VantageFX Review

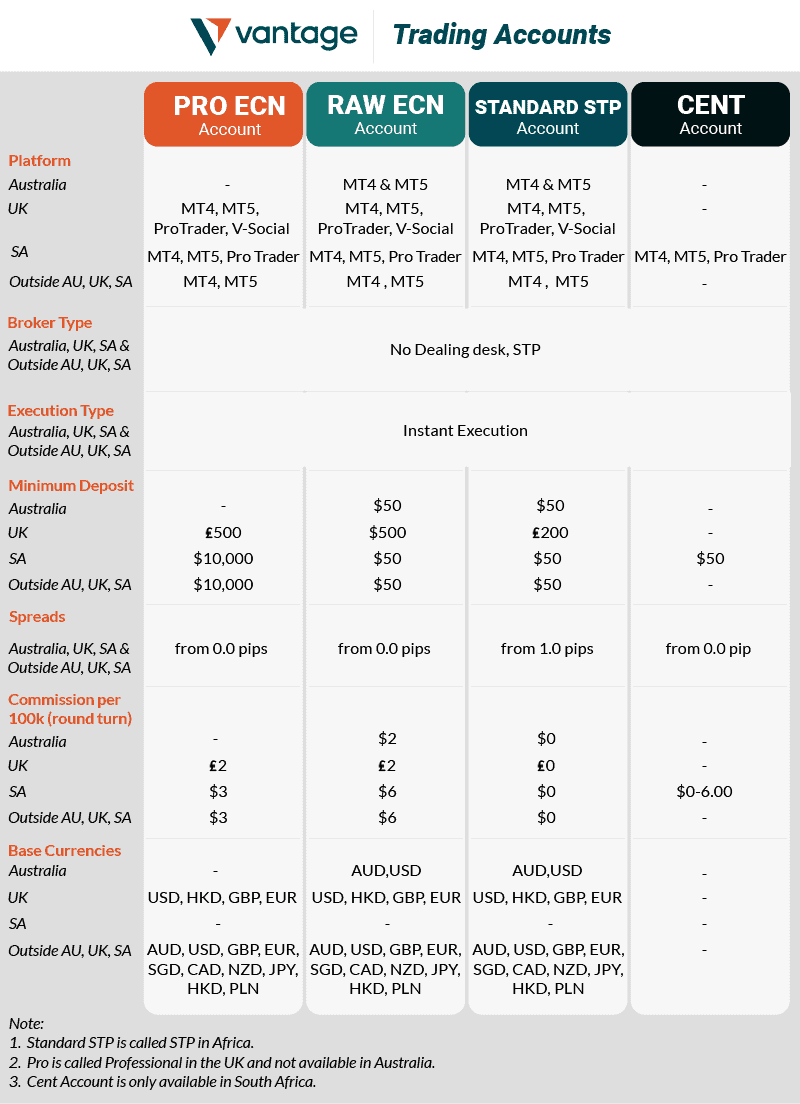

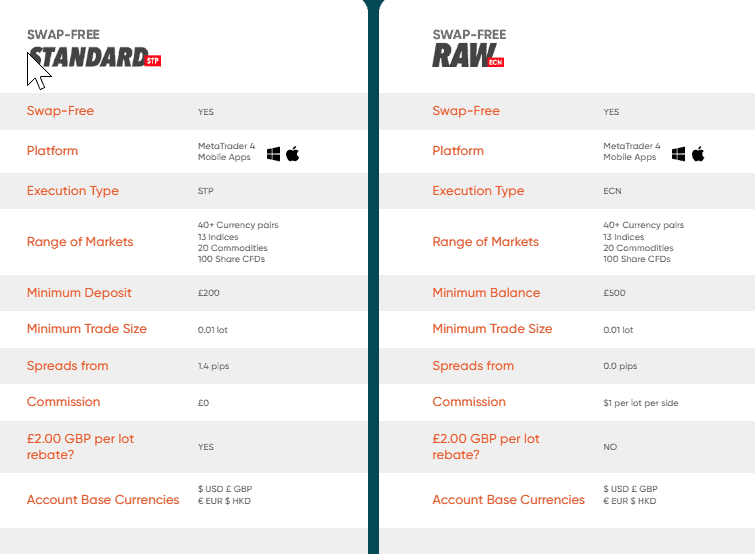

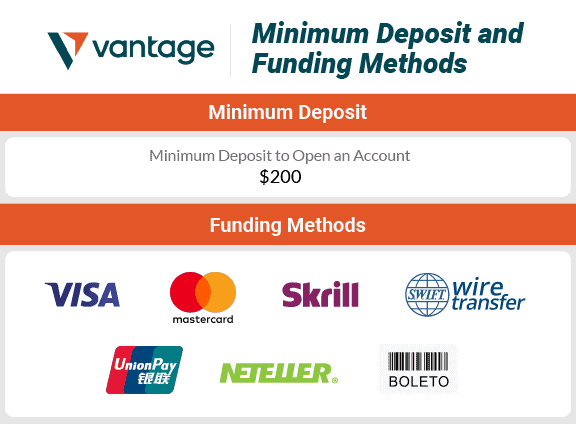

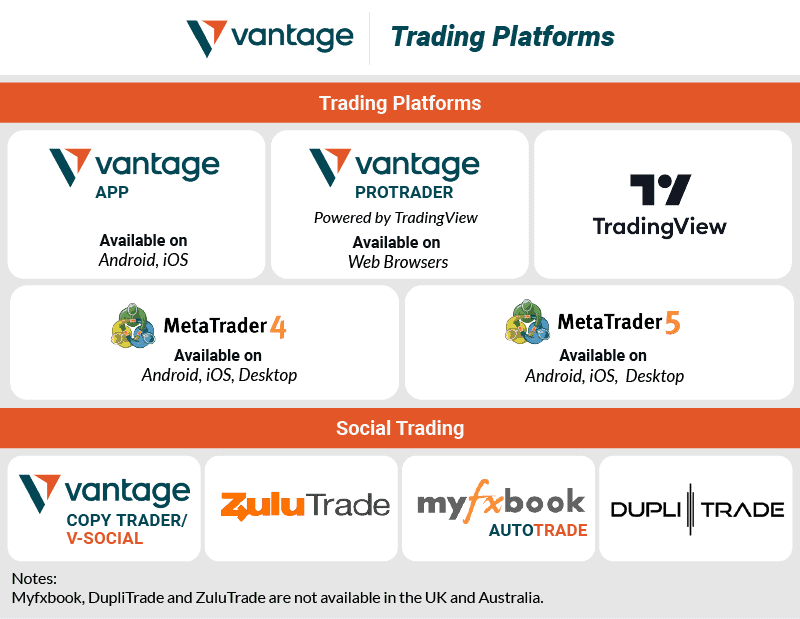

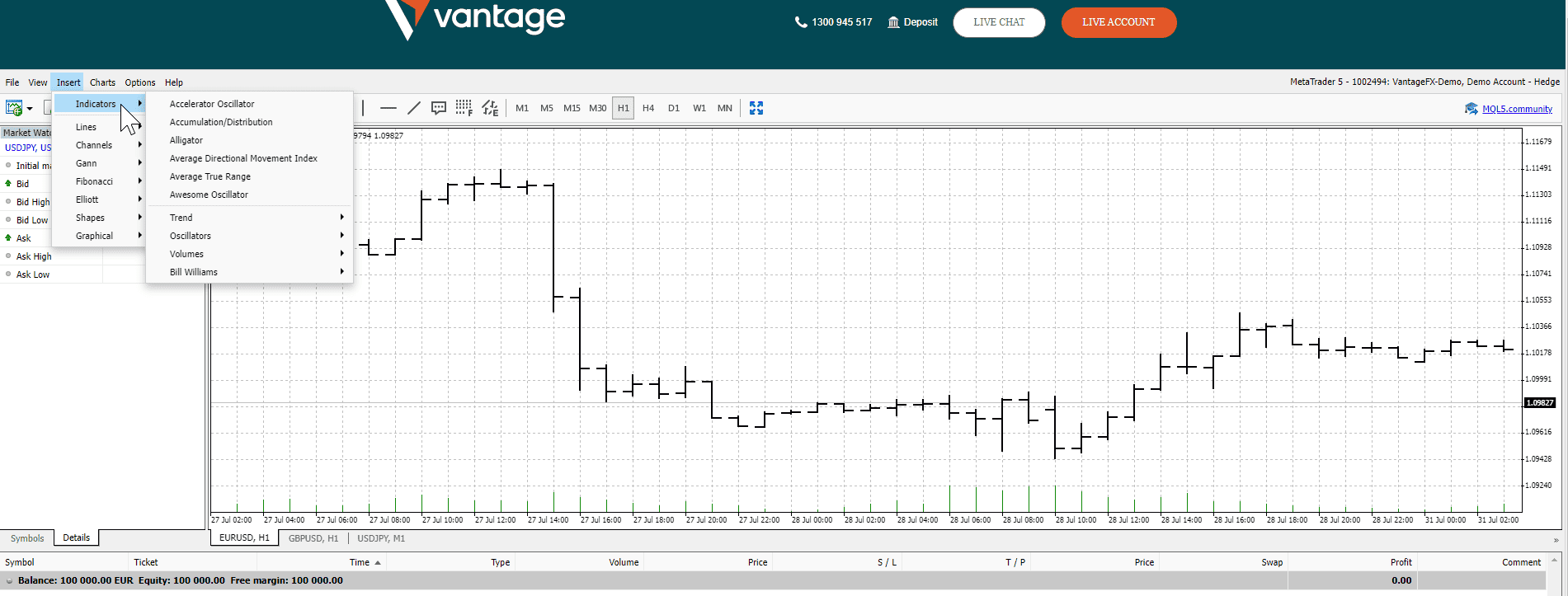

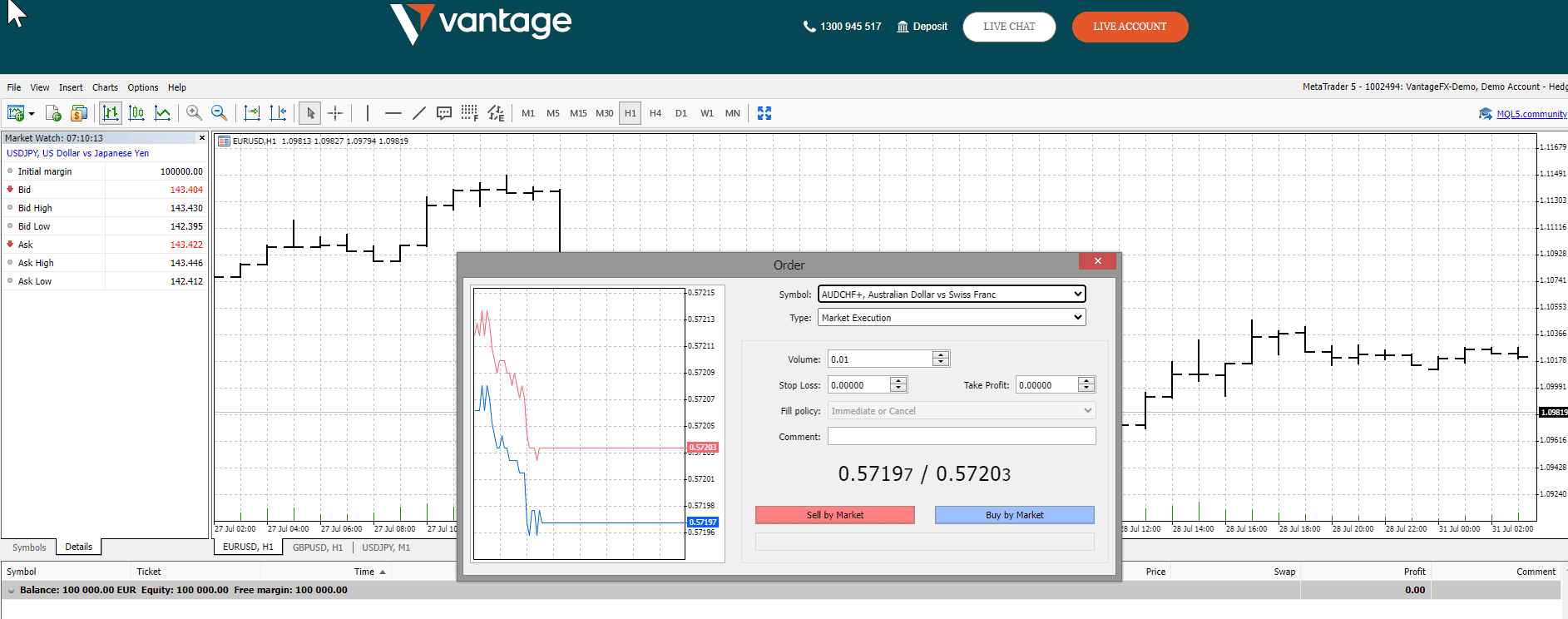

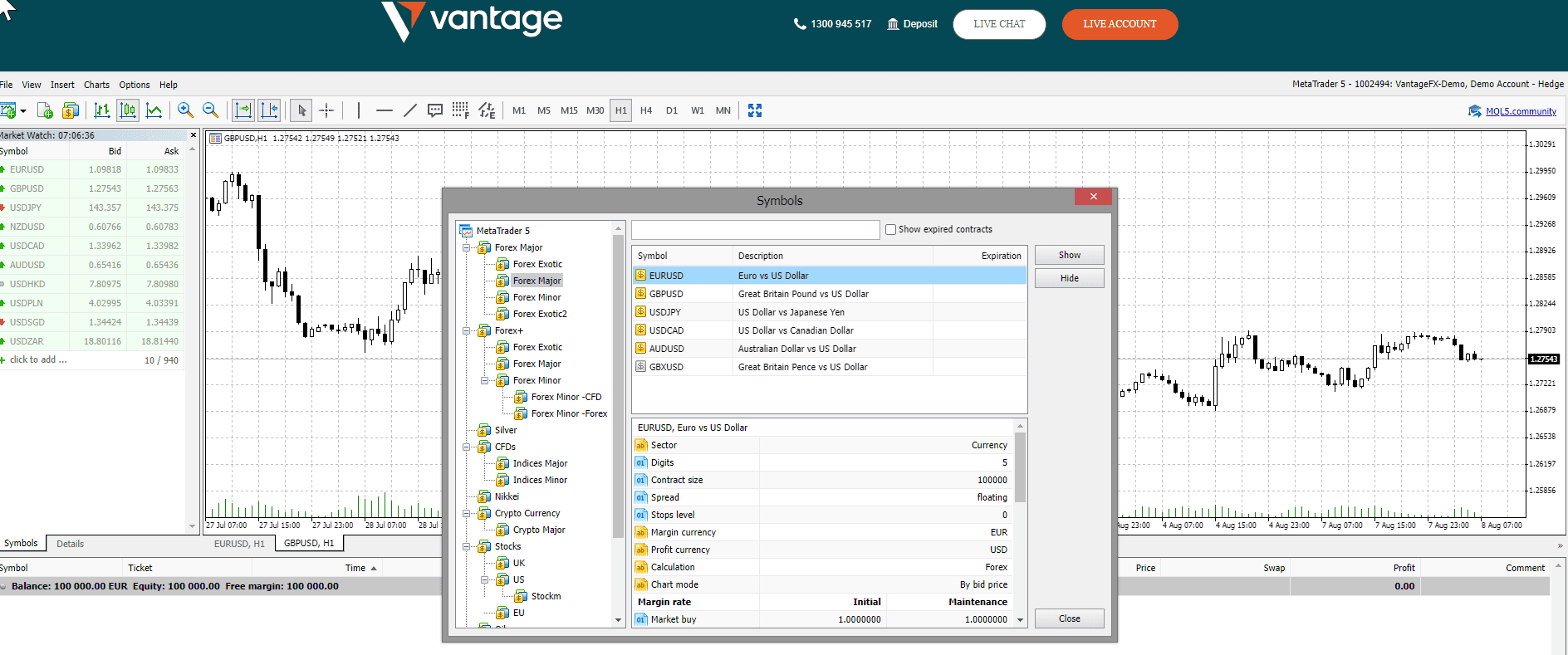

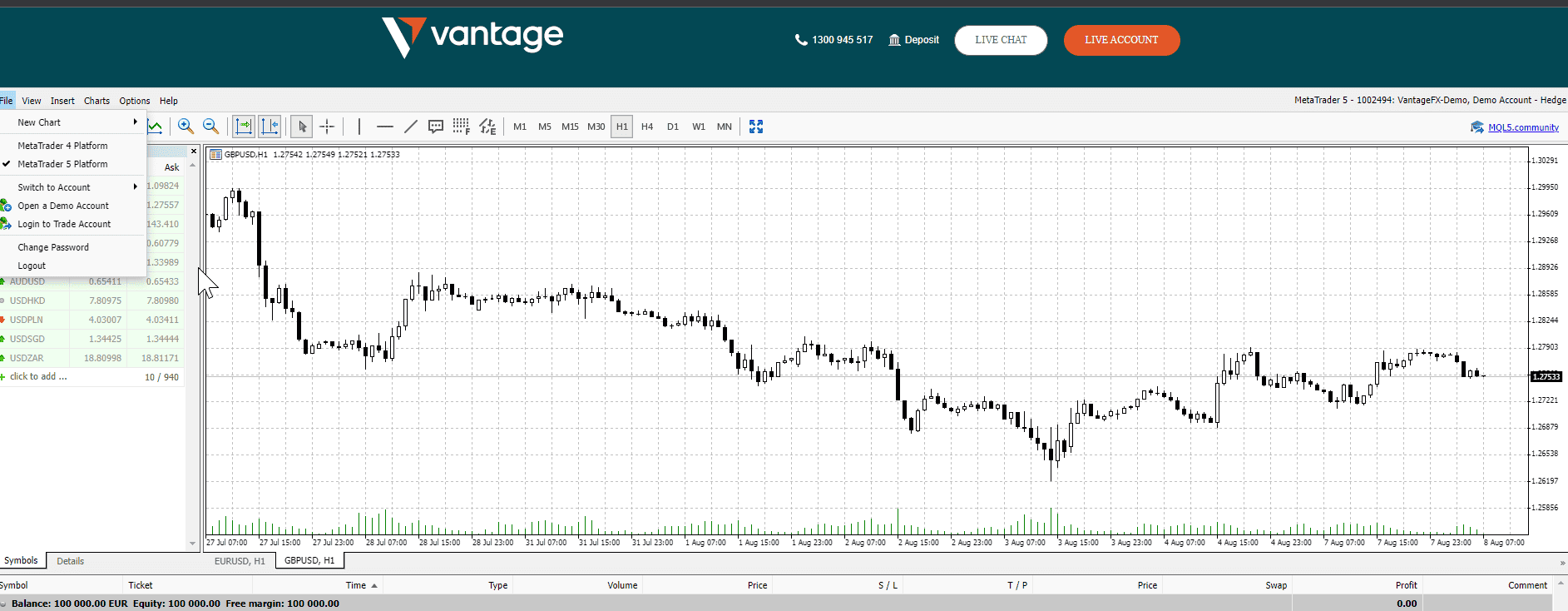

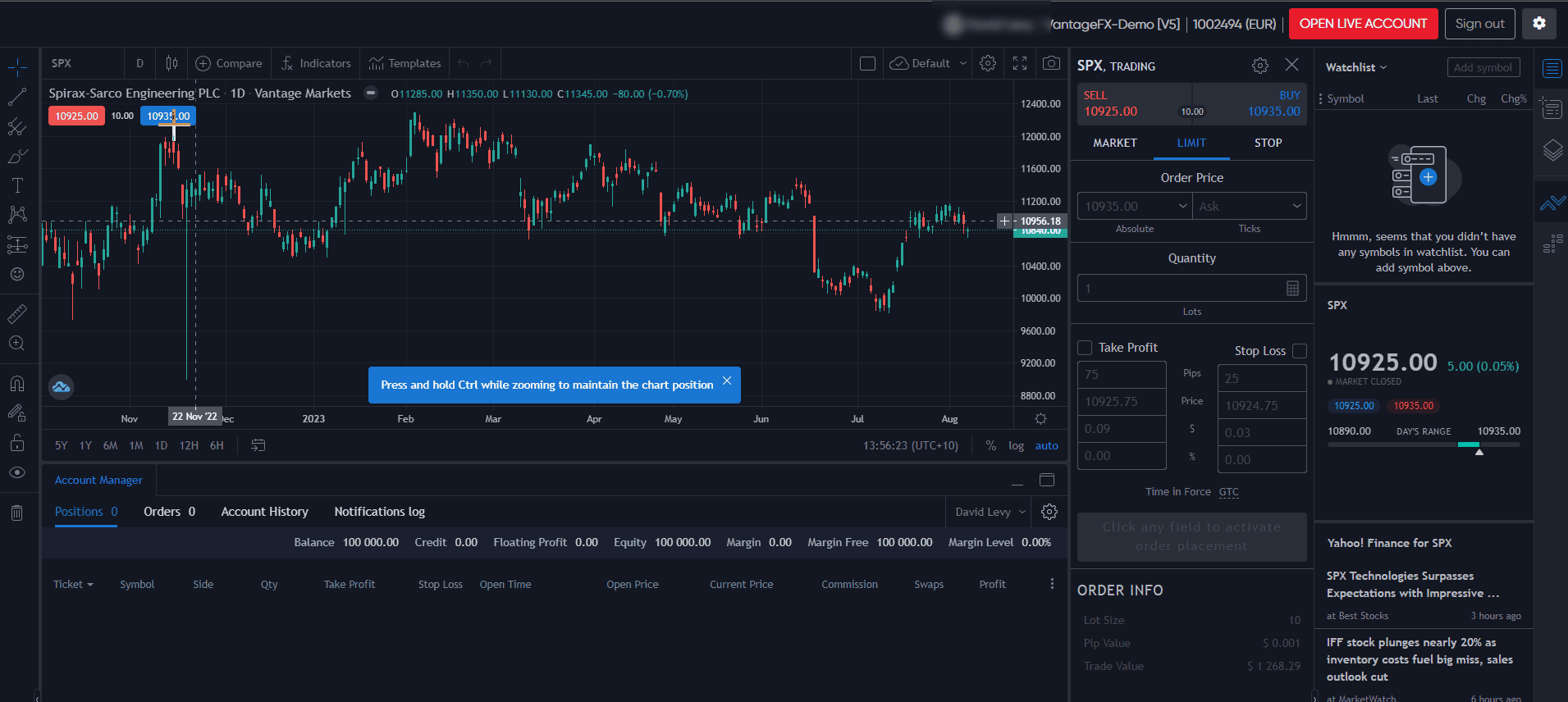

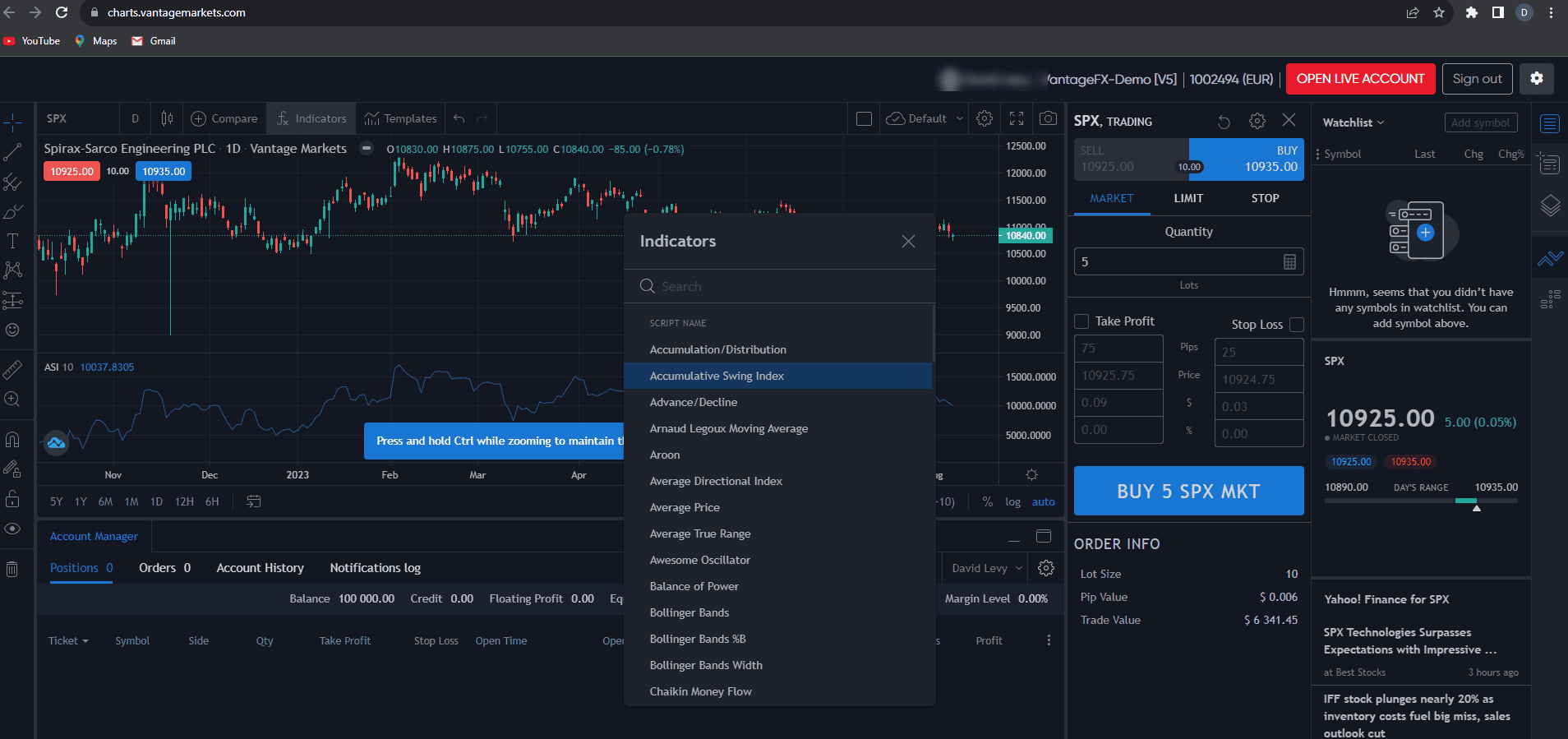

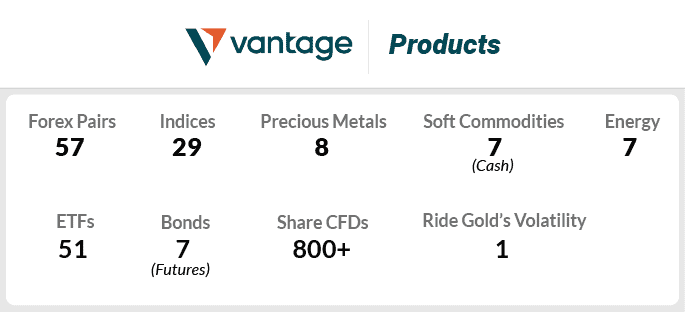

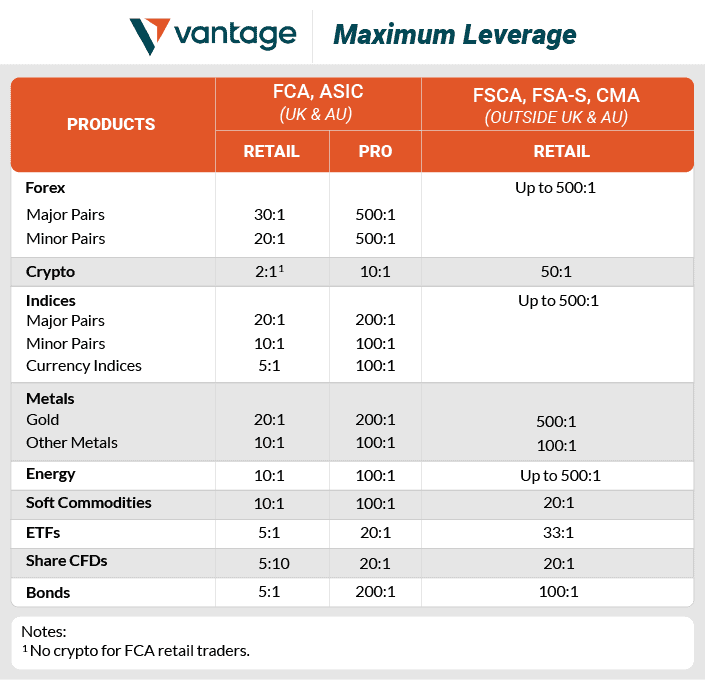

We found VantageFX to have tight spreads and low commissions, beyond that the Forex broker is quite generic with MT4 and MT5 trading platforms and 50+ Forex pairs along with other CFD products. See what we say about the broker.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.