Pepperstone vs FOREX.com: Which One Is Best?

In this review, we will explore the competitive landscape of forex trading by examining how Pepperstone and FOREX.com perform, and how they compare with each other in terms of feature, platform and rates. Let’s explore deeper into this topic and explore how both entities will compete in the brokerage industry. Discover more insights and information.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Futures 6.25:1

Minor Pairs 17:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Minor Pairs 20:1

Overall

Our full comparison covers the 10 most important trading factors. Here are five noticeable differences between Pepperstone and FOREX.com:

- Pepperstone processes an impressive $9.2 billion USD worth of transactions per day.

- Pepperstone’s standard account has much tighter average spreads.

- Pepperstone received 2.1 million website visits in August 2022.

- FOREX.com has its own five top-tier regulators and one third-tier one.

- FOREX.com offers both MT4 and TradingView, along with NinjaTrader and their proprietary platform

- Both brokers specialise in Contract for Difference (CFD) derivative products.

1. Lowest Spreads And Fees – Pepperstone

In this section, we will discuss further brokers with lowest spreads and fees. This feature provides traders with cost-effective trading options. Narrower spreads result in lower transaction costs, a significant advantage for high-frequency traders. Competitive fees not only draw in more clients but also boost trading volumes, leading to increased revenue for brokers. This synergy improves the entire trading experience, making it more lucrative and attractive for both traders and brokers alike.

Spreads

Pepperstone is a major forex CFD broker, processing $9.2 billion in daily transactions since its 2010 founding in Australia. It serves nearly all countries, excluding Canada and the U.S. FOREX.com, part of the StoneX group, excludes Australia, Singapore, and UAE clients, redirecting them to City Index. Both brokers offer CFD products, but U.S. clients of FOREX.com can only spot trade. Pepperstone provides a competitive rate of 1.1 for EUR/USD on its standard account, while FOREX.com slightly edges higher at 1.5, which is also marginally higher than the overall industry average. In the AUD/USD pair, Pepperstone’s rate stands at 1.1, significantly better than FOREX.com’s 1.5, which exceeds the industry standard spread of 1.5. When considering the overall average standard rate of 1.5, Pepperstone remains advantageous at 1.40, compared to FOREX.com’s 1.94.

| Standard Account | Pepperstone Spreads | FOREX.com Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.40 | 1.94 | 1.7 |

| EUR/USD | 1.1 | 1.5 | 1.2 |

| USD/JPY | 1.2 | 1.8 | 1.5 |

| GBP/USD | 1.2 | 1.8 | 1.6 |

| AUD/USD | 1.1 | 1.5 | 1.6 |

| USD/CAD | 1.4 | 2.6 | 1.9 |

| EUR/GBP | 1.2 | 1.6 | 1.5 |

| EUR/JPY | 2.1 | 2.4 | 2.0 |

| AUD/JPY | 1.9 | 2.3 | 2.3 |

Commission Levels

In this section, we will lay out the cards for brokers with their commission rates. For Pepperstone, they offer a $3.50 while FOREX.com offers a wee bit higher than the former of a $6.00. For the minimum deposit, Pepperstone hands out a $0 minimum deposit, in contrast to FOREX.com’s $100. Pepperstone’s recommended deposit is pro-rated at $100 while FOREX.com asks for a $ 1,000 minimum deposit. A recommended deposit of $1,000 at FOREX.com is relatively high compared to Pepperstone’s pro-rated $100 deposit. While a higher deposit can provide more flexibility and better risk management, it may be less accessible for new traders. Pepperstone’s lower recommended deposit makes it more appealing for those starting out or with limited funds, offering a more inclusive trading environment.

Standard Account Fees

In a commission-free standard account, the main trading cost is the spread, which should be tight for cheaper trading. Standard accounts have wider spreads than commission-based accounts, as brokers profit from them. Pepperstone provides a competitive spread of 1.10 for EUR/USD, while FOREX.com offers a higher spread of 1.20. In the case of AUD/USD, Pepperstone maintains a standard spread of 1.20, significantly lower than FOREX.com’s 1.80. Overall, FOREX.com consistently has elevated rates across all listed currencies compared to Pepperstone’s more favorable and average spreads.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.10 | 1.10 | 1.30 | 1.30 | 1.30 |

| 1.20 | 1.80 | 1.60 | 1.70 | 1.60 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 0.94 | 1.48 | 1.45 | 1.68 | 1.90 |

| 1.20 | 1.41 | 1.47 | 1.47 | 1.61 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.52 | 2.08 | 1.46 | 1.87 | 1.67 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Note: While commission costs in the USA and Canada are slightly higher, comparisons with Pepperstone don’t apply as Pepperstone doesn’t accept clients from these markets.

When choosing a broker, consider spread costs and commissions. Also, be aware of funding fees, swap fees, and currency conversion charges.

Our Lowest Spreads and Fees Verdict:

Pepperstone offers lower spreads and generally lower commission costs than Forex, except for trades over $250M where commissions match. Savings with Forex only apply to trades of $500M or more. Evidently, Pepperstone grabs the throne in this category thanks to their lowest spreads and fees.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

2. Better Trading Platform – Pepperstone

Brokers with a better trading platform are a great steal in the world of forex trading. Their offerings include advanced charting tools, real-time market data, and fast execution speeds, along with a user-friendly interface, customizable options, and strong security. They support automated and social trading, providing access to various financial instruments, which improves trading efficiency and decision-making.

| Trading Platform | Pepperstone | FOREX.com |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

Metatrader

In this section, we will talk about brokers and the platforms that they offer in forex trading. For Pepperstone, both MetaTraders 4 and 5 are included in their platform. Always bear in mind that brokers offering platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are gold due to their advanced charting tools, real-time market data, and automated trading capabilities. These platforms support Expert Advisors (EAs) for automated trading, allowing traders to execute strategies with precision. Their customizable interfaces cater to individual trading preferences, enhancing the overall trading experience and efficiency.

Advanced Platforms

cTrader is a highly esteemed trading platform that provides direct access to interbank market depth, specifically designed for algorithmic forex trading. It features a customizable interface with detachable charts, robust back-testing capabilities, and sophisticated options for order modification and placement. This versatile platform is accessible on iOS, Android, WebTrader, and desktop, catering to both PC and Mac users. For Pepperstone, they offer cTrader platform in their trading system, in contrast to FOREX.com having none at all.

Copy Trading

Copy trading – A feature that lets traders replicate successful trades in real-time through copy trading platforms or integrated forex trading functionalities, allowing them to leverage experienced traders’ skills without making their own decisions.

TradingView – TradingView is a robust charting and social networking platform for traders, featuring advanced charting tools, real-time market data, and a community for sharing ideas. Though it has some social trading options, it is mainly recognized for its charting and market analysis tools.

Copy trading focuses on replicating trades, while TradingView is a charting and analysis platform with some social trading features in which both brokers have in their platform as a tool to help traders get the best experience while trading.

Pepperstone offers a robust assortment of platforms, including MetaTrader 4 and MetaTrader 5 (MT4/MT5), Capitalise.ai, TradingView, and cTrader.

- The globally esteemed MT4 and MT5 platforms are provided by the majority of brokers, attesting to their renown as the world’s premier trading platforms. These platforms boast user-friendly interfaces and straightforward trading tools. Additionally, they provide access to an extensive library of Expert Advisors (EAs) for trading enhancement.

- Capitalise.ai, an algorithmic trading platform, is uniquely designed such that no coding is required, making it an excellent choice for forex trading newcomers. With simple written commands, you can construct your own algorithmic bots devoid of any code.

- TradingView is an optimal platform for chart traders. Its vast array of chart types and indicators, coupled with its customisability, allows for the creation of personalised tools.

FOREX.com offers both MT4 and TradingView, along with NinjaTrader and their proprietary platform.

- NinjaTrader stands out with its market analyser and advanced trade management system, allowing for improved trading management. These features can be tailored to suit individual trading styles.

- FOREX.com’s exclusive proprietary platform is also available, which is a requirement for commission-based trading accounts in the USA. This platform is equipped with advanced charting tools, over 80 indicators, and performance analytics tools.

Our Better Trading Platform Verdict

Our team can easily assume that both Pepperstone and FOREX.com are tied to this category in light of their better trading platform and their fair few platforms and trading tools for traders to use.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

3. Superior Accounts And Features – Pepperstone

Let’s discuss how brokers offer tailored accounts with competitive spreads, low commissions, and advanced tools. These can include demo accounts, swap-free options, and various financial instruments. Features like social trading, automated trading, and strong customer support enhance the trading experience, boosting client satisfaction and loyalty.

Pepperstone and FOREX.com provide different account types for trading. Pepperstone’s standard account has tighter spreads, starting at 1.0 pips on major pairs, except EUR/GBP. In contrast, FOREX.com’s standard account offers a minimum spread of 0.8 pips for EUR/USD and AUD/USD but higher spreads for other pairs.

Pepperstone’s Razor Account is notable for its 0.1 to 0.3 pip spreads on EUR/USD and $7 AUD/USD commission per standard lot. In contrast, FOREX.com’s commissions vary by registration country, with some regions lacking commission accounts.

Pepperstone has no minimum deposit but recommends at least $200, while FOREX.com requires a minimum deposit of $100.

| Pepperstone | FOREX.com | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | Yes | No |

Our Superior Accounts and Features Verdict

Based on our team’s perpectives, Pepperstone outperforms the challenger in this category thanks to their superior accounts and features as well as their the diverse account offerings and competitive features.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – Pepperstone

A great trading experience is crucial for forex traders, relying on advanced platforms, fast execution, competitive spreads, and strong customer support. These features help traders make informed decisions and manage accounts effectively. User-friendly interfaces, educational resources, and various tools also enhance the trading experience, making it more enjoyable and profitable.

Our team found that trading with Pepperstone and FOREX.com provides distinct experiences. Pepperstone features platforms like MT4, MT5, Capitalise.ai, and cTrader, all user-friendly with various trading tools. Meanwhile, FOREX.com offers MT4, TradingView, NinjaTrader, and its own platform, all intuitive and advanced.

- Pepperstone offers Capitalise.ai, a unique algorithmic trading platform that requires no coding.

- TradingView, available on both platforms, is a haven for chart traders with its vast array of chart types and indicators.

- Our own testing revealed that Pepperstone stands out as the “Best MT4” broker and also excels in automation with platforms like Capitalise.ai.

- FOREX.com’s proprietary platform comes with over 80 indicators and advanced charting tools, enhancing the trading experience.

Our Best Trading Experience and Ease Verdict

Our team can easily surmise that while both brokers offer commendable trading platforms, Pepperstone takes the cake in the portion as a result of their best trading experience along with their diverse platform offerings and superior automation features, providing an unparalleled trading experience.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – Pepperstone

Establishing stronger trust and regulation in forex trading is essential; traders must ensure that their brokers are fully regulated. This commitment creates a secure, transparent trading environment. Regulated brokers follow strict standards, protecting traders from fraud and encouraging investment. Reliable brokers with strong oversight attract more clients, enhancing their reputation and market influence.

Pepperstone Trust Score

FOREX.com Trust Score

Regulations

Our team’s advice to traders: One of the best ways to stay safe when forex trading is using a broker that is regulated in the country you are trading from.

Pepperstone is regulated by 5 top-tier and one second-tier regulator; meanwhile, FOREX.com has its own five top-tier regulators and one third-tier one.

Traders in the UAE, Australia and Singapore wanting a FOREX.com environment can consider trading with City Index. Both brokers were previously owned by Gain Capital Group and have since been bought by the StoneX Group.

| Pepperstone | FOREX.com | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) | FCA (UK) CIRO (CANADA) NFA/CFTC (USA) CYSEC (Cyprus) |

| Tier 2 Regulation | DFSA (Dubai) | JFSA (Japan) |

| Tier 3 Regulation | SCB (Bahamas) CMA (Kenya) | CIMA (Cayman) |

Reviews

Pepperstone and FOREX.com both enjoy strong reputations on Trustpilot, but FOREX.com holds a slightly higher score. FOREX.com is rated 4.6 out of 5 from over 2,100 reviews, with users frequently praising its professional customer service and reliable trading platform. Pepperstone, meanwhile, has a score of 4.5 out of 5 from around 3,100 reviews, earning positive feedback for its fast execution, low commissions, and helpful support team.

Our Stronger Trust and Regulation Verdict

Based on our team’s research and study, both brokers are using top-tier regulators, so both Pepperstone and FOREX.com makes a draw in this category, this is in light of their stronger trust and regulation – the most important factor when choosing a broker is when they are fully regulated in your home country.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

6. Most Popular Broker – Pepperstone

Pepperstone gets searched on Google more than FOREX.com. On average, Pepperstone sees around 110,000 branded searches each month, while FOREX.com gets about 22,200 — that’s 79% fewer.

| Country | Pepperstone | FOREX.com |

|---|---|---|

| Australia | 8,100 | 210 |

| Brazil | 6,600 | 110 |

| United Kingdom | 5,400 | 880 |

| Thailand | 4,400 | 140 |

| United States | 4,400 | 6,600 |

| Malaysia | 4,400 | 170 |

| Kenya | 4,400 | 320 |

| Germany | 3,600 | 720 |

| Colombia | 3,600 | 140 |

| Hong Kong | 3,600 | 90 |

| Mexico | 3,600 | 210 |

| South Africa | 2,900 | 590 |

| India | 2,900 | 1,900 |

| Spain | 1,900 | 170 |

| Italy | 1,900 | 140 |

| Mongolia | 1,900 | 10 |

| Singapore | 1,600 | 90 |

| Indonesia | 1,600 | 390 |

| Peru | 1,600 | 70 |

| Turkey | 1,600 | 320 |

| Pakistan | 1,300 | 720 |

| Nigeria | 1,300 | 480 |

| Argentina | 1,300 | 110 |

| Bolivia | 1,300 | 20 |

| France | 1,000 | 260 |

| United Arab Emirates | 1,000 | 320 |

| Taiwan | 1,000 | 40 |

| Ecuador | 1,000 | 40 |

| Chile | 1,000 | 50 |

| Netherlands | 880 | 140 |

| Philippines | 880 | 170 |

| Dominican Republic | 880 | 70 |

| Vietnam | 720 | 170 |

| Morocco | 720 | 110 |

| Poland | 720 | 170 |

| Canada | 720 | 1,000 |

| Tanzania | 720 | 40 |

| Japan | 480 | 590 |

| Portugal | 480 | 40 |

| Cyprus | 480 | 30 |

| Costa Rica | 480 | 20 |

| Algeria | 390 | 90 |

| Bangladesh | 390 | 210 |

| Egypt | 390 | 90 |

| Sweden | 390 | 90 |

| Venezuela | 390 | 50 |

| Uganda | 390 | 70 |

| Ethiopia | 390 | 110 |

| Botswana | 390 | 30 |

| Sri Lanka | 320 | 50 |

| Switzerland | 320 | 70 |

| Austria | 320 | 110 |

| Panama | 320 | 10 |

| Cambodia | 320 | 40 |

| Saudi Arabia | 260 | 140 |

| Ireland | 260 | 40 |

| Ghana | 260 | 90 |

| Jordan | 260 | 30 |

| Greece | 210 | 50 |

| New Zealand | 170 | 30 |

| Uzbekistan | 140 | 110 |

| Mauritius | 110 | 20 |

8,100 1st | |

210 2nd | |

5,400 3rd | |

880 4th | |

4,400 5th | |

140 6th | |

4,400 7th | |

170 8th |

Similarweb shows a different story when it comes to February 2024 website visits with Pepperstone receiving 1,273,000 visits vs. 1,779,000 for FOREX.com.

Our Most Popular Broker Verdict

Pepperstone is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – Pepperstone

A robust product range and comprehensive CFD markets are essential features that a broker can provide. These offerings allow traders to diversify portfolios and exploit varying market conditions. With a wide range of financial instruments—like forex, commodities, indices, and cryptocurrencies—brokers enhance profit opportunities and keep trading dynamic and adaptable to different strategies.

The financial instruments offered by these two brokers are contracts-for-differences (CFDs). These are a form of derivative, with underlying assets ranging from forex pairs to shares/ETFs/indices, commodities, and even cryptocurrencies.

| CFDs | Pepperstone | FOREX.com |

|---|---|---|

| Forex Pairs | 94 | 91 |

| Indices | 27 | 17 |

| Commodities | 33 Commodities 7 Metals, 4 Energies, 9 Softs, 13 Hard | 2 Metals (6 Gold crosses (2 Silver crosses) 2 Energies 2 Softs |

| Cryptocurrencies | 44 | 8 |

| Share CFDs | 1,200+ | 220 |

| ETFs | 95 | No |

| Bonds | No | No |

| Futures | 42 Futures | No |

| Treasuries | 7 | No |

| Investments | No | No |

The exception is in the USA with FOREX.com, where spot, not CFD, products are offered.

Pepperstone provides you with 94 different currency pairs and over 1,200 share CFDs. Maximum leverage is set at the maximum allowed by regulation, which is 30:1 on major forex pairs if you are a retail trader and 500:1 if you are a pro trader. In Kenya, leverage is 400:1, and in regions outside the major trading hubs, you get 200:1 leverage.

FOREX.com offers more forex pairs, at 82 in the US and 91 outside of the US. They also have over 3,000 share CFDs, much more than Pepperstone. Leverage is also slightly different, at 50:1 in the US and 33:1 in Canada, and for other regions, at 200:1. For pro traders, leverage is maxed at 400:1.

Our Top Product Range and CFD Markets Verdict

In this category, our team simply voted that FOREX.com steals the show due to their top product range and CFD markets, this is on account of their wider variety of forex pairs and other CFD options.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

8. Superior Educational Resources – Pepperstone

Access to exceptional educational resources is crucial for traders in the trading industry. These resources provide extensive learning materials on forex trading, including webinars, articles, video tutorials, and courses. They equip traders with necessary knowledge and skills to enhance strategies and boost confidence in the forex market, contributing to long-term trading success.

Pepperstone:

- Webinars: Regularly hosts webinars on various trading topics.

- Tutorials: Offers detailed tutorials for both beginners and advanced traders.

- Research Tools: Provides comprehensive research tools to help traders make informed decisions.

- Market Analysis: Delivers up-to-date market analysis to keep traders in the loop.

- Trading Strategies: Shares effective trading strategies for different market conditions.

- Customer Support: Exceptional customer support that assists traders in understanding the platform and tools.

FOREX.com:

- Webinars: Conducts webinars, though not as frequently as Pepperstone.

- Tutorials: Has a range of tutorials, but they might not be as in-depth.

- Research Tools: Offers research tools, but they might not be as comprehensive.

- Market Analysis: Provides market analysis, but it might not be as current.

- Trading Strategies: Shares trading strategies, but they might not be as effective.

- Customer Support: Good customer support, but might not be as responsive as Pepperstone’s.

Our Superior Educational Resources Verdict

Based on our team’s test results, Pepperstone ranks highest in this category thanks to their superior educational resources.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

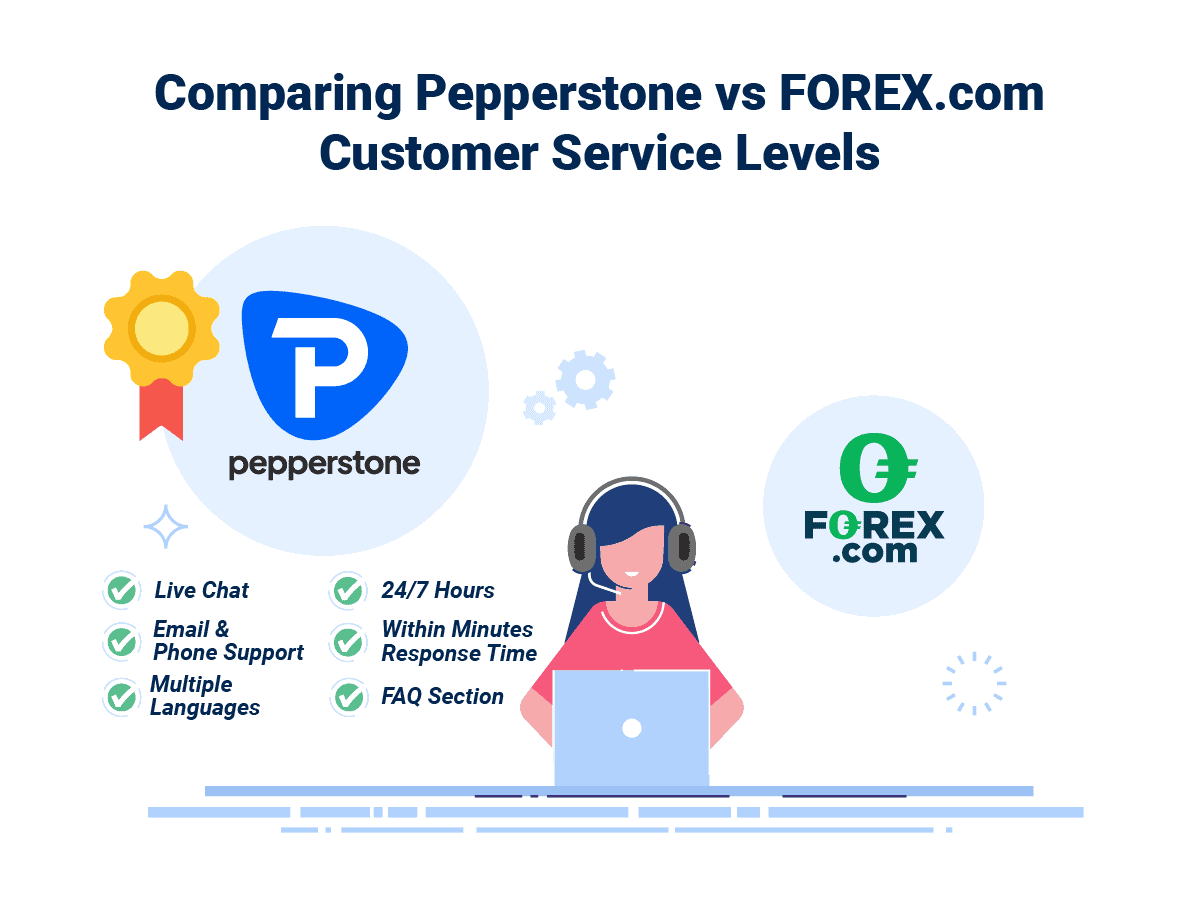

9. Superior Customer Service – Pepperstone

The cornerstone of trading excellence lies in the exceptional customer service offered by brokers. They ensure prompt support and expert guidance for traders, creating a smooth trading environment. With 24/7 live chat, phone, and email support, plus multilingual options, brokers help traders quickly resolve issues. This service enhances satisfaction and builds trust and loyalty.

Based on our experience in trading, customer service can make or break a broker’s reputation. Both Pepperstone and FOREX.com have made significant strides in ensuring their clients receive top-notch support.

Pepperstone stands out for its swift response times and expert support team, providing multiple communication channels that allow traders to connect in the most convenient manner. In contrast, while FOREX.com offers various support options, our testing has shown that their response times can occasionally fall short.

Here’s a comparative table highlighting the key customer service features of each broker:

| Feature | Pepperstone | FOREX.com |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

In the field of customer service, it’s not just about availability but also the quality of support provided. Both brokers have their strengths, but it’s the nuances in service quality, response times, and depth of knowledge that set them apart.

Our Superior Customer Service Verdict

Based on our team’s testing scores and the data gathered, Pepperstone secures first place on account of their superior customer services, standing out with its rapid response times and in-depth support.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

10. Better Funding Options – Pepperstone

One of the most important steps before trading is funding your account. And brokers with Better funding options in industry of forex trading are a great find. Brokers offer traders flexibility through various funding methods, including bank transfers, credit/debit cards, digital wallets (PayPal, Skrill, Neteller), and cryptocurrencies. Low or no fees enhance account management and the overall trading experience.

Our research reveals that Pepperstone does not impose a minimum deposit requirement; however, they advise traders to start with at least $200 to adequately fulfill margin requirements.

The funding methods available will depend on the country you are trading from and, except for international bank transfers, don’t have funding fees.

| Funding Option | Pepperstone | FOREX.com |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | No |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | No |

| Klarna | No | No |

Visa and MasterCard are available as credit and debit cards to all traders in all countries except the UAE. Here, retail traders can only use debit cards, while professional traders can also use credit cards.

It is also interesting to note that except for PayPal with Pepperstone UK and Kenya, eWallets are not available in the UK, Kenya, Europe and UAE. Traders in other countries, such as Australia, however, can make deposits with eWallets such as Skrill, Neteller, BPAY, POLi and Union Pay.

Our Better Funding Options Verdict

Our team has reached a verdict on this category, based on our team’s research and studies, that Pepperstone dominates this portion by having better funding options.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

11. Lower Minimum Deposit – Pepperstone

And lastly, a lower minimum deposit in forex trading means that brokers make the market more accessible to a wider range of traders. It allows beginners and those with limited capital to start trading with a smaller investment, lowering the entry barrier. This encourages participation and helps traders gain experience without significant upfront costs.

Pepperstone has a lower minimum deposit amount of $0, compared to FOREX.com’s $100 minimum. The broker Pepperstone offers a distinct advantage by requiring no minimum deposit to start trading, beneficial for novice traders.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £0 Minimum Deposit | $0 Minimum Deposit | €0 Minimum Deposit | $0 |

| Paypal | £0 Minimum Deposit | $0 Minimum Deposit | €0 Minimum Deposit | $0 |

| Bank Wire | £0 Minimum Deposit | $0 Minimum Deposit | €0 Minimum Deposit | $0 |

| Skrill | £0 Minimum Deposit | $0 Minimum Deposit | €0 Minimum Deposit | $0 |

On the other hand, FOREX.com has a tiered approach to their minimum deposit requirements, with just the initial amount shown below.

| Minimum Deposit | GBP | USD | EUR | AUD |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 | $100 | €100 | $100 |

| Bank Wire | £100 | $100 | €100 | $100 |

| Skrill | £100 | $100 | €100 | $100 |

| Neteller | £100 | $100 | €100 | $100 |

Here’s a comparative table highlighting the minimum deposit amounts of each broker:

| Minimum Deposit | Recommended Deposit | |

| Pepperstone | $0 | $200 |

| FOREX.com | $100 | $1,000 |

Our Lower Minimum Deposit Verdict

Pepperstone truly distinguishes itself in this category with an impressive minimum deposit requirement of just $0. However, to open a trading position, traders still need to have a minimum of $200 available.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

Is FOREX.com or Pepperstone The Best Broker?

Pepperstone undoubtedly stands out in this review because it consistently outperforms in the majority of the key areas that traders value most. The table below summarises the key information leading to this verdict.

| Categories | Pepperstone | FOREX.com |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | Yes | Yes |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | Yes | Yes |

| Top Product Range And CFD Markets | Yes | No |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | Yes | No |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | Yes | No |

Pepperstone: Best For Beginner Traders

Pepperstone is the ideal choice for beginner traders due to its user-friendly platform, comprehensive educational resources, and low entry barriers.

Pepperstone: Best For Experienced Traders

While both brokers cater well to experienced traders, Pepperstone offers a slight edge with its advanced trading tools and competitive spreads.

FAQs Comparing Pepperstone Vs FOREX.com

Does FOREX.com or Pepperstone Have Lower Costs?

Pepperstone generally offers lower costs compared to FOREX.com. Specifically, Pepperstone boasts tighter spreads, especially on major currency pairs. For instance, their average spread for the EUR/USD is often more competitive. To get a broader perspective on low commission brokers, you can check out this comprehensive guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both FOREX.com and Pepperstone offer MetaTrader 4, but Pepperstone is often recognised for its enhanced MT4 features and tools. They provide a seamless trading experience with faster execution speeds. For traders specifically interested in MT4 platforms, this detailed review of the best MT4 brokers can provide more insights.

Which Broker Offers Social Trading?

Pepperstone stands out when it comes to offering social or copy trading features. They have partnerships with various social trading platforms, allowing traders to copy strategies from experienced traders. If you’re keen on exploring more about social trading platforms, here’s a comprehensive list of the best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither Pepperstone nor FOREX.com offer spread betting as a primary service. Spread betting is a unique form of trading popular in the UK and some other regions, and not all brokers provide this service. If you’re specifically interested in spread betting, you might want to explore this comprehensive guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Pepperstone is the superior choice for Australian forex traders. Not only is Pepperstone ASIC regulated, but it’s also an Australian-founded broker, which gives it a home-ground advantage in understanding the needs of Aussie traders. They offer competitive spreads, a range of trading platforms, and exceptional customer service. If you’re an Australian trader looking for more options, here’s a detailed review of the Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I personally lean towards Pepperstone. While both brokers are FCA regulated, which is crucial for UK traders, Pepperstone’s commitment to providing a seamless trading experience sets it apart. Moreover, even though Pepperstone is founded overseas, their dedication to catering to UK traders is evident in their tailored services and offerings. For a broader perspective on UK forex trading, this guide on the Forex Brokers In UK can be quite insightful.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert