Pepperstone vs Admiral Markets: Which One Is Best?

Welcome to our review of Pepperstone and Admiral Markets. In this critique, we will examine the strengths and weaknesses of each broker, providing valuable insights for both novice and experienced traders. The deeper we dive into the details, the more knowledge you’ll gain to make an informed decision between these two platforms. Keep reading to discover more!

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors, but here are five quick differences between Pepperstone and Admiral Markets:

- Pepperstone offers a lower spread on major currency pairs like EUR/USD.

- Pepperstone provides a faster execution speed, crucial for scalping strategies.

- Pepperstone has a more user-friendly interface, especially for beginners.

- Admiral Markets is regulated by more financial authorities, including the FCA and CySEC.

- Admiral Markets offers a broader range of educational resources.

- Admiral Markets is best for seasoned and experienced trader due to their robust trading environment and advanced tools.

1. Lowest Spreads And Fees – Admiral Markets

When we speak of forex trading, these brokers with low spreads and fees are highly recommendable as they offer lower trading costs. This benefits traders executing many trades, saving on transaction costs and enhancing profitability. Such brokers attract more clients, increasing trading volumes and revenue through commissions. Competitive pricing also boosts the broker’s reputation, appealing to cost-conscious traders.

Clearly, we can see here that Pepperstone and Admiral Markets use STP / ECN style execution. This type of trading execution means the brokers have no dealing desk involved in the quoting process as prices come from liquidity providers. This is different from market makers who are the counterparty to your trades.

Spreads

As we analyse the details presented in our comparison table, we can observe that for the EUR/USD pairing, Pepperstone offers a spread of 1.1, while Admiral Markets provides a slightly lower spread of 0.8. Additionally, Pepperstone boasts a selection of five more currency pairs than Admiral Markets, with the latter having two additional currency pairs that are higher in value. When examining the overall averages, Pepperstone’s average spread stands at 1.35, in contrast to the lower figure of 1.26 attributed to Admiral Markets, indicating that both brokers are still offering fairly competitive rates relative to the industry standard. Overall, it’s evident that while both brokers have their strengths and weaknesses, they appear to provide spreads that are quite appealing in the current market landscape.

| Standard Account | Pepperstone Spreads | Admiral Markets Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.35 | 1.26 | 1.7 |

| EUR/USD | 1.1 | 0.8 | 1.2 |

| USD/JPY | 1.2 | 1 | 1.5 |

| GBP/USD | 1.2 | 1 | 1.6 |

| AUD/USD | 1.1 | 1 | 1.6 |

| USD/CAD | 1.4 | 1.6 | 1.9 |

| EUR/GBP | 1.2 | 1 | 1.5 |

| EUR/JPY | 2.1 | 1.5 | 2.1 |

| AUD/JPY | 1.9 | 2.2 | 2.3 |

Commission Levels

A RAW account incurs a secondary fee in the form of a commission, which is a fixed charge determined by the volume of the trade based on the number of units traded. When we compare the commission rates of two brokers, we find that Pepperstone charges a commission of $3.50 (USD base), while Admiral Markets offers a slightly lower rate of $3.00. Regarding deposits, Pepperstone has a significant advantage with zero fees compared to Admiral Markets’ $100 charge. Notably, both brokers provide swap-free accounts, also known as “Islamic accounts in forex trading,” designed to comply to Islamic finance principles.

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| Pepperstone | $3.50 | $3.50 | £2.25 | €2.60 |

| Admiral Markets | $3.00 | $4.00 | £2.40 | €2.60 |

We created the exclusive fee calculator below which in most scenarios will show the current trend in both brokers currency rate.

Standard Account Fees

Both brokers provide a standard account in addition to their RAW accounts. The standard account is characterized by wider spreads, which serve as the main source of revenue for the brokers. To assess the competitiveness of these accounts, we compared the average spreads of both brokers with those of other prominent providers.

Admiral Markets boasts slightly lower spreads on their STP-style account, the ECN Prime, averaging 0.8 pips compared to Pepperstone’s 1.1 pips. Although minimum spreads for the EUR/USD can dip as low as 0.1 pips, it’s worth noting that the general spread levels for both brokers are quite comparable, primarily due to their extensive networks of liquidity providers.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.10 | 1.10 | 1.30 | 1.30 | 1.30 |

| 0.80 | 1.00 | 1.00 | 1.00 | 1.00 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 1.18 | 1.45 | 1.40 | 1.49 | 1.60 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.40 | 1.90 | 1.30 | 1.60 | 1.50 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

Our team can safely suggest that if you are looking for commission-free trading, then Admiral Markets is likely to be a better choice than Pepperstone. With a commission account, traders may be better off using Pepperstone due to the more competitive spreads.

Our Lowest Spreads and Fees Verdict

From my experience, Admiral Markets stands out as the top choice in this category, offering the most competitive spreads and fees. If you’re seeking commission-free trading, I strongly recommend Admiral Markets over Pepperstone. However, for traders who prefer a commission account, Pepperstone may be the more advantageous option due to its tighter spreads.

Admiral Markets ReviewVisit Admiral Markets

*Your capital is at risk ‘74% of retail CFD accounts lose money’

2. Better Trading Platform – Pepperstone

When discussing superior trading platforms, we are referring to broker offerings that include advanced charting tools, real-time market data, and lightning-fast execution speeds. A standout platform boasts a user-friendly interface, customizable features, and strong security protocols. Furthermore, it facilitates automated trading, social trading, and access to a diverse array of financial instruments. These capabilities enrich the trading experience, empowering traders to make informed decisions and execute trades with precision and efficiency.

| Trading Platform | Pepperstone | Admiral Markets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

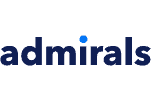

Metatrader

This section probes into the MetaTrader platforms, widely recognized as the gold standard in trading. MetaTrader 4 (MT4) is preferred for its safety, supported by a larger user base and extensive broker compatibility. In contrast, MetaTrader 5 (MT5) offers advanced features and a broader selection of Contracts for Difference (CFDs), positioning itself as the future choice as MT4 slowly fades in relevance. Both platforms provide essential trading analysis tools and are accessible through respected brokers like Pepperstone and Admiral Markets. However, Pepperstone stands out with its innovative trading tools, including advanced charting capabilities and order signals. Therefore, whether you opt for MT4 or MT5, Pepperstone solidifies its status as the top choice with its superior offerings.

Advanced Platforms

cTrader is a highly regarded trading platform that grants direct access to interbank market depth for algorithmic forex trading. It boasts a customizable interface with detachable charts, extensive back-testing features, and advanced order modification and placement options available on iOS, Android, WebTrader, and desktop for both PC and Mac. Retail investors will find valuable trading tools offered by both Pepperstone and Admiral Markets. Admiral Markets’ MetaTrader Supreme Edition provides a suite of analytical indicators and advanced trade management features, akin to Pepperstone’s Smart Trader Tool, which includes expert advisors and market scanners. Notably, cTrader is distinguished as the most advanced automation software, a unique offering from Pepperstone. Additionally, Pepperstone grants access to TradingView, an increasingly popular platform renowned for its advanced charting capabilities and mobile-first design.

| Trading Tools Offered by Pepperstone and Admiral Markets | Pepperstone | Admiral Markets |

|---|---|---|

| MetaTrader Signals | ✅ | ✅ |

| Pelican | ✅ (Europe only) | ❌ |

| DupliTrade | ✅ (Not in Europe) | ❌ |

| Expert Advisors/Algorithmic Trading | ✅ | ✅ |

| Myfxbook AutoTrade | ✅ (not in Europe) | ❌ |

| Advanced MetaTrader Tools | ✅ Smart Trader Tools | ✅ Supreme Edition |

| cTrader Automate | ✅ | ❌ |

| Autochartist | ✅ | ✅ |

| API Trading | ✅ Sm | ✅ |

Copy Trading

Pepperstone stands out by offering advanced social and copy trading tools via third-party applications, a feature unmatched by its competitors. While Admiral Markets provides MetaTrader Signals, Pepperstone enhances the trading experience with its proprietary Copy Trading system in addition to these signals. Pepperstone also supports a wider array of social trading tools, including MyFxBook and DupliTrade, compared to Admiral Markets, which is limited to MetaTrader Signals. Traders in Australia can access MyFxBook, while those in the UK and Europe have the option to use Pelican as an alternative.

Our Better Trading Platform Verdict

According to our team’s research, Pepperstone distinguishes itself with superior social trading tools and offers both the MetaTrader and cTrader platforms, whereas Admiral Markets solely provides MetaTrader. The added platform choice and an extensive array of social and supplementary features make Pepperstone’s offerings clearly more impressive.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

3. Superior Accounts And Features – Pepperstone

Brokers with superior accounts offer tailored options for traders, including competitive spreads, low commissions, and advanced tools. These accounts typically feature demo options, swap-free options, and a variety of financial instruments. Enhanced features like social trading, automated trading, and strong customer support improve the trading experience and promote client satisfaction.

When it comes to accounts and features, Pepperstone really shines. They offer two main types of accounts: Standard and Razor. The Razor account is particularly appealing for its lower spreads and commission-based pricing.

- Razor account with lower spreads

- Standard account with zero commissions

- cTrader platform available

- Social trading features

Admiral Markets, on the other hand, offers a range of account types, including their Admiral Prime and Admiral MT5 accounts. While diverse, the account types can be a bit confusing for traders who are new to the game.

- Admiral Prime for professional traders

- Admiral MT5 for diverse asset trading

- Volatility protection settings

- Negative balance protection

| Pepperstone | Admiral Markets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | No |

| Spread Betting (UK) | Yes | No |

We can easily suggest that Pepperstone offers superior accounts and features, making it easier for both new and experienced traders to find an account that suits their needs. Pepperstone outshines in this portion thanks to their superior accounts and features.

Our Superior Accounts and Features Verdict

Based on my experience, Pepperstone provides outstanding accounts and features that cater to the diverse needs of both novice and seasoned traders. Their offerings truly set them apart, making it effortless for anyone to find an account that perfectly aligns with their trading requirements.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – Pepperstone

A great experience stems from advanced platforms, fast execution, competitive spreads, and strong customer support in forex trading. These factors help traders make informed decisions and manage accounts effectively. A user-friendly interface and access to educational resources and tools also improve the trading experience, making it more enjoyable and profitable.

When it comes to trading experience and ease, Pepperstone takes the cake. Their platform is incredibly user-friendly, and the execution speed is top-notch.

- Lower latency for high-frequency trading

- User-friendly interface

- Customisable trading environment

- Advanced charting tools

Admiral Markets isn’t far behind, though. They offer a robust trading environment, but their platform could be a bit intimidating for new traders.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| Pepperstone | 77ms | 2/36 | 100ms | 10/36 |

| Admiral Markets | 132ms | 15/36 | 182ms | 27/36 |

Our Best Trading Experience and Ease Verdict

From my experience, Pepperstone offers a superior trading experience with its user-friendly interface and faster execution speeds.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – Admiral Markets

Trust and regulation are vital for a secure forex trading environment. Regulated brokers protect traders from fraud, boosting confidence and encouraging active trading. Reliable brokers with robust oversight attract more clients, improving their reputation.

Admiral Markets Trust Score

Pepperstone Trust Score

Trust is a big deal in forex trading, and here, Admiral Markets has a slight edge. They’re regulated by multiple financial authorities, including the FCA and CySEC.

- FCA and CySEC regulation

- Strong financial backing

- Transparent fee structure

- Established in 2001

We can surmise that with Pepperstone, while trustworthy, is primarily regulated by ASIC, which might not offer the same level of investor protection.

| Pepperstone | Admiral Markets | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) | ASIC (Australia) FCA (UK) CYSEC (Cyprus) CIRO (CANADA) |

| Tier 2 Regulation | DFSA (Dubai) | ASIC (Australia) FCA (UK) CYSEC (Cyprus) CIRO (CANADA) |

| Tier 3 Regulation | SCB (Bahamas) CMA (Kenya) | FSA-S (Seychelles) CMA (Kenya) JSC FSCA (South Africa) |

Reviews

As shown below, Pepperstone is rated 4.4 out of 5 from over 3,000 reviews, with 81% of users giving it 5 stars. Admiral Markets has a Trustpilot rating of 4.0 out of 5, based on around 2,000 reviews. Pepperstone is generally seen as more consistent and reliable, especially in terms of execution speed and customer support. Admirals offers a solid trading experience with strong educational tools but receives slightly more mixed feedback.

Our Stronger Trust and Regulation Verdict

From my perspective, Admiral Markets really stands out with its multiple financial regulations, including FCA and CySEC. This gives me a lot of confidence in their reliability and trustworthiness.

Admiral Markets ReviewVisit Admiral Markets

*Your capital is at risk ‘74% of retail CFD accounts lose money’

6. Most Popular Broker – Admiral Markets

Admiral Markets gets searched on Google more than Pepperstone. On average, Admiral Markets sees around 220,000 branded searches each month, while Pepperstone gets about 110,000 — that’s 50% fewer.

| Country | Pepperstone | Admiral Markets |

|---|---|---|

| Austria | 320 | 550,000 |

| United Kingdom | 5,400 | 450,000 |

| Italy | 1,900 | 60,500 |

| Greece | 210 | 60,500 |

| United States | 4,400 | 33,100 |

| Germany | 3,600 | 33,100 |

| India | 2,900 | 9,900 |

| Spain | 1,900 | 6,600 |

| Philippines | 880 | 5,400 |

| Japan | 480 | 4,400 |

| France | 1,000 | 3,600 |

| Canada | 720 | 3,600 |

| Poland | 720 | 2,900 |

| Brazil | 6,600 | 2,400 |

| Indonesia | 1,600 | 2,400 |

| Switzerland | 320 | 2,400 |

| Turkey | 1,600 | 2,400 |

| Australia | 8,100 | 1,900 |

| Netherlands | 880 | 1,900 |

| Malaysia | 4,400 | 1,600 |

| Ireland | 260 | 1,600 |

| Sweden | 390 | 1,300 |

| Thailand | 4,400 | 1,000 |

| United Arab Emirates | 1,000 | 1,000 |

| Nigeria | 1,300 | 1,000 |

| Egypt | 390 | 1,000 |

| Argentina | 1,300 | 1,000 |

| South Africa | 2,900 | 880 |

| Pakistan | 1,300 | 880 |

| Mexico | 3,600 | 880 |

| Saudi Arabia | 260 | 880 |

| Taiwan | 1,000 | 880 |

| Chile | 1,000 | 880 |

| Vietnam | 720 | 720 |

| Colombia | 3,600 | 720 |

| Singapore | 1,600 | 720 |

| Cyprus | 480 | 720 |

| Hong Kong | 3,600 | 590 |

| Portugal | 480 | 590 |

| Morocco | 720 | 480 |

| New Zealand | 170 | 480 |

| Bangladesh | 390 | 390 |

| Uzbekistan | 140 | 390 |

| Algeria | 390 | 320 |

| Kenya | 4,400 | 320 |

| Peru | 1,600 | 320 |

| Jordan | 260 | 260 |

| Ghana | 260 | 210 |

| Ecuador | 1,000 | 170 |

| Venezuela | 390 | 170 |

| Uganda | 390 | 170 |

| Bolivia | 1,300 | 170 |

| Sri Lanka | 320 | 140 |

| Dominican Republic | 880 | 140 |

| Costa Rica | 480 | 90 |

| Panama | 320 | 90 |

| Cambodia | 320 | 90 |

| Ethiopia | 390 | 70 |

| Mongolia | 1,900 | 70 |

| Tanzania | 720 | 70 |

| Mauritius | 110 | 50 |

| Botswana | 390 | 30 |

550,000 1st | |

320 2nd | |

450,000 3rd | |

5,400 4th | |

60,500 5th | |

1,900 6th | |

60,500 7th | |

210 8th |

Similarweb shows a different story when it comes to February 2024 website visits with Admiral Markets receiving 595,437 visits vs. 1,273,000 for Pepperstone.

Our Most Popular Broker Verdict

Admiral Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

Admiral Markets ReviewVisit Admiral Markets

*Your capital is at risk ‘74% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – Pepperstone

A diverse product range and extensive CFD markets are essential for traders to diversify portfolios and capitalize on market conditions in forex trading. Brokers that offer various financial instruments provide traders with more profit opportunities, enhancing the trading experience and adaptability to different strategies.

Forex CFD

Pepperstone offers leverage up to 500:1 on over 94 major, minor, cross, and exotic currency pairs for trading the forex market if you are trading with the SCB-regulated branch, or 30:1 for majors and 20:1 for minors under ASIC, FCA and CySEC regulation.

Admiral Markets provides forex traders with access to over 50 forex major, minor and exotic currency pairs. Leverage is up to 30:1 in Australia, the UK and Europe.

Cryptocurrencies CFD

The emerging market of cryptocurrencies is gaining interest from many traders and investors. The volatile nature of cryptocurrency trading has become appealing for traders wanting to take advantage of swing trading.

- Pepperstone: Five major cryptocurrencies with leverage up to 2:1.

- Admiral Markets: 10 Cryptocurrency types and 32 combinations using 22 Fiat currencies (Bitcoin vs USD, Ethereum vs Euro) and 10 Crypto cross pairs (i.e. Stellar vs Litecoin) with leverage up to 2:1 for retail investors.

Admiral Markets offers a wider range of cryptocurrencies and crypto combinations (crypto vs crypto, crypto vs US/EURO) than Pepperstone, however, Pepperstone does offer the most popular currency pairs with high leverage.

Please note that if you are trading with a broker’s UK-based subsidiary, you will not be able to trade cryptocurrency. The country’s regulator (FCA) recently banned retail traders from trading cryptocurrency products.

Other CFDs

If you are looking for a greater choice of CFDs to trade with, Admiral Markets offers a greater choice of products. Not only do they offer more choices, but they offer both spots and futures. Pepperstone only offers spot options.

Pepperstone:

- Commodities: Gold & Silver (with USD, EUR, AUD and GBP) crosses, Platinum and Palladium (USD), 9 Agricultural, 4 Energies

- Indices: 16 Stock Indices, 3 Cash Indices

- Stocks: 64 US Stock

Admiral Markets:

- Commodities: 5 Metals, 3 Energies, 7 Agricultural, 5 Commodity Futures

- Indices: 43 Cash Indices, 25 Index Futures

- Stocks: 3350+ Stocks including 152 ASX, 273 LSE, 1358 NYSE, 869 NASDAQ, 18 AMEX, 111 EuropeNext)

- ETFs: 300+ including 54 NASDAQ, 23 LSE, 16 EuroNext

- Bonds: 2 Bonds Futures (10-year German Bund, 10 US Treasury Note)

| CFDs | Pepperstone | Admiral Markets |

|---|---|---|

| Forex Pairs | 94 | 50 |

| Indices | 27 | 42 |

| Commodities | 33 Commodities 7 Metals, 4 Energies, 9 Softs, 13 Hard | 29 Commodities 7 Metals (3 x Gold) 4 Energies 7 Softs (11 Futures) |

| Cryptocurrencies | 44 | 37 |

| Shares CFDs | 1,200+ | 300 |

| ETFs | 95 | 362 |

| Bonds | No | 2 |

| Futures | 42 Futures | No |

| Treasuries | 7 | 2 |

| Investment | No | No |

Our Top Product Range and CFD Markets Verdict

Pepperstone and Admiral Markets both provide a variety of tradable CFDs featuring leverage, competitive spreads, and minimal commissions. However, when it comes to forex and cryptocurrencies, Pepperstone stands out by offering a broader selection of pairs and more flexible leverage options than Admiral Markets.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

8. Superior Educational Resources – Admiral Markets

From my perspective, having superior educational resources is a game-changer in forex trading. With access to comprehensive learning materials like webinars, articles, video tutorials, and structured courses, As a broker, they empower traders to make informed decisions and enhance their trading strategies. These high-quality educational resources help traders to navigate the forex market confidently, fostering continuous learning and growth, which ultimately contributes to long-term trading success.

We can elaborate further on Admiral Markets excelence in educational resources, offering a plethora of webinars, articles, and tutorials.

- Webinars

- In-depth articles

- Video tutorials

- Trading glossaries

- E-books

- Interactive courses

Pepperstone follows in second with their list of educational resources too:

- Youtube materials and videos

- Podcasts

- Webinars and online seminars

- In-house analyst

Our Superior Educational Resources Verdict

From my experience, Admiral Markets truly excels in providing top-notch educational resources, earning an impressive score of 9.5. Their comprehensive materials make learning both accessible and effective for traders at all levels.

Admiral Markets ReviewVisit Admiral Markets

*Your capital is at risk ‘74% of retail CFD accounts lose money’

9. Superior Customer Service – Pepperstone

From my team’s perspective, having top-notch customer service in forex trading is a game-changer. It means traders get timely support and guidance, making their trading experience smooth and confident. With responsive live chat, phone, and email support available 24/7, and multilingual assistance, traders can resolve issues quickly. This not only enhances their overall satisfaction but also builds trust in the broker.

Pepperstone offers excellent customer service, available 24/5 via multiple channels.

- Live chat

- Email support

- Phone support

- FAQ section

Admiral Markets also offers reliable customer service which are:

- Emails

- Social Media Customer Service

- Dedicated account managers

But what makes them separate is that they lack the 24/5 availability that Pepperstone provides.

| Feature | Pepperstone | Admiral Markets |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

Our Superior Customer Service Verdict

From our team’s perspective, Pepperstone truly excels in customer service, earning an impressive score of 9.2 in our testing. Their dedication to providing top-notch support makes them a standout choice for traders seeking reliable and responsive assistance.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

10. Better Funding Options – Pepperstone

We’ll discuss how better funding options are crucial for providing traders with flexibility and convenience. Various methods like bank transfers, credit/debit cards, digital wallets (e.g., PayPal, Skrill, Neteller), and cryptocurrencies cater to different preferences. Offering multiple low or no-fee funding methods helps traders manage their accounts and conduct transactions seamlessly, enhancing the overall trading experience.

Pepperstone offers a variety of funding options, including a base currency of 20, making it easier for traders to get started.

- Visa/Mastercard

- Wire transfer

- Mastercard

- Neteller

And for Admirals, they offer a base currency of 5

- Visa Mastercard

- Wiretransfer

- Neteller

The following table lists the funding methods available through both Pepperstone and Admiral Markets.

| Funding Option | Pepperstone | Admiral Markets |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | No |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | Yes |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Our Better Funding Options Verdict

This is coming from our team’s experience, Pepperstone truly stands out with its impressive array of funding options. Whether I prefer traditional bank transfers, credit/debit cards, or modern e-wallet solutions like PayPal, Skrill, and Neteller, Pepperstone has me covered. This flexibility ensures that I can manage my account with ease and convenience.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

11. Lower Minimum Deposit – Pepperstone

For both new and seasoned traders, a lower minimum deposit in forex trading is highly beneficial. It makes the market more accessible, allowing traders to start with a smaller investment and reducing the financial barrier to entry. This inclusivity encourages more participation and provides an excellent opportunity for traders to gain experience and build their skills without a significant upfront cost. Whether you’re just starting out or have years of experience, a lower minimum deposit can enhance your trading journey.

In this section, we can see that Pepperstone has a lower minimum deposit of $0 against the $100 imposed by Admiral Markets. Below, we show you the required and recommended deposit amounts by each broker:

| Minimum Deposit | Recommended Deposit | |

| Pepperstone | $0 | $200 |

| Admiral Markets | $100 | $100 |

Our Lower Minimum Deposit Verdict

Pepperstone shines with its flexible minimum deposit requirement, offering traders the advantage of starting with a lower amount. This flexibility makes Pepperstone the clear winner in this category, catering to both new and seasoned traders alike.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

Is Admiral Markets Or Pepperstone The Best Broker?

Pepperstone is the winner because it offers a more comprehensive trading experience, from lower spreads to superior customer service. The table below summarises the key information leading to this verdict.

| Categories | Pepperstone | Admiral Markets |

|---|---|---|

| Lowest Spreads And Fees | ❌ | ✅ |

| Better Trading Platform | ✅ | ❌ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ❌ | ✅ |

| Most Popular Broker | ❌ | ✅ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ❌ | ✅ |

| Superior Customer Service | ✅ | ❌ |

| Better Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ❌ | ✅ |

Admiral Markets: Best For Beginner Traders

Admiral Markets is better suited for beginner traders due to its user-friendly platform and educational resources.

Pepperstone: Best For Experienced Traders

For experienced traders, Pepperstone offers a more robust trading environment with advanced features.

FAQs Comparing Pepperstone vs Admiral Markets

Does Admiral Markets Or Pepperstone Have Lower Costs?

Pepperstone has lower costs. They offer some of the lowest spreads in the industry, starting from 0.0 pips for EUR/USD. For more information on low-cost brokers, check out our list of Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Pepperstone is the superior choice for MetaTrader 4 users. They offer advanced features and customisability. For more details, visit our Best MT4 Brokers.

Which Broker Offers Social Trading?

Neither Pepperstone nor Admiral Markets offer social trading. However, both brokers do provide options for copy trading. If you’re interested in social trading, you might want to look at other best copy trading platforms.

Does Either Broker Offer Spread Betting?

No, neither Pepperstone nor Admiral Markets offer spread betting. For those interested in spread betting, check out the best brokers for spread betting.

What Broker is Superior For Australian Forex Traders?

In my opinion, Pepperstone is superior for Australian forex traders. They are ASIC-regulated and founded in Australia. For more information, check out the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, Admiral Markets is the better choice. They are FCA-regulated and offer a robust trading environment. For more details, visit our Best Forex Brokers In UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Can I buy crypto in Admiral Markets?

Yes, Admiral offers 27 crypto coins to choose from, the exception is in the UK where crypto trading is not permitted for retail traders