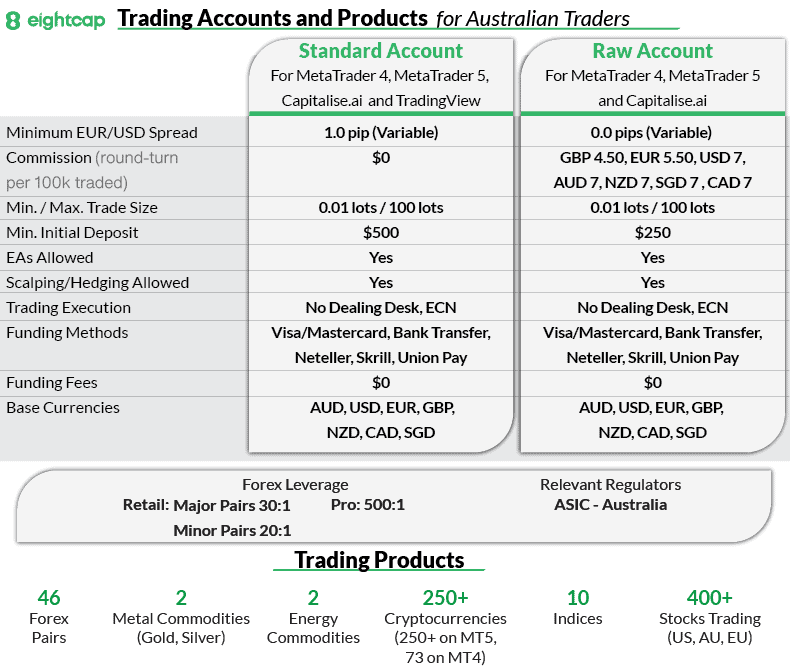

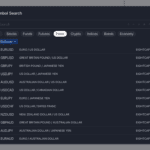

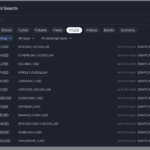

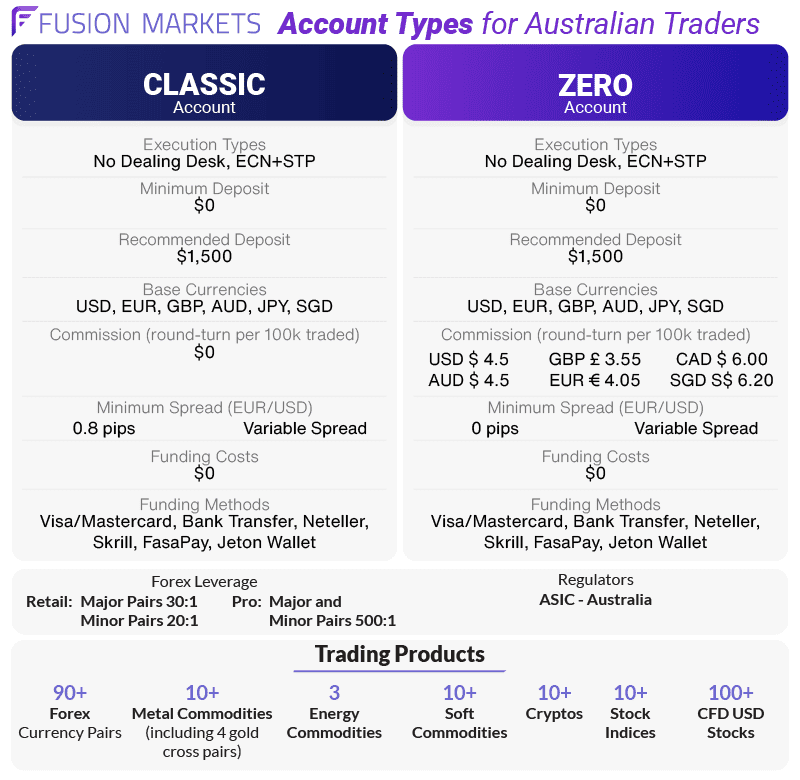

Raw Spread Trading Accounts In Australia

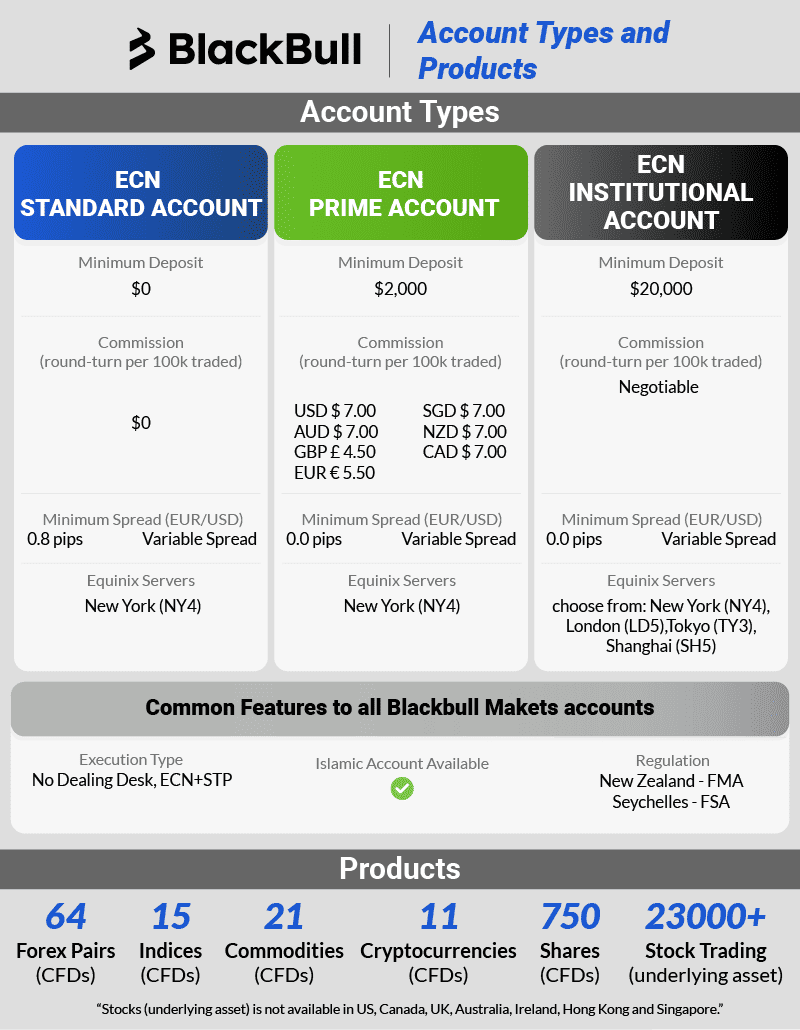

RAW Accounts (aka ECN accounts) have the tightest spreads even with added commissions (typically $6.00 per lot). Here are the Forex brokers we think have the best RAW Spread Forex trading accounts.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.