Plus500 vs City Index: Which One is Best?

Plus500 and City Index are both market makers, so the spreads should be similar. Let’s see if this is the case, along with other key features such as leverage, risk tools, customer services and accounts, to decide which broker is best for each category.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 10:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are some key differences:

- Plus500 offers a proprietary platform, while City Index provides multiple platforms, including MetaTrader 4 and their Web Trader platform.

- City Index offers a wider range of risk management tools, with Plus500 notably providing guaranteed negative balance protection.

- Plus500’s demo account has unlimited access, whereas City Index’s demo account has a 12-week limit.

- City Index offers more comprehensive research and educational tools compared to Plus500.

- Plus500 has a minimum deposit of $100, while City Index requires no minimum deposit.

1. Lowest Spreads And Fees – Tie

Both Plus500 and City Index are known as market makers with No Dealing Desk Brokers. This means the brokers are always the counterparty when you execute a trade. This trading model is sometimes known as B-book, as the brokers keep the customer’s trades on their own books.

Although market maker types broker profits when your trades lose and can be therefore seen to be working against you, there are still good reasons to consider choosing a market maker. These include:

- Your spreads will generally be fixed. Advantages of this include:

- Easier to trade when large market shocks occur

- Better consistency during peak and off-peak trading hours

- No commissions add-ons to your costs

- Your trades are more likely to fill even when liquidity in the general market is low

- Market maker spreads need to be competitive due to competition, so spreads will generally reflect market prices.

Spreads Comparison

| Spreads | EUR/USD | USD/JPY | AUD/USD | GBP/USD |

|---|---|---|---|---|

| Plus500 (31/07/2019) | 0.60 | 0.70 | 0.60 | 1.11 |

| City Index (CFD) | 0.69 | 0.77 | 0.73 | 1.22 |

| City Index (MT4) | 1.7 | 2.2 | 1.5 | 2.1 |

Looking at our sample of spreads, it does appear that Plus500 spreads are slightly more narrow than City Index using each broker’s own platforms. Spreads on MT4 for City Index are wider and, therefore, more costly and not suitable for scalping.

It is worth noting that City Index spreads are taken from their website and are a time-weighted average for the first quarter of 2017. Plus500, on the other hand, don’t provide a time-weighted average and instead provide real-time quotes offering a transparent pricing model.

Given we are comparing spreads across a different time period, we can’t say with certainty that Plus500 spreads are going to be narrower than City Index, but we can say they are likely to be very similar.

Other Costs

Guaranteed Stop Loss Order (GSLO) –

- Both brokers offer GSLO for a small premium

Inactivity Fees –

- If you don’t trade with your City Index account for a 24-month period, then you will incur a monthly $15 charge.

- If you don’t log into your account for 3 months, Plus500 will charge you USD$10 once a month until you log back in.

Deposit And Withdrawal Charges / Funding Charges

| Plus500 | City Index | Plus500 Minimum (Deposit) | City Index Minimum (Withdrawals) | |

|---|---|---|---|---|

| Debit / Credit Card (Visa/MasterCard) | No Charge | No Charge | 200 | 50 |

| PayPal | No Charge | Not Offered | 200 | 50 |

| Skrill | No Charge | Not Offered | 200 | 50 |

| Bank Transfer | No Charge | No Charge | 500 | 50 |

| BPay | No Charge | No Charge | 100 | 50 |

| PayID | Not Offered | No Charge | N/A | N/A |

Additional Notes:

- City Index allows a maximum of $20,000 for a single transaction

- City Index allow $20,000 per 24 hours when you withdraw online with credit cards and debit cards

Our Lowest Spreads and Fees Verdict

We noted that Plus500 had slightly cheaper spreads than City Index; however, we realise we have applied sample spreads for a different time period. If choosing between Plus500 and City Index, we suggest looking at other criteria as part of your selection, as this is where the most noticeable differences will be found.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

2. Better Trading Platform – Tie

| Trading Platform | Plus500 | City Index |

|---|---|---|

| MetaTrader 4 | No | Yes |

| MetaTrader 5 | No | No |

| cTrader | No | No |

| TradingView | No | Yes |

| Copy Trading | No | Yes |

| Proprietary Platform | Yes | Yes |

Plus500 Trading Platform

Plus500 has its own propriety platform; they do offer MetaTrader, which is commonly available with other brokers. The platform is available for web, desktop and mobile apps(Android and iOS). Regardless of which medium you use for trading, the platform is the same for all tools, meaning you can seamlessly switch between trading mediums.

One unique feature is that the platform is available in 30 languages. This may appeal to you if English is not your preferred language.

The platform’s main feature is its user-friendly design. Its clean interface and ease of navigation are exceptionally good for those new to trading, as they will not be overwhelmed with too much information. The main catch with this design is that the platform has limited customisation features.

On the main screen, you will find all the information you need, along with 4 tabs where you can access your past and current positions.

The platform allows you access to 2000+ instruments, and you can choose from over 100 technical indicators.

One issue some users may find with the platform is that one cannot add 3rd party tools to the platform. This means you can only use Plus500 charting tools.

City Index Trading Platforms

Released in Nov 2018, Web Trader is City Index’s online platform will Advantage Web, which is being phased out. Web Trader is built using HTML5 rather than Flash, which means better loading performance with less power.

The following key features are available:

Customisation

- 10 workspaces that you can build with your desired charts, news, positions and watch lists.

- Single click between workspaces. and the ability to switch between them with a single click.

- Advanced charts, which consist of custom indicators and drawing tool can capture precise information

- Charts with an overlay of 2 different markets

Charts

- 10 different chart types powered by Trading View

- Trade within charts

- 57 indicators

Intelligent Tools

Intelligent Tools

- Improved search functionality

- Search by market name

- Search by stock code

- Browse by product

- Browse by region

- P&L balance bar

- Risk management features in the smart trade ticket

- Set ticket by P&L, price or points away.

- Real-time ‘Margin required’ is shown on the ticket price.

- Set more than one stop and limit for each position on the trade ticket

- hedging via trade ticket

360° Market view

- Reuters

- Latest market prices

- Economic Calendars

City Index AT Pro

Available as a download on desktop, AT Pro is for advanced users as it offers the most powerful trading features in the City Index trading suite. The following features are available:

- Creation of custom templates with .NET, C# or Visual Basic

- 140 indicators

- Backtesting tools

- 25 drawing tools

- 15 timeframes

City Index Apps For IOS And Android

- Apple. Android mobiles and tablets

- 60 indicators are available

MetaTrader 4 (MT4) – City Index

City Index offers MetaTrader 4. MetaTrader 4 is the most commonly used trading platform for both traders and brokers. Its popularity means you can be sure to find all the essential features you will need for successful trading.

As MT4 is common, it means you can easily change to other brokers without needing to learn a new trading platform.

MT4 is best if you trade Forex or other decentralised assets such as commodities. It is not the best platform for assets that trade via a centralised exchange, such as shares or stocks.

Our Better Trading Platform Verdict

Normally, we would recommend the MetaTrader 4 platform; however, we have previously noted that spreads with MT4 for City Index are wider, so we advise looking at one of the brokers’ custom platforms.

Choosing between Plus500 or City Index custom platforms is a case of personal preference. We are impressed with City Index Web Trader platform because it has all the charts, timeframes and indicators the majority of traders will require and is built to HTML5, meaning faster speeds and, therefore, less slippage.

We suggest signing up for a demo of each broker’s platform and testing them out for yourself.

City Index ReviewVisit City Index

Your capital is at risk ‘68% of retail CFD accounts lose money with City Index’

3. Superior Accounts And Features – City Index

When comparing the account features of Plus500 and City Index, several distinctions emerge. City Index provides a diverse range of risk management tools, some of which are not available with Plus500. However, Plus500 stands out with its unlimited access demo account, a feature not matched by City Index’s 12-week limited demo. Plus500’s proprietary trading platform is user-friendly and available in 30 languages, catering to a global audience.

In contrast, City Index offers a variety of platforms, including the popular MetaTrader 4 and their newly introduced Web Trader platform. City Index further distinguishes itself with a comprehensive suite of research and educational tools, giving traders an edge in their trading journey.

Account Features Comparison

| Plus500 | City Index | |

|---|---|---|

| ASIC Regulation | ✔ | ✔ |

| No Commissions | ✔ | ✔ |

| Fixed or Variable Spreads? | Fixed | Fixed and Variable |

| Currency Pairs | 61 | 84 |

| Lots | Standard, Micro, Mini | Standard, Micro, Mini |

| Minimum Deposits | No Minimum | No Minimum |

| Hedging | ✘ | ✔ |

| Expert Advisors | ✘ | ✔ |

| Social Copying | ✘ | ✘ |

At the trading account level, both accounts are relatively similar. The main difference of note is that City Index does allow hedging, which Plus500 doesn’t. Hedging is a useful risk management tool as it allows you to protect your position with currency movements.

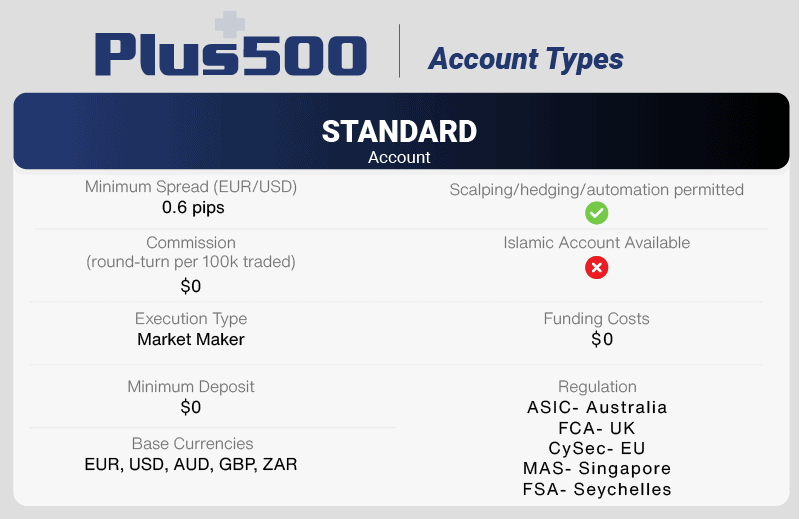

Plus500 Account Details

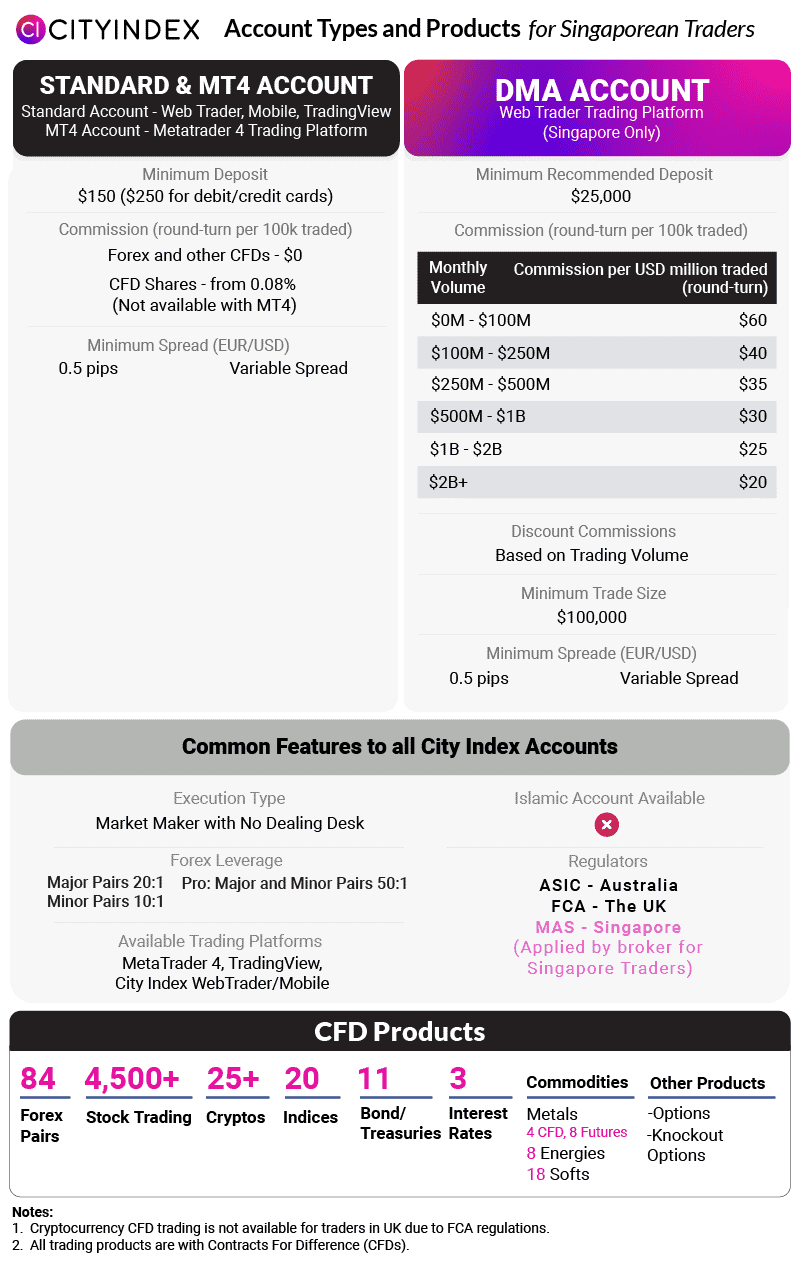

City Index Account Details

| Plus500 | City Index | |

|---|---|---|

| Standard Account | Yes | No |

| Raw Account | No | Yes |

| Swap Free Account | No | No |

| Active Traders | No | No |

| Spread Betting (UK) | No | Yes |

Our Superior Accounts and Features Verdict

While both brokers have their strengths, City Index offers a more comprehensive suite of tools and features, making it the preferable choice for traders looking for versatility and depth in their trading accounts.

City Index ReviewVisit City Index

Your capital is at risk ‘68% of retail CFD accounts lose money with City Index’

4. Best Trading Experience And Ease – Tie

Having spent a considerable amount of time on both Plus500 and City Index, I can confidently share my insights on the trading experience. Plus500’s proprietary platform is intuitive and caters to traders of all levels, making it a breeze to navigate and execute trades.

The platform’s availability in 30 languages is a testament to its global appeal. On the other hand, City Index offers the flexibility of multiple platforms, including the renowned MetaTrader 4. This gives traders the freedom to choose a platform that aligns with their trading style.

- From our testing, the best MT4 broker is Pepperstone.

- For those who prefer MT5, IC Markets stands out.

- EightCap takes the crown for offering the best TradingView experience.

- ThinkMarkets, with its ThinkTrader, is our top pick for the best trading app.

Continuing with the comparison, City Index’s comprehensive research tools and educational resources provide an added advantage, especially for traders keen on expanding their knowledge. Plus500, while user-friendly, might not offer the same depth in terms of research tools.

However, its unlimited demo account access is a significant advantage for those looking to practice without time constraints. In conclusion, both brokers offer a unique trading experience, but the choice ultimately boils down to individual preferences and trading needs.

Our Best Trading Experience and Ease Verdict

City Index ReviewVisit City Index

Your capital is at risk ‘68% of retail CFD accounts lose money with City Index’

5. Stronger Trust And Regulation – Tie

City Index Trust Score

Plus500 Trust Score

Regulation

Both brokers are multi-regulated, and the leverage you’ll be offered is dependent on the subsidiary you are signed up to and the asset class you are trading.

Plus500’s maximum leverage is 300:1 and is offered via its FSA-regulated branch in Seychelles. In Singapore, MAS requires Plus500 to cap forex leverage at 20:1, while elsewhere in Australia (ASIC), NZ (FMA), Europe (CySEC), the UK (FCA) and South Africa (FSCA), the broker limits leverage to 30:1.

If you are a City Index trader, 30:1 is the highest leverage available through the Best Forex Brokers In Australia, UK and Dubai (DFSA) subsidiaries.

Leverage can be seen as a way to supercharge your earnings, as the brokers will lend you greater levels of cash for each dollar you deposit in your account. Generally, forex currency pairs do not change enough for major savings to occur; however, with greater funds invested, you can increase your profits despite marginal changes in currency.

It is important to note currency movements can be either favourable or unfavourable. When currency movements don’t move in your favour, you will make large losses, which will need to be paid to the broker.

It is, therefore, important to use leverage responsibly. This means assessing the risks with your trade and the level of leverage you are willing to take on.

| Plus500 | City Index | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) CYSEC (Cyprus) FMA (New Zealand) MAS (Singapore) | ASIC (Australia) FCA (UK) MAS (Singapore) |

| Tier 2 Regulation | DFSA (Dubai) EFSRA | |

| Tier 3 Regulation | FSA-S (Seychelles) FSCA (South Africa) |

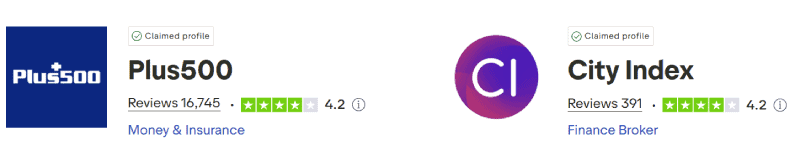

Reviews

As shown below, both Plus500 and City Index maintain a Trustpilot rating of approximately 4.2 out of 5. Notably, Plus500’s score is derived from over 16,000 customer reviews, whereas City Index’s rating is based on around 400 reviews. City Index edges ahead in overall customer satisfaction, though Plus500 remains popular due to its simplicity and accessibility.

Our Stronger Trust and Regulation Verdict

Plus500 offers the highest leverage via its offshore, FSA-regulated branch in Seychelles. Elsewhere, both brokers are overseen by top-tier regulators and restricted to offering low leverage of 30:1 or less.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

6. Most Popular Broker – Plus500

Plus500 gets searched on Google more than City Index. On average, Plus500 sees around 201,000 branded searches each month, while City Index gets about 8,100 — that’s 95% fewer.

| Country | Plus500 | City Index |

|---|---|---|

| Poland | 18,100 | 40 |

| Thailand | 14,800 | 90 |

| India | 12,100 | 3,600 |

| Brazil | 9,900 | 1,000 |

| United Arab Emirates | 9,900 | 50 |

| Colombia | 6,600 | 260 |

| Pakistan | 6,600 | 50 |

| Hong Kong | 6,600 | 20 |

| Germany | 5,400 | 110 |

| Sweden | 5,400 | 20 |

| Canada | 3,600 | 10 |

| Austria | 3,600 | 10 |

| United Kingdom | 2,900 | 30 |

| Peru | 2,900 | 70 |

| Netherlands | 2,900 | 40 |

| Vietnam | 2,400 | 10 |

| Ghana | 2,400 | 10 |

| Mongolia | 1,900 | 10 |

| Bangladesh | 1,600 | 390 |

| Argentina | 1,300 | 880 |

| Italy | 1,300 | 10 |

| Indonesia | 1,000 | 10 |

| Spain | 1,000 | 10 |

| United States | 880 | 70 |

| Portugal | 880 | 10 |

| Panama | 880 | 10 |

| Greece | 720 | 20 |

| Cyprus | 480 | 10 |

| Taiwan | 480 | 10 |

| Jordan | 480 | 90 |

| Philippines | 320 | 70 |

| Algeria | 320 | 30 |

| Singapore | 320 | 40 |

| Uzbekistan | 320 | 40 |

| Bolivia | 320 | 20 |

| Malaysia | 260 | 30 |

| Turkey | 260 | 40 |

| Nigeria | 260 | 30 |

| Saudi Arabia | 210 | 20 |

| Ecuador | 210 | 70 |

| Australia | 210 | 10 |

| Morocco | 140 | 30 |

| Venezuela | 110 | 10 |

| Uruguay | 110 | 20 |

| Sri Lanka | 90 | 10 |

| Switzerland | 90 | 10 |

| Cambodia | 90 | 20 |

| Uganda | 90 | 10 |

| South Africa | 70 | 20 |

| Mexico | 70 | 10 |

| Dominican Republic | 70 | 10 |

| New Zealand | 70 | 10 |

| Tanzania | 50 | 10 |

| Ethiopia | 50 | 10 |

| Botswana | 50 | 10 |

| Costa Rica | 50 | 10 |

| Ireland | 40 | 10 |

| Egypt | 20 | 10 |

| Chile | 20 | 10 |

| Japan | 20 | 10 |

| Kenya | 20 | 10 |

| Mauritius | 20 | 10 |

| France | 10 | 10 |

18,100 1st | |

40 2nd | |

12,100 3rd | |

3,600 4th | |

9,900 5th | |

50 6th | |

6,600 7th | |

20 8th |

Similarweb shows a similar story when it comes to August 2025 website visits with Plus500 receiving 6,096,000 visits vs. 144,523 for City Index.

Our Most Popular Broker Verdict

Plus500 is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

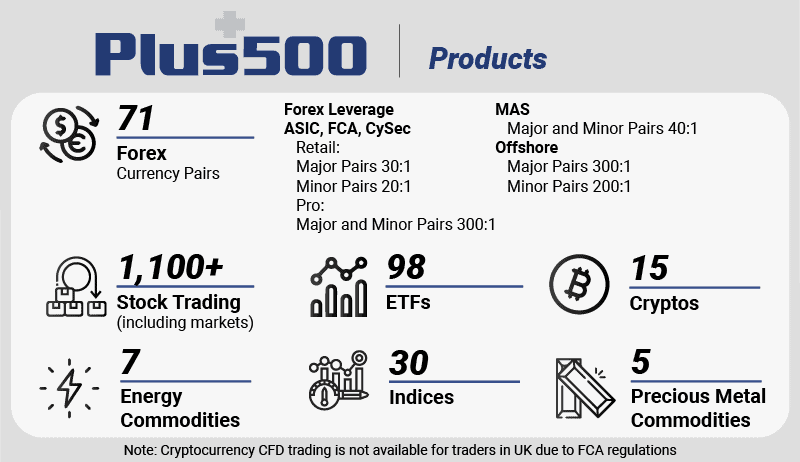

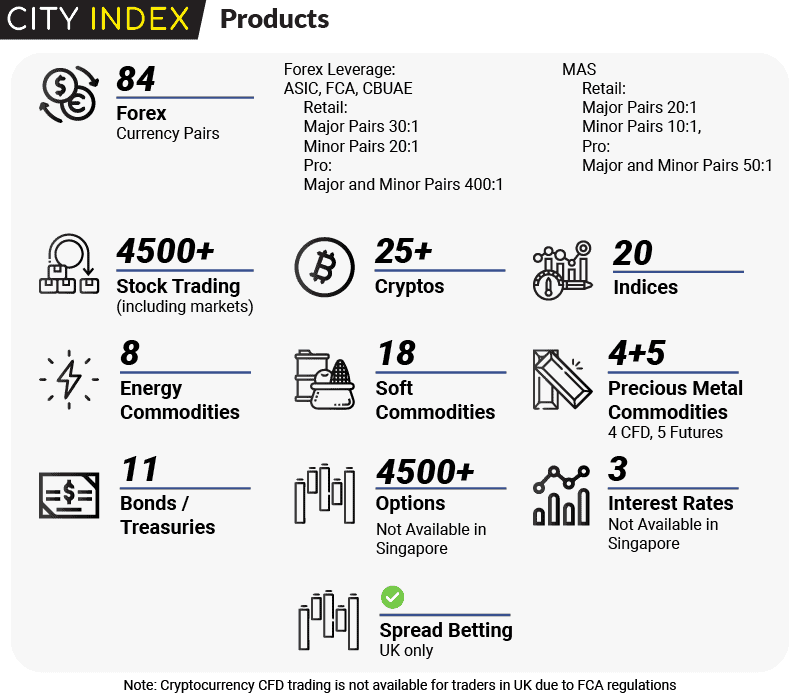

7. Top Product Range And CFD Markets – Tie

Both brokers offer a good range of CFDs. In terms of forex market access, City Index provides access to 84 currency pairs, while Plus500 offers over 71 fx pairs.

- City Index CFDs: Forex, indices, shares, cryptocurrency, metals, bonds, options and interest rates.

- Plus500 CFDs: Forex, shares, commodities, indices, cryptos, options and ETFs.

Shares

If you buy shares CFDs with City Index, then you will pay 0.08% / $5 for Australian shares and 2 cents per share / $15 for international shares.

Plus500, on the other hand, doesn’t charge a commission for trading share CFDs.

Commodities

City Index offers both cash CFD and futures for trade. Cash CFDs are ideal for short-term trading and have tighter spreads. Futures are better for long-term trade and have wider spreads, but you won’t incur overnight finance charges.

Disclaimer: The FCA (Financial Conduct Authority) ban on the sales of digital cryptocurrencies to retail clients prohibits UK traders from accessing these types of financial services. However, clients from Europe, Australia and the rest of the world can still trade crypto assets via their retail investor accounts.

Disclaimer: The FCA (Financial Conduct Authority) ban on the sales of digital cryptocurrencies to retail clients prohibits UK traders from accessing these types of financial services. However, clients from Europe, Australia and the rest of the world can still trade crypto assets via their retail investor accounts.

Our Top Product Range and CFD Markets Verdict

Both brokers offer a diverse range of CFD products. We recommend deciding on the CFDs you may wish to trade with and investigating the spreads, margins/leverage each broker offers or will require. Global financial regulators consider CFDs as complex instruments that need to be treated with caution.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

8. Superior Educational Resources – City Index

Education is paramount in the world of trading, and both Plus500 and City Index understand this. Plus500 offers a range of educational resources, including video tutorials, webinars, and articles that cater to both beginners and experienced traders. Their content is designed to be easily digestible, ensuring traders can quickly grasp complex concepts.

On the other hand, City Index goes above and beyond with its educational offerings. Their platform boasts a comprehensive suite of research tools, webinars, and in-depth articles that delve into the intricacies of trading.

- Plus500 provides video tutorials covering a range of trading topics.

- City Index offers a plethora of webinars, ensuring traders stay updated with market trends.

- Plus500’s articles are concise and beginner-friendly.

- City Index’s research tools are extensive, providing traders with a competitive edge.

- Both brokers offer demo accounts, but Plus500’s unlimited access stands out.

- City Index’s educational content is more in-depth, catering to traders looking for a deep dive into specific topics.

Our Superior Educational Resources Verdict

Based on our testing, City Index takes the lead in offering superior educational resources, ensuring traders are well-equipped with knowledge and tools for a successful trading journey.

City Index ReviewVisit City Index

Your capital is at risk ‘68% of retail CFD accounts lose money with City Index’

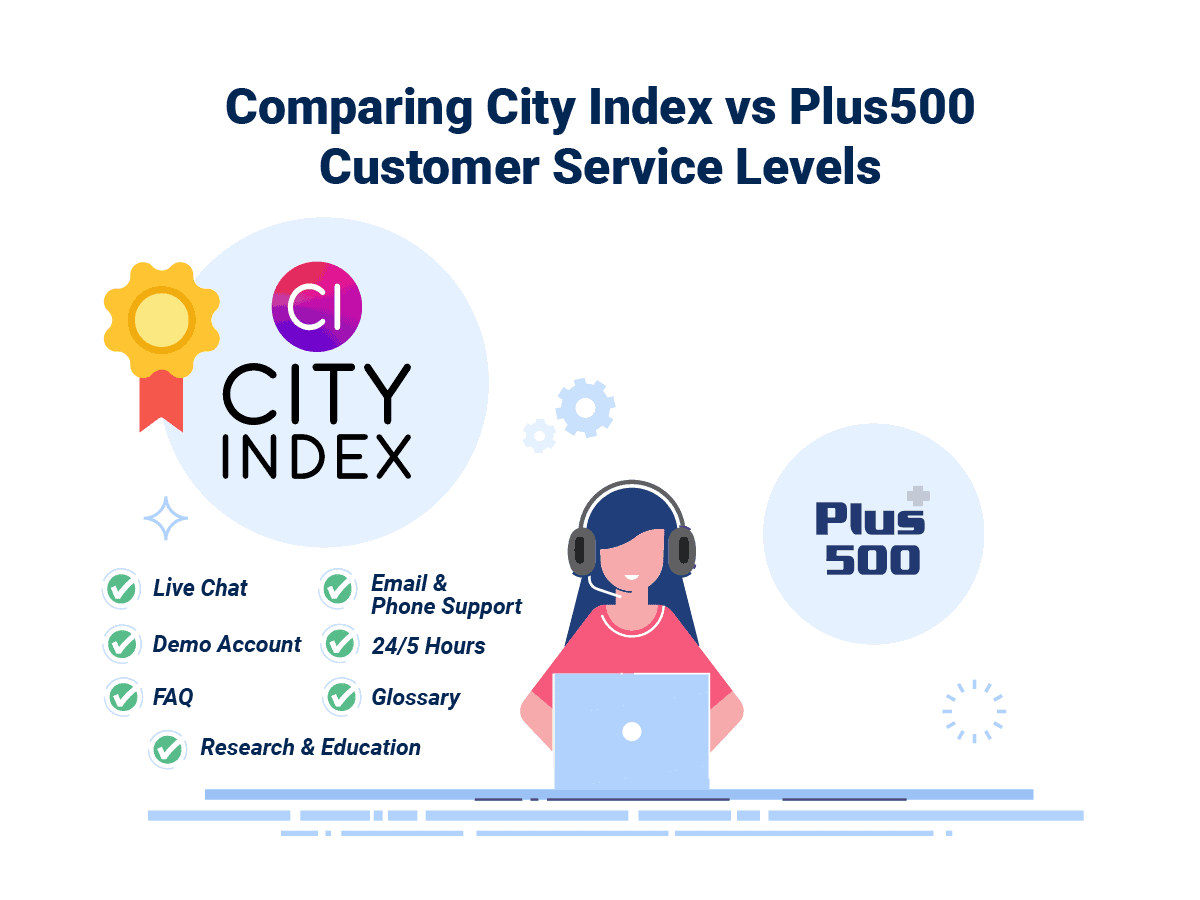

9. Superior Customer Service – City Index

City Index offers a training course that will teach you all about training strategy. This course is valued at $5000 and is developed by TECHFX TRADERS. The course covers 3 different modules “including forex”, “learn to trade” and “How to trade like a pro”.

TECHFX TRADERS are an independent firm that offers top-quality and timely technical analysis to traders. They know the trading industry inside and out, so are able to provide information that will help grow your trading knowledge.

TECHFX TRADERS also managed to run the City Index Webinars. Here a range of trading topics is covered over the web, where you will have the opportunity to ask questions as part of the session.

Demo Account:

| Demo Account | Plus500 | City Index |

|---|---|---|

| Time Limit | No | Yes - 12 Weeks |

| Virtual Funds | Unlimited | $20,000 |

| Easy switch between real and demo accounts | Yes | Yes |

With City Index, you can choose if you wish to use City Index CFD platform or MT4. The demo account has a limit of 12 weeks however, you can contact support, and they will reactivate the account at the end of the 12-week period. This refresh means you will lose access to existing virtual funds.

Plus500, however, offers unlimited access with their demo account. If your virtual funds dip below $200, then your virtual funds will reset to default.

| Feature | Plus500 | City Index |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | No | Yes |

It is interesting to note that Plus500 doesn’t offer phone contact with their customer services. If you desire human interaction for your support, then City Index will be a better option for you.

Research And Education:

Research And Education:

| Research | Plus500 | City Index |

|---|---|---|

| Daily Market Commentary | ✘ | ✔ |

| Webinars | ✘ | ✔ |

| Economic Calendar | ✘ | ✔ |

| Technical Analysis Tools. | ✘ | Trading Central - Opportunities - Market Analysis - Alert Notifications - Screening of Markets |

| Fundamental Analysis Tools | ✘ | Trading Central - Stock valuations - Best buys - Company metrics - Global data |

| In-House Analysts | ✘ | ✔ |

| CFD analysis | ✘ | ✔ |

Plus500 offers little in the way of research tools. Research tools are valued by traders as they can help them make the right trading decisions in order to be profitable. Many of City Index’s research tools are powered by Trading Central. This company specialises in providing award-winning analysis and pattern recognition tools that help traders better participate in financial markets.

| Education | Plus500 | City Index |

|---|---|---|

| Trading Strategy Course | ✘ | ✔ |

| Trading Instructional Videos | ✘ | ✔ |

| Webinar Masterclasses | ✘ | ✔ |

| Introduction to Trading Series | ✘ | ✔ |

As you can see, Plus500 doesn’t offer Education tools. City Index, however, offers a wealth of educational resources.

Our Superior Customer Service Verdict

Without a doubt, City Index offers better customer support tools. If you need assistance, City Index has a contact you can use to directly reach customer service for support. Plus500 does provide support; however, their customer support team doesn’t have the same immediate presence City Index has. For example, support contact in Australia.

City Index also offers free custom services like research, education tools and video tutorials. Plus500 does not offer any of these.

We do, however, like the fact that Plus500 offer an unlimited time/funds platform demo. This is a feature we would like to see offered by more brokers.

City Index ReviewVisit City Index

Your capital is at risk ‘68% of retail CFD accounts lose money with City Index’

10. Better Funding Options – Plus500

In the realm of online trading, the ease and variety of funding options play a pivotal role in a trader’s experience. Both Plus500 and City Index offer a range of funding methods, catering to the diverse needs of their clientele.

Plus500, known for its user-friendly interface, provides straightforward deposit and withdrawal processes. They ensure that traders can seamlessly fund their accounts and access their profits. City Index, on the other hand, boasts a broader spectrum of funding options, reflecting their commitment to accommodating traders from various financial backgrounds and regions.

Here’s a comparative table of the funding options offered by the two brokers:

| Funding Option | Plus500 | City Index |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | Yes |

| Skrill | Yes | No |

| Neteller | No | No |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Our Better Funding Options Verdict

While both brokers offer a commendable range of funding options, Plus500 edges out with a more diverse set of methods, ensuring traders have multiple avenues to fund their accounts.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

11. Lower Minimum Deposit – City Index

City Index has a lower minimum deposit of $0 compared to $100, which Plus500 requires. That said, the deposit requirement does vary by payment method and by the currency you make the deposit in (base currency). For example, below shows the deposit requirements of City Index.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $150 |

| Paypal | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $150 |

| Bank Wire | £0 Minimum Deposit | $0 Minimum Deposit | €0 Minimum Deposit | $150 |

| Skrill | N/A | N/A | N/A | N/A |

Now compare this to the deposit requirements of Plus500.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Paypal | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Bank Wire | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Skrill | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

Our Lower Minimum Deposit Verdict

City Index has the lowest minimum deposit of $0 but this does vary by region. Plus500 is generally higher so was the loser for this category.

City Index ReviewVisit City Index

Your capital is at risk ‘68% of retail CFD accounts lose money with City Index’

Is City Index or Plus500 The Best Broker?

City Index is the winner because of its comprehensive suite of tools, diverse funding options, and superior educational resources. The table below summarises the key information leading to this verdict:

| Criteria | Plus500 | City Index |

|---|---|---|

| Lowest Spreads And Fees | Yes | Yes |

| Better Trading Platforms | Yes | Yes |

| Superior Accounts And Features | No | Yes |

| Best Trading Experience | Yes | Yes |

| Stronger Trust And Regulation | Yes | Yes |

| CFD Product Range And Financial Markets | Yes | Yes |

| Superior Educational Resources | No | Yes |

| Better Customer Service | No | Yes |

| More Funding Options | Yes | No |

| Lower Minimum Deposit | No | Yes |

Plus500: Best For Beginner Traders

Plus500 is the ideal choice for beginner traders due to its user-friendly platform and better funding options.

City Index: Best For Experienced Traders

For seasoned traders, City Index stands out with its extensive research tools, diverse trading platforms, and comprehensive educational resources.

FAQs Comparing Plus500 Vs City Index

Does City Index or Plus500 Have Lower Costs?

City Index generally offers more competitive costs. The broker provides tighter spreads, especially on major currency pairs. For a detailed breakdown of spreads across various brokers, you can refer to this comprehensive lowest spread forex brokers guide. It’s essential to consider both spreads and other associated fees when evaluating the overall cost of trading.

Which Broker Is Better For MetaTrader 4?

Both City Index and Plus500 support MetaTrader 4, but City Index offers a more enhanced experience with additional tools and features. Traders who are keen on using MT4 as their primary platform can benefit from City Index’s comprehensive offerings. For a deeper dive into the best MT4 brokers, check out this detailed review of top MT4 brokers.

Which Broker Offers Social Trading?

City Index does not specifically offer social trading, while Plus500 also doesn’t have a dedicated social trading platform. However, social or copy trading is a growing trend, and many brokers are integrating these features. If you’re interested in exploring platforms that excel in copy trading, here’s a comprehensive list of the best copy trading platforms.

Does Either Broker Offer Spread Betting?

City Index offers spread betting, while Plus500 does not. Spread betting is a popular form of trading in the UK, allowing traders to speculate on the price movement of financial instruments without owning the underlying asset. For those interested in exploring this further, here’s a comprehensive guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Plus500 has a slight edge for Australian Forex traders. Both brokers are ASIC regulated, ensuring a high level of trust and security for traders. Plus500, however, was founded in Israel, while City Index has its roots in the UK. The Australian market has its unique characteristics, and while both brokers cater well to Aussie traders, Plus500’s platform and offerings align more closely with the preferences of the local audience. For a broader perspective on the best brokers in Australia, you can check out this list of the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I personally feel that City Index stands out. Both brokers are FCA regulated, which is crucial for ensuring the safety and security of funds. City Index, being founded in the UK, has a deep understanding of the local market dynamics and trader preferences. Plus500, although offering a competitive platform, originates from overseas. UK traders seeking a broker that aligns with their specific needs might find City Index to be a more fitting choice. For more insights, here’s a detailed review of the Best Forex Brokers In UK.

Related Forex Broker Comparison Tables

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert