FXCM vs AXI: Which Broker is Better?

This FXCM vs Axi review compares trading accounts and platforms. Both offer MT4, but FXCM provides spreads from 0.9 pips, while Axi starts at 0 pips with commissions. With broader platform options and competitive pricing, FXCM takes the lead in this review.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs: 33:1

0-50k 400:1

50k+ 200:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

FXCM spreads start at 0.9 pips, while Axi offers 0 pips plus commissions. Axi provides Standard, Pro, and Elite accounts.

- FXCM offers spread betting, which is available for UK traders.

- FXCM provides advanced algorithmic trading tools for enhanced strategy execution.

- Axi, on the other hand, features RAW spreads from 0.0 pips plus commission for cost-effective trading.

1. Lowest Spreads And Fees – Axi

FXCM and Axi go head-to-head by catering to different trader preferences. Axi shines with its tight spreads in its Pro Account, offering lower average RAW spreads across popular currency pairs, including EUR/USD at 0.2. FXCM adopts a commission-based structure but tends to have slightly higher spreads, such as GBP/USD averaging 0.9. Axi’s competitive pricing model attracts traders prioritising cost-efficiency, while FXCM appeals to those valuing structured accounts and broader offerings. Both make strides in their fee approaches, highlighting varying paths to meet diverse trader requirements.

Spreads

Axi outperforms FXCM with tighter spreads, offering RAW spreads as low as 0.2 for EUR/USD and averaging 1.1 for standard accounts. FXCM, while competitive, averages slightly higher spreads, such as 0.9 for GBP/USD. For active traders, these differences add up, positioning Axi as the cost-effective choice for frequent forex trades.

| RAW Account | FXCM Spreads | Axi Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 0.82 | 0.64 | 0.77 |

| EUR/USD | 0.3 | 0.2 | 0.21 |

| USD/JPY | 0.6 | 0.5 | 0.39 |

| GBP/USD | 0.9 | 0.5 | 0.50 |

| AUD/USD | 0.4 | 0.5 | 0.43 |

| USD/CAD | 0.6 | 0.5 | 0.54 |

| EUR/GBP | 0.7 | 0.5 | 0.59 |

| EUR/JPY | 0.8 | 0.6 | 0.79 |

| AUD/JPY | 1.1 | 0.7 | 1.11 |

| USD/SGD | 2 | 1.8 | 2.38 |

Try the AXI vs FXCM fee calculator below based on the most popular forex pairs and base currencies.

Standard Account Analysis Updated October 2025[1]October 2025 Published And Tested Data

Commission Levels

Axi leads with its lower commission rates at $3.50, compared to FXCM’s $4. This minor difference can accumulate over large trading volumes, favouring Axi for traders seeking cost optimisation. FXCM counters with its structured commission model that may align better for traders with specific budget strategies.

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| FXCM | $4.00 | $4.00 | N/A | N/A |

| Axi | $3.50 | $3.50 | £2.25 | €3.25 |

Standard Account Fees

Axi’s standard account spreads surpass FXCM with tighter averages across multiple forex pairs, such as EUR/UUSD at 1.2 compared to FXCM’s 1.3. These lower fees enhance Axi’s appeal for entry-level and cost-conscious traders, while FXCM delivers broader compatibility for diverse trading strategies.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 0.70 | 0.80 | 1.30 | 1.00 | 1.00 |

| 0.70 | 0.70 | 0.90 | 0.80 | 0.80 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 1.18 | 1.45 | 1.40 | 1.49 | 1.60 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.40 | 1.90 | 1.30 | 1.60 | 1.50 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 12/01/2025

Axi shines in this segment with its tighter spreads, lower commission rates, and cost-friendly standard account fees, making it an attractive choice for frequent and budget-focused traders. FXCM provides robust alternatives with its commission-based structure, higher spreads, and broader account options, appealing to traders seeking structure and diversity. Both contribute to enhancing trading experiences, yet Axi’s emphasis on affordability and efficiency makes it particularly appealing for cost-conscious forex traders. Their respective strengths ensure versatility and adaptability in meeting trader needs.

Our Lowest Spreads and Fees Verdict

Geared with lower spreads, competitive commissions, and cost-effective standard account fees, AXI wins in this category due to its lowest spreads and fees.

*Your capital is at risk ‘71.4% of retail CFD accounts lose money’

2. Better Trading Platforms – FXCM

FXCM and Axi cater to diverse trading preferences with their platforms. Both provide the widely used MetaTrader 4 (MT4), known for its intuitive design and advanced charting tools. However, FXCM outshines with its proprietary platform, Trading Station, alongside TradingView for social charting. Axi remains focused on MT4 but elevates functionality through Myfxbook integration for copy trading. FXCM’s broader platform diversity attracts traders exploring advanced and social trading tools, while Axi’s specialisation appeals to forex-focused traders seeking simplicity and precision.

Metatrader

Both FXCM and Axi offer MetaTrader 4, celebrated for its robust analytical tools and user-friendly interface. Axi enhances MT4 with its Myfxbook integration, supporting copy trading and detailed performance analytics. FXCM complements its MT4 offering with algorithmic trading via NinjaTrader and features tools such as Capitalise.ai for strategy automation. While Axi excels in enhancing MT4’s usability for forex traders, FXCM diversifies its offerings with additional platform integrations.

| Trading Platform | FXCM | Axi |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | No | No |

| cTrader | No | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | No |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

Advanced Platforms

FXCM’s proprietary Trading Station platform provides cutting-edge tools tailored to advanced traders, including customisable layouts and real-time data analysis. Additionally, FXCM’s compatibility with TradingView facilitates social charting and community-driven insights. Axi doesn’t have proprietary or supplementary platforms beyond MT4, leaning on its strength in optimising a single platform. For traders valuing platform diversity and innovation, FXCM leads this category.

Copy Trading

Both support copy trading, but their approaches differ. Axi integrates Myfxbook for seamless copy trading functionality, particularly suitable for forex-focused strategies. FXCM offers copy trading via its proprietary tools and TradingView integration, providing a more social experience for diverse markets. FXCM’s broader market reach enhances its appeal, while Axi’s targeted approach suits forex specialists.

FXCM takes the lead in this segment with its comprehensive platform of offerings, including proprietary tools and social integrations like TradingView. Its advanced capabilities cater to traders seeking innovation and versatility. Axi focuses on enhancing MT4 with Myfxbook for copy trading, appealing to traders prioritising simplicity and streamlined forex operations. Both contribute meaningfully to the trading ecosystem, yet FXCM’s wide-ranging tools and platform diversity give it the edge for providing superior trading experiences.

Our Better Trading Platform Verdict

Highly regarded for its proprietary platform, TradingView integration and advanced tools, FXCM excels in this niche thanks to its better trading platform.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

3. Superior Accounts And Features – FXCM

Axi and FXCM offer distinct account features tailored to different trader needs. Axi provides three account types- Standard, Pro, and Elite-catering to traders seeking cost-efficiency and flexibility. Its Pro account offers spreads from 0.0 pips with a $7 round-trip commission, while the Elite account reduces commissions to $3.50 per lot for high-volume traders. FXCM, on the other hand, offers a broader range of accounts, including Standard, Active Trader, and Spread Betting (UK only), with spreads starting from 0.2 pips for Active Trader accounts. Both emphasise accessibility, with Axi requiring no minimum deposit and FXCM starting at $50.

Axi’s accounts focus on affordability and efficiency, making it a strong choice for traders prioritising low costs. Its Elite account, while requiring a higher deposit, offers competitive commissions and spreads, appealing to high-volume traders. FXCM complements its account offerings with advanced features like tiered commissions for Active Trader accounts and spread betting for UK clients. FXCM’s broader range of accounts and regional customisation enhance its appeal for traders seeking diverse options. Both contribute to the forex industry by addressing varied trader needs, with Axi excelling in cost-effectiveness and FXCM in versatility.

Australian traders with FXCM do not have the option of commission-based trading.

| FXCM | Axi | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | Yes | No |

FXCM leads in this segment with its comprehensive account options and regional flexibility, catering to professional traders and those seeking diverse market access. Axi remains competitive with its cost-effective accounts and low spreads, making it an excellent choice for budget-conscious traders. Together, they highlight the importance of tailored account offerings in meeting diverse trader requirements. While FXCM’s advanced tools and broader range of instruments position it as the leader, Axi’s focus on affordability and efficiency ensures its relevance in the forex trading industry.

Our Superior Accounts and Features Verdict

Powered with versatile account options and advanced features, FXCM takes the cake in this section owing to its superior accounts and features.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

4. Best Trading Experience – FXCM

Axi and FXCM bring unique strengths to the table when it comes to trading experience. Axi provides a no-dealing desk setup, enabling direct access to liquidity pools and ensuring swift execution speeds. Its platform’s simplicity and intuitive interface make it an attractive option for traders valuing ease of use. FXCM, on the other hand, caters to a wider spectrum of traders with its diverse tools and platforms. Its TradingView integration and proprietary Trading Station are tailored for both beginners and advanced users. While Axi impresses with its user-friendly design, FXCM’s broader range of tools ensures versatility.

After conducting comprehensive testing, we have identified some important findings to consider.

- FXCM offers a diverse range of platforms, catering to both beginners and seasoned traders.

- Axi, on the other hand, is known for its intuitive interface and seamless trading experience.

- Both brokers have their strengths, but it’s essential to choose one that aligns with your trading style and preferences.

- While FXCM has a broader range of tools, Axi shines in its simplicity and user-friendly design.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| FXCM | 108ms | 28/36 | 189ms | 29/36 |

| Axi | 90ms | 8/36 | 164ms | 25/36 |

Axi’s commitment to efficiency is evident in its limit order speeds of 90ms and market order speeds of 164ms, positioning it as one of the fastest in the industry. This is further complemented by its straightforward platform, which simplifies trading without compromising on execution quality. FXCM diversifies its offering by integrating TradingView, enabling community-driven charting and insights, and providing advanced proprietary tools like Trading Station. Its focus on versatility caters to traders who prefer a robust toolkit. Together, both brokers significantly contribute to enhancing forex trading by aligning their platforms with diverse trader preferences and requirements.

Axi and FXCM deliver commendable trading experiences, each with unique focal points. Axi excels in providing a seamless, user-friendly experience powered by rapid execution speeds, making it ideal for traders who prioritise simplicity and efficiency. FXCM stands out with its extensive platform options and advanced trading tools, appealing to those seeking versatility and access to community-driven analytics. While Axi’s streamlined approach is perfect for traders seeking clarity and speed, FXCM’s broad suite of tools ensures it caters to a wider audience. Both underscore the importance of tailored solutions in delivering superior trading experiences.

Our Best Trading Experience and Ease Verdict

By having versatile platform offerings and advanced trading tools, FXCM comes out ahead in this segment thanks to its best trading experience and ease.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – FXCM

FXCM and Axi are reputable brokers with strong regulatory frameworks and trust scores. FXCM holds a higher trust score of 78, supported by multiple Tier 1 and Tier 2 regulatory licenses, including FCA, ASIC, CySEC, and DFSA. Axi follows with a trust score of 61, backed by Tier 1 regulations with FCA and ASIC and Tier 2 oversight in South Africa and Israel. FXCM’s additional Tier 1 licenses and extensive global coverage position it ahead. However, both maintain credibility with robust reviews and focus on maintaining compliance, making them reliable choices for traders.

FXCM has a high trust score of 74, with AXI following behind with 66. These scores were based on each broker’s regulation, reputation, and reviews.

FXCM Trust Score

Axi Trust Score

FXCM’s higher trust score reflects its broader regulatory reach and reputation, attributed to Tier 1 licenses in Cyprus and Canada and Tier 2 licenses in Dubai and New Zealand. Its earlier establishment (1999)compared to Axi (2007) adds weight to its credibility. FXCM also secures higher review scores, with an average of 4.4/5 on Trustpilot, while Axi averages 4.0/5. Axi compensates with faster limit and market order speeds, enhancing operational efficiency. Both emphasise transparency in operations, yet FXCM’s additional licenses and longer track record make it a preferred choice for global clients prioritising trust.

1. Regulation

The most respectable regulators are classified as ‘Tier 1’, and both FXCM and Axi share Australian regulation (ASIC) and UK regulation (FCA). FXCM has an edge, though, with regulation in Canada (IIROC) and Cyprus (CySEC). When it comes to ‘Tier 2’ regulations, there are no cross-overs. FXCM has Dubai regulation (DFSA) and the New Zealand regulator (FMA). Axi has regulations in three different areas, including South Africa (FSCA), France (AMF) and Israel (ISA). Neither broker is regulated by any lower-tier (tier 3) regulator.

When it comes to awards, FXCM came second on the Best Forex Brokers In UAE list and Best Forex Brokers In Australia list, while Axi was shortlisted on the Best Forex Brokers In NZ and FCA Regulated Brokers in UK lists.

| FXCM | Axi | |

|---|---|---|

| Tier 1 Regulation | ASIC FCA CySEC CIRO BaFin | FCA ASIC FMA |

| Tier 2 Regulation | FSCA ISA (Israel) | DFSA |

| Tier 3 Regulation | SVGFSA |

In terms of trust and regulation, FXCM emerges as the leader with its higher trust score and broader regulatory coverage. Its longevity and global footprint further strengthen its reputation. Axi remains competitive with its focus on fast execution speeds and efficient trading environments, appealing to traders prioritising operational performance. Both highlight the importance of regulatory compliance and trustworthiness in delivering secure forex trading experiences. While FXCM leads with its comprehensive oversight and reliability, Axi provides a credible alternative for traders seeking speed and simplicity within regulated frameworks.

2. Reputation

FXCM gets searched on Google more than Axi. On average, FXCM sees around 40,500 branded searches each month, while Axi gets about 11,000 — that’s 72% fewer. Similarweb shows a different story when it comes to February 2024 website visits with FXCM receiving 365,000 visits vs. 993,000 for Axi.

| Country | FXCM | Axi |

|---|---|---|

| India | 2,900 | 210 |

| United Kingdom | 2,900 | 27,100 |

| United States | 2,900 | 260 |

| France | 1,600 | 14,800 |

| Australia | 1,300 | 9,900 |

| Malaysia | 1,300 | 5,400 |

| Japan | 1,300 | 449 |

| South Africa | 1,000 | 2,900 |

| Pakistan | 1,000 | 2,400 |

| Germany | 1,000 | 9,900 |

| Thailand | 1,000 | 4,400 |

| Indonesia | 1,000 | 190 |

| Colombia | 1,000 | 3,600 |

| Canada | 880 | 18,100 |

| Nigeria | 880 | 2,900 |

| Vietnam | 880 | 3,600 |

| Italy | 720 | 8,100 |

| Spain | 590 | 9,900 |

| Taiwan | 590 | 6,600 |

| Turkey | 480 | 9,900 |

| Brazil | 480 | 9,900 |

| Morocco | 480 | 880 |

| Singapore | 480 | 5,400 |

| United Arab Emirates | 480 | 3,600 |

| Hong Kong | 480 | 2,900 |

| Mexico | 480 | 9,900 |

| Netherlands | 390 | 4,400 |

| Philippines | 390 | 9,900 |

| Egypt | 390 | 2,900 |

| Venezuela | 390 | 720 |

| Poland | 320 | 6,600 |

| Argentina | 320 | 4,400 |

| Bangladesh | 260 | 1,600 |

| Kenya | 260 | 720 |

| Algeria | 260 | 480 |

| Saudi Arabia | 260 | 2,400 |

| Greece | 210 | 1,000 |

| Peru | 210 | 2,400 |

| Chile | 210 | 2,900 |

| Switzerland | 170 | 2,400 |

| Cambodia | 170 | 480 |

| Sweden | 170 | 5,400 |

| Ecuador | 170 | 2,400 |

| Cyprus | 140 | 320 |

| Dominican Republic | 140 | 480 |

| Portugal | 110 | 2,900 |

| Austria | 110 | 1,300 |

| Sri Lanka | 110 | 1,000 |

| Ghana | 110 | 720 |

| Bolivia | 110 | 2,400 |

| Tanzania | 90 | 260 |

| Uganda | 90 | 210 |

| Ethiopia | 70 | 720 |

| Ireland | 70 | 1,300 |

| Jordan | 70 | 390 |

| Uzbekistan | 70 | 70 |

| New Zealand | 70 | 1,900 |

| Botswana | 50 | 70 |

| Panama | 50 | 260 |

| Mongolia | 50 | 210 |

| Mauritius | 40 | 260 |

| Costa Rica | 30 | 390 |

1st | |

2nd | |

3rd | |

4th | |

5th | |

6th | |

7th | |

8th |

3. Reviews

As shown below, FXCM has an excellent TrustPilot score of 4.3/5.0 from around 750 reviews. On the other hand, Axi scored 4.4/5.0 from over 4,300 reviews.

Our Stronger Trust and Regulation Verdict

Powered by a higher trust score and extensive regulatory coverage, FXCM outperforms the challenger in this category thanks to its stronger trust and regulation.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

6. CFD Product Range And Financial Markets – FXCM

FXCM and Axi excel in CFD offerings and forex trading, but cater to different trading preferences. FXCM provides a robust CFD product range, including 440+ products such as 219 Shares CFDs and 7 Cryptocurrency CFDs. Axi focuses heavily on forex trading with 72 forex pairs, complemented by broader cryptocurrency CFDs (37 options). While FXCM emphasises diversification across multiple asset classes, Axi sharpens its specialisation with high-quality forex pairings and competitive spreads. Both present unique strengths, ensuring traders have options tailored to their strategies and goals.

| CFDs | FXCM | Axi |

|---|---|---|

| Forex Pairs | 42 | 72 |

| Indices | 16 | 17 Indices 14 Index Futures |

| Commodities | 3 Metals 5 Energies 3 Softs | 3 Metals (5 Gold crosses) 2 Energies 3 Metals Futures 3 Energy Futures 3 Softs Futures |

| Cryptocurrencies | 7 | 37 |

| Shares CFDs | 219 | 50 |

| ETFs | No | No |

| Bonds | 1 | No |

| Futures | No | No |

| Treasuries | 1 | No |

| Investment | No | No |

FXCM’s versatility shines through its expansive CFD range, catering to traders seeking access to stocks, indices, and treasuries alongside forex and cryptocurrency CFDs. With detailed tools like TradingView for analytics, it supports in-depth market exploration. Axi, on the other hand, concentrates on forex and cryptocurrencies, offering 140+ cross pairs and faster limit order speeds. Its streamlined focus on fewer but high-impact markets ensures traders achieve precision. While FXCM provides broader market reach, Axi refines trading efficiency through competitive spreads and execution times. These brokers significantly contribute to the forex industry by addressing specific trader priorities.

FXCM leads with its broad CFD offerings and asset class diversity, appealing to traders who prioritise flexibility and a wider range of opportunities. Axi remains a key player for those specialising in forex and cryptocurrencies, ensuring focused execution and optimised trading costs. Both enhance forex trading experiences by delivering tailored solutions to suit traders’ needs. While FXCM takes the lead in versatility, Axi’s specialised approach demonstrates its strength in maintaining simplicity and precision. These distinct approaches underline their importance in shaping the forex trading ecosystem.

Our Top Product Range and CFD Markets Verdict

Fueled with its extensive CFD product range and asset diversity, FXCM tops this category owing to its top product range and CFD markets.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

7. Superior Educational Resources – FXCM

FXCM and Axi are committed to empowering traders with educational resources. FXCM provides a library of webinars, market analyses, and trading tools, appealing to advanced traders with a focus on market research. Axi emphasises interactive learning through live webinars, trading courses, and e-books, creating an engaging experience for beginners. Both prioritise fostering knowledge and skills, but their unique educational styles cater to different levels of expertise. They also provide demo accounts, allowing traders to practice risk-free. Both brokers focus on holistic trader education.

FXCM shines with in-depth market research, tutorials, and trading tools tailored for more seasoned traders aiming to refine strategies. Its unique trading tools bring advanced insights to users, enhancing their technical analysis capabilities. Axi’s approach is built around simplicity and hands-on learning, with live webinars and trading courses designed to guide new traders into the forex world. Both provide a strong foundation for trader education, addressing different learning curves effectively. While FXCM advances technical understanding, Axi simplifies the learning process for traders who are just starting, making education accessible across levels.

Both FXCM and Axi have invested in providing educational resources to help traders at all levels. After conducting research and testing, we have compared the educational resources offered by each broker.

- FXCM provides a comprehensive library of webinars, video tutorials, and market analysis.

- Axi offers an extensive range of educational materials, including eBooks, webinars, and trading courses.

- Both brokers have a dedicated section for beginners, ensuring newcomers have a smooth start.

- FXCM stands out with its unique trading tools and market research, which can be invaluable for advanced traders.

- Axi emphasises interactive learning with its hands-on trading courses and live webinars.

- Both brokers offer demo accounts, allowing traders to practice and hone their skills without any financial risk.

FXCM leads in offering comprehensive educational resources for advanced traders, complemented by its extensive market research and technical analysis tools. Axi, on the other hand, makes learning engaging and accessible with interactive webinars and focused trading courses, offering an ideal platform for beginners. Both contribute significantly to trader education, addressing varied needs and learning styles. FXCM impresses with its depth, while Axi excels in user-friendly, engaging formats. Their dedication to equipping traders demonstrates the value of education in achieving success in forex trading.

Our Superior Educational Resources Verdict

Built with in-depth market research and trading tools, FXCM shines with excellence in this category due to its superior educational resources.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

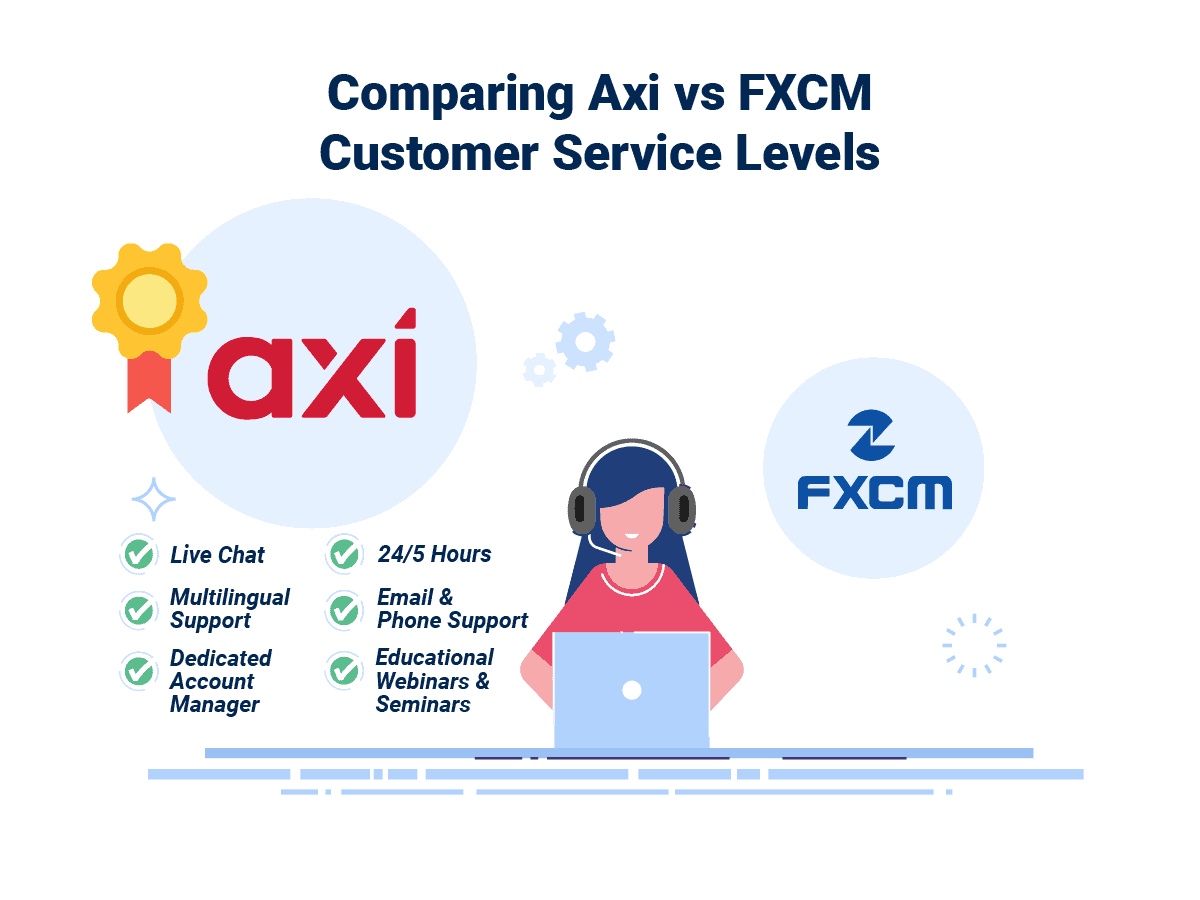

8. Better Customer Service – FXCM

FXCMM and Axi recognise the critical importance of reliable customer service for traders in a fast-paced market. Both offer 24/5 support through live chat, email, and phone, ensuring timely assistance during trading hours. Their multilingual capabilities and provision of educational webinars reflect their commitment to comprehensive trader support. While FXCM impresses with its seasoned team and professional outreach, Axi emphasises personalised service to cater to diverse trader needs. Both ensure a supportive and seamless trading experience for their clients.

FXCM’s strong customer service infrastructure is built on years of market experience, offering knowledgeable assistance for both beginners and advanced traders. Its consistent focus on trader education and multilingual capabilities make it a dependable choice. Axi matches these efforts with a personalised approach, providing equally accessible support channels and placing an emphasis on client satisfaction. Bot value empowering traders, evidenced by their inclusion of webinars and educational content to guide users. Their focus on support reflects an understanding of the challenges traders face and a drive to deliver effective solutions promptly.

| Feature | FXCM | Axi |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/5 | 24/5 |

| Multilingual Support | Yes | Yes |

FXCM and Axi deliver high standards of customer service, each with unique strengths. FXCM’s professional experience, extensive resources and robust support system cater to a global audience, ensuring reliability. Axi’s approachable and personalised service appeals to traders seeking tailored assistance and clarity in navigating the market. These brokers exemplify how excellent customer service can significantly enhance the reading experience. While FXCM’s established reputation may give it an edge, Axi’s customer-centric approach remains competitive and commendable.

Our Superior Customer Service Verdict

Loaded with a seasoned team and extensive global reach, FXCM comes out ahead in this niche owing to its superior customer service.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

9. More Funding Options – Axi

FXCM and Axi excel in providing diverse funding options tailored to traders’ needs. Axi leads with 12 funding methods, including modern solutions like cryptocurrency and e-wallets such as Skrill and Neteller. FXCM also offers a robust selection, including PayPal, POLi, and bPay for localised payments. Both ensure efficient transactions to support seamless trading, but Axi’s broader array slightly edges ahead, offering flexibility for global traders. These funding options reflect their shared commitment to enhancing the overall trader experience, m making financial management straightforward and accessible.

Axi’s variety in funding methods is key to its appeal, combining traditional options like credit cards and bank transfers with innovative solutions such as crypto payments. This ensures accessibility for tech-cavvy traders and those in emerging markets. FXCM’s localised methods, including PayPal and POLi, enhance its relevance for specific regional markets, showcasing its adaptability. Both provide options to suit diverse trader preferences, emphasising convenience and reliability. Axi’s broader suite ensures greater inclusivity for traders globally, while FXCM’s focus on efficient regional methods demonstrates a commitment to user-centric approaches.

The table below provides a comprehensive comparison of the funding options available with each broker:

| Funding Option | FXCM | Axi |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | No |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

FXCM and Axi deliver dependable and user-friendly funding options, empowering traders to manage accounts effortlessly. Axi’s comprehensive array of 12 methods appeals to a diverse international audience, while FXCM’s localised focus enhances usability for specific regions. Together, they exemplify the importance of seamless financial processes in the trading ecosystem. Axi’s range reflects its emphasis on inclusivity and global reach m making it a preferred choice for flexibility, while FXCM remains a strong contender with its regional payment innovations. These efforts highlight their dedication to refining trader experiences.

Our Better Funding Options Verdict

By having extensive funding options, which offer enhanced flexibility and inclusivity, Axi wins in this category due to its better funding options.

*Your capital is at risk ‘71.4% of retail CFD accounts lose money’

10. Lower Minimum Deposit – Axi

Axi and FXCM take different approaches with their minimum deposit requirements. Axi allows traders to start without financial barriers by offering a zero minimum deposit on its Standard and Pro accounts. This makes it highly accessible for beginners and cautious investors. On the other hand, FXCM requires a $50 minimum deposit for its Standard account, which is suitable for traders preferring to invest a moderate amount upfront to leverage their trades. Both of these brokers cater to diverse financial preferences, ensuring that traders can begin their trading journey with confidence.

FXCM and Axi have distinct approaches when it comes to their minimum deposit requirements. Here’s a breakdown:

| Minimum Deposit | Recommended Deposit | |

| FXCM | $50 | $50 |

| Axi | $0 | $200 |

Both enhance the trading ecosystem with thoughtfully designed deposit structures. Axi’s zero deposit provides unmatched accessibility for beginners and budget-conscious traders, helping them engage without hesitation. FXCM balances this with its modest $50 deposit requirement, appealing to traders looking for a structured entry into trading. While Asi shines as the more inclusive option, FXCM still remains competitive for its reliability and balanced financial requirements. Combined, they highlight the importance of adaptable financial solutions in supporting trader success in forex trading.

Our Lower Minimum Deposit Verdict

Loaded with zero minimum deposit, Axi claims the crown in this segment thanks to its lower minimum deposit.

*Your capital is at risk ‘71.4% of retail CFD accounts lose money’

So, Is Axi or FXCM The Best Broker?

Axi wins as the best choice for both beginners and experienced traders, offering cost-efficient, supportive, and trader-focused solutions across skill levels. FXCM, in contrast, could enhance spreads, customer service, and educational resources to better compete across more key trading categories

| Criteria | FXCM | Axi |

|---|---|---|

| Lowest Spreads And Fees | ❌ | ✅ |

| Better Trading Platform | ✅ | ❌ |

| Superior Accounts And Features | ✅ | ✅ |

| Best Trading Experience And Ease | ❌ | ✅ |

| Stronger Trust And Regulation | ✅ | ❌ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ❌ | ✅ |

| Superior Customer Service | ❌ | ✅ |

| Better Funding Options | ❌ | ✅ |

| Lower Minimum Deposit | ❌ | ✅ |

AXI: Best For Beginner Traders

Axi wins in the beginner traders segment due to its zero minimum deposit, superior educational resources, and responsive customer service, creating an accessible and supportive environment.

AXI: Best For Experienced Traders

Axi also takes the lead as an experienced trader with its lower spreads and fees, efficient trading experience, and inclusive account features tailored for strategic trading needs.

FAQs Comparing FXCM Vs Axi

Does Axi or FXCM Have Lower Costs?

Axi generally offers lower costs compared to FXCM. Traders often find Axi’s spreads to be more competitive, especially on major pairs. For instance, Axi’s spreads can start from as low as 0.0 pips on certain accounts. For a more detailed comparison of broker costs, you can explore the lowest spreads forex brokers.

Which Broker Is Better For MetaTrader 4?

Both Axi and FXCM offer MetaTrader 4, but Axi is often preferred for its seamless integration and user-friendly experience on the platform. FXCM, while also supporting MT4, provides additional platforms that might appeal to some traders. If you’re keen on diving deeper into MT4 offerings, check out this comprehensive review of top MT4 brokers.

Which Broker Offers Social Trading?

Axi stands out when it comes to offering social trading options, allowing traders to follow and replicate the strategies of professionals. FXCM, on the other hand, focuses more on traditional trading platforms. Social trading has become a significant trend in the forex world, and if you’re interested in exploring more, here’s a detailed guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

FXCM offers spread betting for its traders. This form of trading allows individuals to speculate on the direction of a financial market without owning the underlying asset. It’s a popular method in the UK due to its tax benefits. If you’re keen to explore more about spread betting and the best brokers offering this service, you can check out this comprehensive guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Axi is the superior choice for Australian forex traders. Being ASIC regulated and founded in Australia, Axi has a deep understanding of the local market and its traders’ needs. On the other hand, FXCM, while also offering services in Australia, is originally based overseas. Axi’s strong local presence and commitment to adhering to Australian regulations make it a top choice. For a broader perspective on the best brokers in Australia, you might want to visit this list of Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I personally feel that FXCM stands out. Being FCA regulated and with a significant presence in the UK market, FXCM offers a level of trust and reliability that traders seek. Axi, while also offering services in the UK, originates from overseas. The stringent regulations and standards set by the FCA ensure that FXCM maintains high standards of operation. If you’re looking for more insights on the best platforms for UK traders, here’s a detailed review of the Best Forex Brokers In UK.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert