GO Markets Review Of 2026

GO Markets introduced the GO Plus+ forex trading account. We take a look at their 0.0 pip spreads, the MT4 trading platform, strong customer support and a range of currency pairs backed by ASIC regulation including segregated clients’ funds.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

GO Markets Summary

| 🗺️ Tier 1 Regulation | ASIC, CySEC |

| 🗺️ Tier 3 Regulation | FSA-S, FSC-M |

| 💰 Trading Fees | Low Spreads |

| 📊 Trading Platforms | MT4, MT5, cTrader |

| 💰 Minimum Deposit | $200 (recommended) |

| 💰 Withdrawal Fees | $0 |

| 🛍️ Instruments Offered | Forex, Shares CFD, Cryptos, Indices, Commodities |

Why Choose GO Markets

In a competitive market, where it can be difficult to differentiate between forex brokers, GO Markets stands out for their extra low commission cost. Founded in Melbourne, Australia in 2006, Go Markets has no-dealing desk with STP-style execution meaning some forex pairs have 0 pips spreads.

Execution speeds are low too, with a minimum execution speed of 50ms and an average of 80ms. In our recent Execution Speeds test of forex brokers, the average execution speed of the top brokers was below 100ms, putting GO Markets in a very competitive position. Traders can choose between MetaTrader 4 and MetaTrader 5 when trading 49 forex pairs along with a wealth of other CFD products and share equities for Australian traders.

GO Markets Pros and Cons

- Tight spreads from 0.0 pips

- MetaTrader 4 and 5 support

- Wide range of CFDs

- Limited cryptocurrency options

- No fixed spread accounts

- Higher fees on minor pairs

Open Demo AccountOpen Live Account

*Your capital is at risk ‘72% of retail CFD accounts lose money’

The overall rating is based on review by our experts

Trading Fees

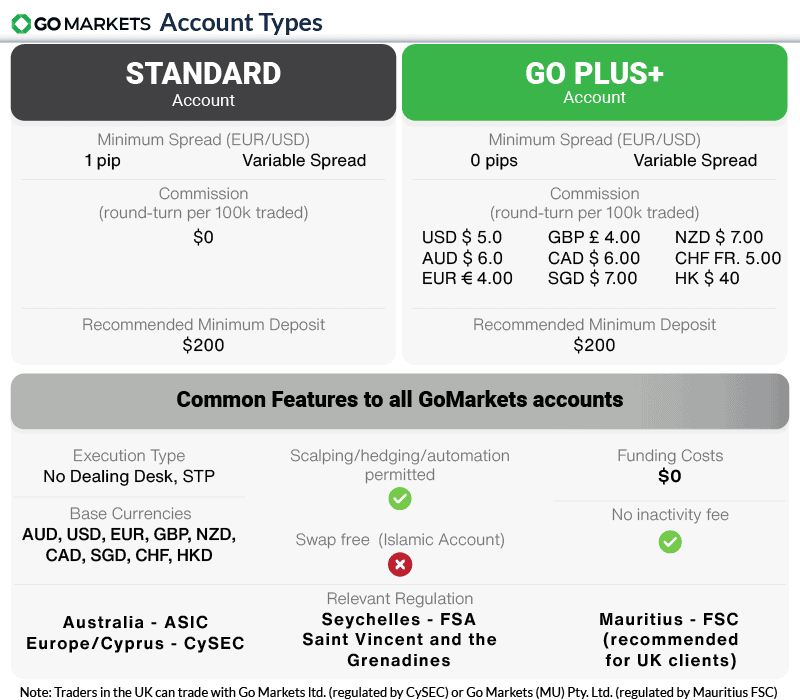

GO Markets is a no-dealing desk, STP-type broker that offers two types of retail investor accounts:

- Standard Account

- Go Plus+ Account

1. Raw Account Spreads

Go Markets Plus Account is the broker’s true no-dealing desk account with commission costs in place of a widened spread. As this is GO Markets’ standout account, we list this account first.

When comparing spreads from the GO Markets Plus+ account with other STP/ECN pricing brokers, GO Markets offers lower commissions than most competitors. While Go Markets Plus+ spreads already compare well against their competitors for most currency pairs, they may actually be cheaper when one takes into account the lower commission cost.

Given GO Markets spreads match or closely match most currency pairs compared with other brokers, the broker’s spreads compare very favourably.

ECN Forex Spread Comparison | |||||

|---|---|---|---|---|---|

| 0.10 | 0.20 | 0.20 | 0.30 | 1.00 |

| 0.14 | 0.31 | 0.39 | 0.51 | 0.75 |

| 0.06 | 0.20 | 0.10 | 0.10 | 0.20 |

| 0.10 | 0.10 | 0.30 | 0.30 | 1.30 |

| 0.90 | 0.13 | 0.14 | 0.14 | 0.14 |

| 0.30 | 0.40 | 0.60 | 0.30 | 0.50 |

| 0.10 | 0.20 | 0.20 | 0.30 | 0.20 |

| 0.16 | 0.29 | 0.59 | 0.24 | 0.68 |

| 0.20 | 0.40 | 0.60 | 0.30 | 0.70 |

| 0.80 | 0.40 | 0.50 | 0.40 | 0.90 |

| 0.10 | 0.50 | 2.00 | 0.60 | 0.40 |

| 0.51 | 1.15 | 0.66 | 0.64 | 1.28 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

The spreads on this account are tighter than the standard average, except for the EUR/JPY pair but only by a small margin.

| Raw Account Spreads | GO Markets | Average Spread |

|---|---|---|

| Overall | 0.42 | 0.74 |

| EUR/USD | 0.1 | 0.21 |

| USD/JPY | 0.3 | 0.39 |

| GBP/USD | 0.2 | 0.48 |

| AUD/USD | 0.2 | 0.39 |

| USD/CAD | 0.5 | 0.53 |

| EUR/GBP | 0.3 | 0.55 |

| EUR/JPY | 1.0 | 0.74 |

| AUD/JPY | 0.6 | 1.07 |

| USD/SGD | 0.6 | 2.34 |

Spreads for this account start from 0.0 pips, nothing unusual in a competitive market but what is impressive is the low commission costs the broker charges.

Use the calculator below to compare GO Markets’ trading costs with competitors such as Pepperstone, Eightcap and CMC Markets adjusting for trade size, currency pair, and base currency.

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

2. Raw Account Commission Rate

GO Markets commissions are USD 2.50 / AUD 3.00 per side and USD$5.00 / $6.00 round-turn, which is among the best in the industry. A commission of $3.50 per side and a $7.00 round-turn is relatively standard among most brokers. This means you are paying $1 less per round-turn when you close your trading position, which will save you a lot over time.

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| GO Markets Commission Rate | $2.50 | $3.00 | £2.00 | €2.00 |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

Anyone can use this account and it is the best choice to save on trading costs. High-volume traders in particular will benefit when using this account as frequent trading can see your commission costs add up since you pay for each lot when you enter and exit the market.

3. Standard Account Fees

The Standard Account is commission-free, with spreads starting at 1 pip for major Forex pairs, which is average for the industry.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| GO Markets Average Spread | 0.9 | 1.1 | 1.0 | 1.0 | 1.3 | 1.1 | 1.5 | 1.4 |

| Industry Average Spread | 1.2 | 1.5 | 1.6 | 1.5 | 1.8 | 1.6 | 1.9 | 2.1 |

This account is ideal for beginner forex traders given that the main charge is primarily in the spreads. As such, you don’t need to factor in commissions when working out brokerage.

General Account Information

On both accounts, scalping, hedging and automation are all permitted by the broker, which is good news for day traders with a little more experience.

Unfortunately, for those of the Islamic faith, GO Markets doesn’t offer a swap-free or Islamic account.

You can, however, open a demo account to practice trading if you’re not confident opening a live account yet. This account is free to open, gives you $50,000 in virtual funds and lets you trade on most markets, other than share CFDs, using real-time spreads.

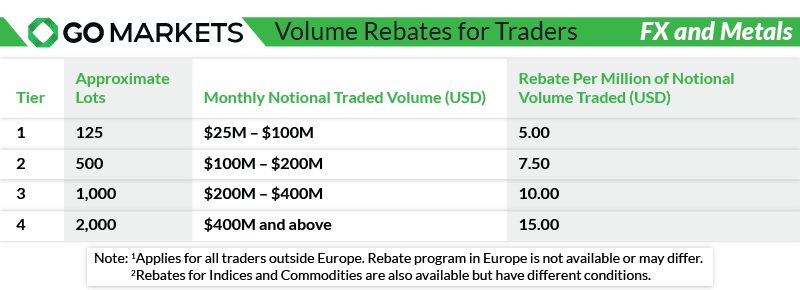

Volume Rebates For Traders

Regardless of whether you are using Go Markets Go Plus+ or Standard account, the broker offers rebates for traders meeting minimum monthly volume conditions spanning across Forex & Metals, Indices, and Commodities.

As an example, for forex or metals, you will need to trade a minimum of $25 million every month to qualify for a rebate. Once this level is reached, you will receive $5 to $15 in rebates. These rebates will be credited to your trading account in the first week of the next calendar month.

See the table below for Forex & Metals rebates. Rebates for indices and commodities are also available but at different rates.

To get rebates, you will need to sign up with Go Markets and then contact your account manager. Traders with the Go Markets European affiliate may have different rebate conditions.

4. Other Fees

Deposits and withdrawals are free of charge, and there are no inactivity fees at GO Markets.

Verdict Of GO Markets Fees

Overall, GO Markets has spreads that are in line with or better than the industry, and competitive commissions , making it ideal for traders looking for low fees. If you are an active trader, you also get the benefit of receiving rebates for high-volume trading, meaning further savings.

Open a demo accountVisit GO Markets

*Your capital is at risk ‘72% of retail CFD accounts lose money’

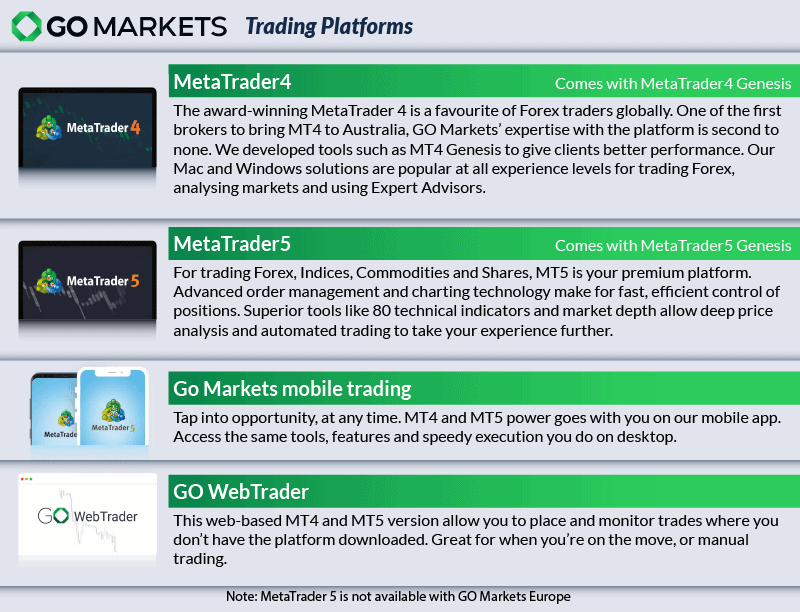

Trading Platforms

GO Markets specialises in the MetaTrader platforms. Not only does the broker offer the full MetaTrader suite, which includes both MetaTrader 4 and MetaTrader 5, but you can also access Genesis. This is a suite of tools that enhances the MetaTrader platform experience.

| Trading Plaform | Available With GO Markets |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | Yes |

| TradingView | Yes |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

Both MT4 and MT5 are available for mobile trading on Android or iOS compatible devices, on desktop for windows or mac PCs and as a WebTrader.

MetaTrader 4

The MT4 platform is the most popular forex platform globally and GO Markets is one of the first brokers to introduce the platform in Australia. Key features of the platform include:

- Trading across forex, commodities and indices

- +61 technical analysis objects and indicators

- Automated trading through Expert Advisors (EAs)

- 30 built-in indicators that monitor market movements

While not as intuitive as other platforms, the MetaTrader 4 interface is functional. The platform was designed with de-centralised trading in mind, hence why it is popular for forex trading. This, combined with the fast execution speed is the founding reason for the MT4 platform’s popularity.

The other key strength is the Expert Advisors (EAs). EAs allow you to buy and sell trading applications to automatically trade on the market. With the MT4 platform being the most popular, this marketplace has the most applications available worldwide.

Overall, the MT4 platform is suited for currency markets but is limited to share trading. Other than that, the platform is great for those considering automation and purchasing algorithmic packages from developers. Choosing the MT4 platform also makes it easy to switch providers, as the best forex brokers mostly offer the MetaTrader 4 platform.

MetaTrader 5

MetaTrader 5 is an upgrade of MT4, in nearly every way. MT5 allows you to trade on centralised exchanges, which means a bigger range of share CFDs, in particular. The platform also gives you access to a greater range of advanced trading tools, including:

- 80+ technical analysis objects and indicators

- 21 timeframes

- Market depth insights

- Exchange trading (particularly shares)

- One-Click trading

- EAs, scalping and day trading available

While MetaTrader 5 is slightly newer than MetaTrader 4, it shouldn’t be viewed as a better platform. Rather, a trader should view this as a different trading platform where MetaQuotes have focused on an integrated trading experience. This means that instead of just focusing on forex trading, the platform has a balanced trading experience for shares (stocks), futures and CFDs.

Overall, if you are looking to trade more than just currency markets on a regular basis, you may want to consider MT5 over MT4.

Genesis (For MT4 and MT5)

An exclusive bonus for GO Markets clients is the ability to upgrade your MetaTrader platforms using Genesis. This is available when opening a new account and depositing $500 or more. From here, you simply need to opt-in and fill out a short form to request MT4 genesis access. The key strengths of upgrading to MT4 Genesis are:

- Access to MT4 and MT5 add-ons that enhance a trader MetaTrader 4 and 5 experience

- Enhanced order management setup

- Alert system based on existing trades or market conditions

cTrader

GO Markets has recently (as of 2024), introduced cTrader as an additional trading platform to their existing suite of MetaTrader platforms. cTrader is a solid alternative as a third-party trading platform, with advanced trading capabilities, especially for order management. The platform offers fast order entry and execution, depth of market features, showing the full range of executable prices, and top risk management tools. Additional advanced order protection tools include:

- Choice of trigger methods (pending orders and stop loss)

- Two stop-out types (including Smart Stop-Out)

- Quick trade

- Volume tooltips

- Symbol info

- Market snapshot

- Unlimited watchlists

- Live market sentiment indicator

- Email alerts

Share Trading

GO Markets also offers a share trading platform for Australian clients. This platform is available on mobile and as a WebTrader, which adds further diversity to its platform suite.

Available exclusively for shares and ETFs listed on the ASX in Australia. Secure and reliable, the platform allows you to access market data and news as well as a choice of insightful tools. You will need to search TradeCentre by FinClear Technology to find the GO Markets app on your Apple or Android store.

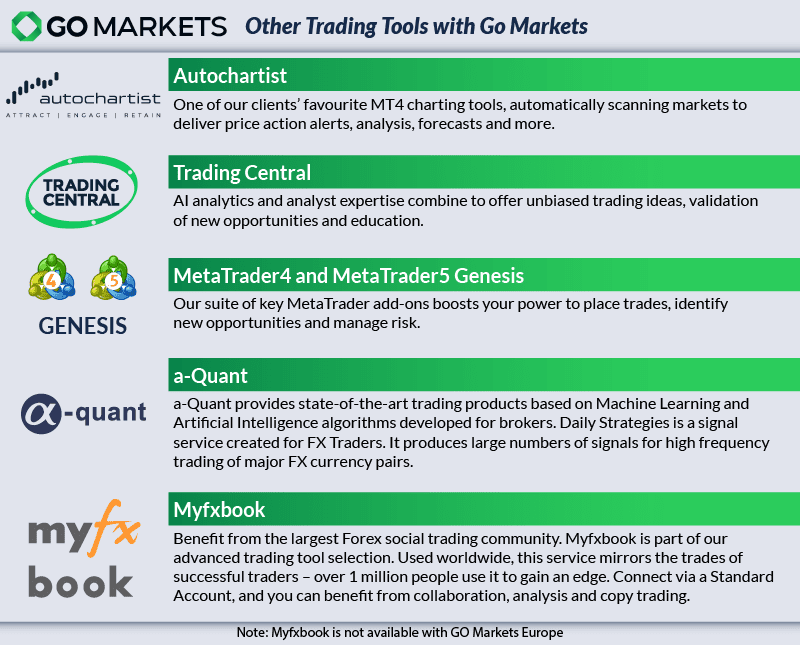

Other Trading Tools with GO Markets

In addition to a great range of trading platforms, GO Markets offers useful social and copy trading tools and platform add-ons to improve your trading strategies. These include Autochartist, Trading Central, Genesis, a-Quant and Myfxbook.

You can also link with a fast, reliable server using a VPS (Virtual Private Server) on both MT4 and MT5.

Autochartist

Autochartist is a great charting tool for technical analysis. Features of Autochartist include algorithms that automatically scan the markets 24 hours a day, a customisable search pane and a built-in price movement scanner. The benefits of Autochartist are that you get chart pattern recognition, faster analysis, alerts and flexibility for potential trading opportunities. You can integrate this tool with your MT4 platform.

Trading Central

Trading Central, which combines AI technology and expert analysis, helps scan the markets for trading opportunities. The platform offers sophisticated technical and fundamental analysis, as well as back-tested trading strategies and premium analytics for chart interactions. Additional features include:

- Analyst Views (market research from experienced senior analysts)

- Newsletters (investment insight)

- Alpha Generation (pattern recognition indicators)

- TC Research Platform (Trading Central’s research dashboard)

Genesis

As mentioned, the MetaTrader upgrade, Genesis, provides the biggest trading tool advantage that GO Markets offers. This is a full suite of tools that enhances your MetaTrader platform’s power. Key features include a sophisticated order management system, alerts, insights and market sentiment. There is also a range of EAs (expert advisors), to help identify market opportunities.

a-Quant

a-Quant, like Trading Central, uses AI and machine learning to develop algorithms for brokers. The platform aggregates millions of data points to produce high-probability trading signals of certain risk/reward characteristics. A key feature of a-Quant is Daily Strategies, which generates 9-12 signals per day for 10 popular FX currency pairs that are delivered straight to your inbox.

Myfxbook

Myfxbook is a Forex-specific social trading platform with millions of expert traders to copy from. All expert traders on the platform have a demonstrable history of successful trades, giving them a level of trust and authority. You can easily control your auto-copied trades, which is useful during volatile market conditions. There is also a range of tools for accurate analysis and statistics.

Note: Myfxbook is not available for clients of GO Markets in Europe.

4X Solutions

Recently added to GO Markets’ suite of trading tools, 4X Solutions is an advanced technology provider, specialising in copy trading. 4X Solutions features award-winning copy technology, fast and stable infrastructure and risk management powered by machine learning. Other key features of the platform include high-frequency trading capabilities, automated monitoring and pending order support. In addition, 4X Solutions offers top risk management features for money management, capital protection, restricting specific currency pairs and multiple master accounts.

Open a demo accountVisit GO Markets

*Your capital is at risk ‘72% of retail CFD accounts lose money’

Is GO Markets Safe?

GO Markets has a trust score of 61, based on its regulation, reputation, and reviews.

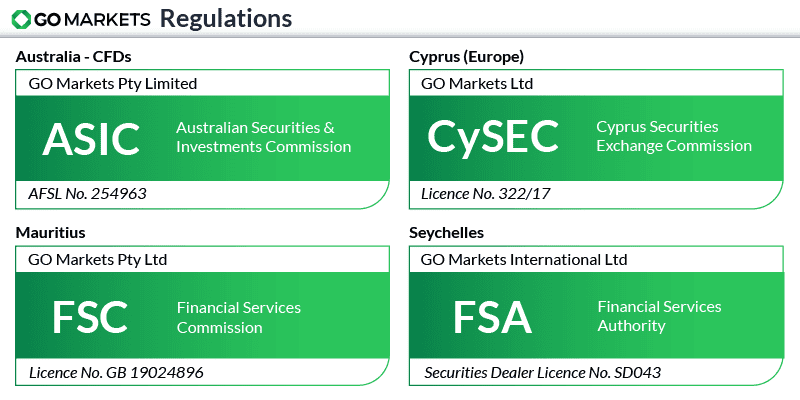

1. Regulation

GO Markets is licensed to offer financial services under an Australian Financial Services Licence (AFSL). The broker also holds licenses from two tier-1 regulators and two tier-3 regulatory authorities globally, giving traders from multiple regions access to its services.

| GO Markets Safety | Regulators |

|---|---|

| Tier-1 | ASIC (Australia) - Australian Securities and Investments Commission CySEC (Cyprus) - Cyprus Securities and Exchange Commission |

| Tier-2 | X |

| Tier-3 | FSA (Seychelles) - Financial Services Authority FSC (Mauritius) - Financial Services Commission |

Having multiple regulators not only proves GO Markets’ trustworthiness but also means the broker can offer financial services to traders globally.

One thing to note is that GO Markets is not regulated in the UK by the Financial Conduct Authority. Clients in the UK wanting to join GO Markets can choose between GO Markets European subsidiary or GO Markets Seychelles subsidiary.

Choosing the European subsidiary does mean the broker needs to comply with the higher-level requirements set by CySEC. On the other hand, choosing the broker’s Seychelles-based subsidiary means the ability to trade with cryptos and a leverage of up to 500:1 for Forex.

2. Reputation

GO Markets was founded in Melbourne, Australia in 2006. The broker maintains a modest profile in the online forex trading space. With approximately 4,000 monthly Google searches, it ranks as the 60th most popular forex broker among the 65 brokers analyzed. Web traffic data shows a slightly better positioning, with Similarweb reporting 50,000 global visits in February 2024, placing GO Markets as the 55th most visited broker.

They are one of the early adopters of the MetaTrader platform in the Australian market. While the broker doesn’t publicly disclose its client numbers or trading volumes, its limited search and traffic metrics suggest a niche operator with a specialized rather than mass-market presence. Despite this modest online visibility, GO Markets has expanded its regulatory footprint to include oversight from authorities in Australia, Cyprus, and the Seychelles, supporting its international operations.

| Country | 2025 Monthly Searches |

|---|---|

| Mexico | 27,100 |

| United States | 12,100 |

| Vietnam | 9,900 |

| Indonesia | 2,400 |

| Australia | 2,400 |

| Canada | 1,000 |

| France | 1,000 |

| India | 880 |

| Thailand | 880 |

| United Kingdom | 480 |

| Poland | 480 |

| Malaysia | 480 |

| Philippines | 390 |

| Turkey | 390 |

| Egypt | 390 |

| Taiwan | 320 |

| Dominican Republic | 320 |

| Italy | 260 |

| Argentina | 260 |

| Hong Kong | 260 |

| Spain | 210 |

| Brazil | 210 |

| Pakistan | 210 |

| Chile | 210 |

| Costa Rica | 210 |

| Japan | 170 |

| Singapore | 170 |

| Germany | 140 |

| Colombia | 140 |

| Uzbekistan | 140 |

| Ecuador | 140 |

| Mongolia | 140 |

| South Africa | 110 |

| Peru | 110 |

| Greece | 90 |

| Nigeria | 90 |

| Algeria | 90 |

| Netherlands | 70 |

| United Arab Emirates | 70 |

| Cambodia | 70 |

| Ireland | 50 |

| New Zealand | 50 |

| Sri Lanka | 50 |

| Saudi Arabia | 40 |

| Cyprus | 40 |

| Portugal | 30 |

| Bangladesh | 30 |

| Venezuela | 30 |

| Panama | 30 |

| Switzerland | 20 |

| Sweden | 20 |

| Morocco | 20 |

| Kenya | 20 |

| Mauritius | 20 |

| Austria | 10 |

| Jordan | 10 |

| Bolivia | 10 |

| Ghana | 10 |

| Uganda | 10 |

| Uruguay | 10 |

| Tanzania | 10 |

| Ethiopia | 10 |

| Botswana | 10 |

27,100 1st | |

12,100 2nd | |

9,900 3rd | |

2,400 4th | |

2,400 5th | |

1,000 6th | |

1,000 7th | |

880 8th | |

880 9th | |

480 10th |

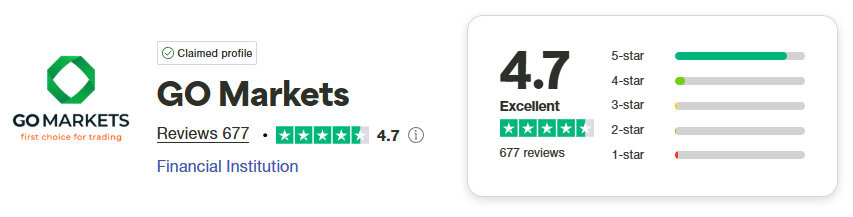

3. Reviews

GO Markets has a TrustPilot score of 4.7 out of 5.0 from 677 reviews.

Conclusion

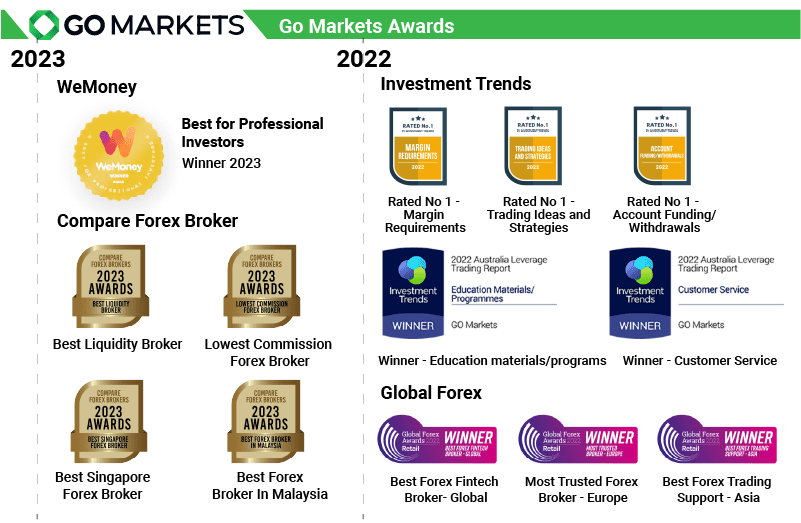

All in all, there are many reasons to choose GO Markets as your broker of choice. GO Markets is a multi-award-winning CFD and non-CFD broker, with some of the best commissions out there. That’s not all, the broker also offers tight spreads, great platforms and useful advanced tools to improve your overall trading experience. Lastly, GO Markets offers useful educational resources, has great customer support and is multi-regulated, proving it is a trusted broker to boot.

Open a demo accountVisit GO Markets

*Your capital is at risk ‘72% of retail CFD accounts lose money’

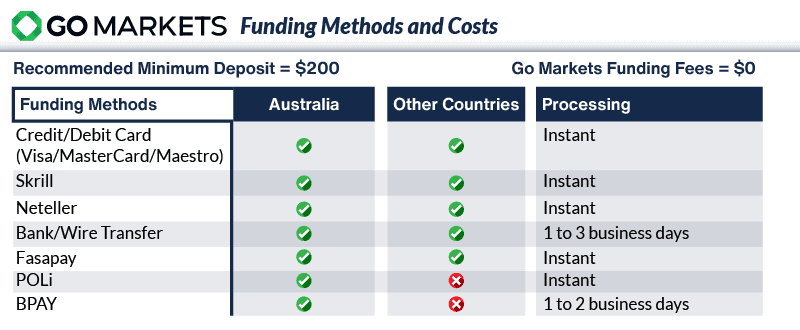

Deposit and Withdrawal

To open an account with GO Markets, there is a range of funding methods available.

What is the minimum deposit at GO Markets?

The required minimum deposit at GO Markets is $200.

Account Base Currencies

To fund your account, GO Markets allows several base currencies including AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF and HKD. It is recommended that you have a minimum deposit of $200 before you start trading however this is not required.

Deposit and Withdrawal Options and Fees

You can use more traditional methods such as wire or bank transfer, credit card, debit card, Visa, MasterCard or Maestro. Then there are the online methods including BPay, Skrill, NETELLER, Fasapay or POLi. Please note that POLi and BPay are only available in Australia as payment methods.

Each of these funding methods have various processing times, from instant to up to 3 business days depending on which you choose.

One bonus of opening a GO Markets account, is there are no funding or inactivity fees.

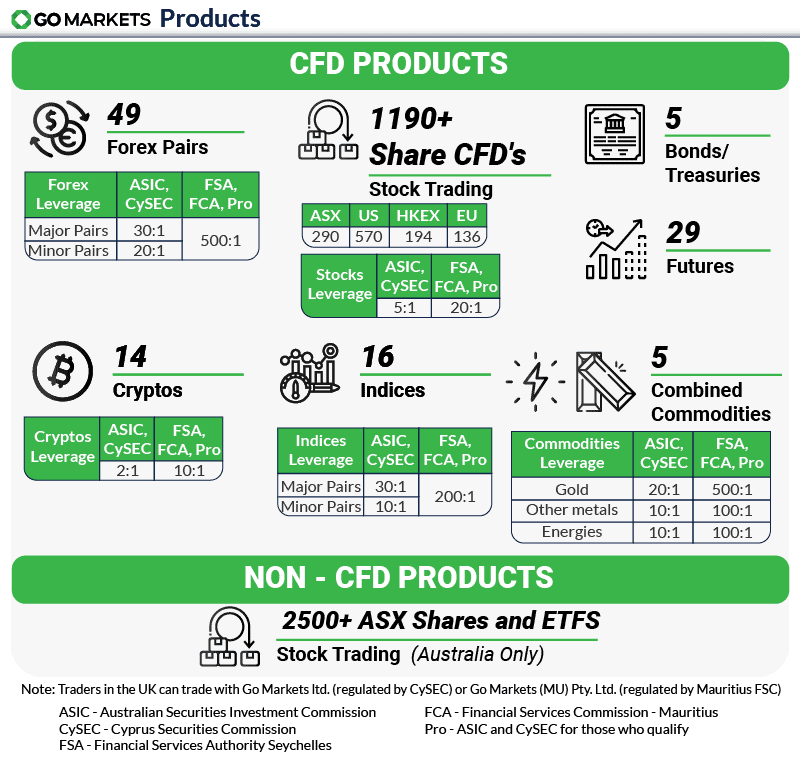

Product Range

CFDs

GO Markets offers both CFD and non-CFD (spot) trading instruments across Forex, shares, cryptocurrencies, indices, bonds, futures and commodities. CFD products available include:

- 49 Forex pairs

- 1190+ shares (CFDs) – across the Australian, US, Hong Kong and Europe stock exchanges

- 1190+ Shares (underlying)

- 16 indices

- 2 Metals (Gold and Silver)

- 3 Energies

- 14 Cryptos (including Bitcoin, Ethereum, and Litecoin)

- 14 Futures (

- 14 Futures (Gold, Silver, Copper, 2 Softs, 5 Bonds, 4 Energies)

- 5 bonds/Treasuries

Additionally, you can obtain leverage of up to 500:1 for Forex and gold, 200:1 for indices, 20:1 for stocks and 10:1 for cryptos. Leverage does depend on the regulations of that particular country. For example, you will obtain higher maximum leverage from the FCA (Financial Conduct Authority) in the UK and the FSA (Financial Services Authority) in Seychelles. If you are being onboarded through ASIC or CySEC regulators, however, you will only obtain leverage of up to 30:1.

If you are an Australian trader, you get the bonus of having access to over 2500 ASX shares and ETFs (Exchange Traded Funds). You can buy and sell ASX shares at a $7.70 flat fee per trade (for trades up to $100,000). This is a unique offering by GO Markets, not available at many other brokers.

Open a demo accountVisit GO Markets

*Your capital is at risk ‘72% of retail CFD accounts lose money’

Customer Service

Customer Service

GO Markets has the ‘gold standard’ when it comes to customer service winning the investment trends 2022 customer service award. This award is based on real traders’ responses to an industry-wide survey asking several elements about the broker(s) they trade with.

In our experience, their contact centre in February 2024 was always available, knowledgeable and fast to respond to the simple and more complicated questions we tested them with.

In addition to being 24/5, their customer support options are what traders prefer from live chat, and e-mail to the phone. For questions that arise during off-hours or are fairly basic, there’s also an excellent and easy-to-navigate FAQ section on the GO Markets website.

Awards

In addition to the 2022 customer service award, GO Markets has won several other awards in 2021 including value for money and educational materials.

Verdict On Customer Service

Based on our team’s contact with GO Markets combined with awards the broker has received, we gave GO Markets the maximum score available for Customer service. It’s evident as well that their customer support team knew more than just the basics from regulation to an in-depth understanding of the forex trading platforms they offered.

Open a demo accountVisit GO Markets

*Your capital is at risk ‘72% of retail CFD accounts lose money’

Research and Education

Go Markets has a range of research, news and educational materials for deeper market analysis. These educational materials include tutorials, webinars, courses, and a detailed FAQ section.

If you’re new to trading online, GO Markets’ video training courses and webinars will help you get started, as well as save you the expense of learning through trial and error. Even for more experienced traders, GO Markets still supports you with a daily market news feed to keep you up to date with the economic events of the world.

Final Verdict on GO Markets

Final Verdict on GO Markets

Overall, GO Markets is an incredibly strong Forex and CFD broker for traders in Australia. Great customer service, full regulation and good spreads make it an attractive option for practically any trader. GO Markets is a broker that is well worth considering, especially if you are a Forex trader.

CompareForexBroker has given GO Markets multiple awards including: The broker with the best liquidity, lowest commissions and best broker for Malaysian and Singaporean traders.

Notable features GO Markets offers include:

- Among the lowest FX commission costs in the industry

- Low-fee trading accounts with spreads from 0.0 pips

- Advanced MT4 or MT5 trading platform offering (MT4 in Europe only)

- Good range of shares for CFD trading plus share dealing in Australia

- Great range of tools for copy and auto-trading

If having read this GO Markets review, you’re interested in the platform but are still not sure about it, you should consider opening a demo GO Markets account. The demo account offers the same basic functionality as a live trading account, but involves no risk of real money. You can also check this comparison between GO Markets and Pepperstone to find out more reasons to choose GO Markets.

GO Markets FAQs

What account types does GO Markets offer?

GO Markets provides two main account types: the Standard Account and the Go Plus+ Account. The Standard Account is commission-free, while the Go Plus+ offers spreads from 0.0 pips and low commissions, making it ideal for high-volume traders.

What is the minimum deposit required for GO Markets?

GO Markets recommends a minimum deposit of $200, but it is not required. Various funding methods are available, including bank transfers, credit cards, and online payment systems.

What trading platforms are supported by GO Markets?

GO Markets supports MetaTrader 4, MetaTrader 5, and cTrader, catering to a wide range of traders. Both MT4 and MT5 offer automated trading tools, while cTrader excels in advanced order management.

Does GO Markets offer rebates for high-volume traders?

Yes, GO Markets offers volume rebates for traders who meet minimum monthly trading conditions. These rebates can range from $5 to $15 and are credited the following month.

Is GO Markets regulated?

GO Markets is regulated by multiple authorities, including ASIC in Australia and CySEC in Cyprus, ensuring its services are globally trusted and reliable.

Compare Go Markets Competitors

Below are a list of versus pages where you can compare GO Markets to similar brokers:

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Go to Go Markets Website

Visit Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert

is segregated account available?

Yes, all Go Markets clients will have a segregated account.