Best Forex Brokers For Beginner Traders In UK

To help select a good beginner forex broker in the UK, our team has compared the top CFD providers based on trading fees, customer support, trade speeds and the best forex trading platforms suitable for UK beginner forex traders.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

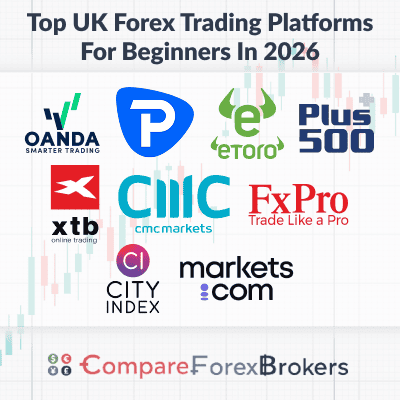

The best forex trading platforms in the UK for beginner traders are the following

- OANDA - Best UK Forex Broker For Beginners

- Pepperstone - Top UK MetaTrader 4 Broker For Beginners

- eToro - Top Beginner Copy Trading Platform

- Plus500 - Good Risk Management Trading Platform

- XTB - Best Mobile Trading Platform For Beginners

- CMC Markets - Best Web Trading Platform

- FxPro - Best cTrader Trading Platform Broker

- City Index - Best Beginner CFD Trading Platform (WebTrader)

- Markets.com - The Best Forex Broker for Small Accounts

What is the best forex platform for beginners in the UK?

OANDA Trade tops the list with simple user interface, partial lot sizing down to 1 unit, no learning curve, and one-click access to charting tools under FCA regulation. Beginner platforms prioritize ease of use with educational resources. We tested interface simplicity and risk management features.

1. OANDA - THE BEST FOREX BROKER FOR BEGINNERS

Forex Panel Score

Average Spread

EUR/USD = 0.89

GBP/USD = 1.54

AUD/USD = 1.37

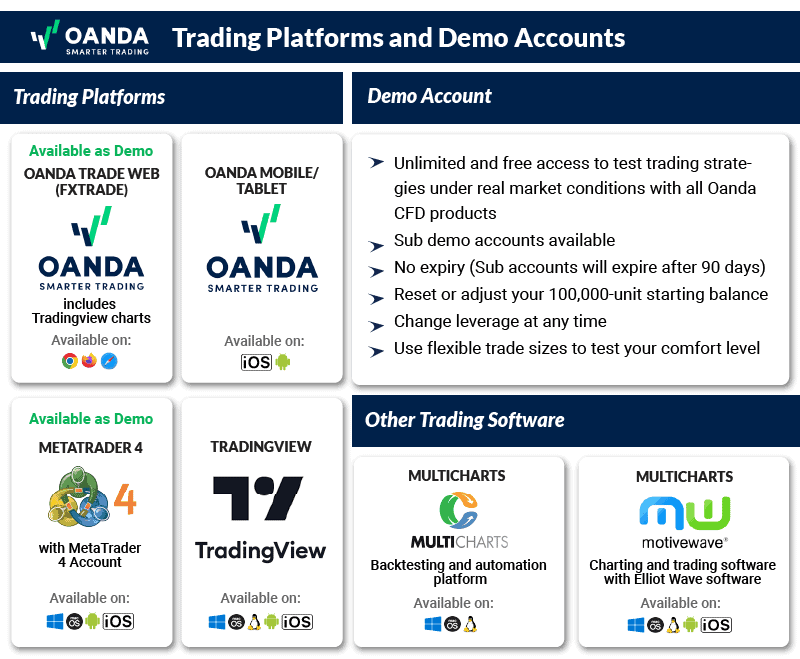

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

We highly recommend OANDA as a top choice for beginner traders in the UK. Having personally utilised their services, we can vouch for their robust regulation by esteemed authorities like the MAS, ASIC, and, notably, the FCA. Newcomers will appreciate the comprehensive charting and trading tools available on their MetaTrader 4 platform. Furthermore, the ability to craft automated trading strategies is a significant advantage for those starting their trading journey.

Pros & Cons

- No minimum deposit

- Can trade partial lots on OANDA Trade

- Good selection of trading platforms

- Limited product portfolio

- Competitive spreads may not be the lowest

- No share CFDs

Broker Details

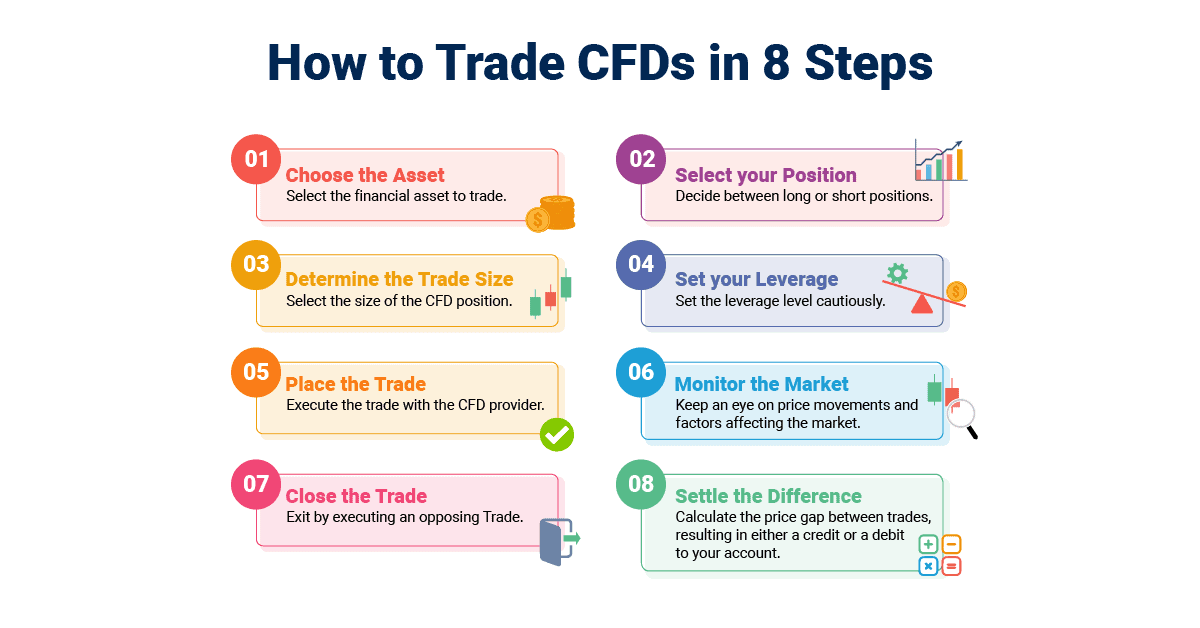

OANDA’s proprietary trading platform, Oanda Trade, allows investors to trade CFDs derived from asset classes such as indices, commodities, and bonds in addition to forex.

- 70+ Fx pairs

- 16+ Stock Index CFDs

- 27+ Commodity CFDs

- 6+ Bond CFDs

The web trader platform is easy to use and provides analysis tools, including 100+ drawing tools and technical indicators. To supplement any technical analysis conducted, you can keep updated with real-time forex industry news on the web-based platform.

An advantage beginner traders gain when using OANDA trade is that they can manually set leverage when trading CFDs. Many of the best brokers do not allow leverage to be changed or reduced from the maximum available, increasing the high risk of forex trading. For instance, OANDA customers new to forex trading may be offered 30:1 leverage under ASIC regulation yet choose to place an order with 5:1 leverage to reduce the high risk and exposure. Some brokers like AvaTrade also allow spreads to be fixed, giving certainty to brokerage fees.

OANDA has regulatory approval in Australia by ASIC and in many other regions, such as in the United States by the US Commodity Futures Trading Commission (CFTC). This is one of the hardest regulators to get approval by, with only a few brokers like Interactive Brokers being US regulated.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

2. Pepperstone - TOP UK METATRADER 4 BROKER FOR BEGINNERS

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.3

AUD/USD = 0.1

Trading Platforms

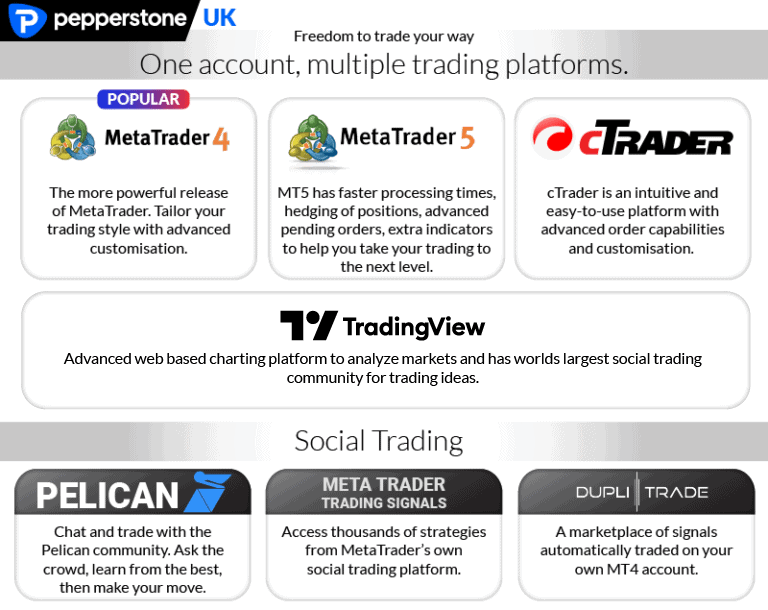

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

We can confidently attest to Pepperstone’s exceptional trading platforms, competitive spreads, and minimal commission costs. Regulated by the FCA, they ensure a trustworthy trading experience. Platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, TradingView, and Capitalise.ai provide comprehensive tools and broad market access. Their superior customer service further sets them apart in supporting newcomers in their forex journey.

Pros & Cons

- Commission-free Standard Account

- Provides new tools for MetaTrader 4

- Fast execution on MT4

- No guaranteed stop-loss orders

- No crypto markets

- Education resources are dated

Broker Details

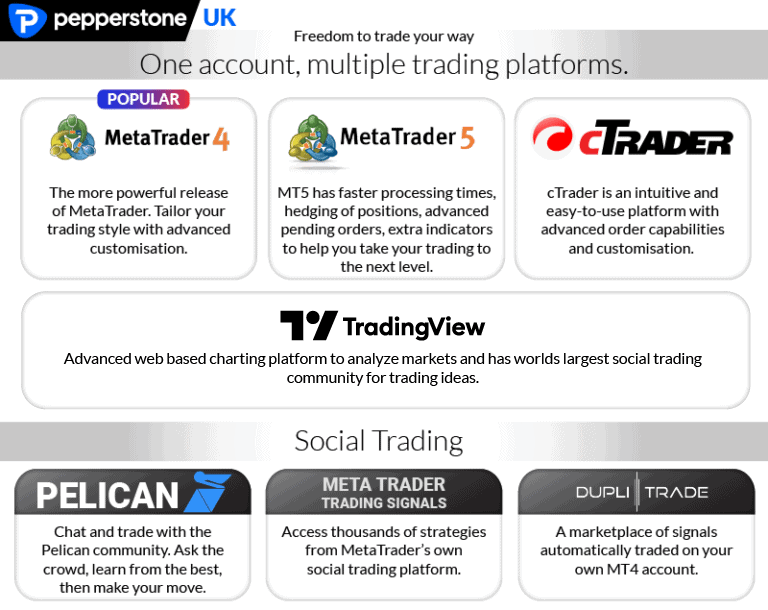

Pepperstone is regulated by the Financial Conduct Authority (FCA) in the UK and is one of the best brokers in the world, thanks to its top trading platforms, tight spreads, low commission fees, and excellent customer support. You can trade CFDs and forex using MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, TadingView and Capitalise.ai, with each platform providing extensive tools and market access.

Pepperstone is regulated by the Financial Conduct Authority (FCA) in the UK and is one of the best brokers in the world, thanks to its top trading platforms, tight spreads, low commission fees, and excellent customer support. You can trade CFDs and forex using MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, TadingView and Capitalise.ai, with each platform providing extensive tools and market access.

cTrader is a popular platform but is better suited if you are an experienced trader. At the same time, MT4 and MT5 are ideal trading platforms for all experience levels, including beginners, with easy-to-use trading tools for analysis and automation.

Beginner Traders can benefit from the following MetaTrader 4 and 5 features:

- You can access over 92 forex markets, commodities, currency indices and shares. (Share CFD trading is only available on MT5).

- Various technical and fundamental analysis tools help you find trading opportunities and develop strategies.

- Autochartist, MetaTrader’s market scanning software, helps beginners with technical analysis by automatically monitoring markets.

- As MT4 and MT5 are the most popular platforms worldwide, you can participate in an extensive forex trading community to interact and learn from more experienced traders.

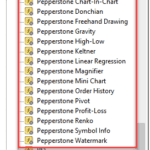

- Rather than developing your own algorithmic strategies, you can download free or paid indicators and Expert Advisors from MetaTrader’s online Marketplace.

- You can use one trading account across a range of devices, with desktop and web trader platforms plus Android and iOS mobile apps.

Automated Trading Tools:

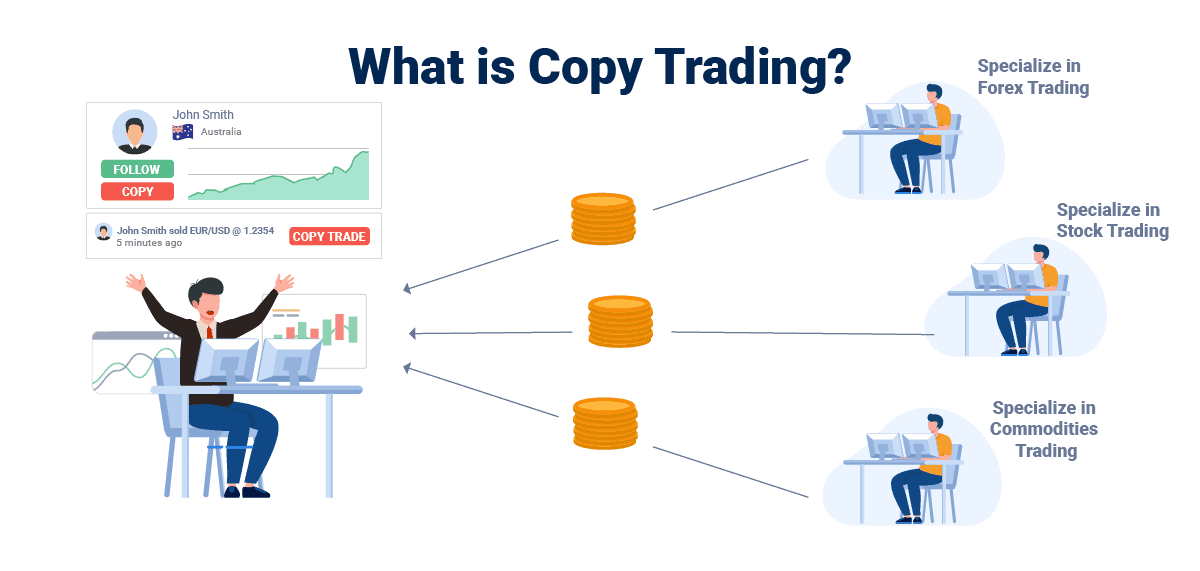

There are two main approaches to automating your trading. Social-copy trading software is account mirroring software that allows you to copy the trading strategies of experienced traders, rather than develop your own.

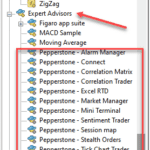

The second option is algorithmic trading, where you use trading robots known as Expert Advisors to monitor markets and enter or exit trades according to your algorithm’s pre-set parameters.

Social-Copy Trading

- Trading Signals: MetaTrader’s inbuilt copy trading service, where users can copy the strategies of signal providers.

- Third-party providers such as Pelican and DupliTrade

Algorithmic Trading

- Expert Advisors: Trading robots using MQL4 and MQL5 programming languages or buying from the MetaQuotes community.

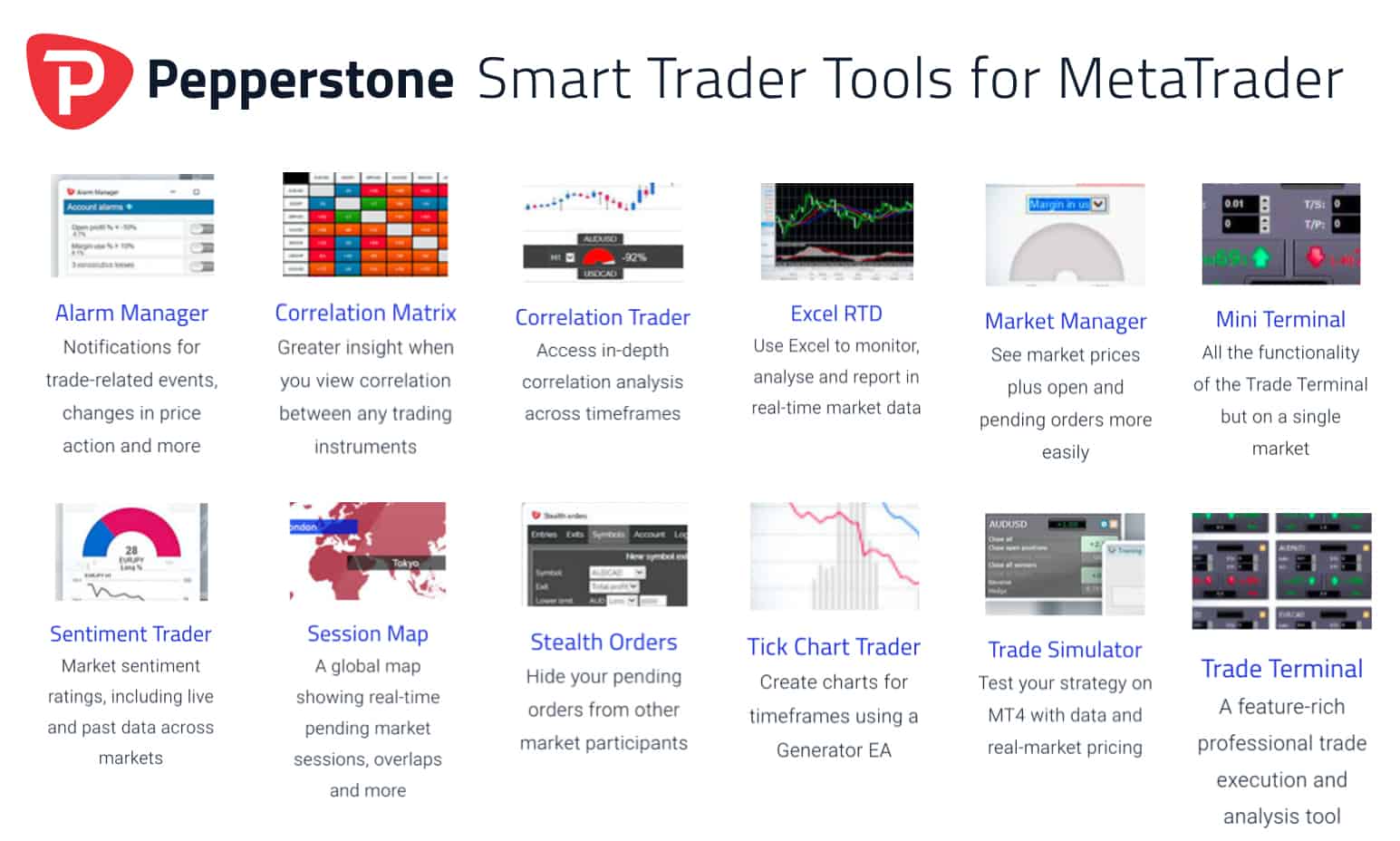

- Smart Trader Tools: Pepperstone’s exclusive package of Expert Advisors and indicators is available for download from the broker’s website.

Trading Account Types

Pepperstone is a no-dealing desk (NDD) broker offering an institutional-grade trading environment with low spreads and fees.

As a Pepperstone client, you can choose between two main trading account types – either a Raw or Standard Account. The best account type that suits you depends on whether you prefer tighter spreads while paying flat-rate commission fees or wider spreads with no commission fees.

Razor vs Standard Account Types

When trading forex with Pepperstone, the critical difference between a Razor and Standard account type is the spreads and commission fees.

If you are a beginner trader, you may prefer a standard account type. The compensation for Pepperstone’s services is included in the spreads, allowing for a simple pricing structure.

If you are an experienced trader, Pepperstone’s Razor account offers an environment ideal for scalping, day trading and expert advisor strategies. With the Razor account, you can trade ultra-low spreads while paying flat-rate commission fees.

- Standard Account Type: Commission-free spreads starting from 1.0 pips

- Razor Account Type: From GBP £4.59 round trip commission fee with low spreads from 0.6 pips

Low Spreads + Commission: Razor Account Type

A Razor account gives you access to low spreads on various currency pairs. As spreads are so tight, you pay a flat rate commission fee per side of each trade per 100,000 traded.

Pepperstone offers tighter spreads than many other leading brokers for a range of currency pairs, including EUR/USD, EUR/JPY and AUD/USD forex pairs. While some brokers may have better spreads for certain FX pairs, Pepperstone offers the best value across the board.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Commission-Free Spreads: Standard Account Type

You can trade spreads inclusive of commission fees as a Standard Account holder. Pepperstone’s no-commission spreads for the EUR/JPY, GBP/USD and USD/CAD are the most competitive compared to other top brokers. While Pepperstone offers 1.34 pips for the EUR/JPY FX pair spreads, Forex.com spreads are nearly double, averaging 2.40 pips.

The EUR/USD and EUR/GBP currency pairs are close to brokers like Saxo Bank, with spreads being wider by just 0.01-0.05 pips.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

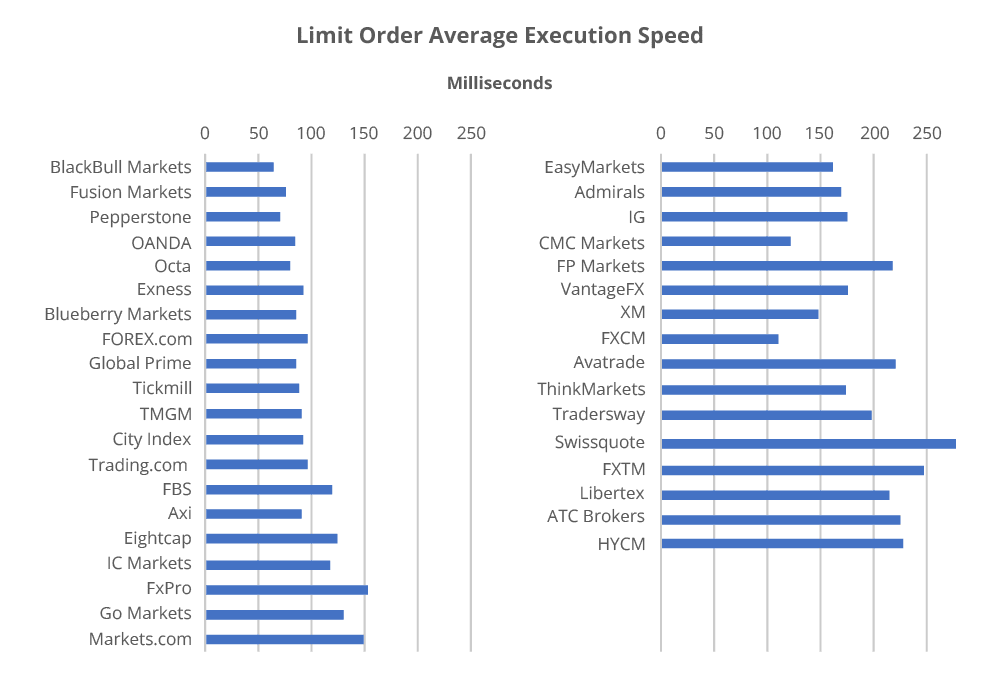

Order Execution Speeds

When placing orders with Pepperstone, the online broker offers fast execution speed. As a no-dealing desk broker, Pepperstone quickly matches orders with liquidity providers. Thus, allowing orders to be filled faster than most competing brokers.

Limit Orders allow you to buy or sell forex and CFDs at a specified price or better. This order type includes buy stop, sell stop, buy limit and sell limit orders. Pepperstone’s limit order execution speed lags just behind FP Markets and ties with Axi, making them one of the best brokers for fast orders.

Pepperstone also offers fast execution for orders that are placed at the current market price, known as Market Orders.

Starting to Trade Forex

After signing up for a Razor or Standard account type and choosing a trading platform, you will select a base currency and make an initial minimum deposit to start trading.

After signing up for a Razor or Standard account type and choosing a trading platform, you will select a base currency and make an initial minimum deposit to start trading.

With such a simple registration process, Pepperstone is one of the best brokers if you are a beginner trader. Pepperstone’s award-winning customer service team is available 24/5 via live chat, email or phone if you need customer support.

A demo account is available with Pepperstone on MetaTrader 4 and 5, a valuable tool for traders with experience and beginner traders. Demo accounts are a great risk management tool. You can practice trading strategies with virtual funds risk-free in real-time market conditions.

If you are new to trading, demos can help you familiarise yourself with different forex trading concepts and the MT4 and MT5 trading platforms.

- Minimum Deposit: No minimum deposit requirements, although the FX broker recommends £500

- Base Currencies: GBP, USD, EUR and CHF

- Customer Support: Available 24/5 via live chat, phone and email

- Demo account: Available for 30 days with a virtual balance of $50,000 provided

- 180+ CFDs: Forex, indices, shares, commodities and currency indices are available to trade as CFDs. Cryptocurrency is no longer available to UK traders after recent changes to FCA regulation banned cryptos for retail traders.

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

3. eToro - THE BEST PURE SOCIAL TRADING PLATFORM FOR BEGINNERS

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 2.0

AUD/USD = 1.0

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why We Recommend eToro

Drawing from our experience, it’s evident why eToro is the world’s leading social trading platform, boasting an intuitive interface and top-notch account mirroring services. Their credibility is further solidified by being regulated by renowned bodies like the FCA, CySEC, and ASIC. Rest assured, with eToro, you’re engaging with a reputable CFD broker.

Pros & Cons

- Outstanding social trading platform

- Easily filter traders to copy trade

- No commissions on trading

- Higher spreads

- Flat fee for withdrawals

- Lacks a choice of trading platforms

Broker Details

eToro is the largest social trading network worldwide, famous for its user-friendly trading platform and account mirroring services. With regulation by the Financial Conduct Authority (FCA, UK), Cyprus Securities Exchange Commission (CySEC, Cyprus) and the Australian Securities and Investments Commission (ASIC), you have the assurance you need that you are trading CFDs with a trusted broker.

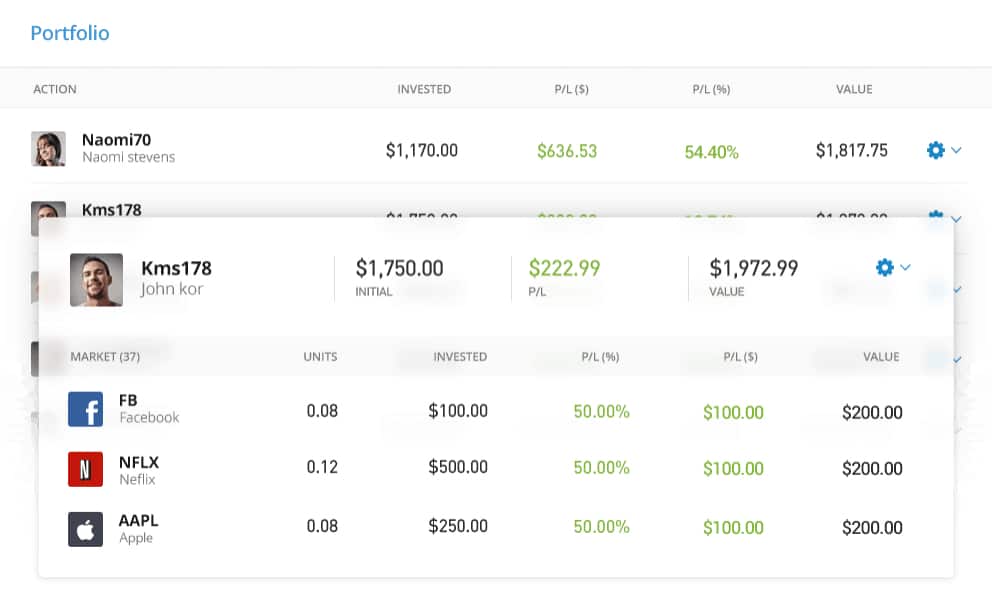

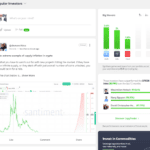

Social Trading

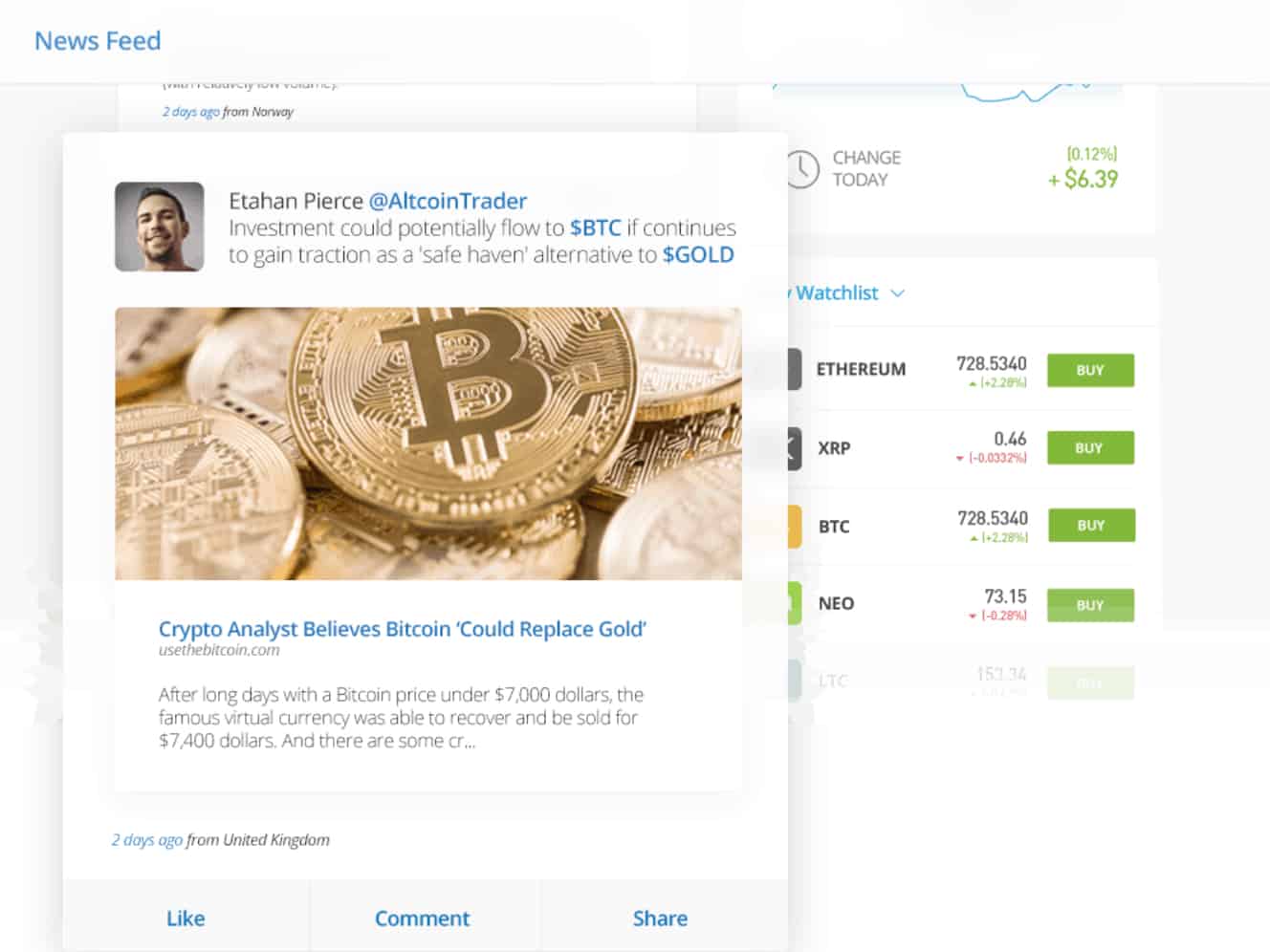

eToro’s social-copy trading platform is well-known for its simplistic platform design and easy-to-use trading tools. You can enjoy many benefits if you are a beginner trader. First, you gain access to a vast trading community with millions of traders from over 140 countries. Second, eToro offers account mirroring services where you can copy the trading strategies of successful investors with proven track records. Known as Popular Investors, experienced traders receive bonuses for profitable strategies, providing incentivises for successful trades.

To find suitable Popular Investors, you can search for trading strategies that match your risk level, markets and location. You can copy strategies surrounding a range of CFDs, with forex, commodities and Share CFDs available. The social trading platform offers a real-time newsfeed function to stay updated with market changes. It shows an analysis conducted by Popular Investors you follow.

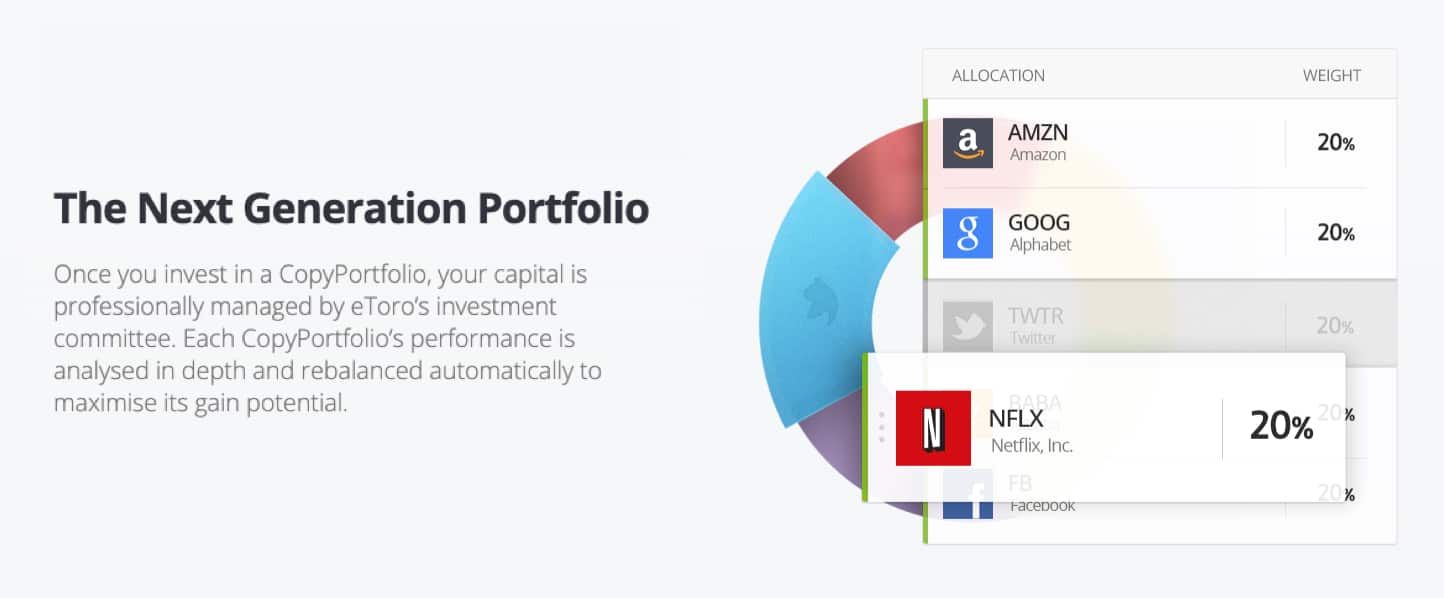

As a beginner trader, you may want a well-diversified portfolio to start. eToro’s CopyPortfolios are an excellent option, with two different portfolio types available:

- Top Trader Portfolios: a portfolio of strategies from the best-performing eToro traders.

- Market Portfolios: a bundle of different asset classes and financial instruments.

*Your capital is at risk ‘61% of retail CFD accounts lose money’

4. Plus500 - A TRADING PLATFORM WITH GREAT RISK MANAGEMENT TOOLS

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.6

AUD/USD = 1.0

Updated 06/02/2026

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Plus500 disclaimer: CFD service. Your capital is at risk. 79% of retail CFD accounts lose money

Why We Recommend Plus500

Having tested their custom trading platform ourselves, we found Plus500 exceptionally user-friendly, perfect for those keen to navigate the forex markets. Whether you’re using their online trader platform or mobile app, the experience is seamless. Notably, Plus500 provides diverse order types to manage CFD trading risks effectively.

Pros & Cons

- User-friendly trading platforms for beginners

- Competitive spreads

- Access sentiment-based trading with +Insights

- No automated trading tools

- Inactivity fee

- Limited educational resources

Broker Details

If you want to familiarise yourself with forex markets via a user-friendly interface, Plus500’s proprietary trading platform is an excellent choice. Plus500’s platform is available as a web trader platform or mobile trading app (compatible with iOS and Android devices). Our testing found that the broker has the best forex trading apps in UK with a range of order types available to manage CFD trading risk.

Risk Management: Order Types

Besides signing up with a trusted regulated broker, you can reduce the high risk of CFD trading by utilising the broker’s trading platform’s risk management tools, such as order types.

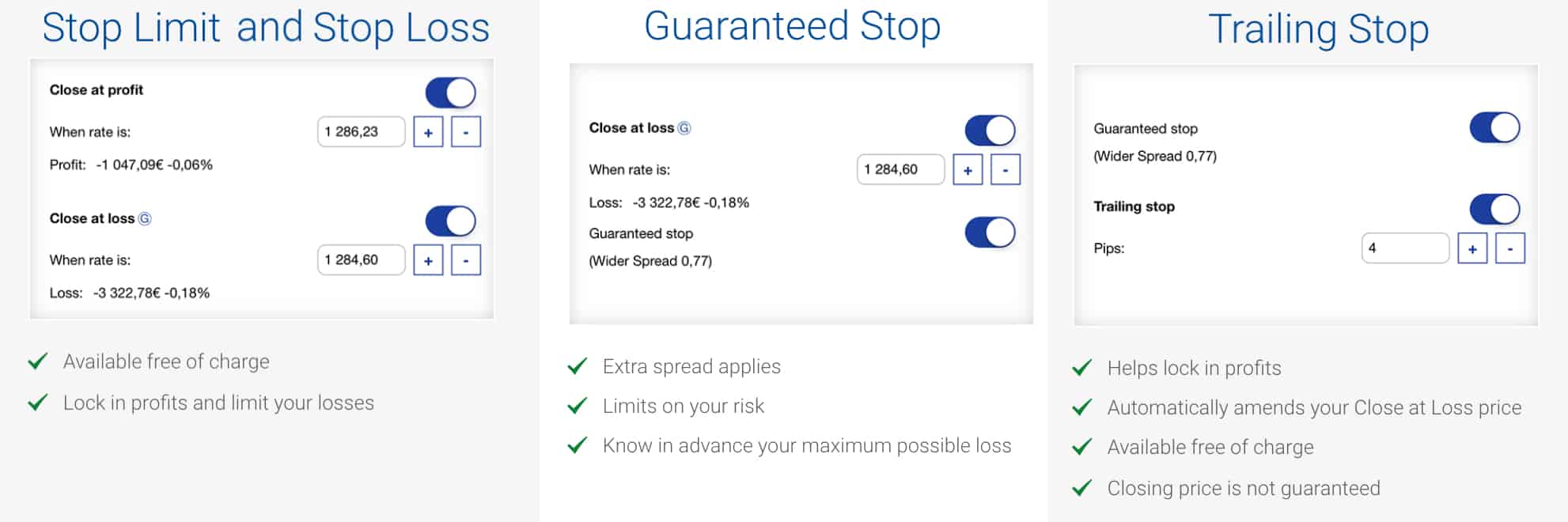

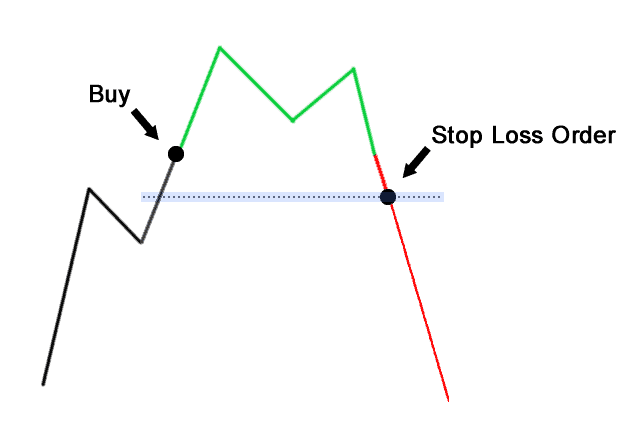

- Stop-Limit & Stop-Loss: Stop-Limit and Stop-Loss order types allow you to specify when to open or close orders at a predetermined price. Although the order type can cap losses and maximise profits, slippage may occur if markets are volatile.

- Guaranteed Stop-Loss (GSLO): A GSLO ensures an absolute maximum on any potential losses. An order automatically closes at your preset price when market prices move in unfavourable directions. The main difference between a basic stop loss and GSLO is that GSLO guarantees no slippage, regardless of volatility. While GSLOs are an excellent risk management tool for beginners, trading costs increase as you pay a fee to use the premium order.

- Trailing Stop: A Trailing Stop Order closes a position when market prices move away from the current price by a specified number of pips or a percentage amount, helping you lock in profits and minimise losses.

FCA Regulated Broker

Plus500 is a regulated broker overseen by the Financial Conduct Authority (FCA) in the UK and other financial authorities worldwide. On top of FCA regulation, Plus500’s listed on the London Stock Exchange. Being a publicly listed company increases transparency by requiring the broker to disclose financial information frequently. As a customer of Pluss500’s UK subsidiary, you receive various forms of investor protection to help you manage the high risk of forex trading.

- Segregated client funds

- Negative balance protection

- Close-out margins

- Leverage caps

While Plus500 also offers brokerage services in Australia (ASIC), NZ (FMA), Singapore (MAS), South Africa (FSCA) and Israel (ISA), if you register with these subsidiaries, you will not receive the same strict investor protection in UK traders receive, except for segregated client funds.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

5. XTB - THE BEST MOBILE TRADING PLATFORM (XSTATION) FOR BEGINNERS

Forex Panel Score

Average Spread

EUR/USD = 0.09

GBP/USD = 0.14

AUD/USD = 0.13

Trading Platforms

MT4, xStation 5, xStation Mobile

Minimum Deposit

$0

Why We Recommend XTB

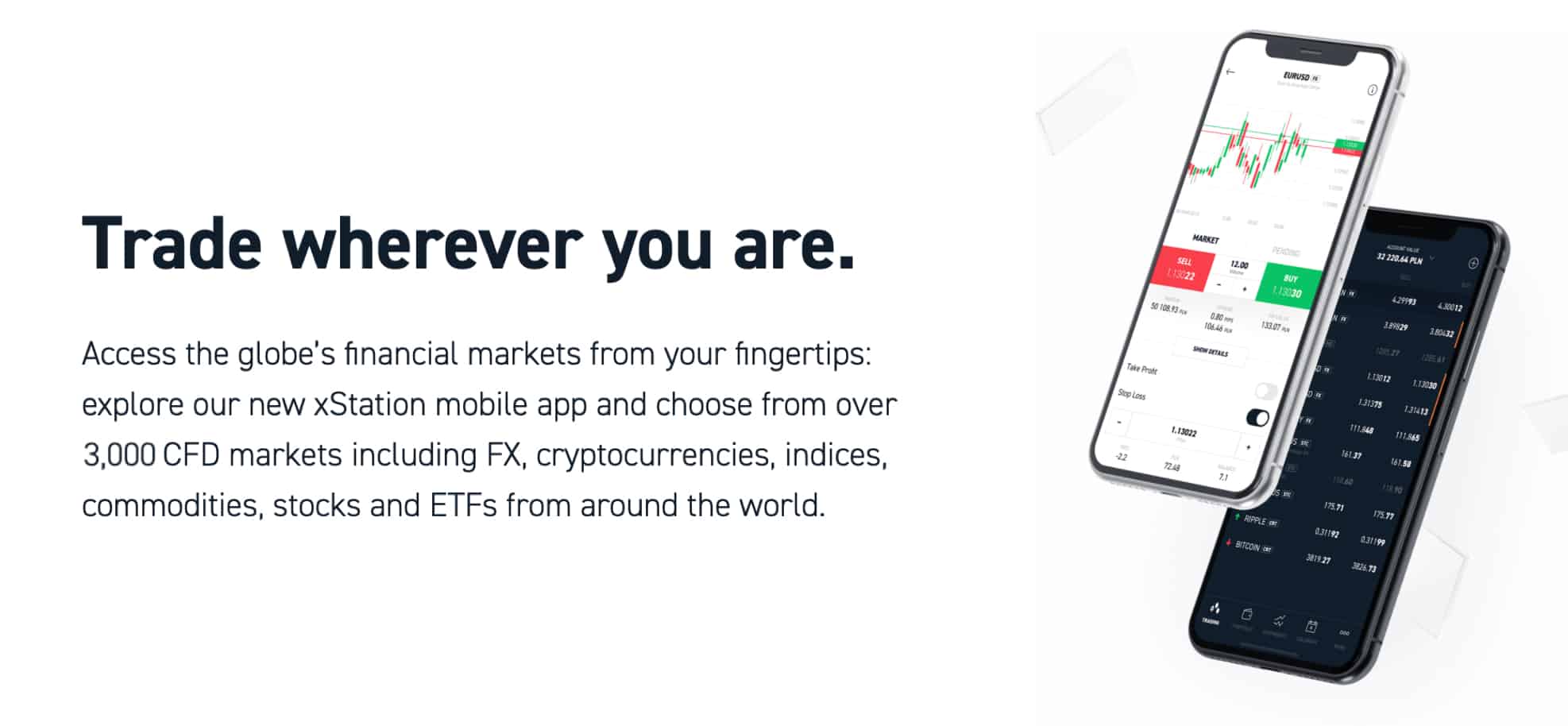

We found the flexibility to choose between a no-commission standard account and a pro account with competitive spreads and a straightforward commission per lot quite advantageous. With XTB, traders can delve into over 3,000 financial markets. Their proprietary trading platform, xStation 5, accessible via desktop, web, or mobile apps, offers a seamless trading experience. This broker simplifies the journey for those new to forex trading in the UK.

Pros & Cons

- User-friendly proprietary platform

- Solid selection of trading products

- Low minimum deposit

- Limited range of technical indicators

- Lacks choice of trading platforms

- Inactivity fee

Broker Details

XTB is an FCA-regulated broker that offers you a choice of either a standard account type with no commission or a pro account with low spreads with a flat-rate commission for each lot you trade. When trading CFDs via xStation, the broker’s proprietary trading platform, over 3,000 financial markets are available using desktop, web or mobile apps.

The mobile trading app is suitable for beginner traders as it provides an easy-to-use and modern design. There are also comprehensive trading tools, including interactive charts and technical indicators. XTB mobile app features include:

- A Traders Calculator to help you calculate a trade’s potential risk and reward

- The ability to trade directly from charts

- Advanced technical indicators, i.e. Fibonacci Retracement and Moving Averages

- Single-click bulk order closing tool

- Economic calendar to get up to date with significant economic events, market news and expert analysis

- Market sentiment data show you whether most traders are buying or selling a specific financial product

- Extensive educational resources based on basic, intermediate, expert and premium trading topics

When trading on the go, you can manage the high risk of CFD trading by utilising different order types. These include market orders, limit orders and stop-loss orders. You can also set up various customisable alerts and notifications to stay updated with market news and trading opportunities.

You can view the best forex broker trading platforms for beginner traders to compare XTB to other leading providers.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

6. CMC Markets - THE BEST WEB TRADING PLATFORM (NEXT GENERATION)

Forex Panel Score

Average Spread

EUR/USD = 0.5

GBP/USD = 0.9

AUD/USD = 0.6

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

We highly recommend the Next Generation platform, exclusive to CMC Markets, for those new to trading in the UK. Drawing from our own use, it offers expansive access to various asset classes, complete with comprehensive trading tools and educational resources. The platform’s flexibility in allowing traders to switch between a regular or advanced view means beginners can opt for a more simplified interface, making their initial trading steps more manageable.

Pros & Cons

- Comprehensive market analysis

- Impressive range of trading tools

- Beginner-friendly proprietary platform

- Lacks social trading tools

- Account inactivity fee

- Forex product offerings may be complex

Broker Details

As a beginner, you might initially prefer an online trader platform to avoid downloading and installing a desktop trading platform. CMC Markets’ proprietary web trading platform, Next Generation, offers comprehensive trading tools and educational resources to develop trading strategies while providing market access to various asset classes.

The web-based platform lets you choose either a standard or advanced view, allowing beginner traders to opt for a simplified interface when starting. If you are new to forex trading, you can benefit from the extensive trading tools and platform features, such as:

- Technical Analysis Tools: Over 12 chart types, 70 chart patterns and 115 drawing tools and technical indicators, with the ability to trade directly from charts

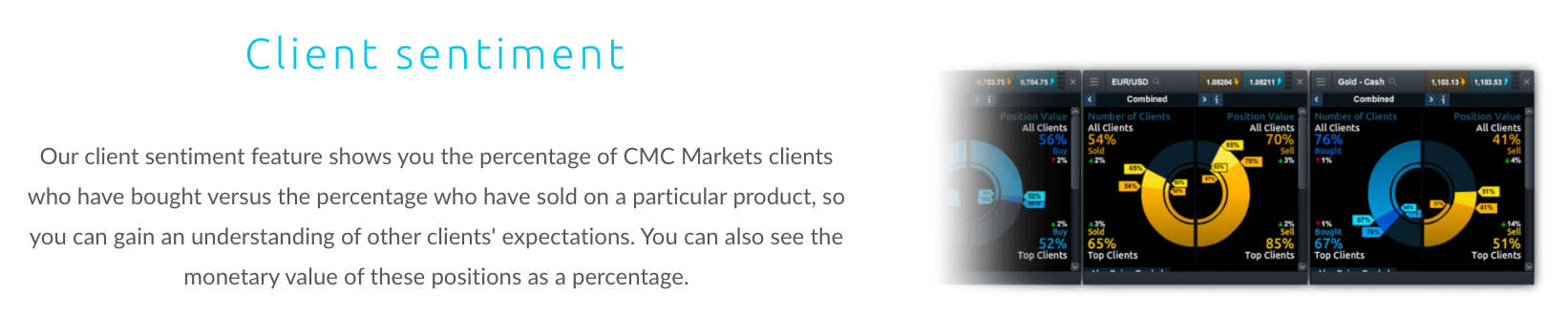

- Client Sentiment Data: allows users to see the percentage of traders buying and selling

- Price Projection Tool: The pattern recognition software automatically detects short and long-term trading opportunities with projected prices

- Next Generation Trading Community: CMC’s chart forum connects you with other traders, allowing you to share ideas and discuss financial markets

- News and Insights: In-house analysts comment daily on CFD and forex markets, with real-time news from Morningstar and Reuters

If you are using the online brokers Next Generation platform, you can access foreign exchange markets as well as the following CFD products:

- Indices

- Shares

- ETFs (Exchange-Traded Funds)

- Commodities

- Treasuries

To supplement CMC Markets’ impressive market access and Next Generation platform, you can learn about risk management, trading strategies and unique platform feature with the broker’s library of educational resources.

CMC Markets’ award-winning educational resources consist of webinars, e-books, videos, articles and trading courses designed for beginner, intermediate and experienced traders. Topics discussed include forex and CFD trading, technical indicators, fundamental analysis, and trading platforms.

CMC Markets is regulated by top-tier financial markets authorities such as the FCA (Financial Conduct Authority, UK), BaFin (Germany), ASIC (Australian Securities and Investments Commission), and the CFTC (Commodities and Futures Trading Commission, US).

*Your capital is at risk ‘69% of retail CFD accounts lose money’

7. FxPro - THE BEST BEGINNER TRADING PLATFORM – CTRADER

Forex Panel Score

Average Spread

EUR/USD = 0.5

GBP/USD = 0.75

AUD/USD = 0.58

Trading Platforms

MT4,MT5, cTrader,

FxPro Trading Platform

Minimum Deposit

$100

Why We Recommend FxPro

We’ve spent time on FxPro and recommend it for beginner traders in the UK. With FxPro, you get the cTrader forex trading software, either via the WebTrader platform or their efficient mobile app, available for iOS and Android. Especially enticing for those keen on tight spreads and rapid execution, cTrader offers spreads on sought-after pairs like the EUR/USD, hitting lows of 0.0 pips. Remember that there’s a flat commission fee, a fair trade for the top-notch services FxPro delivers.

Pros & Cons

- Tight spreads

- Excellent market research resources

- No minimum stop loss

- Initial deposit requirement on some accounts

- Platform difference learning curve

- Limited educational materials

Broker Details

cTrader is a popular forex trading platform offered by FxPro. You can use a WebTrader platform or mobile trading app (iOS and Android) to access the trading software.

Mimicking a professional FX trading environment, cTrader is suited to traders wanting low spreads and ultra-fast execution. Spreads are as low as 0.0 pips on major currency pairs such as the EUR/USD, so you pay a flat rate commission fee to compensate FxPro for their brokerage services.

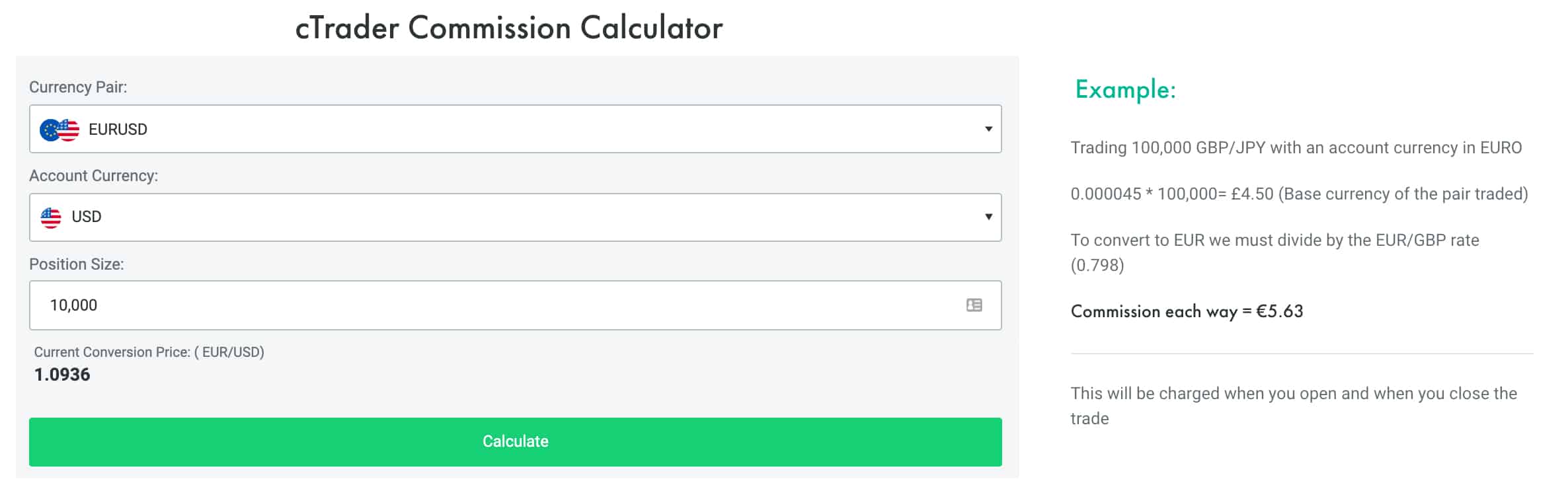

Commission fees depend on the volume traded, $45 charged per million traded and $4.5 per 100k. To assist customers with calculating commission fees for different trade sizes, base currencies and currency pairs, the FX broker provides a commission calculator on its website.

In addition to major, minor, and exotic FX pairs, cTrader users can build diversified trading strategies using other asset classes like indices, energies and metals.

Trading Conditions and Tools

FxPro cTrader customers benefit from the following trading features and tools:

FxPro cTrader customers benefit from the following trading features and tools:

- ECN-style spreads as low as 0.0 pips

- No commission fees on indices

- Average execution time less than 11.06 ms

- Level 2 Depth of Market (DOM)

- Algorithmic trading with cBots, which you can write yourself using the C# programming language or download from the cTrader website online

- Advanced backtesting

In terms of risk management, you can use a range of order types to mitigate losses. Besides standard market orders, the following order types are available to manage the high risk of forex trading:

- Stop Orders

- Stop Loss

- Limit Orders

- Take Profit

- Good till Cancel (GTC)

- Good till Date (GTD)

cTrader VIP Account Type

For traders wanting even tighter spreads and lower commission fees, you can sign up for the broker’s VIP account type. To qualify as a VIP, you need to deposit an amount of $50,000 into your trading account. After you make the required minimum deposit, a FxPro account manager will reach out to process a VIP account application.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

8. City Index - THE BEST BEGINNER CFD TRADING PLATFORM (WEBTRADER)

Forex Panel Score

Average Spread

EUR/USD = 0.7

GBP/USD = 1.1

AUD/USD = 0.5

Trading Platforms

MT4, TradingView, City Index WebTrader

Minimum Deposit

$0

Why We Recommend City Index

After thoroughly testing numerous platforms, we’re confident in naming City Index as the best beginner CFD trading platform for UK traders. Esteemed as a trusted FCA-regulated broker, City Index provides access to over 12,000 financial markets. Their web trading platform impresses with its advanced tools, tailor-made workspace, commendable risk management features, and robust CFD market access. Whether you’re eyeing forex, shares, or indices, City Index makes the initiation into CFD trading straightforward and user-friendly.

Pros & Cons

- Broad market access

- Advanced and customisable platform

- User-friendly for beginners

- Limited product offering

- Platform learning curve

- Can only spread bet using Web Trader

Broker Details

Web Trading Platform With Advanced Tools

When I first tried the Web Trader platform, I was impressed by its simple layout and the wealth of features available, considering it’s a web platform. The workspaces are customisable, allowing you to tailor your trading environment, while the charts (powered by TradingView) let you perform technical analysis easily with its 90+ indicators and drawing tools.

One standout feature is the Market 360 tool, which gives you a comprehensive overview of your chosen markets in a single click. It combines market information, news, economic calendar, charts and watchlist information all in one place. I think this tool is helpful for beginners as you can quickly get a top-down view of a market without analysing multiple charts.

Another excellent tool for beginners is Performance Analytics, which acts as a digital mentor by setting a trading plan, tracking your discipline, analysing your trading patterns, and managing your emotions.

I think this is invaluable for beginners who are still developing their trading skills and learning to control their emotions. With regular data-driven reviews, you can identify areas to improve and track your progress, which can help you accelerate your learning curve.

Low Spreads Make It Cheaper For Beginners

I found City Index’s spreads to be some of the lowest available across its 4,600+ markets. During my tests, the broker averaged 0.7 pips on EUR/USD, which is below the industry average of 1.24 pips. Plus, the broker doesn’t charge commission on most CFD markets, further reducing your trading costs.

The broker doesn’t require a minimum deposit when opening your account, so you can start trading with whatever amount you are comfortable with as a beginner. However, I think it best to deposit at least £100-200 to give yourself a reasonable starting balance.

If you are not ready to go live trading yet, the broker offers a decent demo account for beginners, giving you £10,000 virtual funds. The demo account gives you access to their MT4 and Web Trader platforms, allowing you to familiarise yourself with the platform and your trading strategies in a risk-free environment.

The only negative is these demo accounts expire after 12 weeks (3 months), but you can request to extend the demo account through customer support.

Your capital is at risk ‘69% of retail CFD accounts lose money with City Index’

9. markets.com - THE BEST FOREX BROKER FOR SMALL ACCOUNTS

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 1.0

AUD/USD = 0.6

Trading Platforms

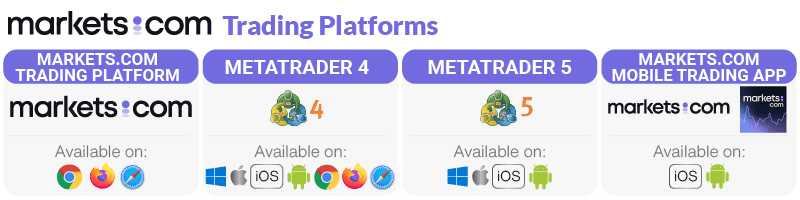

MT4, MT5, TradingView, Markets.com Trading App

Minimum Deposit

$100

Why We Recommend markets.com

We confidently recommend Markets.com as the best forex broker for small accounts in the UK. Operating as a commission-free market maker, they boast a broad array of forex and CFD options, from shares to commodities and ETFs. Markets.com strictly adheres to the UK’s Financial Conduct Authority (FCA) regulations in line with top-tier standards. Additionally, for those based in the UK, the assurance of negative balance and FSCS protection adds an extra layer of security to your investments.

Pros & Cons

- Advanced yet beginner-friendly technology

- Extensive research tools

- No deposit or withdrawal fees

- Trading support is not 24/7

- Has a $100 minimum deposit

- Inactivity fees are charged after 3 months

Broker Details

Markets.com is a commission-free forex broker that follows a market maker business model. The broker offers an excellent range of forex and CFDs with forex, commodities, indices, bonds, and ETFs available, plus thousands of different shares.

The FX broker follows tier-1 regulation, including that set by the UK’s Financial Conduct Authority (FCA). Therefore, Markets.com provides Negative Balance Protection, and as a UK resident, you receive protection from the Financial Services Compensation Scheme (FSCS).

To add another layer of transparency regarding financial reporting and disclosure, the broker’s parent company, PlayTech, is a public company listed on the London Stock Exchange and a component of the FTSE 250 index.

Online Trading Accounts

As a market maker with No Dealing Desk Brokers execution, Markets.com offers one primary account type. It requires a small initial deposit of $250 to open an account, and you will gain access to tight spreads as low as 0.40 pips with no commission fees. The combination of tight spreads with no commission fees and a low initial deposit makes it a great option if you are a beginner trader.

If you make a living and earn a salary as a professional trader, Markets.com offers a Pro Account to access higher leverage and a dedicated account manager.

To qualify for a professional trading account, you need to satisfy two of the following criteria:

- Have over €500k of liquid assets

- 1 or more years of relevant experience in financial services. This could be as a fund manager or forex analyst

- Made at least 10 trades of significant size in each of the last 4 quarters

Online Trading Platforms

In addition to MT4 and MT5, you can also use the broker’s proprietary trading platform to conduct analysis and place orders.

You can access the platform online, via a web trader platform or through mobile trading apps for iOS and Android devices. Both versions of the software offer an excellent range of tools to enhance your trading experience, including:

- One-click trading and the ability to place orders directly from charts, saving time and effort.

- A selection of unique trading tools with 8 sentiment, 2 technical analysis and 4 fundamental analysis tools.

Markets.com’s market sentiment tools are one of the best features the broker and trading platform offers. The tools help determine whether most market participants feel positive or negative about a specific financial instrument.

Examples of Sentiment Tools:

- Signals – an inbuilt client sentiment feature where you can view sentiment data on different instruments while simultaneously analysing charts.

- News Trading Sentiment – Assesses whether current news coverage is positive, negative or neutral for different markets.

- News Alerts – Shows how recent news is affecting the market prices of various financial instruments.

- Trader Trends – Provides sentiment data for traders based on the real-time trades made on the platform by Markets.com clients.

- Analyst Recommendations – Shows how analysts are viewing the biggest US stocks, with star ratings from 0 to 5.

On top of the sophisticated sentiment features, you can also use various technical and fundamental tools to develop trading strategies that include complex instruments and techniques:

- Daily technical analysis levels and ideas

- Advanced charting tools with TradingView

- Real-time financial commentary

- Advanced alerts and notifications

- Real-time news from Dow Jones

- Thomas Reuters stock reports

*Your capital is at risk ‘72.4% of retail CFD accounts lose money’

Ask an Expert