Pepperstone vs Hugo's Way: Which One Is Best?

Our Pepperstone vs Hugosway review found both are ECN brokers with low spreads from 0.0 pips and commissions but Pepperstone is regulated while Hugosway is not. Along with better forex trading platforms, range of CFD trading markets and superior review, Pepperstone is our recommended forex broker.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers the 10 most important trading factors to help you make an informed decision.

- Pepperstone offers a more robust regulatory framework, including ASIC and FCA.

- Hugo’s Way provides a higher leverage option, up to 1:500.

- Pepperstone has a more extensive range of trading platforms, including MT4, MT5, and cTrader.

- Hugo’s Way offers a simpler account structure, making it easier for beginners.

- Pepperstone has a more comprehensive educational section, ideal for traders looking to upskill.

1. Lowest Spreads And Fees: Pepperstone

Both Pepperstone and Hugo’s Way offer a commission-based account that uses ECN pricing. You will incur three major trading costs when using this type of account. These are:

- Spreads

- Commission

- Rollover

Spreads

Spreads are more difficult to compare as Pepperstone provide their average spreads and Hugo’s Way does not. I contacted Hugo Ways, and they were kind enough to provide me with their lowest recorded spreads for each currency pair. While Hugosway’s lowest spread is 0.2 pips, Pepperstone is much more competitive offering minimum spreads of 0.0 pips via its Razor Account.

| Spreads on 02/10/2018 | EUR/USD | USD/JPY | AUD/USD | GBP/USD |

|---|---|---|---|---|

| Hugo's Way (Low) | 0.2 | 0.2 | 0.3 | 0.4 |

To understand Pepperstone’s competitiveness, the table below compares the broker’s average spreads to those of other top brokers. As you can see, Pepperstone’s average spreads are significantly lower than Hugosway’s minimum spreads.

Raw Spread comparison | |||||

|---|---|---|---|---|---|

| 0.10 | 0.10 | 0.30 | 1.30 | 0.30 |

| 0.14 | 0.31 | 0.39 | 0.75 | 0.57 |

| 0.10 | 0.20 | 0.30 | 1.00 | 0.50 |

| 0.16 | 0.29 | 0.54 | 0.68 | 0.70 |

| 0.20 | 0.40 | 0.50 | 0.70 | 0.70 |

| 0.80 | 0.40 | 0.50 | 0.90 | 1.40 |

| 0.10 | 0.50 | 0.60 | 0.40 | 0.60 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Pepperstone also offers very competitive standard account pricing with minimum spreads of 0.6 pips with no commission fees. The commission-free standard account type is a great choice for beginner traders, as you do not need to worry about calculating commission costs whilst you are trading.

| 1.10 | 1.10 | 1.30 | 2.30 | 1.40 |

| 0.70 | 2.20 | 1.10 | 1.60 | 1.60 |

| 1.90 | 2.00 | 2.40 | 2.30 | 2.50 |

| 1.40 | 2.50 | 2.50 | 2.60 | 2.60 |

| 1.40 | 1.60 | 1.40 | 2.10 | 1.90 |

| 1.52 | 2.08 | 1.46 | 2.15 | 1.76 |

| 0.70 | 0.80 | 1.30 | 2.40 | 1.30 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Standard Account Spreads

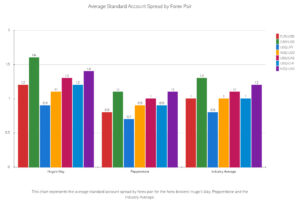

When we look at the average standard account spreads for the forex pairs, we see some interesting differences between Hugo’s Way, Pepperstone, and the industry average.

Hugo’s Way has spreads that are generally higher than the industry average. For example, the spread for EUR/USD is 1.2, which is higher than the industry average of 1.0. This trend continues across all the forex pairs, with Hugo’s Way consistently having higher spreads than the industry average.

On the other hand, Pepperstone offers more competitive spreads. For instance, the spread for EUR/USD is 0.8, which is lower than both Hugo’s Way and the industry average. This pattern is consistent across all forex pairs, making Pepperstone a more cost-effective option for traders.

| Standard Account | Hugo’s Way Spreads | Pepperstone Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.75 | 1.16 | 1.6 |

| EUR/USD | 0.9 | 1.1 | 1.2 |

| USD/JPY | 1.5 | 1.2 | 1.5 |

| GBP/USD | 1.7 | 1.2 | 1.6 |

| AUD/USD | 1.3 | 1.1 | 1.6 |

| USD/CAD | 1.7 | 1.4 | 1.9 |

| EUR/GBP | 3.6 | 1.2 | 1.5 |

| EUR/JPY | 3.0 | 2.1 | 2.1 |

| AUD/JPY | 0.4 | 1.9 | 2.3 |

Standard Account Analysis Updated February 2026[1]February 2026 Published And Tested Data

In my opinion, Pepperstone offers a more affordable trading experience in terms of spreads. The lower spreads can significantly reduce trading costs, especially for high-volume traders. However, it’s important to remember that spreads are just one aspect of trading costs. Other factors, such as commissions, fees, and the trading environment, can also impact the overall cost of trading.

Commission

When it comes to commission – Pepperstone offers better commission without question.

| One way pricing | MetaTrader 4 | MetaTrader 5 |

|---|---|---|

| Pepperstone - AUD | $3.50 | $3.50 |

| Pepperstone - USD | $3.50 | $3.78 |

| Hugo's Way - USD | $5 | Not offered |

Hugo’s Ways charges USD $ 5 per standard lot. This is expensive when compared with Pepperstone, one is essentially paying $1.5 more for each side of the trade. This difference can add up over time. This high commission is surprising given Hugo’s Way is not regulated. I asked them why this is the case for information purposes and this is what they said:

Pepperstone charges in your account currency. So if you’re in Australia, you are better to trade with AUD than USD. IC Markets and Oanda have similar commission rates for the core pricing + commission pricing model.

ECN Trading

Both brokers use ECN-style trading to provide you with the tightest spreads.

ECN Trading With Pepperstone

Pepperstone prefers not to call itself an ECN broker. This is because ‘true ECN’ or STP brokers use someone else’s trading system, independent of their own trading system. Pepperstone is therefore not a ‘true ECN’ as they are the issuer of its own products. Instead, Pepperstone provides you with ECN-level pricing by souring quotes from external liquidity providers via ECN networks and passing these prices directly to you without any intervention from their side.

ECN Trading With Hugo’s Way

Hugo’s Way, unlike Pepperstone, actively calls itself a ‘True ECN’ broker, but the information on its website is conflicting. Hugo’s Way sources your quotes from 50 different banks and dark pool liquidity providers; however, they claim they provide ‘true ECN’ and at other times claim they practice STP execution.

While one can argue that ECN and STP are two sides of the same coin, Hugo’s Way incorrectly claims STP execution means processing via an aggregator. This is ECN, not STP execution. Given Hugo’s Way has wider spreads than Pepperstone, the question has to be asked about Hugo’s Way execution.

Our Lowest Spreads and Fees Verdict

Pepperstone offers lower costs than Hugo’s Way. Commission costs are lower than Hugo’s Way and the spread generally appears narrower. All in all, forex traders can save on their trading costs if they open a trading account with Pepperstone.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

2. Better Trading Platform: Pepperstone

Pepperstone has Hugo’s Way covered hands down when it comes to trading platforms. While Hugo’s Way only offers MetaTrader 4 for Windows, iOS, Android, MacOS and Web Trader for mobiles, Pepperstone offers all these and more.

| Trading Platform | Pepperstone | Hugo's Way |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | No |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | No |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

With Pepperstone you can choose from MetaTrader 4, MetaTrader 5, and cTrader along with all their operating system and mobile versions.

Pepperstone not only offers a decent choice of trading platforms but also a wide range of social trading, copy trading, and advanced trading tools. Something is absent from Hugo’s Way portfolio.

Pepperstone Advanced Trading Tools

- Smart Trader Tools for MetaTrader – advanced trading tools on MetaTrader for greater trading insights and productivity.

- cTrader Automate – Algorithmic tools to automate your trading with cTrader

- Autochartist – Advanced technical analysis tools such as charts and Fibonacci patterns for more advanced trading information.

- API trading

Pepperstone Social And Copy Tools:

- Myfxbook

- ZuluTrade

- Mirror Trader

- MetaTrader signals

- Duplitrade

Our Better Trading Platform Verdict

MetaTrader 4 is a great trading platform as it’s suitable for all investors and depending on your trading needs, can be all you need for successful trading. Traders will usually benefit from extra tools that Pepperstone offers that provide deeper technical analysis so you can make more informed trading decisions and social and copy trading tools so users can learn from other successful traders.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

3. Superior Accounts And Features: Pepperstone

Pepperstone Accounts

Pepperstone offers two main account types. These are:

- Standard

- Razor Accounts

The main difference between each account is Standard account had no commission, instead, the spread is widened by at least 0.6 pips. Spreads on the Razor account are organic. This means they are aggregated from a dark pool of liquidity providers and banks without price interference from Pepperstone. To keep the spreads as low as possible, Pepperstone charges a commission:

- MT4 & MT5: As low as $3.50 per side, $7 round-turn (varies between platform and account base currency).

- cTrader: You pay 0.0035% of the base currency of the pair being traded. I.e. if you are trading 100,000 currency units of the EUR/USD, you will pay €3.50 per side or €7 round-turn.

| Pepperstone | Hugo's Way | |

|---|---|---|

| Standard Account | Yes | No |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | No |

| Active Traders | Yes | No |

| Spread Betting (UK) | Yes | No |

Hugo’s Way Account

Hugo’s only offers one account. This is the ECN account.

Below is a comparison of each broker’s accounts

| Pepperstone Standard | Pepperstone Razor | Hugo's Way | |

|---|---|---|---|

| Spreads (EUR/USD) | from 0.6 | from 0.0 | from 0.2 |

| Commission | None | $3.50 AUD/USD | $5.00 USD |

| Minimum Lots | 0.01 | 0.01 | 0.01 |

| Maximum Lots | 100 | 100 | 100 |

| Minimum account opening balance | $200 AUD / USD (not enforced) | $200 AUD / USD (not enforced) | $10 USD |

| Scalping allowed | Yes | Yes | Yes |

| Expert Advisers | Yes | Yes | Yes |

| Hedging Allowed | Yes | Yes | Yes |

Disclaimer: You can’t open a trading account at Pepperstone or Hugo’s Way if you live in the United States.

Our Superior Accounts and Features Verdict

You will notice that both brokers’ accounts offer similar features. Pepperstone offers lower commissions, more currency pairs, more choice of social tools and therefore better value for all traders.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

4. Best Trading Experience And Ease: Pepperstone

When it comes to trading experience and ease, Pepperstone takes the cake.

- Superior execution speed

- User-friendly interface

- More customisation options

- Advanced charting tools

Our Best Trading Experience and Ease Verdict

Hugo’s Way isn’t far behind, offering a straightforward platform that’s easy to navigate. However, it lacks the advanced features that seasoned traders might look for.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

5. Stronger Trust and Regulation: Pepperstone

Stronger trust and regulation are essential for brokers, as they guarantee a secure and transparent trading environment.

Pepperstone Trust Score

Hugo’s Way Trust Score

One of the biggest differences between Pepperstone and Hugo’s Way is that Pepperstone is regulated, and Hugo’s Way is not.

Pepperstone offers you the safety of the following respected Tier 1 regulatory authorities:

- Australian Securities and Investments Commission (ASIC) – Australia

- Financial Conduct Authority (FCA) – UK

- Cyprus Securities and Exchange Commission (CySEC) and Federal Financial Supervisory Authority (BaFIN) – Europe

- Dubai Finance Services Authority (DFSA) – Dubai / United Arab Emirates

- Capital Markets Authority (CMA) – Kenya

- Securities Commission of The Bahamas (SCB) – Bahamas

Hugo’s Way advises they are in the process of applying for a licence which can take a long time to be set up and implement. This lack of regulation should be a primary concern of yours.

Why It Is Important To Choose A Regulated Broker

Regulation matters because it concerns the safety of your funds, your investments, and the obligations of your broker to use your funds with integrity.

Regulation requirements include:

- Segregated bank accounts: This means your funds are kept in an independent bank account that the broker cannot touch.

- Minimum liquidity/capital requirements: The broker must keep minimum liquidity in reserve to ensure they have funds to pay clients should they incur heavy losses

- Product Disclosure Statement (PDS): A PDS means there is transparency with the broker’s policies and therefore accountability.

- Complaints/Appeals process: The broker must have a complaints and appeals process so clients can resolve any disputes

- Guaranteed Negative Balance Protection: FCA requires brokers to offer Guaranteed Negative Balance Protection. Pepperstone UK has FCA regulation.

Hugo’s Way Is Not A Regulated Broker

Hugo’s Way is not a regulated broker. They are an offshore broker, which means no regulatory authority is monitoring their conduct with your funds. This means they can disappear with your money as there are no regulators to act as a safety net and provide forex traders with some level of protection.

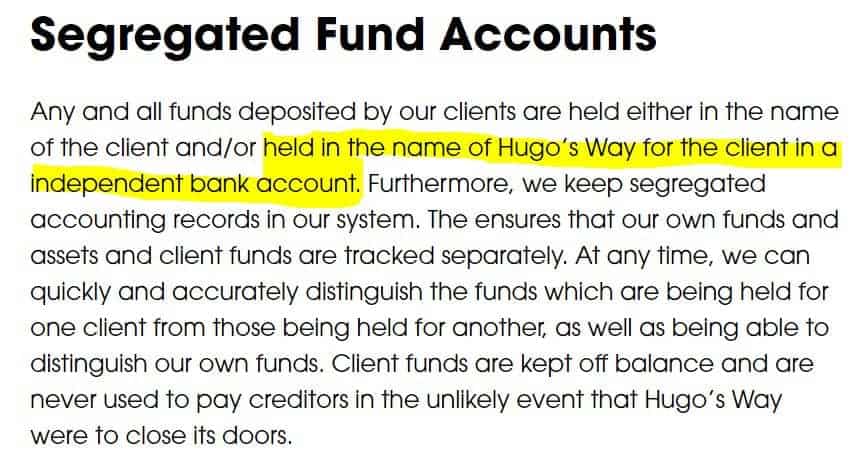

Segregated Accounts With Hugo’s Way

On their website, Hugo’s Way explains how they manage your funds.

Keeping your funds in their own name on your behalf and managing this with a segregated accounting system does not prevent the broker from being able to access your funds. This practice does raise concerns.

| Pepperstone | Hugo's Way | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) | |

| Tier 2 Regulation | DFSA (Dubai) | |

| Tier 3 Regulation | SCB (Bahamas) CMA (Kenya) |

Reviews

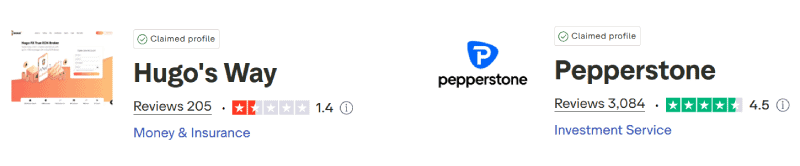

As shown below, Pepperstone holds a strong Trustpilot rating of 4.5 out of 5, based on over 3,000 reviews. Hugo’s Way, in contrast, has a significantly lower Trustpilot score of 1.4 out of 5, based on 205 reviews. Pepperstone is widely trusted and well-reviewed, while Hugo’s Way faces serious criticism from users, making Pepperstone the clear leader in customer satisfaction.

Our Stronger Trust and Regulation Verdict

We started this review by highlighting the importance of regulation. You want to keep your funds and investment safe and secure, so choosing a regulated broker is one measure that can provide peace of mind. Pepperstone provides excellent security as they are regulated by ASIC, CySEC and FCA.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

6. Most Popular Broker – Pepperstone

Pepperstone gets searched on Google more than Hugo’s Way. On average, Pepperstone sees around 135,000 branded searches each month, while Hugo’s Way gets about 6,600 — that’s 95% fewer.

| Country | Pepperstone | Hugo's Way |

|---|---|---|

| Malaysia | 9,900 | 40 |

| Brazil | 8,100 | 20 |

| India | 6,600 | 110 |

| South Africa | 6,600 | 10 |

| Thailand | 5,400 | 30 |

| Indonesia | 5,400 | 40 |

| Colombia | 4,400 | 5,400 |

| Vietnam | 4,400 | 30 |

| United States | 4,400 | 10 |

| Turkey | 4,400 | 10 |

| Argentina | 3,600 | 30 |

| United Kingdom | 3,600 | 10 |

| Poland | 2,900 | 10 |

| Philippines | 2,900 | 10 |

| Germany | 2,900 | 30 |

| United Arab Emirates | 2,400 | 30 |

| Bangladesh | 2,400 | 10 |

| Egypt | 2,400 | 10 |

| Algeria | 1,900 | 10 |

| Peru | 1,600 | 30 |

| Mexico | 1,600 | 10 |

| Pakistan | 1,600 | 10 |

| Italy | 1,600 | 10 |

| Spain | 1,300 | 20 |

| Cyprus | 1,300 | 10 |

| Tanzania | 1,300 | 10 |

| Singapore | 1,300 | 20 |

| Nigeria | 1,300 | 90 |

| Hong Kong | 1,000 | 20 |

| Saudi Arabia | 1,000 | 10 |

| Morocco | 1,000 | 10 |

| Venezuela | 1,000 | 20 |

| France | 1,000 | 10 |

| Ecuador | 880 | 10 |

| Uzbekistan | 880 | 170 |

| Canada | 720 | 10 |

| Netherlands | 720 | 10 |

| Australia | 720 | 10 |

| Portugal | 590 | 10 |

| Chile | 590 | 10 |

| Japan | 590 | 10 |

| Jordan | 480 | 10 |

| Taiwan | 480 | 10 |

| Sri Lanka | 480 | 20 |

| Bolivia | 480 | 10 |

| Dominican Republic | 480 | 10 |

| Kenya | 480 | 20 |

| Sweden | 390 | 10 |

| Switzerland | 390 | 10 |

| Ghana | 390 | 10 |

| Uruguay | 390 | 10 |

| Cambodia | 390 | 10 |

| Uganda | 390 | 10 |

| Ethiopia | 320 | 10 |

| Botswana | 320 | 10 |

| Costa Rica | 320 | 10 |

| Austria | 260 | 10 |

| Greece | 260 | 10 |

| Ireland | 210 | 10 |

| Mongolia | 210 | 10 |

| New Zealand | 210 | 10 |

| Panama | 170 | 10 |

| Mauritius | 170 | 10 |

9,900 1st | |

40 2nd | |

6,600 3rd | |

10 4th | |

4,400 5th | |

5,400 6th | |

2,900 7th | |

10 8th |

Similarweb shows a similar story when it comes to August 2025 website visits, with Pepperstone receiving 1,474,000 visits vs. 33,578 for Hugo’s Way.

Our Most Popular Broker Verdict

Pepperstone is the more popular broker worldwide based on the number of Google-branded searches and visits to the website.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets: Pepperstone

| CFDs | Pepperstone | Hugo's Way |

|---|---|---|

| Forex Pairs | 94 | 55 |

| Indices | 27 | 10 |

| Commodities | 33 Commodities 7 Metals, 4 Energies, 9 Softs, 20 Hard | 4 Metals 2 Energies |

| Cryptocurrencies | 44 | 37 |

| Shares CFDs | 1,200+ | 104 |

| ETFs | 95 | No |

| Bonds | No | No |

| Futures | 42 Futures | No |

| Treasuries | 7 | No |

| Investment | No | No |

Our Top Product Range and CFD Markets Verdict

Pepperstone offers a more comprehensive range of CFDs and markets.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

8. Superior Educational Resources: Pepperstone

The complete absence of education and research tools available with Hugosway is notable. Hugosway does not offer any training videos, learning centres, ebooks, PDFs, podcasts and webinars. While you can find many of these tools free with other brokers or on the internet, it is a little disappointing that Hugosway does not offer any education and research, especially when one compares it with Pepperstone.

Pepperstone offers a wealth of educational resources that cater to both beginners and experienced traders.

- Webinars

- E-books

- Video tutorials

- Trading guides

- Market analysis

- Glossary

Our Superior Educational Resources Verdict

Based on our testing, Pepperstone scores higher in offering superior educational resources.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

9. Superior Customer Service: Pepperstone

Pepperstone Customer Service

Investment Trends and UK Forex Awards have awarded Pepperstone for their customer service several times over the years. Available 24/5, Pepperstone offers live chat, email, and telephone for those wanting human customer service. Pepperstone also offers an expansive FAQ section and glossary, which should provide you with answers to many of your questions.

Hugosway Customer Service

Hugosway is available 24/7 through live chat and online email forms and calls back. There is no phone number, perhaps because the support team is located in Seychelles.

If you use the live chat, you will be greeted by Hugo’s Bot, which will try to find the answer for you before escalating you to the help desk. The live chat team is friendly and helpful. Conversations will usually start with “top of the morning” and “Hope you are having a great day” which is a nice touch. The customer service team is helpful and very willing to provide extra information, to make sure you understand all the trading concepts that may be of interest.

| Feature | Pepperstone | Hugo's Way |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Email | Email, Messenger, Twitter |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/7 |

| Multilingual Support | Yes | No |

Our Superior Customer Service Verdict

Pepperstone offers better customer service, scoring higher in our tests.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

10. Better Funding Options: Pepperstone

Below is a summary of all the funding options each broker provides

| Funding Method | Pepperstone - Deposit/Withdrawal | Hugosway - Deposit/Withdrawal | Pepperstone - Min/Max Deposit/Withdrawal | Hugosway - Min/Max Deposit/Withdrawal | Comments |

|---|---|---|---|---|---|

| Credit Card (Visa/MasterCard) | Free | Free | None | Min Deposit - USD$50 Max Deposit - USD$600 | Hugosway - Profits must be withdrawn via Bitcoin or Bank Transfer |

| Debit Card (Visa/Debit) | Free | Free | None | Min Deposit - USD$50 Max Deposit - USD$600 | Hugosway - Profits must be withdrawn via Bitcoin or Bank Transfer |

| Bitcoin | Not Available | Free | Free | Min Deposit - USD$50 | |

| vLoad | Not Available | Free | Not Available | Not Available | Hugosway -Vouchers accepted in EUR/USD |

| PayPal | Free | Not Available | Free | Not Available | |

| BankWire | Free | USD$25 up to 5k | AUD/USD$20 | Min Deposit - USD$100 | Pepperstone - International Transfer AUD/USD$20 |

| Poli | Free | Not Available | Free | Not Available | |

| BPay | Free | Not Available | Free | Not Available | |

| Neteller | Free | Not Available | Free | Not Available |

Funding With Pepperstone

Funding with Pepperstone is straightforward. You choose your preferred funding method to deposit funds into your account. Withdrawals must be to an account in your name. Funding in nearly all cases is free.

Funding With Hugosway

Bitcoin is the primary method for payments with Hugosway. Funding with Bitcoin means you can trade anonymously however you will need to learn how to buy bitcoin from partner sites. Hugosway provides instructions on how to do this.

To use other trading options, you will need to verify your details with Hugosway. These options will incur charges, making them expensive options.

| Funding Option | Pepperstone | Hugo's Way |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | No |

| Skrill | Yes | No |

| Neteller | Yes | No |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | No |

| Klarna | No | No |

Our Better Funding Options Verdict

Pepperstone gives you a range of conventional funding options with no fees, which makes funding painless and straightforward. The only reason you might wish to consider Hugosway when it comes to funding is cause you prefer to use Bitcoin or you wish to trade anonymously.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

11. Lower Minimum Deposit: Hugosway

When it comes to the initial investment, Hugo’s Way and Pepperstone are worlds apart. Hugo’s Way sets the bar low with a minimum deposit of just $50. This is a fantastic entry point for beginners or those who want to test the waters without committing a large sum.

Pepperstone, on the other hand, requires a minimum deposit of $200. While this isn’t exorbitant, it’s four times higher than Hugo’s Way. This could be a deciding factor for traders who are budget-conscious or new to the forex scene.

| | Minimum Deposit | Recommended Deposit |

| Pepperstone | $0 | $200 |

| Hugo's Way | $10 | - |

Our Lower Minimum Deposit Verdict

Hugo’s Way offers a lower minimum deposit, making it more accessible for beginners or those on a tighter budget.

Is Pepperstone or Hugo’s Way The Best Broker?

Pepperstone is the winner because it excels in most of the key trading factors we’ve examined. Below is a table that summarises the key information leading to this verdict.

| Criteria | Pepperstone | Hugo's Way |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platforms | Yes | No |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience | Yes | No |

| Stronger Trust And Regulation | Yes | No |

| CFD Product Range And Financial Markets | Yes | No |

| Superior Educational Resources | Yes | No |

| Better Customer Service | Yes | No |

| More Funding Options | Yes | No |

| Lower Minimum Deposit | Yes | Yes |

Hugo’s Way: Best For Beginner Traders

Hugo’s Way is better suited for beginner traders due to its lower minimum deposit and simpler account structure.

Pepperstone: Best For Experienced Traders

For experienced traders, Pepperstone is the go-to option, offering a robust trading platform and superior features.

FAQs Comparing Pepperstone Vs Hugo's way

Does Hugo's Way Or Pepperstone Have Lower Costs?

Pepperstone has lower costs. They offer competitive spreads, starting as low as 0.0 pips. For more on low-cost trading, check out our lowest spread brokers.

Which Broker Is Better For MetaTrader 4?

Pepperstone is the superior choice for MetaTrader 4 users. They offer advanced features and tools. For more details, visit our best MT4 brokers page.

Which Broker Offers Social Trading?

Neither Pepperstone nor Hugo’s Way offers social trading. However, you can explore other brokers that do on our best copy trading platforms page.

Does Either Broker Offer Spread Betting?

No, neither Pepperstone nor Hugo’s Way offers spread betting. For alternatives, you can check our best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Pepperstone is superior for Australian Forex traders. They are ASIC regulated and founded in Australia. For more, visit our Forex Brokers In Australia page.

What Broker is Superior For UK Forex Traders?

For UK traders, Pepperstone is the superior option. They are FCA regulated and offer a robust trading environment. Check out our Forex Brokers In UK for more information.

Article Sources

No commission account spread proprietary testing data and published website spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Is there a deposit bonus for Hugosway?

No or not at this time

Comparison, Hugosway vs FP Markets Mt4 Platform

Both brokers offer MT4 with much the same trading features, ie. scalping, expert advisors for automation, signals trading. If i was choosing between the brokers, MT4 would not be a factor.