Pepperstone vs AvaTrade: Which Broker Is Best?

With our team’s head-to-head comparison for both brokers, we found out Pepperstone’s superior to AvaTrade which is based on lower spreads, and has more advanced trading platforms and a wider range of markets. Pepperstone is recommended for intermediate to advanced traders. Come, join us, and let us take a closer look on this comparison.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 17:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

We compared both brokers based on 10 criteria and found 3 core differences:

- Pepperstone has lower trading fees compared to AvaTrade.

- Pepperstone has superior trading platforms including TradingView.

- Pepperstone offers superior customer service.

- AvaTrade is better for beginner traders based on ease of use and education.

- AvaTrade offers superior educational resources with their economic calendar and market analysis and tools like AvaProtect

1. Lowest Spreads – Pepperstone

This review will explore brokers that offer the most competitive spreads and fees, highlighting the mutual benefits for both brokers and traders in the forex trading industry. Reduced spreads lower transaction costs, which is particularly advantageous for high-frequency traders. Meanwhile, competitive fees draw in more clients, resulting in higher trading volumes and increased revenue for brokers. Together, these elements not only enhance the trading experience but also make it more profitable and attractive for traders and brokers alike.

Spreads

Pepperstone provides an average spread of 1.35 pips, outperforming AvaTrade’s 1.44 pips when considering the eight most commonly traded forex pairs. While the difference in average spreads between these two brokers is minor, Pepperstone delivers slightly superior value in terms of spreads.

| Standard Account | Pepperstone Spreads | Avatrade Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.35 | 1.44 | 1.7 |

| EUR/USD | 1.1 | 0.8 | 1.2 |

| USD/JPY | 1.2 | 1.3 | 1.5 |

| GBP/USD | 1.20 | 1.20 | 1.6 |

| AUD/USD | 1.1 | 0.9 | 1.6 |

| USD/CAD | 1.4 | 1.8 | 1.9 |

| EUR/GBP | 1.20 | 1.20 | 1.5 |

| EUR/JPY | 2.1 | 1.8 | 2.1 |

| AUD/JPY | 1.90 | 1.90 | 2.3 |

Commission Levels

Pepperstone provides traders with both standard and raw accounts, the latter being a spread plus commission account, known as a Razor or ECN trading account. This structure delivers exceptional value, particularly for forex traders. In contrast, AvaTrade offers only a standard account, which functions solely on a spread-only or no-commission model.

This fee calculator illustrates the impact of reduced spreads on trading costs. Simply select your base currency, trade amount, and currency pair to see the calculated fees.

Standard Account Fees

Both Pepperstone and AvaTrade do not impose any deposit or withdrawal fees. However, Pepperstone offers the advantage of a $0 inactivity fee, while AvaTrade charges a quarterly inactivity fee of $50. Overall, despite these small discrepancies, Pepperstone’s standard account features a more appealing fee structure, particularly because it doesn’t incur any inactivity charges.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.10 | 1.10 | 1.30 | 1.30 | 1.30 |

| 0.80 | 0.90 | 1.20 | 1.20 | 1.30 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 1.20 | 1.41 | 1.47 | 1.47 | 1.61 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.52 | 2.08 | 1.46 | 1.87 | 1.67 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Based on these given data, we can easily surmise that both brokers off a standard account with Pepperstone having the lower spreads and other trading fees compared to AvaTrade. The Pepperstone razor account (raw account) has even lower spreads and is our recommended choice for the best pricing.

Our Lowest Spreads and Fees Verdict

Pepperstone takes the crown from the challenger due to their lowest spreads and fees.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

2. Best Trading Platforms – Pepperstone

Pepperstone offers 6 vs 4 trading platforms for AvaTrade. One of the additional software packages Pepperstone offers is cTrader which includes cAlgo which allows traders to build cBots and custom technical indicators using C#. TradingView is the second platform offered which is the fastest-growing trading platform for both CFD and forex trading. We like this platform for their advanced charting and the overall trading experience offered.

| Trading Platform | Pepperstone | AvaTrade |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

Another factor when comparing trading platforms is the execution speed. This is critical when algorithmically trading or making trades in volatile markets when slippage can occur. Pepperstone has one of the best technology stacks of any broker achieving:

- Limit order speed of 77ms

- Market order speed of 100ms

Based on our team’s research, we can see that Both brokers offer MetaTrader 4, MetaTrader 5 and their own trading platform but only Pepperstone offers cTrader and TradingView and has supeior execution speeds making it the clear winner in this category.

Our Better Trading Platform Verdict

Pepperstone leads in this category owing to their best trading platforms.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

3. Superior Trading Account – Pepperstone

As mentioned earlier, only Pepperstone offers a Raw Account that comprises a spread and commission resulting in lower trading fees compared to a standard account. The broker also offers an active trading program that discounts $1, $2 or $3 per lot depending on the total amount traded for the month.

| Pepperstone | Avatrade | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | No |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | No |

| Spread Betting (UK) | Yes | Yes |

We can easily say here that Pepperstone is the only broker that offers a raw account that contains a commission which is further discounted for high volume traders. This gives Pepperstone the best features with the lowest trading costs.

Our Superior Accounts and Features Verdict

Pepperstone definitely steals the show here owing to their superior trading account.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

4. Best Trading Experience- Pepperstone

An exceptional trading experience in the forex market hinges on several key factors: state-of-the-art trading platforms, rapid execution speeds, competitive spreads, and strong customer support. These elements empower traders to make well-informed decisions, execute trades effortlessly, and manage their accounts with ease. Additionally, a user-friendly interface, access to educational resources, and a diverse range of trading tools significantly elevate the overall trading journey, transforming it into a more enjoyable and profitable venture for traders.

During our research, we have seen significant comparison for both brokers, Pepperstone and AvaTrader. While the former offers a wider range of trading platforms, the latter AvaTradeGo is the best for beginners. This is due to its simple interface and trading app functionality. Other elements such as it’s webtrader and social trading add-ons make it easier to implement basic trading strategies.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| Pepperstone | 77ms | 2/36 | 100ms | 10/36 |

| AvaTrade | 235ms | 32/36 | 145ms | 21/36 |

Our Best Trading Experience and Ease Verdict

Pepperstone definitely steals the show here owing to their superior trading account.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

5. Stronger Trust Score – Pepperstone

Enhanced trust and regulation create a secure and transparent environment in forex trading. Regulated brokers follow stringent standards that safeguard traders against fraud and unethical practices. This instills confidence, prompting traders to invest and trade more actively. Reputable brokers, backed by solid regulatory oversight, attract a larger client base, thereby strengthening their reputation and market position.

Pepperstone Trust Score

Pepperstone is trustworthy with a trust score of 91/100. This was based on the broker’s:

- Strong regulation with four tier 1, one tier 2 and two tier 3 regulators

- A strong reputation with the broker founded in 2010 and receiving 110,000 Google searches each month

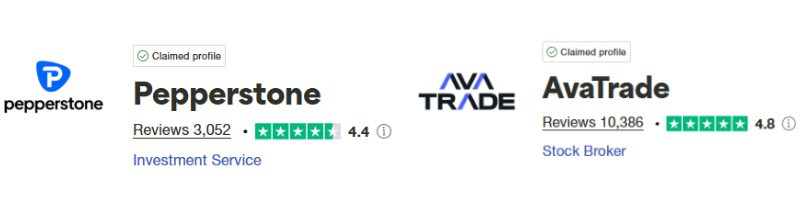

- Positive reviews on Trustpilot with an average score of 4.4 from 3,052 respondents

AvaTrade Trust Score

AvaTrade is trustworthy and has a trust score of 72/100 based on:

- Strong regulation with three tier 1, five tier 2 and two tier 3 regulators

- A medium reputation, founded in 2006 and receiving 90,500 Google searches each month

- Positive reviews on Trustpilot with an average score of 4.8 from 10,386 respondents

Regulations

Below compare head-to-head the regulation of each broker which resulted in a tie when it came to the reputation score.

| Pepperstone | AvaTrade | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) | ASIC (Australia) CIRO (CANADA) CYSEC (Cyprus) |

| Tier 2 Regulation | DFSA (Dubai) | ADGM (UAE) ISA (Israel) JFSA (Japan) CBI KNF (Poland) |

| Tier 3 Regulation | SCB (Bahamas) CMA (Kenya) | FSC- BVI FSCA (South Africa) |

Clearly, we can see here that while this category was extremely close for both brokers, Pepperstone was deemded to have a suprior trust score thanks to the broker’s popularity and growing market share. That said, both brokers can be trusted with strong regulation and reviews.

Reviews

Pepperstone holds a Trustpilot rating of 4.4 out of 5, based on over 3,000 reviews. AvaTrade scores higher with a Trustpilot rating of 4.8 out of 5, from more than 10,000 reviews. Both brokers are well-regarded, but AvaTrade edges ahead in both score and review volume, suggesting broader and more consistent customer satisfaction.

Our Stronger Trust and Regulation Verdict

Pepperstone steals the show as a result of their stronger trust score.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

6. Most Popular Broker – Pepperstone

Pepperstone gets searched on Google more than AvaTrade. On average, Pepperstone sees around 110,000 branded searches each month, while AvaTrade gets about 90,500 — that’s 17% fewer.

| Country | Pepperstone | AvaTrade |

|---|---|---|

| Australia | 8,100 | 1,300 |

| Brazil | 6,600 | 880 |

| United Kingdom | 5,400 | 4,400 |

| United States | 4,400 | 2,900 |

| Malaysia | 4,400 | 1,600 |

| Thailand | 4,400 | 480 |

| Kenya | 4,400 | 590 |

| Germany | 3,600 | 2,900 |

| Mexico | 3,600 | 1,300 |

| Hong Kong | 3,600 | 320 |

| Colombia | 3,600 | 1,000 |

| South Africa | 2,900 | 8,100 |

| India | 2,900 | 3,600 |

| Italy | 1,900 | 5,400 |

| Spain | 1,900 | 2,900 |

| Mongolia | 1,900 | 1,300 |

| Singapore | 1,600 | 1,300 |

| Turkey | 1,600 | 880 |

| Indonesia | 1,600 | 880 |

| Peru | 1,600 | 480 |

| Argentina | 1,300 | 480 |

| Nigeria | 1,300 | 1,900 |

| Pakistan | 1,300 | 1,000 |

| Bolivia | 1,300 | 140 |

| United Arab Emirates | 1,000 | 2,900 |

| France | 1,000 | 4,400 |

| Taiwan | 1,000 | 210 |

| Chile | 1,000 | 390 |

| Ecuador | 1,000 | 320 |

| Netherlands | 880 | 1,300 |

| Philippines | 880 | 590 |

| Dominican Republic | 880 | 210 |

| Poland | 720 | 1,300 |

| Canada | 720 | 2,900 |

| Morocco | 720 | 590 |

| Vietnam | 720 | 720 |

| Tanzania | 720 | 260 |

| Portugal | 480 | 590 |

| Cyprus | 480 | 320 |

| Japan | 480 | 720 |

| Costa Rica | 480 | 90 |

| Sweden | 390 | 590 |

| Egypt | 390 | 480 |

| Bangladesh | 390 | 320 |

| Algeria | 390 | 390 |

| Venezuela | 390 | 390 |

| Uganda | 390 | 260 |

| Ethiopia | 390 | 110 |

| Botswana | 390 | 260 |

| Switzerland | 320 | 590 |

| Austria | 320 | 320 |

| Cambodia | 320 | 140 |

| Panama | 320 | 90 |

| Sri Lanka | 320 | 320 |

| Ireland | 260 | 720 |

| Saudi Arabia | 260 | 390 |

| Jordan | 260 | 260 |

| Ghana | 260 | 320 |

| Greece | 210 | 390 |

| New Zealand | 170 | 70 |

| Uzbekistan | 140 | 210 |

| Mauritius | 110 | 90 |

8,100 1st | |

1,300 2nd | |

6,600 3rd | |

880 4th | |

5,400 5th | |

4,400 6th | |

4,400 7th | |

1,600 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with Pepperstone receiving 1,273,000 visits vs. 713,000 for AvaTrade.

Our Most Popular Broker Verdict

Pepperstone is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

7. Widest CFD Product Range – Pepperstone

Having a top product range and extensive CFD markets allows traders to diversify their portfolios and capitalize on various market conditions in the industry of forex trading. Brokers offering a wide selection of financial instruments, including forex pairs, commodities, indices, and cryptocurrencies, provide traders with more opportunities to profit. This variety enhances the trading experience, making it more dynamic and adaptable to different trading strategies.

Pepperstone offers more markets to be traded compared to Avatrade including:

- 500+ more shares CFDs

- 40 more currency pairs

- 28 more ETFs

| CFDs | Pepperstone | AvaTrade |

|---|---|---|

| Forex Pairs | 94 | 55 |

| Indices | 27 | 33 |

| Commodities | 33 Commodities 7 Metals, 4 Energies, 9 Softs, 13 Hard | 5 Metals 5 Energies 7 Softs |

| Cryptocurrencies | 44 | 17 (+ Crypto10 Index) |

| Share CFDs | 1,200+ | No |

| ETFs | 95 | 59 |

| Bonds | No | 2 |

| Futures | 42 Futures | Yes |

| Treasuries | 7 | 2 |

| Investments | No | Yes |

With 6 of the 7 categories of tradable instruments offered more by Pepperstone than AvaTrade, the broker offers a superior range of markets.

Our Top Product Range and CFD Markets Verdict

Pepperstone outperforms the challenger due to their widest CFD product range.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

8. Superior Educational Resources – AvaTrade

Superior educational resources equip traders with a wealth of comprehensive learning materials for forex trading, including webinars, articles, video tutorials, and structured courses. These invaluable resources empower traders to gain the knowledge and skills essential for making informed decisions, refining their trading strategies, and confidently navigating the forex market. By providing access to high-quality educational content, traders are encouraged to engage in continuous learning and growth, significantly contributing to their long-term success in trading.

Pepperstone and AvaTrade both provide educational resources, but the quality and variety of these resources differ between the two platforms.

- Pepperstone offers webinars and tutorials.

- AvaTrade provides an economic calendar and market analysis.

- Both brokers offer trading guides and FAQs.

- AvaTrade has a dedicated education section on its website.

- Pepperstone provides articles and insights.

- AvaTrade offers risk management tools like AvaProtect.

With these data given, we can easily say that AvaTrade scores higher in offering comprehensive educational resources.

Our Superior Educational Resources Verdict

AvaTrade secures the top spot here in light of their superior educational resources.

*Your capital is at risk ‘66% of retail CFD accounts lose money’

9. Best Customer Service – Pepperstone

Superior customer servicein forex trading ensures traders receive timely support and guidance, fostering a seamless and confident trading experience. It includes responsive live chat, phone, and email support, available 24/7, and multilingual assistance. This level of service helps traders resolve issues quickly, enhances their overall satisfaction, and builds trust in the broker.

Based on our studies, Pepperstone has superior customer service that, unlike AvaTrade, is offered on the weekend. They also offer a dedicated account manager ideal for experienced forex traders.

In conjecture, we can see that while Pepperstone won this category, AvaTrade’s customer support team were more geared towards novice traders making it easier to onboard and explain basic forex concepts over the phone and in our live chat exchanges.

| Feature | Pepperstone | AvaTrade |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 16/5 |

| Multilingual Support | Yes | Yes |

Our Superior Customer Service Verdict

Pepperstone truly excels in this portion thanks to their best customer service.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

10. Top Funding Options – Pepperstone

Brokers offering better funding options in forex trading provide flexibility and convenience through methods like bank transfers, cards, digital wallets (PayPal, Skrill, Neteller), and cryptocurrencies. Multiple low or no-fee methods help traders manage deposits and withdrawals efficiently, enhancing their trading experience.

Funding methods available for each broker are explained below with both brokers having mainstream payment facilities from debit cards, credit cards to bank transfers:

| Funding Methods | Pepperstone | AvaTrade |

|---|---|---|

| Bank Transfer | Yes | Yes |

| Visa | Yes | Yes |

| Mastercard | Yes | Yes |

| AMEX | No | No |

| PayPal | Yes | Yes |

| Neteller | Yes | Yes |

| Skrill | Yes | Yes |

| POLi | Yes | Yes |

| BPay | Yes | No |

| WebMoney | No | Yes |

Our Better Funding Options Verdict

Pepperstone outshines the contender here in light of their top funding option.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

11. Lower Minimum Deposit – Pepperstone

A broker that offers a lower minimum deposit in forex trading significantly enhances market accessibility for a broader spectrum of traders, including novices and those with limited funds. By enabling traders to enter the market with a smaller initial investment, it effectively lowers the financial barriers to entry. This inclusivity not only fosters greater participation but also grants aspiring traders the chance to gain valuable experience and refine their skills without facing substantial upfront costs.

Pepperstone has the lowest minimum deposit of $0, compared to $100 for AvaTrade. Pepperstone doesn’t charge a deposit or withdrawal fee, and the same applies to AvaTrade.

| Minimum Deposit | Recommended Deposit | |

| Peppperstone | $0 | $200 |

| AvaTrade | $100 | - |

Our Lower Minimum Deposit Verdict

Pepperstone undoubtedly excels in this niche owing to their lower minimum deposit.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

So is AvaTrade Vs Pepperstone the Best Broker?

Pepperstone is better than AvaTrade winning 8 categories including having lower trading costs and a superior trading platform.

| Categories | Peppperstone | AvaTrade |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | Yes | No |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | Yes | No |

| Top Product Range And CFD Markets | Yes | No |

| Superior Educational Resources | No | Yes |

| Superior Customer Service | Yes | No |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | Yes | No |

Our team’s analysis strongly indicates that if you’re a novice trader, AvaTrade is an excellent choice for you. Its user-friendly interface, outstanding educational resources, and focus on beginner-friendly customer support set it apart. Conversely, for seasoned traders seeking the best platforms, minimal fees, and advanced features, Pepperstone stands out as the optimal broker.

FAQs

Which Broker Is Best For Scalping?

Pepperstone is the better broker for scalping based on its lower trading costs, faster execution speeds, and trading platform range, which is more suited for automated trading. View our list of the most recommended forex brokers for scalping

What Are The Disadvantages Of Pepperstone And AvaTrade?

Both Pepperstone and AvaTrade don’t offer non-CFD trading such as stockbroker services. If you are looking for a broker that also offers share trading, future trading or even a cryptocurrency exchange then view our trading platform list.

Is Pepperstone Regulated In Australia?

Peppestone is regulated by ASIC (Australian Securities and Investments Commission) ensuring clients’ funds are segregated, minimum training standards are met and that the broker meets reporting expectations. The provider was ranked 1st on our 2026 Australian Forex Broker list.

Is AvaTrade Regulated In The UK?

AvaTrade is not regulated by the FCA (Financial Conduct Authority) in the UK and is therefore not suitable for United Kingdom residents. If you reside in this region we recommend considering instead our list of UK Forex Brokers.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert