FXCM vs FXTM: Which One Is Best?

FXCM and FXTM (or ForexTime) are two multi-regulated forex brokers that have good education, a wide range of trading platforms such as MetaTrader 4 and a range of CFD products. Read about each broker in our head-to-head review.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs: 33:1

0-50k 400:1

50k+ 200:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are five dot points highlighting the most noticeable differences between FXCM and FXTM:

- FXCM offers a raw spread of 0.30 for EUR/USD, while FXTM offers a raw spread of 0.0.

- The minimum deposit for FXCM is $50, whereas for FXTM, it’s $10.

- FXCM provides 7+ cryptocurrency CFDs, while FXTM does not offer any.

- FXCM’s maximum leverage for major pairs in Australia is 30:1, while FXTM offers the same leverage.

- FXCM offers two types of trading accounts, while FXTM provides six different trading accounts.

1. Tie: Lowest Spreads And Fees

Since FXCM and FXTM have different pricing models, we shall present a comparison of minimum spreads offered on a selection of financial instruments. For FXCM, we have used spreads offered on its Active Trader commission-based trading accounts, while for FXTM, we have used spreads offered on its ECN trading accounts.

At FXCM, the commission rate is $3.0 per 100,000 units traded ($6.0 round-turn commission), which can be reduced to $2.5 per 100,000 units traded ($5.0 round-turn commission).

- Minimum spreads on major currency pairs:

- EUR/USD – 0.1 pips at FXCM, 0.1 pips at FXTM;

- GBP/USD – 0.3 pips at FXCM, 0.2 pips at FXTM;

- USD/JPY – 0.1 pips at FXCM, 0.1 pips at FXTM.

- Minimum spreads on minor currency pairs:

- EUR/GBP – 0.2 pips at FXCM, 0.1 pips at FXTM;

- GBP/JPY – 0.5 pips at FXCM, 0.2 pips at FXTM.

- Minimum spreads on Spot Metals:

- Spot Gold (XAU/USD) – 31.0 pips at FXCM, 5.0 pips at FXTM;

- Spot Silver (XAG/USD) – 4.4 pips at FXCM, 0.4 pips at FXTM.

As an STP broker, FXTM clearly offers more competitive spreads. Minimum spreads can go even as low as 0.0 pips on Forex pairs on its Pro Account, but traders are required to keep a minimum account balance of $25,000/EUR 25,000/GBP 25,000 all the time.

On the variable spread model, FXTM offers the following trading conditions:

- Standard account – The brokerage offers variable spreads, which start from 1.3 pips on major Forex pairs and encompass all other trading costs.

- Cent Account – spreads are again all-inclusive and start from 1.5 pips on major currency pairs.

Similar to FXTM, FXCM offers all-inclusive, variable spreads on its Standard account, which starts from 1.2 pips on major pairs such as EUR/USD. Since FXCM is compensated by adding a mark-up to spreads or to rollover fees, it will not charge clients any commissions for trading Forex, Shares, Crypto and Commodity CFDs.

FXTM ECN Account Spreads

At FXTM, spreads start from 0.1 pips on major currency pairs, and a commission of $4.00 per round turn will be charged for every 1 Standard Lot traded. Yet, terms for MT4 ECN account commissions tend to be flexible and will depend on traders’ equity and trading volume (lower commission for higher equity and larger trading volume).

Forex spreads are higher on this ECN Zero account type compared to the other two ECN trading accounts, as they start from 1.5 pips, but yet, ForexTime will not charge any trading commissions.

On the FXTM professional account, there will be no re-quotes and no commissions charged, while Forex spreads start from 0.0 pips. However, institutional-level spreads can be accessed only if traders’ account balance is maintained above the minimum deposit level all the time.

Our Lowest Spreads and Fees Verdict

This is a close match-up, as there is no sizeable difference in terms of the trading costs. By industry standards, both brokers offer relatively high spreads, so there is no material advantage with either of the two brokerage trading firms. On the plus side, at FXCM standard account, you can enjoy commission-free trading.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

2. FXCM: Better Trading Platform

Both brokers have provided clients with a good choice of trading platforms – from MetaTrader 4 to proprietary software solutions. FXCM tops FXTM as it offers a selection of 6 trading platforms compared to 3 platforms found at FXTM. FXCM’s main standout trading platform is Trading Station compared to FXTM’s brand new mobile App.

| Trading Platform | FXCM | FXTM |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | No | Yes |

| cTrader | No | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | No |

FXCM vs. FXTM: Comparing Brokers’ MetaTrader 4 Software

Along with its layout customizability options and technical analysis package of 30 built-in indicators, over 2,000 free custom indicators and 700 paid indicators, FXCM’s MetaTrader 4 also offers a number of other features and benefits:

- Clients can set Stop Loss and Take Profit orders while opening a new position

- Micro lots trading available for tighter risk management

- Ability to develop and use expert advisors for automated trading strategies

- Position hedging allowed

- Partial closing of positions allowed

- No restrictions on trade orders, a condition that best suits trading styles such as scalping

- Copy-trading capability with MT4 Trading Signals

- Access to VPS hosting service – it will be completely free if clients trade an average notional volume of at least 500,000 per month for the prior 3 months

- Access to additional trading tools with FXCM Plus, including Trading Signals, Trading Analytics and Technical Analyzer

- Fast execution with price improvement – FXCM’s MT4 ensures an average execution speed of 28 ms, while, according to 2020 performance statistics, over 87% of client orders were executed with zero or positive slippage

- MT4 WebTrader is compatible with popular web browsers

Meanwhile, FXTM’s MT4 also offers much in terms of features and tools, including:

- The full technical analysis package

- MQL4 environment for development and testing of expert advisors;

- Access to FXTM Trading Signals – a tool that combines popular technical indicators and presents different scenarios

- Access to additional Forex trading indicators such as Orders Indicator, Pivots SR Levels, Spread Indicator, Day Bar Info Indicator, among others

- Execution with price improvement – according to 2020 performance statistics, the majority of FXTM client orders were executed with positive slippage

- Platform accessible from both Windows and Mac OSX devices;

- MT4 WebTrader is compatible with six browsers (Internet Explorer, Microsoft Edge, Mozilla Firefox, Google Chrome, Safari, Opera)

FXCM vs. FXTM: Mobile Trading

Both brokers offer MT4 mobile apps for iOS devices (iPhone, iPad) and Android devices (smartphones, tablets) while ensuring greater trading flexibility for clients.

Additionally, FXTM offers iOS and Android mobile apps for MetaTrader 5, along with the FXTM Trader mobile app. The latter represents FXTM’s proprietary software that features state-of-the-art charting tools, one-click trading and trading across multiple devices.

FXCM vs. FXTM: Other Trading Platforms

Along with MT4, FXTM has also included MetaTrader 5 in its list of available platforms. It offers an even wider range of technical indicators, analytical objects and timeframes, more types of pending orders as well as richer interface customizability options in comparison with the MT4 software. It also offers market-depth functionality.

Meanwhile, FXCM clients can take advantage of the broker’s proprietary CFD and Forex trading platform, Trading Station, available for Windows, Mac OSX, iOS and Android. It offers powerful analytical tools, advanced features and charting as well as good interface customisability options. The Desktop version of the platform grants access to advanced indicators such as Real Volume and Speculative Sentiment Index as well as access to a sound environment for automated strategy backtesting and optimisation.

FXCM also grants access to ZuluTrade, known as one of the best social trading platforms, which allows clients to copy trades in Forex, Shares, Cryptocurrencies and CFDs directly into their FXCM account. For a monthly subscription fee of $30, clients can access strategies from top-performing traders and pay 25% of earnings to a trader they copy in case he/she has generated a positive return.

Finally, another trading platform, available only in FXCM’s EU, UK, Australia and South Africa jurisdictions, includes NinjaTrader 8. Along with CFD trading, it also allows spread betting for UK and Ireland clients.

Our Better Trading Platform Verdict

Overall, FXCM delivers the ultimate trading package with an impressive selection of proprietary trading platforms and third-party platforms. At FXCM, algorithmic traders can also find a complete solution of 8 different third-party platforms. However, we found that FXTM provides a superior mobile trading experience.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

3. FXTM: Superior Accounts And Features

FXCM offers two types of trading accounts:

- Standard accounts and Active Trader accounts.

FXTM provides its clients with a choice of six trading accounts:

- Standard accounts and three ECN trading accounts.

The Standard accounts feature only a bid-ask spread and no trading commissions and are an appropriate choice for novice Forex traders. The ECN accounts feature much lower bid-ask spreads and include a small trading commission. This type of account is best for Forex traders with experience.

| FXCM | FXTM | |

|---|---|---|

| Minimum Deposit | $300 | From $10 |

| Number of Accounts | - 1 Standard account - 1 Active Trader Account | - 3 Standard account - 3 ECN accounts |

| EUR/USD Standard Account Spreads | 1.3 pips | 1.9 pips |

| EUR/USD Raw Account Spreads | 0.2 pips | 0.3 pips |

| Commission (Raw Account) | ✘ | $2 per side per 100k units ($4.0 round-turn) |

| Range of Platforms | Trading Station, NinjaTrader, MT4, TradingView, Capitalize | MT4, MT5 & FXTM Trader App |

| Maximum Leverage | 30:1 | - FXTM UK 1:30 - FXTM Global 1:2000 |

| Instruments | +98 | +250 |

| Social Trading | FXCM PLUS Trading Signals, MQL5 Signals and ZuluTrade | MQL5 Signals and FXTM Invest |

Standard Account Comparison

FXTM offers 3 standard accounts with different trading conditions:

- FXTM’s Standard account can be opened with a minimum deposit of $100 and grants access to global markets through the broker’s MetaTrader 4 platform only. Clients can access 59 currency pairs, 5 Spot Metals and 14 Spot Index and Spot Commodity CFDs.

- FXTM’s Cent account can be opened with a minimum deposit of $10 and grants access to financial markets through the MT4 software only. Price movements and trading results are presented in USD cents, EUR cents, or GBP pence. Clients can access 25 major and minor Forex pairs and 2 Spot Metals.

- And FXTM’s Stock CFDs account grants access to over 120 US Stocks and over 40 European Stocks traded on the MT4 software. The minimum deposit required is $100, spreads start from $0.1 and there will be no trading commissions charged. The maximum leverage on US Shares is 1:5, while that on European Shares is fixed at 1:3.

![]()

Meanwhile, FXCM’s Standard account can be opened with a minimum deposit of $50 in jurisdictions outside the EEA, while the minimum deposit requirement for countries within the EEA is $300. FXCM clients can access 40 currency pairs along with 3 FX baskets and a selection of 5 trading platforms.

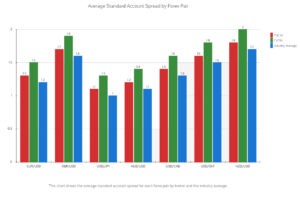

Looking at the data, it’s clear that there are some differences between the spreads offered by FXCM and FXTM. For the EUR/USD pair, FXCM has a spread of 1.3, while FXTM has a slightly higher spread of 1.5. This pattern is consistent across all the forex pairs, with FXCM generally offering lower spreads than FXTM.

In my opinion, FXCM seems to be the cheaper option when it comes to spreads. However, it’s important to remember that spreads are just one aspect of the cost of trading. Other factors, such as commission fees and account types, can also impact the overall cost.

| Forex Pair | FXCM | FXTM | Industry Average |

|---|---|---|---|

| EUR/USD | 1.3 | 1.5 | 1.2 |

| GBP/USD | 1.7 | 1.9 | 1.6 |

| USD/JPY | 1.1 | 1.3 | 1.0 |

| AUD/USD | 1.2 | 1.4 | 1.1 |

| USD/CAD | 1.4 | 1.6 | 1.3 |

| USD/CHF | 1.6 | 1.8 | 1.5 |

| NZD/USD | 1.8 | 2.0 | 1.7 |

Standard Account Analysis Updated July 2025[1]July 2025 Published And Tested Data

When we compare these brokers to the industry average, both FXCM and FXTM offer competitive spreads. In some cases, their spreads are even lower than the industry average. This shows that both brokers are striving to offer competitive pricing to their clients.

In conclusion, while FXCM appears to be the cheaper option based on spreads alone, it’s crucial to consider all costs associated with trading before choosing a broker. Both FXCM and FXTM offer competitive spreads compared to the industry average, making them both viable options for traders.

FXTM ECN Account

| ECN Account | ECN Zero Account | FXTM Pro Account | |

|---|---|---|---|

| Min Deposit | $500 | $200 | $25,000 |

| Account Currency | USD / EUR / GBP | USD / EUR / GBP | USD / EUR / GBP |

| Trading Instruments | - 48 FX pairs - 3 Spot Metals - 14 CFDs | - 48 FX pairs - 3 Spot Metals - 14 CFDs | - 43 FX pairs - 2 Spot Metals |

| Trading Platforms | MT4 / MT5 | MT4 / MT5 | MT4 / MT5 |

![]()

FXTM’s ECN account ensures the best possible pricing for clients, which is derived directly from a pool of top-tier liquidity providers. The ECN account can be opened with a minimum deposit of $500 and grants access to 48 currency pairs, 3 Spot Metals and 14 Spot CFDs traded on ForexTime’s MetaTrader 4 platform.

FXTM’s ECN Zero account can be opened with a minimum deposit of $200. Clients can access 48 Forex pairs, 3 Spot Metals and 14 Spot CFDs on the broker’s MetaTrader 4 software and 33 Forex pairs and 2 Spot Metals on its MetaTrader 5 platform.

And finally, the FXTM Pro Account is designed for professional traders only, with the minimum deposit required being $25,000. It grants access to 43 Forex pairs and 2 Spot Metals traded on ForexTime’s MT4 platform.

All ECN accounts are suitable for trading styles such as scalping as well as for traders who employ expert advisors (EAs).

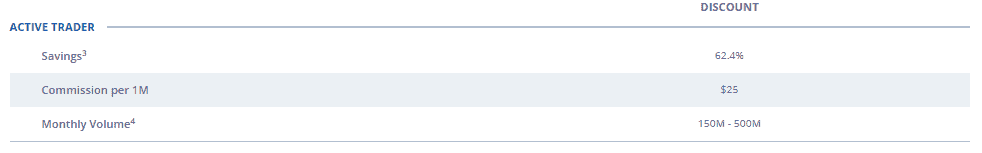

FXCM Active Trader Account

Meanwhile, FXCM’s Active Trader account is an ideal solution for high-volume traders who can receive a set of benefits (dedicated customer support, and premium services, among others) and are eligible for discounted pricing.

The brokerage will offer discounts on spreads for active traders who meet its minimum notional volume requirement of USD 150 million per month. Forex traders will receive different tier rebates depending on their trade volume.

Note* FXCM’s rebate program is valid only for financial instruments such as currency pairs, Stock Indices and a selection of Commodity CFDs.

Note* FXCM’s rebate program is valid only for financial instruments such as currency pairs, Stock Indices and a selection of Commodity CFDs.

Other benefits for active traders include:

- API trading

- Expedited processing of deposits, withdrawals, internal transfers and new account requests

- Market depth functionality on FXCM’s Trading Station software

- VPS hosting service

- All of which are available free of charge.

The minimum deposit required to open an Active Trader account is $25,000, while Forex spreads start from 0.2 pips on major pairs such as EUR/USD.

FXCM vs. FXTM: Are There Demo And Islamic Accounts Available?

Yes, both brokers offer an Islamic account (swap-free) option on their regular trading accounts, suitable for clients of the Muslim faith. Additionally, a free demo account that mimics real-time market conditions is available at both FXCM and FXTM.

| FXCM | FXTM | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | No |

| Spread Betting (UK) | Yes | No |

Our Superior Accounts and Features Verdict

Overall, both forex brokers offer account types that are suitable for beginners and active traders. However, FXTM’s offering includes a more diverse list of account types that cater to every conceivable need.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

4. FXCM: Best Trading Experience And Ease

When it comes to trading, the experience and ease of use are paramount. We’ve spent countless hours testing both FXCM and FXTM on various platforms and in different trading scenarios. From our findings:

- FXCM’s platform is intuitive with a user-friendly interface, making it easy even for beginners.

- FXTM, on the other hand, boasts a more comprehensive set of tools for the seasoned trader.

- Both brokers offer mobile trading options, but FXCM’s mobile app seemed more streamlined in our tests.

- FXTM’s educational resources are top-notch, providing traders with a wealth of knowledge to enhance their trading skills.

Now, after diving deep into both platforms and considering all aspects, it’s time to give our verdict.

Our Best Trading Experience and Ease Verdict

While both brokers offer a commendable trading experience, FXCM edges out slightly due to its user-friendly interface and streamlined mobile app.

5. Tie: Stronger Trust And Regulation

FXCM Trust Score

FXTM Trust Score

Both FXCM and FXTM comply with regulatory standards for a few of the most respected Forex regulators worldwide. FXCM and its corporate arms are authorised to conduct online trading business and are regulated in the following jurisdictions:

- United Kingdom – Forex Capital Markets Limited, an entity regulated by the Financial Conduct Authority (FCA) with registration number 217689

- Australia – FXCM Australia Pty. Limited, an entity regulated by the ASIC with AFSL number 309763

- South Africa – FXCM South Africa (PTY) Ltd, an entity regulated by the Financial Sector Conduct Authority (FSCA) with FSP number 46534

- Internationally – FXCM Global Services LLC, which is incorporated in Bermuda and is not subject to regulatory oversight.

Meanwhile, FXTM and its corporate arms are regulated in the following jurisdictions:

- United Kingdom – ForexTime UK Limited, an entity licensed and regulated by the Financial Conduct Authority (FCA) with License No. 777911

- South Africa – ForexTime Limited, an entity licensed by the Financial Sector Conduct Authority (FSCA) with FSP number 46614

- EEA – ForexTime Limited, regulated by Cyprus-based CySEC with CIF License No. 185/12

- Internationally – Exinity Limited, which is authorised and regulated by the Financial Services Commission (FSC) of the Republic of Mauritius with Investment Dealer License number C113012295.

Fund Protection

Both brokers assure that client funds are kept fully segregated from their corporate accounts at reputable financial institutions. FXCM states that it keeps client money at financial institutions that have a “credit rating equivalent to the FCA’s Credit Quality Step 5 rating.”

In addition, since FXCM is FCA-regulated, retail clients have a guarantee that they will be compensated by the Financial Services Compensation Scheme (up to GBP 85,000) in case the broker fails to meet its financial obligations. At the same time, since FXTM is a member of the Cyprus Investor Compensation Fund, its clients will be compensated in the event of FXTM’s insolvency.

Negative Balance Protection

As far as negative balance protection (NBP) policies are concerned, FXCM states that it “will waive the first US $50,000 of a client’s total negative balance ….. This policy will apply to negative balances incurred during all market conditions, including exceptional market movements.” A negative balance that exceeds the $50,000 threshold will have to be repaid by clients.

FXTM also follows a negative balance protection policy. In case of an unexpected market occurrence that results in a negative balance, the broker will not request the respective amount from its clients and will bring their account balance back to zero.

| FXCM | FXTM | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) CYSEC (Cyprus) CIRO (CANADA) BaFin (Germany) | CYSEC (Cyprus) FCA (UK) |

| Tier 2 Regulation | FSCA (South Africa) ISA (Israel) | FSCA (South Africa) |

| Tier 3 Regulation | FSC-M (Mauritius) CMA (Kenya) |

Our Stronger Trust and Regulation Verdict

The bottom line is that FXCM and FXTM bear several similarities, more or less being regulated in the same jurisdiction and offering fund protection along with NBP policy. In the end, the decision to open an account with FXCM or FXTM comes down to your personal preference and trading needs.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

6. Most Popular Broker – FXTM

FXTM gets the same Google search as FXCM. On average, FXTM and FXCM receive about 40,500 branded searches each month.

| Country | FXCM | FXTM |

|---|---|---|

| India | 2,900 | 5,400 |

| Nigeria | 880 | 5,400 |

| United States | 2,900 | 1,600 |

| Vietnam | 880 | 1,600 |

| Malaysia | 1,300 | 1,300 |

| Kenya | 260 | 1,300 |

| United Kingdom | 2,900 | 1,000 |

| South Africa | 1,000 | 1,000 |

| United Arab Emirates | 480 | 1,000 |

| Pakistan | 1,000 | 880 |

| Turkey | 480 | 720 |

| Egypt | 390 | 720 |

| Thailand | 1,000 | 590 |

| Algeria | 260 | 590 |

| Indonesia | 1,000 | 480 |

| Brazil | 480 | 480 |

| Spain | 590 | 390 |

| Hong Kong | 480 | 390 |

| Australia | 1,300 | 320 |

| Germany | 1,000 | 320 |

| Canada | 880 | 320 |

| Taiwan | 590 | 320 |

| Morocco | 480 | 320 |

| Mexico | 480 | 320 |

| Bangladesh | 260 | 320 |

| France | 1,600 | 260 |

| Japan | 1,300 | 260 |

| Colombia | 1,000 | 260 |

| Singapore | 480 | 260 |

| Philippines | 390 | 260 |

| Saudi Arabia | 260 | 260 |

| Ghana | 110 | 260 |

| Italy | 720 | 210 |

| Venezuela | 390 | 210 |

| Cyprus | 140 | 210 |

| Tanzania | 90 | 210 |

| Netherlands | 390 | 170 |

| Argentina | 320 | 170 |

| Peru | 210 | 170 |

| Uganda | 90 | 170 |

| Jordan | 70 | 170 |

| Ecuador | 170 | 140 |

| Sri Lanka | 110 | 140 |

| Cambodia | 170 | 110 |

| Ethiopia | 70 | 110 |

| Poland | 320 | 70 |

| Greece | 210 | 70 |

| Dominican Republic | 140 | 70 |

| Botswana | 50 | 70 |

| Chile | 210 | 50 |

| Switzerland | 170 | 50 |

| Sweden | 170 | 50 |

| Portugal | 110 | 50 |

| Austria | 110 | 50 |

| Bolivia | 110 | 50 |

| Mauritius | 40 | 40 |

| Uzbekistan | 70 | 30 |

| Ireland | 70 | 30 |

| New Zealand | 70 | 30 |

| Costa Rica | 30 | 30 |

| Panama | 50 | 20 |

| Mongolia | 50 | 10 |

2024 Monthly Searches For Each Brand

FXCM - India

FXCM - India

|

2,900

1st

|

FXTM - India

FXTM - India

|

5,400

2nd

|

FXCM - US

FXCM - US

|

2,900

3rd

|

FXTM - US

FXTM - US

|

1,600

4th

|

FXCM - Malaysia

FXCM - Malaysia

|

1,300

5th

|

FXTM - Malaysia

FXTM - Malaysia

|

1,300

6th

|

FXCM - UAE

FXCM - UAE

|

480

7th

|

FXTM - UAE

FXTM - UAE

|

1,000

8th

|

Similarweb shows a different story when it comes to February 2024 website visits with FXTM receiving 473,000 visits vs. 365,000 for FXCM.

Our Most Popular Broker Verdict

FXTM is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

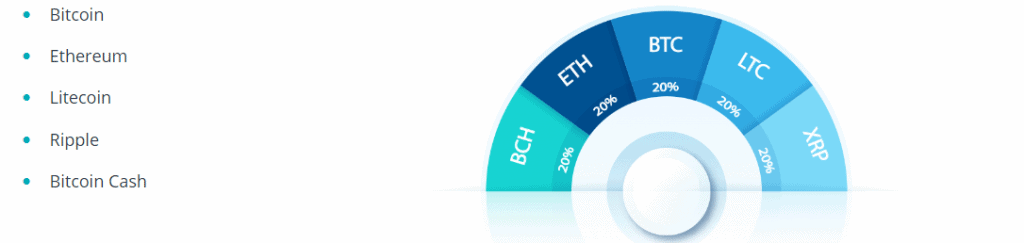

7. Tie: Top Product Range And CFD Markets

Our review has found that FXCM focuses mostly on forex trading along with other unique trading baskets. At the same time, FXTM doesn’t keep its focus only on the FX niche but offers the ability to trade on numerous shares. Both brokers also offer some stock indices and commodities as well as for cryptocurrencies as CFDs.

Although crypto products are offered by both brokers, retail traders in the UK are no longer able to trade cryptocurrencies. The UK’s Financial Conduct Authority (FCA) recently changed regulation, banning retail traders from accessing crypto markets.

Note * At FXTM, traders can access +250 financial instruments compared to only 98 CFDs offered by FXCM.

| FXCM | FXTM | |

|---|---|---|

| Financial Instruments | +98 | +250 |

| FX Pairs | 40 | 62 |

| Indices CFDs | 15 | 11 |

| Commodity CFDs | 8 | 3 (Energies) |

| Metals | 3 | 5 |

| Shares CFDs | 15 | -50 European stocks -141 US stocks |

| Cryptocurrencies | 7 | ✘ |

| FX Basket | 3 | ✘ |

| Stock Basket | 6 | ✘ |

| Crypto Basket | 1 | ✘ |

Risk warning: Trading CFDs on retail investor accounts is associated with a high risk of losing capital rapidly due to high leverage ratios. Therefore, clients need to be fully aware of how such complex instruments work before they start trading on a live account.

Tradable financial instruments offered by both FXCM and FXTM can be summarised as follows:

- Foreign Exchange – 40 major, minor and exotic Forex pairs at FXCM vs. 62 Forex pairs at FXTM

- Stock Index CFDs – 15 contracts at FXCM vs. 11 contracts at FXTM

- Crypto CFDs – 7 Cryptocurrencies at FXCM (Bitcoin, Ethereum, Litecoin, Ripple, etc.) while FXTM lacks crypto trading (not available in UK)

- Commodity CFDs – 11 Spot Metals, Energies and Agricultural Commodities at FXCM vs. 8 Spot Metals and Spot Energies at FXTM

- Stock and ETF CFDs – 15 US Stock CFDs available on FXCM’s MetaTrader 4 and Trading Station platforms vs. 141 US Stock CFDs and 50 European Stock CFDs available on FXTM’s MetaTrader 5 platform.

FXCM stands out for offering unique trading products, including:

- 3 forex baskets (us dollar index, Japanese Yen index and emerging market index) – the currency baskets are designed to display the performance of the USD, JPY and emerging currencies against a basket of major currencies.

- 6 stock baskets (BIOTECH, CANNABIS, ESPORTS, FAANG, CHN.ECOMM and CHN.TECH) acts as benchmarks that track the price movement of different stock sectors.

- 1 crypto basket (CryptoMajor) a weighted crypto index made up of 5 of the most traded cryptocurrencies

Our Top Product Range and CFD Markets Verdict

Overall, FXTM offers more CFD instruments, but FXCM covers more asset classes and has unique baskets that give you exposure to specific sectors. On the other hand, FXTM clients can get access to a wider selection of FX pairs and more stocks to trade. FXCM also has forex trading, but it’s not accessible for all FX pairs like with FXTM.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

8. Tie: Superior Educational Resources

Education And Research

As we were navigating the brokers’ websites, it immediately became clear that both FXCM and FXTM had particularly invested resources in their Forex trading education sections, offering diverse content to clients.

For example, FXTM offers a selection of free eBooks that cover topics such as 50 Successful Traders’ Habits, Elliott Wave Theory, Bitcoin trading, and Bullish and Bearish Candlestick Patterns.

The platform furnishes an illuminating pedagogical zone, delineating Forex strategies such as ‘The Pop ‘n’ Stop Trade’ and ‘Forex Dual Stochastic Trade’. It demystifies Forex indices like Ichimoku Kinko Hyo and Stochastic Oscillator and enlightens trading styles from Day Trading to Position Trading.

As a paragon in Forex education, FXTM organises free, regular webinars, concentrating on risk mitigation, trading psychology, and intricate trading tactics.

Last but not least, the STP broker has provided short Forex trading videos focused on concepts such as Forex Basics, Trading Basics and Technical Analysis.

And let us not forget FXTM’s extensive glossary containing explanations of the most important terms within the Forex industry.

Meanwhile, FXCM offers its clients two comprehensive trading guides – Forex Trading for Beginners and Best Practices of Successful Traders.

The broker’s education section also includes:

- Free forex trading webinars and live market updates, conducted five days per week and featuring Senior Market Specialist Russell Shor.

- A vast Forex video library covering Forex trading basics, platform functionality, trading strategies and more.

- Free subscription service to FXCM’s SMS Trade Alerts in Forex, Shares, Bitcoin and CFDs, which are delivered to their mobile device on a daily basis.

Clients should be aware that all the educational and research content is provided with sole informational purposes and should not be taken as investment advice. If you have an inquiry about the online trading service offered by any of the two brokerage trading firms, don’t hesitate to contact them directly.

Our Superior Educational Resources Verdict

Finally, along with educational materials, FXCM offers an entire suite of research tools and market resources, including an economic calendar, a free daily newsletter, a market scanner, market data signals and a daily snapshot for trading ideas.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

9. Tie: Superior Customer Service

Both brokerages offer professional customer support services through several popular channels. First of all, 24/5 support via live chat is available with both brokers. FXTM also offers other chat options such as WhatsApp, Viber, Telegram and Facebook Messenger. We were left with some positive impressions by the live chat option at both brokers, as we obtained useful information on the matters we asked about.

| FXCM | FXTM | |

|---|---|---|

| Live Chat | ✔ | ✔ |

| ✔ | ✔ | |

| Phone | ✔ | ✔ |

| Social Media | ✘ | WhatsApp, Viber, Telegram & FB Messenger |

| Call Back | ✔ | ✘ |

| FAQs | ✔ | ✔ |

Second, 24/5 support is also available over the phone:

- Clients can contact FXTM’s support team by dialling +357 25 55 87 77

- Clients can contact FXCM’s support team by dialling +1 646 253 1401.

In addition, FXCM provides a list of international free call numbers for its clients. Moreover, FXCM customer support can be contacted via SMS message.

Third, both brokers can be contacted via email. In both cases, we received emailed responses to our inquiries in a bit less than 24 hours, while the information was precise. Clients can contact FXTM for general and account-specific inquiries via email.

Our Superior Customer Service Verdict

Overall, both forex brokers are well prepared to serve and assist clients with their needs via a professional customer support service.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

10. FXCM: Better Funding Options

Deposit And Withdrawal Options

| FXCM | FXTM | |

|---|---|---|

| Base Currencies | 5 | 7 |

| Payment Methods | 5 | 7 |

| Inactivity Fee | $50 | $5 |

| Withdrawal Fees | $40 Bank Transfer | - Eur 20 for bank transfer - 2% for Paypal - $3 for credit card |

With FXCM, clients can choose from five different account funding options, while the broker will charge no deposit fees:

- Debit Card or Credit Card by Visa, MasterCard or Discover – the fastest account funding option, but there will be a maximum deposit limit of $30,000 per calendar month;

- Bank wire transfer – deposits will take between 3 and 5 business days for international transfers, less for domestic transfers;

- Skrill – maximum deposit limit of $20,000 per calendar month;

- Neteller – maximum deposit limit of $20,000 per calendar month;

- UnionPay – maximum deposit limit of $30,000 per calendar month.

In comparison, FXTM allows account funding via seven payment options and will also charge no deposit fees:

- Debit Card or Credit Card by Visa, Maestro or MasterCard;

- Bank wire transfer

- Electronic wallets: PayPal, Neteller, Skrill, Dotpay

- Western Union Quick Pay

When it comes to withdrawal options, FXCM will not charge any withdrawal fees for Debit/Credit Cards and E-wallets. However, it will apply a fee of up to $40 for withdrawals via bank wire transfer. The fees will depend on the base account currency and the location of the target bank account.

Meanwhile, at FXTM, fund withdrawals via Credit Cards, the bank wire transfer will incur a small fee of USD 3, while PayPal withdrawals will incur a 2% commission rate.

FXCM vs. FXTM: Non-Trading Costs

There will be no account maintenance fees and deposit fees at both brokers.

However, both FXCM and FXTM will charge an inactivity fee. FXCM will charge an inactivity fee of $50 in case there is no client-initiated activity for a period of 12 months. FXTM will charge such a fee ($5/EUR 5/ GBP 5) in case there is no trading activity for a period of 6 months.

Our Better Funding Options Verdict

While FXTM supports more base currencies and offers more payment options, both brokers cover the most popular online payment methods. Both forex brokers aim to offer secure and easy ways to fund your trading account. On the downside, we should point out that FXTM charges a small withdrawal fee.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

11. FXTM: Lower Minimum Deposit

FXTM has a lower minimum deposit of $10 vs $50 from FXCM. These minimum amounts apply to all regions and payment channels for both brokers.

Here’s a look at both brokers’ required and recommended deposits:

| Minimum Deposit | Recommended Deposit | |

| FXCM | $50 | $50 |

| FXTM | $10 | $500 |

Our Lower Minimum Deposit Verdict

FXTM wins with its $10 minimum. Plus, FXCM allows deposits made in five different major currencies (EUR, USD, GBP, AUD, CHF), while FXTM supports seven different base account currencies, including USD, EUR, GBP, PLN, CZK, INR and NGN.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

So Is FXTM or FXCM The Best Broker?

FXCM is the winner because it offers a better trading platform, superior educational resources, and a broader product range. The table below summarises the key information leading to this verdict:

| Criteria | FXCM | FXTM |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ✅ |

| Better Trading Platform | ✅ | ❌ |

| Superior Accounts And Features | ❌ | ✅ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ✅ |

| Top Product Range And CFD Markets | ✅ | ✅ |

| Superior Educational Resources | ✅ | ✅ |

| Superior Customer Service | ✅ | ✅ |

| Better Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ❌ | ✅ |

FXTM: Best For Beginner Traders

FXTM is better for beginner traders because of its diverse account types and superior educational resources.

FXCM: Best For Experienced Traders

FXCM is better for experienced traders due to its user-friendly interface and streamlined mobile app.

FAQs Comparing FXCM Vs FXTM

Does FXTM or FXCM Have Lower Costs?

FXCM generally offers more competitive spreads than FXTM. On average, FXCM’s spreads start from 1.3 pips, while FXTM’s spreads can go as low as 0.5 pips on their ECN account. Both brokers have different account types with varying spreads. For more detailed spread comparisons, check out this comprehensive list on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both FXCM and FXTM offer MetaTrader 4 as one of their trading platforms. FXCM’s MT4 platform is known for its advanced features and user-friendly interface. On the other hand, FXTM’s MT4 platform is praised for its speed and reliability. For traders looking for the best MT4 experience, this list of top MT4 brokers might be helpful.

Which Broker Offers Social Trading?

FXTM offers social trading features, allowing traders to copy the trades of experienced professionals. FXCM, on the other hand, does not have a dedicated social trading platform. However, both brokers provide tools and resources for traders to enhance their trading strategies. If you’re interested in social or copy trading, here’s a list of the best copy trading platforms.

Does Either Broker Offer Spread Betting?

FXCM offers spread betting, while FXTM does not. Spread betting is a popular trading method in the UK due to its tax benefits. If you’re interested in exploring the best brokers for spread betting, check this out.

What Broker is Superior For Australian Forex Traders?

In my opinion, FXCM is superior for Australian Forex traders. Both FXCM and FXTM are ASIC regulated, which ensures a high level of security for traders. However, FXCM was founded overseas, while FXTM has its origins in Australia. For a comprehensive list of the Best Forex Brokers In Australia, visit this page.

What Broker is Superior For UK Forex Traders?

From my perspective, FXTM stands out for UK Forex traders. Both brokers are FCA regulated, ensuring trustworthiness and reliability. FXCM was founded overseas, whereas FXTM originated in the UK. If you’re looking for the Best Forex Brokers In UK, here’s a great resource.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Is FXTM good for scalping?

Yes, with low commissions, tight spreads and fast execution, FXTM is a good option for scalping.