FxPro vs IC Markets: Which One Is Best?

This IC Markets against FX Pro review will break down both their features, platforms, strengths, and weaknesses. But after a thorough comparison, we surmise that IC Markets takes the win.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are eight noticeable differences between FxPro and IC Markets:

- IC Markets is an ECN pricing forex broker, while FxPro uses NDD execution for low spreads.

- IC Markets offers a Raw Spread Account with tighter spreads and a commission fee.

- IC Markets provides access to social-copy trading features like ZuluTrade and Myfxbook.

- IC Markets offers tighter average spreads on major currency pairs like EUR/USD at 0.1 pips.

- FxPro offers wider spreads.

- FxPro customers are limited to spread-only account types on MetaTrader platforms.

- FxPro offers features such as FxPro Trading Platform and cTrader Automate and cTrader Copy.

- Both brokers offer 250+ tradable CFD instruments, 60+ currency pairs, and MT4 + 5 and cTrader platforms.

1. Lowest Spreads And Fees – IC Markets

Now, let us take a deep-dive in our research for the lowest spreads and fees with both of our brokers, IC Markets and FxPro. We see here that IC Markets and FxPro are leading forex brokers offering diverse trading platforms and competitive pricing. IC Markets excels in their tight spreads and low-latency execution, while FxPro provides advanced tools and a wider trading experience. Both cater to global traders, which focuses on AUD, GBP, EUR, and USD markets.

Spreads

Spreads are a critical factor in forex trading, directly impacting profitability. Lower spreads mean reduced trading costs, especially for active trader. Known for its tight spreads, IC markets offers an average RAW spread of 0.02 for EUR/USD and 0.03 for AUD/USD, making it highly cost-effective. For FxPro’s spreads are slightly higher, with an average RAW spread of 0.2 for EUR/USD and 0.31 for AUD/USD. While competitive, it does not match IC Markets’ pricing.

| RAW Account | FxPro Spreads | IC Markets Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.39 | 0.29 | 0.75 |

| EUR/USD | 0.45 | 0.02 | 0.22 |

| USD/JPY | 0.35 | 0.14 | 0.38 |

| GBP/USD | 0.52 | 0.23 | 0.53 |

| AUD/USD | 0.57 | 0.03 | 0.47 |

| USD/CAD | 0.86 | 0.25 | 0.56 |

| EUR/GBP | 0.7 | 0.27 | 0.55 |

| EUR/JPY | 0.83 | 0.3 | 0.80 |

| AUD/JPY | 0.98 | 0.5 | 0.96 |

| USD/SGD | 7.29 | 0.85 | 2.29 |

IC Markets is an ECN broker providing STP with no dealing desk. FxPro offers fast execution and low slippage, but its no-commission pricing aligns with wider market maker spreads.

Commission Levels

Commission add to trading costs, and understanding these fees is esential for effective csot managemen. For IC Markets, this broker charges $3.50 per lot, with a minimum deposit of $200. It offers SWAP-free accounts and waives funding fees, appealing to cost-conscious traders. Meanwhile, FxPro also chareges a $3.50 per lot but requires a lower m inimum deposit of $100. FxPro recommends a $1,00 deposit for optimal trading conditions.

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| FxPro | $3.50 | N/A | N/A | N/A |

| IC Markets | $3.50 | $4.50 | £2.50 | €2.75 |

Standard Account Fees

In this standard account fees section, which also include spreads and commissions, influence overall trading expenses. On IC Markets, they offer competitive standard spreads, such as 0.62 for EUR/USD and 0.77 for AUD/USD, making it a cost-effective choice. FxPro, on the other hand, features higher standard spreads, like 1.32 for EUR/USD and 1.95 for AUD/USD, which may deter cost-sensitive traders.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.52 | 2.08 | 1.46 | 1.87 | 1.67 |

| 1.00 | 1.00 | 1.27 | 1.20 | 1.10 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 1.20 | 1.41 | 1.47 | 1.47 | 1.61 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 0.60 | 0.70 | 0.90 | 1.10 | 0.70 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Ultimately, both brokers provide a strong and durable trading platforms and tools to our traders in the forex trading industry. IC Markets stands out for its tighter spreads and lower fees, ideal for cost-focused traders. FxPro’s lower minimum deposit and advanced tools cater to traders, new or seasoned, who are looking for flexibility and innovation. To sum it all up, staying informed about forex trends ensures better trading decisions.

Our Lowest Spreads and Fees Verdict

Without a doubt, IC Markets ranks high in this category owing it to their lowest spreads and fees.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

2. Better Trading Platform – IC Markets

Here is what we will be covering next, both brokers’ better trading platform. We see here that IC Markets and FxPro are top brokers offering competitive forex trading plataforms and tools. IC Markets excels in advanced features, such as low-latency execution and tight spreads, while FxPro is recognised for its detailed trading platforms and quick execution. This comparison explores MetaTrader, Advanced Platforms, and Copy Trading.

| Trading Platform | FxPro | IC Markets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | Yes |

| TradingView | No | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

MetaTrader

MetaTrader platforms are industry favorites for their versatility and advanced trading tools. For IC Markets, this broker provide MetaTrader 4 or MT4, MetaTrader 5, or MT5, and cTrader, whichi s upports advanced charting, automated trading and diverse technical indicators. Meanwhile, FxPro also offers MT4, MT5, and cTrader but instead varies trading conditions which is based on their platform choices, this is ideal for advanced and experiened traders alike.

Trading tools offered by both IC Markets and FxPro on MT5 include:

- Expert Advisors (EAs) developed using MQL5 programming language

- Depth of Market

- Multi-currency backtesting

- Advanced charting tools: 21 timeframes, 30 inbuilt technical indicators, and 31 graphical objects

- 64-bit multi-threaded platform

- MQL5 community chat feature

MetaTrader 5 is popular for broader market access (including share trading), Expert Advisor features, and advanced technical analysis. IC Markets and FxPro provide various trading tools on MT5:

- Expert Advisors (EAs) developed using MQL5 programming language

- Depth of Market

- Multi-currency backtesting

- Advanced charting tools: 21 timeframes, 30 inbuilt technical indicators and 31 graphical objects

- 64-bit multi-threaded platform

- MQL5 community chat feature

Advanced Platforms

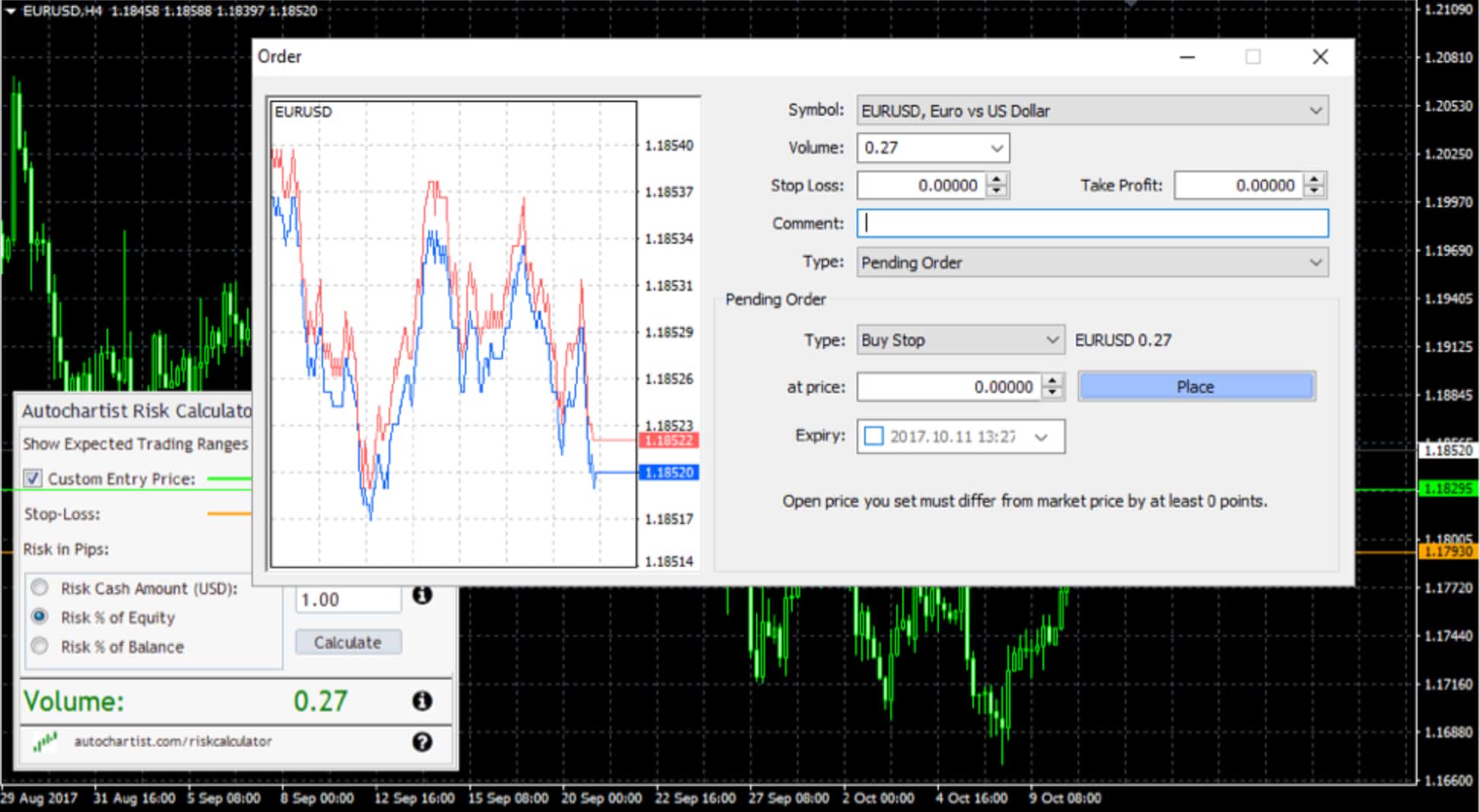

Superior trading platforms are essential for a seamless and efficient trading experience. In this case, IC Markets features tools like Autochartist for market analysis and TradingView integration for a detailed charting ans strategy development. While FxPro excels with its strong and resilient cTrader Platform, which is know for its execution-focused pricing and customisation options.

Copy Trading

Copy trading enables traders to emulate expert strategies for their enhanced trading outcomes. For IC Markets, they offer integration with Myfxbook and MetaTrader Signals, which helps traders explore diversifiied approaches. FxPro, on the other hand, partners with ZuluTrade and HokoCloud, this presents opportunities to learn from seasoned traders.

To sum it all up, both brokers offer excellent features which are tailored to various trading styles. IC Markets, though, appeals with tight spreads and innovative tools, while FxPro’s platforms and flexible options cater to strategy-driven traders. The choice depends on priorities like cost-efficiency, platform features, or strategy enhancements.

Our Better Trading Platform Verdict

Clearly, it is IC Markets who takes home the crown in this niche this is due to their better trading platform.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

3. Superior Accounts And Features – IC Markets

Now, let us talk about superior accounts and features from both brokers. Our brokers, IC Markets and FxPro are trusted forex brokers which offers durable tradin tools and tailored account options. IC Markets excels with competitive pricing, low spreads, and transparency, while FxPro stands out for fast execution and detailed features. Both brokers cater to traders worldwide, which enhances efficiency and fostering trust within the forex industry.

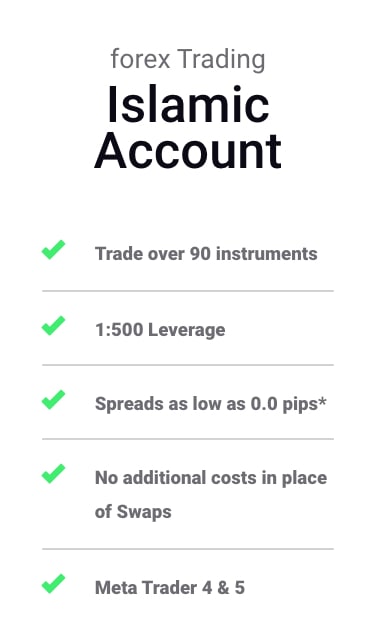

We see here that IC Markets supports diverse trading needs with their Standard and RAW Spread Accounts, this offers spreads as tight as 0.1 pips on major pairs like EUR/USD. During high volatility, spreads may shrink to 0.0 pips, benefiting scalpers and Expert Advisor users. FxPro, while focused on spread-only accounts, complements its advanced MetaTraders 4 and 5 platforms. Clearly, both brokers appeal to Islamic traders with SWAP-free account options, this enables investment in compliance with Sharia Law. In addition, IC Markets integrates innovative tools like Autochartist, while FXPro excels in execution precision, This provides a well-rounded trading experience for varying strategies.

| FxPro | IC Markets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | No | Yes |

| Spread Betting (UK) | Yes | No |

Drawing from our team’s in-depth research, IC Markets and FxPro contribute to trader success with their strong platforms and unique features. IC markets shines with their cost-efficiency and flexibility, while FxPro appeals with quick execution speed and reliability. Put together, they empower traders to refine strategies and achieve financial goals in a dynamic forex landscape.

Our Superior Accounts and Features Verdict

Evidently, IC Markets dominates in this portion thanks to their superior accounts and features.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – IC Markets

A smooth trading experience relies on powerful platforms, fast execution, competitive spreads, and excellent customer support. These factors enable traders to make informed decisions and manage accounts easily. A user-friendly platform with educational resources enhances the process. Whether you’re a novice or expert, the right setup ensures an efficient and profitable trading journey. Let’s compare IC Markets and FxPro in providing this experience.

When it comes to trading experience and ease, both FxPro and IC Markets exhibit distinct advantages. FxPro delivers a seamless trading experience with its intuitive interface and advanced tools, facilitating navigation for both beginners and seasoned traders. Conversely, IC Markets distinguishes itself with its MetaTrader 5 (MT5) platform, widely recognized as the best in the industry. As the leading “Best MT5” broker, IC Markets ensures that traders fully capitalize on the capabilities of the MetaTrader 5 platform.

IC Markets stands out with its exceptional “Best Standard Account,” which provides traders with remarkable flexibility and competitive pricing. Their Raw Spread Account offers even tighter spreads, accompanied by a straightforward flat-rate round-turn commission fee upon trade closure. Both brokers’ standard trading accounts incorporate costs within the spread, eliminating the need for traders to separately tally commission fees. Meanwhile, FxPro delivers an intuitive platform that guarantees a seamless trading experience across multiple devices.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| FxPro | 151ms | 23/36 | 138ms | 16/36 |

| IC Markets | 134ms | 16/36 | 153ms | 22/36 |

In the dynamic world of forex trading, selecting a broker that combines competitive pricing with a seamless trading experience is essential. Both FxPro and IC Markets stand out in these areas, although each has its unique strengths. IC Markets offers advanced tools like Autochartist, enhancing traders’ analysis capabilities, while FxPro is renowned for its rapid execution speeds and versatile trading platforms. Moreover, traders must remain up-to-date with the latest trends in forex, including the integration of AI and machine learning, the growing prominence of cryptocurrencies, and the influence of central bank policies on currency valuations. Staying informed and utilizing the right tools will undoubtedly set traders on the path to success.

Our Best Trading Experience and Ease Verdict

Based on our dedicated team of experts, IC Markets ranks highest in this niche by the reason of their best trading experience and ease.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – A Tie

In forex trading, trust and regulation are crucial. A regulated broker ensures transparency and protects traders from fraud, boosting confidence and attracting more clients. Choosing a broker with strong regulatory support provides security and peace of mind. This review will evaluate IC Markets and FxPro in terms of trust, regulation, and trading security.

IC Markets Trust Score

FxPro Trust Score

1. Regulations

In this section, we observe that IC Markets shows remarkable trust scores. However, trust scores alone are not sufficient; we must delve deeper. It is essential to consider the features, platforms, and overall user experience that each offers

Forex markets are highly regulated to mitigate the significant risks associated with trading CFDs. Financial authorities globally take decisive actions to safeguard investors and maintain fair and efficient market operations. In Australia, brokers are mandated to keep client funds in segregated accounts, while the UK and Cyprus implement even more rigorous financial regulations. Notably, both IC Markets and FxPro operate multiple subsidiaries under the oversight of top-tier regulators, confidently ensuring adherence to these strict standards.

Both IC Markets and FxPro’s subsidiaries based in Cyprus comply with CySEC regulations, ensuring traders benefit from Negative Balance Protection, leverage limits, and close-out margins. Customers of FxPro who are registered with its FCA-regulated UK subsidiary enjoy equivalent investor safeguards. Moreover, FxPro holds authorization to operate under FSCA and SCB regulations in South Africa and The Bahamas, respectively. IC Markets, headquartered in Sydney, Australia, is regulated by ASIC and possesses an Australian Financial Services License. Additionally, traders have the option to register with IC Markets’ subsidiaries regulated by both FSA and CySEC.

Both brokers are regulated by top-tier financial authorities globally, guaranteeing robust investor protection. It’s imperative for traders to thoroughly research the specific protections available in various locations prior to committing to a broker. With regulations established by esteemed authorities like ASIC, FCA, and CySEC, both IC Markets and FxPro offer a secure trading environment. Staying informed about the latest forex trading trends—including the integration of AI and machine learning, the rise of cryptocurrencies, and the impact of central bank policies on currency valuations—is essential for traders as they navigate the dynamic forex market in 2026.

| FxPro | IC Markets | |

|---|---|---|

| Tier 1 Regulation | FCA (UK) CYSEC (Cyprus) | ASIC (Australia) CYSEC (Cyprus) |

| Tier 2 Regulation | ||

| Tier 3 Regulation | SCB (Bahamas) FSC-M (Mauritius) FSCA (South Africa) | FSA-S (Seychelles) SCB (Bahamas) |

2. Reputation

IC Markets gets searched on Google more than FxPro. On average, IC Markets sees around 201,000 branded searches each month, while FxPro gets about 74,000 — that’s 63% fewer.

| Country | FxPro | IC Markets |

|---|---|---|

| India | 2,400 | 33,100 |

| Argentina | 2,400 | 8,100 |

| Germany | 8,100 | 8,100 |

| Colombia | 6,600 | 6,600 |

| Turkey | 1,900 | 6,600 |

| Brazil | 390 | 6,600 |

| United Arab Emirates | 880 | 5,400 |

| Thailand | 1,600 | 5,400 |

| Morocco | 4,400 | 5,400 |

| Philippines | 3,600 | 5,400 |

| Pakistan | 1,000 | 5,400 |

| Peru | 880 | 4,400 |

| Bangladesh | 480 | 4,400 |

| United States | 2,400 | 4,400 |

| Singapore | 1,300 | 4,400 |

| Australia | 480 | 4,400 |

| Poland | 880 | 3,600 |

| Indonesia | 1,300 | 3,600 |

| Vietnam | 880 | 2,900 |

| Nigeria | 2,400 | 2,900 |

| Ethiopia | 70 | 2,900 |

| Ecuador | 480 | 2,400 |

| Uzbekistan | 480 | 2,400 |

| Hong Kong | 590 | 2,400 |

| Saudi Arabia | 260 | 2,400 |

| United Kingdom | 260 | 2,400 |

| Taiwan | 260 | 2,400 |

| South Africa | 1,300 | 2,400 |

| Malaysia | 1,300 | 1,900 |

| Uruguay | 170 | 1,900 |

| Switzerland | 210 | 1,900 |

| Jordan | 1,600 | 1,600 |

| Algeria | 1,900 | 1,600 |

| Italy | 170 | 1,600 |

| Sweden | 140 | 1,600 |

| Mexico | 590 | 1,600 |

| Bolivia | 1,000 | 1,600 |

| Spain | 1,600 | 1,300 |

| Netherlands | 140 | 1,300 |

| Venezuela | 170 | 1,000 |

| Tanzania | 590 | 1,000 |

| Ireland | 480 | 1,000 |

| Sri Lanka | 480 | 880 |

| Cyprus | 260 | 880 |

| Canada | 170 | 880 |

| Portugal | 1,300 | 880 |

| Botswana | 390 | 880 |

| Greece | 90 | 720 |

| Austria | 480 | 720 |

| Chile | 390 | 720 |

| Ghana | 110 | 590 |

| New Zealand | 210 | 590 |

| France | 90 | 590 |

| Kenya | 40 | 480 |

| Mauritius | 140 | 480 |

| Dominican Republic | 110 | 390 |

| Japan | 590 | 320 |

| Egypt | 170 | 260 |

| Panama | 90 | 260 |

| Uganda | 110 | 260 |

| Cambodia | 170 | 260 |

| Mongolia | 90 | 210 |

| Costa Rica | 170 | 170 |

33,100 1st | |

2,400 2nd | |

6,600 3rd | |

6,600 4th | |

5,400 5th | |

4,400 6th | |

4,400 7th | |

480 8th |

Similarweb shows a similar story when it comes to August 2025 website visits with IC Markets receiving 2,290,000 visits vs. 584,533 for FxPro.

3. Reviews

As shown below, IC Markets holds an outstanding Trustpilot rating of 4.8 out of 5, based on over 46,700 reviews. FxPro has a solid rating of 4.3 out of 5, from more than 1,000 reviews. IC Markets is widely favored for its reliability and customer satisfaction, while FxPro offers a strong trading experience but receives more mixed feedback. For traders prioritizing speed, support, and simplicity, IC Markets stands out.

Our Stronger Trust and Regulation Verdict

It’s deadlock for both IC Markets and FxPro on the account of their stronger trust and regulation.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

6. Top Product Range And CFD Markets – IC Markets

A diverse product range and extensive selection of CFDs enhance forex trading by offering more options like forex pairs, commodities, indices, and cryptocurrencies. This variety helps traders diversify portfolios and adapt strategies, boosting profitability. Access to a wide selection of financial instruments increases flexibility and creates a dynamic trading experience, making diversification easy and rewarding.

Navigating the expansive realm of CFD trading, I recognize that the variety of products and markets available can truly be transformative for traders. FxPro and IC Markets are leaders in this space, each offering a comprehensive selection of CFDs, products, and markets. IC Markets is particularly notable for its MT5 platform and its acclaimed “Best Standard Account,” which equips traders with a vast array of trading options. FxPro, with its extensive market reach, ensures that traders have access to diverse instruments, establishing it as a formidable player in CFD trading.

In the ever-evolving landscape of forex trading, being updated with the latest trends and news is non-negotiable. Recent insights reveal a bullish trend reversal for EUR/USD, GBP/USD, and AUD/USD, with significant resistance levels being breached. The EUR/USD pair is advancing into its key resistance area, while GBP/USD has confirmed a medium-term bottoming formation, setting its sights on higher targets. Likewise, AUD/USD has transitioned from a medium-term bearish trend to a bullish trajectory, aiming for elevated targets. These developments underscore the dynamic nature of the forex market and the vital importance of staying informed.

The competitive environment of CFD trading is heavily shaped by the diversity of product offerings. FxPro and IC Markets have made impressive advancements, granting traders a multitude of options. Staying informed about the latest forex trends and news, including the recent bullish trend reversals in major currency pairs, is imperative for making astute trading decisions. As the forex market continues to evolve, traders must remain vigilant and adaptable to seize emerging opportunities.

| CFDs | FxPro | IC Markets |

|---|---|---|

| Forex Pairs | 69 | 61 |

| Indices | 18 | 23 Spot Indices 3 Index Futures |

| Commodities | 8 Metals (3 x Gold) 3 Energies | 4 Precious Metals (gold vs 6 flats) 3 Energies 3 Energy futures 14 Soft commodity futures |

| Cryptocurrencies | 28 | 18 |

| Share CFDs | 2031 | 2100+ |

| ETFs | 18 (11 futures) | 3 NASDAQ 33 NYSE |

| Bonds | No | 12 |

| Futures | No | Yes |

| Treasuries | No | Yes |

| Investments | No | Yes |

Our Top Product Range and CFD Markets Verdict

IC Markets, indisputably, tops this category thanks to their top product range and CFD markets.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

7. Superior Educational Resources – IC Markets

In forex trading, access to quality educational resources is crucial for success. Beginners and experienced traders benefit from webinars, articles, and courses that sharpen strategies and enhance decision-making. Continuous learning is essential, and brokers providing comprehensive education empower clients to navigate the market confidently. A solid educational foundation improves skills and enhances the trading experience.

In the ever busy and active world of forex trading, the importance of educational resources is undeniable. FxPro and IC Markets have both recognized this opportunity and invested significantly in delivering exceptional educational materials. FxPro provides a comprehensive range of educational resources, including webinars, tutorials, and e-books that cater to traders of all levels. IC Markets complements this with an extensive library of video tutorials, specifically designed for visual learners. Additionally, both brokers offer regular market analysis, ensuring traders remain updated on the latest market trends and insights.

- FxPro offers a comprehensive educational section, complete with webinars, tutorials, and e-books.

- IC Markets, on the other hand, boasts an extensive library of video tutorials, ensuring visual learners are catered for.

- Both brokers provide regular market analysis, helping traders stay updated with the latest market trends.

- FxPro’s educational content is tailored for traders of all levels, from beginners to professionals.

- IC Markets offers a demo account, allowing traders to practice their strategies without risking real money.

- Both brokers have a dedicated FAQ section addressing common queries and concerns of traders.

Current forex trading trends point to an optimistic outlook for major currency pairs such as EUR/USD, GBP/USD, and AUD/USD. The EUR/USD pair has demonstrated remarkable resilience, pushing deeper into its key resistance area, while GBP/USD has confirmed a medium-term bottoming formation, poised for higher levels. Likewise, AUD/USD has transitioned from a medium-term bearish phase to a bullish trend, setting its sights on elevated targets. These trends underscore the necessity of staying informed and adapting strategies to leverage the latest market developments.

Education is undeniably the cornerstone of successful trading. Both FxPro and IC Markets have prioritized providing their traders with the finest educational resources available. Whether you’re a newcomer eager to embark on your trading journey or an experienced trader looking to sharpen your skills, both brokers are equipped to meet your needs. Armed with the latest market analysis and educational tools, traders can make informed decisions and seize emerging opportunities in the ever-evolving forex market.

Our Superior Educational Resources Verdict

IC Markets, positively, brings home the gold in this segment on the account of their superior educational resources.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

8. Superior Customer Service – IC Markets

In forex trading, quality customer support is crucial. Reliable help boosts trader confidence and security. Top brokers provide 24/7 assistance via live chat, phone, and email in multiple languages. Efficient service not only keeps traders on track but also fosters trust, enhancing the overall trading experience.

FxPro and IC Markets provide excellent communication channels for traders. FxPro offers a multilingual support team available via live chat, email, or phone 24/5. However, IC Markets stands out with its 24/7 customer support across all mediums, ensuring traders have access to assistance whenever they require it. This round-the-clock service significantly enhances the trading experience.

Regarding educational resources, FxPro’s offerings are not as robust as those of IC Markets. While FxPro provides a few articles and videos focused on trading strategies and basic introductions for novice traders, IC Markets takes the lead with an extensive library tailored for all levels of expertise. From trading platform tutorials to webinars, educational videos, and in-depth articles on risk management and technical analysis, IC Markets equips traders with the knowledge they need to succeed.

Current forex trading trends reflect a bullish sentiment toward key currency pairs like EUR/USD, GBP/USD, and AUD/USD. The EUR/USD pair demonstrates resilience and is pushing deeper into its key resistance levels, while GBP/USD has confirmed a medium-term bottoming pattern, setting its sights on higher targets. AUD/USD has also transitioned from a bearish stance to a bullish outlook, aiming for increased targets. These trends underscore the necessity for traders to stay informed and adjust their strategies to align with market changes. Both FxPro and IC Markets empower their traders with top-notch educational resources and support, positioning them to make informed decisions and seize opportunities in the dynamic forex market.

| Feature | FxPro | IC Markets |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 9/5 | 24/7 |

| Multilingual Support | Yes | Yes |

Our Superior Customer Service Verdict

Clearly, IC Markets ranks highest in this category this is due to their superior customer service.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

9. Better Funding Options – IC Markets

Flexible funding options in forex trading are crucial. Traders need quick ways to deposit and withdraw, with top brokers providing choices like bank transfers, cards, digital wallets, and cryptocurrencies, often with low or no fees. A seamless process enhances trading and allows focus on executing strategies.

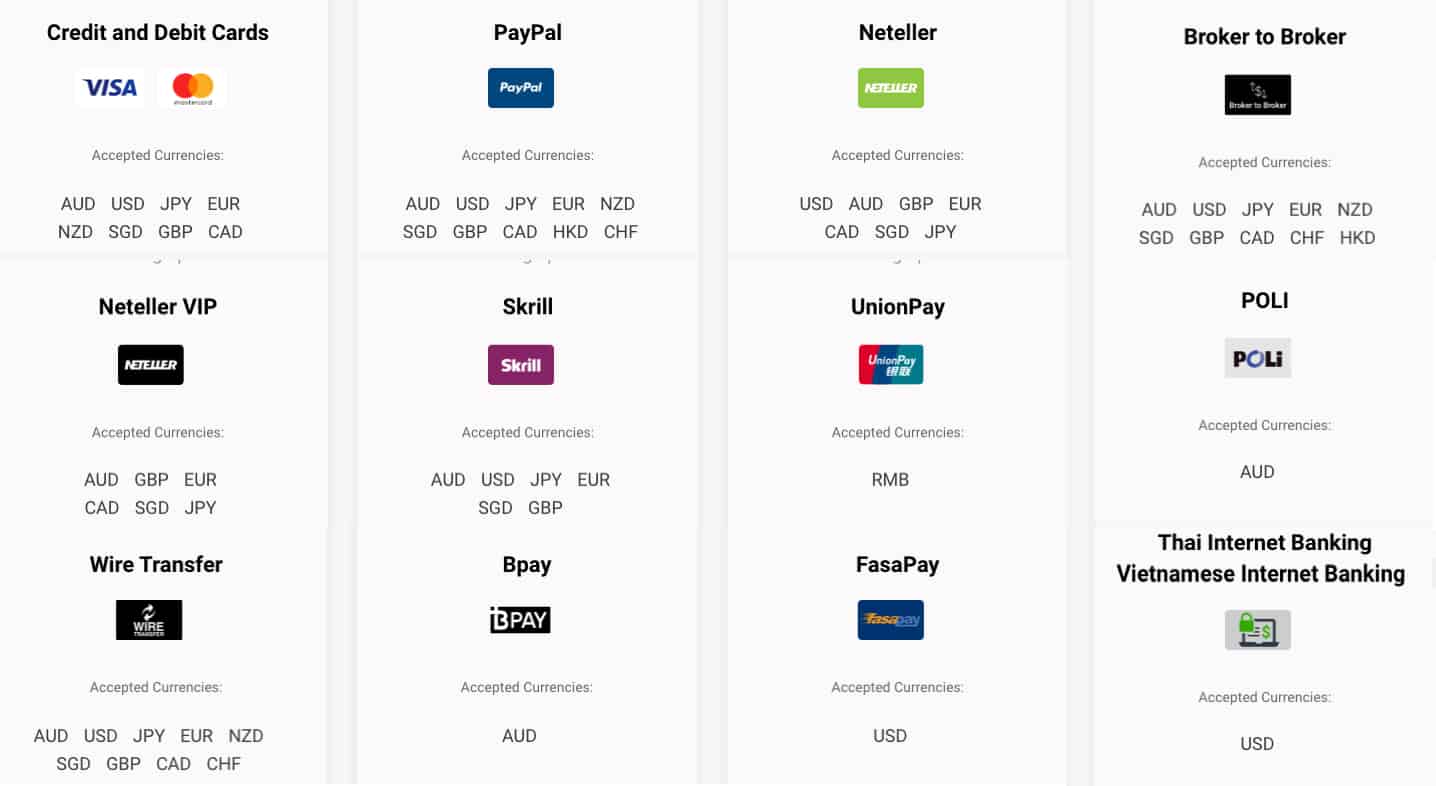

When trading CFDs with FxPro, it’s important to understand that funding methods differ based on the subsidiary with which a customer is registered. FxPro Cyprus and Bahamas clients enjoy a variety of funding options, including bank transfers, broker-to-broker transfers, credit cards (Visa and Mastercard), Skrill, Neteller, and Union Pay. Additionally, Cyprus clients can utilize PayPal. On the other hand, FxPro UK clients face restrictions, limited to bank transfers, broker-to-broker transfers, or credit cards, as e-wallet options are not available. This limitation can hinder UK traders who prefer more versatile funding methods.

In comparison, IC Markets stands out by offering a more extensive range of deposit and withdrawal methods, with 15 options available. These encompass traditional methods such as debit and credit cards, broker-to-broker transfers, wire transfers, and internet banking, as well as e-wallet options like PayPal, Neteller, Neteller VIP, Skrill, Bpay, FasaPay, and POLi. The variety of accepted currencies may differ across payment methods, providing traders with enhanced flexibility and convenience.

| Funding Option | FxPro | IC Markets |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | No | Yes |

| Klarna | No | No |

Current forex trading trends present a bullish outlook for major currency pairs, including EUR/USD, GBP/USD, and AUD/USD. The EUR/USD pair has demonstrated notable resilience, moving deeper into its key resistance area. Meanwhile, GBP/USD has confirmed a medium-term bottoming formation, setting its sights on higher targets. Similarly, AUD/USD has transitioned from a medium-term bearish trend to a bullish trend, aiming for upward momentum. These trends emphasize the necessity of staying informed and adapting strategies to align with the latest market developments. Both FxPro and IC Markets equip their traders with top-notch educational resources and support, empowering them to make informed decisions and seize emerging opportunities in the dynamic forex market.

Base Currencies

- FxPro offers 8 base currencies: AUD, USD, CHF, GBP, EUR, PLN, AUD and JPY.

- IC Markets offers 10 base currencies: AUD, USD, EUR, GBP, CHF, CAD, NZD, SGD, HKD, and JPY.

Our Better Funding Options Verdict

IC Markets rides high in this field thanks to their better funding options.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

10. Lower Minimum Deposit – FxPro

Forex trading can be affordable for beginners with low minimum deposits. IC Markets and FxPro offer flexible options, enabling small starts while gaining experience. This accessibility encourages participation and strategy development without significant financial risk, making forex more practical for all traders.

FxPro sets itself apart with a lower minimum deposit requirement of $100, in contrast to IC Markets, which demands a $200 minimum. While FxPro allows traders to begin with just $100, it advocates for a minimum deposit of $1,000 to enhance the trading experience. This advice aims to equip traders with superior leverage and greater flexibility in their trading strategies.

In today’s dynamic forex trading environment, it is essential to remain vigilant about the latest trends and developments. Current insights reveal an upward trajectory for major currency pairs, including EUR/USD, GBP/USD, and AUD/USD. The EUR/USD pair demonstrates strength as it advances into a crucial resistance zone. Meanwhile, GBP/USD signifies a potential medium-term bottom and is targeting higher levels. Additionally, AUD/USD has transitioned from a bearish to a bullish trend, setting its sights on elevated targets. These trends underscore the necessity of staying informed and adjusting strategies in response to ongoing market changes.

Both FxPro and IC Markets commit to providing their traders with top-notch educational resources and support. This empowers traders to make well-informed decisions and seize new opportunities in the dynamic forex landscape. With access to the latest market analysis and educational tools, traders can approach the complexities of forex trading with assurance and accuracy.

| Minimum Deposit | Recommended Deposit | |

| FxPro | $100 | $1,000 |

| IC Markets | $200 | $200 |

Our Lower Minimum Deposit Verdict

And finally, FxPro steals the crown in this category by the reason of their lower minimum deposit.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

Is IC Markets or FxPro The Best Broker?

IC Markets outshines the contender in almost all categories because of its comprehensive offerings, lower minimum deposit, superior educational resources, and overall better trading experience.

The table below summarises the key information leading to this verdict:

| Categories | FxPro | IC Markets |

|---|---|---|

| Lowest Spreads And Fees | No | Yes |

| Better Trading Platform | No | Yes |

| Superior Accounts And Features | No | Yes |

| Best Trading Experience And Ease | No | Yes |

| Stronger Trust And Regulation | Yes | Yes |

| Top Product Range And CFD Markets | No | Yes |

| Superior Educational Resources | No | Yes |

| Superior Customer Service | No | Yes |

| Better Funding Options | No | Yes |

| Lower Minimum Deposit | Yes | No |

FxPro: Best For Beginner Traders

For those just starting out in the trading world, FxPro offers a more beginner-friendly environment with its extensive educational resources and lower minimum deposit.

IC Markets: Best For Experienced Traders

For seasoned traders looking for a wider range of products and advanced trading platforms, IC Markets stands out as the preferred choice.

FAQs Comparing FxPro Vs IC Markets

Does IC Markets or FxPro Have Lower Costs?

IC Markets generally offers lower costs when compared to FxPro. They are known for their competitive spreads, especially on major currency pairs. For instance, the average spread for the EUR/USD pair can go as low as 0.1 pips. If you’re keen on diving deeper into brokers with low commissions, you might want to check out this comprehensive guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both IC Markets and FxPro offer MetaTrader 4, but IC Markets is often preferred by traders for its enhanced features and tighter spreads on this platform. MT4 is a popular choice among traders worldwide, and its features are enhanced when used with a broker that offers competitive pricing. For a detailed comparison of the best MT4 brokers, you can visit this best MT4 brokers guide.

Which Broker Offers Social Trading?

IC Markets stands out when it comes to offering social trading features, allowing traders to follow and copy the strategies of successful traders. Social trading has become a popular trend in the forex world, enabling traders to leverage the expertise of others. If you’re interested in exploring more about social trading platforms, here’s a detailed review of the best social trading platforms.

Does Either Broker Offer Spread Betting?

FxPro offers spread betting for its UK clients, allowing them to take advantage of price movements without owning the underlying asset. Spread betting is a tax-efficient way to trade, especially in the UK, as profits are exempt from capital gains tax. If you’re keen to explore more about spread betting, you might want to check out this comprehensive guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, IC Markets stands out as the superior choice for Australian forex traders. Founded in Sydney, IC Markets is ASIC regulated, ensuring a high level of trust and security for its clients. The broker offers competitive spreads and a wide range of trading instruments. Moreover, being an Australian-founded broker, they have a deep understanding of the local market dynamics. For a broader perspective on the best brokers in Australia, you can visit this Best Forex Brokers In Australia page.

What Broker is Superior For UK Forex Traders?

For UK traders, I believe FxPro offers a superior trading experience. They are FCA regulated, ensuring the highest standards of security and trust for their clients. While IC Markets is a strong contender globally, FxPro’s deep roots in the UK market and their comprehensive offerings make them a top choice for UK traders. Their commitment to transparency and customer service is commendable. If you’re looking for more insights on the best brokers in the UK, here’s a detailed review of the Best Forex Brokers In UK.

Article Sources

No commission account spread proprietary testing data and published website spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert