BlackBull Markets vs FXCM: Which One Is Best?

BlackBull Markets offers more forex pairs (67 vs 42), while FXCM stands out with a wider range of trading platforms alongside MetaTrader 4. See how these brokers compare, FXCM takes the lead in this review.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs: 33:1

0-50k 400:1

50k+ 200:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are five noticeable differences between BlackBull Markets and FXCM:

- FXCM provides additional trading platforms.

- FXCM has a minimum deposit of $50 for the Standard account.

- BlackBull Markets offers more forex pairs (67).

1. Lowest Spreads And Fees – BlackBull Markets

FXCM and BlackBull Markets are prominent forex brokers with distinct features. BlackBull Markets offers tighter spreads, lower commissions, and a broader range of instruments, while FXCM provides more trading platforms and tools. Both brokers cater to different trader needs, with Blackbull Markets excelling in cost-effectiveness and FXCM in platform diversity.

Spreads

BlackBull Markets offers tighter RAW spreads, making it more cost-effective for traders. For example, the EUR/USD RAW spread averages 0.14 pips, outperforming FXCM’s 0.30 pips, compared to FXCM’s 0.90. These tighter spreads give BlackBull Markets an edge, especially for traders focused on minimising costs. FXCM’s standard spreads are slightly wider but remain competitive, particularly for AUD/USD at 0.7 pips, compared to BlackBull Markets’ 1.2 pips.

| RAW Account | BlackBull Markets Spreads | FXCM Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 0.64 | 0.82 | 0.75 |

| EUR/USD | 0.14 | 0.3 | 0.22 |

| USD/JPY | 0.45 | 0.6 | 0.38 |

| GBP/USD | 0.43 | 0.9 | 0.53 |

| AUD/USD | 0.3 | 0.4 | 0.47 |

| USD/CAD | 0.41 | 0.6 | 0.56 |

| EUR/GBP | 0.75 | 0.7 | 0.55 |

| EUR/JPY | 0.87 | 0.8 | 0.80 |

| AUD/JPY | 1.10 | 1.10 | 0.96 |

| USD/SGD | 1.3 | 2 | 2.29 |

Commission Levels

In terms of commissions, BlackBull Markets charges $3.00 per lot (USD base), making it more affordable compared to FXCM’s $4.00 per lot (USD base). BlackBull Markets’ lower commissions, coupled with its tighter spreads, make it an appealing choice for traders prioritising cost efficiency. On the other hand, FXCM’s higher commissions align with its feature-rich platforms, catering to traders who value additional tools and trading options over reduced fees.

| Commission Rate | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| BlackBull Markets | $3 | $4.5 | N/A | N/A |

| FXCM | $4 | $4 | N/A | N/A |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

Standard Account Fees

For standard accounts, BlackBull markets again demonstrates cost efficiency with EUR/USD spreads averaging 1.10 pips and GBP/USD at 1.40 pips. FXC<M, while slightly higher, remains competitive with EUR/USD at 1.30 pips, providing an advantage for traders focused on that currency pair.

both brokers cater to different trader needs, BlackBull Markets focuses on cost-effectiveness, while FXCM emphasises platform diversity and advanced tools. Each has strengths that can enhance trading experiences based on individual priorities.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.10 | 1.20 | 1.50 | 1.40 | 1.40 |

| 0.70 | 0.80 | 1.30 | 1.00 | 1.00 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 1.20 | 1.41 | 1.47 | 1.47 | 1.61 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.52 | 2.08 | 1.46 | 1.87 | 1.67 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

BlackBull Markets shines in terms of lower trading costs and a wider range of instruments, making it ideal for cost-conscious traders. FXCM, with its diverse platforms and tools, is better suited for traders seeking advanced trading features. Both brokers offer unique advantages, ensuring a tailored trading experience for different needs.

Our Lowest Spreads and Fees Verdict

BlackBull Markets, clearly, takes the cake in this segment due to their lowest spreads and fees.

BlackBull Markets ReviewVisit BlackBull Markets

2. Better Trading Platform – BlackBull Markets

BlackBull Markets and FXCM shine as reputable forex brokers with trading tools and platforms. BlackBull Markets boasts comprehensive options, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and advanced tools like TradingView and Copy Trading. FXCM, meanwhile shines with proprietary solutions such as Trading Station and unique platforms like Capitalis.ai for automated trading. While both provide excellent features, Blackbull Markets offers a more diverse selection of trading platforms.

| Trading Platform | BlackBull Markets | FXCM |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | No |

| cTrader | Yes | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

Metatrader

Regarding MetaTrader offerings, BlackBull Markets supports MetaTrader 4 (MT4) and the more advanced MetaTrader 5 (MT5). ME4 remains a widely used platform due to its large user base and extensive library of Expert Advisors, which allow for customisable trading strategies and automation. However, MT5 surpasses MT4 by offering enhanced features such as additional timeframes, built-in Depth of Market (DoM)data, and advanced backtesting capabilities. BlackBull Markets caters to classic tools or cutting-edge upgrades. FXCM, on the other hand, only supports MT4, limiting access to MT5’s added benefits. While MT4’s strong community support is a plus, the absence of MT5 may be a drawback to traders seeking the latest MetaTrader functionality.

Note: Canadian traders only get access to MT4 and Trading Station.

Advanced Platforms

In the world of advanced trading platforms, both brokers deliver unique strengths. BlackBull Markets excels with a versatile lineup that includes TradingView, a platform renowned for its powerful charting tools and extensive library of community-created indicators. traders also have access to cTrader, known for its lightning-fast execution, and BlackBull’s proprietary Share Trading App for seamless stock trading. In contrast, FXCM focuses on platform customizability with its proprietary Trading Station and NinjaTrader, both of which provide robust charting capabilities and advanced analytics. Moreover, FXCM’s integration with Capitalise.ai simplifies automated trading by allowing users to create trading bots through natural language commands, a feature especially appealing to novice traders. While both brokers offer standout advanced tools, BlackBull Markets edges ahead with a broader and more diverse platform selection.

Copy Trading

For traders interested in social and copy trading, both brokers cater to this need, albeit in different ways. BlackBull Markets provides integration with Myfxbook, ZuluTrade, and its own Social Trading App, which leverages the Metatrader Signals community. These options offer access to trading strategies and social trading experiences, making it a strong choice for traders who value community-driven insights. FXCM supports copy trading, primarily through its proprietary Trading Station and compatible third-party tools. While its offering is user-friendly, it may not match the diversity and depth provided by BlackBull Markets’ suite of options. BlackBull Markets offers a more comprehensive and varied approach to copy trading.

BlackBull Markets edges ahead with tools, including MT5 and innovative options like cTrader and TradingView. This makes it ideal for traders who value versatility and cutting-edge features. FXCM, on the other hand, excels in providing user-friendly proprietary solutions and automation tools like Capitalise.ai, which are perfect for beginners. Both brokers offer advantages, allowing traders to tailor their experience to their preferences. BlackBull Markets takes the lead in platform diversity, but FXCM holds its own for ease of use.

Our Better Trading Platform Verdict

BlackBull Markets, evidently, dominates in this section owing it to their better trading platform.

3. Superior Accounts And Features – BlackBull Markets

BlackBull Markets and FXCM are notable brokers offering tailored trading options to meet diverse trader needs. Blackbull Markets excels with an ECN Standard account requiring no deposit and boasts competitive spreads as low as 0.1 pips for its “True ECN” offering. FXCM stands out with its user-friendly platforms, enhanced order execution, and lower minimum deposits for standard accounts, starting at $50. both brokers provide a mix of accounts and innovative features, but Blackbull Markets’ low spreads give it an edge for cost-conscious traders.

| Blackbull Markets | FXCM | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | No | Yes |

BlackBull Markets supports a diverse range of trading accounts, from commission-free to institutional-grade options, catering to traders at all levels. Its standout features include the “True ECN” model and no minimum deposit requirement for the standard account. FXCM offers a range of accounts, including the Active Trader account for high-volume professionals, with unique offerings like spread betting in the UK. The enhanced execution system ensures precise trading. Both brokers play vital roles in the forex industry, offering features that ensure flexibility and functionality for traders globally.

While both brokers excel in delivering options to meet trader demands, Blackbull Markets takes the lead with its ultra-low spreads, no minimum deposit for standard accounts and superior ECN features. FXCM’s enhanced order execution and account variety cater well to different market segments, making it equally valuable for traders focused on platform usability. Together, these brokers enrich the trading landscape, ensuring that traders of all experience levels can find tools and accounts to enhance their trading journey. BlackBull Markets, however, slightly edges out with its cost efficiency and robust features.

Our Superior Accounts and Features Verdict

BlackBull Markets, clearly, steals the show in this niche on the account of their superior accounts and features.

4. Best Trading Experience And Ease – BlackBull Markets

BlackBull Markets and FXCM are reputable brokers that bring valuable features to the trading table. Blackbull Markets boasts its “TrueECN” model, which ensures ultra-fast execution speeds-72ms for limit orders, ranking first globally. FXCM, with its “Enhanced Order execution,” guarantees the best available quotes for traders. Additionally, Blackbull Markets offers the highest leverage and diverse social trading tools, such as Myfxbook and ZuluTrade, while FXCM’s platforms are user-friendly and backed by comprehensive educational resources.

Digging deeper, BlackBull Markets appeals to cost-conscious traders with its competitive offerings like superior speed and high leverage. Its robust execution ranking (1/36 globally for limit orders) highlights its focus on efficiency. FXCM counters user-friendly platforms and advanced analysis tools. While FXCM shines in nurturing beginner and intermediate traders through rich learning resources, Blackbull Markets empowers traders with advanced options for enhanced performance and greater flexibility.

BlackBull Markets takes the lead, excelling with its unmatched execution speed, high leverage, and wide-ranging trading tools. FXCM, however, remains a strong contender with its reliable execution system and beginner-friendly environment. Both brokers have distinct strengths, ensuring traders across all experience levels can achieve their goals. BlackBull markets, with its focus on execution excellence, provides a seamless trading journey, giving it a slight edge in this competitive landscape.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| Blackbull Markets | 72ms | 1/36 | 90ms | 5/36 |

| FXCM | 188ms | 28/36 | 189ms | 29/36 |

BlackBull came out on top in terms of execution speed. FXCM’s ‘Enhanced Order Execution’ ensures traders get the best quotes.

- BlackBull Markets offers the highest leverage among the brokers we tested.

- FXCM’s trading platforms are user-friendly and offer a range of tools for analysis.

- BlackBull Markets excelled in social trading with Myfxbook and Zulutrade options.

- FXCM’s educational resources are comprehensive, catering to beginners and experienced traders.

Our Best Trading Experience and Ease Verdict

BlackBull Markets takes the lead with its best trading experience and ease.

5. Stronger Trust And Regulation – FXCM

BlackBull Markets, founded in 2014, and FXCM, established in 1999, cater to different aspects of the foreign exchange trading market. Blackbull Markets appeals to traders prioritising impeccable trust and history, leveraging its New Zealand roots and transparency with over 20,000 active traders as of 2021. FCXM, despite its checkered past, is a global broker regulated ty Tier-1 bodies like ASIC and FCA. Its broader regulatory reach and USA-based origin underscore its significant presence. Both brokers compete fiercely by offering unique strengths suited for various trading needs.

FXCM’s trust score is higher by 74, compared to BlackBull Markets’ 63.

FXCM Trust Score

BlackBull Markets Trust Score

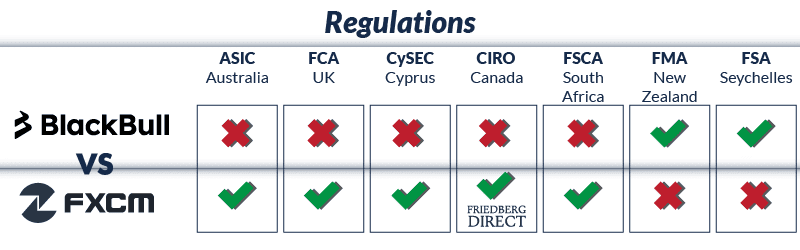

Regulations

Digging deeper, BlackBull Markets outpaces competitors with ultra-fast execution speeds, high leverage, and a “True ECN” trading environment that ensures low spreads for major pairs. Its transparency and tailored features like social trading tools set it apart. Meanwhile, FXCM delivers robust educational resources and proprietary platforms like Trading Station, designed for an intuitive trading experience. FXCM’s global regulatory framework and enhanced order execution provide an added layer of trust. Together, these brokers significantly enhance the forex trading industry, catering to cost-conscious and experience-focused traders.

FXCM is a truly global broker and is regulated by:

- 2 x Tier-1 regulators (ASIC & FCA)

- 2 x Tier-2 regulators (CySEC, IIROC)

- 1 x Tier-3 regulator (FSCA)

BlackBull is more of a regional broker in Asia-Pacific and is regulated by:

- 1 x Tier 2 regulator (FMA)

- 1 x Tier 3 regulator (FSA)

With FXCM regulators in more regions, they were shortlisted in several regions including the Best Forex Brokers In Australia, FCA Regulated Brokers in the UK and CIRO Regulated Brokers lists. In contrast, BlackBull Markets, with its strong trust, takes the number one spot in the Best Forex Brokers in NZ rankings, listed as the High Leverage Forex Brokers globally. FXCM, plainly, is the winner when it comes to regulation.

BlackBull Markets leads with superior execution speed, higher leverage, and an unblemished history that builds trust. FXCM remains a strong competitor with its extensive regulation, intuitive platforms, and reliability, making it ideal for beginners and intermediate traders. Both brokers excel in addressing unique trader preferences, but BlackBull Markets edges ahead for its cost-efficient offerings and seamless trading experience. Their combined strength highlights why both are key players in the ever-evolving forex trading landscape.

| BlackBull Markets | FXCM | |

|---|---|---|

| Tier 1 Regulation | FMA (New Zealand) | ASIC (Australia) FCA (UK) CYSEC (Cyprus) CIRO (CANADA) BaFin (Germany) |

| Tier 2 Regulation | FSCA (South Africa) ISA (Israel) | |

| Tier 3 Regulation | FSA-S (Seychelles) |

Reviews

As shown below, BlackBull Markets is rated 4.8 out of 5 from over 2,300 reviews. FXCM, by comparison, has a score of 4.3 out of 5 from around 800 reviews. Both brokers are well-regarded, but BlackBull Markets stands out for its consistently high ratings and broader base of satisfied users.

Our Stronger Trust and Regulation Verdict

FXCM ranks highes in this category due to their stronger trust and regulation.

*Your capital is at risk ‘65% of retail CFD accounts lose money’

6. Most Popular Broker – FXCM

FXCM gets searched on Google more than BlackBull Markets. On average, FXCM sees around 40,500 branded searches each month, while BlackBull Markets gets about 18,100 — that’s 55% fewer.

| Country | BlackBull Markets | FXCM |

|---|---|---|

| India | 1,300 | 2,900 |

| United Kingdom | 1,600 | 2,900 |

| United States | 880 | 2,900 |

| France | 210 | 1,600 |

| Australia | 1,900 | 1,300 |

| Malaysia | 170 | 1,300 |

| Japan | 50 | 1,300 |

| South Africa | 720 | 1,000 |

| Germany | 1,600 | 1,000 |

| Pakistan | 210 | 1,000 |

| Thailand | 210 | 1,000 |

| Indonesia | 140 | 1,000 |

| Colombia | 170 | 1,000 |

| Canada | 590 | 880 |

| Nigeria | 170 | 880 |

| Vietnam | 70 | 880 |

| Italy | 320 | 720 |

| Spain | 480 | 590 |

| Taiwan | 20 | 590 |

| Turkey | 90 | 480 |

| Brazil | 110 | 480 |

| Singapore | 110 | 480 |

| Morocco | 90 | 480 |

| United Arab Emirates | 140 | 480 |

| Mexico | 480 | 480 |

| Hong Kong | 30 | 480 |

| Netherlands | 320 | 390 |

| Philippines | 50 | 390 |

| Egypt | 40 | 390 |

| Venezuela | 50 | 390 |

| Poland | 170 | 320 |

| Argentina | 170 | 320 |

| Bangladesh | 70 | 260 |

| Kenya | 110 | 260 |

| Algeria | 50 | 260 |

| Saudi Arabia | 40 | 260 |

| Greece | 90 | 210 |

| Peru | 50 | 210 |

| Chile | 50 | 210 |

| Switzerland | 140 | 170 |

| Sweden | 140 | 170 |

| Cambodia | 10 | 170 |

| Ecuador | 70 | 170 |

| Cyprus | 170 | 140 |

| Dominican Republic | 40 | 140 |

| Portugal | 70 | 110 |

| Austria | 210 | 110 |

| Sri Lanka | 70 | 110 |

| Ghana | 50 | 110 |

| Bolivia | 30 | 110 |

| Tanzania | 30 | 90 |

| Uganda | 50 | 90 |

| Ethiopia | 20 | 70 |

| Ireland | 70 | 70 |

| Uzbekistan | 30 | 70 |

| Jordan | 10 | 70 |

| New Zealand | 1,900 | 70 |

| Botswana | 30 | 50 |

| Panama | 10 | 50 |

| Mongolia | 10 | 50 |

| Mauritius | 10 | 40 |

| Costa Rica | 10 | 30 |

1,300 1st | |

2,900 2nd | |

880 3rd | |

2,900 4th | |

210 5th | |

1,600 6th | |

50 7th | |

1,300 8th |

Similarweb shows a different story when it comes to February 2024 website visits with FXCM receiving 365,000 visits vs. 415,000 for BlackBull Markets.

Our Most Popular Broker Verdict

FXCM is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘65% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – BlackBull Markets

BlackBull Markets and FXCM offer traders access to a range of Contract-for-Difference (CFD) products, but they cater to different preferences. BlackBull Markets excels in variety, offering 67 forex pairs, 2,000+ shared CFDs, 16 cryptocurrencies, and 9 types of commodities, including metals, energies, and soft/hard commodities. On the other hand, FXCM provides fewer options with 42 to 43 forex pairs, 219 share CFDs, 7 cryptocurrencies, and a mix of metals and energies. BlackBull’s product diversity ensures broader opportunities for traders, making it a strong contender in this segment.

BlackBull Markets appeals further by providing traders in selected regions, such as New Zealand, access to actual shares through its partnership with Interactive Markets. This feature offers an edge over FXCM, which focuses on CFD trading. FXCM offers unique options like trading bonds and treasures, meeting specific trader demands. However, BlackBull Markets’ extensive product list, and offerings, ensure it remains a top choice for traders seeking variety and flexibility in global markets.

| CFDs | BlackBull Markets | FXCM |

|---|---|---|

| Forex Pairs | 67 | 42 |

| Indices | 12 | 16 |

| Commodities | 10 Metals 3 Energies 7 Soft Commodities 9 Hard Commodities | 3 Metals 5 Energies 3 Softs |

| Cryptocurrencies | 16 | 7 |

| Share CFDs | 2,000+ | 219 |

| ETFs | No | No |

| Bonds | No | 1 |

| Futures | 22 | No |

| Treasuries | No | 1 |

| Investments | Yes 26,000 | No |

BlackBull Markets takes the lead with its comprehensive product range, dominating almost every category, from forex pairs to cryptocurrencies and share CFDs. FXCM, while offering niche options like bongs and treasuries, falls short in product diversity. Together, these brokers provide valuable tools for traders at different expertise levels. However, BlackBull Markets’ expansive product lineup and strategic partnership make it the ideal choice for those looking for market opportunities. It’s the clear winner in delivering superior CFD markets.

Our Top Product Range and CFD Markets Verdict

BlackBull Markets steals the throne here due to their top product range and CFD markets.

8. Superior Educational Resources – FXCM

BlackBull Markets and FXCM excel at providing traders with valuable educational resources. BlackBull Markets focuses on content such as webinars by industry experts, easy-to-follow video tutorials, and a wide range of insightful articles covering trading strategies and market news. FXCM, however, goes a step further with its comprehensive library that includes trading guides tailored for beginners and advanced traders, regularly updated materials, and in-depth market analysis to help traders make well-informed decisions.

BlackBull markets ensures traders build a solid foundation through engaging and accessible learning tools. It fosters learning opportunities that are essential for beginners and intermediate traders to undoubtedly navigate the forex market. On the other hand, FXCM stands out for its thorough and consistent educational approach. With resources like advanced trading guides and regularly refreshed content, FXCM empowers traders by keeping them informed and up-to-date in the forex industry. Both brokers contribute immensely to advancing trader knowledge and expertise.

- BlackBull Markets offers regular webinars hosted by industry experts.

- FXCM’s trading guides cover a range of topics, from basic to advanced.

- BlackBull Markets provides video tutorials that are easy to follow and understand.

- FXCM offers in-depth market analysis, helping traders make informed decisions.

- BlackBull Markets’ articles cover a range of topics, from trading strategies to market news.

- FXCM’s educational resources are regularly updated, ensuring traders have access to the latest information.

FXCM leads by offering superior educational resources that cater to novice and experienced traders. Regularly updated content, coupled with advanced guides and insightful market analysis, makes it an excellent choice for those eager to deepen their trading knowledge. While BlackBull Markets provides strong educational tools, FXCM’s comprehensive and tailored approach ensures it stands out as the preferred option for trader looking to expand their skill set and stay ahead in the forex industry.

Our Superior Educational Resources Verdict

FXCM, undoubtedly, ranks highest in this segment in light of their superior educaitonal resources.

*Your capital is at risk ‘65% of retail CFD accounts lose money’

9. Superior Customer Service – FXCM

Reliable customer service is key in forex trading. Blackbull Markets and FXCM deliver commendably in this area. Black Bull Market shines with its dedicated and responsive stream, available 24/5 via live chat, email, and phone. Their knowledgeable support ensures traders receive quick resolutions to their issues. FXCM, however, has built a strong reputation for customer service, offering years, offering similar support channels but with a long history of effective query handling and problem-solving.

BlackBull markets focuses on accessibility and multilingual support, making it a reliable choice for traders worldwide. They emphasise swift responses and comprehensive assistance. FXCM offers extensive support options, including technical help and account-related inquiries. Their team is well-trained to manage a variety of trader concerns. Additionally, their wide range of communication channels reflects their commitment to making customer service seamless and approachable.

While both brokers excel in providing traders with dependable customer support, FXCM slightly edges ahead with its superior service reputation and long-standing commitment to effective assistance. BlackBull Markets remains a strong contender, offering responsive and accessible support. Together, these brokers demonstrated the value of high-quality customer service in ensuring a smooth and efficient trading experience for all their users. Ultimately FXCM takes the lead in this category with its well-rounded and trustworthy approach to customer care.

| Feature | BlackBull Markets | FXCM |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/6 | 24/5 |

| Multilingual Support | Yes | Yes |

Our Superior Customer Service Verdict

Without any doubt, FXCM rides high in this category due to their superior customer service.

*Your capital is at risk ‘65% of retail CFD accounts lose money’

10. Better Funding Options – FXCM

Funding options are a critical part of creating seamless trading experiences, and both BlackBull Markets and FXCM offer a variety of choices for their clients. BlackBull Markets sticks to traditional methods, including back transfers, credit cards, Skrill, Neteller, and Union Pay. FXCM, however, takes a modern approach by incorporating options like PayPal and Bitcoin, alongside bank transfers, credit cards, and Neteller, giving it a clear edge in terms of diversity.

BlackBull Markets’ funding options cater well to those who prefer established, reliable methods, which an be beneficial for traders with specific preferences for traditional systems. FXCM, meanwhile, widens its appeal by introducing newer, tech-driven payment options such as Bitcoin and PayPal. These methods make funding faster and more accessible, particularly for traders who lean towards digital payment solutions. By ensuring a broader range of choices, FXCM helps traders meet their funding needs effortlessly.

The table below provides a comprehensive comparison of the funding options available with both brokers:

| Funding Methods | BlackBull Markets | FXCM |

|---|---|---|

| Bank Transfer | Yes | Yes |

| Credit Card | Yes | Yes |

| PayPal | No | Yes |

| Skrill | Yes | No |

| Neteller | Yes | Yes |

| UnionPay | Yes | No |

| FasaPay | No | No |

| Bitcoin | No | Yes |

| Klarna | No | No |

| Trustly | No | No |

FXCM takes the lead for better funding options, thanks to its diverse range that includes innovative methods like Bitcoin and PayPal. BlackBull Markets provides solid, traditional funding choices but lacks the modern alternatives offered by FXCM. This makes FXCM the most versatile option for traders looking for flexibility and ease in funding their accounts. Together, both brokers cater to varied trader preferences, but FXCM shines in delivering a more comprehensive funding experience.

Our Better Funding Options Verdict

FXCM excels in this niche owing it to their better funding options.

*Your capital is at risk ‘65% of retail CFD accounts lose money’

11. Lower Minimum Deposit – BlackBull Markets

When it comes to minimum deposit requirements, BlackBull Markets takes the spotlight with its $0 minimum deposit for bank transfers. Thie flexibility makes it an ideal choice for new traders or those starting with a smaller budget. FXCM, on the other hand, sets a minimum deposit of $50 across all payment methods, providing a stable but less flexible entry point. Both brokers ensure accessibility, but BlackBull’s $0 deposit stands out as a unique offering.

BlackBull Markets not only provides a $0 minimum deposit via bank transfers but also accommodates card payments and digital methods like Skrill and Neteller with a $50 minimum. This range appeals to diverse trader needs while encouraging accessibility. FXCM, though limited to a $50 minimum deposit, maintains consistency across all payment channels, including innovative methods like credit cards and bank wire transfers. By offering traders these options, both brokers contribute to a seamless trading experience, catering to different financial preferences.

BlackBull Markets

| Minimum Deposit | GBP | USD | EUR | AUD |

|---|---|---|---|---|

| Credit Card / Debit Card | £50 | $50 | €50 | $50 |

| Bank Wire | £0 | $0 | €0 | $0 |

| Skrill | £50 | $50 | €50 | $50 |

| Neteller | £50 | $50 | €50 | $50 |

FXCM

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

| Bank Wire | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

| Skrill | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

| Neteller | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

| Minimum Deposit | Recommended Deposit | |

| BlackBull Markets | $0 | $500 |

| FXCM | $50 | $50 |

Black Bull Markets takes the lead with its $0 minimum deposit option for bank transfers, making it incredibly accessible for cost-conscious or beginner traders. FXCM holds its ground with a steady $50 requirement, appealing to those prioritising a consistent deposit structure. While both brokers deliver valuable funding solutions, BlackBBulls Markets’ lower deposit options ensure it remains the go-to choice for traders seeking flexibility and affordability. This feature undoubtedly gives it an edge in this segment.

Our Lower Minimum Deposit Verdict

BlackBull Markets reigns supreme in this segment by the reason of their lower minimum deposit.

Is BlackBull Markets or FXCM The Best Broker?

With its list of comprehensive trading experience, FXCM dominates this level since it has consistently outperformed BlackBull Markets in several key areas. The table below summarises the key information leading to this verdict:

| Criteria | BlackBull Markets | FXCM |

|---|---|---|

| Lowest Spreads And Fees | Yes | Yes |

| Better Trading Platform | No | Yes |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | No | Yes |

| Top Product Range And CFD Markets | Yes | No |

| Superior Educational Resources | No | Yes |

| Superior Customer Service | No | Yes |

| Better Funding Options | No | Yes |

| Lower Minimum Deposit | Yes | No |

FXCM: Best For Beginner Traders

FXCM is the ideal choice for beginner traders, offering a more user-friendly interface and simpler account structures.

BlackBull Markets: Best For Experienced Traders

For seasoned traders looking for advanced tools and a wider range of funding options, BlackBull Markets stands out as the preferred broker.

FAQs Comparing BlackBull Markets Vs FXCM

Does FXCM or BlackBull Markets Have Lower Costs?

FXCM generally offers lower costs compared to BlackBull Markets. While both brokers have competitive spreads, FXCM often provides tighter spreads on major currency pairs. For instance, the EUR/USD spread can be as low as 0.7 pips with FXCM. For a more detailed comparison on broker costs, you can refer to this comprehensive guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both FXCM and BlackBull Markets support MetaTrader 4, but FXCM offers additional features and plugins for the platform. This makes FXCM a more versatile choice for traders who rely heavily on MT4. If you’re keen on exploring more about MT4 brokers, check out this list of the best MT4 brokers.

Which Broker Offers Social Trading?

BlackBull Markets stands out when it comes to social trading, offering integration with platforms like Myfxbook and Zulutrade. Social trading allows traders to follow and copy the trades of professionals, making it easier for beginners to navigate the forex market. For those interested in diving deeper into social trading platforms, here’s a comprehensive review of the best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither BlackBull Markets nor FXCM offer spread betting as a primary service. Spread betting is a unique form of trading popular in the UK, allowing traders to bet on the direction of market movements without owning the underlying asset. If you’re interested in brokers that do offer this service, you can explore this list of the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, BlackBull Markets is the superior choice for Australian forex traders. Being founded in New Zealand and regulated by ASIC, they have a strong presence in the Australasian region. FXCM, on the other hand, is based overseas. BlackBull Markets offers a more localized experience, understanding the unique needs of traders in this region. For a broader perspective on Australian forex brokers, you can check out this comprehensive guide on the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I believe FXCM stands out as the superior choice. Being FCA regulated, they offer a level of trust and security that’s crucial for traders in the UK. While BlackBull Markets is a strong contender in many areas, FXCM’s regulatory status in the UK gives them an edge. Additionally, FXCM’s global presence and extensive experience make them a reliable choice for UK traders. If you’re looking for more insights on UK forex brokers, here’s a detailed review of the best forex brokers in UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert