FXCM vs City Index: Which One Is Best?

We used our scoring methodology to find out which forex brokers in our FXCM vs City Index we think is best. To do this we looked at the costs, platforms like MT4 and MT5 and broker trust. See how the brokers did.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs: 33:1

Minor Pairs 10:1

0-50k 400:1

50k+ 200:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers the 10 most important trading factors you should consider.

- FXCM offers a wider range of trading platforms including Trading Station.

- City Index has a more extensive product range, including options and spread betting.

- FXCM provides a slightly lower spread on major currency pairs.

- City Index is regulated by multiple authorities, including the FCA.

- FXCM has a more user-friendly interface, making it easier for beginners.

1. Lowest Spreads And Fees– FXCM

When we refer to a broker’s trading costs, we lean heavily on spreads and commissions. To illustrate this point, 60% of our scoring is weighted towards spreads and 15% is weighted towards commissions. So we’ll focus on spreads and commissions here.

When we tested Standard Account Spreads (i.e. no commission account), we found FXCM had on average lower spreads than City Index. If we combine and then average the 6 currency pairs we tested over a 24 hours period, FXCM achieved average spread of 1.47 pips compared to City Index’s wider average of 1.79 pips. If we look at each individual pair, FXCM had tighter spreads for 5 of the six pairs, with City Index on triumph being AUD/USD.

The flip side is that City Index did very well in our Raw Account Spreads testing. While this account is only available in Australia (called RAW FX Account and Singapore (called DMA account) our tests showed that City Index averaged 0.23 pips for AUD/USD (4th of the 20 brokers we tested), 0.22 pips for EUR/USD (9th of 20 brokers we tested) and finished on top for GBP/USD with 0.17 pips.

In terms of commissions, City Index does have competitive commissions with the RAW FX account but this is only available in Australia. Provided you are using the City Index Trading Platform, you will pay USD $5 round-turn ($1-2 cheaper than the industry average for a commission-based account). But this doesn’t mean City Index is cheaper compared to FXCM since FXCM have discounts with their active trader account. In Australia, these come in the form of rebates (the more you trade, the more you get back) while in the UK, the active trader account revolves around discounts on commissions, the more you trade, the lower your commissions.

As a rule, we think you should assume FXCM is better for a standard account while City Index is best for a RAW spread account but keep in mind, such accounts are only available with City Index in Australia and Singapore, If you are not in Australia, Singapore or the UK and really wish to be part of the City Index family, your best bet is to join Forex.com who is also owned by the StoneX. Forex.com have a similar RAW account in Canada and in emerging markets. Read our full Forex.com Review for more information.

Other costs such as inactivity fees, minimum deposit, and funding fees were relatively even across the board.

| FXCM | City Index | |

|---|---|---|

| Spread | Standard - Min 1.0 pips, Avg 1.4 pips Active traders (not Australia, Canada) - Min 0.0 pips | Standard & MT4 - Min 0.5 pips (avg RAW FX (Australia) - Min 0.0 pips DMA Account (Singapore) - 0.0 pips |

| Commission per 100,000 Round-turn | Active traders (not Australia, Canada) - $5.00 min volume $150M-500M | RAW FX - AUD 5.00 (Web Trader), AUD 7 (MT4) DMA Account - tiered commission $20 to $60 per million) |

| Inactivity fees | Yes 50 units after 12 months of inactivity | Yes. $/£12/€14 per month after 12 months of inactivity. |

| Active Trader Discount | Yes | N/A |

| Minimum deposit | $300 to open, $50 per deposit | Standard/MT4/RAW FX - $150 ($250 with debit/credit card) DMA Account - $25,000 |

| Deposit or Withdrawal fees | Only International bank transfer | Only International bank transfer |

| Our Cost Score | 6 | 3 |

Standard Account Spreads

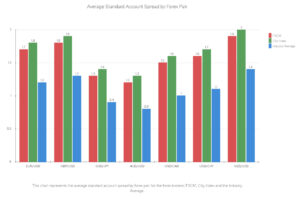

Looking at the data, it’s clear that there are some differences in the average standard account spreads between FXCM, City Index, and the industry average.

For the EUR/USD pair, FXCM has a spread of 1.13, City Index is lower at 0.7, and the industry average is lower at 1.2. This pattern is consistent across all the pairs, with City Index generally having the highest spreads, followed by FXCM, and then the industry average.

However, it’s important to remember that lower spreads aren’t the only factor to consider when choosing a forex broker. Other factors such as the trading environment, trustworthiness, and customer service are also crucial.

| Standard Account | FXCM Spreads | City Index Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.30 | 1.45 | 1.7 |

| EUR/USD | 1.13 | 0.7 | 1.2 |

| USD/JPY | 1.1 | 0.6 | 1.5 |

| GBP/USD | 1.2 | 1.6 | 1.6 |

| AUD/USD | 0.7 | 2.2 | 1.6 |

| USD/CAD | 1.13 | 1.6 | 1.9 |

| EUR/GBP | 1.10 | 1.10 | 1.5 |

| EUR/JPY | 1.7 | 1.6 | 2.1 |

| AUD/JPY | 2.3 | 2.2 | 2.3 |

Standard Account Analysis Updated February 2026[1]February 2026 Published And Tested Data

In my opinion, while City Index and FXCM might have slightly higher spreads, they offer robust trading platforms and excellent customer service, which can more than make up for the slightly higher costs. However, if you’re a trader who prioritises low spreads above all else, then you might find the industry average more appealing.

Here is the bar chart visualising the average standard account spread by forex pair for FXCM, City Index, and the Industry Average:

Our Lowest Spreads and Fees Verdict

Overall, we scored FXCM higher for trading costs (6/10 compared to 3/10) largely because of having lower average spreads overall, across most major currency pairs. In every other area, the brokers are evenly matched.

*Your capital is at risk ‘65% of retail CFD accounts lose money’

2. Better Trading Platform– Tie

Our testing behind trading platforms gave a higher weighting to popular third-party platforms like the MetaTrader platforms and cTrader, compared to any proprietary platform a broker might offer. When combined, MT4, MT5 and cTrader contributed 40% to our overall weighting. Throw in TradingView, and that rises to 50%.

| Trading Platform | FXCM | City Index |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | No | No |

| cTrader | No | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

As such, it was hard to split FXCM and City Index across the board. Both brokers offer MT4 (which is still the most popular forex trading platform), while also offering TradingView, which is a powerful charting platform.

Both brokers also offer proprietary platforms, which are both solid platforms, although City Index offers more advanced charting tools (with 90 indicators compared to 60).

In terms of trading tools, including copy trading and automated trading, both brokers offer the same basic features (MetaTrader Signals and EAs). However, FXCM does offer Capitalise.ai for code-free automation, which you can integrate with the MT4 platform.

Our Better Trading Platform Verdict

Overall, FXCM and City Index were dead even when comparing trading platforms. While both brokers offer a good MT4 experience, neither offers MT5 or cTrader, which is one reason they didn’t score higher. However, both brokers make up for it with their solid proprietary platforms.

View City Index ReviewVisit City Index

*Your capital is at risk ‘69% of retail CFD accounts lose money’

3. Superior Accounts And Features– FXCM

When rating our broker trading experience, we base it largely on execution speeds, account opening and the availability of account types. As such, 30% is based on execution speeds (limits and market orders), 25% on account opening and withdrawals, and 20% on the availability of Standard and Raw/ECN accounts.

When looking at execution speeds, FXCM is faster overall but the difference is not significant. Our chief of technology research, Ross Collins, tested limit and against 20 top brokers and FXCM ranked 6th overall while City Index was close behind at 7th position. While City Index had quicker limit order speeds, FXCM had quicker market orders. Having said that, it’s Both City Index and FXCM were the fastest market makers that we tested.

We also tested account opening, in which City Index marginally pips FXCM, largely due to FXCM having more unexpected errors come up. Once again, our very own Ross Collins, tested 20 forex brokers by opening accounts with each one. What he liked about both FXCM and City Index is the account manager that was assigned. There were several aspects he wasn’t overly happy about, including having multiple touchpoints to open an account and taking days to actually open an account.

Where FXCM and City Index are similar (and unique), is they are both market makers with enhanced execution (FXCM) or DMA/STP features (City Index). This means both brokers match the spread the pool of spread their liquidity providers are offering.

| FXCM | City Index | |

|---|---|---|

| Standard Account | Yes | No |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | No |

| Active Traders | Yes | No |

| Spread Betting (UK) | Yes | Yes |

When looking at other trading experience aspects like the number of base currencies, the availability of swap-free accounts and maximum leverage, both brokers are identical.

| FXCM | City Index | |

|---|---|---|

| Execution Type | FXCM Enhanced Execution - Market Maker matched to best prices in liquidity pool (with Market Execution) | Market Maker (with Market Execution) |

| Demo Account | Yes | Yes |

| Standard Account | Standard | Standard, MT4 |

| Commission Account | In UK/ EU with Active Trader | RAWFX (Australia) DMA (Singapore |

| Fixed-spread Account | No | No |

| Swap-free Account | On request | On request |

| # of Base Currencies | 9 | 9 (3 with RAW fX) |

| Maximum Forex Leverage | 1:30 or 1:500 | 1:30 or 1:500 |

| Execution Speed | Limit Order 108 Market Order 123 | Limit Order 95 Market Order 135 |

| Our Ease Of Account Opening Score (out of 15) | 7 | 8 |

| Our Overall Trading Experience Score | 7 | 5 |

Our Superior Accounts and Features Verdict

Our overall score above indicates FXCM has a slightly better trading experience than City Index, but this is largely due to having slightly faster execution speeds. In reality, the two brokers offer a fairly similar trading experience, with City Index having the better account opening process (albeit, marginally). For trading experience we gave City Index a score of 5.40 and FXCM a score of 6.60.

*Your capital is at risk ‘65% of retail CFD accounts lose money’

4. Best Trading Experience And Ease– FXCM

When it comes to the trading experience, FXCM’s Trading Station is a game-changer. It’s intuitive, easy to navigate, and the charting tools are second to none.

- City Index offers a highly customisable platform

- FXCM provides one-click trading, streamlining the process

- City Index has more built-in indicators for technical analysis

- FXCM offers a demo account loaded with $50,000 of virtual money

City Index’s AT Pro platform, on the other hand, is robust and feature-rich but has a steeper learning curve.

Our Best Trading Experience and Ease Verdict

If you’re after a straightforward, user-friendly experience, FXCM is your go-to. However, for traders looking for more advanced features, City Index’s AT Pro platform is worth the learning curve.

*Your capital is at risk ‘65% of retail CFD accounts lose money’

5. Stronger Trust And Regulation– City Index

In forex trading, establishing a secure and transparent environment relies heavily on strong trust and regulation.

City Index Trust Score

FXCM Trust Score

Regulations

When it comes to trust and regulation, both FXCM and City Index are overseen by some of the most respected regulatory bodies in the world. However, the scope and breadth of these regulations differ. Here’s a detailed table for clarity:

FXCM is regulated by four key bodies: the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa. These regulations ensure a high level of oversight, but they are somewhat limited in geographical scope.

City Index, on the other hand, is regulated by five major bodies, including the FCA in the UK and ASIC in Australia, similar to FXCM. Additionally, they are regulated by the Monetary Authority of Singapore (MAS), the Investment Industry Regulatory Organization of Canada (IIROC), and the Commodity Futures Trading Commission (CFTC) in the USA. This wide range of regulatory oversight provides an extra layer of security and trustworthiness.

| FXCM | City Index | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) CYSEC (Cyprus) CIRO (CANADA) BaFin (Germany) | ASIC (Australia) FCA (UK) MAS (Singapore) |

| Tier 2 Regulation | FSCA (South Africa) ISA (Israel) | |

| Tier 3 Regulation |

Reviews

FXCM holds a Trustpilot rating of 4.3 out of 5, based on over 700 reviews. City Index has a slightly lower score of 4.2 out of 5, from around 395 reviews. FXCM edges ahead in user satisfaction, especially for customer service, while City Index offers broader market access and institutional-grade tools.

Our Stronger Trust and Regulation Verdict

While both brokers are well-regulated, City Index has the edge with more comprehensive regulatory oversight, including key financial markets like Singapore, Canada, and the USA. This makes City Index a more trustworthy and reliable option for traders who are concerned about the safety of their investments.

View City Index ReviewVisit City Index

*Your capital is at risk ‘69% of retail CFD accounts lose money’

6. Most Popular Broker – FXCM

FXCM gets searched on Google more than City Index. On average, FXCM sees around 40,500 branded searches each month, while City Index gets about 9,900 — that’s 75% fewer.

| Country | FXCM | City Index |

|---|---|---|

| United Kingdom | 2,900 | 4,400 |

| United States | 2,900 | 390 |

| India | 2,900 | 590 |

| France | 1,600 | 70 |

| Japan | 1,300 | 90 |

| Australia | 1,300 | 1,000 |

| Malaysia | 1,300 | 110 |

| Germany | 1,000 | 140 |

| Colombia | 1,000 | 20 |

| Thailand | 1,000 | 40 |

| South Africa | 1,000 | 90 |

| Indonesia | 1,000 | 90 |

| Pakistan | 1,000 | 40 |

| Vietnam | 880 | 40 |

| Canada | 880 | 50 |

| Nigeria | 880 | 70 |

| Italy | 720 | 50 |

| Spain | 590 | 50 |

| Taiwan | 590 | 50 |

| Brazil | 480 | 40 |

| United Arab Emirates | 480 | 40 |

| Mexico | 480 | 10 |

| Morocco | 480 | 20 |

| Turkey | 480 | 50 |

| Hong Kong | 480 | 40 |

| Singapore | 480 | 720 |

| Netherlands | 390 | 40 |

| Egypt | 390 | 20 |

| Philippines | 390 | 30 |

| Venezuela | 390 | 10 |

| Poland | 320 | 90 |

| Argentina | 320 | 10 |

| Saudi Arabia | 260 | 20 |

| Algeria | 260 | 10 |

| Bangladesh | 260 | 20 |

| Kenya | 260 | 30 |

| Chile | 210 | 10 |

| Peru | 210 | 10 |

| Greece | 210 | 20 |

| Switzerland | 170 | 30 |

| Ecuador | 170 | 10 |

| Sweden | 170 | 40 |

| Cambodia | 170 | 10 |

| Dominican Republic | 140 | 10 |

| Cyprus | 140 | 20 |

| Portugal | 110 | 30 |

| Austria | 110 | 10 |

| Bolivia | 110 | 10 |

| Sri Lanka | 110 | 10 |

| Ghana | 110 | 10 |

| Tanzania | 90 | 10 |

| Uganda | 90 | 10 |

| Ireland | 70 | 30 |

| Jordan | 70 | 10 |

| Uzbekistan | 70 | 10 |

| New Zealand | 70 | 10 |

| Ethiopia | 70 | 10 |

| Panama | 50 | 10 |

| Botswana | 50 | 10 |

| Mongolia | 50 | 10 |

| Mauritius | 40 | 10 |

| Costa Rica | 30 | 10 |

2,900 1st | |

4,400 2nd | |

2,900 3rd | |

590 4th | |

1,300 5th | |

90 6th | |

1,300 7th | |

1,000 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with FXCM receiving 365,000 visits vs. 216,000 for City Index.

Our Most Popular Broker Verdict

FXCM is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘65% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets– City Index

FXCM offers a decent range of products, but City Index goes above and beyond with its extensive options and spread betting.

| CFDs | FXCM | City Index |

|---|---|---|

| Forex Pairs | 42 | 84 |

| Indices | 16 | 40+ |

| Commodities | 3 Metals 5 Energies 3 Softs | 6 Metals 8 Energies 13 Softs |

| Cryptocurrencies | 7 | 5+ |

| Shares CFDs | 219 | 4700+ |

| ETFs | No | 4 |

| Bonds | 1 | 11 |

| Futures | No | No |

| Treasuries | 1 | 11 |

| Investment | No | No |

Our Top Product Range and CFD Markets Verdict

City Index offers a more comprehensive product range, making it the better choice for traders who want to diversify their portfolios.

View City Index ReviewVisit City Index

*Your capital is at risk ‘69% of retail CFD accounts lose money’

8. Superior Educational Resources– FXCM

FXCM and City Index both offer a range of educational resources, but FXCM has a slight edge with its advanced courses and live webinars.

- FXCM offers live webinars for real-time learning

- City Index provides video tutorials for self-paced learning

- FXCM has a glossary and FAQ section for quick reference

- City Index offers beginner courses for those new to trading

- FXCM provides advanced courses for skill enhancement

- City Index has a comprehensive FAQ section for common queries

Our Superior Educational Resources Verdict

Based on our scores, FXCM takes the lead in educational resources, making it ideal for both beginners and experienced traders looking to upskill.

*Your capital is at risk ‘65% of retail CFD accounts lose money’

9. Superior Customer Service– FXCM

Customer service is a crucial aspect of trading, and both brokers excel in this area. FXCM offers 24/7 support, a significant advantage for traders operating across different time zones.

| Feature | FXCM | City Index |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/5 | 24/5 |

| Multilingual Support | Yes | Yes |

City Index, however, offers more localized support and tends to respond a bit faster.

Our Superior Customer Service Verdict

While FXCM offers round-the-clock support, City Index wins in terms of response time and localized service, making it slightly more reliable in customer service.

*Your capital is at risk ‘65% of retail CFD accounts lose money’

10. Better Funding Options– FXCM

Funding is straightforward with both brokers, but FXCM offers a wider range of options, giving traders more flexibility.

| Funding Methods | FXCM | City Index |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | Yes |

| Skrill | Yes | No |

| Neteller | Yes | No |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Our Better Funding Options Verdict

FXCM offers a broader range of funding options, making it more convenient for traders with different financial preferences.

*Your capital is at risk ‘65% of retail CFD accounts lose money’

11. Lower Minimum Deposit– City Index

City Index has a lower minimum deposit of $0 compared to FXCM, which requires a $50 minimum. However, if you mainly use PayPal or a credit card, you will find yourself paying a minimum of between $50-150 with City Index.

We are providing further details on this matter below.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $150 |

| Paypal | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $150 |

| Bank Wire | £0 Minimum Deposit | $0 Minimum Deposit | €0 Minimum Deposit | $150 |

| Skrill | N/A | N/A | N/A | N/A |

For FXCM, however, no matter which payment method you use, the required minimum is constant at $50 or equivalent.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

| Bank Wire | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

| Skrill | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

| Neteller | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $50 |

Our Lower Minimum Deposit Verdict

City Index wins over FXCM when it comes to minimum deposits. Nevertheless, the $0 minimum feature is rather limited, and you may end up paying higher (than FXCM’s fixed minimum) with City Index depending on your payment channel.

View City Index ReviewVisit City Index

*Your capital is at risk ‘69% of retail CFD accounts lose money’

So Is City Index or FXCM The Best Broker?

FXCM is the winner because it offers a more balanced package for traders, excelling in lower spreads, better trading experience, and diverse funding options. The table below summarises the key information leading to this verdict.

| Criteria | FXCM | City Index |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ✅ | ✅ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ❌ | ✅ |

| Top Product Range And CFD Markets | ❌ | ✅ |

| Superior Educational Resources | ✅ | ❌ |

| Superior Customer Service | ✅ | ❌ |

| Better Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ✅ | ❌ |

City Index: Best For Beginner Traders

City Index is better suited for beginner traders due to its superior educational resources and user-friendly platform.

FXCM: Best For Experienced Traders

For experienced traders, FXCM offers a more competitive edge with lower spreads and better customer service.

FAQs Comparing FXCM vs City Index

Does City Index or FXCM Have Lower Costs?

FXCM has lower costs, particularly when it comes to spreads on Standard Accounts. For example, FXCM’s average spread for EUR/USD is 1.7 pips, whereas City Index is at 1.8 pips. For more on low-cost trading, check out our guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

FXCM is the better choice for MetaTrader 4 users. They offer a seamless integration with this popular platform. For more details, check out our best MT4 brokers list.

Which Broker Offers Social Trading?

Neither FXCM nor City Index offers social or copy trading. However, there are other brokers that do. For more information, you can visit best copy trading platforms.

Does Either Broker Offer Spread Betting?

City Index offers spread betting, making it a more versatile choice for traders interested in this form of trading. For more on this, you can check out best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, FXCM is the superior choice for Australian Forex traders. Both brokers are ASIC regulated, but FXCM offers a more user-friendly experience. For more information, you can visit this Best Forex Brokers In Australia list.

What Broker is Superior For UK Forex Traders?

For UK traders, City Index is the better option. They are FCA regulated and offer a robust trading platform suitable for experienced traders. For more details, you can check out Best Forex Brokers In UK.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads Standard Account Spreads.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Is FXCM a prime broker?

No, they are not.

Does FXCM allow hedging?

Yes, FXCM allows hedging. You can enable this feature by logging into your account and selecting “Hedging Functionality” from the “Account Settings” drop-down menu.