CMC Markets vs OANDA: Which One is Best?

Both CMC Markets and OANDA are market makers who offer their own trading platforms and MetaTrader 4. CMC offers 9500 CFD products and 348 forex currency pairs starting from 0.3 pips for EUR/USD. OANDA offers 2 account types, fewer CFDs, but 70 forex pairs with low spreads from 0.1 pips.

This review is not intended for U.S. traders. For details relevant to the U.S. market, please see our OANDA U.S. Review.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 33:1

Minor Pairs 16:1

Minor Pairs 33:1

Minor Pairs 10:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most essential trading factors between CMC Markets and OANDA.

- CMC Markets offers a vast range of 9,500 CFD products, while OANDA provides fewer CFDs but 70 forex pairs.

- OANDA boasts spreads as low as 0.1 pips for EUR/USD, whereas CMC Markets starts from 0.3 pips for the same pair. CMC Markets is considered the clear winner for tighter spreads on most major currency pairs compared to OANDA.

- OANDA provides a Standard or Premium retail investor account, while CMC Markets offers a choice between a CFD or Corporate account.

1. OANDA: Lowest Spreads And Fees

Both brokers offer a diverse range of currency pairs; customers of OANDA can trade 70 different fx pairs, while CMC Markets have access to a staggering 348 foreign exchange markets.

| Standard Account | CMC Markets Spreads | OANDA Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.53 | 1.2 | 1.7 |

| EUR/USD | 1.3 | 0.9 | 1.2 |

| USD/JPY | 1.3 | 1.9 | 1.5 |

| GBP/USD | 1.5 | 1.78 | 1.6 |

| AUD/USD | 1.5 | 1.54 | 1.6 |

| USD/CAD | 1.5 | 2.1 | 1.9 |

| EUR/GBP | 1.5 | 1.52 | 1.5 |

| EUR/JPY | 1.7 | 3.41 | 2.1 |

| AUD/JPY | 1.9 | 2.99 | 2.3 |

Standard Account Analysis Updated December 2025[1]December 2025 Published And Tested Data

When it comes to standard account spreads, both CMC Markets and OANDA have their strengths. CMC Markets offers a spread of 1.3 for EUR/USD, which is slightly lower than the industry average of 1.2. However, OANDA outperforms both CMC Markets and the industry average with a spread of just 0.92.

In the case of USD/JPY, the situation is quite similar. CMC Markets has a spread of 1.3, which is just a hair above the industry average of 1.4. Again, OANDA shines with a spread of 0.92, significantly lower than both CMC Markets and the industry average.

But let’s not rush to conclusions. When we look at GBP/USD, CMC Markets has a spread of 1.5, which is slightly lower than the industry average of 1.6. OANDA, while still competitive, has a slightly lower spread of 0.9.

We built a tool to show how smaller spreads affect fees. Enter your base currency, trade size, and the pair to calculate the cost.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘69% of retail CFD accounts lose money’

Other Fees

Both CMC Markets and OANDA do not charge any fees for deposits and withdrawals. For inactive accounts, their respective fees are as follows:

- CMC Markets: $15 per month after 12 months

- OANDA: $10 per month after 12 months

Our Lowest Spreads and Fees Verdict

OANDA seems to be the cheaper option. However, it’s important to remember that spreads can vary based on a variety of factors, including market conditions and the specific account type. As always, I recommend doing your own research and considering all the factors that are important to you before choosing a broker.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

2. Tie: Better Trading Platforms

OANDA and CMC Markets have similar platform offerings. Both online brokers offer a choice of MetaTrader 4 (MT4) and proprietary trading platforms, with neither broker offering MetaTrader 5 (MT5) or cTrader. Unfortunately, both brokers do not offer any social trading features, with no third-party providers available such as Myfxbook or ZuluTrade available.

| Trading Platform | CMC Markets | OANDA |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | No | No |

| cTrader | No | No |

| TradingView | No | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

CMC Markets’ proprietary software, Next Generation, is available in a Standard or Advanced format, with both versions offering advanced trading and charting tools. Next Generation is available as a desktop platform, web-based platform, as well as iPhone, iPad and Android trading apps. Features available on the desktop version of Next Generation include:

- 115 technical indicators and drawing tools

- 70 chart patterns

- 12 chart types

- Client Sentiment Tool

- Pattern Recognition Scanner

- Price Projection Tool

- One-click trading

OANDA’s proprietary platform, OANDA Trade is a fully customisable interface available as a desktop, web or mobile trading platform. Technical analysis tools available on OANDA Trade include:

- 50 drawing tools

- 10 chart layouts

- 10 chart types

- up-to-the-minute market analysis and news

Although the intuitive design makes it excellent for those new to trading, advanced traders may prefer MT4 due to the lack of Expert Advisors and advanced technical tools offered on OANDA Trade.

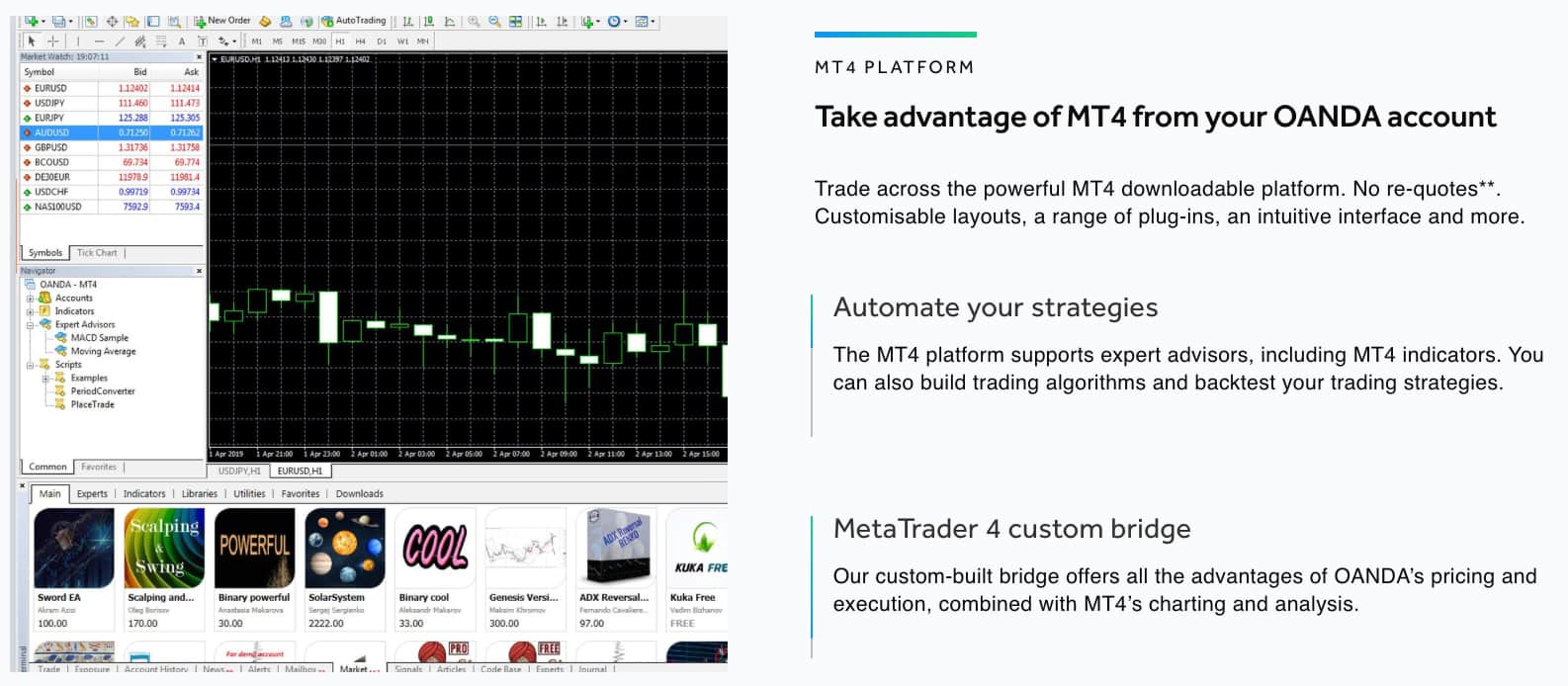

MetaTrader 4

Many traders prefer MetaTrader 4 over online brokers’ proprietary trading platforms as they offer Expert Advisor functionality. MT4 is the gold standard of forex trading platforms, with Expert Advisors allowing for sophisticated algorithmic strategies to be implemented when trading with both CMC Markets or OANDA. Expert Advisors can be created using MQL4 (MetaQuotes Language 4) or downloaded from online libraries. Advantages of using MT4 include:

- 50+ inbuilt technical indicators

- 9 timeframes

- Expert Advisors (MQL4)

- Back-testing

OANDA also offers a proprietary plug-in for MT4 to enhance technical analysis. The additional features include access to intraday market scanning, pattern recognition tools, client sentiment data and automated alerts.

MetaTrader 4 is available as a desktop platform, webtrader platform, as well as iOS and Android mobile apps with both CMC Markets and OANDA.

Our Better Trading Platform Verdict

When comparing the trading platforms offered by both brokers, CMC Markets and OANDA tie as they offer a similar selection of proprietary platforms and MetaTrader 4. At CompareForexBrokers, we recommend using MT4 due to its Expert Advisor and technical analysis tools.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

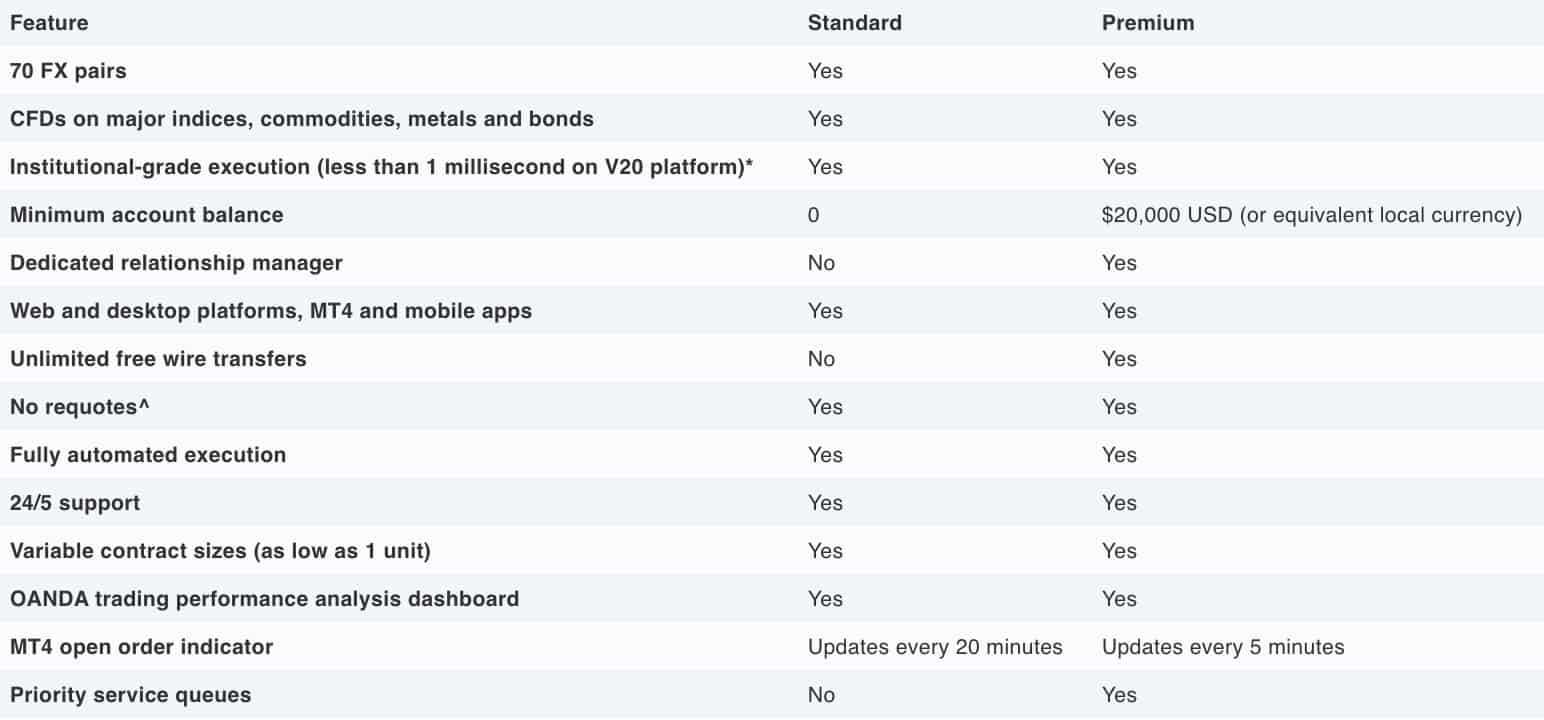

3. Tie: Superior Accounts And Features

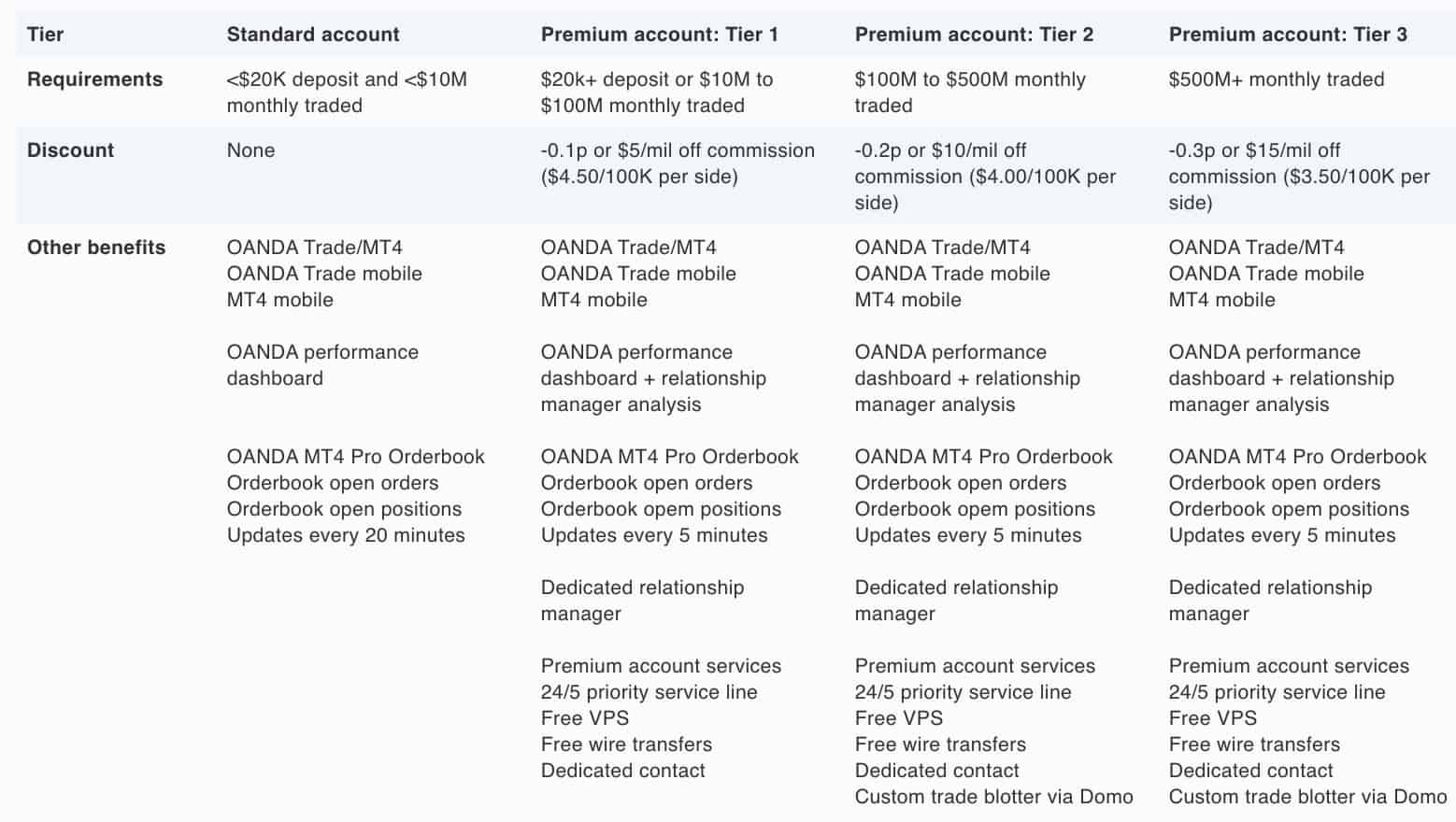

OANDA offers a Standard or Premium retail investor account. Both account types provide access to the same products, yet premium account holders receive personalised customer support and access to priority service. Additionally, if premium account holders traded a certain volume, they can access tighter spreads. On the other hand, forex traders using CMC Markets can choose from a CFD or Corporate account, with spreads, market access and trading tools the same across both account types.

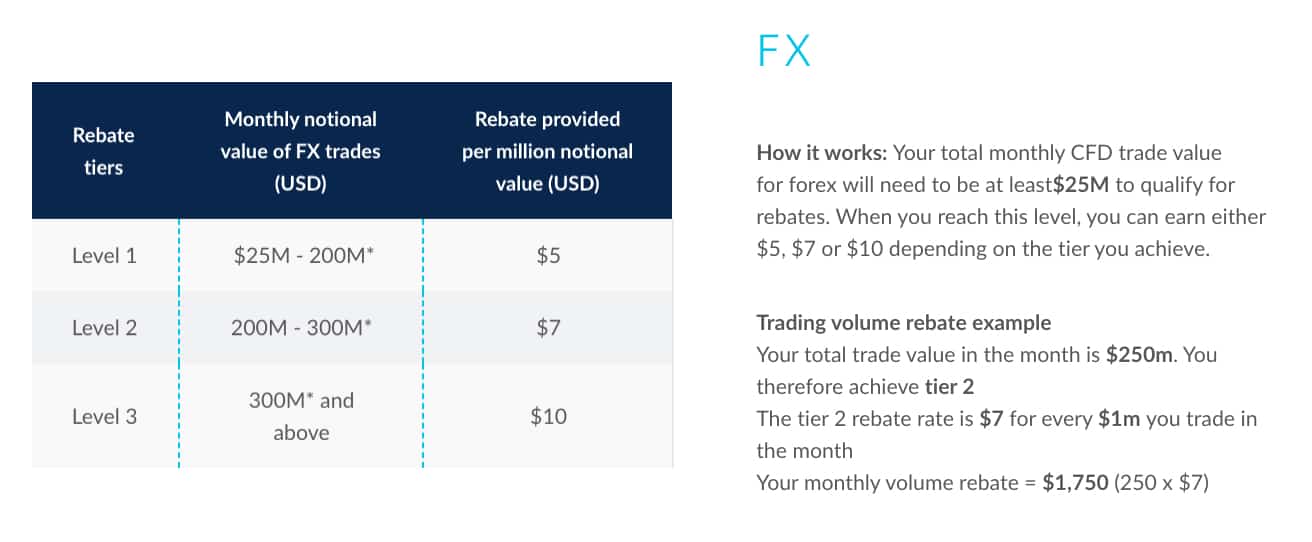

Both online brokers provide perks to high-volume traders through reward programs. At CMC Markets, traders can earn monthly rebates. To qualify for rebates, a minimum trading volume is required per month, which differs between asset classes. The broker offers three rebate tiers, depending on trading volume and rebate amount.

At OANDA, high-volume traders gain benefits through the broker’s Advanced Trader Reward Program. With three different premium account tiers, customers gain access to tighter spreads as their trading volume increases. For instance, if a trading account’s monthly trading volume surpasses $500 million, the trader will gain access to spreads that are 0.3 pips less than a Standard account.

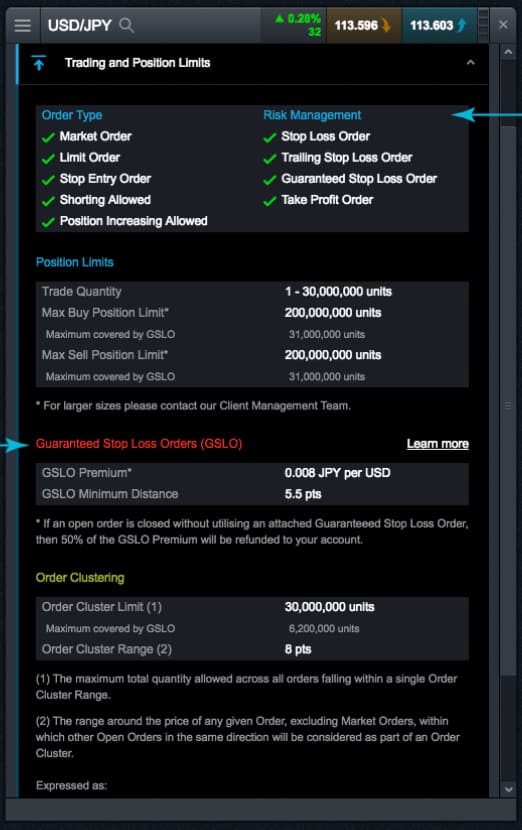

Risk Management

When trading CFDs with OANDA or CMC Markets, risk management tools vary depending on the trading platform being used. Both online brokers offer a similar range of order types to minimise trading strategies’ risk.

OANDA Order Types

- Market

- Limit

- Take Profit

- Stop Loss

- Trailing Stop

CMC Markets Order Types

CMC Markets Order Types

- Stop

- Limit

- Market

- Trailing Stop-Loss

- Guaranteed Stop Loss Order

As well as the above order types, CMC Markets offers Good till Cancelled and Good till Time order time limits, while Only Good till Date is available at OANDA.

When using the CMC Markets platform Next Generation, clients can incorporate Guaranteed Stop Loss Orders (GSLOs) to reduce the high risk of CFD trading. Traders pay a premium to place a GSLO, yet if the order is not executed, the fee is refunded.

Leverage

CFD trading is a high-risk investment activity due to volatile markets and the high leverage available. Maximum leverage limits vary with the asset class and the brokers’ location. For instance, foreign exchange leverage is capped at 30:1 in the United Kingdom, while Australian forex traders can leverage positions up to 500:1. Traders are encouraged to account for leverage levels in risk management strategies, as leverage magnifies gains as well as losses, increasing the risk of forex trading.

| CMC Markets | OANDA | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | No | Yes |

| Swap Free Account | No | No |

| Active Traders | Yes | No |

| Spread Betting (UK) | Yes | Yes |

Our Superior Accounts and Features Verdict

Both CMC Markets and OANDA offer basic account types, with no ECN-like option available. Other than both brokers rewarding high-volume traders, customers are limited to a classic account structure. As CMC and OANDA both lack options when it comes to trading account types, they tie in this round.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

4. OANDA: Best Trading Experience

When it comes to trading experience and ease of use, both CMC Markets and OANDA have their strengths. Having dived deep into the platforms and even cross-referencing with our own testing, we’ve gathered some insights that might help you decide which broker aligns with your trading style.

- OANDA stands out as the Best For Beginners, making it a great choice for those just starting out in the trading world.

- While neither CMC Markets nor OANDA took the top spot for Best Trading App, it’s worth noting that ThinkMarkets with ThinkTrader leads in this category.

- For those keen on automation, neither of these brokers clinched the title of Best For Automation, which went to Pepperstone and Eightcap.

- When it comes to spreads, neither broker could beat Eightcap or IC Markets for the Lowest Spread.

Now, after all the analysis and hands-on experience, it’s time for the verdict. While both brokers offer a commendable trading experience, OANDA’s beginner-friendly interface gives it a slight edge for those new to the game.

Our Best Trading Experience and Ease Verdict

OANDA offers a more user-friendly trading experience, especially for beginners.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

5. CMC Markets: Stronger Trust And Regulation

CMC Markets Trust Score

OANDA Trust Score

Regulations

CMC Markets and OANDA are well-established online brokers overseen by multiple financial authorities around the globe. OANDA was founded in 1995, while CMC Markets was established in 1989 and is listed on the London Stock Exchange. Subsidiaries of online brokers follow the regulation of the jurisdiction they are operating from, therefore, investor protection varies between countries.

Both OANDA and CMC Markets have the following regulators:

- FCA in the United Kingdom (Financial Conduct Authority),

- ASIC in Australia (Australian Securities and Investments Commission),

- MAS in Singapore (Monetary Authority of Singapore) and

- CIRO in Canada (Canadian Investment Regulatory Organization formerly IIROC). Additionally

OANDA is also overseen by the following regulators

- FAS in Japan (Financial Services Agency),

CMC Markets is also overseen by the following regulators

- FMA in New Zealand (Financial Markets Authority)

- BaFin in Germany and Austria for Europe

As regulation varies between regulators, traders registered with different subsidiaries of the brokers will receive a different level of protection. For example, traders with European-based regulators such as FCA, CySEC, and BaFin will receive negative balance protection. Other regulators do not receive these benefits unless the broker chooses to offer it as a feature.

While the FCA enforces some of the most stringent regulations, authorities such as ASIC, MAS and the FMA require basic investor protection such as segregated client accounts, where customer funds must not be used as operational capital.

Reputation

OANDA gets searched on Google more than CMC Markets. On average, OANDA sees around 550,000 branded searches each month, while CMC Markets gets about 110,000 — that’s 80% fewer.

| Country | CMC Markets | OANDA |

|---|---|---|

| Colombia | 1,600 | 49,500 |

| Thailand | 3,600 | 40,500 |

| Argentina | 1,600 | 33,100 |

| India | 9,900 | 27,100 |

| Peru | 880 | 22,200 |

| United Arab Emirates | 3,600 | 22,200 |

| Sweden | 260 | 22,200 |

| Poland | 1,000 | 18,100 |

| Jordan | 390 | 14,800 |

| Uzbekistan | 5,400 | 12,100 |

| Saudi Arabia | 320 | 9,900 |

| Germany | 480 | 9,900 |

| Bangladesh | 2,400 | 9,900 |

| Indonesia | 70 | 9,900 |

| Canada | 140 | 8,100 |

| Malaysia | 210 | 6,600 |

| United States | 720 | 6,600 |

| Brazil | 60,500 | 6,600 |

| Vietnam | 90 | 6,600 |

| Pakistan | 390 | 6,600 |

| Hong Kong | 320 | 6,600 |

| Turkey | 210 | 5,400 |

| Nigeria | 720 | 5,400 |

| Ghana | 590 | 5,400 |

| South Africa | 170 | 4,400 |

| Algeria | 320 | 4,400 |

| Spain | 50 | 4,400 |

| United Kingdom | 590 | 4,400 |

| Ecuador | 1,600 | 4,400 |

| Netherlands | 590 | 4,400 |

| Portugal | 140 | 4,400 |

| Philippines | 880 | 3,600 |

| Singapore | 480 | 2,900 |

| Botswana | 70 | 2,900 |

| Italy | 210 | 2,900 |

| Austria | 140 | 2,900 |

| Greece | 390 | 2,900 |

| Mauritius | 40 | 2,900 |

| Bolivia | 90 | 2,400 |

| Uruguay | 110 | 2,400 |

| Morocco | 320 | 2,400 |

| Taiwan | 110 | 2,400 |

| Mexico | 40 | 2,400 |

| Australia | 110 | 1,900 |

| New Zealand | 40 | 1,600 |

| Japan | 30 | 1,600 |

| Mongolia | 2,400 | 1,600 |

| Chile | 50 | 1,300 |

| Switzerland | 70 | 1,300 |

| Ethiopia | 90 | 1,300 |

| Cyprus | 50 | 1,300 |

| Venezuela | 30 | 1,300 |

| Tanzania | 20 | 1,000 |

| Uganda | 20 | 1,000 |

| Sri Lanka | 30 | 880 |

| Dominican Republic | 10 | 880 |

| Kenya | 30 | 720 |

| Panama | 10 | 720 |

| Cambodia | 110 | 590 |

| Egypt | 10 | 590 |

| Ireland | 40 | 480 |

| Costa Rica | 20 | 390 |

| France | 10 | 70 |

49,500 1st | |

1,600 2nd | |

33,100 3rd | |

1,600 4th | |

27,100 5th | |

9,900 6th | |

22,200 7th | |

3,600 8th |

Similarweb shows a similar story when it comes to August 2025 website visits with OANDA receiving 7,047,000 visits vs. 1,592,000 for CMC Markets.

Reviews

As shown below, CMC Markets has a Trustpilot rating of 4.0 out of 5, based on over 2,200 reviews. OANDA also holds a 4.0 out of 5 rating, with around 1,100 reviews. Both brokers have similar Trustpilot scores, but CMC Markets is favored for platform usability, while OANDA stands out for customer service and technical reliability. Each has its strengths depending on what traders prioritize.

Our Stronger Trust and Regulation Verdict

Both CMC Markets and OANDA are regulated by multiple top-tier financial authorities and considered safe, trusted online brokers. Yet CMC Markets is also listed on the London Stock Exchange and therefore offers increased transparency and security.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

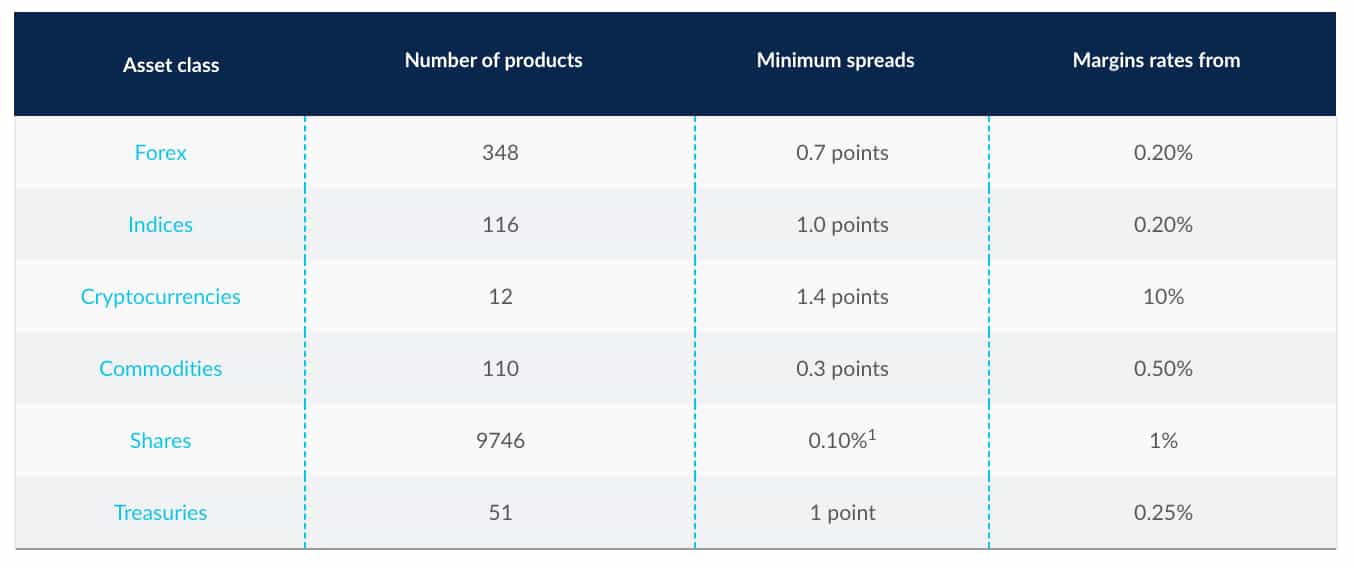

6. CMC Markets: CFD Product Range And Financial Markets

With over 9,500+ financial instruments, CMC Markets offers one of the best CFD product ranges available to retail investor accounts. While OANDA, on the other hand, offers a limited catalogue of CFDs, with only 33 additional CFDs on top of their 70 forex pairs.

| CFDs | OANDA | CMC Markets |

|---|---|---|

| Forex pairs | 70 | 348 |

| Commodities | 12 | 110 |

| Treasuries | 6 | 51 |

| Indices | 14 | 116 |

| Shares and ETFs | 0 | 9405 |

| Cryptocurrency | 1 | 12 |

When trading CFDs with CMC Markets, customers can easily develop diversified portfolios that include a variety of asset classes. To access the full product range, a user is required to trade via the broker’s proprietary platform, Next Generation. CMC Markets customers using MetaTrader 4 are restricted to trading Forex, Commodities and Indices, with Crypto, Share and Treasury markets not accessible via MT4.

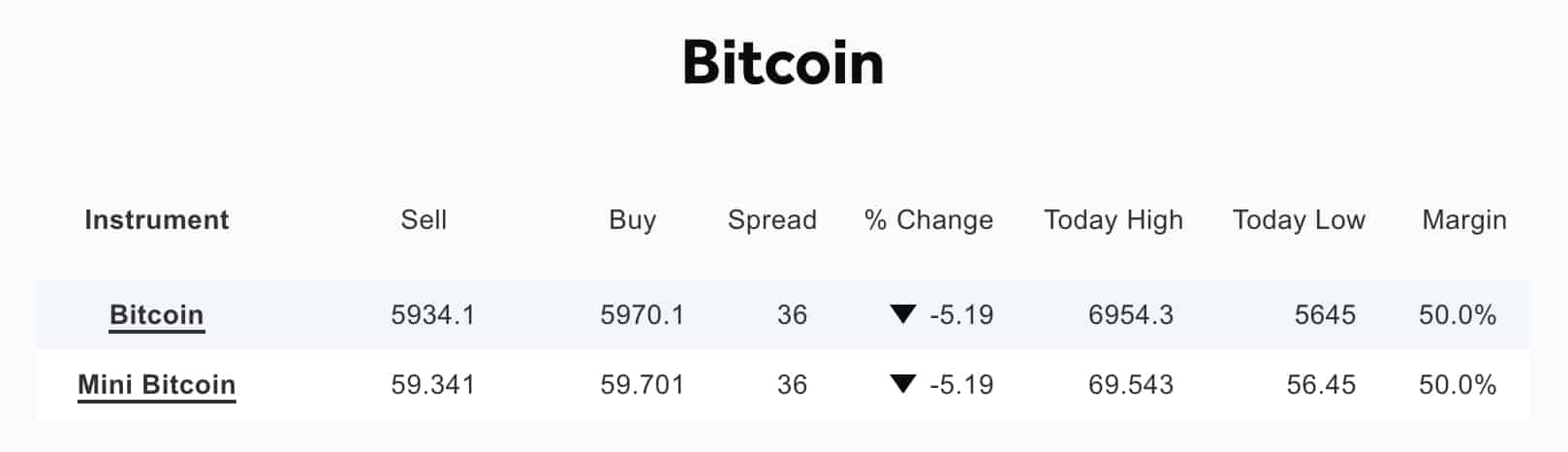

Cryptocurrency CFDs

OANDA customers wanting to trade Crypto CFDs are limited in choice. The online broker offers only Bitcoin CFDs with 2:1 leverage.

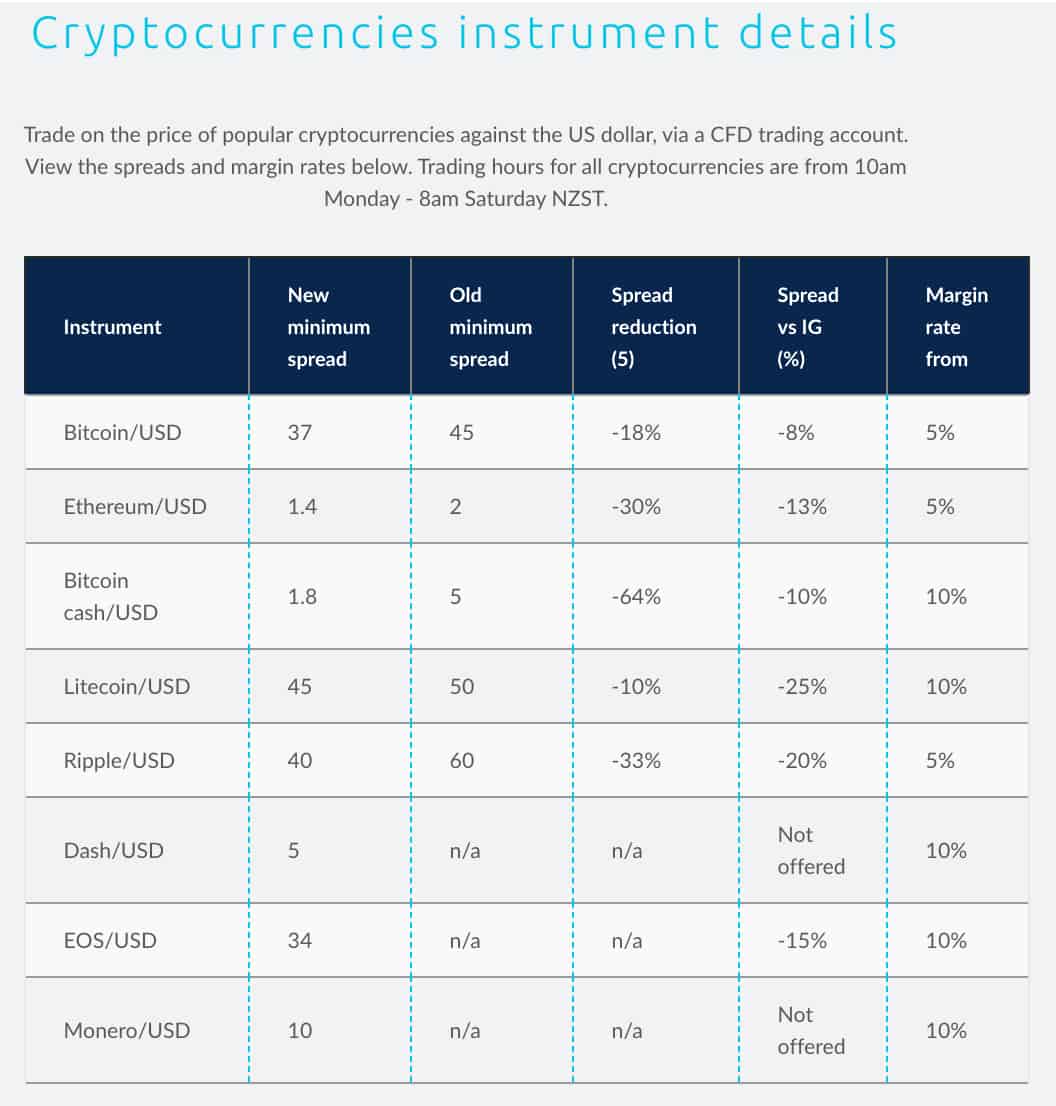

At CMC Markets, clients have 8 different Cryptocurrencies to choose from Bitcoin, Bitcoin Cash, Ethereum, Ripple, Litecoin, Dash, EOS and Monero.

As well as individual Crypto instruments, clients can trade CMC Markets Cryptocurrency Indices that eliminate a trader’s need to develop trading strategies with multiple Crypto CFDs. The broker offers three index structures:

- Major Crypto Index: Bitcoin, Bitcoin Cash, Ethereum, Ripple, and Litecoin

- Emerging Crypto Index: EOS, Stellar Lumens, Cardano, TRON, Monero, Dash, and NEO

- All Crypto Index: Bitcoin, Bitcoin Cash, Ethereum, Ripple, Litecoin, EOS, Stellar Lumens and Cardano

For those wanting to integrate Crypto CFDs into their trading strategies, CMC Markets is the clear winner due to the diversity in products.

Which Broker Offers The Most Crypto CFDs?

Like with other asset classes, CMC Markets offers a greater range of Cryptocurrencies than OANDA. As well as the ability to trade 8 different individual Cryptos, customers can integrate Crypto Indices into their trading strategies.

One thing that is important to note is that clients with OANDA Europe Limited and CMC Markets UK plc cannot offer cryptocurrency trading. This is because these subsidiaries are regulated by the FCA, which forbids cryptocurrency trading.

If you are trading from mainland Europe, then cryptocurrency trading is an option for CMC Markets clients are they have a European subsidiary known as CMC Markets Germany GmbH, which is regulated by BaFin, Germany’s financial regulator currently permits crypto trading.

Our Top Product Range and CFD Markets Verdict

CMC Markets offers its clients one of the widest product ranges available. With over 9,500 financial instruments to choose from, it is impossible for OANDA to beat CMC Markets in this round.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

7. CMC Markets: Superior Educational Resources

When it comes to educational resources, both CMC Markets and OANDA have invested significantly in ensuring their traders are well-equipped with knowledge. From our analysis and our own testing, we’ve pinpointed some key differences in the educational offerings of both brokers.

- CMC Markets provides an extensive library of webinars catering to both beginners and advanced traders.

- OANDA, on the other hand, shines with its range of video tutorials, making complex topics easily digestible.

- Both brokers offer market analysis, but CMC Markets tends to delve deeper with more frequent updates.

- OANDA’s educational blog is a treasure trove of articles covering a wide array of trading topics.

- CMC Markets offers a unique feature in the form of its ‘Insights’ section, providing traders with real-time market intelligence.

- OANDA doesn’t fall behind, offering a comprehensive economic calendar, and helping traders stay ahead of market-moving events.

From our testing, while both brokers offer robust educational resources, one does stand out slightly more in terms of depth and breadth.

Our Superior Educational Resources Verdict

CMC Markets offers superior educational resources, providing a more comprehensive learning experience for traders.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

8. CMC Markets: Better Customer Service

Traders can use live chat, phone and email to contact an OANDA representative, with phone and live chat available 24 hours a day, Sunday to Friday. OANDA’s customer service is known to be slow, with up to 7-day delays with email responses.

Although their customer support could be improved, OANDA’s educational material is a useful resource for traders. The broker offers webinars, platform tutorials and other educational videos covering topics ranging from trading strategies to account management.

Unlike OANDA, CMC Markets provides award-winning customer support, with quick responses via live chat, phone or email. While customer service representatives are only contactable 24 hours a day, Monday to Friday, enquiries are usually responded to within one working day. Similarly to OANDA, CMC Markets offers a great selection of educational resources, including webinars, tutorials and articles covering CFD trading and strategies.

Our Superior Customer Service Verdict

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

9. Tie: More Funding Options

When opening an account with OANDA, clients can choose from 9 different base currencies: EUR, AUD, USD, GBP, CAD, CHF, JPY, SGD and HKD. OANDA requires no initial minimum deposit to start trading, with most funding methods fee-free. When depositing funds with OANDA, no initial minimum deposit is required.

Deposit methods include debit and credit card, PayPal, internet banking, wire transfer, SWIFT wire and bank transfer, although certain methods are restricted in some countries. Withdrawals are free of charge if funds are withdrawn through PayPal or if it is the client’s first debit card withdrawal for the month. Further withdrawals made within that month cost $15, while funds withdrawn via bank transfer incur a $20 fee.

CMC Markets, on the other hand, offers 10 base currencies (NZD, EUR, CAD, GBP, USD, SGD, AUD, NOK, PLN and SEK) and no fees for deposits and withdrawals (except instant and international bank transfers which incur a £15 fee). Deposit and withdrawal methods vary between broker locations, with options including wire transfer, credit and debit cards and e-wallet methods such as POLi and PayPal.

Other Account Fees

OANDA charges a $10 monthly inactivity fee if a trader does not place an order for 2 years, while CMC Markets charges £10 after 1 year of inactivity.

Our Better Funding Options Verdict

Both brokers provide a range of deposit and withdrawal methods. Although most funding methods are free of charge, fees are applicable in some circumstances (i.e. more than one withdrawal a month with OANDA or for instant transactions with CMC). Therefore, the online brokers tie in regards to funding methods.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

10. Tie: Lower Minimum Deposit

Starting out in the world of forex trading can be daunting, especially when it comes to initial investments. Both CMC Markets and OANDA understand this, offering a $0 minimum deposit to help traders ease into the market without the pressure of a hefty initial outlay. This approach not only lowers the barrier to entry but also allows traders to test the waters and get a feel for the platform before committing more funds.

Here’s a quick comparison table for clarity:

| | Minimum Deposit | Recommended Deposit |

| CMC Markets | $0 | $100 |

| OANDA | $0 | $25 |

While both brokers are on par in this category, it’s essential to consider other factors like spreads, leverage, and educational resources when choosing a broker. The minimum deposit might be the same, but the overall trading experience can vary based on these other elements.

Our Lower Minimum Deposit Verdict

Both CMC Markets and OANDA offer a $0 minimum deposit, making them equally accessible for new traders.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

So is CMC Markets or OANDA The Best Broker?

CMC Markets is the winner because of its comprehensive educational resources, superior trading experience, and more extensive product range. The table below summarises the key information leading to this verdict.

| Criteria | CMC Markets | OANDA |

|---|---|---|

| Lowest Spreads And Fees | No | Yes |

| Better Trading Platforms | Yes | Yes |

| Superior Accounts And Features | Yes | Yes |

| Best Trading Experience | No | Yes |

| Stronger Trust And Regulation | Yes | No |

| CFD Product Range And Financial Markets | Yes | No |

| Superior Educational Resources | Yes | No |

| Better Customer Service | Yes | No |

| More Funding Options | Yes | Yes |

| Lower Minimum Deposit | Yes | Yes |

Best For Beginner Traders

For those just starting out, CMC Markets offers a more beginner-friendly environment with its extensive educational resources and user-friendly platform.

Best For Experienced Traders

For seasoned traders, OANDA might be a better fit due to its advanced trading tools and superior customer service.

FAQs Comparing CMC Markets Vs OANDA

Does OANDA or CMC Markets Have Lower Costs?

CMC Markets generally offers lower costs compared to OANDA. While OANDA boasts spreads as low as 0.1 pips for EUR/USD, CMC Markets starts from 0.3 pips for the same pair. However, it’s essential to note that spreads can vary based on market conditions. For a more detailed comparison of broker costs, check out our guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both OANDA and CMC Markets support MetaTrader 4, but OANDA offers a more seamless integration with the platform. CMC Markets, on the other hand, also provides its proprietary platform which some traders prefer. If you’re looking to explore more options, our list of the best MT4 brokers might be of interest.

Which Broker Offers Social Trading?

Neither OANDA nor CMC Markets are particularly known for their social trading features. However, social or copy trading is becoming increasingly popular, allowing traders to mimic the strategies of successful traders. If you’re keen on exploring platforms that offer this feature, our guide on the best social trading platforms provides a comprehensive overview.

Does Either Broker Offer Spread Betting?

CMC Markets offers spread betting, while OANDA does not. Spread betting is a popular form of trading in the UK, allowing traders to bet on the direction of market movements without owning the underlying asset. For those interested in exploring this further, our guide on the best spread betting brokers in the UK provides a detailed overview.

What Broker is Superior For Australian Forex Traders?

In my opinion, CMC Markets is superior for Australian forex traders. CMC Markets is ASIC regulated, ensuring a high level of trust and security for Australian traders. While OANDA is also ASIC regulated, CMC Markets has a stronger presence in Australia, being founded overseas but having a significant local presence. For a broader perspective on the best options available, check out our list of Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I believe OANDA holds a slight edge. Both OANDA and CMC Markets are FCA regulated, ensuring they adhere to the stringent regulations set by the UK’s financial authority. However, while CMC Markets was founded in the UK, OANDA originated overseas. The UK forex market is competitive, and for a comprehensive comparison, our guide on the Best Forex Brokers In UK can provide more insights.

Article Sources

No commission account spread proprietary testing data and published website spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

What bank does CMC Markets use?

IN Australia, CMC Markets Stock Broking account uses BankWest. While we are unsure which bank CMC Markets use for CFD trading,it will depend on the country you are based in. Being a highly regulated broker, you can be confident only uses top tier banks.

Is CMC Markets regulated by MAS?

Yes, CMC Markets is regulated by MAS meaning they can accept traders in Singapore.