Plus500 vs CMC Markets: Which One Is Best?

CMC Markets is a highly regarded broker for share trading, but are they better than contracts for difference (CFD) specialist Plus500? Both forex and CFD brokers offer excellent trading platforms with over 80 technical indicators and 10+ charting tools. We compare the brokers’ key trading features to establish the winning broker for 2025.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 16:1

Minor Pairs 10:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers 10 crucial trading factors to assist traders in making an informed decision between Plus500 and CMC Markets. Below are five notable distinctions:

- Plus500 and CMC Markets differ in their leverage offerings, with CMC Markets providing a more generous margin rate in certain regions.

- CMC Markets offers a wider selection of trading platforms, including their proprietary ‘Next Generation’ platform and MetaTrader 4, while Plus500 only provides its proprietary platform.

- Plus500 offers a more extensive range of Contracts for Difference (CFDs) compared to CMC Markets, which is renowned for its share and forex offerings.

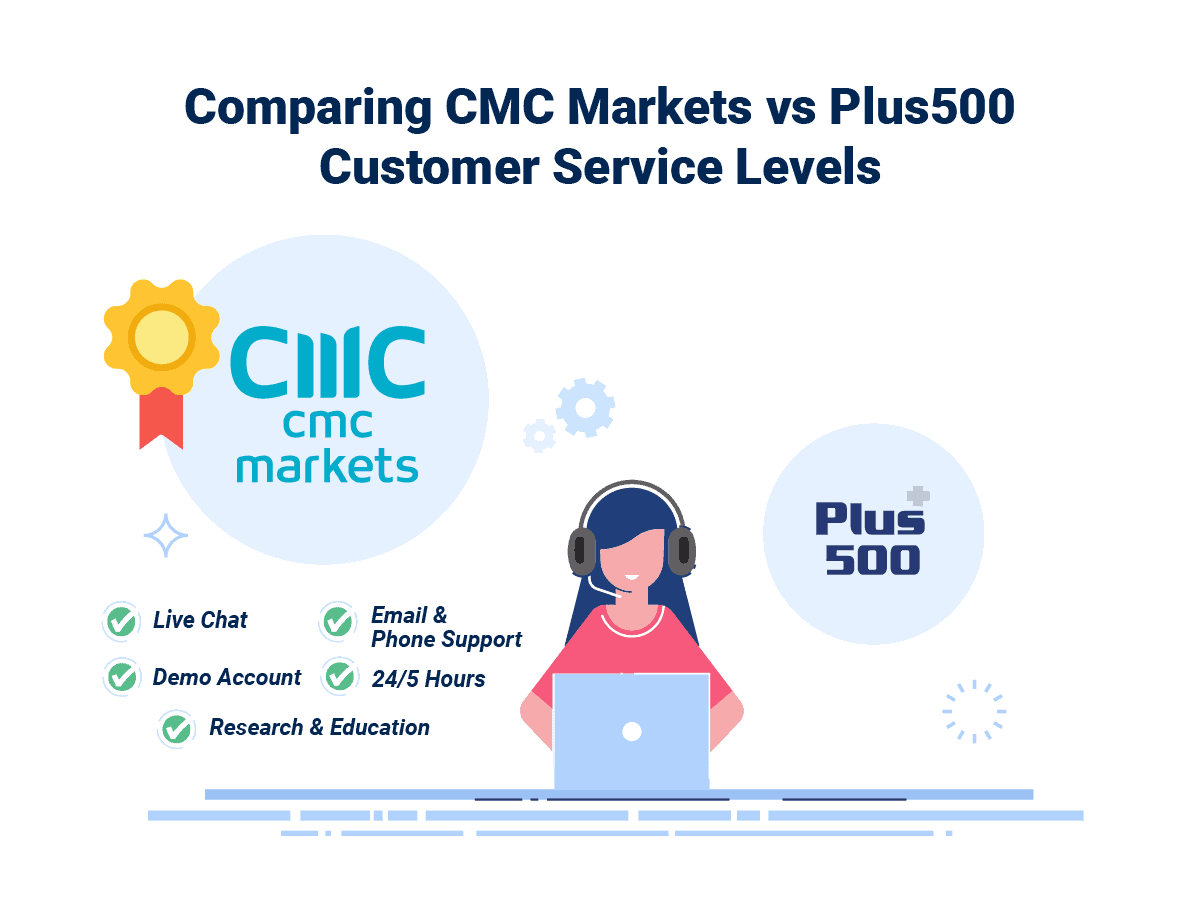

- CMC Markets provides more thorough customer service and educational resources compared to Plus500, which has limited support and educational materials.

- Plus500 has an ongoing rebate program and a first deposit program, whereas CMC Markets offers a deposit bonus, rebate, and a refer-a-friend bonus.

1. Lowest Spreads And Fees: Tie

| Broker/Currency Pairs | EUR/USD | USD/JPY | AUD/USD | GBP/USD |

|---|---|---|---|---|

| CMC - Nov 2021 | 0.7 | 0.7 | 0.7 | 0.9 |

| Plus500 - Nov 2021 | 0.00006 or 0.01% | 0.007 or 0.01% | 0.00006 or 0.01% | 0.00009 or 0.05% |

Spreads are one of the main costs for each forex trade executed. Spreads (the difference between bid/ask prices) are the trading fees charged to clients and how brokers are compensated for facilitating trades and providing market access.

Our sample of spreads shows a selection of major currency pairs. At most, there the spreads appear to differ by no more than 0.1 pip between Plus500 and CMC Markets.

Given the lack of difference in spreads for each broker, spreads need not be a major factor when choosing between Plus500 and CMC Markets. Both online brokers offer competitive spreads that are conducive to scalping and other trading styles.

Other Costs

Inactivity Fees

| Account | Inactivity Period | Amount Charge | How Often |

| Plus500 | 3 Consecutive Months | $10 | One off |

| CMC | 12 Consecutive Months | $12 | Monthly |

Funding Costs

| Payment Method | Plus500 Fees | CMC Fees | Plus500 Withdrawal Time | CMC Withdrawal Time |

|---|---|---|---|---|

| Debit Card (Visa/MasterCard) | Free | 0.6% | N/A | N/A |

| Credit Card (Visa) | Free | 1% | Varies by Bank | N/A |

| Credit Card (MasterCard) | Free | 1% | Varies by Bank | N/A |

| PayPal | Free | N/A | 3-7 | N/A |

| bPay | Free | N/A | N.A | N/A |

| Poli | Free | free | 3-7 days | N/A |

| Skrill | Free | Not Offered | 3-7 days | N/A |

| Bank Transfer | Free | Free | 5-7 | N/A |

Funding charges may apply for the following situations

- When international credit cards are processed via a foreign acquirer.

- Bank transfers to/from a bank account to Plus500 (rare).

- Forex conversion when payment method does not support currency type.

Other notes:

- With Plus500, you may incur a fee when the maximum monthly withdrawal limit is breached.

- CMC Markets have no withdrawal limits, but if withdrawing to a credit or debit card, you can only withdraw up to the amount you deposited using the card. In other words, if you made a profit, then this amount cannot be withdrawn from your card.

- With CMC Markets, if a margin call has been made because your account balance is at risk, then you will need to call CMC Markets customer support in order to add or withdraw funds.

- CMC Markets does not offer PayPal for those with a share trading account.

Other funding costs include

- Overnight Holding Costs

- Guaranteed Stop Loss Orders Premiums

Our Lowest Spreads and Fees Verdict

*Your capital is at risk ‘80% of retail CFD accounts lose money’

2. Better Trading Platform: Tie

| Trading Platform | Plus500 | CMC Markets |

|---|---|---|

| MetaTrader 4 | No | Yes |

| MetaTrader 5 | No | No |

| cTrader | No | No |

| TradingView | No | No |

| Copy Trading | No | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

Plus500 Trading Platforms

Plus500 clients are restricted to the broker’s proprietary trading platform. The Plus500 platform is available on desktop, web and mobile (iOS and Android).

The Plus500 platform is popular with casual investors due to its clean design and emphasis on simplicity. However, the platform lacks advanced features that more advanced traders may require. For instance, the platform does not offer social trading, the ability to trade directly from charts, or drawing tools. The mobile version lacks certain essential features that are available on the desktop version, such as drawing tools.

Plus500 offers the following

- 103 technical indicators (18 indicators on the mobile version).

- 10 fields for watchlists.

- Custom chart templates that can be saved.

CMC Markets Trading Platforms

Clients have a choice of two trading platforms. These are CMC Markets’ own proprietary ‘Next Generation’ trading platform and MetaTrader 4. Both of these platforms are available to clients on a tablet or mobile (Android, Windows, Mac, iOS), as well as a Webtrader platform. Those using the ‘Next Generation’ app on mobiles will have access to the same features as those on Webtrader, however, those using a browser will have a more comprehensive selection of tools and features.

Generation Next Trading Platform has the following features:

- 81 Trading Indicators: great for in-depth technical analysis (note: the mobile version on has 23 indicators).

- Expandable trade ticket design – users can add features such as stops and limits and level 2 pricing.

- Chart pattern recognition – a tool to analyse trading and pricing. The tool can auto-adjust when time scales of charts are changed to show updated patterns.

- Alerts for chart patterns.

- Sentiment Tool for Social Trading.

- 24 drawing tools.

- Trading directly from charts.

- Eight fields for the watch list.

MetaTrader 4

In late 2018, CMC Markets began to offer MetaTrader 4 (MT4) as a trading option. The MT4 platform is known as the gold standard of trading platforms and is offered by more brokers than any other platform.

Introducing MT4 was a smart move by CMC Markets, given this will encourage traders using MT4 with other brokers to switch to CMC Markets. MT4 is a great platform in its own right but has one big advantage over many other platforms in that it does not lock you into a particular client’s ecosystem. By this, we mean you can switch brokers also offering MT4 with few issues.

If you choose to use MetaTrader 4, you will still need a Next Generation Account. CMC Markets require this to overcome funding limitations with their MT4 platform.

It is important to note that you cannot trade shares via the CMC Markets MT4 platform. CMC Markets only allow trading of Forex, Indices and Commodities, yet users can still trade shares via the Next Generation platform.

Pros Of MT4

- The same functionality is on mobile as on Webtrader (except for Expert Advisors).

- 30 technical indicators that can be expanded with add-ons.

- 24 drawing tools.

- Three different interactive charts with nine time periods are customisable.

- Inbuilt Expert Advisors.

- Hedging allowed.

- Customisable platform and charting.

Cons

- No support for futures and options.

- Originally built for the FX market. Support for other asset classes is available but may not be as accessible as other platforms.

- No share trading.

Our Better Trading Platform Verdict

Plus500 is a great platform for beginner and intermediate traders. If you require more advanced trading tools and analysis, then we suggest you use one of the CMC Markets platforms, such as MetaTrader 4.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

3. Superior Accounts And Features: CMC Markets

When comparing Plus500 and CMC Markets in terms of accounts and features, several distinctions emerge:

- Trading Platforms: CMC Markets provides traders with a choice between their proprietary ‘Next Generation’ platform and the widely recognised MetaTrader 4. In contrast, Plus500 restricts its clients to its proprietary platform, which, while user-friendly, may lack some advanced features desired by more experienced traders.

- Contracts For Difference (CFDs): CMC Markets is globally recognised for its extensive offerings in shares and forex. However, for traders specifically interested in CFDs, Plus500 boasts a broader CFD product range.

- Leverage and Margin: Both brokers utilise margin rates, which dictate the minimum deposit required to maintain a trading position. CMC Markets, especially in regions like New Zealand, offers a more generous margin rate compared to Plus500.

- Customer Service: CMC Markets stands out with its comprehensive customer support, available via phone, live chat, and email. Plus500, on the other hand, lacks phone support, which many traders still value for immediate assistance.

- Educational Resources: CMC Markets offers a plethora of educational materials, including webinars, articles, and a dedicated forex education program. Plus500’s educational offerings are comparatively limited, which might hinder the development of novice traders.

| Plus500 | CMC Markets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | No | No |

| Swap Free Account | No | No |

| Active Traders | No | Yes |

| Spread Betting (UK) | No | Yes |

Our Superior Accounts and Features Verdict

Based on the comprehensive analysis of accounts and features, CMC Markets offers a superior and well-rounded trading experience for both novice and experienced traders.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

4. Best Trading Experience And Ease: CMC Markets

Navigating through the trading world requires a platform that not only offers robust features but also ensures a seamless and intuitive user experience. Our journey exploring Plus500 and CMC Markets revealed distinct aspects that cater to varied trader preferences.

Plus500, with its proprietary platform, has always prided itself on simplicity and user-friendliness, making it a preferred choice for beginners or casual traders. The platform’s clean design and straightforward navigation ensure that new traders can find their way around without feeling overwhelmed.

- Plus500 offers a straightforward and user-friendly platform.

- CMC Markets provides a choice between two platforms, catering to different trader needs.

- Plus500’s platform, while simple, may lack advanced features for seasoned traders.

- CMC Markets’ ‘Next Generation’ platform offers advanced charting and analysis tools.

Diving deeper into CMC Markets, we encountered a platform that doesn’t compromise on advanced features while maintaining a balanced user interface. The ‘Next Generation’ platform, with its advanced charting tools and analytical features, provides a rich trading experience for those who love to dive deep into market analysis.

Moreover, the availability of MetaTrader 4 caters to traders who prefer a platform that’s recognised for its stability and comprehensive features. It’s a blend that ensures whether you’re a novice or a seasoned trader, your trading journey is well-accommodated.

Our Best Trading Experience and Ease Verdict

While Plus500 offers a simplified and accessible platform for new traders, CMC Markets stands out by providing a balanced and enriched trading experience, catering to both new and experienced traders with its dual platform offering.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

5. Stronger Trust And Regulation: CMC Markets

CMC Markets Trust Score

Plus500 Trust Score

Both Plus500 and CMC Markets use margin rates rather than leverage. The margin rate is the minimum deposit you will require to open and maintain your trading position. From this margin, one can determine how much leverage the broker will lend you, yet this varies between asset class and the subsidiary’s local regulator.

- Plus500 operate in Australia (ASIC), NZ (FMA), Europe (CySEC), the UK (FCA), South Africa (FSCA) and Singapore (MAS), Dubai (DFSA), Estonia (EFSRA) and Seychelles (FSA-S).

- CMC Markets operates in Australia, the UK, NZ, Singapore, Canada (CIRO), Germany (BaFin) and Dubai (DFSA).

CMC Markets in NZ and regulated by the FMA have a more generous margin rate of 0.20% (500:1) than Plus500, which only offers 0.37.5% (300:1) via its offshore branch in Seychelles regulated by the FSA.

Under ASIC (Australia), FCA (UK) and CySEC (Europe) regulation, both Plus500 and CMC Markets are restricted to offering maximum leverage of 30:1 for major forex pairs and 20:1 for minor pairs.

Leverage is a useful tool in a trader’s arsenal. Currency pairs only change a few cents most of the time, making it hard to make large profits without a large initial investment. More money invested means greater returns when prices move in your favour.

It is, however, important to understand that leverage comes with a high risk that can lead to large losses when prices move in unfavourable directions. Therefore, it is important to understand the high risks associated with leveraged positions and use leverage responsibly. Trading platforms offer risk management tools that can assist in minimising losses and protecting capital.

| Plus500 | CMC Markets | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) CYSEC (Cyprus) FMA (New Zealand) MAS (Singapore) | ASIC (Australia) FCA (UK) BaFin (Germany) FMA (New Zealand) CIRO (CANADA) MAS (Singapore) |

| Tier 2 Regulation | DFSA (Dubai) EFSRA | DFSA (Dubai) |

| Tier 3 Regulation | FSA-S (Seychelles) FSCA (South Africa) |

Reviews

As shown below, Plus500 holds a Trustpilot rating of approximately 4.2 out of 5, based on a large volume of user reviews. CMC Markets also has a Trustpilot score of around 4.0 out of 5, but with fewer reviews. Both brokers share almost similar Trustpilot scores, but their strengths differ—Plus500 is favored for simplicity and cost-effectiveness, while CMC Markets appeals to more advanced traders seeking robust tools and market coverage.

Our Stronger Trust and Regulation Verdict

CMC Markets offers a better margin rate than Plus500, therefore, we recommend CMC Markets.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

6. Most Popular Broker – Plus500

Plus500 gets searched on Google more than CMC Markets. On average, Plus500 sees around 201,000 branded searches each month, while CMC Markets gets about 110,000 — that’s 45% fewer.

| Country | Plus500 | CMC Markets |

|---|---|---|

| Poland | 18,100 | 1,000 |

| Thailand | 14,800 | 3,600 |

| India | 12,100 | 9,900 |

| Brazil | 9,900 | 60,500 |

| United Arab Emirates | 9,900 | 3,600 |

| Colombia | 6,600 | 1,600 |

| Pakistan | 6,600 | 390 |

| Hong Kong | 6,600 | 320 |

| Germany | 5,400 | 480 |

| Sweden | 5,400 | 260 |

| Canada | 3,600 | 140 |

| Austria | 3,600 | 140 |

| United Kingdom | 2,900 | 590 |

| Peru | 2,900 | 880 |

| Netherlands | 2,900 | 590 |

| Vietnam | 2,400 | 90 |

| Ghana | 2,400 | 590 |

| Mongolia | 1,900 | 2,400 |

| Bangladesh | 1,600 | 2,400 |

| Argentina | 1,300 | 1,600 |

| Italy | 1,300 | 210 |

| Indonesia | 1,000 | 70 |

| Spain | 1,000 | 50 |

| United States | 880 | 720 |

| Portugal | 880 | 140 |

| Panama | 880 | 10 |

| Greece | 720 | 390 |

| Cyprus | 480 | 50 |

| Taiwan | 480 | 110 |

| Jordan | 480 | 390 |

| Philippines | 320 | 880 |

| Algeria | 320 | 320 |

| Singapore | 320 | 480 |

| Uzbekistan | 320 | 5,400 |

| Bolivia | 320 | 90 |

| Malaysia | 260 | 210 |

| Turkey | 260 | 210 |

| Nigeria | 260 | 720 |

| Saudi Arabia | 210 | 320 |

| Ecuador | 210 | 1,600 |

| Australia | 210 | 110 |

| Morocco | 140 | 320 |

| Venezuela | 110 | 30 |

| Uruguay | 110 | 110 |

| Sri Lanka | 90 | 30 |

| Switzerland | 90 | 70 |

| Cambodia | 90 | 110 |

| Uganda | 90 | 20 |

| South Africa | 70 | 170 |

| Mexico | 70 | 40 |

| Dominican Republic | 70 | 10 |

| New Zealand | 70 | 40 |

| Tanzania | 50 | 20 |

| Ethiopia | 50 | 90 |

| Botswana | 50 | 70 |

| Costa Rica | 50 | 20 |

| Ireland | 40 | 40 |

| Egypt | 20 | 10 |

| Chile | 20 | 50 |

| Japan | 20 | 30 |

| Kenya | 20 | 30 |

| Mauritius | 20 | 40 |

| France | 10 | 10 |

18,100 1st | |

1,000 2nd | |

9,900 3rd | |

60,500 4th | |

6,600 5th | |

1,600 6th | |

3,600 7th | |

140 8th |

Similarweb shows a similar story when it comes to August 2025 website visits with Plus500 receiving 6,096,000 visits vs. 1,592,000 for CMC Markets.

Our Most Popular Broker Verdict

Plus500 is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

7. Top Product Range and CFD Markets: Tie

CMC Markets has a global reputation as a share and forex broker, with some commodities available. CMC Markets offers extensive market access to a range of share and forex instruments available. However, if you want to trade CFDs, Plus500 offers a larger CFD product range.

| Plus500 | CMC | |

|---|---|---|

| Forex | 71 | 338 |

| Commodities | 22 | 117 |

| Indices | 67 | 99 |

| Shares | 1816 | 4925 |

| Treasuries | 0 | 55 |

| Cryptocurrencies | 14 | 12 |

| ETF | 80+ | 0 |

| Options | 100+ | 0 |

Disclaimer: The Financial Conduct Authority (FCA), the main regulator in the UK, banned cryptocurrency trading, coming into effect on Jan 6, 2022. Neither Plus500 nor CMC Markets advertise the sales of financial instruments such as Bitcoin, Ethereum, Ripple, etc., to UK retail traders. Please take note that traders outside of the UK can still trade cryptocurrencies.

Our Top Product Range and CFD Markets Verdict

If you are looking for a broker with a wide range of contracts for difference, then we recommend Plus500. If you are looking for a broker that offers a large range of shares, then we recommend CMC Markets.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

8. Superior Educational Resources: CMC Markets

Embarking on the trading journey demands not only a robust platform but also a wealth of educational resources to navigate through the financial markets effectively. Our exploration into the educational offerings of Plus500 and CMC Markets has unveiled a spectrum of resources that cater to traders at various stages of their trading journey.

Plus500, while offering a simplistic and user-friendly platform, somewhat limits its educational resources, primarily providing a series of articles and a demo account for traders to get accustomed to the platform.

- Plus500 offers a range of articles covering basic trading concepts.

- A demo account is available on Plus500 for practice trading.

- Plus500’s educational resources are somewhat limited in scope and depth.

- There is no webinar or advanced educational content available on Plus500.

On the flip side, CMC Markets emerges as a hub of educational wealth, offering a plethora of resources that cater to both novice and seasoned traders. From detailed articles and insightful webinars to a dedicated forex education program, CMC Markets ensures that traders have a well-rounded educational foundation.

The availability of these resources not only aids in making informed trading decisions but also in understanding the nuances of market dynamics, which is crucial for crafting effective trading strategies.

- CMC Markets provides a comprehensive forex education program.

- A variety of webinars are available on CMC Markets for enhanced learning.

- Detailed articles and insights are provided to understand market dynamics.

- CMC Markets caters to both novice and seasoned traders with its educational offerings.

Our Superior Educational Resources Verdict

Based on our exploration and testing, CMC Markets distinctly outshines with its extensive and diverse educational resources, providing a more comprehensive and insightful learning experience for traders at all levels.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

9. Superior Customer Service: CMC Markets

Plus500

Plus500 lacks customer support features when you compare it with the main online forex brokers. While they do offer 24/7 live chat and email support and even WhatsApp, the absence of phone support is glaring. While you can certainly use live chat or email to resolve your issues, it is safe to say, that many people still do like to have phone access to customer support when needed.

Not only are the customer support features scarce, but Plus500 also does not offer much in the way of customer service and education. Most CFD and forex brokers offer educational resources to assist clients of all levels of experience. Plus500’s lack of such resources may hinder traders’ forex trading development.

Education:

Education:

Not only do Plus500 not offer much in the way of education, but Plus500 also fails to offer comprehensive technical analysis from experts. Many brokers engage analysts to provide input, education, and updates on news or trends in the market. Plus500 offers neither in-house nor 3rd party technical analysis. They also do not offer economic calendars, which are a basic feature in the industry.

With all this said, the lack of these features does not make Plus500 a bad product. Not everyone needs these features, and much of the information provided by other forex brokers is available for free elsewhere.

Demo Account:

The Plus500 demo account has two key benefits that make it superior to other virtual accounts offered by brokers. Firstly, there is no access restriction. This means you have unlimited access to your demo account with no time restrictions. Secondly, there are no funds restrictions, meaning you have all the virtual funds you need to practice your trading.

CMC Markets Customer Support

Unlike Plus500, CMC Markets offers customer support via phone, live chat and email. This service is available Monday from 8 am to 8 am Saturday. You can also reach the CMC Markets support team via the CMC Markets Twitter and Facebook accounts.

It is interesting to note that if you use the live chat via the website, you will be dealing with the stock market support team. This can lead to some confusion, given the support team will assume you’re asking questions relating to CMC Markets stock market accounts.

If you have questions regarding CFDs, then you will need to log in with your account to chat with the live chat team. This is not always convenient if you don’t have a CFD account, meaning you will need to call the help desk if you have questions.

CMC Markets Customer Services

CMC Markets offers a great collection of customer service tools.

Research: CMC Markets offers a range of news and analysis features that help you stay on top of all the latest news and events in financial markets. These include:

- A dedicated team of in-house analysts that offer expert insights. Australia has two analysts in its panel. Michael McCarthy and Ric Spooner. These analysts regularly appear on CNBC, Sky, ABC and BBC so you can be sure they know their chops.

- Third-party resources – Morningstar, Reuters News and so on.

- An economic calendar outlining significant corporate and economic events.

Education: CMC Markets offers a wealth of educational material, these include:

Education: CMC Markets offers a wealth of educational material, these include:

- Webinars covering a range of topics, including trading, market analysis, and technical analysis.

- Articles, guides, ebooks and whitepapers.

- CFD trading and forex education program.

- Glossary of key trading terms.

- FAQ.

Demo Account: CMC Markets provide access to $10,000 of virtual funds in a demo account. The account is free for you to use as long as you have a CMC Markets Account.

Our Superior Customer Service Verdict

CMC Markets offers superior customer experience and provides quality educational and research resources, while Plus500 offers below-average support and education. Therefore, CMC won this round by a mile.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

10. Better Funding Options: CMC Markets

Navigating through the funding options of Plus500 and CMC Markets, we’ve observed a variety of methods tailored to meet the diverse needs of traders globally. Plus500, renowned for its simplicity across its platform, extends this ethos to its funding options, providing straightforward methods that are accessible and user-friendly.

Traders can effortlessly navigate through the deposit and withdrawal processes, ensuring a smooth transition from account funding to trading.

CMC Markets, on the other hand, not only provides a variety of funding options but also ensures that the processes are secure and efficient. With a focus on providing a seamless experience, CMC Markets has crafted its funding options to cater to both novice and experienced traders, ensuring that they can manage their trading finances with ease and confidence.

| Funding Option | Plus500 | CMC Markets |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | No |

| Skrill | Yes | No |

| Neteller | No | No |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Our Better Funding Options Verdict

While both brokers offer a variety of common funding options, CMC Markets provides a slightly more diverse range, catering to a broader spectrum of trader preferences and thereby offering superior funding options.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

11. Lower Minimum Deposit: CMC Markets

Embarking on a trading journey often begins with understanding the financial commitment required to open and maintain a trading account. The minimum deposit is a crucial factor, especially for novice traders, as it allows them to step into the trading world without necessitating a hefty initial investment.

Plus500, known for its user-friendly platform and straightforward trading approach, sets its standard account minimum deposit at $100. This allows traders to access the markets and explore the platform’s features without a significant financial outlay.

In contrast, CMC Markets demonstrates a commitment to accessibility and inclusivity by offering a $0 minimum deposit for its CFD Account and FX Active account. This approach not only lowers the barrier to entry for new traders but also provides an opportunity for more individuals to explore and engage with the financial markets. CMC Markets, with its diverse account offerings and comprehensive trading platforms, ensures that traders, regardless of their financial capacity, can explore the trading world.

| | Minimum Deposit | Recommended Deposit |

| Plus500 | $100 | $100 |

| CMC Markets | $0 | $100 |

In the realm of trading, where every dollar counts, the initial deposit can be a determining factor for many, especially those who are new to the trading environment. The ability to start trading without a mandatory deposit provides a risk-free entry into the world of trading and allows traders to get accustomed to the platform before committing financially.

Our Lower Minimum Deposit Verdict

CMC Markets clearly takes the lead in offering a lower barrier to entry with a $0 minimum deposit, making trading accessible to a wider audience and providing a risk-free start to the trading journey.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

Is Plus500 or CMC Markets The Best Broker?

CMC Markets is the winner because it consistently provides a more comprehensive and accessible trading experience across various aspects, such as educational resources, customer service, and funding options. The table below summarises the key information that has led to this verdict, providing a snapshot of how each broker performs across ten critical areas.

| Criteria | Plus500 | CMC Markets |

|---|---|---|

| Lowest Spreads And Fees | Yes | Yes |

| Better Trading Platforms | Yes | Yes |

| Superior Accounts And Features | No | Yes |

| Best Trading Experience | No | Yes |

| Stronger Trust And Regulation | Yes | No |

| CFD Product Range And Financial Markets | Yes | Yes |

| Superior Educational Resources | No | Yes |

| Better Customer Service | No | Yes |

| More Funding Options | No | Yes |

| Lower Minimum Deposit | No | Yes |

CMC Markets: Best For Beginner Traders

For those embarking on their trading journey, CMC Markets stands out as the better broker due to its extensive educational resources and a $0 minimum deposit.

CMC Markets: Best For Experienced Traders

For seasoned traders, CMC Markets also takes the lead by offering a more versatile trading platform and a wider array of funding options, catering to diverse trading strategies and needs.

FAQs Comparing Plus500 Vs CMC Markets

Does CMC Markets or Plus500 Have Lower Costs?

Plus500 generally offers lower costs in terms of spreads. Plus500 is known for its tight spreads, starting from 0.8 pips for EUR/USD, which is considered competitive in the industry. For a more detailed comparison of brokers based on spreads, you might want to explore our guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

CMC Markets is the better choice for MetaTrader 4 users. While Plus500 offers a user-friendly proprietary platform, it does not support MetaTrader 4, limiting its appeal to traders who prefer using this popular platform. For a comprehensive list of brokers offering MetaTrader 4, feel free to visit our page dedicated to the Best MT4 Forex Brokers in the UK.

Which Broker Offers Social Trading?

Neither Plus500 nor CMC Markets offers social trading. Both brokers have focused on developing their proprietary platforms and have not integrated social or copy trading features into their offerings. If you’re interested in exploring brokers that do offer social trading, check out our guide to the best copy trading platforms.

Does Either Broker Offer Spread Betting?

Yes, CMC Markets offers spread betting, while Plus500 does not. CMC Markets provides a robust platform for spread betting, catering to traders with various experience levels and trading preferences. For a deeper dive into spread betting and to explore other brokers offering this service, you might find our guide on the best spread betting brokers quite insightful.

What Broker is Superior For Australian Forex Traders?

In my opinion, Plus500 is superior for Australian Forex traders. Plus500 is not only ASIC regulated, ensuring a secure trading environment, but it also offers a simple and intuitive platform that’s quite popular among Australian traders. While CMC Markets is also ASIC regulated and provides a robust trading platform, Plus500 has a slight edge due to its user-friendly interface and straightforward trading experience. For more insights into Forex trading in Australia, feel free to visit our Best Forex Brokers In Australia page.

What Broker is Superior For UK Forex Traders?

From my perspective, CMC Markets is superior for UK Forex traders. CMC Markets is FCA regulated and provides a wealth of resources and a versatile platform that caters to various trading needs. Plus500, while also FCA regulated and offering a user-friendly platform, may not provide the depth of resources and platform features that CMC Markets does. For a comprehensive look at various brokers in the UK, you might find our guide on the Best Forex Brokers In UK to be of great help.

Related Forex Broker Comparison Tables

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Does CMC Markets have a monthly fee?

No, there is no monthly fee to have a CFD trading account but there is an inactivity fee of $15 per month if your account is dormant for 12 months.

Can you buy gold on CMC Markets?

You can buy Gold derivatives such as CFDs with CMC Markets outside the USA. In the USA you can buy spot Gold.