FXCM vs easyMarkets: Which One Is Best?

This FXCM and easyMarkets Forex broker comparison will help you decide which broker suits your needs. To compare the brokers, we cover trading accounts and costs, Forex platforms and regulations to help you choose the right broker.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

$3,000 (Premium)

$10,000 (VIP)

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs: 33:1

0-50k 400:1

50k+ 200:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers the 10 most important trading factors. Here are five key differences between FXCM and easyMarkets:

- FXCM offers lower spreads and fees compared to easyMarkets, making it more cost-effective for traders.

- FXCM supports both MetaTrader 4 and 5, while easyMarkets offers only MetaTrader 4.

- FXCM provides a wider range of account types, including Standard and RAW accounts, offering more flexibility for traders.

- FXCM’s trading platforms, including MetaTrader 4, 5, cTrader, and TradingView, offer advanced features and faster execution speeds.

- While both brokers are highly regulated, FXCM’s broader regulatory oversight gives it a slight edge over easyMarkets.

1. Lowest Spreads And Fees – FXCM

FXCM provides traders with variable spreads and a commission-based model, while easyMarkets offers fixed spreads without any commission fees.

To compare trading costs between these two brokers, try our FXCM vs easyMarkets fee calculator below. You can compare rates offered across different markets by adjusting currency pairs, lot sizes, and base currency.

FXCM Spreads

When compared to other brokers, the standard spreads offered by FXCM are typically in the middle range. The currency pairs AUD/USD and EUR/USD offer the most competitive spreads.

| Currency pair | Spread |

|---|---|

| EUR/USD | 0.7 |

| GBP/USD | 1.0 |

| AUD/USD | 0.9 |

| EUR/CHF | 2.4 |

| EUR/GBP | 1.3 |

easyMarkets Spreads

easyMarkets offers fixed spreads starting at 0.7 pips for EUR/USD on VIP accounts, with variations based on the chosen trading platform and account level. However, to achieve VIP status, you need to deposit at least USD 10,000, which may be unaffordable for many traders. easyMarkets’ standard account has higher spreads than FXCM, beginning at 1.7 pips.

| Platform | Spread Type | Standard | Premium | VIP |

|---|---|---|---|---|

| easyMarkets Platform | Fixed | 1.8 pips | 1.5 pips | 0.8 pips |

| TradingView | Fixed | 1.7 pips | 1.2 pips | 0.7 pips |

| MT4 | Fixed | 1.7 pips | 1.2 pips | 0.7 pips |

| MT5 | Variable | 0.5 pips |

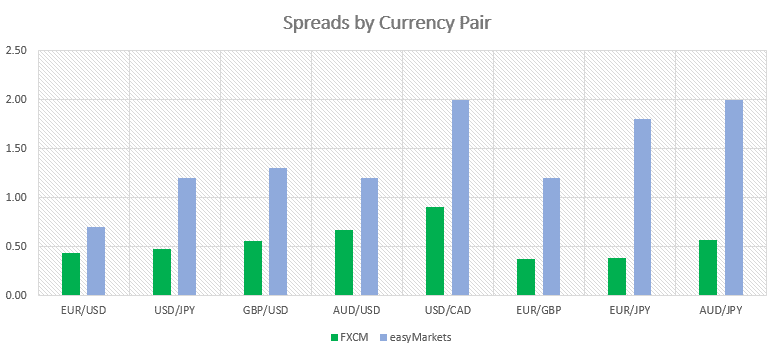

The graph below shows the consensus data from various sources, with FXCM having lower spreads in all major currency pairs.

Standard Account Spreads

FXCM’s standard account offers competitive spreads, making it a cost-effective option for traders who prefer a spread-only pricing model. easyMarkets offers fixed spreads, which means that the cost of trading is predictable. This can help traders plan and manage their trading activities more effectively.

Commission Rates

FXCM charges a commission on its RAW account, while easyMarkets does not charge any commission on trades.

| Broker | Commission Fee | Spread Type | Overnight Funding Fees | Inactivity Fee |

|---|---|---|---|---|

| easyMarkets Fixed Spreads | No | Fixed | Yes | No |

| FXCM Standard Spreads | No | Variable | Yes | Yes |

| FXCM Raw Spreads | Yes | Variable | Yes | Yes |

Other Fees

FXCM charges a rollover fee for positions held overnight, while easyMarkets does not charge any such fees.

Our Lowest Spreads and Fees Verdict

While both brokers offer competitive trading costs, FXCM‘s lower spreads on the RAW account and the absence of deposit and withdrawal fees make it the more cost-effective option.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

2. Better Trading Platform – easyMarkets

FXCM offers MetaTrader 4, TradingView, and Trading Station, while easyMarkets provides both MT4 and MT5, along with their easyMarkets proprietary platform.

| Trading Platform | FXCM | easyMarkets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | No | Yes |

| cTrader | No | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

MetaTrader 4 and 5

Traders can choose between MetaTrader 4 and 5, as easyMarkets supports both platforms to cater to different trading styles. On the other hand, FXCM only provides MetaTrader 4.

cTrader and TradingView

FXCM also offers TradingView but no cTrader. easyMarkets offers neither.

Social And Copy Trading

Both brokers offer social and copy trading features, allowing traders to follow and copy the trades of successful traders.

VPS and Other Trading Tools

FXCM offers VPS services and other trading tools, such as Trading Central, for market analysis. easyMarkets does not offer these additional tools.

Our Better Trading Platform Verdict

easyMarkets‘ wider range of trading platforms and additional trading tools make it the better choice for traders seeking a comprehensive trading environment.

3. Superior Accounts And Features – FXCM

FXCM offers a simple account structure with the Standard Account being the preferred choice for most clients, while Active Traders is designed for high-volume traders who want to decrease costs. easyMarkets offers three account types: Standard, Premium, and VIP. All accounts have no commission fees, but Premium and VIP accounts require higher minimum deposits and offer tighter spreads.

| Account Type | Plus500 | FXCM |

|---|---|---|

| Demo Account | ✅ | ✅ |

| Standard Account | ✅ | ✅ |

| Active Trader Account | ✅ | ❌ |

| Professional Account | ✅ | ✅ |

| Islamic Account | ✅ | ✅ |

| VIP Account | ❌ | ✅ |

| Premium Account | ❌ | ✅ |

| μBTC Account | ❌ | ✅ |

FXCM Account Types:

- Demo Account: Unlimited use, ideal for practice.

- Standard Account: Suitable for casual traders with a minimum deposit requirement ranging from $50 to $300, depending on the regulatory region. Access over 100 assets, including forex, commodities, and cryptocurrencies with floating spreads starting from 1.3 pips.

- Active Trader Account: Designed for high-volume traders with dedicated support and up to 2 free withdrawals monthly. Spreads start from 1.3 pips.

- Spread Betting Account: Traders in the UK can place bets on a variety of markets starting at just 7p per point.

- Professional Account: For expert traders, offering leverage up to 1:200 and a cash rebate program. Requires meeting certain conditions for eligibility.

- Islamic Account: Provides services that cater to Muslim traders, with no rollover fees. However, additional markup may apply.

easyMarkets Account Types:

- Demo Account: Unlimited access for practice.

- Standard Account: Best for casual traders, with fixed spreads from 1.8 pips and a minimum deposit of $25-$200; offers over 200 assets, including forex, shares, and crypto.

- VIP Account: Tailored for experienced traders, with fixed spreads starting from 0.8 pips and a dedicated account manager. Requires a $10,000 minimum deposit.

- Premium Account: Also for experienced traders, with fixed spreads from 1.5 pips and a minimum deposit of $25.

- MT4/MT5 Accounts: Specialised accounts for forex and non-forex traders, offering tight spreads and access to a wide range of markets.

- Professional Account: For high-level traders, offering higher leverage and advanced tools.

- Islamic Account: Designed for Muslim traders, with no rollover fees on CFDs.

- μBTC Account: A unique offering for crypto traders, allowing trading in over 275 CFD instruments with bitcoin.

| FXCM | easyMarkets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | No |

| Swap Free Account | Yes | No |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | Yes | No |

Our Superior Accounts and Features Verdict

Both FXCM and easyMarkets provide comprehensive account options catering to various trader needs. Overall, FXCM might offer better versatility for traders looking for specialised accounts, while easyMarkets excels in providing innovative trading features and lower entry requirements for casual traders.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – FXCM

FXCM offers advanced charting tools that are intuitive for both novice and professional traders, while easyMarkets provides a straightforward and user-friendly interface with unique features like dealCancellation and Freeze Rate.

- easyMarkets offers a no-slippage guarantee on its web platform and mobile app, ensuring that your trade is executed at the price you expect, without any surprises.

- The Trading Station platform by FXCM is highly customisable, allowing traders to tailor their trading environment to their personal preferences.

- easyMarkets provides free guaranteed stop loss on most trading instruments, adding an extra layer of risk management for your trades.

Our Best Trading Experience and Ease Verdict

For traders seeking greater depth and customisation in their trading tools, FXCM offers a more advanced and versatile platform, providing the best trading experience.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – FXCM

FXCM has a higher trust score of 78 overall, while easyMarkets has 58. Find out what factor kept FXCM ahead – regulation, reputation, or reviews.

FXCM Trust Score

easyMarkets Trust Score

Regulation

FXCM is regulated by five tier 1 and two tier 2 financial authorities. In contrast, easyMarkets is being regulated by two tier 1 and 2 tier 3 regulators.

Below is a comparison of the regulation of the two brokers with that of both ASIC Regulated Brokers.

| FXCM | easyMarkets | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) CYSEC (Cyprus) CIRO (CANADA) BaFin (Germany) | ASIC (Australia) CYSEC (Cyprus) |

| Tier 2 Regulation | FSCA (South Africa) ISA (Israel) | |

| Tier 3 Regulation | FSC-BVI FSA-S (Seychelles) |

Reputation

FXCM was founded in 1999 and publically listed status based in New York. easyMarkets was established in 2001 in Cyprus.

FXCM gets a monthly search volume of 38,100, while easyMarkets’ is quite low with just 6,600.

Reviews

Points were also awarded to FXCM based on its positive TrustPilot review of 4.5 based on 455 reviews. easyMarkets has a similar score to FXCM, receiving 4.5 stars from 1,560 reviews.

Our Stronger Trust and Regulation Verdict

FXCM is the more trusted broker with a trust score of 78 vs 58 for easyMarkets primarily due to greater regulation and the fact it’s publically listed.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

6. Most Popular Broker – easyMarkets

easyMarkets gets searched on Google more than FXCM. On average, easyMarkets sees around 49,500 branded searches each month, while FXCM gets about 40,500 — that’s 18% fewer.

| Country | FXCM | easyMarkets |

|---|---|---|

| Italy | 720 | 18,100 |

| Brazil | 480 | 3,600 |

| Australia | 1,300 | 2,400 |

| United States | 2,900 | 1,900 |

| India | 2,900 | 1,600 |

| France | 1,600 | 1,000 |

| Japan | 1,300 | 1,000 |

| Malaysia | 1,300 | 880 |

| South Africa | 1,000 | 720 |

| Germany | 1,000 | 590 |

| Cyprus | 140 | 590 |

| Vietnam | 880 | 590 |

| Egypt | 390 | 590 |

| Pakistan | 1,000 | 480 |

| Indonesia | 1,000 | 480 |

| Philippines | 390 | 480 |

| United Kingdom | 2,900 | 390 |

| Greece | 210 | 390 |

| Spain | 590 | 390 |

| Nigeria | 880 | 390 |

| Uzbekistan | 70 | 390 |

| Poland | 320 | 320 |

| Colombia | 1,000 | 320 |

| Mexico | 480 | 320 |

| Bangladesh | 260 | 260 |

| Kenya | 260 | 260 |

| Canada | 880 | 210 |

| Singapore | 480 | 210 |

| United Arab Emirates | 480 | 210 |

| Algeria | 260 | 210 |

| Morocco | 480 | 170 |

| Netherlands | 390 | 170 |

| Saudi Arabia | 260 | 170 |

| Hong Kong | 480 | 170 |

| Argentina | 320 | 170 |

| Turkey | 480 | 140 |

| Thailand | 1,000 | 140 |

| Cambodia | 170 | 140 |

| Peru | 210 | 140 |

| New Zealand | 70 | 140 |

| Switzerland | 170 | 110 |

| Sweden | 170 | 110 |

| Austria | 110 | 110 |

| Taiwan | 590 | 90 |

| Sri Lanka | 110 | 90 |

| Chile | 210 | 90 |

| Costa Rica | 30 | 90 |

| Portugal | 110 | 70 |

| Dominican Republic | 140 | 70 |

| Ghana | 110 | 70 |

| Panama | 50 | 70 |

| Tanzania | 90 | 50 |

| Ireland | 70 | 50 |

| Jordan | 70 | 50 |

| Ecuador | 170 | 50 |

| Botswana | 50 | 50 |

| Venezuela | 390 | 40 |

| Uganda | 90 | 40 |

| Ethiopia | 70 | 30 |

| Bolivia | 110 | 20 |

| Mauritius | 40 | 10 |

| Mongolia | 50 | 10 |

2024 Monthly Searches For Each Brand

FXCM - Italy

FXCM - Italy

|

720

1st

|

easyMarkets - Italy

easyMarkets - Italy

|

18,100

2nd

|

FXCM - Brazil

FXCM - Brazil

|

480

3rd

|

easyMarkets - Brazil

easyMarkets - Brazil

|

3,600

4th

|

FXCM - Australia

FXCM - Australia

|

1,300

5th

|

easyMarkets - Australia

easyMarkets - Australia

|

2,400

6th

|

FXCM - Japan

FXCM - Japan

|

1,300

7th

|

easyMarkets - Japan

easyMarkets - Japan

|

1,000

8th

|

Similarweb shows a different story when it comes to February 2024 website visits with easyMarkets receiving 296,000 visits vs. 365,000 for FXCM.

Our Most Popular Broker Verdict

easyMarkets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

7. Top Product Range And CFD Markets – FXCM

FXCM has more diverse products, with over 440, while easyMarkets has around 203+.

FXCM is renowned for its extensive selection of CFDs, appealing to traders looking for wide market coverage. Their offerings include but are not limited to:

- Forex: A comprehensive list of major, minor, and exotic currency pairs, including EUR/USD, USD/JPY, GBP/USD, and USD/CHF.

- Indices: When trading indices with any type of FXCM account, you only need to pay the spread. Additionally, you can enjoy low spreads on indices and unrestricted stop and limit orders.

- Commodities: You can speculate on the price movements of metals, oil, and gas, similar to forex trading. All you need to know is the symbol and contract size for the product you want to trade.

- Cryptocurrencies: Trading Crypto CFDs allows you to use only a fraction of the capital. Individual equities for retail clients are available with leverage of approximately 4:1. If you decide to open a trade valued at $100, you will need to have a margin of approximately $25. The margin requirements for each share are updated on a daily basis.

FXCM’s platform provides advanced trading tools and features for both experienced traders and newcomers to the market. Their technology enables advanced analysis and strategy implementation, making it a top choice for CFD traders.

easyMarkets, on the other hand, prioritises simplicity and risk management in its CFD offerings. Their product range includes:

- Forex: The most popular currency pairs traded include EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CHF, NZD/USD, and USD/CAD.

- Indices: You don’t have to own the stocks to trade them. Some stock market indices, like the Nasdaq, are made up of companies that belong to a specific category. For instance, the Nasdaq includes non-financial companies such as Apple, Amazon, Intel, and more.

- Commodities: Commodities may be grouped together, but they are actually a diverse range of products. Oil, natural gas, heating oil, gas oil, and crude oil – these are industrial products. In addition, there are agricultural commodities such as wheat, soybeans, sugar, coffee, cocoa, corn, and cotton. There are various factors that influence the price of goods or services, but the law of supply and demand mainly determines their value.

For traders who prioritise simplicity and safety over extensive market access, easyMarkets is an attractive option despite its narrower range of CFDs compared to FXCM, thanks to its user-friendly features and risk management tools.

Comparative Table of CFD Offerings:

| Feature | FXCM | EasyMarkets |

|---|---|---|

| Currency Pairs | 42+ | 62+ |

| Cryptocurrency CFDs* | 7+ | 17+ |

| Index CFDs | 13+ | 14+ |

| Share CFDs | 15+ | 26+ |

| Commodities CFD | 12+ | 31+ |

Our Top Product Range and CFD Markets Verdict

FXCM offers a broader and more diverse range of CFDs, catering to traders looking for extensive market access and advanced trading capabilities.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

8. Superior Educational Resources – FXCM

Both FXCM and easyMarkets offer educational resources for traders of all levels, including webinars, video tutorials, and market analysis. Here’s a quick rundown:

- FXCM provides webinars that cover a wide range of trading topics, from beginner to advanced strategies.

- easyMarkets offers an extensive collection of easily accessible eBooks that cover various trading topics.

- FXCM offers a vast library of video tutorials aimed at simplifying complex trading concepts for traders.

- easyMarkets has a comprehensive FAQ section that provides answers to frequently asked trading questions.

- FXCM delivers daily market analysis to assist traders in making informed decisions.

- easyMarkets presents trading charts and indicators as part of its educational resources.

Our Superior Educational Resources Verdict

FXCM offers a stronger educational experience than easyMarkets with a score of 5 compared to easyMarkets’ 4.5. That said, we found easyMarkets was better for those new to trading.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

9. Superior Customer Service – easyMarkets

Both FXCM and easyMarkets provide 24/5 customer support via phone, email, live chat, and WhatsApp (easyMarkets).

| Criteria | FXCM | easyMarkets |

|---|---|---|

| Customer Service | 24/5 Phone, Email, Live Chat | 24/5 Phone, Email, Live Chat, WhatsApp |

Our Superior Customer Service Verdict

While both brokers offer excellent customer service, easyMarkets‘ additional support via WhatsApp gives it a slight edge over FXCM.

10. Better Funding Options – FXCM

FXCM offers a wider variety of payment methods, including PayPal, which is notably absent in easyMarkets. On the other hand, easyMarkets supports a wide range of base currencies, making it more flexible for international traders.

FXCM doesn’t fall far behind, though. It supports a variety of payment methods, but its higher overall score sets it apart in our testing. This indicates that FXCM may be a more trustworthy option for traders who value a variety of funding alternatives.

| Funding Options | FXCM | EasyMarkets |

|---|---|---|

| Base Currencies | ✅ | ✅ |

| Visa/MasterCard | ✅ | ✅ |

| Wire Transfer | ✅ | ✅ |

| PayPal | ✅ | ❌ |

| Neteller | ✅ | ❌ |

| Skrill | ✅ | ✅ |

| Rapid Pay (EUR/GBP) | ❌ | ❌ |

| POLi / bPay (AU/NZ) | ✅ | ✅ |

| Klarna | ❌ | ❌ |

| Other Methods | ✅ | ✅ |

Our Better Funding Options Verdict

Based on our testing, FXCM offers a more diverse range of funding options, making it more flexible.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

11. Lower Minimum Deposit – FXCM

FXCM requires a lower minimum deposit amounting to $50 than easyMarkets, which requires $200. While FXCM has a relatively low barrier to entry with a standard minimum deposit of $50, it only requires $50 for each subsequent deposit. This makes it accessible for traders who might not have a large amount of capital to start with.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

| Bank Wire | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

| Skrill | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

| Neteller | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

easyMarkets offers different account types with varying minimum deposit requirements. The VIP account has a minimum deposit of $10,000, while the Premium account requires $3,000. However, their Standard and MT4/MT5 accounts require a minimum deposit of $200, which is lower than FXCM’s standard account.

| easyMarkets Funding | Countries | Depositing Processing Time | Fee |

|---|---|---|---|

| Credit Card / Debit Card | All countries(subject to exclusions) | Instant | Free |

| AstroPay | All countries | Instant | Free |

| Local Bank Transfer | LATAM, Africa, India, Indonesia, Vietnam, Thailand, Malaysia | up to 24 hours | Free |

| WebMoney | All countries | 1 working day | Free |

Our Lower Minimum Deposit Verdict

When it comes to lower minimum deposit requirements, FXCM takes the lead with its Standard accounts requiring only $50, making it more accessible for traders with limited capital.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

Is FXCM Or EasyMarkets The Superior Broker?

FXCM is the winner because it outperforms easyMarkets in most of the key areas that matter to traders, from spreads and fees to educational resources. The table below summarises the key information leading to this verdict.

| Criteria | FXCM | easyMarkets |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ❌ | ✅ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ❌ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ✅ | ❌ |

| Superior Customer Service | ❌ | ✅ |

| Better Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ✅ | ❌ |

easyMarkets: Best For Beginner Traders

easyMarkets is better suited for beginner traders due to the customer support and educational resources being more suited to those new to forex trading. A downside, though, is the higher minimum deposit of $200.

FXCM: Best For Experienced Traders

FXCM is the better choice for experienced traders, offering a more comprehensive range of products and superior trading platforms.

FAQs Comparing FXCM Vs easyMarkets

Does easyMarkets or FXCM Have Lower Costs?

FXCM has lower costs compared to easyMarkets. FXCM offers more competitive spreads, making it a cost-effective choice for traders. For more detailed information on low-cost brokers, you can visit this Lowest Commission Brokers page.

Which Broker Is Better For MetaTrader 4?

Both FXCM and easyMarkets support MetaTrader 4, but FXCM offers a more comprehensive range of features and tools on the platform. If you’re looking for the best MT4 experience, you can check out this list of best MT4 brokers.

Which Broker Offers Social Trading?

Neither FXCM nor easyMarkets offer social or copy trading as a feature. If social trading is a key factor for you, you might want to explore other options. For more information, you can visit this list of best copy trading platforms.

Does Either Broker Offer Spread Betting?

FXCM offers spread betting, while easyMarkets does not. This makes FXCM a more versatile option for traders interested in this form of trading. For more on spread betting, you can check out this list of best spread betting brokers.

What Broker is Superior For Australian Forex Traders?

In my opinion, FXCM is the superior choice for Australian Forex traders. Both FXCM and easyMarkets are ASIC-regulated, but FXCM has a more comprehensive offering that suits the needs of Aussie traders. For more details, you can visit this list of the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I’d recommend FXCM. Both brokers are FCA regulated, but FXCM’s broader range of services and platforms make it a more appealing choice for traders in the UK. For more information, you can check out this list of Best Forex Brokers In UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert