Pepperstone vs FXTM: Which One is Best?

Pepperstone and FXTM are two MetaTrader 4 forex brokers offering ECN broker accounts types with EUR/USD spreads from 0.0 pips and tradable CFDs from Crypto to EFTs, with FXTM offering higher leverage while Pepperstone has lower fees, superior CFDs trading platforms and customer service.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

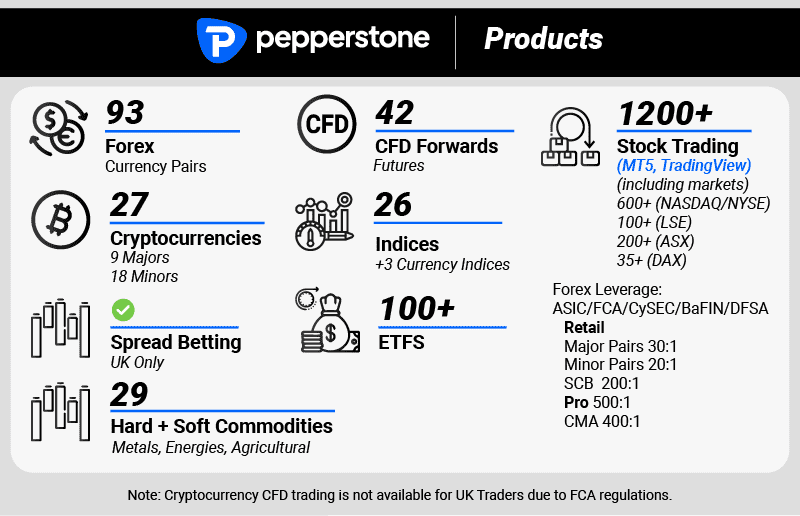

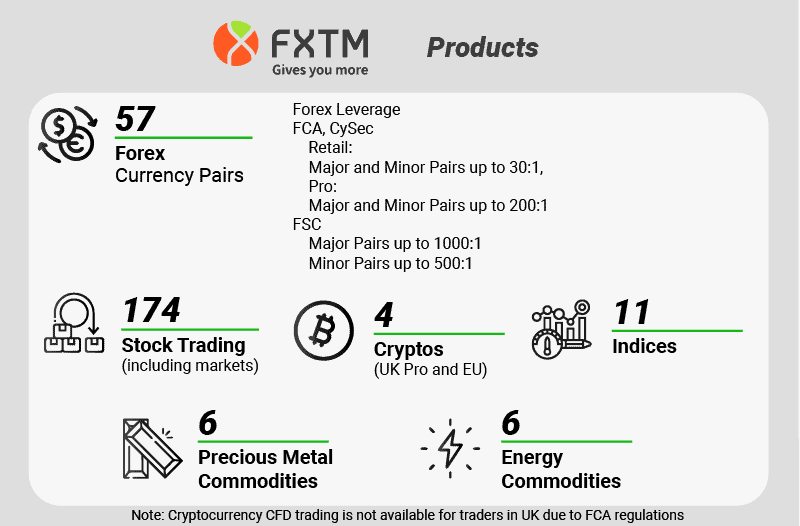

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

How Do FXTM Vs Pepperstone Compare?

Our full comparison covers the 10 most important trading factors. Here are five noticeable differences between Pepperstone and FXTM:

- FXTM offers higher leverage, while Pepperstone boasts lower fees.

- Pepperstone provides superior CFD trading platforms and customer service compared to FXTM.

- While Pepperstone offers CFD trading on 12 cryptocurrency products, FXTM offers only 4.

- Pepperstone’s Razor account offers institutional-grade spreads as tight as 0.0 pips, whereas FXTM’s spreads can go as low as 0.1 pips.

- FXTM charges inactivity fees, making it more expensive than Pepperstone in terms of both trading and non-trading fees.

1. Lowest Spreads And Fees: Pepperstone

Average Spreads

Pepperstone’s Razor spreads can be as tight as 0.0 pips for a range of currency pairs, including CAD/JPY, AUD/JPY, CHF/JPY, EUR/JPY, EUR/GBP, EUR/CHF, USD/CHF and CHF/SGD. The Razor account is similar to an ECN due to Pepperstone’s top-tier liquidity providers. Traders have access to a professional financial market environment with institutional grade spreads and ultra-fast execution.

The table below shows FXTM and Pepperstone’s average spreads. Average spreads are sourced directly from the broker’s website and updated monthly to ensure accuracy. As you can see, FXTM comes in a close second to Pepperstone, with tighter spreads across the board for all major currency pairs.

|

Raw Spread comparison

|

|||||

|---|---|---|---|---|---|

|

0.10 | 0.90 | 0.20 | 1.10 | 0.40 |

|

0.50 | 0.70 | 0.60 | 0.40 | 0.60 |

|

0.30 | 0.50 | 0.30 | 0.60 | 0.40 |

|

0.20 | 0.60 | 0.30 | 1.00 | 0.50 |

|

0.50 | 0.70 | 0.50 | 0.60 | 0.50 |

|

0.29 | 1.50 | 0.54 | 0.68 | 0.70 |

|

0.40 | 0.60 | 0.50 | 0.70 | 0.70 |

|

0.60 | 0.14 | 0.70 | 0.10 | 0.15 |

|

0.50 | 0.70 | 0.60 | 0.40 | 0.60 |

|

0.90 | 0.85 | 0.73 | 1.17 | 1.13 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Fees

FXTM fees and commissions depend on the account. Many of FXTM’s account types charge no commission fees, including Standard Accounts, Pro Accounts, ECN Zero Accounts, Shares Accounts, and Cent Accounts. While some ECN accounts charge a commission fee of $2-4 per lot, others charge a floating commission dependent on the trade volume and equity. Pepperstone commission fees vary between trading platforms:

- MT4 & MT5: Commission fees start from $3.50 per side.

- cTrader: Commission is calculated as 0.0035% of the base currency of the fx pair being traded.

Unlike Pepperstone, FXTM charges inactivity fees, resulting in FXTM being significantly more expensive than Pepperstone in regards to both trading and non-trading fees. If traders do not execute any trades for 6 months, a fee of $5 per month is imposed.

Our Lowest Spreads and Fees Verdict

Overall, Pepperstone has the lowest spreads on major currency pairs, such as the EUR/USD. If you’re unsure what account to open, then view the comparison ofPepperstone razor vs standard accounts to make sure you select the type that is right for you.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

2. Better Trading Platform: Pepperstone

| Trading Platform | Pepperstone | FXTM |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | No |

Pepperstone is offered on MetaTrader and cTrader platforms, while FXTM is restricted to MetaTrader platforms (MT4 and MT5). If you are unsure of which platform suits your trading needs, both forex brokers offer demo accounts to familiarise yourself with the software and practise trading and analysis. Although not as popular as MetaTrader software, cTrader has established a following due to its advanced trading tools attractive to experienced traders.

With MetaTrader platforms, forex traders tend to have a personal preference between the two different versions. MetaTrader 4 (MT4) remains the gold standard for many foreign currency traders, although MetaTrader (MT5) is popular due to the advanced analysis and research tools.

Desktop Platforms

Both MT4, MT5, and cTrader desktop platforms are available on Mac and Windows computers. Yet, Mac users wanting to use MT4 are required to install additional software to enable Mac compatibility. For this reason, many forex traders on Mac computers prefer MT5 or cTrader.

Mobile Apps And WebTrader

MetaTrader provides online (WebTrader), mobile, and desktop platforms to enable trading from any location. Both the MT4 and MT5 versions of WebTrader offer one-click trading, real-time quotes, and comprehensive analysis and research tools. Yet MT5 WebTrader offers some unique features compared to its predecessor, including more tools and chart types as well as 21 timeframes compared to MT4’s 9 timeframes.

MetaTrader’s mobile applications are compatible with iOS and Android devices. MT4 and MT5 mobile applications offer a range of sophisticated trading tools and indicators. FXTM also offers a proprietary mobile app, FXTM Trader. The iOS and Android compatible app allows one-click trading, live currency stats, an account overview, and trading on over 250 products.

cTrader was originally designed as a web platform, therefore, the online platform offers an intuitive design suitable for beginners to experienced traders.

Expert Advisors, Automated Trading, And Other Trading Tools

Expert Advisors, Automated Trading, And Other Trading Tools

Both Pepperstone and FXTM allow Expert Advisors and automated trading. Yet FXTM does not offer the advanced suite of Smart Trader Tools that Pepperstone provides.

Although FXTM lacks Pepperstone’s extensive Smart Trader Tools, FXTM offers substitutes with similar features. FXTM traders using cTrader can utilise the trading platform’s advanced algorithmic trading software, cAlgo. Additionally, FXTM’s Pivot Points Strategy is similar to Pepperstone’s Market Sentiment Smart Trader Tool.

Our Better Trading Platform Verdict

Given Pepperstone’s platform options and features, FXTM comes in second to Pepperstone in regard to trading platforms.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

3. Superior Accounts And Features: Pepperstone

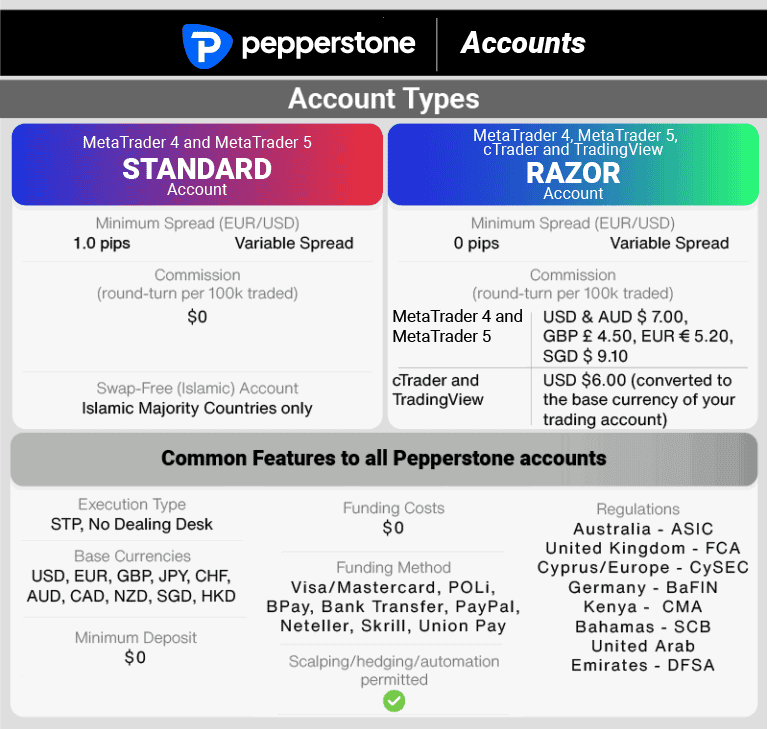

Pepperstone: Standard, Razor, And VIP/Pro Account Types

Pepperstone offers retail investors two main account types. Standard accounts are commission-free and offer minimum EUR/USD spreads of 1.0 pips. Yet Pepperstone’s most popular account, the Razor Account, gives traders access to ECN-type spreads as low as 0.0 pips with AUD$7 round turn commission (per 100k traded).

Both Standard and Razor accounts provide No Dealing Desk Brokers execution and Expert Advisor compatibility and are available in 10 base currencies (AUD, JPY, CHF, NZD, HKD, EUR, GBP, USD, CAD, SGD).

A reason why Pepperstone is so popular among forex traders is the rebate and incentive programs offered to investors. High-volume trading is rewarded with cash rebates paid daily into traders’ accounts. For instance, if you trade between 200-500 lots, a typical monthly rebate would be between $200-500.

High-volume traders may also qualify to upgrade from a retail investor account to a Premium Pepperstone client. VIP clients receive increased leverage, market insights from Pepperstone’s in-house analysts, premium rebates, and invitations to VIP events, seminars, sporting events, and private dining experiences.

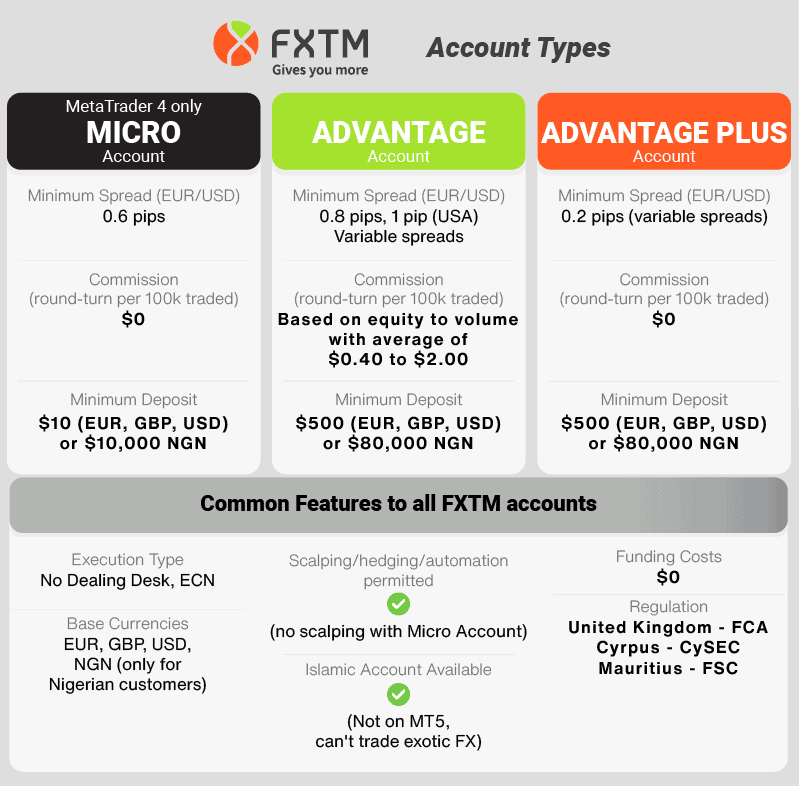

FXTM: Standard, ECN, And VIP Account Types

FXTM offers Standard, ECN, and Pro account types. Within each account type, there are sub-accounts with varying commissions, lot sizes, leverage, and product availability.

Leverage with FXTM varies according to the appropriate regulator. Traders in Europe will have the standard leverage ratio of 30:1 for major currency pairs, but traders outside this region can access significantly higher than the market average as FXTM offers floating leverage up to 1000:1. Yet, investors who are new to forex trading should be aware of the high risk that comes with High Leverage Forex Brokers.

Standard Account Types:

- Standard Account: Available on MT4 and offers floating leverage up to 1000:1 (30:1 in Europe), swap-free structures,

- CENT Account: For micro lot trading, MT4 compatible, competitive floating spreads, min deposit of $5 (or Eur and GBP equivalent) and available in US cent, EU cent and GBP pence.

- Shares Account: Leverage is fixed at 10:1 (5:1 Europe) with access to over 180 Share CFDs

ECN Account Types:

FXTM offers ECN trading where there is no dealing desk (NDD) involvement. With no dealing desk interference, FXTM provides deep interbank liquidity and instant trade execution to ECN account holders.

- ECN ZERO Account: Offer commission-free tight floating spreads, high floating leverage of 1000:1 (30:1 Europe), no re-quotes and also allows both hedging and scalping. FXTM Invest is available through an ECN Zero account. FXTM Invest is a copy trading and strategy manager program where traders can follow other investors’ strategies and potentially earn profits when others copy theirs.

- ECN MT4/MT5 Account: Commission starts at $4 with spreads from 0.1 pips and the same leverage and scalping and hedging allowances as an ECN Zero Account. Islamic (swap-free) ECN accounts are only available on MT4, and exotic currency pairs are not available.

PRO Account

- FXTM Pro: Available on both MT4 and MT5, a Pro account offers floating leverage up to 100:1, no re-quotes, fast market execution and tight spreads under 0.1 pips.

| Pepperstone | FXTM | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | No |

| Spread Betting (UK) | Yes | No |

Our Superior Accounts and Features Verdict

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

4. Best Trading Experience And Ease: Pepperstone

When it comes to trading, the experience and ease of use are paramount. Having spent a considerable amount of time on both Pepperstone and FXTM platforms, I can confidently say that both brokers have their strengths. Pepperstone, for instance, stands out with its MetaTrader 4 offering, which is renowned for its user-friendly interface and robust features. On the other hand, FXTM, while also supporting MetaTrader platforms, has a more diverse range of account types catering to different trader needs.

- Pepperstone offers top-notch automated trading, especially with its integration of Expert Advisors.

- FXTM, while lacking Pepperstone’s extensive Smart Trader Tools, compensates with features like cTrader’s advanced algorithmic trading software, cAlgo.

- Both brokers provide demo accounts, allowing traders to familiarise themselves with the platforms.

- Pepperstone’s customer service is slightly ahead, with quicker email response times compared to FXTM.

Our Best Trading Experience and Ease Verdict

Based on our analysis and the data from our testing, Pepperstone offers a slightly better overall trading experience in terms of platform ease and features.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

5. Stronger Trust And Regulation: Pepperstone

Pepperstone Trust Score

FXTM Trust Score

Pepperstone is an Australian forex broker and is regulated by ASIC (Australia) and FCA (UK); and is in the process of receiving an FSCA (South Africa) financial services license. Pepperstone is seen as a trustworthy forex broker as it is regulated by regulatory bodies in Australia and the United Kingdom. Traders in the UK are protected through the Financial Services Compensation Scheme (FSCS), offering investors cover of up to £50,000 if the forex broker fails. Additionally, Pepperstone holds client funds in segregated bank accounts in accordance with FCA and ASIC regulations.

FXTM is not ASIC regulated but overseen by the FCA (UK), CySEC (Cyprus), and FSCA (South Africa). FXTM forex traders in the UK receive similar protection to Pepperstone clients with FSCS protection. Although international clients (including South African investors) receive no protection, CySEC ensures EU clients receive up to €20,000 if FXTM fails.

In regards to regulation, Pepperstone is considered more trustworthy due to being based in Australia and overseen by two major authorities, the FCA and ASIC. While FXTM, on the other hand, operates from Cyprus and lacks ASIC oversight.

| Pepperstone | FXTM | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) | CYSEC (Cyprus) FCA (UK) |

| Tier 2 Regulation | DFSA (Dubai) | FSCA (South Africa) |

| Tier 3 Regulation | SCB (Bahamas) CMA (Kenya) | FSC-M (Mauritius) CMA (Kenya) |

Our Stronger Trust and Regulation Verdict

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

6. Most Popular Broker – Pepperstone

Pepperstone gets searched on Google more than FXTM. On average, Pepperstone sees around 110,000 branded searches each month, while FXTM gets about 40,500 — that’s 63% fewer.

| Country | Pepperstone | FXTM |

|---|---|---|

| Australia | 8,100 | 320 |

| Brazil | 6,600 | 480 |

| United Kingdom | 5,400 | 1,000 |

| United States | 4,400 | 1,600 |

| Malaysia | 4,400 | 1,300 |

| Kenya | 4,400 | 1,300 |

| Thailand | 4,400 | 590 |

| Germany | 3,600 | 320 |

| Colombia | 3,600 | 260 |

| Mexico | 3,600 | 320 |

| Hong Kong | 3,600 | 390 |

| India | 2,900 | 5,400 |

| South Africa | 2,900 | 1,000 |

| Spain | 1,900 | 390 |

| Italy | 1,900 | 210 |

| Mongolia | 1,900 | 10 |

| Singapore | 1,600 | 260 |

| Turkey | 1,600 | 720 |

| Indonesia | 1,600 | 480 |

| Peru | 1,600 | 170 |

| Nigeria | 1,300 | 5,400 |

| Argentina | 1,300 | 170 |

| Pakistan | 1,300 | 880 |

| Bolivia | 1,300 | 50 |

| France | 1,000 | 260 |

| United Arab Emirates | 1,000 | 1,000 |

| Taiwan | 1,000 | 320 |

| Chile | 1,000 | 50 |

| Ecuador | 1,000 | 140 |

| Philippines | 880 | 260 |

| Netherlands | 880 | 170 |

| Dominican Republic | 880 | 70 |

| Canada | 720 | 320 |

| Poland | 720 | 70 |

| Vietnam | 720 | 1,600 |

| Morocco | 720 | 320 |

| Tanzania | 720 | 210 |

| Japan | 480 | 260 |

| Portugal | 480 | 50 |

| Cyprus | 480 | 210 |

| Costa Rica | 480 | 30 |

| Sweden | 390 | 50 |

| Egypt | 390 | 720 |

| Bangladesh | 390 | 320 |

| Algeria | 390 | 590 |

| Uganda | 390 | 170 |

| Venezuela | 390 | 210 |

| Ethiopia | 390 | 110 |

| Botswana | 390 | 70 |

| Switzerland | 320 | 50 |

| Austria | 320 | 50 |

| Sri Lanka | 320 | 140 |

| Panama | 320 | 20 |

| Cambodia | 320 | 110 |

| Ireland | 260 | 30 |

| Ghana | 260 | 260 |

| Saudi Arabia | 260 | 260 |

| Jordan | 260 | 170 |

| Greece | 210 | 70 |

| New Zealand | 170 | 30 |

| Uzbekistan | 140 | 30 |

| Mauritius | 110 | 40 |

2024 Monthly Searches For Each Brand

Pepperstone - Australia

Pepperstone - Australia

|

8,100

1st

|

FXTM - Australia

FXTM - Australia

|

320

2nd

|

Pepperstone - UK

Pepperstone - UK

|

5,400

3rd

|

FXTM - UK

FXTM - UK

|

1,000

4th

|

Pepperstone - US

Pepperstone - US

|

4,400

5th

|

FXTM - US

FXTM - US

|

1,600

6th

|

Pepperstone - Germany

Pepperstone - Germany

|

3,600

7th

|

FXTM - Germany

FXTM - Germany

|

320

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with Pepperstone receiving 1,273,000 visits vs. 473,000 for FXTM.

Our Most Popular Broker Verdict

Pepperstone is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets: Pepperstone

Both FXTM and Pepperstone offer CFD trading on a large range of indices and shares, as well as currency pairs with ECN-like spreads. This includes major, minor and exotic currencies, as well as cryptocurrency.

Due to the range of CFD products available at FXTM, it is easy to diversify your portfolio among asset classes. FXTM’s product range includes CFD trading on indices, shares, commodities and ETFs.

Our Top Product Range and CFD Markets Verdict

While Pepperstone offers CFD trading on 12 cryptocurrency CFD products, FXTM offers 4 cryptocurrencies. Pepperstone’s CFD offering wins this round.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

8. Superior Educational Resources: Pepperstone

In the realm of forex trading, continuous learning is the key to success. Both Pepperstone and FXTM understand this and have invested in providing top-notch educational resources for their traders. From our analysis and our own testing, here’s a breakdown of what each broker offers in terms of educational content:

- Pepperstone:

- Offers webinars and seminars for both beginners and advanced traders.

- Provides a comprehensive trading glossary and FAQ section.

- Features in-depth articles and market analysis.

- FXTM:

- Hosts regular educational events and webinars.

- Provides E-books and educational videos for various trading levels.

- Features a dedicated ‘Education’ section with a wide range of topics.

It’s evident that both brokers are committed to educating their traders, but there are subtle differences in their approaches and the depth of content they offer.

Our Superior Educational Resources Verdict

Based on our testing and the scores provided, Pepperstone slightly edges out FXTM in offering superior educational resources.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

9. Superior Customer Service: Tie

Pepperstone can be contacted 24 hours a day, five days a week, via multiple channels such as live chat, email, and phone support. Customer service representations are fluent in an array of languages, including English, Russian, Vietnamese or Thai. Representatives are helpful, offering quick answers and helpful responses.

Pepperstone can be contacted 24 hours a day, five days a week, via multiple channels such as live chat, email, and phone support. Customer service representations are fluent in an array of languages, including English, Russian, Vietnamese or Thai. Representatives are helpful, offering quick answers and helpful responses.

FXTM offers similar customer service features as Pepperstone. The forex broker also provides a multilingual customer service team to cater to its international client base. FXTM is available via live chat, phone, and email 25/4. Email responses from FXTM lag behind Pepperstone in speed, with FXTM taking 2-4 hours to respond while Pepperstone takes 0-2 hours.

Our Superior Customer Service Verdict

When it comes to customer service with Pepperstone vs FXTM, it’s a tie between the two forex brokers. Both offer helpful and efficient responses, multilingual representatives, and a range of contact methods. Yet, due to Pepperstone’s quicker email response, they win by a whisker.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

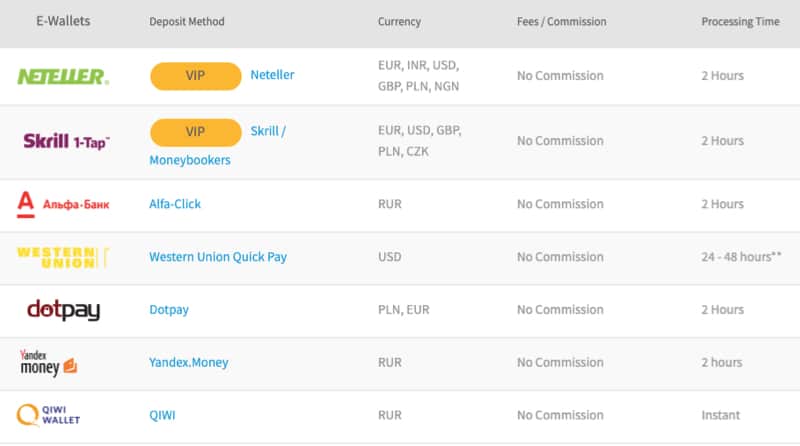

10. Better Funding Options: Pepperstone

FXTM does not charge any fees on deposits and requires a minimum amount of $500 for all account types except a Pro Account, which requires $25,000. The broker ensures all traders around the globe have a suitable deposit and withdrawal method, with online bank transfers available in a range of countries such as Thailand, Vietnam, Malaysia, Iraq, China, and Bangladesh, plus many more.

Additionally, traders can deposit funds with Visa and Mastercard credit cards, bank wire transfers, as well as via cryptocurrencies, i.e. Bitcoin via Skrill. Unfortunately, only VIP account holders can deposit funds via Skrill and Neteller.

Here’s a breakdown of the funding options available for both brokers:

| Funding Option | Pepperstone | FXTM |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | No |

| Skrill | Yes | Yes |

| Neteller | Yes | No |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | No |

| Klarna | No | No |

Withdrawals

At FXTM, withdrawals can be made with the same methods as deposits with the addition of China Union Pay. Yet, some withdrawal methods, including credit cards, carry either fixed or percentage-based fees. FXTM generally processes withdrawals within 24-48 hours, with the exception of Neteller and Skrill withdrawals, which are processed within one business day.

Our Better Funding Options Verdict

Based on our testing and the available options, Pepperstone offers a slightly more diverse range of funding options, making it more convenient for traders globally.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

11. Lower Minimum Deposit: Pepperstone

The initial deposit amount is often a deciding factor for many traders, especially those who are just starting out. A lower minimum deposit allows traders to test the waters without committing a significant amount of capital.

Pepperstone and FXTM, both leading brokers in the industry, understand this need and have set their minimum deposit requirements accordingly. While both brokers aim to cater to a wide range of traders, from beginners to professionals, their minimum deposit requirements differ.

| | Minimum Deposit | Recommended Deposit |

| Pepperstone | $0 | $200 |

| FXTM | $10 | $500 |

Our Lower Minimum Deposit Verdict

With no minimum deposit requirement for its Standard Account, Pepperstone offers a more accessible entry point for traders, making it the preferable choice for those looking to start without any initial capital commitment.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

Is Pepperstone or FXTM The Best Broker?

Pepperstone is the winner because it consistently offers a more comprehensive range of services, superior trading platforms, and more accessible entry points for traders.

The table below summarises the key information leading to this verdict:

| Criteria | Plus500 | FXTM |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platforms | Yes | No |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience | Yes | No |

| Stronger Trust And Regulation | Yes | No |

| CFD Product Range And Financial Markets | Yes | No |

| Superior Educational Resources | Yes | No |

| Better Customer Service | Yes | Yes |

| More Funding Options | Yes | No |

| Lower Minimum Deposit | Yes | No |

Best For Beginner Traders:

For those just starting out, Pepperstone offers a more user-friendly platform and a wealth of educational resources, making it the ideal choice for beginner traders.

Best For Experienced Traders:

For seasoned traders looking for advanced tools and tighter spreads, Pepperstone remains the top choice, offering a more comprehensive trading experience.

FAQs Comparing Pepperstone Vs FXTM

Does FXTM or Pepperstone Have Lower Costs?

Pepperstone generally offers lower costs compared to FXTM. While both brokers have competitive spreads, Pepperstone’s Razor account is known for its tight spreads, often starting from 0.0 pips. FXTM, on the other hand, offers spreads as low as 0.1 pips on its Micro Account. For a more detailed comparison of broker costs, you can refer to this comprehensive guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both Pepperstone and FXTM offer MetaTrader 4, but Pepperstone is often lauded for its enhanced MT4 experience, complete with advanced tools and features. FXTM also provides a solid MT4 platform, but with fewer customisation options. If you’re keen on diving deeper into the MT4 offerings of various brokers, check out this list of the best MT4 brokers.

Which Broker Offers Social Trading?

FXTM stands out when it comes to social trading, offering traders the opportunity to engage in copy trading. This allows less experienced traders to replicate the trades of seasoned professionals. Pepperstone, while having a robust platform, doesn’t have as pronounced a focus on social trading as FXTM. For those interested in exploring the world of social trading further, here’s a comprehensive review of the best social trading platforms.

Does Either Broker Offer Spread Betting?

Pepperstone offers spread betting, allowing traders to speculate on the price movements of various financial instruments without owning the underlying asset. FXTM, on the other hand, does not currently offer this service. Spread betting is particularly popular in the UK due to its tax benefits. For a deeper dive into spread betting and the top brokers offering this service, you can check out this comprehensive guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Pepperstone is the superior choice for Australian forex traders. Founded in Australia and regulated by ASIC, Pepperstone offers a trusted and localised trading experience. FXTM, while also a reputable broker, is based overseas. Pepperstone’s deep roots in the Australian market, combined with its robust platform offerings, make it a top choice. For those wanting to explore more about the Australian forex landscape, here’s a detailed review of the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I believe FXTM has a slight edge. While both brokers offer exceptional services, FXTM is FCA regulated, ensuring a high level of trust and security for UK-based traders. Pepperstone, though also FCA regulated, originated in Australia. FXTM’s strong regulatory framework in the UK, combined with its diverse platform offerings, positions it as a top choice for UK traders. For a more in-depth look at the best brokers in the UK, here’s a comprehensive list of Best Forex Brokers In UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Which broker among the two do most traders use?

According to FXTM website, they are trusted by 4 million worldwide seemingly with a large number in Nigeria. Pepperstone processes US9.2bn a day making them one of the worlds largest and they are trusted by over 400,000 registered account holders.