Plus500 Review Of 2025

Plus500 is an excellent option for forex traders as it offers fixed spreads, low fees, negative balance protection, and a user-friendly platform. It still offers a wide range of trading products as of 2025.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Plus500 Summary

| 🗺️ Tier 1 Regulation | ASIC, FCA, CySEC, FMA, MAS |

| 🗺️ Tier 2 Regulation | DFSA, EFSRA |

| 📊 Trading Platforms | Plus500 Trading Platform |

| 💰 Minimum Deposit | $100 |

| 💰 Withdrawal Fees | $0 |

| 🛍️ Instruments Offered | Forex, Shares, Indices, ETFs, Options, Crypto, Commodities |

| 💳 Credit Card Deposit | Yes |

Why Choose Plus500

We think the main reasons to choose Plus500 is for their trading platform and wide range of trading products. The platform has risk management tools like a guaranteed stop-loss and works well on both desktop and mobiles.

While there is a large range of CFD Forex pairs, stocks and cryptos to trade, the spreads are on the wider side even if there are no commissions to factor in.

Plus500 Pros and Cons

- No CFD commissions + low spreads

- Customer support

- Ease of trading CFDs

- No direct phone support

- Lacks advanced features

- High CFD fees

Open Demo AccountOpen Live Account

The overall rating is based on review by our experts

Trading Fees

Plus500 offers four types of accounts: the CFD Account, Professional Account, Invest Account, and Futures Account. The Plus500 CFD Account is the default and is available to all clients worldwide.

- CFD Account: Spread based trading fees from 0.8 pips

- Professional Account: Available to EU-based traders, with maximum leverage of 1:300

- Invest Account: Unleveraged equity trading with brokerage commissions at 0.045% for most markets

- Futures Account: Available to US-based traders, more suitable to advanced traders

Spreads

Plus500 offers two types of spreads: fixed and dynamic. The average EUR/USD and GBP/USD spread is 1.7 pips.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

1.70

1.40

1.70

2.40

2.00

0.82

0.83

1.27

1.30

1.05

0.83

1.12

1.29

1.65

1.31

1.00

1.20

1.00

1.20

1.00

0.80

1.20

1.20

1.50

1.20

1.00

1.00

1.20

N/A

1.10

0.80

1.00

1.00

1.50

1.60

0.90

1.70

1.60

2.10

1.70

1.20

1.50

1.60

2.10

1.60

1.00

1.11

N/A

1.30

1.28

0.84

0.83

1.79

2.32

1.92

1.10

1.10

1.10

1.20

1.20

1.20

1.30

1.20

1.50

1.30

1.20

1.30

1.20

1.20

4.00

1.20

1.40

1.40

1.90

1.50

Their spreads tend to be wider than the average broker as shown below.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| Plus500 Average Spread | 1.2 | 2 | 1.7 | 1.1 | 2 | 1.5 | 2.5 | 2 |

| Industry Average Spread | 1.2 | 1.4 | 1.6 | 1.5 | 1.8 | 1.5 | 1.9 | 2.1 |

Plus500 does not charge any commissions on any of their trades. The no-commission spreads are only available with the ECN style account for more experienced/high-volume traders.

Other Fees

Two additional fees traders may incur is an overnight holding fee and a $10 USD inactivity fee if your account remains unused for three months.

To find out more, you can read our in-depth review of Plus500 fees.

Verdict on Plus500 Fees

Plus500’s spreads suit beginners with its simple pricing structure with no commission.

Trading Platforms

Plus500 provides a proprietary trading platform available as a desktop application, WebTrader, and mobile apps.

The platform is designed with simplicity in mind, making it particularly accessible for beginner traders with a straightforward interface.

While the platform is user-friendly, it may not meet the needs of expert traders accustomed to more sophisticated trading tools available on platforms like MetaTrader 4, MetaTrader 5, or cTrader.

| Trading Plaform | Available With Plus500 |

|---|---|

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| TradingView | No |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

Trading Tools on Plus500 Platform

- Charting: Over 100 indicators and various drawing tools for detailed technical analysis.

- Customisable Watchlists: Personalise and track preferred instruments.

- Alerts: Notifications on client sentiment data.

- Economic Calendar: Includes news from Dow Jones and instrument details from Yahoo Finance.

- Demo Account: Plus500 offers an unlimited demo account, allowing traders to familiarise themselves with the platform’s features and services risk-free.

Mobile Trading Apps

The Plus500 mobile app, available for mobiles and tablets on both Android and iOS (iPhone and iPad), replicates the WebTrader platform’s functionality, ensuring a smooth transition across devices. It encompasses features such as real-time alerts, live quotes, charts, and a demo account for practice trading.

Although the app is solid in its fundamental offerings, it falls short in some advanced features and functionalities like automated trading.

Trade Experience

In our Best Forex Brokers In Australia analysis, the Plus500 trading platform won the award for the most user-friendly forex platform and interface. To determine this, we tested the CFD provider’s live account and compared its features to other brokers trading platform offerings.

It’s important to note that Plus500 is not suitable for scalping strategies, as accounts employing rapid trade executions within a two-minute window may be subject to closure.

Verdict on Plus500 Trading Platforms

Overall, the Plus500 offers a good trading platform for beginners, providing an uncomplicated, user-friendly entry point.

Open a demo accountVisit Plus500

*Your capital is at risk ‘72% of retail CFD accounts lose money’

Is Plus500 Safe?

Plus500 has a trust score of 78 out of 100, making it a safe broker to trade with.

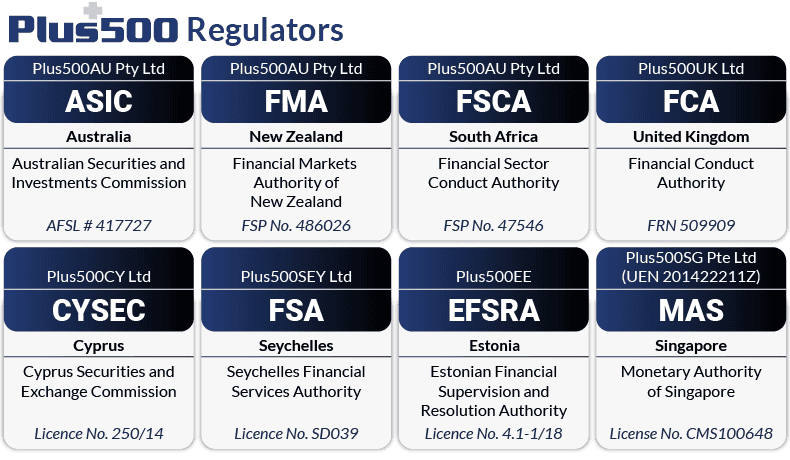

Regulation

Plus500 is regulated by five ‘tier-1’ financial authorities, which include the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investment Commission (ASIC), the Monetary Authority of Singapore (MAS), and New Zealand’s Financial Markets Authority (FMA).

| Plus500 Safety | Regulators |

|---|---|

| Tier-1 | ASIC FCA CySEC FMA MAS |

| Tier-2 | DFSA EFSRA |

| Tier-3 | FSA-S FSCA |

Reputation

Plus500 was established in Haifa, Israel, in 2008, which means they have almost two decades’ worth of visibility in the industry.

The broker is quite popular with traders, with over 246,000 searches per month.

Reviews

Plus500’s TrustPilot score is 4.0 out of 5.0 from 12,099 reviews. This further strengthens the broker’s reliability and confidence score.

Verdict on Plus500’s Trustworthiness

Plus500 has shown a high level of trust, which garnered its top scores all over.

How Popular Is Plus500?

Plus500 is one of the most popular online brokers globally, particularly in the CFD trading sector. It receives around 270,000 Google searches each month, ranking it as the 8th most searched forex broker worldwide.

Web traffic data from Similarweb supports this popularity, with Plus500 being the 9th most visited broker in February 2024, drawing 6,888,000 global visits.

In terms of client base, the broker had 254,138 active customers in 2024 — a 9% increase year-over-year — and added 118,010 new customers, marking 30% annual growth.

Financially, Plus500 reported $768.3 million in revenue and $342.3 million in EBITDA for 2024, along with $3 billion in client deposits. The average deposit per active customer was approximately $12,000.

The company operates in over 60 countries, is listed on the London Stock Exchange, and is part of both the FTSE 250 and STOXX Europe 600 indices, confirming its strong global footprint and credibility.

| Country | 2024 Monthly Searches |

|---|---|

| Italy | 22,200 |

| Germany | 18,100 |

| United Kingdom | 14,800 |

| Spain | 9,900 |

| Australia | 8,100 |

| Netherlands | 8,100 |

| Poland | 8,100 |

| United States | 5,400 |

| South Africa | 5,400 |

| Switzerland | 5,400 |

| Portugal | 4,400 |

| United Arab Emirates | 4,400 |

| Greece | 4,400 |

| Sweden | 2,900 |

| Austria | 2,900 |

| Mexico | 2,900 |

| Hong Kong | 2,400 |

| France | 1,900 |

| Singapore | 1,900 |

| Argentina | 1,600 |

| Taiwan | 1,300 |

| New Zealand | 1,300 |

| Colombia | 1,300 |

| India | 1,000 |

| Cyprus | 880 |

| Saudi Arabia | 720 |

| Malaysia | 720 |

| Turkey | 720 |

| Ireland | 720 |

| Chile | 590 |

| Japan | 390 |

| Egypt | 390 |

| Pakistan | 320 |

| Thailand | 320 |

| Canada | 320 |

| Brazil | 320 |

| Indonesia | 320 |

| Nigeria | 320 |

| Morocco | 210 |

| Vietnam | 170 |

| Philippines | 170 |

| Algeria | 170 |

| Bangladesh | 170 |

| Dominican Republic | 140 |

| Jordan | 140 |

| Costa Rica | 140 |

| Cambodia | 110 |

| Peru | 90 |

| Venezuela | 90 |

| Panama | 90 |

| Kenya | 70 |

| Ghana | 70 |

| Uzbekistan | 70 |

| Sri Lanka | 40 |

| Ecuador | 40 |

| Tanzania | 30 |

| Ethiopia | 30 |

| Uganda | 30 |

| Botswana | 20 |

| Bolivia | 20 |

| Mauritius | 10 |

| Mongolia | 10 |

2024 Average Monthly Branded Searches By Country

Italy

Italy

|

22,200

1st

|

Germany

Germany

|

18,100

2nd

|

United Kingdom

United Kingdom

|

14,800

3rd

|

Spain

Spain

|

9,900

4th

|

Australia

Australia

|

8,100

5th

|

Netherlands

Netherlands

|

8,100

6th

|

Poland

Poland

|

8,100

7th

|

United States

United States

|

5,400

8th

|

South Africa

South Africa

|

5,400

9th

|

Switzerland

Switzerland

|

5,400

10th

|

Deposit and Withdrawal

Plus500 offer multiple fee-free options to deposit and withdraw funds.

What is the minimum deposit at Plus500?

To open a trading position with Plus500, a minimum deposit of $100 or equivalent in your currency is required.

Account Base Currencies

The base currencies available at Plus500 include EUR, USD, JPY, GBP, AUD, CAD, and JPY.

Deposit Options And Fees

Plus500 charges no deposit fees with the following funding methods available:

- Credit Cards/Debit Cards (Mastercard, Visa)

- Electronic Wallets (Skrill, PayPal)

- Bank Transfer

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Paypal | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Bank Wire | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Skrill | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

Withdrawal Options And Fees

Customers are not charged any fees for withdrawing funds. When you withdraw funds from your trading account in a foreign currency, you may be charged foreign exchange fees.

If you withdraw funds to PayPal, you’ll receive slightly less due to PayPal’s foreign exchange rates being worse than transferring to your bank account.

Product Range

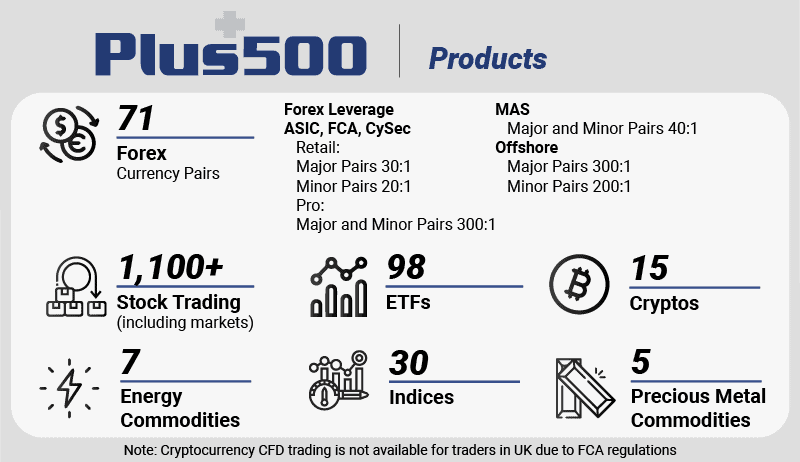

Plus500 offers a range of 2,800+ financial products to trade as CFDs including forex, shares, commodities, and options.

CFDs

Forex: Plus500 offers CFD trading on 71 different forex pairs ranging from major currency pairs to more exotic currencies.

Shares:The platform offers more than 1,100 stock CFDs, allowing traders to speculate on global stock movements.

Indices: Plus500’s offering includes 30 indices, featuring popular ones like the USA 500 and US-TECH 100.

Cryptocurrencies: 15 crypto CFDs are available, including major names like Bitcoin, Ethereum, and Litecoin.

Note: Cryptocurrency trading is prohibited in the UK by the Financial Conduct Authority (FCA).

Commodities: A variety of commodities, from gold and oil to agricultural products, are available for CFD trading.

ETFs (Exchange Traded Funds): Traders can choose from 98 ETFs, including the NASDAQ-100 Index, S&P 500, and Gold, traded as CFDs.

Options: Options CFDs are offered at various strike prices, providing additional trading flexibility.

Verdict on Plus500 Trading Products

Plus500 offers an extensive selection of CFD trading products, including forex, shares, indices, cryptocurrencies, commodities, ETFs, and options, catering to a broad range of trading interests and strategies.

Customer Service

Plus500 provides 24/7 customer support through email and live chat, available in multiple languages.

The customer service team is available in 30 languages and has a local office in Sydney, ensuring efficient issue resolution. Responses to inquiries are prompt and without delay.

However, a significant limitation is the absence of a direct phone line, which may be a concern for customers needing immediate assistance, especially in the fast-paced forex trading industry.

Verdict on Plus500 Customer Support

Plus500 offers reliable 24/7 customer support through email and live chat in over 30 languages, backed by a dedicated team in their Sydney office for efficient resolution of issues.

Research and Education

Plus500 provides several educational materials for beginners as well as advanced traders.

- Trading Academy will teach you about trading and financial markets. Traders can learn about economic facts, terms, and available instruments for trading.

- News & Market Insights show the latest information on the markets from around the globe.

- Economic Calendar to help you plan your trades and future orders

- Risk Management tools to help you maximise profits

- Alerts to your device in real time

Verdict on Plus500’s Education

Plus500’s educational and research offerings, including a Trading Academy, market insights, and practical tools like an Economic Calendar and real-time alerts, provide valuable resources for traders at all levels.

Final Verdict on Plus500

Our team of experts gave Plus500 a 57/100 because they have low fees, fixed spreads, negative balance protection, and a simple-to-use platform combined with a guaranteed stop offering.

Although they offer several benefits for beginners, expert CFD traders may prefer more mainstream forex platforms with higher leverage to increase their risk profile. That said, the company offers a wide range of trading products that customers might find useful.

Overall, Plus500 is worth considering for those looking to make their first steps towards currency trading.

Plus500 FAQs

What is the minimum deposit at Plus500?

Plus500 has a $100 minimum deposit requirement for traders. The broker believes it’s a good amount to start trading as their recommended deposit is also at $100.

What Demo Account Does Plus500 Offer?

Plus500 lets you open a demo account with no time limit. You can use the trial account for as long as you need to familiarise yourself with the platform and create trading strategies.

Is Plus500 Safe?

Yes, it is safe to trade with Plus500, having a high trust score of 78 out of 100.

The broker is also regulated by multiple top-tier authorities, ensuring all traders are protected.

What Leverage Does Plus500 Offer?

The leverage for a Plus500 account varies based on the instrument being traded. For instance, crypto, including bitcoin, has a leverage of 2:1, commodities have a leverage of 10:1 (20:1 for gold), and forex has a leverage of 30:1. Each instrument traded on Plus500 has a specific leverage that cannot be modified. Also, there are differences in Plus500 Leverage levels for retail and professional traders.

Does Plus500 offer bitcoin trading?

Plus500 not only offers bitcoin trading but also a variety of other cryptocurrencies for trading and speculation. If you want to trade Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Ripple, and IOTA with Plus500, you’re in luck.

The cryptocurrency market operates 24 hours a day, seven days a week, making it unique compared to other financial markets that have specified trading hours. If you want to trade on weekends, you can do so at any time except for a two-hour window on Sundays between 12:00 and 14:00 UTC.

About Compare Forex Brokers

All reviews and forex provider comparison tables were created by Australians who don’t work for any of the forex providers compared. The forex provider comparisons information was gained from each provider’s website (including this Plus500 Review) or from demo & trading accounts. The forex comparisons look at elements, including the trading platforms, spreads and key trading features. Each financial services provider compared must be ASIC regulated, including the account types offered. Tables were designed to make forex trading setup easier, providing the pros/cons of different providers. The providers selected are all nationally certified with a strong market share to avoid scams or other poor conduct of some smaller unregulated forex service providers.

Compare Plus500 Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Verdict

Verdict

Fees

Fees

Trading Platforms

Trading Platforms

Safety

Safety

Funding

Funding

Product Range

Product Range

Support

Support

Market Research

Market Research

Ask an Expert

Does Plus500 offer negative balance protection?

Historically Plus500 distinguished itself from many brokers as they always included Negative Balance Protection.

While Plus500 still include this feature, all brokers regulated by ASIC, FCA or European Regulators such as CySEC of BaFIN much offer Negative Balance Protection.

Is Plus500 a Forex Broker or CFD Provider?

Plus500 prefer to call themselves a CFD Provider rather than a broker. This might be to emphasise their range of product which is quite diverse

Can you owe money on Plus500?

No, all clients with Plus500 receive negative balance protection

is plus500 safe?

Yes, we consider Plus500 to be a highly trusted broker. We gave them a score of 78 out of 100 for trust and 87 out of 100 for regulation. Regulation plays a large role in trust and Plus500 is regulated 9 regions including 5 tiers 1 regulators. Plus500 is also listed on the London stock market (LON:PLUS) which requires the broker meet strict guidelines set by the regulator.

Is Plus500 good for day trading?

While you can day trade with PLus500, day traders and scalp traders tend to prefer RAW spread rather than Standard style accounts so there may be better brokers to consider.

Is Plus500 better than eToro?

eToro and Plus500 target different markets. eToro is best for social and copy trading, Plus500 is best for traditional Forex trading and has a guaranteed stop loss option for risk management.

Can I buy Bitcoin on Plus500?

Plus500 doesn’t sell Bitcoins directly. However, you can trade Bitcoin CFDs (Contracts for Difference) instead. This allows you to speculate on BTC’s price movements without owning the actual digital currency,

Does Plus500 provide VPS?

NO, Plus500 does not provide VPS