IC Markets vs FXCM: Which One Is Best?

Our in-depth evaluation of both IC Markets and FXCM has led to an impressive discovery of their outstanding features, platforms, and competitive fees. However, only one will emerge as the ultimate victor in this comparison. Find out which one comes out on top by reading our detailed review.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs: 33:1

0-50k 400:1

50k+ 200:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers the 10 most important trading factors. Here are six key differences between IC Markets and FXCM:

- IC Markets offers lower average spreads on major pairs.

- IC Markets supports a wider variety of base currencies for account funding.

- IC Markets has a higher leverage of up to 1:500.

- FXCM provides a proprietary trading platform.

- FXCM features a range of unique trading tools and resources.

- FXCM offers a leverage of a maximum of 1:400.

1. IC Markets: Lowest Spreads And Fees – IC Markets

In 2025, the spotlight is on brokers offering the lowest spreads and fees, giving traders a more cost-effective trading experience. Smaller spreads lower transaction costs, which is a game-changer for high-frequency traders looking to maximize profits. On top of that, competitive fees draw in more clients, driving up trading volumes and boosting revenue for brokers. This ideal scenario fosters a mutually beneficial environment, boosting profitability and enriching the trading experience for both traders and brokers alike.

IC Markets and FXCM are two well-known brokers in the forex trading landscape, each offering a range of services tailored to traders seeking competitive conditions. Both brokers have built strong reputations for their platforms, low-cost trading options, and wide selection of currency pairs. In this comparison, we’ll break down their differences in key areas such as spreads, commission levels, and standard account fees, shedding light on which broker stands out as the more cost-effective choice in today’s fast-paced forex market.

Spreads

When it comes to spreads, IC Markets comes out ahead, offering significantly lower rates compared to FXCM. For example, the EUR/USD spread at IC Markets averages just 0.02, far lower than FXCM’s 0.3, which is well above the industry average of 0.28. Similarly, the AUD/USD spread is 0.03 at IC Markets, while FXCM’s spread for this pair sits at 0.4, considerably higher than the industry’s typical 0.45. On the whole, IC Markets delivers an average spread of 0.29 across their offerings, which is well below FXCM’s 0.82, making IC Markets a more cost-effective choice for those looking to minimize their trading costs.

| RAW Account | IC Markets Spreads | FXCM Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 0.29 | 0.82 | 0.72 |

| EUR/USD | 0.02 | 0.3 | 0.28 |

| USD/JPY | 0.14 | 0.6 | 0.44 |

| GBP/USD | 0.23 | 0.9 | 0.54 |

| AUD/USD | 0.03 | 0.4 | 0.45 |

| USD/CAD | 0.25 | 0.6 | 0.61 |

| EUR/GBP | 0.27 | 0.7 | 0.55 |

| EUR/JPY | 0.3 | 0.8 | 0.74 |

| AUD/JPY | 0.5 | 1.1 | 0.93 |

| USD/SGD | 0.85 | 2 | 1.97 |

Commission Levels

In terms of commissions, IC Markets maintains a competitive edge with a $3.50 per lot commission, slightly lower than FXCM’s $4.00. Both brokers offer a low minimum deposit requirement, with IC Markets set at $200 compared to FXCM’s $50. While IC Markets recommends a $200 deposit for optimal trading conditions, FXCM’s minimum deposit is much lower at $50. Notably, both brokers offer no funding fees, along with the option for SWAP-free accounts, giving traders flexibility in how they manage their positions.

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| IC Markets | $3.50 | $4.50 | £2.50 | €2.75 |

| FXCM | $4.00 | $4.00 | N/A | N/A |

Try the IC Markets vs FXCM fee calculator below based on the most popular forex pairs and base currencies.

Standard Account Fees

For standard account fees, IC Markets also proves to be the more favorable option. For EUR/USD, IC Markets charges a low fee of 0.62, significantly less than FXCM’s 1.30. When it comes to AUD/USD, IC Markets charges 0.77, while FXCM’s fee is a higher 1.40. These differences reflect IC Markets’ commitment to providing a cost-efficient trading environment, further solidifying its position as a go-to broker for cost-conscious traders.

|

Standard Account Spreads

|

|||||

|---|---|---|---|---|---|

|

0.62 | 0.77 | 1.27 | 0.83 | 0.74 |

|

1.30 | 1.70 | 2.10 | 1.40 | 1.50 |

|

1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

|

1.20 | 0.90 | 1.50 | 1.80 | 1.80 |

|

1.20 | 1.40 | 1.50 | 1.60 | 1.50 |

|

1.10 | 1.20 | 1.30 | 1.30 | 1.30 |

|

1.20 | 1.80 | 1.90 | 1.90 | 1.60 |

|

1.32 | 1.95 | 1.37 | 1.70 | 1.40 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 06/01/2025

After a thorough comparison of spreads, commissions, and standard account fees, it’s clear that IC Markets offers more attractive pricing options than FXCM. Whether you’re a high-frequency trader looking to capitalize on tight spreads or someone seeking lower overall trading costs, IC Markets stands out with its competitive pricing. However, FXCM still remains a strong contender, especially for traders with lower deposit budgets, but overall, IC Markets provides the better value in today’s market.

Our Lowest Spreads and Fees Verdict

Without a doubt, IC Markets steals the show in this portion due to their lowest spreads and fees.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

2. Better Trading Platform – FXCM

In 2025, having a top-tier trading platform is a game-changer for brokers. It’s all about improving the user experience with cutting-edge tools, faster execution, and consistent performance. This not only draws in more clients but also ramps up trading volumes and builds the broker’s reputation. A high-quality platform empowers traders to make smarter, more informed decisions, leading to higher success rates and greater satisfaction across the board.

In today’s competitive forex market, choosing the right trading platform is essential for both beginner and professional traders. IC Markets and FXCM offer a variety of powerful trading platforms, each designed to meet the diverse needs of their clients. From beginner-friendly interfaces to advanced tools for experienced traders, these platforms provide a range of features that enhance the overall trading experience. In this comparison, we’ll dive into the key platforms offered by IC Markets and FXCM, focusing on MetaTrader, advanced platforms, copy trading, and our final conclusion.

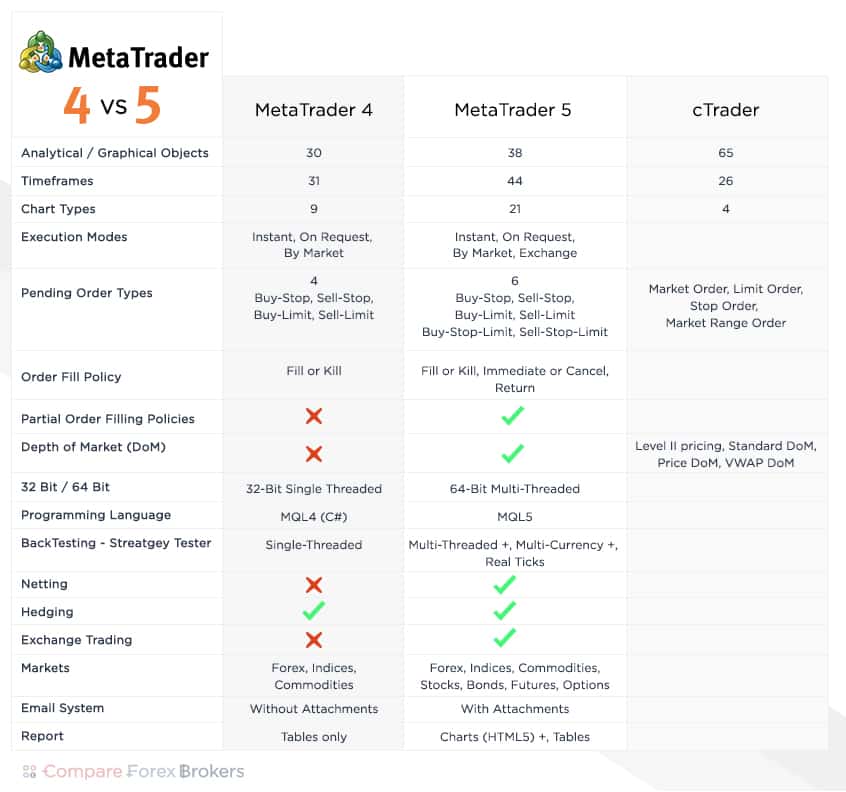

MetaTrader

IC Markets:

- MetaTrader 4 (MT4): IC Markets offers the industry-standard MT4 platform, providing ECN trading conditions on the Raw Spread account. Clients benefit from quotes derived from multiple liquidity providers (LPs), ensuring competitive pricing and low spreads.

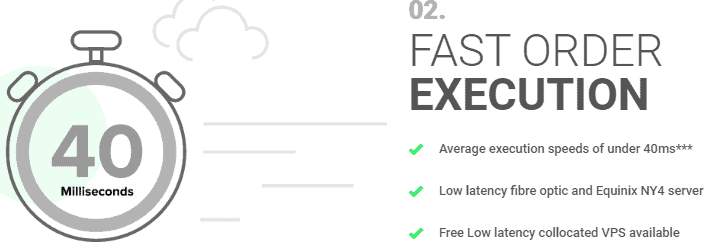

With almost 25 LPs and collocated servers in New York’s Equinix NY4 data center, traders experience fast order execution speeds of 40ms and minimal latency. - MetaTrader 5 (MT5): IC Markets also provides the more advanced MT5, which supports additional forex pairs, CFDs, and a broader range of indicators. MT5 includes enhanced features such as Depth of Market (DOM) for one-click trading and no FIFO policy, allowing greater flexibility for traders.

FXCM:

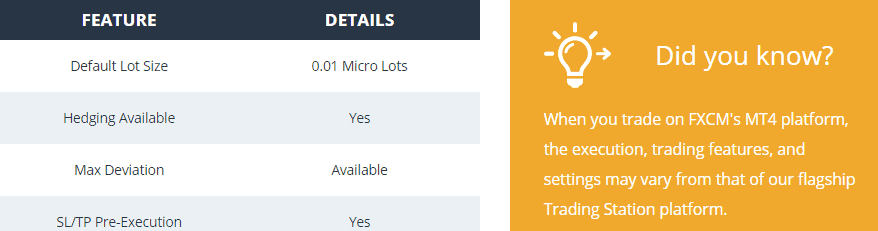

- MetaTrader 4 (MT4): FXCM also offers MT4, the leading platform in the industry. FXCM’s MT4 gives traders access to forex, futures, and CFDs with interactive charts, advanced analytics, and multiple order types. FXCM also allows for all types of trading strategies, including scalping, and provides additional paid and free tools like Expert Advisors and custom scripts.

| Trading Platform | IC Markets | FXCM |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | No |

| cTrader | Yes | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

Advanced Platforms

IC Markets:

cTrader: IC Markets offers cTrader, which provides a sleek, customizable interface, designed for algorithmic and high-speed traders, including scalpers. The platform is known for deep liquidity pools and fast execution, thanks to its servers collocated in the LD5 IBX Equinix Data Centre in London. Traders enjoy features like Smart Stop Out levels, Volume Weighted Average Price (VWAP), advanced order types, and real-time reports.

FXCM:

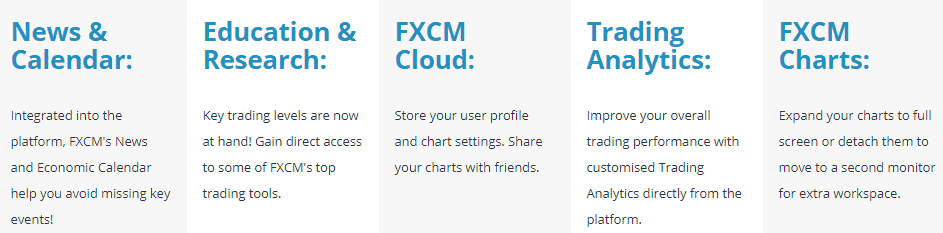

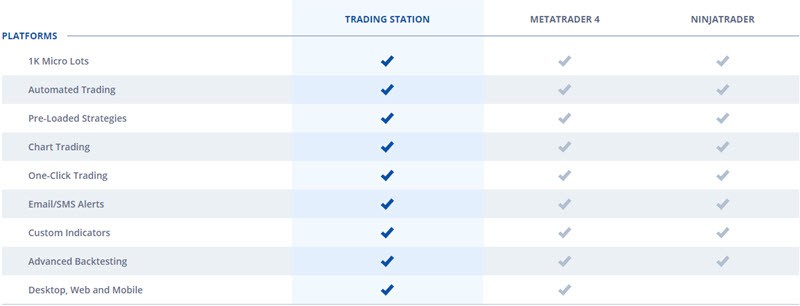

Trading Station: FXCM’s proprietary platform, Trading Station, combines powerful tools with a robust charting package. The platform includes add-ons via the FXCM Apps Store, such as an economic calendar, news stream, and strategy optimization tools.

Trading Station is perfect for traders who prefer a more tailored trading environment with access to advanced trading analytics and the Speculative Sentiment Index (SSI).

NinjaTrader: FXCM also offers NinjaTrader, a platform ideal for active traders and scalpers. NinjaTrader’s advanced charting tools and risk management features make it a strong contender for those looking for a customizable and efficient trading platform. The NinjaScript programming language allows users to develop trading strategies with ease, even without programming experience.

Advanced Platforms

IC Markets:

- cTrader:IC Markets offers cTrader, which provides a sleek, customizable interface, designed for algorithmic and high-speed traders, including scalpers. The platform is known for deep liquidity pools and fast execution, thanks to its servers collocated in the LD5 IBX Equinix Data Centre in London. Traders enjoy features like Smart Stop Out levels, Volume Weighted Average Price (VWAP), advanced order types, and real-time reports.

FXCM:

- Trading Station:FXCM’s proprietary platform, Trading Station, combines powerful tools with a robust charting package. The platform includes add-ons via the FXCM Apps Store, such as an economic calendar, news stream, and strategy optimization tools. Trading Station is perfect for traders who prefer a more tailored trading environment with access to advanced trading analytics and the Speculative Sentiment Index (SSI).

- NinjaTrader:FXCM also offers NinjaTrader, a platform ideal for active traders and scalpers. NinjaTrader’s advanced charting tools and risk management features make it a strong contender for those looking for a customizable and efficient trading platform. The NinjaScript programming language allows users to develop trading strategies with ease, even without programming experience.

Copy Trading

Copy Trading

IC Markets:

- cTrader Copy Trading: One of the standout features of IC Markets is its cTrader platform’s copy trading capabilities. This allows traders to automatically copy the strategies of experienced traders in real time, making it a great option for beginners or those looking to diversify their trading strategies without investing significant time in research.

FXCM:

- FXCM Copy Trading: FXCM offers copy trading options through its Trading Station platform. This feature allows traders to mirror the trades of top-performing accounts, making it an ideal solution for those who prefer a hands-off approach to trading. FXCM’s copy trading allows users to benefit from the expertise of seasoned traders, with an easy-to-use interface for setting up automatic trade copying.

Both IC Markets and FXCM offer robust trading platforms catering to various trader needs. IC Markets stands out with its superior ECN technology on MetaTrader 4 and 5, as well as its customizable cTrader platform, which is perfect for algorithmic and high-speed trading. FXCM, on the other hand, provides a versatile mix of platforms, including its proprietary Trading Station, MT4, and NinjaTrader, along with strong copy trading features. Ultimately, the choice between these two brokers depends on your specific trading preferences—whether you prioritize low spreads, advanced tools, or a customizable trading experience. Both brokers offer top-tier solutions to suit traders of all levels.

Our Better Trading Platform Verdict

Without a doubt, FXCM come up trumps in this category this is due to their better trading platform.

*Your capital is at risk ‘63% of retail CFD accounts lose money’

3. Superior Accounts And Features – IC Markets

IC Markets and FXCM offer variable spread with ECN pricing. These brokers’ business models operate with no dealing desk intervention as they source their prices from liquidity providers with which they have no relationship.

Most traders with IC Markets will be one of their RAW spread accounts as these accounts offer IC Market’s best value trading conditions. Traders with FXCM are most likely to be using their Standard account. This is FXCM’s default account. If you trade a minimum of 10 million USD on a monthly basis, then you will be eligible for FXCM’s Active trader account. This is similar to IC Markets RAW Spread Account.

IC Markets Account Types

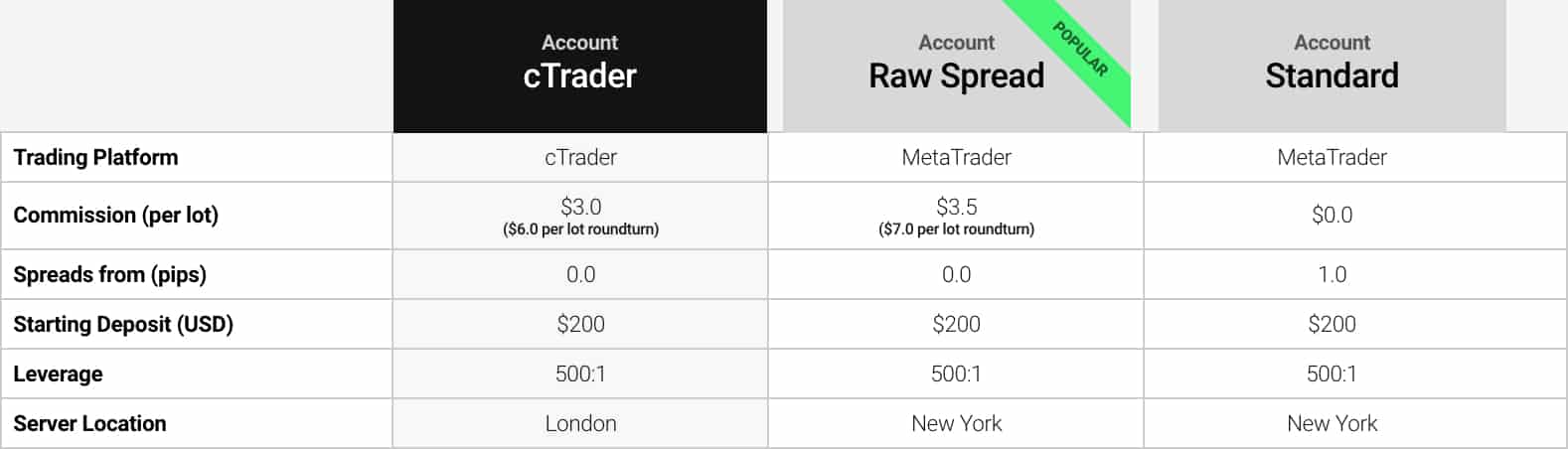

IC Markets offers three main types of trading accounts for clients; all accounts have a $200 minimum deposit requirement.

1) Standard Account

The Standard Account offers you commission-free trading on the MetaTrader 4 and MetaTrader 5 trading platforms. Spreads are slightly wider (starting from 1.0 pips) as trading fees are included in the spread. This account is popular with beginner traders due to its basic cost structure.

2) Raw Spread Account

The Raw Spread Account offers IC Markets the best STP/ECN broker spreads, starting from 0.0 pips EUR/USD. You can trade on the MetaTrader 4 or MetaTrader 5 trading platforms while paying only a $3.50 commission per lot payable each way. The Raw Spread Account has deep liquidity and fast trade execution, making it ideal for high-volume traders, scalpers and trading robots or algorithms. Due to the lower trading fees and ECN broker spreads, this is IC Market’s most popular account.

3) cTrader Raw Account

The cTrader Raw Account also offers low spreads on a range of CFDs with only a $6.00 commission per lot round turn. This account is for traders that prefer the cTrader trading platform to MetaTrader platforms.

For a realistic indication of what costs you can expect when trading with IC Markets, see our trading calculator. This tool calculates spread costs plus commission using the average spreads the broker provides each month.

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

FXCM Account Types

FXCM offers two main account types:

1) Standard Account

The Standard Account is FXCM’s default account for retail traders. This account has no commission fees and spreads starting from 0.8 pips. If you use this account, there is a $50 minimum deposit.

2) Active Trader Account

The Active Trader Account is for professional traders or high-volume investors, as there is a minimum $10 million monthly trading volume to qualify. This account, like the IC Markets Raw Spread account, has commissions, so spreads can be tighter. Commission fees start at $3.00 per lot and reduce the more you trade.

| Standard Account | Active Trader Account | |

|---|---|---|

| Minimum Deposit Requirement (Clients can open account with as little as $1) | $50 (depending on payment method) | To keep equity above $25,000 |

| Minimum Lot Trading Size | 0.1 | 0.1 |

| Commission Costs - Forex/ CFDs | No commissions | $50M to 150M - $3 per 1K lot $150 to 500M - $2.5 per 1K lot |

| Trading Platforms | Trading Station MetaTrader 4 Ninja Trader Zulu Trader Trading View Capitalise.ai | Trading Station MetaTrader 4 Ninja Trader Zulu Trader Trading View Capitalise.ai |

| Trading Execution | Market Maker/Dealing desk | Market Maker/Dealing desk |

| Social Trading | Yes | Yes |

| Trading Automation | Yes | Yes |

| Scalping | Yes | Yes |

| Hedging | Yes | Yes |

| Base Currencies - Australia | AUD, USD, NZD and more | AUD, USD, NZD and more |

| Base Currencies - UK, Europe | UK, GBP, USD, EUR, CHF and more | UK, GBP, USD, EUR, CHF and more |

| Base Currencies - South Africa | USD, EUR, GBP and more | USD, EUR, GBP and more |

| IC Markets | FXCM | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | No | Yes |

Our Superior Accounts and Features Verdict

ECN pricing accounts offer better value spreads than standard spreads, even with commission fees taken into consideration. For this reason, we consider the IC Markets Raw spread account as the best available option, as FXCM’s Active trader account has higher barriers to entry.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – IC Markets

In forex trading, effective tools are crucial for success. A user-friendly platform aids trade execution and account management, while educational materials and advanced tools help traders refine strategies. Key factors like advanced platforms, fast execution, tight spreads, and responsive service enhance the experience. Real-time data and intuitive interfaces enable traders to navigate the forex market confidently and maximize profitability.

When it comes to achieving the best trading experience, both IC Markets and FXCM offer their own set of strengths, tailored to the needs of various traders. From our recent analysis, IC Markets distinguishes itself with its MT5 platform, which is widely regarded as one of the top choices for traders in 2025. With an intuitive interface, advanced charting tools, and a seamless trading experience, the platform delivers a high level of functionality, making it an attractive option for both beginners and experienced traders. In contrast, FXCM, while not leading in platform innovation, still offers a strong trading environment with a diverse range of platforms, ensuring traders can select the one that suits their preferences and strategies.

Both brokers cater to mobile traders, allowing seamless portfolio management on the go. Furthermore, when it comes to customer support and educational resources, both IC Markets and FXCM excel. They offer comprehensive support, educational materials, and market insights, helping traders at all levels make informed decisions. Ultimately, whether you’re seeking the advanced features of IC Markets’ MT5 platform or the flexibility offered by FXCM’s diverse platform range, both brokers provide excellent opportunities for traders in the EUR and AUD markets.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| IC Markets | 134ms | 16/36 | 153ms | 22/36 |

| FXCM | 188ms | 28/36 | 189ms | 29/36 |

Our Best Trading Experience and Ease Verdict

Our team can surmise that IC Markets outshines in this niche by reason of their best trading experience and ease.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – A Tie

When it comes to forex trading, trust and regulation are the backbone of a secure and transparent trading experience. Regulated brokers adhere to strict compliance standards, ensuring fair practices, financial security, and fraud protection. This oversight safeguards traders, allowing them to focus on strategy and builds confidence. A well-regulated broker attracts more traders and enhances its reputation in the global forex market, providing a safer trading environment.

FXCM Trust Score

IC Markets Trust Score

Regulatory oversight in forex trading is crucial for creating a secure environment for traders. Brokers following strict regulations protect against fraud and malpractice, building trader confidence and participation. Trustworthy, well-regulated brokers enhance their reputation and attract more clients, boosting their market presence.

IC Markets Regulation

IC Markets operates under multiple regulatory authorities, including:

Australian Securities and Investments Commission (ASIC): AFSL 335692

Cyprus Securities and Exchange Commission (CySEC): Licence No. 362/18

Seychelles Financial Services Authority (FSA): Licence No. SD018

Regulation under these entities indicates that the broker is committed to providing superior financial services.

FXCM Regulation

FXCM is regulated by several authorities, including:

Financial Conduct Authority (FCA): Registration No. 217689

Financial Sector Conduct Authority (FSCA): FSP No. 46534

Australian Securities and Investments Commission (ASIC): AFSL 309763

It’s important to note that FXCM currently does not accept clients residing in certain jurisdictions, including the United States, Russia, Ukraine, Singapore, Turkey, Japan, and the Virgin Islands.

Risk Management

Both IC Markets and FXCM implement risk management measures to protect their clients.

Negative Balance Protection: This feature ensures that traders cannot lose more than their account balance. While FCA and CySEC require brokers to offer guaranteed negative balance protection to retail clients, it’s essential to verify the specific terms with each broker, as policies may vary depending on the regulatory jurisdiction and client classification.

In 2025, IC Markets and FXCM maintain strong regulatory frameworks, ensuring a secure trading environment. Traders should consider regulatory oversight and risk management to align with their needs and jurisdiction.

| IC Markets | FXCM | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) | ASIC (Australia) FCA (UK) CYSEC (Cyprus) CIRO (CANADA) BaFin (Germany) |

| Tier 2 Regulation | FSCA (South Africa) ISA (Israel) |

|

| Tier 3 Regulation | FSA-S (Seychelles) SCB (Bahamas) |

Our Stronger Trust and Regulation Verdict

Once again, it’s a stalemate for both IC Markets and FXCM, as a result of their stronger trust and regulation.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

6. Most Popular Broker – IC Markets

IC Markets gets searched on Google more than FXCM. On average, IC Markets sees around 246,000 branded searches each month, while FXCM gets about 40,500 — that’s 83% fewer.

| Country | IC Markets | FXCM |

|---|---|---|

| United Kingdom | 33,100 | 2,900 |

| South Africa | 9,900 | 1,000 |

| India | 8,100 | 2,900 |

| Thailand | 8,100 | 1,000 |

| Vietnam | 8,100 | 880 |

| United States | 6,600 | 2,900 |

| Australia | 6,600 | 1,300 |

| Spain | 6,600 | 590 |

| Germany | 5,400 | 1,000 |

| Pakistan | 5,400 | 1,000 |

| France | 4,400 | 1,600 |

| Brazil | 4,400 | 480 |

| United Arab Emirates | 4,400 | 480 |

| Morocco | 4,400 | 480 |

| Malaysia | 3,600 | 1,300 |

| Colombia | 3,600 | 1,000 |

| Indonesia | 3,600 | 1,000 |

| Nigeria | 3,600 | 880 |

| Italy | 3,600 | 720 |

| Singapore | 3,600 | 480 |

| Poland | 2,900 | 320 |

| Sri Lanka | 2,900 | 110 |

| Canada | 2,400 | 880 |

| Mexico | 2,400 | 480 |

| Hong Kong | 2,400 | 480 |

| Netherlands | 2,400 | 390 |

| Philippines | 2,400 | 390 |

| Kenya | 2,400 | 260 |

| Algeria | 2,400 | 260 |

| Bangladesh | 1,900 | 260 |

| Saudi Arabia | 1,900 | 260 |

| Egypt | 1,600 | 390 |

| Peru | 1,600 | 210 |

| Switzerland | 1,600 | 170 |

| Japan | 1,300 | 1,300 |

| Turkey | 1,300 | 480 |

| Argentina | 1,300 | 320 |

| Sweden | 1,300 | 170 |

| Taiwan | 1,000 | 590 |

| Ecuador | 1,000 | 170 |

| Dominican Republic | 1,000 | 140 |

| Portugal | 1,000 | 110 |

| Uzbekistan | 1,000 | 70 |

| Cyprus | 880 | 140 |

| Ghana | 880 | 110 |

| Ireland | 880 | 70 |

| Venezuela | 720 | 390 |

| Chile | 720 | 210 |

| Greece | 720 | 210 |

| Austria | 720 | 110 |

| Uganda | 720 | 90 |

| Ethiopia | 720 | 70 |

| Mongolia | 720 | 50 |

| Jordan | 590 | 70 |

| Mauritius | 480 | 40 |

| Costa Rica | 390 | 30 |

| Tanzania | 320 | 90 |

| Bolivia | 260 | 110 |

| Botswana | 260 | 50 |

| Panama | 260 | 50 |

| New Zealand | 210 | 70 |

| Cambodia | 170 | 170 |

2024 Monthly Searches For Each Brand

IC Markets - UK

IC Markets - UK

|

33,100

1st

|

FXCM - UK

FXCM - UK

|

2,900

2nd

|

IC Markets - ZA

IC Markets - ZA

|

9,900

3rd

|

FXCM - ZA

FXCM - ZA

|

1,000

4th

|

IC Markets - Thailand

IC Markets - Thailand

|

8,100

5th

|

FXCM - Thailand

FXCM - Thailand

|

1,000

6th

|

IC Markets - Australia

IC Markets - Australia

|

6,600

7th

|

FXCM - Australia

FXCM - Australia

|

1,300

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with IC Markets receiving 2,425,000 visits vs. 365,000 for FXCM.

Our Most Popular Broker Verdict

IC Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – IC Markets

A wide and vast product range and access to extensive CFD markets are key factors that elevate a broker’s appeal, allowing traders to explore multiple asset classes and adapt to shifting market conditions. Brokers with a wide range of financial instruments—forex, commodities, indices, and cryptocurrencies—offer traders more flexibility for diversifying portfolios and optimizing strategies. This variety enhances the trading experience and opens new opportunities. This review will compare brokers based on product offerings and market accessibility.

In the active and busy industry of forex trading, the breadth of available financial instruments plays a pivotal role in shaping a trader’s strategy and potential success. As of 2025, IC Markets and FXCM continue to be prominent brokers, each offering a distinct range of trading products.

IC Markets’ Expansive Offerings

IC Markets has significantly broadened its spectrum of financial products, now providing access to over 2,250 CFDs. This includes more than 61 currency pairs, 24 commodities, over 2,100 stocks, 25 indices, 21 cryptocurrencies, and 4 futures. citeturn0search3 This extensive variety enables traders to diversify their portfolios effectively, mitigating risks across different asset classes.

FXCM’s Diverse Portfolio

FXCM, while offering a more streamlined selection, caters to traders with a focus on specific markets. Their portfolio encompasses nearly 40 currency pairs, 13 stock indices and share CFDs, 9 commodities (including 3 metals), and 5 cryptocurrencies such as Bitcoin, Ethereum, Ripple, Litecoin, and Bitcoin Cash. citeturn0search0 Additionally, FXCM provides unique trading baskets, including 3 forex baskets, 6 stock baskets, and 1 cryptocurrency basket, allowing traders to engage with grouped assets for strategic exposure.

Choosing a broker depends on available instruments. IC Markets offers over 2,250 CFDs for diversification, while FXCM has a more focused selection for specific interests. The best choice aligns with individual trading goals and market exposure preferences.

| CFDs | IC Markets | FXCM |

|---|---|---|

| Forex Pairs | 61 | 42 |

| Indices | 25 | 16 |

| Commodities | 4 Metals (Gold vs 6 currencies) (Silver vs 3 currencies) 8 Softs 5 Energies | 3 Metals 5 Energies 3 Softs |

| Cryptocurrencies | 23 | 7 |

| Share CFDs | 2100+ | 219 |

| ETFs | No | No |

| Bonds | 9 | 1 |

| Futures | Yes | No |

| Treasuries | 9 | 1 |

| Investments | Yes | No |

Our Top Product Range and CFD Markets Verdict

IC Markets, evidently, is riding high in this portion in light of their top product range and CFD markets.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

8. Superior Educational Resources – IC Markets

In the busy and competitive arena of forex trading, having access to exceptional educational resources is crucial for traders to succeed. IC Markets and FXCM offer extensive learning materials for traders at all levels, including webinars, articles, video tutorials, and courses. These resources help traders gain knowledge, improve strategies, and confidently navigate the forex market. Access to quality education supports continuous growth and long-term success. This review will explore the educational offerings of both platforms, highlighting unique features and trends in forex trading.

IC Markets:

- Webinars: Regularly hosts educational webinars on various trading topics.

- Tutorials: Offers comprehensive video tutorials for beginners and advanced traders.

- E-books: Provides a range of e-books on forex trading, strategies, and market analysis.

- Trading Tools: Equips traders with advanced trading tools for better decision-making.

- Market Analysis: Delivers daily market analysis and insights to its users.

- Customer Support: 24/7 customer support to assist with any educational queries.

FXCM:

- Webinars: Conducts occasional webinars, but not as frequently as IC Markets.

- Tutorials: Limited video tutorials are available for traders.

- E-books: A few e-books on trading basics and strategies.

- Trading Tools: Basic trading tools with limited advanced features.

- Market Analysis: Offers weekly market analysis, not as detailed as IC Markets.

- Customer Support: Provides customer support, but not round the clock.

Our Superior Educational Resources Verdict

Based on our team’s in-depth research, IC Markets come up trumps in this category owing this to their superior education resources.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

9. Superior Customer Service – A Tie

Exceptional customer support is a cornerstone of a reliable forex broker, ensuring traders receive timely assistance and expert guidance whenever needed. A broker’s commitment to service quality is reflected in its responsiveness across multiple channels, including live chat, phone, and email—ideally available 24/7 to accommodate global trading hours. Multilingual support boosts accessibility for diverse clients. An efficient customer service system promptly resolves issues, builds trader trust, and enhances the trading experience. This review will evaluate how brokers deliver quality support.

When assessing forex brokers, the quality of customer support and the availability of educational resources play a vital role in shaping your trading experience. In this review, we will closely examine IC Markets and FXCM, highlighting their customer service capabilities and educational offerings. Our analysis will equip you with a thorough understanding of what each broker has to offer, empowering you to make an informed decision in line with the latest trends and insights in the forex market for 2025.

| Feature | IC Markets | FXCM |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

Customer Support

IC Markets provides exceptional local customer support through its Sydney, Australia office and its UK branch. Traders can easily reach the broker via email, Skype, phone, or the live chat feature on their website, ensuring they can connect using their preferred method. On the other hand, FXCM also excels in customer support, offering assistance through email, phone, live chat, SMS, and their dedicated trading desk line. With toll-free global numbers available in countries where FXCM has a local presence, they significantly enhance accessibility for international traders. Furthermore, both brokers feature extensive FAQ sections to address any additional questions.

Customer Services

The head-to-head FXCM vs IC Markets review shows that both brokers supply resources for training purposes and market research materials. However, IC Markets tops FXCM in this category as it offers plenty of educational resources in video format, trade set-ups via WEB TV powered by Trading Central, and an exclusive Information Hub. The IC Markets Information Hub is a forex learning center that is a portal to everything you need to know about:

– Forex trading (technical analysis, fundamental analysis, risk management, trading psychology, trading plan, and webinars)

– Daily technical analysis reports

– Daily fundamental analysis reports

– Trading data (dividend calendar, earnings reports, etc.)

– Announcements for scheduled server maintenance and company news

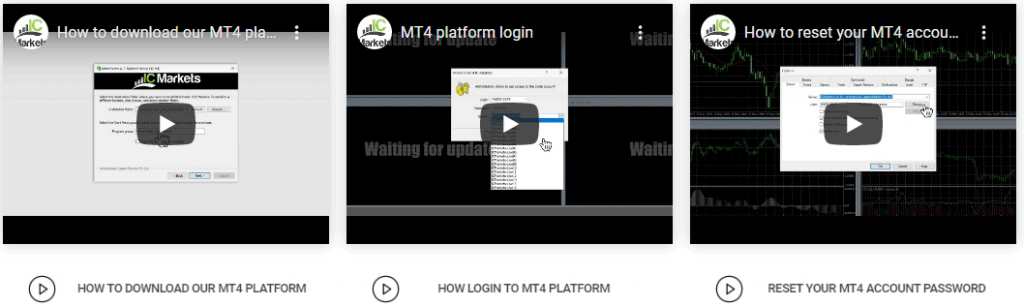

IC Markets provides a comprehensive video tutorial series on MetaTrader 4 for all skill levels and offers exclusive trading ideas from Trading Central’s professional analysts.

Educational Resources

FXCM provides basic educational resources and a daily newsletter, “Before the Bell,” featuring key technical levels, but it covers only a few instruments. Both FXCM and another broker offer an economic calendar, while FXCM also has a market scanner for identifying trading opportunities based on technical parameters.

IC Markets and FXCM both offer strong customer support and educational resources. IC Markets excels with extensive materials like video tutorials and an Information Hub, while FXCM provides solid support but less depth. Access to these resources is crucial for traders, making both platforms valuable depending on individual needs.

Our Superior Customer Service Verdict

Undeniably, it’s deadlock for both brokers, IC Markets and FXCM, this is due to their superior customer service.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

10. Better Funding Options – A Tie

When it comes to forex trading, having flexible and convenient funding options can make all the difference. Top brokers provide various deposit and withdrawal methods, including bank transfers, credit/debit cards, digital wallets like PayPal, and even cryptocurrencies. The focus is on seamless transactions, low fees, and quick processing to enhance the trading experience. This review examines how funding options affect trading and highlights standout brokers in this area.

Evaluating forex brokers requires careful consideration of several key factors, notably their funding options and withdrawal methods. These elements play a critical role in shaping the overall trading experience and convenience. In this review, we will delve into a comparison of IC Markets and FXCM, with particular emphasis on their funding options and withdrawal processes. Through this analysis, we aim to equip you with a thorough understanding of each broker’s offerings, enabling you to make a well-informed decision informed by the latest trends and insights in forex trading.

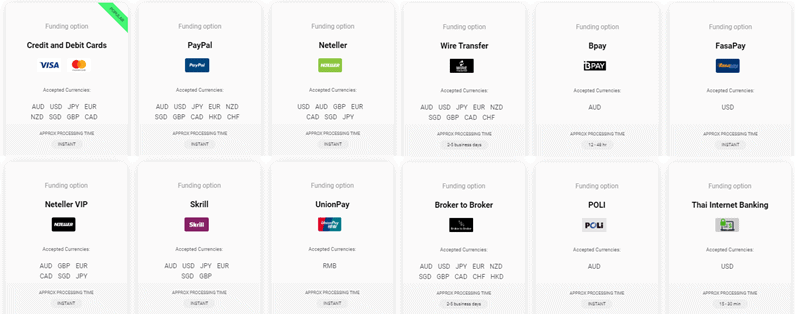

Funding Options

Both IC Markets and FXCM offer fee-free deposits when adding funds to your account. However, IC Markets provides a wider range of funding options, making it more versatile for traders from different regions. IC Markets supports 19 funding methods, including:

– Debit or credit card (Visa or MasterCard)

– Wire bank transfer and BPay (for Australia)

– Neteller and FasaPay (for the US)

– Skrill and Union Pay (for China)

On the other hand, FXCM also offers a variety of deposit methods, including:

– Debit or credit card (Visa or MasterCard)

– Wire bank transfer, Skrill, and Neteller (for international)

– BPay, POLi, and Union Pay (for Australia)

– Klarna and Rapid Transfer (for Europe and the UK)

| Funding Option | IC Markets | FXCM |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

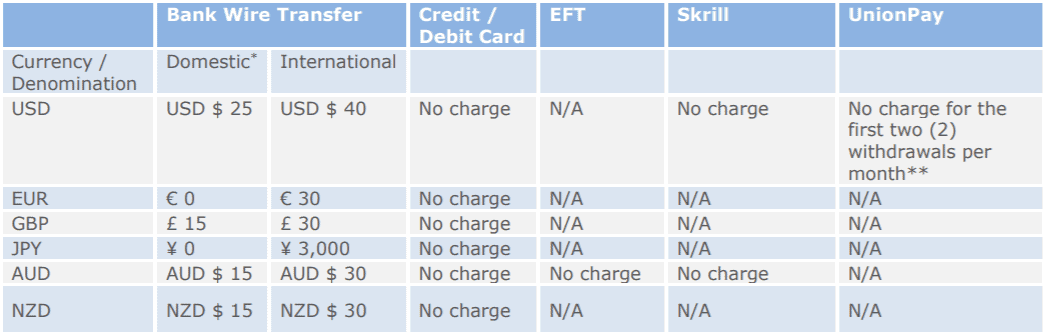

Withdrawal Methods

To withdraw funds from an IC Markets account, you are required to use the same method as you used for the deposit. There are no withdrawal fees associated, and the time taken for your account to be withdrawn is typically:

– Instant for PayPal, Neteller, and Skrill

– 1 working day for domestic bank transfer

– 3-5 working days for debit or credit cards

Similarly, FXCM offers a range of withdrawal options. However, there are only withdrawal fees when using Bank Wire and Union Pay. The available withdrawal methods include:

– Wire bank transfer

– Debit or credit card

– EFT

– Skrill

– Neteller

– Union Pay

Both IC Markets and FXCM offer a diverse array of funding and withdrawal options designed to meet the varying needs of their clients. IC Markets particularly excels with its extensive selection of funding methods, making it an

Our Better Funding Options Verdict

Both IC Markets and FXCM offer a range of funding methods covering all the most common options.

*Your capital is at risk ‘63% of retail CFD accounts lose money’

11. Lower Minimum Deposit – FXCM

For traders in the industry, the opportunity to begin with a lower minimum deposit can be transformative, especially for newcomers and those with constrained resources. This lowered barrier to entry improves market accessibility, allowing you to start your trading journey with a modest investment instead of a hefty initial outlay. By lowering the financial barrier, you gain the invaluable opportunity to acquire hands-on experience, experiment with strategies, and cultivate confidence— all while minimizing the initial risks involved.

In the ever busy world of forex trading, selecting the right broker is pivotal. As of 2025, both IC Markets and FXCM continue to be prominent names in the industry, each offering distinct advantages to cater to diverse trading needs.

Minimum Deposit Requirements

FXCM allows traders to start with just $50, making it ideal for beginners or those wanting to test without significant financial commitment. In contrast, IC Markets has a $200 minimum deposit, aligning with its extensive services and advanced trading platforms.

In summary, FXCM’s lower minimum deposit is appealing for those exploring options with minimal risk, while IC Markets, despite the higher deposit, offers superior trading conditions and tools for serious traders. Ultimately, the choice depends on your trading style and financial strategy: FXCM for accessibility or IC Markets for a professional environment.

When choosing between IC Markets and FXCM, it’s essential to consider your individual trading objectives, experience level, and regional conveniences. FXCM’s lower minimum deposit and localized banking options make it an attractive choice for beginners and those seeking straightforward account funding. Conversely, IC Markets’ higher deposit requirement is complemented by a robust suite of advanced tools and platforms, appealing to seasoned traders aiming for a comprehensive trading experience. Ultimately, aligning your choice with your trading goals and regional considerations will ensure a more tailored and effective trading journey.

Here are FXCM’s available methods of payment and base currencies:

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

| Bank Wire | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

| Skrill | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

| Neteller | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

Next, we also have IC Markets’ details on minimum deposits:

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Paypal | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Bank Wire | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Skrill | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Minimum Deposit | Recommended Deposit | |

| IC Markets | $200 | $200 |

| FXCM | $50 | $50 |

Our Lower Minimum Deposit Verdict

FXCM is riding high in this niche this is due to their lower minimum deposit.

*Your capital is at risk ‘63% of retail CFD accounts lose money’

So Is FXCM or IC Markets The Best Broker?

IC Markets is riding high in this expertise due to its comprehensive offerings, competitive spreads, robust trading platforms, and superior educational resources. The table below summarises the key information leading to this verdict:

| Categories | IC Markets | FXCM |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | No | Yes |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | Yes | Yes |

| Top Product Range And CFD Markets | Yes | No |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | Yes | Yes |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | No | Yes |

IC Markets: Best For Beginner Traders

For those just starting out in the trading world, IC Markets offers a more beginner-friendly environment with comprehensive educational resources and a user-friendly platform.

IC Markets: Best For Experienced Traders

For seasoned traders looking for advanced tools and competitive spreads, IC Markets stands out as the preferred choice.

FAQs Comparing IC Markets Vs FXCM

Does FXCM or IC Markets Have Lower Costs?

IC Markets generally offers lower costs compared to FXCM. With competitive spreads, IC Markets is often favoured by traders aiming to minimise their trading expenses. For instance, IC Markets boasts an average spread of 0.1 pips for the EUR/USD pair. For a deeper dive into Lowest Commission Brokers, check out our detailed analysis.

Which Broker Is Better For MetaTrader 4?

Both FXCM and IC Markets offer MetaTrader 4, but IC Markets is often preferred for its enhanced MT4 features and tighter spreads. Their platform integration is seamless, providing traders with a robust trading experience. If you’re keen on exploring more about MT4 brokers, our guide on the best MT4 brokers offers comprehensive insights.

Which Broker Offers Social Trading?

IC Markets provides options for social trading, allowing traders to mimic strategies of successful traders. This feature is especially beneficial for beginners looking to gain insights from seasoned traders. FXCM, on the other hand, doesn’t have a strong emphasis on social trading. For those interested in exploring the world of social trading further, our article on the best social trading platforms is a must-read.

Does Either Broker Offer Spread Betting?

FXCM offers spread betting for traders, especially those based in the UK. Spread betting is a tax-efficient way of trading in the UK, and FXCM provides a platform tailored for this type of trading. IC Markets, on the other hand, does not have a dedicated spread betting platform. For a comprehensive list of the best spread betting brokers, you can refer to our guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, IC Markets is the superior choice for Australian forex traders. It’s an Australian-based broker, founded in Sydney, and is regulated by the Australian Securities and Investments Commission (ASIC). Their deep understanding of the Australian market, combined with competitive spreads and a robust platform, makes them a top choice. Moreover, their ASIC regulation ensures a high level of trust and security for traders. For more insights on Australian forex brokers, you might want to check out our detailed review of the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

From my perspective, FXCM stands out for UK forex traders. They are regulated by the Financial Conduct Authority (FCA), ensuring a high level of trust and security for traders based in the UK. While IC Markets is a strong contender in the global market, FXCM’s FCA regulation and tailored offerings for the UK market give them an edge. Furthermore, their platform integration and customer support are tailored to cater to the needs of UK traders. For a deeper dive into UK forex brokers, our guide on the Best Forex Brokers In UK offers a comprehensive overview.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

What is a margin in FXCM?

In FXCM, margin refers to the minimum amount of capital required in your account to open and maintain a trading position. For example, if you are trading with 100:1 leverage, you would need to deposit 1% of the total position size as margin. To put it into perspective, 100:1 leverage allows you to trade with $10,000 in the market by setting aside only $100 as a security deposit.