Plus500 vs ThinkMarkets: Which One Is Best?

We compared Plus500 and ThinkMarkets to help you settle on which broker is for you. We dissect trading features like account types, costs, and Forex trading platforms.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors, but here are five noticeable differences between Plus500 and ThinkMarkets:

- Plus500 offers a user-friendly proprietary platform, while ThinkMarkets provides advanced platforms like MetaTrader 4 and 5.

- ThinkMarkets has superior execution speed compared to Plus500.

- ThinkMarkets offers more account types, including micro accounts and a ThinkZero account for experienced traders.

- Plus500 is regulated in 9 countries, while ThinkMarkets is regulated in 5 countries.

- ThinkMarkets offers social trading through its partnership with ZuluTrade, while Plus500 does not offer social or copy trading.

1. Lowest Spreads And Fees – ThinkMarkets

When it comes to trading costs, both Plus500 and ThinkMarkets offer competitive pricing. However, ThinkMarkets stands out with its Lowest Commission Brokers and Lowest Fixed Spread Brokers.

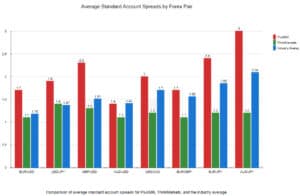

1. Standard Account Spreads

When we look at the average standard account spreads for Plus500 and ThinkMarkets, we see some interesting differences. Plus500’s spreads tend to be higher across the board, with the most significant difference seen in the AUD/JPY pair, where Plus500’s spread is a whopping 3 compared to ThinkMarkets’ 1.2. This trend continues across all pairs, with Plus500 consistently showing higher spreads.

Comparing these brokers to the industry average, ThinkMarkets consistently comes out on top, with spreads lower than the industry average across all pairs. Plus500, on the other hand, tends to have spreads higher than the industry average. This suggests that, purely from a cost perspective, ThinkMarkets could be the more economical choice for traders.

| Forex Pair | Plus500 | ThinkMarkets | Industry Average |

|---|---|---|---|

| EUR/USD | 1.7 | 1.1 | 1.18 |

| USD/JPY | 1.9 | 1.4 | 1.37 |

| GBP/USD | 2.3 | 1.3 | 1.51 |

| AUD/USD | 1.4 | 1.1 | 1.41 |

| USD/CAD | 2 | 1.2 | 1.70 |

| EUR/GBP | 1.7 | 1.1 | 1.56 |

| EUR/JPY | 2.4 | 1.2 | 1.85 |

| AUD/JPY | 3 | 1.2 | 2.09 |

While Plus500’s higher spreads might seem like a deterrent, it is essential to consider the overall trading experience. However, if cost is a significant factor for you, ThinkMarkets appears to be the cheaper option compared to both Plus500 and the industry average.

2. RAW Account Spreads

ThinkMarkets is the only provider that offers a raw spread account and is listed as a Zero Spread Accounts. Plus500 only offers no commission accounts. So, if this is the type of account you’re looking for, it rules out Plus500 as an option.

3. Commission Rates

ThinkMarkets offers competitive commission rates, especially for high-volume traders.

4. Deposit & Withdrawal Fees

Both brokers offer free deposits and withdrawals, but it’s always a good idea to check with your bank or payment provider for any potential fees on their end.

5. Other Fees

Neither broker charges inactivity or account maintenance fees, which is a plus for traders who do not trade frequently.

| Criteria | Plus500 | ThinkMarkets |

|---|---|---|

| Standard Account Spreads | Competitive | Not Published |

| RAW Account Spreads | Available | Available |

| Commission Rates | Competitive | Competitive |

| Deposit & Withdrawal Fees | None | None |

| Other Fees | May apply | May apply |

Our Lowest Spreads and Fees Verdict

When it comes to trading costs, ThinkMarkets is the clear winner due to its lower spreads and competitive commissions.

ThinkMarkets ReviewVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

2. Better Trading Platform – ThinkMarkets

Plus500 offers a proprietary platform that’s user-friendly and intuitive, making it a great choice for beginners. ThinkMarkets, on the other hand, offers the Best MT4 Brokers and Best MT5 Brokers, which are popular among experienced traders.

| Trading Platform | Plus500 | ThinkMarkets |

|---|---|---|

| MetaTrader 4 | No | Yes |

| MetaTrader 5 | No | Yes |

| cTrader | No | No |

| TradingView | No | Yes |

| Copy Trading | No | Yes |

| Proprietary Platform | Yes | Yes |

1. MetaTrader 4 and 5

ThinkMarkets offers both MetaTrader 4 and MetaTrader 5, the industry’s leading trading platforms known for their advanced charting features and automated trading capabilities. Plus500, on the other hand, offers a proprietary platform with a user-friendly interface but does not support MetaTrader.

2. cTrader and TradingView

Neither Plus500 nor ThinkMarkets offer cTrader or TradingView platforms.

3. Social And Copy Trading

While Plus500 does not offer social or copy trading, ThinkMarkets provides social trading through its partnership with ZuluTrade.

| Broker | Social And Copy Trading Platform |

|---|---|

| Plus500 | — |

| ThinkMarkets | MetaTrader Signals |

Our Better Trading Platform Verdict

ThinkMarkets, with its MetaTrader support, social trading, and VPS services, offers a more comprehensive trading platform offering than Plus500.

ThinkMarkets ReviewVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

3. Superior Accounts And Features – ThinkMarkets

Plus500 offers a standard account and a professional account. ThinkMarkets offers the Best Brokers for Micro Trading and a ThinkZero account for more experienced traders.

| Plus500 | ThinkMarkets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | No | Yes |

| Swap Free Account | No | No |

| Active Traders | No | No |

| Spread Betting (UK) | No | No |

| Broker | Account Types |

|---|---|

| Plus500 | Standard, Professional, Demo |

| ThinkMarkets | Standard, ThinkZero, Pro, Demo |

Our Superior Accounts and Features Verdict

ThinkMarkets offers more account types to suit different trading needs and styles.

ThinkMarkets ReviewVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – ThinkMarkets

When it comes to the trading experience and ease of use, both Plus500 and ThinkMarkets have their strengths. Plus500 offers a user-friendly proprietary platform that is perfect for beginners. It’s intuitive and straightforward, making it easy for anyone to start trading. On the other hand, ThinkMarkets provides advanced platforms like MetaTrader 4 and 5, which are popular among experienced traders. These platforms offer a range of features and tools that can help traders make informed decisions.

From our own testing, we found that:

- ThinkMarkets has the best trading app, ThinkTrader, which is highly rated for its user interface and functionality.

- Both brokers offer 24/7 customer service, with support available via live chat, email, and phone.

- Plus500 is regulated in 9 countries, while ThinkMarkets is regulated in 5 countries.

- ThinkMarkets offers social trading through its partnership with ZuluTrade, which can be a valuable tool for traders looking to learn from others.

Our Best Trading Experience and Ease Verdict

ThinkMarkets offers the best trading experience due to its advanced platform offerings, superior execution speed, and additional features like social trading.

ThinkMarkets ReviewVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – Plus500

Plus500 Trust Score

ThinkMarkets Trust Score

Plus500 is regulated in 9 different countries or regions, while ThinkMarkets is regulated in 5 countries. Neither broker is regulated in the US or in Canada.

| Plus500 | ThinkMarkets | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) CYSEC (Cyprus) FMA (New Zealand) MAS (Singapore) | ASIC (Australia) FCA (UK) CYSEC (Cyprus) |

| Tier 2 Regulation | DFSA (Dubai) EFSRA | JFSA |

| Tier 3 Regulation | FSA-S (Seychelles) FSCA (South Africa) | FSCA (South Africa) FSA-S (Seychelles) CIMA (Cayman) FSC-M (Mauritius) |

Our Stronger Trust and Regulation Verdict

Both brokers are trustworthy and well-regulated, but Plus500 has the edge with a few more regulators.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

6. Most Popular Broker – Plus500

Plus500 gets searched on Google more than ThinkMarkets. On average, Plus500 sees around 270,000 branded searches each month, while ThinkMarkets gets about 18,100 — that’s 55% fewer.

| Country | Plus500 | ThinkMarkets |

|---|---|---|

| Italy | 22,200 | 140 |

| Germany | 18,100 | 260 |

| United Kingdom | 14,800 | 590 |

| Spain | 9,900 | 260 |

| Netherlands | 8,100 | 210 |

| Poland | 8,100 | 90 |

| Australia | 8,100 | 320 |

| United States | 5,400 | 1,000 |

| South Africa | 5,400 | 880 |

| Switzerland | 5,400 | 50 |

| United Arab Emirates | 4,400 | 210 |

| Greece | 4,400 | 110 |

| Portugal | 4,400 | 50 |

| Mexico | 2,900 | 110 |

| Austria | 2,900 | 70 |

| Sweden | 2,900 | 70 |

| Hong Kong | 2,400 | 140 |

| France | 1,900 | 590 |

| Singapore | 1,900 | 110 |

| Argentina | 1,600 | 90 |

| Colombia | 1,300 | 170 |

| Taiwan | 1,300 | 480 |

| New Zealand | 1,300 | 30 |

| India | 1,000 | 720 |

| Cyprus | 880 | 90 |

| Malaysia | 720 | 170 |

| Turkey | 720 | 170 |

| Saudi Arabia | 720 | 140 |

| Ireland | 720 | 30 |

| Chile | 590 | 40 |

| Japan | 390 | 720 |

| Egypt | 390 | 1,600 |

| Thailand | 320 | 390 |

| Indonesia | 320 | 260 |

| Brazil | 320 | 320 |

| Pakistan | 320 | 260 |

| Canada | 320 | 170 |

| Nigeria | 320 | 260 |

| Morocco | 210 | 390 |

| Vietnam | 170 | 880 |

| Philippines | 170 | 90 |

| Algeria | 170 | 480 |

| Bangladesh | 170 | 90 |

| Jordan | 140 | 40 |

| Dominican Republic | 140 | 90 |

| Costa Rica | 140 | 10 |

| Cambodia | 110 | 20 |

| Peru | 90 | 50 |

| Venezuela | 90 | 110 |

| Panama | 90 | 10 |

| Uzbekistan | 70 | 70 |

| Kenya | 70 | 140 |

| Ghana | 70 | 50 |

| Sri Lanka | 40 | 20 |

| Ecuador | 40 | 40 |

| Ethiopia | 30 | 40 |

| Uganda | 30 | 30 |

| Tanzania | 30 | 40 |

| Botswana | 20 | 20 |

| Bolivia | 20 | 10 |

| Mongolia | 10 | 10 |

| Mauritius | 10 | 10 |

2024 Monthly Searches For Each Brand

Plus500 - Italy

Plus500 - Italy

|

22,200

1st

|

ThinkMarkets - Italy

ThinkMarkets - Italy

|

140

2nd

|

Plus500 - UK

Plus500 - UK

|

14,800

3rd

|

ThinkMarkets - UK

ThinkMarkets - UK

|

590

4th

|

Plus500 - Spain

Plus500 - Spain

|

9,900

5th

|

ThinkMarkets - Spain

ThinkMarkets - Spain

|

260

6th

|

Plus500 - Australia

Plus500 - Australia

|

8,100

7th

|

ThinkMarkets - Australia

ThinkMarkets - Australia

|

320

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with Plus500 receiving 6,888,000 visits vs. 283,000 for ThinkMarkets.

Our Most Popular Broker Verdict

Plus500 is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – Plus500

When it comes to product range and CFD markets, both Plus500 and ThinkMarkets offer a wide variety of options for traders. Plus500 provides access to over 11,000 shares CFDs, 18 cryptos CFDs, and 65 forex CFDs, among others. ThinkMarkets, on the other hand, offers a more limited range of shares CFDs (3670) but has a competitive offering of 27 cryptos CFDs and 46 forex CFDs.

Here’s a table comparing the range of CFDs, products, and markets available:

| Criteria | Plus500 | ThinkMarkets |

|---|---|---|

| Shares CFDs | 11,000+ | 3670 |

| Cryptos CFDs | 18 | 27 |

| Forex CFDs | 65 | 46 |

| Commodities CFDs | 5 Metals, 7 Energies, 10 Softs | 4 Metals (3 x Golds), 3 Energies |

| Indices CFDs | 65 | 16 |

| Bonds/Treasuries CFDs | No | No |

| Spread Betting (UK only) | No | Yes |

| Other Products | No | No |

| Shares (underlying) | No | Yes |

| Minimum Deposit | $100 | $0 |

| Payment Methods | Variety | Variety |

Our Top Product Range and CFD Markets Verdict

While both brokers offer a comprehensive range of CFDs and markets, Plus500 has the edge with its extensive offering of shares CFDs and overall larger product range.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

8. Superior Educational Resources – ThinkMarkets

When it comes to educational resources, both Plus500 and ThinkMarkets offer a range of materials to help traders improve their skills and knowledge. However, there are some noticeable differences in the educational resources each broker provides.

- Plus500 offers a comprehensive range of educational materials, including webinars, video tutorials, and articles.

- ThinkMarkets also offers a variety of educational resources, such as trading guides, webinars, and video tutorials.

- Plus500 provides a demo account that allows traders to practice their skills in a risk-free environment.

- ThinkMarkets offers a demo account as well, giving traders the opportunity to test out their strategies without risking real money.

- Plus500 has a dedicated customer support team that can help traders with any questions or issues they may have.

- ThinkMarkets also offers customer support, with the added benefit of a personal account manager for some account types.

Our Superior Educational Resources Verdict

Based on our testing, ThinkMarkets offers the best educational resources, with a score of 9 out of 10 compared to Plus500’s score of 8 out of 10. This makes ThinkMarkets the better choice for traders who are looking for comprehensive educational materials to help them succeed in the forex market.

ThinkMarkets ReviewVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

9. Superior Customer Service – Tie

Customer service is a crucial aspect of the trading experience. Both Plus500 and ThinkMarkets offer 24/7 customer service, with support available via live chat, email, and phone. They are committed to providing prompt and helpful service to their clients.

| Broker | Customer Service |

|---|---|

| Plus500 | 24/7, Live Chat, Email, Phone |

| ThinkMarkets | 24/7, Live Chat, Email, Phone |

Our Superior Customer Service Verdict

It’s a tie in this category, as both Plus500 and ThinkMarkets provide excellent customer service.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

10. Better Funding Options – ThinkMarkets

When it comes to funding options, both Plus500 and ThinkMarkets offer a range of methods to suit different trader needs. Plus500 provides a variety of payment methods, including credit/debit cards, bank transfers, and e-wallets such as PayPal and Skrill. ThinkMarkets also offers a range of payment options, including credit/debit cards, bank transfers, and e-wallets like Neteller and Skrill. However, ThinkMarkets has the added benefit of offering cryptocurrency deposits, which can be a convenient option for some traders.

Here’s a table comparing the funding options available:

| Funding Option | Plus500 | ThinkMarkets |

|---|---|---|

| Credit/Debit Card | ✓ | ✓ |

| Bank Transfer | ✓ | ✓ |

| PayPal | ✓ | ✗ |

| Skrill | ✓ | ✓ |

| Neteller | ✗ | ✓ |

| Cryptocurrency | ✗ | ✓ |

| Other | ✗ | ✗ |

Our Better Funding Options Verdict

ThinkMarkets offers the best funding options, with a wider range of payment methods available, including the unique option of cryptocurrency deposits. This makes it a more flexible and convenient choice for traders looking to fund their accounts.

ThinkMarkets ReviewVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

11. Lower Minimum Deposit – ThinkMarkets

ThinkMarkets has a lower minimum deposit of $0 than Plus500’s requirement of $100. While ThinkMarkets doesn’t require a minimum deposit with this Standard Account, they do require at least $500 to open a ThinkZero account.

Plus500 by contrast only has one account type which as mentioned requires a minimum deposit of $100. Overall, $100 is only a small deposit and of course, you will get this back should you not use the funds and close the account.

Here’s a table comparing the minimum deposit amounts for each broker:

| Minimum Deposit | Recommended Deposit | |

| Plus500 | $100 | $100 |

| ThinkMarkets | $0 | $500 |

Our Lower Minimum Deposit Verdict

ThinkMarkets offers a lower minimum deposit, with a $0 requirement for its standard account. Given how this broker performed in our other categories, their minimum deposit is the icing on the cake.

ThinkMarkets ReviewVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

So Is ThinkMarkets or Plus500 The Best Broker?

ThinkMarkets is the winner because it outperforms Plus500 in most of the key areas that are important to traders. The table below summarises the key information leading to this verdict.

| Criteria | Plus500 | ThinkMarkets |

|---|---|---|

| Lowest Spreads And Fees | ❌ | ✅ |

| Better Trading Platform | ❌ | ✅ |

| Superior Accounts And Features | ❌ | ✅ |

| Best Trading Experience And Ease | ❌ | ✅ |

| Stronger Trust And Regulation | ✅ | ❌ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ❌ | ✅ |

| Superior Customer Service | ❌ | ❌ |

| Better Funding Options | ❌ | ✅ |

| Lower Minimum Deposit | ❌ | ✅ |

ThinkMarkets: Best For Beginner Traders

ThinkMarkets is better for beginner traders because it offers a $0 minimum deposit, superior educational resources, and a user-friendly trading platform.

ThinkMarkets: Best For Experienced Traders

ThinkMarkets is also better for experienced traders because it offers a range of advanced trading platforms, superior accounts and features, and competitive spreads and fees.

FAQs Comparing Plus500 Vs ThinkMarkets

Does ThinkMarkets or Plus500 Have Lower Costs?

ThinkMarkets has lower costs compared to Plus500. ThinkMarkets offers competitive spreads starting from 0.4 pips on major forex pairs, while Plus500 has wider spreads starting from 0.6 pips. Additionally, ThinkMarkets provides more account options that can further reduce trading costs for experienced traders. For more information on low-cost brokers, check out our Lowest Commission Brokers page.

Which Broker Is Better For MetaTrader 4?

ThinkMarkets is the better broker for MetaTrader 4 as it offers this popular trading platform along with additional tools and features to enhance the trading experience. Plus500, on the other hand, does not offer MetaTrader 4. ThinkMarkets also provides a range of educational resources and customer support to assist traders in using the platform effectively. For a list of the best MetaTrader 4 brokers, visit our best MT4 brokers page.

Which Broker Offers Social Trading?

ThinkMarkets offers social trading through its partnership with ZuluTrade, while Plus500 does not offer social or copy trading. Social trading allows traders to copy the trades of experienced traders, which can be a valuable tool for beginners looking to learn from others. For more information on the best social trading platforms, check out our best copy trading platforms page.

Does Either Broker Offer Spread Betting?

Plus500 offers spread betting, while ThinkMarkets does not. Spread betting is a tax-efficient way of speculating on the price movements of financial markets without actually owning the underlying asset. Plus500 provides a range of markets for spread betting, including forex, indices, and commodities. For more information on the best spread betting brokers, visit our best spread betting brokers page.

What Broker is Superior For Australian Forex Traders?

In my opinion, ThinkMarkets is superior for Australian forex traders. ThinkMarkets is ASIC regulated, which is important for Australian traders looking for a reliable and trustworthy broker. Plus500 is also a good option, but it is not founded in Australia. ThinkMarkets offers a range of trading platforms, including MetaTrader 4 and its proprietary ThinkTrader platform. For more information on the best Australian forex brokers, check out our Best Forex Brokers In Australia page.

What Broker is Superior For UK Forex Traders?

In my opinion, Plus500 is superior for UK forex traders. Plus500 is FCA-regulated, which is important for UK traders looking for a reliable and trustworthy broker. ThinkMarkets is also a good option, but it is not founded in the UK. Plus500 offers a user-friendly proprietary trading platform, while ThinkMarkets provides advanced platforms like MetaTrader 4 and 5. For more information on the best UK forex brokers, visit our best UK forex brokers page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert