Plus500 vs XTB 2025

Our comparison of Forex brokers Plus500 and XTB looks at differences and similarities between trading costs, platforms, regulation, and more to help you decide on a broker to trade with.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Allowed but not supported

Overall

Our full comparison dives deep into the 10 most pivotal trading factors. Here are five standout differences:

- Plus500 boasts tighter spreads, potentially increasing profitability.

- XTB excels in offering a rich array of educational resources.

- The user interface at Plus500 is streamlined, catering to beginners.

- XTB’s platform is feature-rich, with advanced charting tools for seasoned traders.

- Starting with XTB is more budget-friendly due to its lower minimum deposit.

1. Lowest Spreads And Fees – Tie

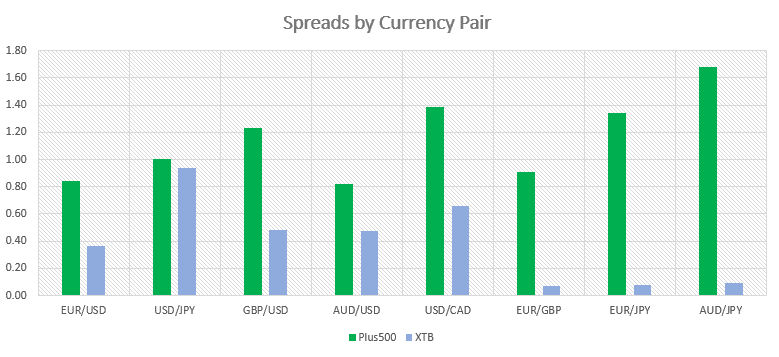

Both Plus500 and XTB offer competitive pricing, but the specifics can vary depending on the account type and trading conditions. Try the XTB vs Plus500 fee calculator below based on the most popular forex pairs and base currencies.

Plus500 Spreads

Plus500 offers tighter spreads on its standard account compared to XTB. This can lead to lower trading costs in the long run.

| Plus500 | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | All-in Cost EUR/USD - Active | EUR/USD Standard Account |

|---|---|---|---|---|---|---|---|---|---|---|

| MyFxBook | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| BrokerChooser | 0.80 | 1.00 | 1.30 | 0.80 | 2.00 | N/A | N/A | N/A | N/A | N/A |

| ForexBrokers.com | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| CompareForexBrokers | 1.70 | 1.90 | 2.30 | 1.40 | 2.00 | 1.70 | 2.40 | 3.00 | N/A | N/A |

| Plus500 | 0.02 | 0.11 | 0.09 | 0.25 | 0.15 | 0.11 | 0.28 | 0.36 | N/A | N/A |

| Consensus | 0.84 | 1.00 | 1.23 | 0.82 | 1.38 | 0.91 | 1.34 | 1.68 | N/A | N/A |

XTB Spreads

XTB’s pro account provides more competitive pricing for traders who prefer raw spreads to Plus500’s equivalent.

| Plus500 | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | All-in Cost EUR/USD - Active | EUR/USD Standard Account |

|---|---|---|---|---|---|---|---|---|---|---|

| MyFxBook | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| BrokerChooser | 1.00 | 1.40 | 1.30 | 1.30 | 1.80 | N/A | N/A | N/A | N/A | N/A |

| ForexBrokers.com | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 1.04 | 1.07 |

| CompareForexBrokers | 0.09 | 1.40 | 0.14 | 0.13 | 0.18 | 0.14 | 0.14 | 0.17 | N/A | N/A |

| XTB | 0.00 | 0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.02 | 0.02 | N/A | N/A |

| Consensus | 0.36 | 0.94 | 0.48 | 0.48 | 0.66 | 0.07 | 0.08 | 0.10 | 1.04 | 1.07 |

The graph below shows the consensus data with XTB having lower spreads in all major currency pairs.

Commission Rates

Plus500 operates on a commission-free model, making money through spreads, while XTB charges commissions on certain account types.

Other Fees

Plus500 and XTB both charge inactivity fees, but Plus500’s fee kicks in after a shorter period of inactivity.

Our Lowest Spreads and Fees Verdict

Both Plus500 and XTB charge inactivity and overnight fees. It’s important for traders to be aware of these costs, especially if they plan to hold positions overnight or remain inactive for extended periods.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

2. Better Trading Platform – XTB

Plus500 and XTB offer different trading platforms to their users mainly.

| Trading Platform | Plus500 | XTB |

|---|---|---|

| MetaTrader 4 | No | Yes |

| MetaTrader 5 | No | No |

| cTrader | No | No |

| TradingView | No | No |

| Copy Trading | No | No |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

MetaTrader 4 and 5

While Plus500 offers its proprietary platform, XTB supports MetaTrader 4, a popular platform known for its advanced features and customisability.

cTrader and TradingView

Neither Plus500 nor XTB offers cTrader or TradingView.

Social And Copy Trading

XTB and Plus500 do not offer social or copy trading.

Our Better Trading Platform Verdict

XTB wins this category due to its support for MetaTrader, a proprietary platform and mobile trading app.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

3. Superior Accounts And Features – Plus500

Plus500 offers a simple account type, while XTB provides accounts designed for novice and professional traders. The Plus500 platform is designed with a focus on simplicity and ease of use, making it ideal for beginners.

Plus500 Account Types:

- Primary CFD Account: Available to all clients, offering a wide range of over 2,800 tradable instruments, including options, ETFs, and cryptocurrencies. Features include:

- Minimum Forex Spreads: 0.8 pips

- Commission-Free Trading

- Maximum Leverage: 1:30 to 1:300 (depending on the subsidiary and asset)

- Market Maker Order Execution Model

- User-friendly web-based trading platform and mobile app

- Unlimited demo account for practice trading

- Professional Account: For EU-based traders, offering higher leverage up to 1:300 and cash rebates but requires meeting certain criteria such as significant trading activity or experience in the financial sector.

- Invest Account: Geographically restricted unleveraged equity trading account with access to 17 exchanges in the US and Europe, offering low commission rates.

- Futures Trading Account: Exclusive to US clients, providing futures and options trading on several exchanges.

- VIP Account: An invite-only account offering tailor-made experiences and additional services.

XTB Account Types:

- Standard Account: XTB offers commission-free trading for stocks and ETFs up to a certain turnover, after which a commission of 0.2% applies.

- Swap-Free Account: Available for traders who require it, offering no swap fees for keeping trades overnight on specific products.

| Plus500 | XTB | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | No | Yes |

| Swap Free Account | No | Yes |

| Active Traders | No | No |

| Spread Betting (UK) | No | No |

Our Superior Accounts and Features Verdict

Both Plus500 and XTB offer competitive account features tailored to different types of traders. If variety and specialised account options are your priority, Plus500 might be the better choice. However, for traders seeking simplicity and ease of access, XTB’s approach could be more appealing.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – XTB

Trading should be a breeze, not a chore. Plus500’s platform is designed with simplicity in mind, making it a favourite among newcomers. Its clean interface ensures that traders aren’t overwhelmed. Conversely, XTB seems to cater to the more experienced crowd. Their platform, brimming with advanced charting tools, is a haven for those who love in-depth analysis.

- Plus500’s design is intuitive and perfect for those starting out.

- XTB’s advanced tools cater to analytical minds.

- Beginners find Plus500 less cluttered and more navigable.

- Professionals often lean towards XTB for its comprehensive features.

Our Best Trading Experience and Ease Verdict

While Plus500 is a haven for beginners, XTB is the go-to for traders seeking advanced functionalities.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – Plus500

Plus500 has a higher trust score of 71 than XTB, which is 62. We have evaluated both brokers based on their regulations, reputation, and reviews.

Plus500 Trust Score

XTB Trust Score

Regulation

Both Plus500 and XTB are highly regulated. Plus500 is regulated by several top-tier financial authorities worldwide, including the Australian Securities and Investments Commission (ASIC), the UK’s Financial Conduct Authority (FCA), and the Cyprus Securities and Exchange Commission (CySEC). It’s also regulated by other notable regulatory bodies, such as BaFin in Germany, FINMA in Switzerland, and the Monetary Authority of Singapore (MAS), among others.

| Plus500 | XTB | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) CYSEC (Cyprus) FMA (New Zealand) MAS (Singapore) | FCA (UK) CYSEC (Cyprus) |

| Tier 2 Regulation | DFSA (Dubai) EFSRA | DFSA (Dubai) CMNV (Spain) KNF (Poland) |

| Tier 3 Regulation | FSA-S (Seychelles) FSCA (South Africa) | FSC-BZ |

Similarly, XTB is also regulated by multiple top-tier financial authorities, including ASIC, FCA, and CySEC. In addition, it’s regulated by the KNF in Poland, where it’s headquartered, and other regulatory bodies such as the Dubai Financial Services Authority (DFSA) and the Financial Sector Conduct Authority (FSCA) in South Africa.

Reputation

Plus500 was established in 2008 in Haifa, Israel, which means they have earned a name for themselves. This fact is further backed up by the Google monthly search they get at 246,000 hits.

XTB also has a long history, with its origins dating back to 2002 in London, UK. Similarly, they have around 246,000 monthly searches.

Reviews

Plus500 has gained a TrustPilot score of 4.2 out of 5 from over 16,000 reviews, while XTB scored 4.0 out of 5 based on around 2,000 reviews.

Our Stronger Trust and Regulation Verdict

Plus500 has more weight in this category despite both brokers being regulated by multiple top-tier authorities and having similar scores in a couple of factors.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

6. Most Popular Broker – XTB

XTB gets searched on Google more than Plus500. On average, XTB sees around 368,000 branded searches each month, while Plus500 gets about 270,000 — that’s 26% fewer.

| Country | Plus500 | XTB |

|---|---|---|

| Poland | 8,100 | 135,000 |

| Portugal | 4,400 | 40,500 |

| Spain | 9,900 | 27,100 |

| France | 1,900 | 18,100 |

| Germany | 18,100 | 12,100 |

| Brazil | 320 | 9,900 |

| Vietnam | 170 | 5,400 |

| Chile | 590 | 5,400 |

| United Kingdom | 14,800 | 4,400 |

| Italy | 22,200 | 4,400 |

| Colombia | 1,300 | 3,600 |

| United States | 5,400 | 2,400 |

| Thailand | 320 | 2,400 |

| Peru | 90 | 2,400 |

| Mexico | 2,900 | 1,900 |

| United Arab Emirates | 4,400 | 1,900 |

| Netherlands | 8,100 | 1,600 |

| India | 1,000 | 1,300 |

| Switzerland | 5,400 | 1,300 |

| Argentina | 1,600 | 1,300 |

| Austria | 2,900 | 1,000 |

| Saudi Arabia | 720 | 1,000 |

| Morocco | 210 | 1,000 |

| Algeria | 170 | 880 |

| Ecuador | 40 | 880 |

| Canada | 320 | 720 |

| Egypt | 390 | 720 |

| Bolivia | 20 | 720 |

| Nigeria | 320 | 480 |

| Turkey | 720 | 480 |

| Sweden | 2,900 | 480 |

| Ireland | 720 | 480 |

| Japan | 390 | 390 |

| South Africa | 5,400 | 390 |

| Jordan | 140 | 390 |

| Philippines | 170 | 320 |

| Australia | 8,100 | 320 |

| Malaysia | 720 | 320 |

| Indonesia | 320 | 320 |

| Dominican Republic | 140 | 320 |

| Costa Rica | 140 | 320 |

| Venezuela | 90 | 320 |

| Cyprus | 880 | 260 |

| Greece | 4,400 | 210 |

| Pakistan | 320 | 210 |

| Hong Kong | 2,400 | 170 |

| Cambodia | 110 | 170 |

| Singapore | 1,900 | 140 |

| Taiwan | 1,300 | 140 |

| Bangladesh | 170 | 110 |

| Uzbekistan | 70 | 110 |

| Sri Lanka | 40 | 90 |

| Kenya | 70 | 70 |

| Ghana | 70 | 70 |

| Tanzania | 30 | 70 |

| Panama | 90 | 70 |

| New Zealand | 1,300 | 50 |

| Uganda | 30 | 40 |

| Ethiopia | 30 | 30 |

| Mauritius | 10 | 20 |

| Botswana | 20 | 20 |

| Mongolia | 10 | 10 |

8,100 1st | |

135,000 2nd | |

4,400 3rd | |

40,500 4th | |

1,900 5th | |

18,100 6th | |

320 7th | |

9,900 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with XTB receiving 7,682,000 visits vs. 6,888,000 for Plus500.

Our Most Popular Broker Verdict

XTB is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – XTB

Plus500 offers a commendable array of CFDs, covering popular markets like forex, commodities, and indices. XTB, however, goes a step further. Their expansive features include emerging markets such as cryptocurrencies and ETFs, which are gaining traction among traders.

| Product/Market | Plus500 | XTB |

|---|---|---|

| Forex | ✓ | ✓ |

| Commodities | ✓ | ✓ |

| Indices | ✓ | ✓ |

| Cryptocurrencies | ✕ | ✓ |

| ETFs | ✕ | ✓ |

| Stocks | ✓ | ✓ |

| Bonds | ✕ | ✓ |

| Options | ✕ | ✓ |

| Futures | ✕ | ✓ |

| Precious Metals | ✓ | ✓ |

Our Top Product Range and CFD Markets Verdict

While Plus500 offers a solid range of CFDs, XTB clearly has the upper hand with its broader spectrum of markets, making it the preferred choice for traders seeking variety and depth in their trading portfolio.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

8. Superior Educational Resources – XTB

Plus500 does offer educational resources, but they’re more on the basic side. XTB, in contrast, is like an open university for traders. Their range is vast, from webinars to e-books, catering to all levels.

- Plus500 provides foundational courses for novices.

- XTB’s webinars dive deep into complex trading topics.

- Plus500’s content, though helpful, pales in comparison to XTB.

- XTB’s e-books are a treasure trove of knowledge.

- Interactive tools are missing from Plus500’s educational arsenal.

- XTB’s portal is a comprehensive learning hub.

Our Superior Educational Resources Verdict

For those hungry for knowledge, XTB is the clear winner with its extensive educational resources.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

9. Superior Customer Service – XTB

Plus500 offers swift responses, but their avenues for support are somewhat limited. XTB stands out with its round-the-clock support and a plethora of contact methods.

| Feature | Plus500 | XTB |

|---|---|---|

| 24/7 Support | ✕ | ✓ |

| Live Chat | ✓ | ✓ |

| Phone Support | ✓ | ✓ |

| Email Support | ✓ | ✓ |

| Multilingual Support | ✓ | ✓ |

| Educational Webinars | ✕ | ✓ |

Our Superior Customer Service Verdict

When it comes to unparalleled support, XTB takes the crown with its diverse and always-available customer service.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

10. Better Funding Options – XTB

Smooth trading is backed by seamless funding. Brokers offer various funding options which differentiate them.

| Payment Options | Plus500 | XTB |

|---|---|---|

| Visa/Mastercard | ✓ | ✓ |

| Wire Transfer | ✓ | ✓ |

| PayPal | ✓ | ✓ |

| Neteller | ✕ | ✓ |

| Skrill | ✓ | ✓ |

| Other methods (i.e. Crypto, digital wallets, cheque) | ✓ | ✓ |

Our Better Funding Options Verdict

XTB emerges as the more versatile option for traders seeking varied funding avenues.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

11. Lower Minimum Deposit – XTB

XTB has a lower minimum deposit of $0 than Plus500, which requires $100. By setting a lower threshold, XTB simplifies the process for beginners, allowing them to start small before diving deep. Although Plus500 offers a wide range of features, it requires a substantial initial investment.

Plus500

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Paypal | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Bank Wire | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Skrill | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

XTB

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £0 | $0 Minimum Deposit | €0 Minimum Deposit | $0 |

| Bank Wire | £0 | $0 Minimum Deposit | €0 Minimum Deposit | $0 |

| Skrill | £0 | $0 Minimum Deposit | €0 Minimum Deposit | $0 |

| Neteller | £0 | $0 Minimum Deposit | €0 Minimum Deposit | $0 |

Here’s a quick look at each broker’s required and recommended deposit amounts.

| Broker | Minimum Deposit | Recommended Deposit |

|---|---|---|

| Plus500 | $100 | $100 |

| XTB | $0 | $250 |

Our Lower Minimum Deposit Verdict

XTB wins this category with its no minimum deposit requirement.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

So Is XTB or Plus500 The Best Broker?

XTB emerges as the winner due to its comprehensive offerings in terms of educational resources, trading platforms, customer service, and product range.

| Criteria | Plus500 | XTB |

|---|---|---|

| Lowest Spreads And Fees | ❌ | ✅ |

| Better Trading Platform | ❌ | ✅ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience And Ease | ❌ | ✅ |

| Stronger Trust And Regulation | ✅ | ❌ |

| Top Product Range And CFD Markets | ❌ | ✅ |

| Superior Educational Resources | ❌ | ✅ |

| Superior Customer Service | ❌ | ✅ |

| Better Funding Options | ❌ | ✅ |

| Lower Minimum Deposit | ❌ | ✅ |

Plus500: Best For Beginner Traders

Plus500 is better for beginner traders due to its streamlined user interface and simpler account structure, making it easier for newcomers to start trading.

XTB: Best For Experienced Traders

XTB is the preferred choice for experienced traders, offering advanced charting tools, a wider range of educational resources, and a more diverse product portfolio.

FAQs Comparing Plus500 Vs XTB

Does XTB or Plus500 Have Lower Costs?

Plus500 generally offers lower costs. Their spreads are competitive, often outperforming many in the industry. For a deeper dive into low commission brokers, check out our guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Only XTB has MetaTrader 4, thus giving it its win here. For more insights on MT4 brokers, explore our detailed review of the best MT4 brokers.

Which Broker Offers Social Trading?

XTB shines in the realm of social trading, offering robust tools for traders to collaborate and share strategies. For a broader perspective on social trading platforms, visit our comprehensive guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

Yes, Plus500 offers spread betting for traders, especially appealing to UK traders. For more on spread betting, consider our guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Plus500 has a slight edge for Australian traders. They’re ASIC regulated, ensuring a high level of trust. While XTB offers a plethora of features, Plus500’s foundation in Australia gives it a home advantage. Dive deeper into the best options for Aussie traders at our Best Forex Brokers In Australia comparison.

What Broker is Superior For UK Forex Traders?

For UK traders, XTB is the superior choice. They’re FCA regulated, ensuring top-notch security and trustworthiness. Plus, their global foundation and vast features make them a favourite among UK traders. For more insights on UK trading, check out our Best Forex Brokers In UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert