Saxo Capital Markets vs IG Group: Which One Is Best?

Saxo Capital Markets and IG are market makers offering $0 commission accounts and tight spreads for its 90+ currency pairs. but are otherwise quite different. Read our comparison for Saxo Capital Markets vs IG and see why they are different and which broker is better for you.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 10:1

Minor Pairs 20:1

Pro 2: 250:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 10:1

Minor Pairs 20:1

Minor Pairs 16:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Explore our comprehensive comparison, covering the 10 most pivotal trading factors, to discern the nuanced distinctions between Saxo Markets and IG Markets.

- Saxo Markets demands a minimum deposit of $2000, whereas IG Markets allows traders to start with as low as $450.

- While Saxo Markets provides access to over 30,000 Share CFDs, IG Markets offers a selection of over 12,000.

- Saxo Markets does not offer cryptocurrency CFDs to UK retail traders due to FCA regulations, but IG Markets provides access to 12+ cryptocurrency CFDs.

- IG Markets provides a variety of trading platforms, including MT4 and MT5, whereas Saxo Markets primarily relies on its proprietary platforms.

- Saxo Markets offers slightly tighter spreads compared to IG Markets, potentially being a more cost-effective option for some traders.

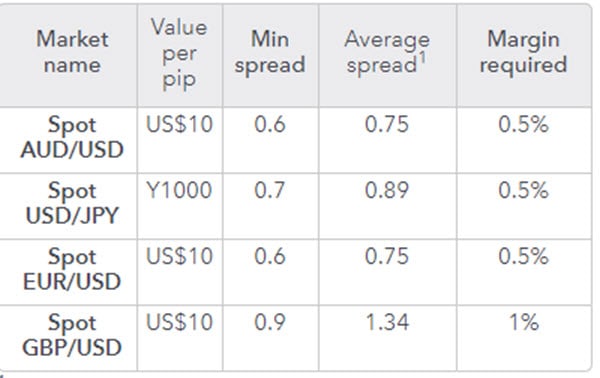

1. Lowest Spreads And Fees: Saxo Markets

| Saxo | IG | CMC | AxiTrader | |

|---|---|---|---|---|

| EUR/USD | 0.6 | 0.6 | 0.7 | 0.44 |

| AUD/USD | 0.5 | 0.6 | 0.7 | 0.42 |

| GBP/USD | 0.7 | 0.9 | 0.9 | 0.85 |

| USD/JPY | 0.6 | 0.7 | 0.7 | 0.62 |

Above is a comparison of Saxo Markets, IG and commission-free accounts that other brokers offer. As one can see, Saxo Markets offers the tightest spreads in this collection of online brokers. So if you are after a ‘market maker’ style broker with the tightest possible spreads, then Saxo Markets might be for you.

Both brokers can offer low volumes because they use a combination of order-driven and quote-driven markets. In the order-driven market, you can place the amount you are willing to buy or sell your currency pairs at.

These orders will be on the books until another trader places an order to sell or buy at the same rate. This is different from a quote where the market maker provides their quote for a short period, and you are free to accept or reject the quote.

The main benefit of the order-driven market is the transparency it offers from traders visible to you; however, sometimes it can be challenging to complete your order if there is not enough liquidity in the order-driven market. Quote-driven will likely mean there is a dealing desk in the process, while the order-driven market has No Dealing Desk Brokers.

Our Lowest Spreads and Fees Verdict

Saxo Markets offers slightly tighter spreads, so might be the best option if you’re looking for the tightest spreads. Saxo Markets, however, do have a high minimum deposit if you wish to open an account with them. IG, on the other hand, offer very similar spreads to Saxo but doesn’t have the same minimum deposit and also offers a greater choice of risk management tools.

Saxo Markets ReviewVisit Saxo Markets

*Your capital is at risk ‘65% of retail CFD accounts lose money’

2. Better Trading Platform: Tie

| Trading Platform | Saxo Capital Markets | IG Group |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | No | No |

| cTrader | No | No |

| TradingView | Yes | Yes |

| Copy Trading | No | Yes |

| Proprietary Platform | Yes | Yes |

Saxo Markets’ major point of difference is that they have built their trading platforms from the ground up. So confident are Saxo Markets that their platforms are quality products that they don’t offer platforms many other brokers offer, such as MetaTrader 4, MetaTrader 5 or cTrader.

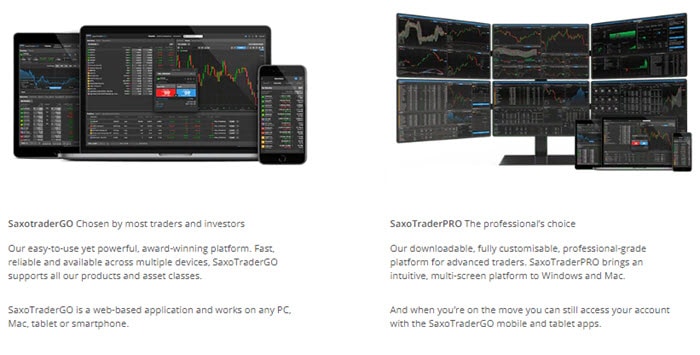

This confidence can be demonstrated by the numerous awards it has won, including the ADVFN platform award for best trading platform. Traders have a choice of two different platforms, these are SaxoTraderGO and SaxoTraderPRO. Both platforms are available to Classic account users.

SaxoMarkets Trading Platforms

SaxoTraderGO – For Trader and Investors (Web-Based)

SaxoTraderGo is a web-based platform built to HTML5 standards and is the platform most traders use. The platform allows for smooth trading across multiple devices across desktops, laptops, mobiles and tablets. With this platform, you can trade across all the asset classes Saxo Markets offers, which means over 35,000 instruments.

The platform is highly customisable, which means charts, live feeds, news features, watch lists, and sentiment indicators can be set to suit your needs. The user interface can also be tailored to your preferences. This means you can set the interface to show as many technical indicators, reporting metrics and charting tools as you may desire.

SaxoTraderGo offers the following

- Charts that offer 47 indicators and 17 drawings

- 12 fields for watchlists

- Social trading and copy trading

- Technical and fundamental analysis tools

- Integrated news and analysis research. Saxo Markets has its own in-house research team.

- Trade Ticket – reduces the number of clicks to implement a trade order by including information on the ticket itself.

SaxoTraderPro – For Professionals (Desktop)

This platform can be used by all traders however is designed mostly for traders who want to achieve more with the platform. SaxoTraderPro gives traders the ability to set up 6 screens at once while trading. Unlike SaxoTraderGO, this platform is not web-based but instead needs to be downloaded onto Mac and Windows or added as an App for mobile and tablet devices as it is built for desktops.

Some main features include:

- Extra order types, including algorithmic orders

- Real-time netting or end-of-day netting

- Caters to the professional trader

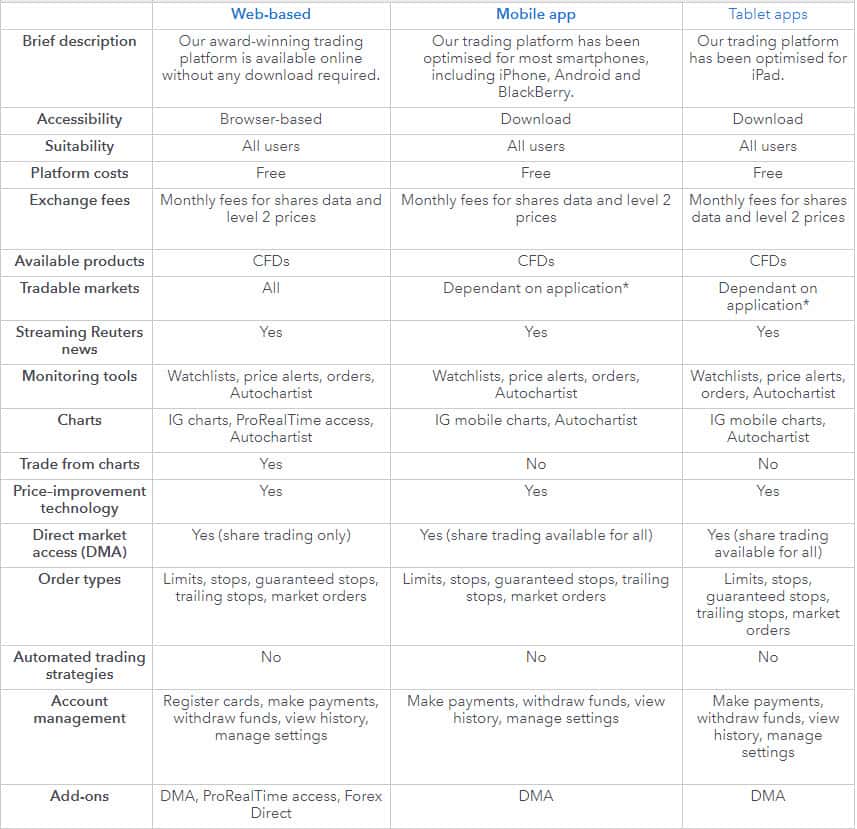

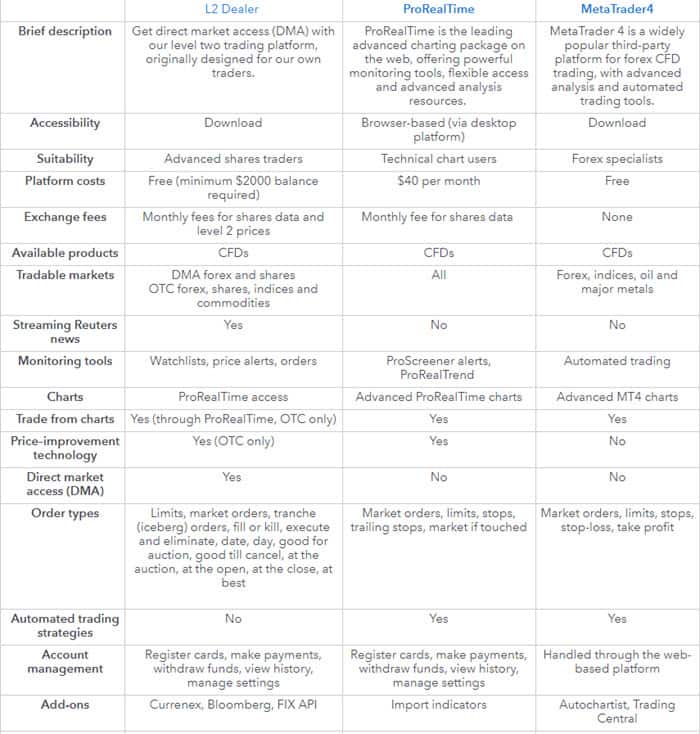

IG Markets Trading Platforms

Like Saxo Markets, IG has its own platform, but they take things further. As they offer a choice of 6 different platforms.

The main platforms to note are:

- MetaTrader 4 (MT4): This is the world’s most popular trader platform, both with brokers and traders. Key features include:

- Best for forex trading, indices and commodities but not ideal for share trading.

- The reputation of the world’s most popular platform is built on its offering of all the trading features, such as charts and indicators that you will need

- Expert Advisors (automated trading, robots, algorithmic trading)

- Not locked into brokers’ trading ecosystem. Many brokers offer MT4, so you can switch brokers more easily.

- IG’s Proprietary Platforms:

- Available on the web and app

- Can integrate with Direct Market Access (DMA) for share trading as long as you have a Forex Direct account

- Good for all CFD types

- No Automated trading

- Great for streaming Reuters news

- L2 Dealer:

- Best for share trading

- Designed for Direct Market Access (DMA) trading

- Requires a Forex Direct Account. This is available for Australian traders however other countries may not have this option as they will need a professional/institutional account

- Wide range of order types

- Access to ProRealTime

- Free as long as your account has $2000 balance

- ProRealTime:

- Monthly fee

- Best for those needing advanced charts and monitoring tools

- Browser-based

IG Markets Trading Platforms summary

Our Better Trading Platform Verdict

Saxo Capital Markets platform is actually one of the best ‘self-made’ platforms in the industry, and we highly recommend it. IG also offers an excellent proprietary platform that is just as good as SaxoTrader. The main issue with proprietary platforms is that they limit your future ability to change providers. We, therefore, recommend a broker that offers MT4 or MT5, such as Pepperstone.

Saxo Markets ReviewVisit Saxo Markets

*Your capital is at risk ‘65% of retail CFD accounts lose money’

3. Superior Accounts And Features: IG Group

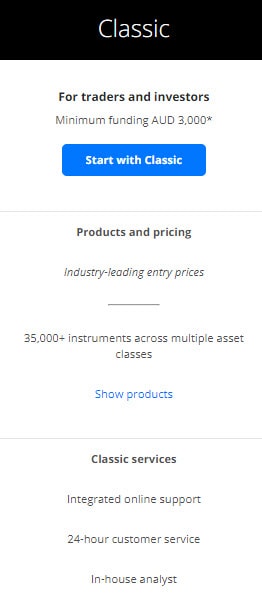

Saxo offers 3 different types of trading accounts. The classic account has a minimum deposit requirement of AUD$3000. This account will be the focus of our comparison review. Saxo offers two other accounts, Platinum and VIP. These accounts have a minimum deposit requirement of at least $50,000, which we consider to be too high for the average trader.

IG also offers several accounts; however, we will only focus on the Standard Account. Professional accounts, like the Saxo Markets Platinum and VIP, have minimum entry requirements to be eligible. To be qualified as a professional, you need net assets of $2.5 million or a gross income of at least AUD$250,000. The IG Standard account does not have a minimum deposit requirement. You will still need to have minimum available funds to cover margin requirements.

Key Account details

Saxo Markets Classic Account

Saxo Capital Markets Classic Account

- $3000 minimum deposit

- Choice of 182 currency pairs / 140 forex forwards / 40 forex options

- Market Maker

- No commissions

- In-house analyst

- Integrated online support

- 24/5 hour customer support

- The option of a limited-risk account

- Automatic upgrade to Platinum and VIP when you meet trade volumes (which can mean tighter spreads).

- Scalping (no hedging)

IG Personal Account

- No minimum deposit/balance to open an account

- Market maker (except with DMA)

- Over 90 currency pairs / weekly fx options/currency futures

- No commissions

- 24/7 hour customer support

- The option of a limited-risk account

- The option of Direct Market Access (DMA) trading execution via Forex Direct Account. (available to Australians only).

- Hedging

- Scalping

- Risk management tools

- Cash rebate program

| Saxo Capital Markets | IG Group | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | No | Yes |

| Swap Free Account | No | No |

| Active Traders | Yes | No |

| Spread Betting (UK) | No | Yes |

Our Superior Accounts and Features Verdict

While Saxo Capital Markets offers a comprehensive platform and a wide array of instruments, IG Markets stands out for its flexibility in platform choices and a more accessible entry point with no minimum deposit, potentially making it the preferable choice for traders seeking varied platform options and lower initial investment requirements.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

4. Best Trading Experience And Ease: IG Group

When it comes to trading experience and ease, both Saxo Capital Markets and IG have their unique strengths. Saxo Capital Markets is known for its proprietary platforms, which are tailored to provide a seamless trading experience across various devices. On the other hand, IG Markets offers a variety of trading platforms, including the popular MT4 and MT5, catering to a wide range of trader preferences.

• Platform Diversity: IG Markets stands out with its choice of six different platforms, ensuring that traders have options that suit their trading style.

• User Experience: Saxo Capital Markets’ platforms, especially SaxoTraderGO, are designed for smooth trading, allowing customization to suit individual needs.

• Accessibility: IG Markets is notable for its flexibility, with platforms that cater to both beginners and professionals.

• Innovative Features: Both brokers continuously update their platforms, integrating advanced tools and features to enhance the trading experience.

From our own testing, it’s evident that the best trading experience is not just about the platform but also about the range of instruments, customer support, and overall user satisfaction. Both brokers have shown commitment to providing top-notch services, but nuances in their offerings can make a difference based on individual preferences.

Our Best Trading Experience and Ease Verdict

While both brokers offer exceptional trading experiences, IG Markets slightly edges out with its diverse platform options and user-friendly interface, making it the preferred choice for those seeking the best trading experience.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

5. Stronger Trust And Regulation: IG Group

IG Group Trust Score

Saxo Markets Trust Score

Saxo Markets and IG are both multi-regulated, meaning the leverage you’ll be able to trade with is dependent on the subsidiary you are trading with.

For example, if you are trading forex with either Best Forex Brokers In Australia (ASIC) or European-regulated entities such as the UK (FCA) or Switzerland (FINMA), the maximum leverage available will be capped at 30:1.

Elsewhere, both these brokers offer very low leverage levels by online broking industry standards. The highest leverage available is available via IG’s Dubai subsidiary, where the leverage of 50:1 is permitted by the DFSA.

To be more accurate, both Saxo Capital Markets and IG offer margin rates rather than leverage. These are essentially the same thing, but the margin is expressed as %. This % essentially defines the minimum capital you require to have in your account in order to open your position.

Saxo Capital Market Margins

| Market Name | Margin | Min Trade Size | Commission Threshold |

|---|---|---|---|

| AUD/USD | 2.0% | AUD $1,000 | AUD $100,000 |

| USD/JPY | 2.5% | USD $1,000 | USD $50,000 |

| EUR/USD | 1.5% | EUR 1,000 | EUR 50,000 |

| GBP/USD | 4.0% | GBP 1,000 | GBP 50,000 |

IG Margins

Low leverage can be both good and bad. Low ability to take on debt can help protect you against excessive loss; however, it can mean you will miss opportunities to make worthwhile gains for your investments. Forex movements tend to be only marginal, so larger leverage can be valuable in achieving significant profits.

We always prefer brokers that offer larger leverage. The most important aspect is to understand the risks when trading with leverage and use this capital responsibly. This means using leverage when you have done your research and have confidence your investments will lead to favourable returns.

| Saxo Capital Markets | IG Group | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) MAS (Singapore) FINMA (Switzerland) | ASIC (Australia) FCA (UK) BaFin (Germany) FINMA (Switzerland) NFA/CFTC (USA) CYSEC (Cyprus) MAS (Singapore) FMA (New Zealand) |

| Tier 2 Regulation | SFC | JFSA (Japan) DFSA (Dubai) |

| Tier 3 Regulation | BMA (Bermuda) FSCA (South Africa) |

Our Stronger Trust and Regulation Verdict

Both brokers offer an ‘ordinary’ margin (leverage), with IG slightly superior.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

6. Most Popular Broker – Saxo Markets

Saxo Markets gets searched on Google more than IG Group. On average, Saxo Markets sees around 165,000 branded searches each month, while IG Group gets about 97,080 — that’s 41% fewer.

| Country | Saxo Markets | IG Group |

|---|---|---|

| France | 18,100 | 14,800 |

| Netherlands | 14,800 | 480 |

| Spain | 6,600 | 110 |

| United Kingdom | 4,400 | 2,900 |

| Italy | 3,600 | 8,100 |

| Singapore | 3,600 | 1,000 |

| Peru | 3,600 | 50 |

| Argentina | 2,900 | 50 |

| Turkey | 2,900 | 320 |

| Poland | 1,900 | 90 |

| Switzerland | 1,900 | 320 |

| Greece | 1,900 | 140 |

| India | 1,900 | 4,400 |

| Germany | 1,600 | 5,400 |

| Australia | 1,600 | 6,600 |

| United States | 1,600 | 2,900 |

| Brazil | 1,600 | 170 |

| Portugal | 1,300 | 320 |

| Mexico | 1,300 | 90 |

| Hong Kong | 1,300 | 5,400 |

| Algeria | 1,300 | 90 |

| Colombia | 1,000 | 70 |

| Chile | 1,000 | 50 |

| Malaysia | 880 | 480 |

| Japan | 880 | 140 |

| Indonesia | 720 | 110 |

| United Arab Emirates | 590 | 260 |

| Sweden | 590 | 3,600 |

| Ecuador | 480 | 20 |

| Taiwan | 390 | 480 |

| Canada | 390 | 320 |

| Thailand | 320 | 320 |

| Morocco | 320 | 260 |

| Saudi Arabia | 260 | 1,000 |

| Pakistan | 260 | 1,000 |

| Venezuela | 260 | 10 |

| Bolivia | 260 | 10 |

| Austria | 210 | 480 |

| South Africa | 170 | 2,400 |

| Ireland | 170 | 90 |

| Vietnam | 170 | 260 |

| Philippines | 140 | 90 |

| Dominican Republic | 140 | 30 |

| Cyprus | 110 | 70 |

| Egypt | 110 | 50 |

| Nigeria | 110 | 90 |

| Mauritius | 90 | 30 |

| New Zealand | 70 | 170 |

| Bangladesh | 70 | 50 |

| Cambodia | 70 | 30 |

| Uzbekistan | 70 | 10 |

| Costa Rica | 50 | 10 |

| Sri Lanka | 50 | 40 |

| Ethiopia | 50 | 10 |

| Panama | 40 | 10 |

| Kenya | 40 | 90 |

| Jordan | 30 | 20 |

| Ghana | 20 | 20 |

| Uganda | 20 | 10 |

| Tanzania | 10 | 20 |

| Botswana | 10 | 20 |

| Mongolia | 10 | 10 |

Saxo Markets - France

Saxo Markets - France

|

18,100

1st

|

IG Group - France

IG Group - France

|

14,800

2nd

|

Saxo Markets - Netherlands

Saxo Markets - Netherlands

|

14,800

3rd

|

IG Group - Netherlands

IG Group - Netherlands

|

480

4th

|

Saxo Markets - UK

Saxo Markets - UK

|

4,400

5th

|

IG Group - UK

IG Group - UK

|

2,900

6th

|

Saxo Markets - Singapore

Saxo Markets - Singapore

|

3,600

7th

|

IG Group - Singapore

IG Group - Singapore

|

1,000

8th

|

Similarweb shows a different story when it comes to February 2024 website visits with Saxo Markets receiving 1,047,000 visits vs. 9,438,000 for IG Group.

Our Most Popular Broker Verdict

Saxo Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

Saxo Markets ReviewVisit Saxo Markets

*Your capital is at risk ‘65% of retail CFD accounts lose money’

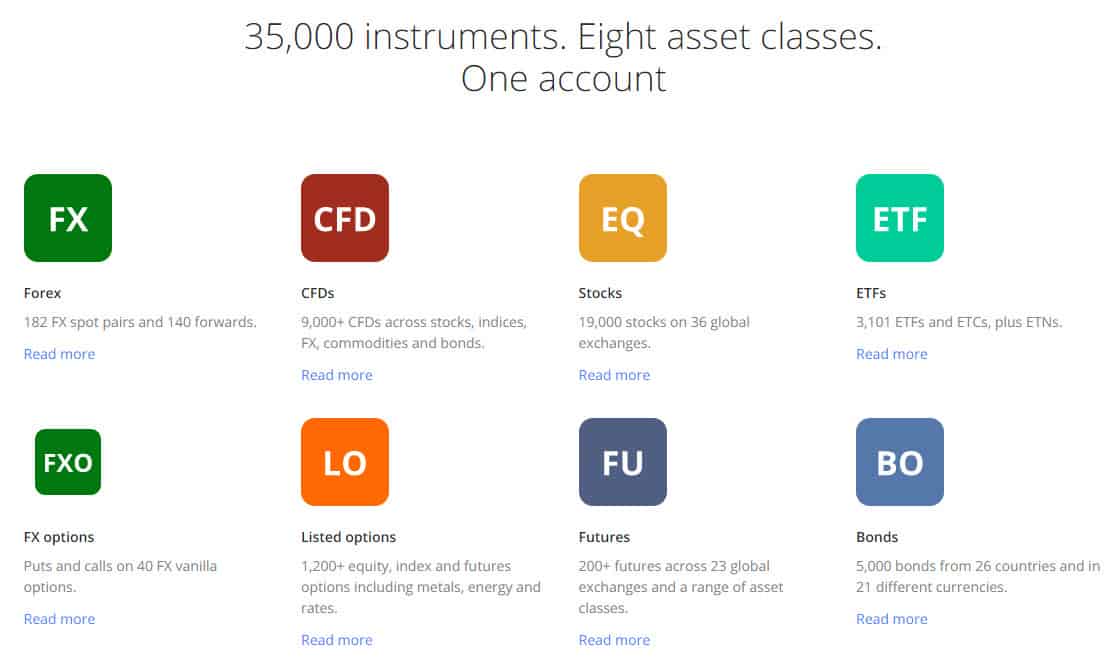

7. Top Product Range And CFD Markets: Tie

Saxo Capital Markets CFDs

This broker offers an extensive range of derivatives across multiple asset classes. Here, you can find some 35,000 instruments across 8 different asset classes.

When it comes to CFDs, Saxo Capital Markets offers the following:

- Stocks – 8,800 single stocks and 675 ETFs

- Index Trackers – 29 index tracking CFDs

- Bonds – 5 government bonds

- Commodities 0 19 commodities CFDs, including both hard and soft commodities.

- Index Options – 15 index options

CFDs – IG

IG, like Saxo, also offers a very extensive range of CFDs.

In addition to the above, IG also offers ETFs/ETPs, IPOs Interest Rates and Bonds.

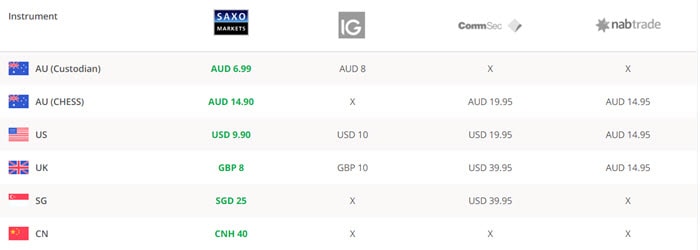

Shares Comparison

Purchasing shares with Saxo appears to be slightly cheaper. When purchasing Australia shares, issuer sponsored shares are $6.99 vs $8 for IG. IG does not offer a CHESS share option. While Saxo CHESS shares are more, we believe they are worth considering, as they will help reduce administrative hassles when buying and selling shares.

Our Top Product Range and CFD Markets Verdict

Both brokers have extensive CFDs, and both should adequately cover all your trading needs. When it comes to shares, Saxo offers both Issuers and Chess sponsored shares, unlike IG, which only offers ‘Issuers sponsored’ shares, which may present a reason to choose Saxo Capital Markets.

Saxo Markets ReviewVisit Saxo Markets

*Your capital is at risk ‘65% of retail CFD accounts lose money’

8. Superior Educational Resources: IG Group

Saxo Capital Markets:

- Offers beginner, intermediate, and expert resources.

- Provides market research and analysis.

- Features in-house analysts for expert insights.

- Conducts webinars and online seminars for continuous learning.

- While they lack eBooks and a glossary, they do offer YouTube materials and videos for visual learners.

IG:

- Comprehensive educational suite catering to beginners, intermediates, and experts.

- Provides in-depth market research and analysis.

- Features in-house analysts for expert insights.

- Offers webinars, online seminars, and online classrooms.

- Provides eBooks and other downloadable materials.

- Includes a glossary for trading terms and YouTube materials for visual learners.

Our Superior Educational Resources Verdict

Based on our team’s testing, IG offers superior educational resources with a score of 9, making it the top choice for traders seeking comprehensive learning materials.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

9. Superior Customer Service: IG Group

Customer Support – IG

IG customer support is more extensive than Saxo Markets. Support is available every day of the week, though hours are limited on Saturdays. You can reach out to IG support via Live chat, phone, email and even Twitter. They also have a forum where you can ask questions to the IG community.

Customer Service – IG

Education

- Online Trading Courses / IG Academy. IG has 8 training courses for all levels of users. That covers a wide range of trading areas, including trading psychology, understanding risk, and how to trade. This series can also be downloaded to your mobile via the IG Academy app. These courses are interactive and include infographics and quizzes.

- Live sessions – IG hosts trading webinars and in-person seminars where you have the opportunity to engage with experts and ask questions you may have.

Other education tools:

- News and Analysis – here, you can receive insights into different strategies based on the latest trading news.

- Financial Events – Advice on upcoming financial events that may influence your trading decisions.

Demo Account:

IG offers a demo account, which gives you access to $20,000 of virtual funds. It is important to be aware that IG demo accounts do not include slippage and do not reject your positions if size or price is insufficient, which are important considerations when trading in the real world.

Customer Support – Saxo Capital Markets

Saxo Markets’ customer support is somewhat unusual in that they do not offer a live chat service. Live chat is a standard offering from nearly all online brokers. Saxo Capital Markets, however, offers phone and email support throughout the standard trading week (i.e., Monday to Friday).

Saxo Capital Markets provides an extensive customer support section where you can find just about all the answers you may be looking for. This includes answers to frequently asked questions and the ability to browse by topic.

Customer Service – Saxo Capital Markets

Saxo Markets provides extensive research and education for its clients. Many of these features are integrated into their platform. Saxo Capital Markets is a specialist in-house team of experts providing good research and education content.

The following research is available and can be in the form of articles, videos or chart analysis.

- Morning Call

- Market analysis and news

- Predictions

- Quarterly Outlook

- Expert strategies

Research:

Trading education includes video courses and webinars.

- Video series – This covers topics for each type of trading medium such as stocks, CFDs or commodities. These videos will generally go for 10 to 15 minutes.

- Webinar series – This looks in depth at the SaxoTrading platform and various trading topics and opportunities rather than actual education on how to trade.

- Events – Sometimes, Saxo Markets might host conferences where traders can get together and learn from experts about various topics.

Demo Account:

Saxo Capital Markets provides a free 20-day demo account which comes with $100,000 of virtual money. You can practice with either SaxoTraderGo or SaxoTraderPro platforms.

Our Superior Customer Service Verdict

Both brokers offer great customer support and service tools. IG customer support not only is available for more hours but also provides more mediums to contact them, so we recommend IG. We also believe that IG education and research tools are superior.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

10. Better Funding Options: Tie

Saxo Capital Markets Funding

Saxo Markets only offers 3 ways to find your account. These are Visa and MasterCard for debit and credit transfers, bank transfers and personal cheques. Saxo Capital Markets does not charge to deposit or withdraw; however, there is a USD 100,000 daily limit and a 30-day USD 160,000 limit. It is interesting to note that Saxo Markets does not offer any eWallet options such as PayPal, BPay and the like.

IG Markets Funding

IG allows the following deposit methods. Visa, MasterCard, PayPal and BPay, in addition to the usual Bank Transfer. There is a 1% fee for Visa credit card and PayPal transactions and 0.5% for MasterCard credit card transactions. The fee is 1.5% for non-AUD transactions. There is a minimum $450 deposit for card transactions.

There is a limit of AUD 35,000 you can withdraw to your card.

Our Better Funding Options Verdict

Saxo Capital Markets provides limited funding options; however, it does not have fees or minimum deposits. So it comes down to if you prefer to use cards or e-wallets for funding.

Saxo Markets ReviewVisit Saxo Markets

*Your capital is at risk ‘65% of retail CFD accounts lose money’

11. Lower Minimum Deposit: IG Group

Entering the world of forex trading can be both exciting and daunting. One of the primary considerations for many traders, especially those just starting, is the initial deposit requirement. A lower minimum deposit can be a gateway for beginners, allowing them to test the waters without committing a significant amount of capital. Both Saxo and IG have structured their deposit requirements to cater to a diverse range of traders, from novices to seasoned professionals.

The table below offers a clear comparison of the minimum deposit amounts required by each broker:

| Broker | Account Type | Minimum Deposit |

|---|---|---|

| Saxo | Classic | $100 |

| Platinum | $300,000 | |

| VIP | $1,500,000 | |

| IG | CFD Account | $0 |

| DMA | $450 |

While the initial deposit is a crucial factor, it’s equally important to weigh other aspects, such as the broker’s trading platforms, customer service, and overall trading conditions. Always remember to consider the broker’s reputation and regulatory standing when making your final decision.

Our Lower Minimum Deposit Verdict

IG offers a more accessible entry point with a $0 minimum deposit for their CFD Account, making it an attractive option for beginners. However, for traders looking for premium services, Saxo’s tiered deposit system provides flexibility based on the trader’s preferences and financial capacity.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

Is Saxo Capital Markets or IG Group The Best Broker?

IG Markets is the winner because of its comprehensive offerings, user-friendly platform, and accessibility for both beginners and experienced traders. The table below summarises the key information leading to this verdict:

| Criteria | IG Markets | Saxo Markets |

|---|---|---|

| Lowest Spreads And Fees | ❌ | ✅ |

| Better Trading Platform | ✅ | ✅ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ❌ |

| Top Product Range And CFD Markets | ✅ | ✅ |

| Superior Educational Resources | ✅ | ❌ |

| Superior Customer Service | ❌ | ✅ |

| Better Funding Options | ✅ | ✅ |

| Lower Minimum Deposit | ✅ | ❌ |

IG Group: Best For Beginner Traders

For those just starting out in the trading world, IG Group offers a more accessible and user-friendly platform, making it the ideal choice for beginner traders.

Saxo Markets: Best For Experienced Traders

For seasoned professionals looking for advanced features and a comprehensive product range, Saxo Markets stands out as the preferred broker.

FAQs Comparing Saxo Markets vs IG Group

Does IG Group or Saxo Markets Have Lower Costs?

IG Markets generally offers more competitive pricing. Both brokers have their own pricing structures, but IG Markets often edges out with tighter spreads. For a detailed comparison of spreads and commissions, you can check out this comprehensive guide on Lowest Commission Brokers. It’s always essential to consider the overall trading costs, including non-trading fees and any additional charges.

Which Broker Is Better For MetaTrader 4?

Both IG Markets and Saxo Markets support MetaTrader 4, but IG Markets provides a more seamless integration with the platform. MetaTrader 4 is a popular choice among traders for its user-friendly interface and advanced charting tools. If you’re keen on diving deeper into MT4 offerings, this list of the best MT4 brokers might be of interest.

Which Broker Offers Social Trading?

IG Markets offers a robust platform for social trading, allowing traders to follow and copy the strategies of experienced traders. Social trading has become increasingly popular as it provides an opportunity for less experienced traders to benefit from the strategies of market veterans. For those interested in exploring more about social trading platforms, here’s a comprehensive review of the best social trading platforms.

Does Either Broker Offer Spread Betting?

IG Markets offers spread betting services, allowing traders to speculate on price movements without owning the underlying asset. Spread betting is a tax-efficient way of trading, especially popular in the UK. For those interested in exploring more about this form of trading, here’s a comprehensive guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Saxo Markets stands out for Australian forex traders. They offer a robust platform, competitive pricing, and are ASIC regulated, ensuring a high level of trust and security for Australian traders. While both brokers have a significant presence in the Australian market, Saxo Markets, being founded overseas, brings a global perspective to the Australian trading community. For a broader look at the best options for Australian traders, you can check out this list of the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

From my perspective, IG Markets is the superior choice for UK forex traders. They are FCA regulated, which provides an added layer of trust and security for UK-based traders. While both brokers offer services in the UK, IG Markets, being founded in the UK, has a deep understanding of the local market and its nuances. For those keen on exploring the Best Forex Brokers In UK, here’s a comprehensive review of the best forex brokers in UK.

Related Forex Broker Comparison Tables

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert