Best Offshore Forex Brokers

The best offshore forex brokers usually differ from regulated brokers because they have less trust, higher leverage and often have crypto funding. All brokers have STP no dealing desk trading with MetaTrader 4.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Our recommended list of brokers onboarding offshore residents:

- HFM - Best Offshore Forex Broker

- Octafx - Offers A Great Social Copy Platform

- BDSwiss - A Good MetaTrader 5 Forex Broker

- Trader'sway - Has A Great Range Of Trading Platforms

- Hugo's Way - Top No Dealing Desk ECN Forex Broker

- KOT4x - Best For Low Trading Fees

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

46 |

FCA, FSCA, CYSEC DFSA, CMA, FSA-S |

- | - | - | $3.00 | 1.4 | 1.6 | 1.6 |

|

|

|

$0 | 38+ | 19+ |

|

|||

Read review ›

Read review ›

|

88 |

CySEC MISA, FSCA, FSC-M |

- | - | - | - | 0.9 | 1.2 | 1.5 |

|

|

|

81ms | $25 | 35 | 32 | 1000:1 | 1000:1 |

|

Read review ›

Read review ›

|

3 |

CySEC FSA-S,FSC-M |

0.7 | 0.9 | 0.7 | $0 | 1.6 | 1.8 | 1.7 |

|

|

|

0.5 | $100 | 39+ | 32+ |

|

||

Read review ›

Read review ›

|

43 | - | 0.5 | 0.5 | 0.7 | $3.00 | 1.4 | 2.1 | 2.5 |

|

|

|

130ms | $10 | 41 | 9+ | 100:1 | 100:1 |

|

Read review ›

Read review ›

|

31 | none | - | - | - | $5 | 0.9 | 1.7 | 1.3 |

|

|

|

104ms | $10 | 55+ | 37 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

34 | - | 0.4 | - | - | $3.50 | 0.8 |

|

|

|

120ms | $10-$25 | 57 | 31 | 500:1 | 500:1 |

|

What Are The Best Forex Brokers For Offshore Trading?

You should always choose a broker regulated in your appropriate country, but sometimes they may not meet your trading needs. This list contains the best offshore forex brokers we found based on much analysis. Please note, none of the below brokers will accept US clients and, in some cases, Canadian clients. As always, be aware of the risks when using an offshore broker.

1. HFM - BEST OFFSHORE FOREX BROKER

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.9

AUD/USD = 1.8

Trading Platforms

MT4, MT5, HFM App

Minimum Deposit

$0

Why We Recommend HF Markets

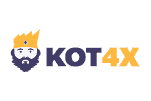

We chose HFM as the best offshore broker because it offers high leverage and a good choice of accounts. We also feel it’s a particularly sound choice for beginner or intermediate traders who want to trade in small lots.

Its offshore division is regulated by the Financial Services Authority (FSA) in Seychelles and HFM maintains a solid level of protection to enable safe trading.

We were also impressed by HFM’s in-house research department which, depending on your trading type, can provide a valuable source of information.

Pros & Cons

- Regulated in six countries and regions

- Tight spreads for the major currency pairs.

- Trading accounts have low minimum or $0 deposits

- Super-high-leverage (1:2,000)

- The in-house research team provides valuable market insights

- Decent level of safety and protection measures

- Not available to residents based in Australia, Canada, or the USA

- Limited tradable products and markets

- Uncompetitive spreads on cross-currency pairs.

- Customer support is sub-par

- Lacks advanced trader education resources

Broker Details

The Best Overall Offshore Broker For Australian Traders

HFM (HF Markets) is the most regulated broker on our list and is a major reason why we have included them. HFM is regulated by multiple tier-1 oversite such as the Financial Conduct Authority for traders in the UK, the Cyprus Securities and Investments Commission for counties in the Europe Union, the Dubai Financial Services Authority (DFSA) for traders in the UAE and the Financial Sector Conduct Authority (FSCA) for South Africa. While the only relevant subsidiary and regulator will be the one that applies locally, having multiple regulators does mean trust by reputation.

With this understanding in mind, we have included HFM on our list because traders outside the above regions join one of the HFM offshore subsidiaries being based in Seychelles or St Vincent and the Grenadines. HF Markets (Seychelles) Ltd is regulated by the Financial Services Authority of Seychelles while HFM (SV) Ltd is only registered as a business in the Grenadines.

With a combination of factors including an enhanced MetaTrader offering, a solid copy trading platform and quality research, HFM is our best overall broker. Premium Trader Tools, developed by FX Blue Labs, is a MetaTrader plugin available with HFM that enhances the overall MetaTrader trading experience.

HFM also has a proprietary copy trading platform, HFCopy, as an additional option for both copy traders and providers out there. In addition, the broker provides a great balance of educational resources including in-house market analysis, third-party research content, and news.

To find out more about this broker and what we think about them, we have in depth HFM Review.

Fees and Commissions

Operating as a pure ECN broker pricing model with direct market execution, HFM offers tight, competitive spreads across all assets with fast execution times from leading liquidity providers in the market.

Commissions are only charged on the HFMs Zero spread account, which you pay in the spread costs. Fees start as low as $6.00 per 100k lot on major forex pairs like EUR/USD, USD/JPY and GBP/JPY. Commissions on other forex pairs start as low as $8.00 per standard lot for minor pairs.

The broker charges swap rates for positions held overnight but there are no additional fees like inactivity charges. HFM also offers an Islamic (or swap-free) account that complies with Sharia Law.

Trading Platforms

HFM offers both popular MetaTrader platforms, MT4 and MT5 as well as HFM App, a powerful multi-asset mobile application platform.

The MetaTrader platforms are still the most popular, globally, for different reasons. MT4 has long been the most used Forex platform on the market while MT5 is a multi-asset platform with more trading tools available so is better suited for CFD trading.

HFM App is free and offers financial analysis tools, the latest news, updates and direct access to your trading account while on the go.

There is also the broker’s in-house copy trading app, HFCopy, which is available to both Strategy Providers (SPs) and Followers who have joined HFcopy. SPs can build their inventory of Followers for a performance fee while Followers can deposit funds and start copying the trades of their selected SPs.

2. OctaFX - OFFERS A GREAT SOCIAL COPY PLATFORM

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1

AUD/USD = 1.2

Trading Platforms

MT4, MT5, OctaTrader

Minimum Deposit

$50

Why We Recommend OctaFX

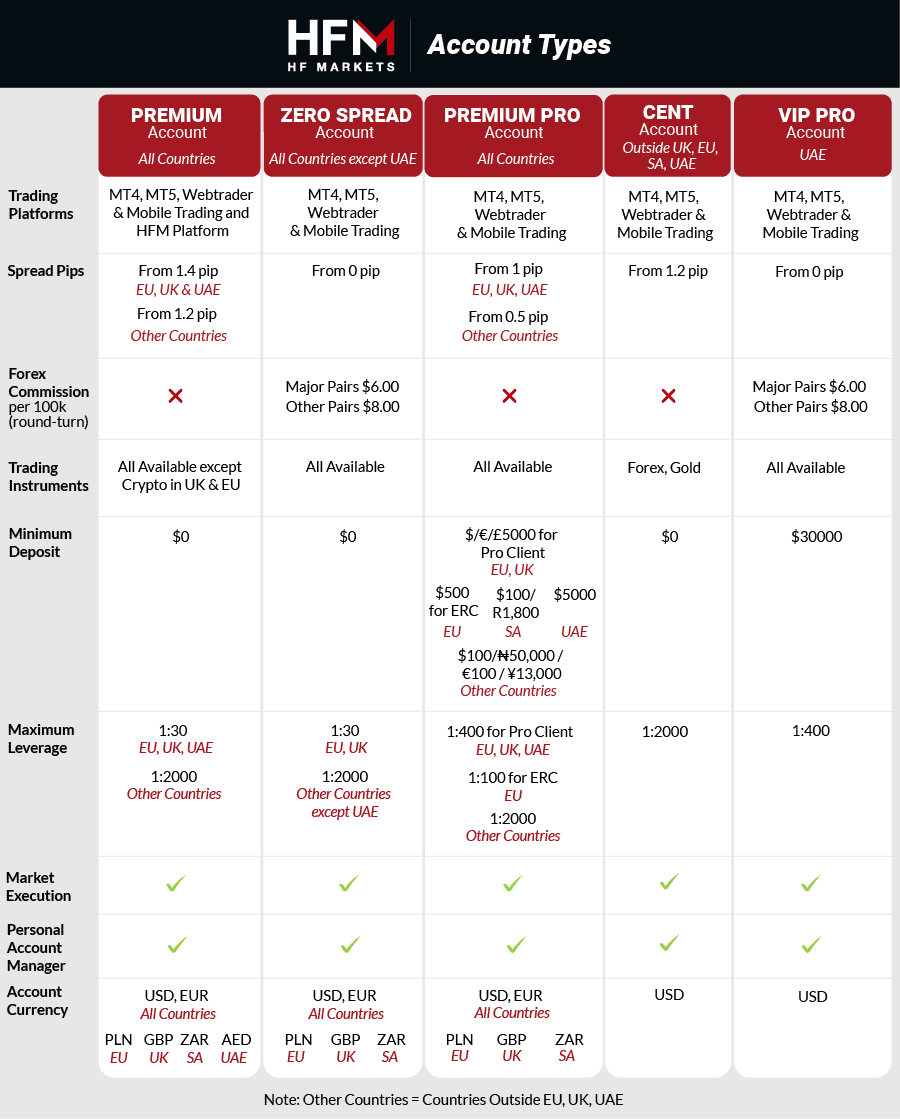

OctaFX differs from other brokers as they have truly zero swaps. If you are of the Islamic faith, then this is an essential feature.

The other highlight of OctoFX is its copy trading software OctaFX copytrader. If you’re looking to copy off other (better) traders, then this is the place to start.

The software lets you copy other traders’ trading signals or even broadcast your own trading signals making it a pretty useful learning tool.

Pros & Cons

- Unlimited swap-free trading

- Unlimited demo account

- Social trading platform

- MT4 and MT5 trading platforms

- $0 commission

- Only two account types

- Offshore clients have no formal regulatory protection

- Wide spreads

- Only 38 currency pairings

- Account currencies are limited to EUR and USD

Broker Details

The Forex Broker That Has A Quality Social Copy Platform

Based in the Caribbean nation of St. Vincent and the Grenadines, OctaFX is a low-cost Forex broker with a great, in-house social copy-trading platform.

It has also become one of the lowest-cost MetaTrader brokers hence its inclusion on this list given the MT platform’s popularity.

There is also a growing array of well-organized research, with trading ideas, daily updates, weekly forecasts, and third-party content.

While St Vincent and the Grenadines technically do not have a financial regulator, OctaFX has been operating since 2011 and has an impressive score of 4.6 from over 2800 reviews on Trustpilot, the broker has several security measures in place including a segregated account, SSL-protected personal area, tight account verification, 3D secure authorization and a security team to monitor their technical environment 24/7 to ensure you don’t experience technical issues.

As a bonus, OctaFX also protects you with negative balance protection so you cannot lose more than you deposit.

Fees and Commissions

OctaFX is fast becoming one of the lowest-cost MetaTrader brokers out there.

Trading costs are low but will also depend on what region your account is regulated by. For offshore (Non-EU-based) customers, the minimum spread for EUR/USD is competitive at 0.9 pips.

You can open either an MT4 or MT5 account based on your preferred MetaTrader platform. Both are spread-only accounts and have commissions of 7 USD.

There are also no deposit or withdrawal fees, while there is a minimum deposit of 100 USD, with many funding methods including Skrill, NETELLER and Bitcoin in addition to more traditional means.

Trading Platforms

While OctaFX is a MetaTrader-only broker, it has established itself as a low-cost MT broker.

If you are an offshore client (I.E. not based in Europe), you can use either MT4 or MT5. OctaFX only offers MT5 for European clients.

The broker also offers a quality, proprietary copy-trading platform, which can be connected as a web platform with MT4 or used through their OctaFX Copytrading mobile app.

3. BDSwiss - A GOOD METATRADER 5 FOREX BROKER

Forex Panel Score

Average Spread

EUR/USD = 0.3

GBP/USD = 0.5

AUD/USD = 0.5

Trading Platforms

MT4, MT5, BDSwiss Mobile App, BDSwiss WebTrader

Minimum Deposit

N/A

Why We Recommend BDSwiss

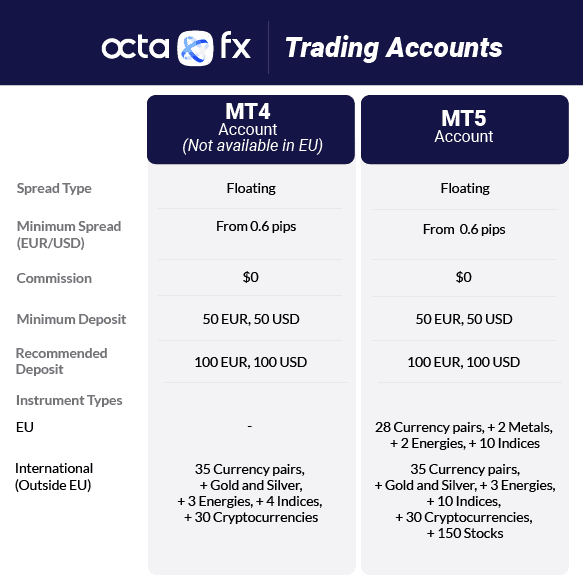

BDSwiss earns our recommendation due to its diverse account options, ranging from beginner-friendly to advanced trader-centric choices.

The broker provides flexibility with MT4, MT5, and BDSwiss WebTrader. All platforms have a wealth of technical indicators, varied timeframes, and an economic calendar. But BDSwiss WebTrader includes Autochartist and Trends Analysis tools.

Pros & Cons

- Highly regulated in other jurisdictions

- Uses MT4 and MT5

- Cent account available

- Zero or low commission

- Good online reputation

- Speedy executions

- Does not accept clients from EU, USA, or Canada

- Demo account limited to 30 days

- High minimum deposits for VIP and RAW account

- Charges a $30/month inactivity fee

Broker Details

A Good MT5 Broker

Offering the full MetaTrader suite as well as its in-house platform, BDSwiss caters to 1.6 billion registered Forex and CFD traders.

BDSwiss (like HotForex) is regulated by some tier-1 financial oversites, these being the Cyprus Securities Exchange Commission (CySEC) and the Federal Financial Supervisory Authority (BaFin) in Germany. This means if you are trading from the European Economic Zone you will have either CySEC or Bafin protection.

Traders outside the EEC will use the BDSwiss subsidiary regulated by either the Financial Services Commission (FSC) in Mauritius or the Financial Services Authority in Seychelles. Regardless of which subsidiary you join, services are the same.

The broker also provides useful additional trading tools such as Autochartist and Trends Analysis to finetune your ideal trading strategy.

Fees and Commissions

BDSwiss offers three main account types: Classic, Raw and VIP, with the fees and commissions varying depending on which account you open.

Their Raw account offers the tightest spreads, starting at 0.3 pips for EUR/USD which is ultra-competitive. The minimum deposit, however, is $5000.

BDSwiss also offers Negative Balance Protection, which not many offshore brokers do, adding an extra layer of security and investment safeguarding.

There are over 1000 financial instruments available to trade, which will depend on what account you sign up for.

Trading Platforms

BDSwiss is primarily a MetaTrader broker, both MT4 and MT5, but also offers its proprietary trading platform.

You can access BDSwiss Web Trader without a download by simply logging into the platform via your Facebook or Google accounts. You can also trade easily from your tablet while on the go, and all asset classes are covered by the BDSwiss mobile platform.

Additional trading tools include Autochartist and the broker’s proprietary Trends Analysis as well as trading signals and real-time alerts via the BDSwiss Telegram channel.

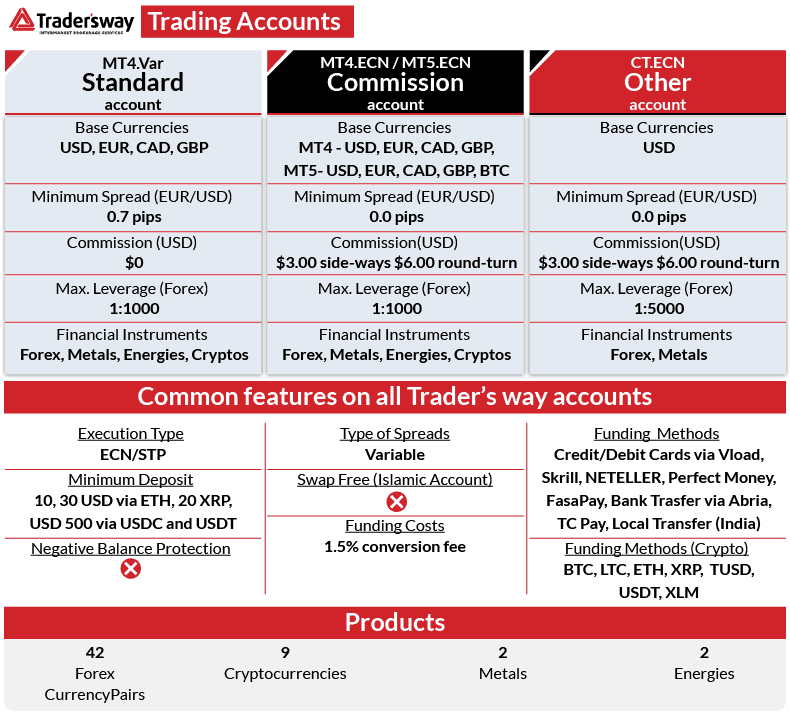

4. Trader's Way - HAS A GREAT RANGE OF TRADING PLATFORMS

Forex Panel Score

Average Spread

EUR/USD = 1.4

GBP/USD = 2.1

AUD/USD = 2.5

Trading Platforms

MT4, MT5, cTrader

Minimum Deposit

$10

Why We Recommend TradersWay

Traders Way is on this list for its versatile platform options, including MT4, MT5, and the notably fast CTrader. MT4 is user-friendly for beginners, while MT5 caters to advanced traders with additional features.

With a low minimum deposit of $10 and the advantage of unregulated status allowing high leverage, Traders Way offers a comprehensive and accessible trading experience, making it a commendable choice for traders seeking flexibility and competitive conditions.

Pros & Cons

- Good choice of trading platforms

- Low minimum deposits

- Four account choices

- High leverage

- Wide spreads

- Completely unregulated

- Low trust score

- No physical office location

- Limited crypto and commodity options

Broker Details

The Broker With A Great Range of Trading Platforms

Headquartered in Dominica, Trader’s Way is a forex brokerage with a great range of trading platforms including both MetaTrader platforms and cTrader.

TradersWay offers flexibility using an ECN and VAR model on its accounts, to tailor to your trading style and preferences and the prevailing market conditions.

The broker also offers a 100% deposit bonus scheme on the MT4.VAR and MT4. ECN accounts, which can be applied daily.

There is no financial regulator in Dominica so there is no formal oversight for Traders’ Way. The broker however has been operating since 2011 so does have some trading history and does have a decent score of 4.2 on Trustpilot. Measures the broker offers to protect you include AML (Anti-money laundering) and KYC (Know your compliance).

Fees and Commissions

Trader’s Way offers 4 main account types based on the trading platform of choice: MT4.Var, MT4.ECN, MT5.ECN and CT.ECN. Fees vary as follows:

The MT4.Var is the no commissions (or standard) account, with commissions factored into the spread. Spreads start at 0.5 pips for popular Forex pairs like the EUR/USD.

For all the ECN (or commission) accounts, spreads start from 0 pips with $6 commissions, round turn. The main difference in ECN accounts is the high leverage that is available (up to 1:1000 for MT4.ECN and MT5.ECN) and more tradeable instruments on the MetaTrader platforms.

Depending on monthly trading volumes, Trader’s Way also offers cashback on commissions. You simply need to make a deposit in Private Office and choose the bonus amount, which is then credited into the account on a daily trading volume basis. The deposit bonus is limited to $5,000 per account and is only available on MT4.VAR and MT4. ECN accounts.

If you wish to find your account with credit or debit cards, you will need to use vLoad since the broker does not allow direct deposits with cards. Similarly, if you wish to find your account using bank transfer or crypto, you will need to use Ariba.

Trading Platforms

As mentioned, Trader’s Way offers both MT4 and MT5 as well as cTrader as an additional trading platform.

Having access to both MT4 and MT5 is great for flexibility in your market preferences particularly, with MT4 suited for foreign exchange markets and MT5 for CFD trading.

cTrader is an additional platform specifically designed to harness the full power of ECN trading. This means fast entry and execution, level II pricing, direct access to liquidity providers, enhanced charting and one-click functionality.

The other benefit of multiple trading platforms is additional plugins such as cAlgo for algorithmic traders, which adds extra choice for diverse trading styles.

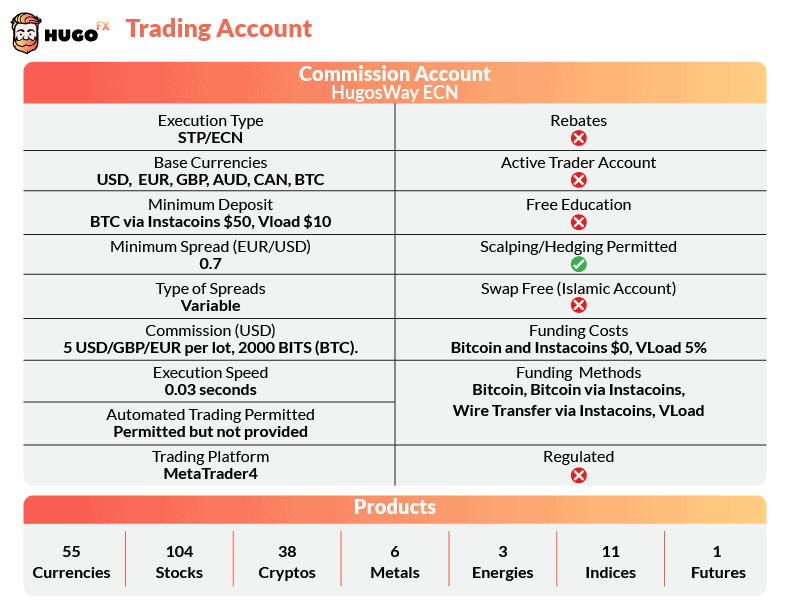

5. Hugo's Way - TOP NO DEALING DESK ECN FOREX BROKER

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.7

AUD/USD = 1.3

Trading Platforms

MT4

Minimum Deposit

$10

Why We Recommend Hugo's Way

Hugo’s Way is a non-regulated, true ECN forex broker designed specifically for professional traders. If you want access to a wide trading portfolio, high leverage, and a broad range of trading instruments, then Hugo’s Way might just satisfy you.

We have also found it’s a good option for crypto traders with 38 currency pairings available and lower-than-average spreads.

However, the main highlight of this brokerage is its ECN connectivity which ensures you get full transparency of market-leading pricing and fair trading conditions.

Pros & Cons

- True ECN forex broker

- Low spreads

- Uses MT4 trading platform

- Low deposits

- High crypto leverage

- Not regulated

- Poor online reputation

- High commission fees

- No free education tools

Broker Details

A Top ECN Broker

Hugo’s Way is an NDD (no dealing desk) broker that offers STP/ECN execution by connecting you with over 50 top-tier liquidity providers, to deliver tight spreads.

It does this through one account with a USD 5 commission fee, adjusted based on your selected trade size, to keep the spread at the raw prices set by the liquidity providers. This means your spread costs are not manipulated as you would normally see with Standard accounts and by market makers.

An additional server has also been introduced to further enhance trading conditions and improve your overall trading experience.

Hugo’s Way is a relative newcomer to the trading world having only been founded in 2017, however, the broker is a fast-growing thanks to its extensive social media presence. Like some other brokers on this list, they are headquartered in St Vincent and the Grenadines which means they are not regulated. However, the broker does have some measures to protect you such as 2FA authentication, AML and KYC policies and segregated bank accounts.

Fees and Commissions

Hugo’s Way only has one account option, their ECN (or Commission) account.

As mentioned earlier, there is a 5 USD commission with a minimum spread starting at 0.9 pips for EUR/USD which is very competitive against other offshore brokers.

Another benefit of Hugo’s Way is that scalping and hedging are permitted, which is not always the case.

Interestingly, Hugo’s Way does not accept direct credit cards or bank transfers. All funding needs to be done via a 3rd party provider known as Instacoins or vLoad. This does provide the advantage of funding flexibility as the tools allow transfer via a range of funding methods. Alternatively, you can fund your account directly using crypto.

Platforms and Products

Hugo’s Way only offers MetaTrader 4 (MT4) which is still one of the most popular Automated Trading Platforms for forex markets. You can use MT4 as a WebTrader, Mac and PC desktop versions, and also on iOS and Android mobile devices.

With MT4, you can access great additional trading tools including 30 technical indicators, such as Relative Strength Index (RSI) and Bollinger Bands, 9-time frames and 24 customisable graphical tools, which will further enhance your trading strategies.

There is also a good range of Forex and CFDs you can trade with Hugo Way’s MT4 offering including 55 Forex pairs, over 100 shares and 31 cryptocurrencies with up to 100:1 leverage for some crypto instruments.

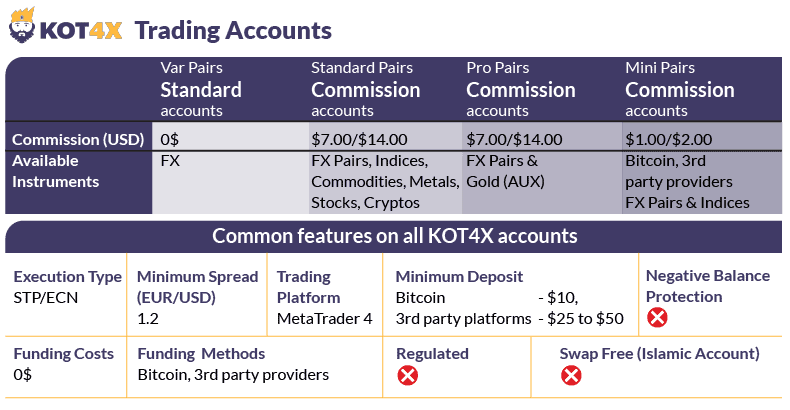

6. Kot4x - BEST FOR LOW TRADING FEES

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

MT4

Minimum Deposit

$25

Why We Recommend Kot4x

Kot4x or “Kings of Transparency” has a somewhat ironic name since they are an unregulated brokerage. One thing they are transparent about, though, is their lack of withdrawal and deposit fees.

Kot4x also offers a MINI Pairs account which trades in micro-lots. If you’re new to trading, this is a good account to start with as allows you to practice real trading with much less financial outlay.

Pros & Cons

- $0 withdrawal and deposit fees

- MT4 trading platform

- Choice of four accounts, including a micro-lot account

- High leverage

- Low minimum deposit

- Terrible online reputation

- Unregulated

- Unpublished spreads

- Poor customer service

- No Islamic account option

Broker Details

The Broker That Has Low Trading Fees

Self-proclaimed as the King of Transparency, Kot4X is a relatively young broker, founded in 2018, with low trading fees across their 4 account types, particularly their Mini account.

Kot4X also have a good mix of tradeable over 250 instruments, particularly their Standard account, which comes with a range of forex pairs. Automated Trading Platforms are also available for algorithmic trading.

Other benefits the broker offers include a maximum leverage of up to 1:500 (for deposits of $250 or more) as well as a low minimum deposit of $25.

Like Hugo’s Way, KOT4X is another (relative) newcomer to the forex world that is based in St Vincent and the Grenadines.

Fees and Commissions

With Kot4X, there are multiple accounts with fees that vary across each.

The Standard and the Pro account have a $7 fee per lot, whereas the Mini account has a $1 per lot fee. There is also the VAR account which comes with no commission fee, although this is factored into the spread and only 28 FX pairs are available to trade.

Average spreads vary too, with the Pro account the tightest, starting from 0.4 pips which widens to 1.2 pips for the VAR account.

Overall, Kot4X’s fees are competitive and amongst the lowest when compared to other offshore brokers.

Be mindful that the broker only accepts Bitcoin funding, which may be a drawback for some. There is also an inactivity fee of $10 (USD) if you haven’t traded within the last 6 months.

Trading Platforms

Like many offshore brokers, Kot4X only offers MT4 as its sole trading platform.

The benefit here is that MT4 is great for beginners and experienced traders alike, with options for web trading, desktop or via Android or iOS mobile apps.

On Kot4X’s MT4 offering, you can trade 55 Forex pairs, 104 stock CFDs, 31 cryptos and 8 indices amongst a smattering of others for a good range of tradeable markets.

Ask an Expert