2.0

AUD/USD = 1.0

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why We Recommend eToro

We discovered that eToro stands out as a premier social trading platform, especially in copy trading. Boasting one of the world’s most expansive trading communities, it’s a hotspot for traders to exchange insights and strategies. Aussie users don’t just get a platform for copy trading; they tap into a vibrant community that fosters learning and collaboration.

Pros & Cons

- Intuitive platform for copy trading

- Solid choice of markets to trade

- No commission on trades

- No RAW spread accounts

- Fees to withdraw funds

- No support for other platforms

Broker Details

We’ve found eToro to be an exceptional choice for those seeking an integrated social trading platform without needing third-party solutions. This is because eToro isn’t just a broker but a standout player in the social trading scene. Authorised to provide online trading services in the following regions:

- The European Economic Area, where it operates as eToro (Europe) Ltd., regulated by the Cyprus Securities and Exchange Commission (CySEC),

- The United Kingdom, where it operates as eToro (UK) Ltd., regulated by the Financial Conduct Authority (FCA),

- Australia, where it operates as eToro AUS Capital Pty Ltd., is regulated by the Australian Securities and Investments Commission (ASIC).

What sets eToro apart for our Australian-based community is more than just a copy trading platform. It’s an entrance to one of the globe’s most expansive trading communities. Here, seasoned traders and newcomers can exchange insights, share trading strategies, and continually grow their market knowledge.

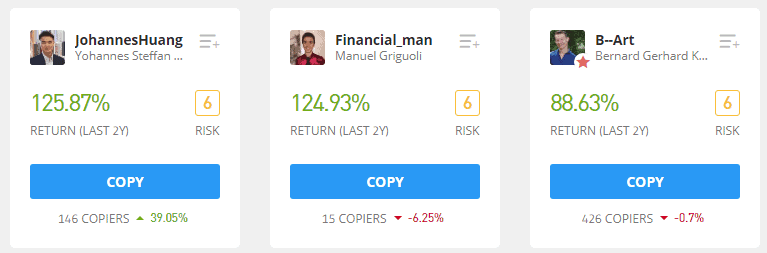

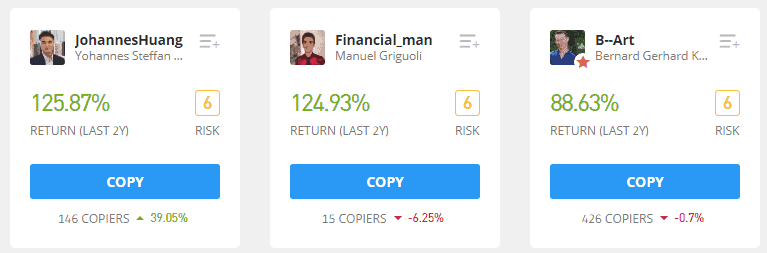

CopyTrader – eToro’s Social Trading Solution With Benefits For Beginners

The CopyTrader feature allows eToro clients to rely on the “wisdom of the crowd.” In other words, you can freely observe how others position themselves in asset classes such as stocks, foreign exchange, cryptocurrencies, etc., and automatically replicate their trading activity without additional costs.

At eToro, the only trading cost comes from the standard bid-ask spread (see table below).

| Forex | Crypto | Commodities | Indices | Stocks &ETFs | |

|---|---|---|---|---|---|

| eToro Spreads Starting From | 1.0 pips | 0.75% | 2.0 pips | 100 pips | 0.09% |

CopyTrader is a golden ticket for newcomers seeking passive earnings by mimicking top-tier traders within eToro’s extensive networks. Busy bees who can’t constantly monitor market shifts will find this feature particularly valuable.

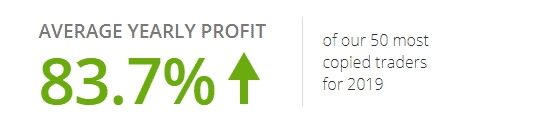

The average yearly profit on eToro’s CopyTrader platform was around 83.7% – based on “50 most copied traders for 2019.”

With CopyTrader, you can search through the broker’s impressive customer base and discover the best traders with the help of specific criteria (risk score, return for the past 12 months, assets under management, number of copiers, and so on).

eToro allows its clients to copy up to 100 traders at one time and modify copied trades as per their desires. Because of the sheer size of eToro’s customer base, every user can access a variety of trading styles (day trading, swing trading, etc.) and tradable instruments (Shares and ETFs, currency pairs such as AUD/USD or EUR/USD, digital currencies such as Bitcoin as well as other derivatives, CFDs, on Stock Indices or Commodities).

eToro’s Popular Investor Program – An Incentive for Seasoned Traders

Seasoned traders aren’t left out, either. Those with a commendable trading history can reap rewards when copied by peers. Through the Popular Investor program, veterans can potentially earn additional income funded by eToro once they meet certain criteria. (For an in-depth look, refer to the table below.)

| Minimum Equity | Track Record | Risk Score | Profile Bio | eToro Feed | |

|---|---|---|---|---|---|

| eToro Requirements | $1,000 | 2-Months | Lower than 7 | Minimum 150 characters | Active feed |

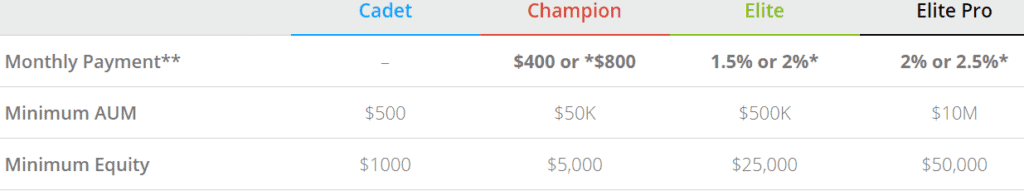

eToro’s program offers four distinct tiers (Cadet, Champion, Elite, Elite Pro), each with unique prerequisites and perks. For instance, to be classified as a Cadet, traders should maintain a minimum equity of $1,000 and have at least $500 as the value of assets their followers manage. However, you must attain the Champion rank to enjoy a monthly income.

Bottom Line – Best Social Trading Network

In summary, eToro masterfully combines the perks of social networking with a high-calibre copy trading platform. For Australians wishing to utilise CopyTrader, there’s a minimum deposit requirement of $50, and it’s worth noting that each copied position must hold a value of at least $1.

3. IC Markets - Good Copy Trading With MetaTrader 4 And 5

Forex Panel Score

Average Spread

EUR/USD = 0.62

GBP/USD = 0.83

AUD/USD = 0.77

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$200

Why We Recommend IC Markets

We liked that IC Markets, based in Sydney since 2007, stands tall among its peers for copy trading with MetaTrader 4 and 5. It’s gained quite a reputation, being one of the world’s largest CFD and Forex brokers when it comes to daily transaction volume. IC Markets is undeniably a top pick for Aussie traders keen on using the MetaTrader platforms for copy trading. Their consistent performance and home-ground advantage make them a reliable choice in the trading landscape.

Pros & Cons

- Low spreads

- No fees on deposits or withdraws

- Multiple copy trading options

- $200 minimum deposit

- Limited product selection

- No proprietary trading app

Broker Details

We’ve identified IC Markets as our top choice for copy trading with MetaTrader 4 and MetaTrader 5. With its roots in Sydney since 2007, IC Markets has become one of the largest CFD and Forex brokers worldwide in terms of daily trading volume.

Regulatory oversight of the brokerage is maintained by:

- International Capital Markets Pty Ltd. – in Australia by the Australian Securities and Investments Commission (ASIC),

- IC Markets (EU) Ltd. – in the European Union by the Cyprus Securities and Exchange Commission (CySEC),

- Raw Trading Ltd. handles the broker’s international operations and is regulated by the Financial Services Authority of Seychelles.

Through the MQL5 community, IC Markets extends MT4 and MT5 trading signal services, enabling Australian traders like us to mirror the trading actions of others in real-time automatically.

Copy Trading on MetaTrader 4 And MetaTrader 5

MetaTrader 4

With its set of valuable features and 20 exclusive trading tools, IC Markets’ user-friendly MetaTrader 4 trading platform may suit the preferences of both new traders and professionals based in Australia and employing various trading styles and strategies (from scalping to Automated Trading Platforms).

The platform combines IC Markets’ raw pricing on:

- 490 financial trading instruments (from currency pairs to cryptocurrencies),

- With a powerful trading execution technology, this allows for no dealing desk execution with no re-quotes and minimised risk of slippage.

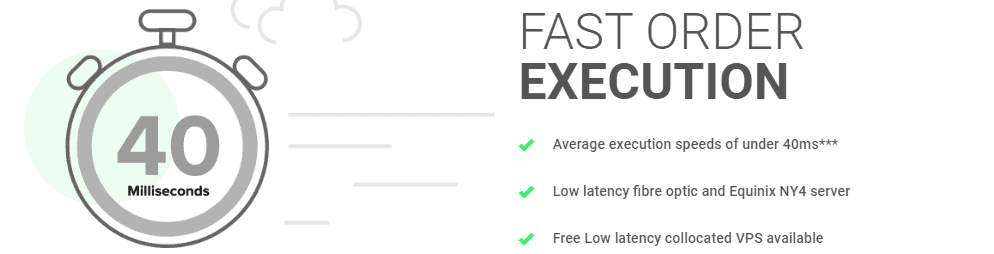

Thanks to IC Markets’ diverse liquidity sources, we, as Australian clients, have been able to experience trading Forex and Spot Metals with incredibly tight spreads, beginning from 0.0 pips. Furthermore, the platform boasts competitive average spreads around the clock for the entire CFD product range. An added advantage is the rapid execution speed – under 40 ms, courtesy of the MetaTrader 4 server in the Equinix NY4 data centre in New York.

MetaTrader 4 Signals

Along with access to deep interbank liquidity and exceptional execution speed, Australia-based clients can also trade Forex by using MetaTrader 4’s trading signals tool. The MQL5 community powers the MetaTrader 4 signals.

You can select from over 3,200 free and paid signals and copy trades in real-time directly into your live trading account without the need to leave the trading platform. You can also test copy trading with MT4 signal service on IC Markets’ free demo account.

The list of signal providers can be accessed in the “Signals” tab of the MetaTrader 4 terminal window, where you can choose a provider and subscribe to his/her trading signals. You can select a signal provider based on certain parameters such as the number of subscribers, trading history, maximum drawdown, or assets under management.

As we discussed earlier, because IC Markets’ MT4 trading platform delivers both reliability and speed, you can take advantage of a variety of trading strategies – from scalping and day trading to swing trading copy trades. At the same time, the online broker’s rich Forex and CFD product list (490 tradable instruments), coupled with the platform’s comprehensive technical analysis tools, allow you to access a multitude of trading systems to copy.

MetaTrader 5 Signals

Australia-based traders can also subscribe to trading signals from a range of providers by using the MQL5 Signals service, fully integrated with IC Markets’ MetaTrader 5 platform. Because of its global cloud infrastructure, MQL5 allows for faster signal execution and is not associated with hidden fees or commissions.

Additional CFD And Forex Copy Trading Solutions For Australian Clients

1) ZuluTrade

Another option includes ZuluTrade, a leading social trading platform. With it, IC Markets clients can choose from 100,000 experienced traders from 192 countries and trade based on their trading signals without any additional charges. Copy-trading with the ZuluTrade platform is suitable for clients who do not have the time to build and test their own trading strategies and those who want to eliminate the emotional factor in Forex and CFD trading.

2) MyFxBook

Last but not least, IC Markets clients can use AutoTrade, an account mirroring service owned by MyFxBook. With it, clients can copy trade directly into their IC Markets MT4 trading account without paying any volume-based fees or installing sophisticated software. They only need to connect their account to MyFxBook and choose the trading system they wish to copy.

Verdict On IC Markets MetaTrader Signal Offering

Overall, IC Markets’ MetaTrader 4 and MetaTrader 5 signals are fairly accessible for automatic copy trading of experienced traders directly to your MetaTrader trading account. IC Markets offers an environmental ideal for the platform as a High Leverage Forex Brokers that offers low fees and favourable customer service. The combination of low fees and a strong trading environment makes IC Markets a logical choice.

4. ZuluTrade - Great Custom Copy Trading Platform

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

N/A

Minimum Deposit

N/A

Why We Recommend ZuluTrade

We liked how ZuluTrade sits among the elite when it comes to social trading platforms globally. Its unique feature sets it apart, allowing users to emulate the trading strategies of seasoned pros in the Forex market and other financial segments. It’s a dynamic tool that allows Aussie traders to leverage the wisdom of experienced peers.

Pros & Cons

- Access 90k+ traders to copy trade

- ZuluRank to find top-performing traders

- Decent range of markets

- Some traders post signals on demo accounts

- Traders are not vetted

- Few brokers provide free access to ZuluTrade

Broker Details

We’ve used ZuluTrade, a top-tier social trading platform globally, allowing traders to mimic the trading patterns of seasoned professionals in the Forex market and other financial sectors.

The platform’s social trading service is overseen by Triple A Experts SA, which now holds a licence from the Hellenic Capital Market Commission (HCMC) in Greece, ensuring it aligns with the EU’s regulatory standards for such service providers. This means brokers collaborating with ZuluTrade aren’t required to have extra regulations to provide this platform to their clients.

How ZuluTrade Works

ZuluTrade does not function on its own. It must be paired with a CFD and Forex broker for clients to utilise the copy trading service. Consequently, the minimum deposit and the bid-ask spread are contingent on the specific broker in use. For instance, with IC Markets, one of the brokers supporting ZuluTrade, the requisite minimum deposit is $200.

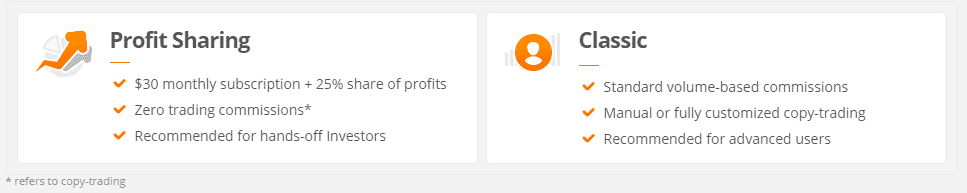

To begin copy trading on ZuluTrade, you must first set up an account (either a Profit Sharing or Classic account) and then choose a broker to execute trades.

Profit Sharing accounts, tailored for newcomers, come with a monthly fee of $30 and a 25% profit share. No additional trading commissions will be charged for copy trading. On the other hand, Classic accounts are designed for experienced traders and are associated with volume-based commissions.

ZuluTrade Signal Providers

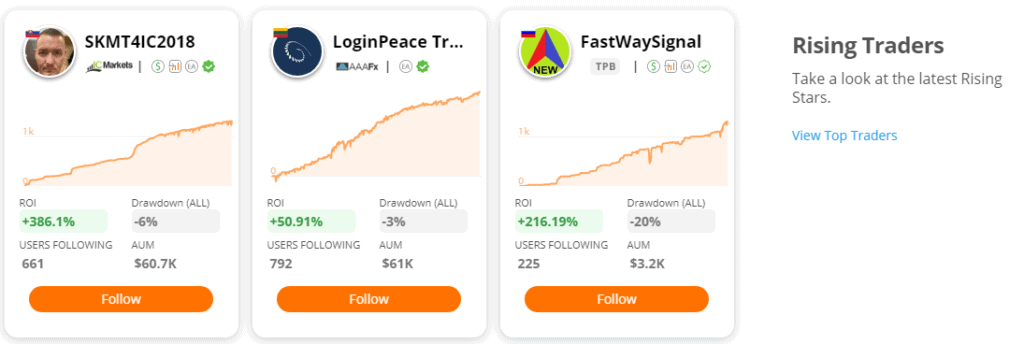

ZuluTrade platform users can be either signal providers or followers. Signal providers can be selected based on their ZuluRank, which aggregates factors such as return on investment, assets under management, drawdown, trading volume, age, log-in frequency, duration of active trades, etc.

To become a signal provider, a trader must meet the following requirements:

- keep his/her maximum historic drawdown lower than 30%,

- have a trading history with ZuluTrade of at least 12 weeks,

- his/her average pip win per trade must exceed 3 pips.

ZuluTrade also features a free and unlimited demo account and offers copy trading options on a range of asset classes – Foreign Exchange, Stocks, Commodities, Stock Indices, and Cryptocurrencies. Additionally, the vast trading network allows for a choice among thousands of signal providers to copy, which could ensure better earnings potential when copy trading.

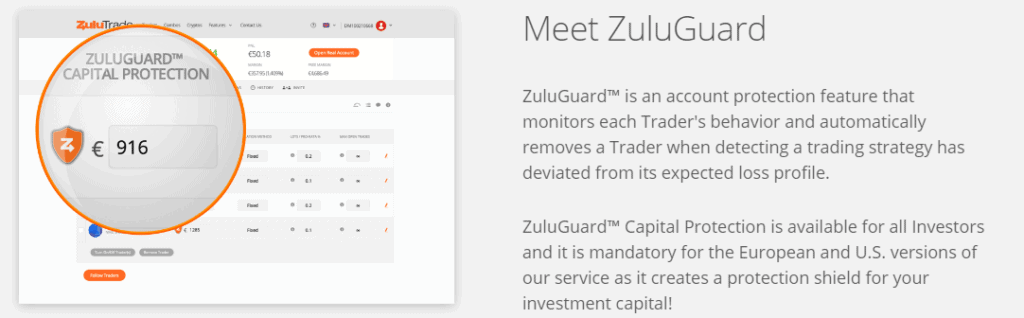

However, we should also mention one significant drawback. Unlike other social trading platforms, ZuluTrade does not require signal providers to trade with their own capital. This means followers may be allocating and risking real money while copying a user’s trading activity on a demo account.

Yet, there is a feature that could help followers mitigate such a risk – the ZuluGuard. Other unique tools include:

- ZuluScript – programming language to create trading robots

- LockTrade – this feature enables traders not to allow any changes to a copied trade

Bottom Line – ZuluTrade Copy Trading Platform

ZuluTrade is distinct from a forex broker; it’s a copy trading platform in sync with the MetaTrader 4 software. Supporting over 37 forex brokers worldwide, ZuluTrade presents the flexibility for traders like us to select the broker that fits our requirements seamlessly.

5. Darwinex - Best Copy Trading Platform And Broker

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

N/A

Minimum Deposit

$500

Why We Recommend Darwinex

We liked how Darwinex seamlessly blends copy trading and online trading solutions, positioning itself as a top-tier all-in-one broker. It ingeniously bridges the gap between seasoned traders in the global financial markets and those offering private seed capital. Moreover, it’s noteworthy that Darwinex operates under the banner of Tradeslide Trading Tech Limited, a firm duly licensed and overseen by the UK’s Financial Conduct Authority (FCA).

Pros & Cons

- Wide choice of trading strategies to follow

- Low spreads and commissions

- Works with MT4/MT5

- Forex pairs offered are limited

- Has withdrawal fees

- High initial deposit ($500)

Broker Details

Having tried out Darwinex, we can vouch for its all-in-one broker solution, seamlessly blending online trading with copy trading functions. Since its inception in 2012, Darwinex has stood out as a cutting-edge online broker, bridging the gap between proficient traders active in worldwide financial markets and private capital seed funding.

Darwinex is the trading name of Tradeslide Trading Tech Limited, a company licenced and regulated by the Financial Conduct Authority (FCA) in the United Kingdom.

| Management Fee | Performance Fee | Investment Opportunities | Invested in DARWINs | DARWIN Providers Earning Potential | |

|---|---|---|---|---|---|

| Darwinex | 1.2% annual fee on invested equity | 20% | + 2,000 DARWINs | +$55M | 15% performance fee on investor profits |

Invest in DARWINs

We can say that what Darwinex offers its clients is not a traditional copy trading platform. Instead of copying the trading activity of other users directly, Darwinex clients have the opportunity to make Dynamic Asset and Risk Weighted Investments, or DARWINs.

A DARWIN represents a tradable asset, which is based either on a trader who trades at Darwinex or on an automated strategy. DARWINs can be bought and sold, and their valuation is tightly related to the performance of that trader or the automated strategy.

Social interactions between traders and investors are not allowed, which is another key difference between Darwinex and traditional social trading platforms.

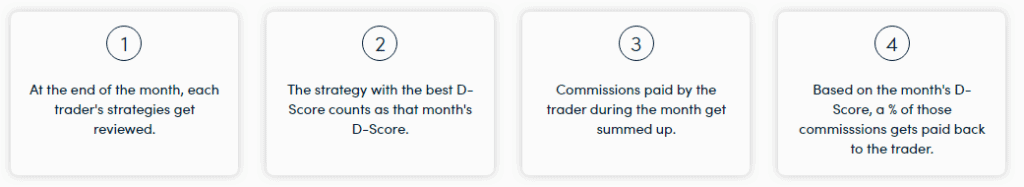

DarwinIA Allocation

To be considered investable, traders must meet specific criteria. Your performance is graded on a 0-10 scale by taking into account parameters such as:

- Experience,

- Risk management,

- Consistency,

- Timing

- and scalability.

All these parameters combined comprise the DARWIN investor appeal (DarwinIA) score or D-Score. Every month, Darwinex allocates up to EUR 7.5 million to the best 120 DARWINs and maintains the allocation for 6 straight months to incentivise traders to trade responsibly and generate consistent returns in the medium term.

The final ranking criteria include the DARWINs’ D-Score over the past 9-18 months, their return during the month of the competition, and their regularity (their monthly activity compared to the average from the prior three months).

Note that the traders’ track record and active trades will not be disclosed to investors or other members of the public. Investors will only be able to invest in traders as DARWINs.

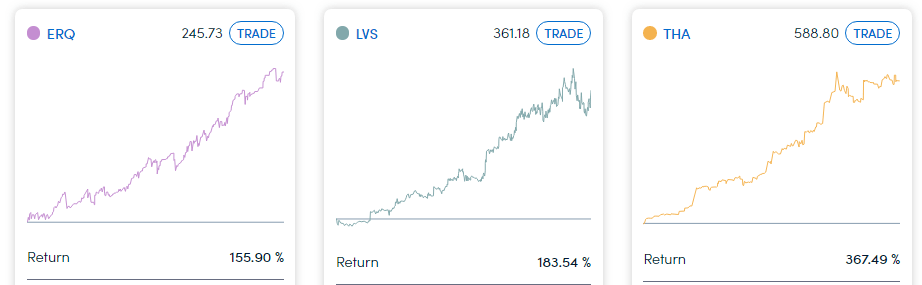

Investment Opportunity in +2,000 DARWINs

In addition, Darwinex lists over 2,000 liquid alpha strategies (DARWINs), both short-term and long-term, in which investors are able to invest. The DARWINs’ underlying instruments include currency pairs, stocks, commodities, and stock indices. Strategies (DARWINs) are never correlated with their underlying markets.

In exchange for Darwinex services, investors will be charged an annual 1.2% fee on their invested equity. Additionally, a 20% performance fee will apply if they profit from DARWINs. 15% of that 20% performance fee will go to DARWIN providers (traders), while the remaining 5% will go to Darwinex. Therefore, traders’ sole incentive is to remain consistently profitable.

Bottom Line – Best Copy Trading Broker

In essence, Darwinex distinguishes itself from the crowd, presenting a fresh take on traditional copy trading platforms. The principles steering DARWINs are tailored to cater to both novice and seasoned traders alike. With a modest initial deposit of just USD 500, you’re all set to venture into DARWINs.

6. MyFxBook - Best To Automate Copy Trading

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

N/A

Minimum Deposit

N/A

Why We Recommend myfxbook

We liked how MyFxBook positions itself at the forefront for those keen on automating their copy trading experience. Aussie traders can effortlessly duplicate a range of trading strategies into their MetaTrader 4 accounts. To kick things off and seek an apt trading strategy, users just need to link their live MT4 account to MyFxBook’s AutoTrade function.

Pros & Cons

- They verify all trading strategies

- Detailed statistics for each strategy

- Test on a demo account

- The interface is outdated and clunky

- Limited signal providers to choose from

- No filter to screen traders to copy from

Broker Details

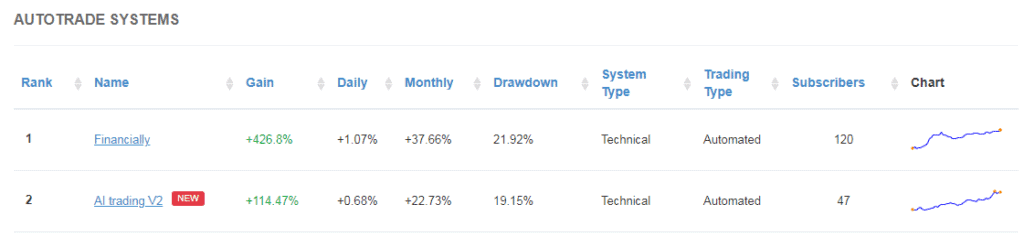

Having experienced MyFxBook firsthand, we consider it a prime choice for the finest automated copy trading software tailored for Australian traders. This platform allows you to mimic an extensive selection of trading systems into their MetaTrader 4 accounts. The process is quite straightforward: link your active MT4 trading account to MyFxBook’s AutoTrade tool. Once that’s done, exploring a suitable trading system to copy can begin.

Note* AutoTrade is a copy trading platform owned and operated by Myfxbook.

MyfxBook Forex Trading Systems

In order to get listed on MyFxBook, all trading systems must meet certain criteria:

- Traders must operate with real money through a verified MetaTrader 4 account linked with MyFxBook,

- Traders must have 3 months of trading history and at least 100 trades,

- Traders’ minimum account balance must be maintained above $1,000,

- Traders’ historical drawdown must be maintained below 50%,

- Traders’ historical return on their account must exceed 10%, and the maximum drawdown,

- Traders’ average pip win per position must be higher than 10 pips,

- Traders’ average time of holding the position must be longer than 5 minutes.

The last two requirements make it quite clear that scalping strategies are not allowed.

We should note that the AutoTrade platform will visualise only proven trading systems and only real-time systems that are traded with real money. This means trading systems used on a demo account will not be listed.

AutoTrade Copy Trading Features

Myfxbook’s AutoTrade will visualise only real data with accurate statistics. This can be useful for you to reduce the high risk associated with CFD trading and to improve their returns. Or, you will not be presented with misleading statistics that point to bottomless drawdowns.

The AutoTrade service is fully automated, thus, all trades will be copied to Australian clients’ trading accounts automatically. Some Forex brokers may provide a reliable VPS service as well, thus, you will not have to rent a VPS of your own.

Here’s a table to guide you through the premier forex brokers providing complimentary VPS services contingent on trading volume and/or initial deposits:

| Pepperstone | IC Markets | ThinkMarkets | FP Markets | IG Markets | |

|---|---|---|---|---|---|

| ForexVPS | Free 3 month VPS subscription | ✘ | ✘ | ✘ | ✘ |

| ForexVPS | Free for minimum 15 Lots traded/month | Free for minimum 15 Lots traded/month | Free for minimum 15 Lots traded/month | ✘ | ✘ |

| NYCservers | 25% off any VPS plan. | Free for minimum 15 Lots traded/month | ✘ | ✘ | |

| Beeks FX VPS | ✘ | Free for minimum 15 Lots traded/month | 15% discount | ✘ | Free if you maintain a minimum account balance of $5,000 |

| Liquidity Connect | ✘ | ✘ | ✘ | -Free for minimum 10 Lots traded/month (Standard Account) -Free for minimum 20 Lots traded/month (Raw Account) | ✘ |

MyFxBook’s tool will also grant you full control to add and remove trading systems from your accounts anytime.

Bottom Line – Best Automated Copy Trading Platform

Overall, AutoTrade by MyFxBook is an active automated copy trading software with over 60,000 clients and 64 AutoTrade systems you can follow. Platforms that are compatible with MyFxBook include MetaTrader 4, MetaTrader 5, cTrader, Strategy Trader, and TradeStation. Should your preferred FX provider support any of these trading platforms, you’re all set to dive into the expansive trading community that MyFxBook nurtures.

7. AvaTrade - Top Copy Trading Platforms Inc. Duplitrade

Forex Panel Score

Average Spread

EUR/USD = 1.9

GBP/USD = 2.0

AUD/USD = 2.0

Trading Platforms

MT4, MT5,

AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

We discovered that AvaTrade provides a diverse range of copy trading options, notably including third-party platforms like DupliTrade alongside its in-house service. It’s not just us taking note; AvaTrade has secured a licence from ASIC here in Australia and from six other regulatory bodies across the globe, vouching for its credibility as a CFD and Forex provider.

Pros & Cons

- Trade with fixed spreads

- Unique and varied strategies to follow

- Access copy trading through MT4

- Limited strategy providers available

- Requires a high deposit to use DupliTrade

- Spreads are higher than average

Broker Details

Having engaged with AvaTrade, we can attest to the versatility they bring by integrating their signature copy trading solution alongside third-party platforms like DupliTrade. As a prominent CFD and Forex entity, AvaTrade is licenced under Australia’s ASIC, further solidifying its credibility with accreditations from six other regulators spanning six continents.

Recognising the evolving needs of traders, AvaTrade presents four leading copy trading avenues, empowering Australian clients to harness market fluctuations:

- AvaSocial

- DupliTrade

- ZuluTrade

- MQL5

| AvaSocial | ZuluTrade | DupliTrade | MQL5 | |

|---|---|---|---|---|

| Minimum deposit | $100 | $500 | $2,000 | $100 |

| Free or Paid Signals | Free Signals | Paid Signals | Free Signals | Free and Paid |

| Social Network | ✔ | ✘ | ✘ | ✘ |

Replicating CFD And Forex Trading Positions With AvaTrade’s Own Copy Trading Platform

AvaTrade’s own trading platform and app, AvaSocial, is a good copy trading solution for both beginners and experienced traders. This platform significantly reduces the learning curve for those venturing into the financial markets, facilitating access to valuable insights from expert traders.

AvaTrade offers AvaSocial as a service in partnership with FCA-regulated Pelican Exchange Limited. With AvaSocial, you will be able to find and connect with successful traders and qualified mentors, discuss with them trading-related matters one-on-one or in a group chat and copy their trading activity with a simple tap.

The app allows you to receive real-time updates on the people you follow and copy trading signals from the palm of your hand.

How To Sign Up With AvaSocial

Signing up for AvaSocial is a simple process of several steps. Clients need to:

- Download the app

- Open a social trading account with AvaTrade

- Input MetaTrader 4 login details

- Specify a tradable asset of their interest

- Fund their social trading account

- Begin copy trading

Other Copy Trading Options Offered By AvaTrade

Along with AvaSocial, the brokerage also offers two more third-party automated trading platforms – DupliTrade and ZuluTrade.

DupliTrade offers simplicity and convenience for both beginners and people who do not have the time to watch market developments closely. With an initial deposit starting from $2,000, you can access an array of top-tier strategy providers, mirroring their trading decisions seamlessly within your MetaTrader 4 and MetaTrader 5 accounts via AvaTrade.

Rest assured, all strategy providers at DupliTrade are audited and vetted and have extensive trading experience. Thus, you can have peace of mind that you will be following genuine professionals.

Furthermore, ZuluTrade, a renowned automated trading platform, lists AvaTrade among its supported brokerages. This platform interfaces directly with both MT4 and MT5 via an API. With a modest investment starting from $500, you can open your copy trading account, gaining access to an extensive network of over 10,000 ZuluTrade signal providers.

Bottom Line – Good Range Of Copy Trading Platforms

Overall, AvaTrade offers diverse signal copy services, the ability to message a trader directly, a quick sign-up process, access to trading mentors, and third-party copy trading platforms ZuluTrade and DupliTrade.

Ask an Expert

Do I have to pay any fees to copy trade on eToro in Australia?

No, eToro offer spread on forex trading, this means the spread is widened in place of commissions