FXCM vs Admiral Markets: Which One Is Best?

With 50 forex pairs, Admiral’s range of FX products is superior to FXCM. FXCM however, has a wider choice of trading platforms. This Admirals vs FXCM review also looks at differences in trading accounts and commission costs.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs: 33:1

0-50k 400:1

50k+ 200:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers the 10 most crucial trading factors to help you make an informed decision. FXCM is regulated by three ‘tier 1’ and three ‘tier 2’ authorities, while Admirals has two ‘tier 1’ and one ‘tier 2’ regulators.

In terms of popularity, Admirals edges out with more Trustpilot reviews and a slightly higher rating. FXCM is headquartered in the more financially reputable USA, whereas Admirals is based in Estonia. Admirals offers lower average spreads starting from 0.5 pips, while FXCM’s standard account starts from 0.7 pips. FXCM charges deposit and withdrawal fees, whereas Admirals does not.

1. Lowest Spreads And Fees – Admiral Markets

Regarding fees and spreads, Admiral Markets has a slight edge over FXCM, with no commission and lower average spreads. Admiral Markets offers commission-free trading with their Trade.MT4 and .MT5 accounts with spreads starting from 0.5 pips. The other account known as ZERO MT5 and .MT4 has spreads from 0 pips and variable commissions meaning the more you trade, the lower your commissions will be.

To compare the trading costs between Admirals and FXCM, use the fee calculator below. You can adjust currency pairs, lot sizes, and base currency to compare rates offered by different brokers across various markets.

FXCM also offers competitive spreads for the two accounts they offer. The standard account has spread from 0.7 pips while the Active trader account has spreads from 0.2 pip but uses tiered commissions for traders in the UK, EU and South Africa while other countries don’t get a commission but instead receive reduced pips in the form of a rebate.

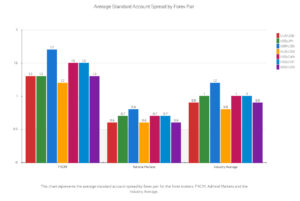

Standard Account Spreads

Looking at the data, it’s clear that there are some differences in the standard account spreads between FXCM, Admiral Markets, and the industry average.

Admiral Markets tends to have higher spreads across the board, with the lowest being 0.8 for EUR/USD and the highest being 2.2 for AUD/JPY. This might make Admiral Markets less attractive for traders who are looking to minimise their trading costs, especially if they’re trading these particular forex pairs frequently.

FXCM offers lower spreads, with the highest being 1.9 for EUR/JPY and the lowest being 0.7 for EUR/USD. This could make FXCM a more cost-effective choice for traders, particularly those who trade these forex pairs.

| Standard Account | FXCM Spreads | Admiral Markets Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.23 | 1.26 | 1.6 |

| EUR/USD | 0.7 | 0.8 | 1.2 |

| USD/JPY | 1.00 | 1.00 | 1.4 |

| GBP/USD | 1.00 | 1.00 | 1.5 |

| AUD/USD | 0.8 | 1 | 1.5 |

| USD/CAD | 1.3 | 1.6 | 1.9 |

| EUR/GBP | 1.3 | 1 | 1.5 |

| EUR/JPY | 1.9 | 1.5 | 1.9 |

| AUD/JPY | 1.8 | 2.2 | 2.2 |

Standard Account Analysis Updated January 2026[1]January 2026 Published And Tested Data

When we compare these brokers to the industry average, we see that Admiral Markets is consistently below the average, while FXCM is consistently above. This suggests that, on average, traders might find better value with Admiral Markets.

However, spreads are just one part of the overall cost of trading. Other factors, such as commission fees and account types, can also impact the overall cost. Therefore, while Admiral Markets appears to be the cheaper option based on spreads alone, I would recommend traders to consider all costs before making a decision.

Our Lowest Spreads and Fees Verdict

After thoroughly examining the spreads and fees, it’s clear that Admirals offers a more cost-effective trading environment. With lower spreads and no additional fees for deposits and withdrawals, Admirals takes the cake in this category.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

2. Better Trading Platforms – Admiral Markets

Both FXCM and Admirals offer MetaTrader 4, but only Admirals has MetaTrader 5, while FXCM has TradingView.

| Trading Platform | FXCM | Admirals |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | No | Yes |

| cTrader | No | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

- Admirals provides a more user-friendly interface on MT4.

- FXCM offers a feature-rich MT4 platform but can be complex for beginners.

- Admirals has additional tools and indicators that enhance trading.

- FXCM provides advanced charting tools for technical analysis.

Our Better Trading Platform Verdict

When it comes to the trading platform, Admirals stands out for its MT4 and MT5 user-friendly interface and additional tools that make trading not just easier but also more effective. While FXCM offers a strong platforms, it can be a bit overwhelming for those who are new to trading.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

3. Superior Accounts And Features – Admiral Markets

Most FXCM clients use the Standard Account, while high-volume traders prefer the Active Traders account to save on costs. Admirals offers multiple account types, including standard and premium accounts, each with its own set of features tailored to different trading styles.

- Admirals offers a wider variety of account types, catering to beginners and professionals.

- FXCM provides fewer account options but focuses on feature-rich environments.

- Admirals offers premium features like free market analysis and trading signals.

- FXCM provides a strong research and educational section but lacks in premium features.

Islamic Accounts

Other account types available for FXCM and Admirals include an Interest-free account, which is designed for Swap Free Islamic Accounts who can’t pay swaps.

| FXCM | Admirals | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | No |

| Spread Betting (UK) | Yes | No |

Our Superior Accounts and Features Verdict

After a thorough review, it’s clear that Admirals offers superior accounts and features. With a range of account types and premium features like free market analysis and trading signals, Admirals provides a more versatile trading environment. FXCM, while strong in research, doesn’t offer the same level of premium features.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

4. Best Trading Experience – Admiral Markets

An FXCM dealing desk determines the best execution, which can result in FXCM acting as a market maker or using a dealing desk. Admiral Markets is a no dealing desk broker, which means they connect clients with liquidity providers for each trade.

FXCM provides a powerful platform with a range of tools that may be complex but are highly valuable for experienced traders. Admirals offers a more user-friendly interface, suitable for beginners to get started quickly.

- Admirals offers a more intuitive user interface.

- FXCM provides a feature-rich platform for advanced traders.

- Admirals boasts quicker execution speeds.

- FXCM allows for greater customisation of trading strategies.

| | Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank |

|---|---|---|---|---|

| FXCM | 108ms | 28/36 | 189ms | 29/36 |

| Admiral Markets | 132ms | 15/36 | 182ms | 27/36 |

Our Best Trading Experience and Ease Verdict

After extensive testing, it’s clear that Admirals offers a smoother and more user-friendly trading experience, particularly for those who are new to forex trading. FXCM, while feature-rich, can be a bit overwhelming for beginners.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – FXCM

FXCM and Admirals both garnered an overall trust score of 74. However, where they vary lies in their regulations, reputation, and reviews.

FXCM Trust Score

Admirals Trust Score

Regulation

Both FXCM and Admirals are regulated, but there are some key differences worth noting. FXCM is regulated by both the FCA (UK) and ASIC (Australia), offering a higher level of trust.

- Admirals is regulated by the FCA (UK) and CySEC (Cyprus), which are reputable but not as globally recognized as ASIC.

- Both brokers have been in operation for a significant amount of time, with FXCM having over 20 years of experience.

- Both offer segregated accounts and negative balance protection, adding an extra layer of security for traders.

| FXCM | Admirals | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) CYSEC (Cyprus) CIRO (CANADA) BaFin (Germany) | ASIC (Australia) FCA (UK) CYSEC (Cyprus) CIRO (CANADA) |

| Tier 2 Regulation | FSCA (South Africa) ISA (Israel) | ASIC (Australia) FCA (UK) CYSEC (Cyprus) CIRO (CANADA) |

| Tier 3 Regulation | FSA-S (Seychelles) CMA (Kenya) JSC FSCA (South Africa) |

Reputation

FXCM has been around since 1999, with headquarters in New York. Admirals doesn’t fall far behind, being established in 2001 in Tallinn, Estonia.

FXCM gets searched on Google around 38,100 per month while Admirals has a slightly higher search volume of 40,500 hits monthly.

Reviews

As shown below, FXCM got a 4.3 out of 5 score on TrustPilot based on over 700 reviews, while Admiral Markets got a 3.9 out of 5 from around 2,000 reviews.

Our Stronger Trust and Regulation Verdict

When it comes to trust and regulation, FXCM takes the lead. With dual regulation from both the FCA and ASIC, and over 20 years in the business, FXCM offers a more secure and trustworthy trading environment compared to Admirals.

*Your capital is at risk ‘65% of retail CFD accounts lose money’

6. Most Popular Broker – Admiral Markets

Admirals gets searched on Google more than FXCM. On average, Admiral Markets sees around 220,000 branded searches each month, while FXCM gets about 40,500 — that’s 81% fewer.

| Country | FXCM | Admirals |

|---|---|---|

| Austria | 110 | 550,000 |

| United Kingdom | 2,900 | 450,000 |

| Italy | 720 | 60,500 |

| Greece | 210 | 60,500 |

| United States | 2,900 | 33,100 |

| Germany | 1,000 | 33,100 |

| India | 2,900 | 9,900 |

| Spain | 590 | 6,600 |

| Philippines | 390 | 5,400 |

| Japan | 1,300 | 4,400 |

| France | 1,600 | 3,600 |

| Canada | 880 | 3,600 |

| Poland | 320 | 2,900 |

| Indonesia | 1,000 | 2,400 |

| Brazil | 480 | 2,400 |

| Turkey | 480 | 2,400 |

| Switzerland | 170 | 2,400 |

| Netherlands | 390 | 1,900 |

| Australia | 1,300 | 1,900 |

| Malaysia | 1,300 | 1,600 |

| Ireland | 70 | 1,600 |

| Sweden | 170 | 1,300 |

| Thailand | 1,000 | 1,000 |

| Egypt | 390 | 1,000 |

| Nigeria | 880 | 1,000 |

| United Arab Emirates | 480 | 1,000 |

| Argentina | 320 | 1,000 |

| South Africa | 1,000 | 880 |

| Mexico | 480 | 880 |

| Pakistan | 1,000 | 880 |

| Taiwan | 590 | 880 |

| Saudi Arabia | 260 | 880 |

| Chile | 210 | 880 |

| Colombia | 1,000 | 720 |

| Vietnam | 880 | 720 |

| Singapore | 480 | 720 |

| Cyprus | 140 | 720 |

| Portugal | 110 | 590 |

| Hong Kong | 480 | 590 |

| Morocco | 480 | 480 |

| New Zealand | 70 | 480 |

| Uzbekistan | 70 | 390 |

| Bangladesh | 260 | 390 |

| Algeria | 260 | 320 |

| Kenya | 260 | 320 |

| Peru | 210 | 320 |

| Jordan | 70 | 260 |

| Ghana | 110 | 210 |

| Ecuador | 170 | 170 |

| Venezuela | 390 | 170 |

| Bolivia | 110 | 170 |

| Uganda | 90 | 170 |

| Sri Lanka | 110 | 140 |

| Dominican Republic | 140 | 140 |

| Cambodia | 170 | 90 |

| Costa Rica | 30 | 90 |

| Panama | 50 | 90 |

| Mongolia | 50 | 70 |

| Ethiopia | 70 | 70 |

| Tanzania | 90 | 70 |

| Mauritius | 40 | 50 |

| Botswana | 50 | 30 |

110 1st | |

550,000 2nd | |

2,900 3rd | |

450,000 4th | |

1,000 5th | |

33,100 6th | |

1,300 7th | |

4,400 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with Admiral Markets receiving 595,437 visits vs. 365,000 for FXCM.

Our Most Popular Broker Verdict

Admiral Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

7. CFD Product Range And Financial Markets – Admiral Markets

FXCM clients can trade a range of CFD products, including 39 Forex currency pairs, 13 stock indices, shares CFD for 9 commodities, 3 metals, 3 types of baskets, and 7 cryptocurrencies. Admirals offers over 3,000 CFDs across various asset classes for trading.

| CFDs | FXCM | Admirals |

|---|---|---|

| Forex Pairs | 42 | 50 |

| Indices | 16 | 42 |

| Commodities | 3 Metals 5 Energies 3 Softs | 7 Metals (3 x Gold) 4 Energies 7 Softs (11 Futures) |

| Stocks | 219 | 300 |

| Bonds | 1 | 2 |

| Cryptocurrency | 7 | 37 |

| Futures | 0 | 0 |

| Options | 0 | 0 |

Our Top Product Range and CFD Markets Verdict

Admirals clearly offers a more diverse and comprehensive range of CFDs and markets, making it the go-to choice for traders looking for variety.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

8. Superior Educational Resources – Admiral Markets

Both FXCM and Admirals offer a range of educational resources, but the extent and variety differ significantly.

- FXCM offers webinars and video tutorials.

- Admirals provides in-depth articles and eBooks.

- FXCM has a demo account for practice.

- Admirals offers trading courses.

- FXCM provides market analysis.

- Admirals has a community forum for traders.

Our Superior Educational Resources Verdict

Based on our team’s scoring, Admirals offers a more comprehensive educational package, making it the better choice for traders looking to expand their knowledge base.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

9. Better Customer Service – FXCM

FXCM offers 24/5 customer service in multiple languages, while Admirals provides 24/5 support but in fewer languages.

| Feature | FXCM | Admirals |

|---|---|---|

| Live chat | 24/5 | 24/5 |

| Customer Service Knowledge | Excellent | Good |

| FAQ Knowledge Base | Good | Average |

| Email/Social Media | Email, WhatsApp | Email, Messenger, Twitter |

| Multilingual Support | Yes | Yes |

Our Superior Customer Service Verdict

Our testing shows that FXCM offers a more comprehensive customer service experience, especially for traders who may need support in multiple languages.

*Your capital is at risk ‘65% of retail CFD accounts lose money’

10. Better Funding Options – FXCM

Funding your account is a straightforward process with both brokers, but FXCM offers more options.

| Funding Option | FXCM | Admirals |

|---|---|---|

| Credit Card | ✅ | ✅ |

| Debit Card | ✅ | ✅ |

| Bank Transfer | ✅ | ✅ |

| PayPal | ✅ | ❌ |

| Skrill | ✅ | ✅ |

| Neteller | ✅ | ✅ |

| Crypto | ✅ | ✅ |

Our Better Funding Options Verdict

FXCM provides a wider range of funding options, but only with its Paypal availability.

*Your capital is at risk ‘65% of retail CFD accounts lose money’

11. Lower Minimum Deposit – FXCM

FXCM has a lower minimum deposit of $50 vs Admiral Markets’ minimum of $100. Both brokers provide numerous payment methods for brokers to deposit their initial funds, including credit/debit cards, bank wire, Skrill, and Neteller.

FXCM

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

| Bank Wire | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

| Skrill | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

| Neteller | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

Admiral Markets

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Bank Wire | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Skrill | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Neteller | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

Our Lower Minimum Deposit Verdict

FXCM wins this round with its $50 minimum deposit. Having said that, we feel that the $50 difference between the two brokers’ requirements shouldn’t be a huge factor in choosing which broker to trade with.

*Your capital is at risk ‘65% of retail CFD accounts lose money’

So Is Admirals or FXCM The Best Broker?

Admiral Markets is the winner because it offers a more comprehensive range of services, from lower spreads and fees to a wider range of CFD markets. Below is a table that summarises the key information leading to this verdict.

| Categories | FXCM | Admiral Markets |

|---|---|---|

| Lowest Spreads And Fees | ❌ | ✅ |

| Better Trading Platform | ❌ | ✅ |

| Superior Accounts And Features | ❌ | ✅ |

| Best Trading Experience And Ease | ❌ | ✅ |

| Stronger Trust And Regulation | ✅ | ❌ |

| Top Product Range And CFD Markets | ❌ | ✅ |

| Superior Educational Resources | ❌ | ✅ |

| Superior Customer Service | ✅ | ❌ |

| Better Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ✅ | ❌ |

Admiral Markets: Best For Beginner Traders

For beginner traders, Admirals is the better choice due to its user-friendly interface and educational resources.

FXCM: Best For Experienced Traders

For experienced traders, FXCM offers stronger platforms with advanced features.

FAQs Comparing FXCM vs Admirals

Does Admirals or FXCM Have Lower Costs?

Admirals has lower costs. They offer lower average spreads starting from 0.5 pips. FXCM’s spreads start at 0.7 pips. For more information on low-cost brokers, you can visit our lowest spread forex brokers in the UK.

Which Broker Is Better For MetaTrader 4?

FXCM is better for MetaTrader 4. They offer a more feature-rich experience for advanced traders. For more details, check out our best MT4 forex brokers in the UK.

Which Broker Offers Social Trading?

Neither FXCM nor Admirals offer social trading. However, there are other brokers that do. For more information, you can visit best copy trading platforms.

Does Either Broker Offer Spread Betting?

FXCM offers spread betting, while Admirals does not. For more on this, you can check out best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Admirals is superior for Australian Forex traders. They are ASIC regulated and offer a wide range of CFD markets. For more details, visit the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, FXCM is the better choice in my view. They are FCA regulated and offer a robust trading platform. For more information, you can visit Best Forex Brokers In UK.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert