Pepperstone Spreads And Fees Review

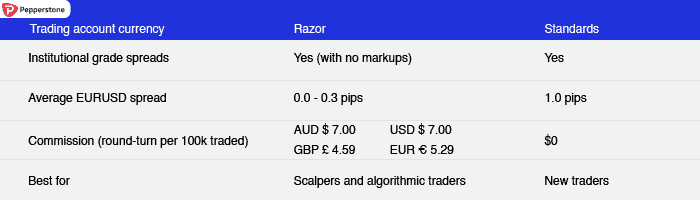

The Pepperstone account chosen impacts trading costs. The standard account has higher average spreads but no commissions, while the ECN-like razor account has the lowest spreads from 0 pips and low commissions, plus rebates via active trader status.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Pepperstone Fees Calculator

To calculate Pepperstone fees when trading our Fee Comparison tool can be used. This factors in Pepperstone spreads (published on their website) and Pepperstone commissions (pegged to the traders base currency) to competitors who publish similar data monthly. This is updated periodically and a full explanation of charges are explained below.

Types Of Fees And Spreads Charged By Pepperstone

Pepperstone has some of the most competitive fees of any CFDs provider, with the forex broker having some of the lowest spreads from 0.0 pips, ensuring that it is suitable for all investors. There are four types of Pepperstone fees which are detailed in the table below:

Pepperstone essentially offers two main types of trading accounts, and each account applies differently.

Razor Spreads

The best spreads are offered by Pepperstone with its Razor Account and can be as low as 0.0 pips. As mentioned, rather than widening the spreads, Razor account holders trade low spreads while compensating Pepperstone for their brokerage services via a commission fee. Overall, Pepperstone offers ultra-tight forex spreads when compared to other brokers. When trading Pepperstone’s tight spreads, commission fees are $7 per round turn (explained in more detail in the next section).

|

Raw Spread comparison

|

|||||

|---|---|---|---|---|---|

|

0.10 | 0.10 | 0.20 | 1.10 | 0.40 |

|

0.10 | 0.30 | 0.30 | 0.60 | 0.40 |

|

0.10 | 0.20 | 0.30 | 1.00 | 0.50 |

|

0.20 | 0.50 | 0.50 | 0.60 | 0.50 |

|

0.16 | 0.29 | 0.54 | 0.68 | 0.70 |

|

0.20 | 0.40 | 0.50 | 0.70 | 0.70 |

|

0.10 | 0.60 | 0.70 | 0.10 | 0.15 |

|

0.10 | 0.50 | 0.60 | 0.40 | 0.60 |

|

0.21 | 0.90 | 0.73 | 1.17 | 1.13 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Standard Spreads

As shown below, Pepperstone’s standard spreads with no commission fees are some of the best available. Starting from 1.0 pips commission-free, retail traders can keep trading costs low while enjoying the hassle-free nature of a standard account type.

|

|

|||||

|---|---|---|---|---|---|

|

1.10 | 1.10 | 1.20 | 2.10 | 1.40 |

|

0.70 | 2.20 | 1.10 | 1.60 | 1.60 |

|

1.90 | 2.00 | 2.40 | 2.30 | 2.50 |

|

1.40 | 2.50 | 2.50 | 2.60 | 2.60 |

|

1.40 | 1.60 | 1.40 | 2.10 | 1.90 |

|

1.46 | 2.06 | 1.52 | 2.04 | 1.78 |

|

1.30 | 1.70 | 2.10 | 1.70 | 2.10 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Pepperstone offers low fees and a lower average spread across the 8 forex pairs compared to 43 other brokers.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| Pepperstone Average Spread | 1.1 | 1.2 | 1.2 | 1.1 | 1.4 | 1.2 | 2.1 | 1.9 |

| Industry Average Spread | 1.2 | 1.4 | 1.6 | 1.6 | 1.8 | 1.5 | 2.0 | 2.2 |

| Pepperstone Fee Type | Charge |

|---|---|

| Razor MetaTrader (forex) - commission | AUD $7 Round-turn per standard lot |

| Razor (forex) spreads From | 0.0 Pips |

| Standard Account - spreads (forex) from | 1.0 Pips |

| cTrader Razor commission (Forex) | $7 per Standard Lot in base currency |

| Rollover / Overnight Fees | Varies |

| Withdrawal Fees | $0 (Except bank wire transfer) |

| Deposit Fees | $0 |

| Inactivity Fees | $0 |

Pepperstone ReviewVisit Pepperstone

The overall rating is based on review by our experts

Pepperstone Forex Spreads Explained

Your spreads are the difference between the ask and bidding price for your currency pairs. There are different types of spreads, including fixed spreads and variable spreads. A variable spreads continuously changes value. A wider spread will mean greater cost, so a narrow spread presents greater potential savings. If you want to calculate your spread, then apply the formula:

Spread (Pips) = Ask – Bid

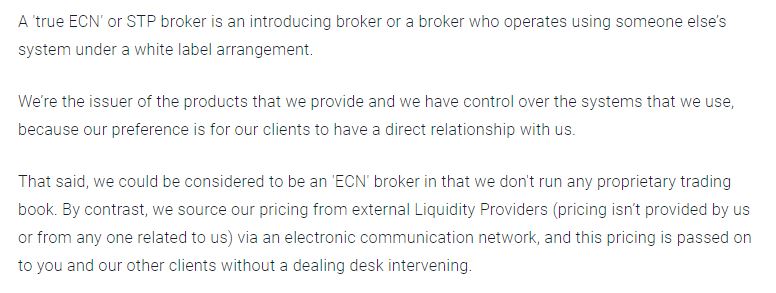

Pepperstone uses ECN ‘style’ trading and No Dealing Desk Brokers. Pepperstone explains ‘Electronic Communication Network ‘(ECN) and ‘Straight Through Processing’ trading with the following statement:

To iterate what Pepperstone explains: ‘ECN’ and/or ‘STP’ brokers spreads or fees are set by external liquidity providers and these fees are passed onto you without interference from a dealing desk. This is why ‘ECN’ or ‘STP’ style trading can offer the best spreads. Market-makers such as Plus500, IG Markets and CMC will incorporate their fees into your spreads which is why they are wider.

To iterate what Pepperstone explains: ‘ECN’ and/or ‘STP’ brokers spreads or fees are set by external liquidity providers and these fees are passed onto you without interference from a dealing desk. This is why ‘ECN’ or ‘STP’ style trading can offer the best spreads. Market-makers such as Plus500, IG Markets and CMC will incorporate their fees into your spreads which is why they are wider.

This is why we recommend ‘ECN’ and/or ‘STP’ style accounts if you want the lowest fees.

Comparing commission with other brokers

Of the brokers that offer commission-style accounts, Pepperstone offers among the most competitive commissions in the industry.

When choosing a broker based on commission, you will want to check what currency the broker charges their commission in as some use USD. Pepperstone charges in AUD which provides them with a competitive advantage over other brokers for Australian traders.

Calculating your costs

Total cost = (Spread) x (Pip Cost) x (Number of Lots Traded)

Where Pip cost:

- Micro-lots (1000 lots base currency) = USD$0.10c per pip

- Mini-lots (10,000 lots base currency) = USD$1.00 per pip

- Standard-lots (100,000 base currency) = USD$10.00 per pip

Pip cost will be converted to your account currency at the spot forex rate.

Standard Account – This is a commission-free account. Instead of commission pricing, your cost is in the spread. Pepperstone’s no commission spreads can be as low as 1.0 pips which is very competitive compared to other no-dealing desk brokers.

Razor (MetaTrader 4 and 5) – This account is for traders using MetaTrader 4 and 5 trading platforms. The low spreads are determined by external liquidity providers, with Pepperstone charging a commission instead of adding to the spread. This commission is:

-

- Standard lots (100,000 units) = AUD$7.00 round turn,

- Mini lots (10,000) = AUD$0.70 round turn

- Micro lots (1000) = AUD$0.08 round turn (MT5) / AUD$0.07 round turn (MT4

Razor (cTrader and TradingView) – This account works the same as Razor (MetaTrader) account, however, for those using the cTrader and TradingView platforms Pepperstone commission fees are calculated slightly differently:

-

-

- Commission equals USD 6.00 per lot converted to the account currency using interbank rates at the time.

-

Trading Fees Conclusion

When choosing a broker, you need to consider what type of fee and pricing structure suits your need. This means selecting between a commission or non-commission retail investor account.

The differences between the accounts can be summarised by below:

If you decide on a commission account, then:

- Look for a broker that offers the narrowest spreads for the currency pair you wish to trade.

- Choose a broker that offers the lowest commission and check the currency you will be charged in

- Decide on a trading platform and check how fees are applied for that platform. MetaTrader and cTrader apply fees differently.

If you decide on a no-commission account:

- These are popular beginner traders

- Expect wider spreads and higher trading cost

- Expect calculation of your costs to be simpler as you do not need to include commission costs

We like to recommend the Pepperstone Razor MetaTrader account as this offers the lowest fees when spreads and commission are taken into account.

Finance charge/overnight holding fee

Pepperstone, like all forex brokers, applies swap rates when you hold your position after 5 pm American eastern time (New York time). This rollover interest can either be earned or paid, depending on currency movements and market volatility.

Pepperstone release swap charges for each currency pair every week using standard lots (100,000 base units) as the standard size for measurement. This swap rate can be found when you log in to your Pepperstone account.

Non-Trading Costs

Pepperstone has no charges for deposits and most withdrawals. The sole exception is if you withdraw using an international bank wire. If you use bank wire, then the following fees and minimum withdrawals will apply:

| Currency | Fee | Minimum withdrawal amount |

|---|---|---|

| AUD | 20 | 80 |

| EUR | 15 | 80 |

| CAD | 20 | 80 |

| CHF | 20 | 80 |

| GBP | 15 | 80 |

| SGD | 25 | 80 |

| USD | 20 | 80 |

| JPY | 1700 | 6700 |

| NZD | 25 | 80 |

| HKD | 140 | 540 |

These fees are competitive compared to many other brokers. Pepperstone, however, stand out as they have no inactivity charges which several other brokers charge for:

| Deposit Fees | Withdrawal Fees | Inactivity Fees | |

| IC Markets | ✘ | ✘ | ✘ |

| Pepperstone | ✘ | Bank Wire AUD$20 Minimum withdrawal $80 | ✘ |

| IG Markets | Credit Card (If AUD then Visa 1%, MasterCard 0.5%, Non AUD then 1.5% ) , PayPal 1%), Min AUD$450 deposit with Credit Card | ✘ | $50 per quarter if inactive for 3 months |

| Plus500 | ✘ | ✘ | USD$10 if not active for 3 months |

| Go Markets | ✘ | ✘ | ✘ |

| Think Market | ✘ (minimum deposit $0 for standard, $500 for go account) | ✘ | AUD$30 each month if inactive for 6 months of more |

| AxiTrader | ✘ | ✘ | ✘ |

| CMC Markets | Credit card payment will incur 1% fee or 0.6% for debit card | ✘ | AUD$12 per month if inactivty for 12 months |

One good thing about Pepperstone is the wide range of funding methods for deposits they will accept. These are:

- Visa

- Mastercard

- POLi

- Bank Transfer

- BPay

- PayPal

- Neteller

- Skrill

- Union Pay

Pepperstone Shares CFD Fees

With Pepperstone you can trade CFDs of hundreds of the top listed companies in the NYSE, ASX, LSE, and XETRA. This means you can trade well-known companies such as Alphabet, Apple, Facebook, Boeing and Microsoft.

Shares CFD Costs

- Commission: USD 0.02 per share when you open a US Share CFD position. There is no cost to close your position.

- Spread costs: Prices are taken directly from the New York Stock Exchange (NYSE fee). Pepperstone does not add any pips to the spread. You simply pay the market Spread Bid/Ask from the exchange.

Other Shares CFD Fees:

- Swap rates or overnight holding fees will apply if your position remains open after the market closes.

A couple of points to note when trading Shares CFD with Pepperstone.

- Traders must use the MetaTrader 5 platform. Shares CFD trading will not work with MetaTrader 4 and cTrader

- While you do not own or have rights with your stocks, you will receive dividends.

Pepperstone Fees for Cryptocurrency, Commodities and Indices (cash and index).

Cryptocurrency, commodities and indices are ‘spread only’ products. This means your fee is incorporated into the spread. Pepperstone do not charge commission nor do Pepperstone act as a market maker.

How Pepperstone CFD Trading fees work

Pepperstone sources their fees from a deep pool of liquidity providers for commodities and indices and LMAX Exchange for Cryptocurrency and then add a small markup by slightly widening the spread. By adding only a slight increase in the spreads, Pepperstone can keep spreads as close to ‘raw’ liquidity as possible. While this may mean lower revenue margins for Pepperstone for each trade, the low-cost environment allows them to attract high volume traders and achieve high retention rates.

As Pepperstone use liquidity providers and include your trading CFD costs in the spread, you have the following advantages:

- Pepperstone spreads maintain integrity as spreads are tied to liquidity providers.

- No commissions charge, so the spread cost is your actual trading cost (though slippage may occur).

- The broker does not act as your counterparty (like a market maker does). This means Pepperstone does not profit from your losses.

Other fees for CFDs trading

- Margin Payment – While not a fee or expense, it is capital you will require to open your position. To calculate your margin, apply the formula: Margin required: Contract Size x Volume (in lots). Margin required will vary depending on your instrument.

- Swap Rates – like with Forex trading, there are fees if you hold your position overnight. Prices are triple is held after closing on a Wednesday.

- Contract Roll Fee – Certain instruments such as soft commodities may derive their prices from underlying futures contracts. As underlying prices may change when one contract ends and the new contract is opened, balance adjustments may need to be done. In this case, a contract roll fee will either be charged or credit to your account.

Cryptocurrencies

Pepperstone has 12 different Cryptocurrencies for you to choose from. Cryptocurrency is a highly speculative derivative meaning it can have large swings. These swings present profit-taking opportunities, making it an increasingly popular option with traders.

With Pepperstone, prices are taken from the LMAX Exchange.

Pepperstone offers the following trading conditions

- Choice of 9 Cryptocurrencies (Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Chainlink, Dash, Polkadot, Ripple, and Stellar Lumens)

- 3 Crypto baskets (Crypto10, Crypto20, and Crypto30)

- No commissions (trading fees are included in the spread)

Please note: Cryptocurrency is a highly volatile product so can present a high risk. Due to this, the United Kingdom’s financial regulator, the FCA, has banned retail investor accounts from accessing crypto markets.

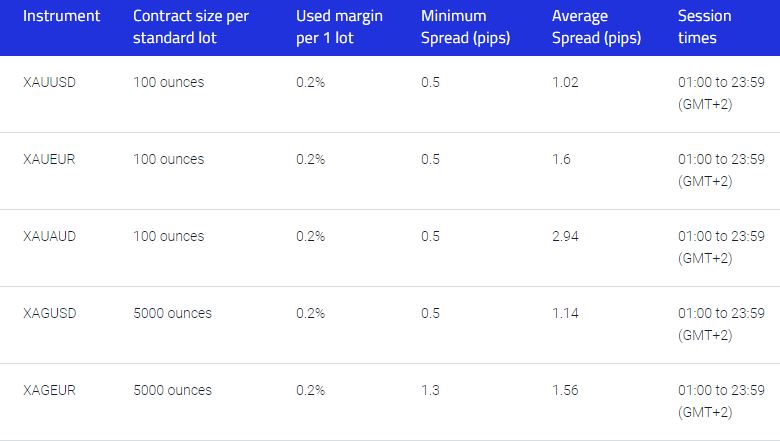

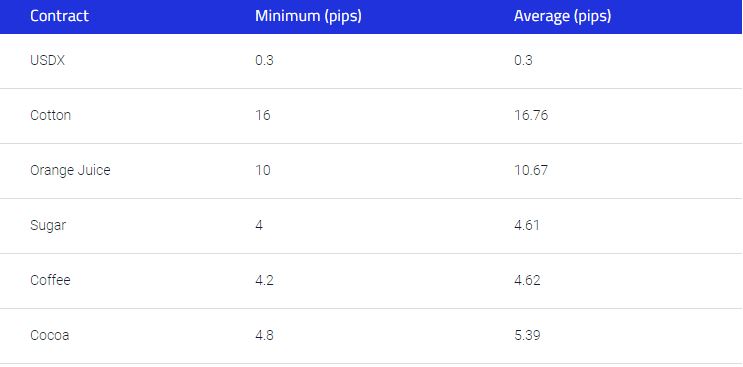

Pepperstone Commodity Fees

Several types of commodities are available with Pepperstone. These fall into the following sections: metals, soft commodities and energy. Commodities tend to move in the same direction as the general market and inflation, meaning they provide a good strategy to diversify your assets. Precious metals such as gold are a good defensive strategy as they become popular when markets struggle.

Pepperstone commodity trading has the following conditions:

- Minimum trade size of 10c per pip

- No commission

Precious Metals – Gold and Silver

6 different metal pairs are available for trade against the USD, AUD or Euro. This includes silver and gold crosses.

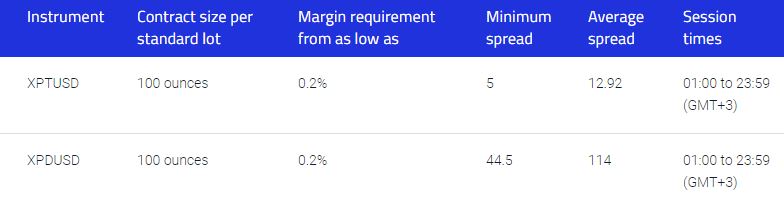

Platinum and palladium

Available on all trading platforms Pepperstone offer, trading is done against the USD.

Soft commodities

Trading of agricultural goods that are grown is one of the oldest assets available for trade. While not as popular as hard commodities, owning soft commodities such as corn, cocoa and rice can form a valuable part of a diverse portfolio to protect yourself against volatility and risk.

Energy

Oil and gas products are tradable commodities on MetaTrader 4, MetaTrader 5 and cTrader and are available to all Pepperstone account holders. Trading of oil includes access to two major oil markets – West Texas Intermediate (WTI) Crude Oil and Brent Crude oil.

Energy instruments trade against the US and have a minimum trade size of 10c per pip.

Index CFDs

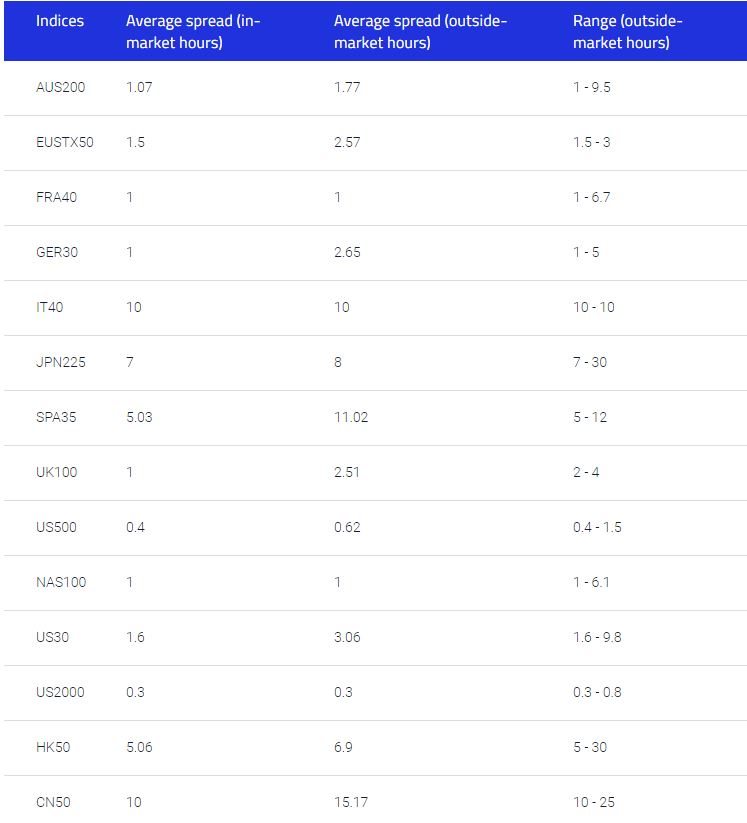

Index CFDs

Trading on indices allows you to speculate on some of the top financial and stock markets around. Indices are a calculation of the weighted average of share prices for groups of high performing stocks in a stock exchange. Pepperstone offers some of the most well-known indices such as the S&P 500, NASDAQ 100 and ASX 200.

Pepperstone offers the following

- 23 major stock markets around the world

- No commission (cost is in the spread, so no hidden markups)

- No dealing desk

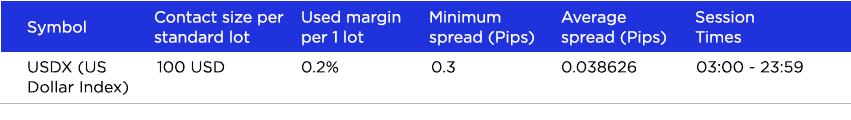

Currency Index CFD

You can speculate on movements in the value of the USD against a grouping of 6 other currencies, including the Pound, Euro and Yen). Trading with Currency Index CFD with Pepperstone includes:

- No commission

Other Fees

Our full FXCM vs Pepperstone and Pepperstone vs OANDA comparisons found that Pepperstone has other features you may wish to use for more advanced trading experiences. Some of these features are free and some come for a small cost.

Demo Account:

Pepperstone offers you a demo practice account free for use for 30 days. If you wish for longer than 30 days, you can contact support and they will extend your demo account period.

With the demo account, you will get $50,000 in virtual funds. If you run out of funds, Pepperstone support can reset the fund back to $50,000.

Demo accounts are available for MetaTrader 4, MetaTrader 5 or cTrader.

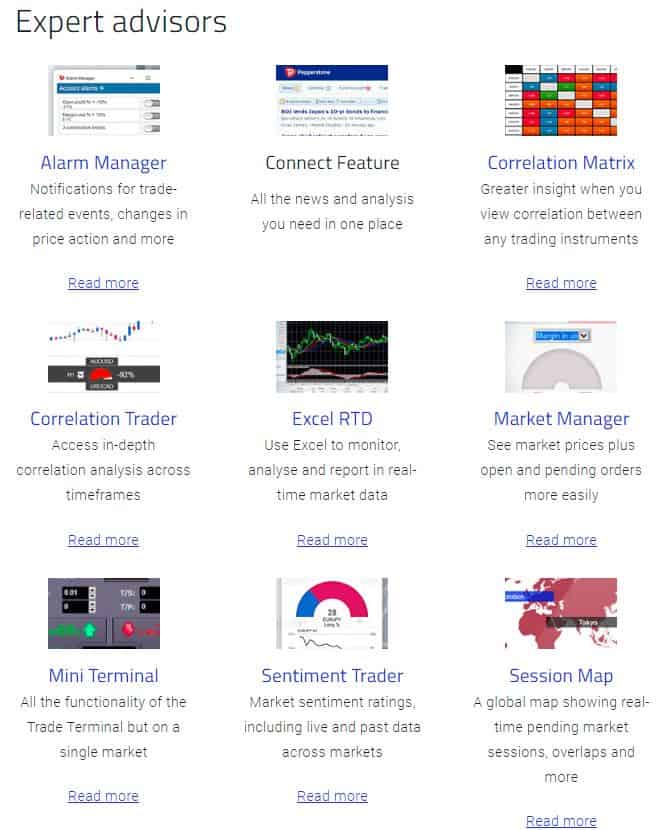

MT4 and MT5 Smart Trader Tools

Pepperstone offers a suite of 28 smart trading tools that give you a superior trading experience. These features are free for all traders using MetaTrader 4 or MetaTrader 5.

Best features include

- Mini Terminal and Smart Lines – Suite of risk management tools to help manage your risks when investing

- Trade Terminal – A terminal that allows you to execute all your trades from one single terminal

- Correlation Matrix – This helps you trade pairs that have no obvious correlation

cTrader Automate

This is cTraders algorithmic trading program. Formerly known as cAlgo is available as an add-on the app, cTrader Automate is now integrated into cTrader itself.

If you are using cTrader this program will appeal to you as it allows you to build automated trading robots and custom indicators using c# language.

There is no cost to use cTrader Automate with Pepperstone however cTrader may have fees from their side.

Autochartist

One of the most advanced tools on the markets for identification of chart and Fibonacci patterns. Autochartist can identify opportunities as they occur with constant simultaneous monitoring across thousand of forex instruments.

Pepperstone does not implement cost to install and use Autochartist however Autochartist may charge you to use their service. You will need to be using MetaTrader.

Social Trading Tools

With Pepperstone, you have one of the largest range of social trading tools to choose from among all online brokers.

Myfxbook AutoTrade

Myfxbook is AutoTrade is a forex copy service that aims to help you find only the best quality forex traders. The product does this in two main ways.

- a verification system so only forex traders with a proven and successful track record are approved by Myfxbook

- Performance monitoring to remove low-performing and demo accounts as options for auto copy

Myfxbook is available via a browser meaning no need for software downloads and provides in-depth analysis tools for accurate statistics and figures to help with your copying, which can be automated or manual.

Your cost to use Myfxbook is incorporated into the spread and will depend on what account type you have.

ZuluTrade

One of the more popular platforms that combine social and copy trading. With ZuluTrade, you can use automation tools to copy the trades of other experienced and successful traders. Its social features include the ability to post feedback on other traders and share your ideas with the community.

With over one million users, ZuluTrade has a large community base to draw from to help you trade successfully.

To use ZuluTrade you need to be using a Standard account and 1.5 pip will be added to the spread.

![]()

Mirror Trader

Developed by Tradency, this web-based tool provides a powerful social trading interface that allows users to take full advantage of the power of social trading.

Mirror Trader analysis trading strategies of uses in its community and breaks it down so other traders can evaluate which strategies they would like to follow via the interface.

Sophisticated filtering allows traders to see in high- and low-level detail all information about the strategies of other traders. Filters include weighted scores, maximum drawdowns, and a number of trades. Traders can then choose to automate, semi-automated or manually copy these traders.

Pepperstone charges no fees from their end however Mirror Trader may charge fees from their side.

MetaTrader Signals

This is a copy trading service built in to the MetaTrader trading platform. MetaTrader has a phenomenally large marketplace with thousands of free and paid signals. MetaTrader signals sort these signal providers to help you find the signal that suits your needs. Sorting options include trading results, growth and equity charts. You can then choose the signal you desire so you can execute real-time copying of your desired traders.

Pepperstone does not charge fees to use MetaTrader Signals however MetaTrader may charge fees to use their service.

DupliTrade

DupliTrade allows you to access a strategy marketplace where you can automate your trading. The product taps into the expertise of traders who own proprietary signals. These features allow you to grow your trading knowledge and develop a better understanding of the techniques of professional traders.

To use DupliTrade you will need to have a minimum $AUD5000 deposit in your account and to be using MetaTrader 4 (not 5). Your spreads will receive a 1.8 pip markup when you trade. Duplicate trade is available for both Standard and Razor accounts.

Is Pepperstone a scam?

No, Pepperstone is not a scam. The forex broker is highly regarded thanks to being regulated by multiple financial authorities, including the FCA in the United Kingdom and ASIC in Australia among others. To find out more, read our full Pepperstone Review.

Is Pepperstone the forex broker with the best spreads?

Pepperstone is among the Best Forex Brokers In Australia offering low spreads and ECN style trading conditions. A similar, no dealing desk broker is IC Markets. See our Pepperstone vs IC Markets review for additional information.

Does Pepperstone have a minimum deposit?

Pepperstone minimum deposit is zero, but the broker recommends of $200 AUD/USD or 500 GBP/EUR.

About Pepperstone

Pepperstone is an Australian forex broker that is known for low spreads and fast execution. Whether you are a beginner trader, scalping or using Expert Advisers, the broker offers excellent trading conditions and features.

- Ultra-competitive pricing with low spreads which makes them ideal for EAs, scalping and day trading strategies.

- A choice of user-friendly trading platforms that are available as desktop trading platforms, WebTrader platforms or mobile apps for Android and iOS devices.

- Free educational materials including articles, tutorials and quality webinars.

- Spread betting services for traders in the United Kingdom

- Award-winning customer support

Risk Disclaimer

Forex and CFDs are complex instruments, and trading comes with a high risk of losing money. When trading online, it is important to be aware of the risks and investor protections available through your broker. To protect yourself against scams, sign up to a broker that is overseen by top tier regulators.

Pepperstone is seen as trusted thanks to oversight from the following regulators:

- The Financial Conduct Authority (FCA), United Kingdom

- The Australian Securities and Investments Commission (ASIC), Australia

- The Dubai Financial Services Authority (DFSA), UAE

- The Securities Commission of the Bahamas (SCB), Global

- The Cyprus Securities and Exchange Commission (CySEC), Europe

- The Federal Financial Supervisory Authority of Germany (BaFin), Germany.

- Please note: Pepperstone is not regulated in the United States.

Click here to read a full Pepperstone Review.

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Ask an Expert

DEAR SIR. I WANT TO ASK YOU ABOUT THE MINIMUM DEPOSIT AND ABOUT THE SPREAD AND COMMISSION OF A SMALL ACCOUT TO START WITH BECAUSE I AM A NEW TRADER AND I WANT TO START WITH YOUR INSTITUTION WHICH SEEMS VERY SECUIRE AND REGULATED.THANK YOU FOR YOUR COOPERATION

Sorry – we are not a broker, we compare different brokers to help you find a broker. The minimum deposit will depend on the broker you join with, many brokers don’t have a minimum deposit (and if they do, it is goes towards your trades). To commence trading you will need to have enough deposited in your account to meet margin requirements. If you are new to trading, we recommend practising with a demo account.