XM vs FXTM: Which One Is Best?

Commission-free trading is popular with beginner traders. Our XM vs FOREXTIME (FXTM) forex broker comparison found both brokers offer trading accounts with spread-only conditions. Let’s have a closer look.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers the 10 most crucial trading factors between XM and FXTM. Here are five standout differences:

- XM operates as a market maker, setting its own bid-ask prices, while FXTM is a no dealing desk (NDD) broker using straight-through-processing (STP).

- XM offers a guarantee of no requotes, ensuring 100% of trades are processed without order rejection.

- FXTM sources prices from multiple liquidity providers, offering traders ECN-like pricing conditions.

- XM’s Ultra Low Account, not available in Europe or the UK, provides tight no commission spreads, making its pricing similar to ECN spreads.

- FXTM’s ECN Zero Account, exclusive to the EU and UK, offers commission-free trading with spreads starting from 1.5 pips.

1. XM: Lowest Spreads And Fees

XM and FXTM are regulated CFD brokers that offer a range of trading instruments, platform options, and account types. With different business structures (market maker vs no dealing desk), there are key differences between the two brokers that traders should be aware of before they open an account and start trading.

XM is a market maker broker that sets its own bid-ask prices and uses internal liquidity to fill orders. Unusual for a market maker, XM offers the guarantee of no requotes, with 100% of trades being processed with no orders rejected.

FXTM is a no dealing desk (NDD) broker with orders processed using straight-through-processing (STP). No dealing desk brokers fill orders using external liquidity providers and therefore do not set their own bid-ask prices. Instead, prices are sourced from multiple liquidity sources, allowing traders to access institutional trading conditions with ECN-like pricing.

FXTM is a no dealing desk (NDD) broker with orders processed using straight-through-processing (STP). No dealing desk brokers fill orders using external liquidity providers and therefore do not set their own bid-ask prices. Instead, prices are sourced from multiple liquidity sources, allowing traders to access institutional trading conditions with ECN-like pricing.

Forex Spreads

Both brokers offer the choice of commission-free and commission account spreads. Commission-free spreads tend to be wider as compensation for the broker’s services is included in the spread, while no commission accounts provide access to ECN-like spreads with traders paying flat-rate commission fees. As explained in the section below, XM and FXTM offer a significant number of account types with different spreads depending on a trader’s location and the trading platform they use.

Commission-Free Spreads

For those wanting a simple pricing structure with no additional commission fee charges, XM and FXTM offer multiple commission-free account options. Although not available to traders based in Europe or the UK, XM’s Ultra Low Account type provides access to some of the tightest no commission spreads available to retail investor accounts. Averaging 0.80 pips for the EUR/USD fx pair, XM’s Ultra Low spreads are half of what is offered to XM Standard and FXTM’s Standard and ECN Zero account holders, making the pricing similar to ECN spreads when commission charges are included.

As well as the EUR/USD, XM’s Ultra-Low Account offers the best spreads across all major currency pairs shown below (AUD/USD, USD/JPY and EUR/GBP) with better pricing than some of the world’s best brokers such as Pepperstone and IC Markets. The account types are shown in the following order:

- XM Ultra Low (Outside of EU/UK only)

- XM Standard Account

- FXTM Standard, MetaTrader 4 (MT4)

- FXTM Standard, MetaTrader 5 (MT5)

- FXTM ECN Zero (MT4 and MT5)

- Pepperstone Standard Account

- IC Markets Standard Account

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

0.60 0.90 0.90 0.10 0.11

1.10 1.40 2.00 2.30 2.30

2.10 2.10 2.70 2.50 2.80

2.10 2.10 2.10 2.50 2.80

1.90 2.00 2.40 2.30 2.50

0.10 0.50 0.60 0.40 0.60

1.10 1.10 1.30 2.30 1.40

1.00 1.00 1.27 1.30 1.20

ECN-Style Spreads

When XM and FXTM’s commission account types are compared, XM’s Zero Account (UK and Europe only) provides more competitive spreads for the EUR/USD and GBP/USD currency pairs, with FXTM’s MT4 ECN account providing tighter spreads for the USD/JPY. For instance, traders using an XM Zero Account are offered average spreads of 0.10 pips for the EUR/USD, and FXTM ECN accounts using either MT4 or MT5 are offered 0.40 pips.

As spreads are much narrower than standard account spreads, traders pay round-turn commission fees of $7 when trading with XM and from $4 when trading with FXTM. While XM and FXTM provide reasonable ECN-style spreads, brokers such as Pepperstone and IC Markets offer better pricing with tighter spreads and low commission fees across all major currency pairs.

The spread table below shows XM’s Zero Account, FXTM’s MT4 ECN account, and FXTM’s MT5 ECN account compared to other top brokers.

Commission Account Spreads | |||||

|---|---|---|---|---|---|

| 0.30 | 0.80 | 0.80 | 1.20 | 1.30 |

| 0.10 | 0.50 | 0.60 | 0.40 | 0.60 |

| 0.10 | 0.50 | 0.60 | 0.40 | 0.60 |

| 0.01 | 0.02 | 0.27 | 0.30 | 0.04 |

| 0.10 | 0.10 | 0.30 | 1.30 | 0.30 |

| 0.20 | 0.40 | 0.50 | 0.70 | 0.70 |

| 0.50 | 0.70 | 0.60 | 0.80 | 0.80 |

| 0.10 | 0.20 | 0.30 | 0.20 | 0.20 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Compare Lowest Spread Forex Brokers

Other Trading Costs

As well as spreads and commission fees, XM and FXTM traders will incur swap fees for positions held open for longer than one day. Also known as overnight financing fees, swap rates are derived from interest rates for each currency pair involved in the trade.

If you trade infrequently, another trading cost to consider is inactivity fees. If you do not make a trade for a specific length of time, XM and FXTM will charge your trading account a $5 inactivity fee.

- FXTM $5 per month after 6 months of inactivity

- XM $5 per month if you have not traded for 3 months

Our Lowest Spreads and Fees Verdict

With tight no commission spreads as well as competitive ECN-style spreads, XM traders gain access to better pricing and trading conditions than ForexTime. Although a market maker, XM’s Ultra-Low Account type (not available to EU/UK traders) provides spreads similar to ECN pricing when commission costs are accounted for, while the broker’s Zero Account (UK/EU only) offers ECN-style spreads. Additionally, XM promotes a no requote guarantee, meaning traders are certain their orders will never be rejected.

*Your capital is at risk ‘75.18% of retail CFD accounts lose money’

2. Tie: Better Trading Platform

| Trading Platform | XM | FXTM |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | No | No |

| TradingView | No | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | No |

XM and FXTM both offer the choice of either MetaTrader 4 (MT4) or MetaTrader 5 (MT5). The trading platforms are two of the most popular worldwide due to their algorithmic trading capabilities using Expert Advisors.

MT4 and MT5 are compatible with a range of devices, with desktop and webtrader platforms available, as well as mobile trading apps for Android and iOS devices.

MetaTrader 4

Designed to facilitate forex trading for retail investor accounts, MT4 offers a range of trading tools to help users conduct analysis and develop strategies. Although the gold standard of forex trading platforms, market access is limited when compared to MT5, as share trading is not permitted.

Key features include:

- Charting tools for technical analysis: 30 technical indicators, 31 objects, and 9 timeframes.

- Automated trading with Expert Advisors (EAs). Traders can write their own EAs using MetaQuotes Language 4 (MQL4) or download EAs from the MetaTrader Marketplace.

- Expert Advisors can be tested and optimised against historical data using the platform’s backtesting tools. You can only backtest one currency pair at a time on MT4.

- While traders can execute hedging strategies, netting is not permitted on MT4.

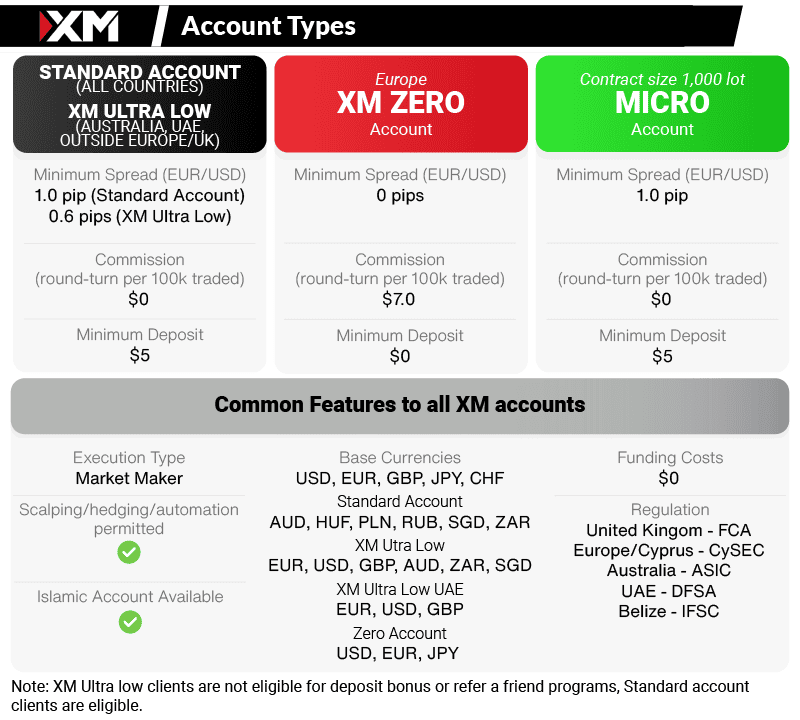

MetaTrader 5

While MT5 provides a similar trading environment to MT4, there are certain benefits over its predecessor, such as wider market access, improvements to EAs and more trading tools:

- A larger collection of technical analysis tools: 38 technical indicators, 44 objects, and 21 timeframes.

- Expert advisors are developed using the more efficient MetaQuotes Language 5. MQL5 is similar to the object-oriented C++ programming language and considered easier to use.

- Enhanced backtesting allows for multi-currency backtesting of Expert Advisors.

- Depth of market pricing, ideal for day traders and scalpers.

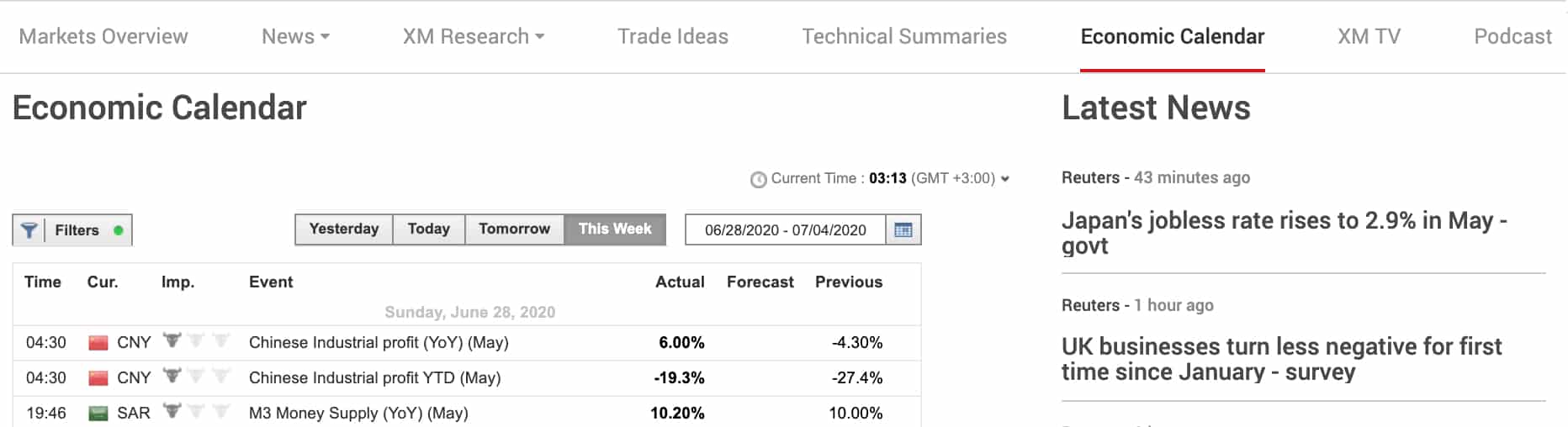

- The addition of an inbuilt economic calendar.

- Share CFD trading, as well as hedging and netting, are permitted.

Our Better Trading Platform Verdict

As both XM and ForexTime offer MetaTrader 4 (MT4) and MetaTrader 5 (MT5), the brokers tie this round. Regardless of whether you choose XM or FXTM, you are able to automate trading using Expert Advisors and conduct advanced research on the platforms. Most traders prefer MT5 as it offers greater market access along with several improvements over MT4, such as improved backtesting and more charting tools.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

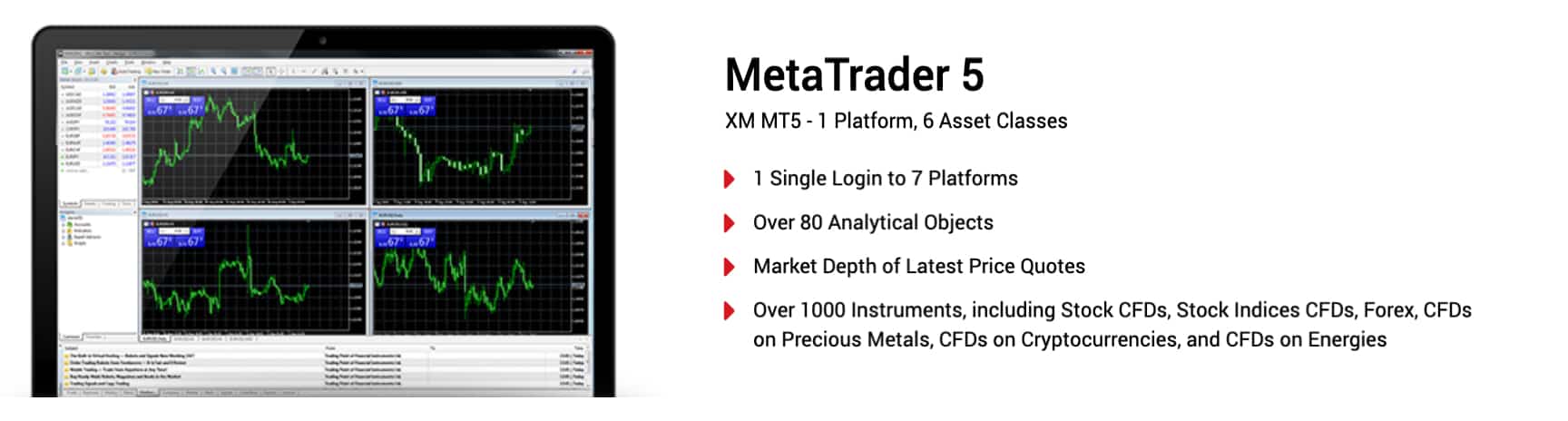

3. XM: Superior Accounts And Features

Both brokers offer a choice of commission or commission-free account types, although availability is dependent on your location and the broker’s local regulator.

No Commission Trading Account Types

Commission-free account types are ideal for beginner traders wanting a simple pricing structure along with those who trade infrequently. Although spreads are wider than ECN Accounts, traders only pay the spread with no additional commission costs incurred. Both XM and FXTM offer multiple no commission account types with different lot sizes and minimum deposits.

XM Accounts

XM Micro Account

XM’s Micro Account requires a low minimum deposit and allows traders to make more precise trades with smaller contract sizes. Traders pay no commission fees, with minimum spreads of 1.0 pip on major forex pairs.

- Contract Size: 1 lot = 1,000

- Min Trade Volume: 0.01 lots (MT4), 0.1 lots (MT5)

- Max Trade Volume: 100 lots

- Minimum Deposit: $5

- Trading Platform: MT4 or MT5

XM Standard Account

XM’s standard account provides minimum spreads of 1.0 pip. Although spreads are wider, traders do not pay any commission fees, with the simple fee structure suiting beginner traders or those who do not trade forex regularly.

- Contract Size: 1 lot = 100,000

- Min Trade Volume: 0.01 lots

- Max Trade Volume: 50 lots

- Minimum Deposit: $5

- Trading Platform: MT4 or MT5

XM Ultra-Low Account (Not available To EU/UK Traders)

For those residing outside of Europe and the United Kingdom, XM’s Ultra-Low Account is a commission-free option with tighter spreads than the broker’s Standard or Micro Accounts. Contract sizes are flexible, with both standard and micro lot sizes available.

- Contract Size: Standard Ultra 1 lot = 100,000, Micro Ultra 1 lot = 1,000

- Min Trade Volume: Standard Ultra 0.01 lots, Micro Ultra 0.1 lots

- Max Trade Volume: Standard Ultra 50 lots, Micro Ultra 100 lots

- Minimum Deposit: $50

- Trading Platform: MT4 or MT5

Minimum spreads are as low as 0.6 pips and with no additional commission costs on top of the spread, overall trading costs are similar to an ECN trading account.

- XM Ultra-Low Account: EUR/USD = 0.8 pips = $8 in total

- XM Zero Account: EUR/USD = 0.1 pips + $7 commission = $8 in total

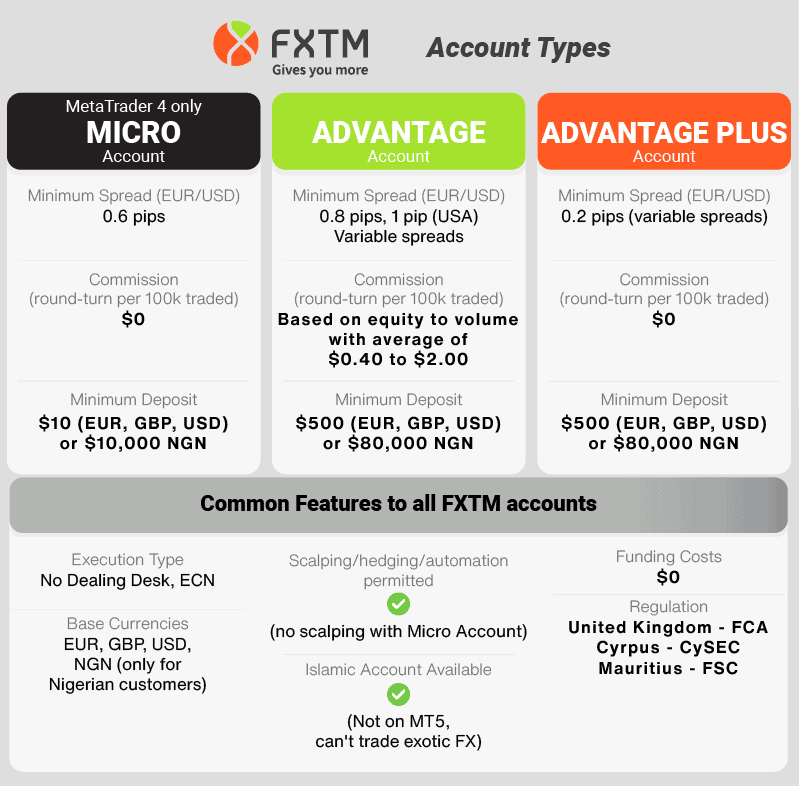

FXTM Accounts

FXTM Cent Account

The broker’s Cent Account is a great option for those wanting to trade smaller volumes due to lower account balances or inexperience. With minimum spreads of 1.5 pips, pricing is less competitive than ECN-style accounts, yet traders pay no additional commission fees on top of the spread.

When placing orders, Cent Account holders have increased control over their trade sizes and can choose between micro-lots (0.01), mini-lots (0.1) or standard lots (1).

- Contract Size: 1 lot = 1,000

- Min Trade Volume: 0.01 lots

- Max Trade Volume: 100-cent lots

- Minimum Deposit: £/€/$10

- Trading Platform: MT4 only

FXTM Standard Account

FXTM’s Standard Account offers commission-free spreads as low as 1.3 pips. When signed up to the broker’s standard account, customers are required to use the MT4 trading platform.

- Contract Size: 1 lot = 100,000

- Min Trade Volume: 0.01 lots

- Max Trade Volume: 30 lots

- Minimum Deposit: £/€/$100

- Trading Platform: MT4 only

FXTM ECN Zero Account (EU And UK Only)

The broker’s ECN Zero Account is similar to its pure ECN Account, except traders pay no commission fees on top of the spread. Due to this, minimum spreads are higher, starting from 1.5 pips. As with FXTM’s Cent Account, the ECN Zero Account smaller offers contract sizes for more precise trading.

- Contract Size: 1 lot = 1,000

- Min Trade Volume: 0.01 lots

- Max Trade Volume: 100-cent lots

- Minimum Deposit: $200

- Trading platforms: MT4 or MT5

ECN-Style Trading Account Types

Those wanting an ECN-style trading environment may prefer XM’s Zero Account or FXTM’s ECN Account. The commission accounts offer access to ultra-tight spreads, with traders paying a flat-rate commission fee as compensation to the broker. With low spreads and commission fees, the ECN-like accounts are excellent choices for those using Expert Advisors or executing day trading and scalping strategies.

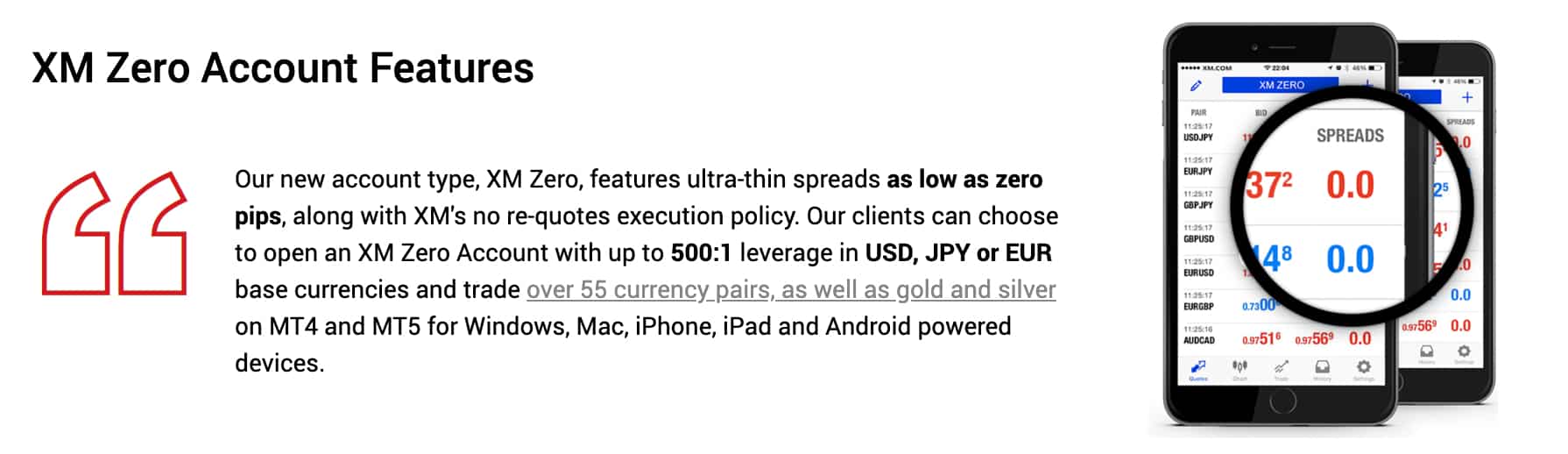

XM’s Zero Account (UK And Europe Only)

XM’s Zero Account is similar to an ECN account with minimum spreads of 0.0 pips, and as with all account types, XM guarantees no requotes on all orders. As traders gain access to ECN-style spreads, commission fees are $3.5 per side per $100,000 traded.

- Contract Size: 1 lot = 100,000

- Min Trade Volume: 0.01 lots

- Minimum Deposit: $100

- Trading Platform: MT4 or MT5

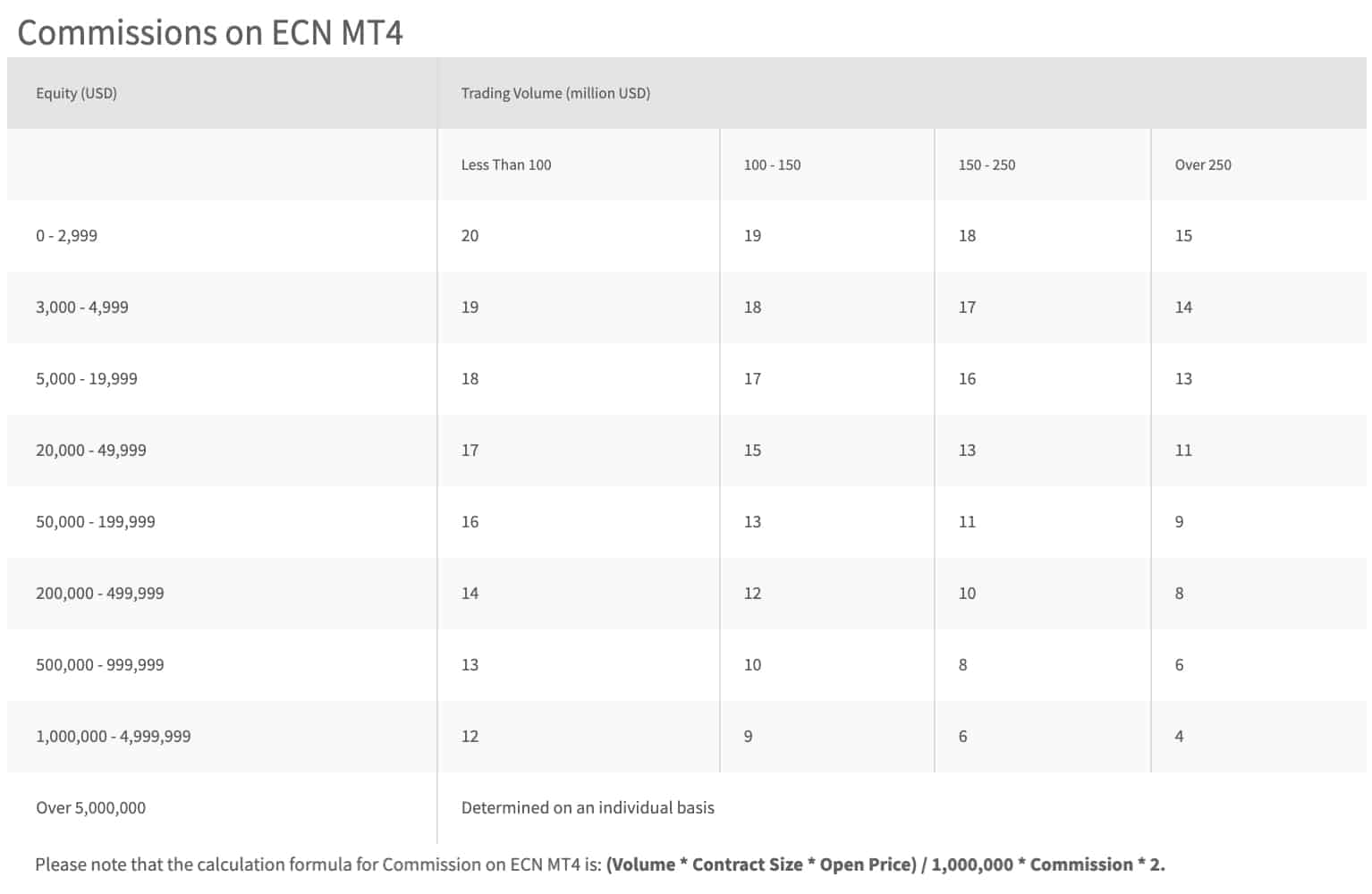

FXTM ECN Account

FXTM’s ECN Account allows customers to trade tight spreads similar to institutional-grade pricing. Although the account type is available when using MT4 or MT5, different commission fees apply for each platform. While MT5 users pay a flat rate commission fee of $4 round-turn, those using MT4 pay commission fees based on their equity levels and trading volume, as shown below.

- Contract Size: 100,000

- Min Trade Volume: 0.01 lots

- Max Trade Volume: 100

- Minimum Deposit: $500

- Trading Platform: MT4 or MT5

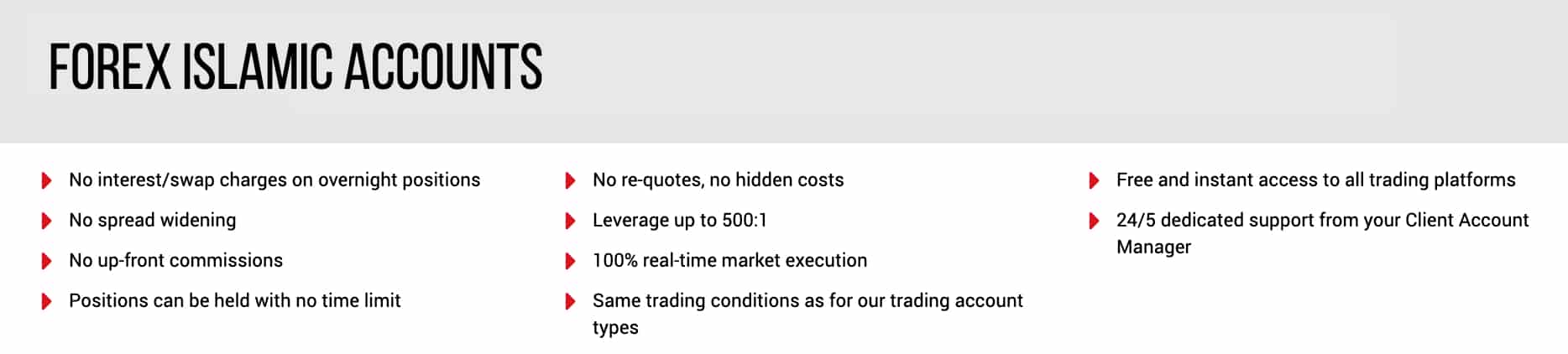

Swap-Free/Islamic Accounts

Both XM and FXTM offer Swap-Free Accounts for traders following Islamic finance practices. As Islamic traders can not pay or receive interest, swap-free accounts do not charge interest-based overnight financing fees (aka swap fees).

XM provides Islamic Account options for Micro, Standard and Ultra-Low account types. While some of the best brokers widen Islamic Account spreads to compensate for the loss in swap fees, XM promotes no widened spreads or hidden fees.

FXTM offers swap-free options for Standard, Cent, ECN and ECN Zero Accounts. When trading with FXTM, swap-free account holders are required to use MT4, with no access granted to MT5. Additionally, you are only able to trade major and minor currency pairs, with no exotic fx pairs available to swap-free accounts.

FXTM offers swap-free options for Standard, Cent, ECN and ECN Zero Accounts. When trading with FXTM, swap-free account holders are required to use MT4, with no access granted to MT5. Additionally, you are only able to trade major and minor currency pairs, with no exotic fx pairs available to swap-free accounts.

XM Leverage

Leverage for traders in Australia and Europe is in line with the requirements of the regulator ASIC, FCA and CySEC.

This means leverage will range from 2:1 to 30:1, depending on the derivative you are trading.

Traders outside these regions can use a leverage ratio of up to 1:888 as the IFSC have more relaxed leverage requirements.

Fixed Tiered Leverage: FXTM

FXTM offers a tiered system that is also dependent on an order’s value, yet the leverage offered is fixed.

As with XM, FXTM traders based in the UK and Europe are only offered leverage of 30:1 as required by the FCA and CySEC.

FXTM clients residing elsewhere are offered much higher leverage than most brokers offer, with a maximum of 2000:1 on major currency pairs. As shown below, the value of your order determines your leverage. For instance, if the value of your trade equates to more than $2M, you are confined to a leverage limit of 200:1.

As leverage enhances gains and magnifies losses, clients should be aware of the high risk of trading with such significant leverage.

| XM | FXTM | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | No | No |

| Spread Betting (UK) | No | No |

Our Superior Accounts and Features Verdict

With low minimum deposits, tight spreads, plus flexible commission and contract sizes, XM offers the best range of account types with both commission-free and ECN-style pricing available. Although XM’s Zero account is only available to traders based in Europe or the UK, traders outside of this area can still access ECN-like spreads via the broker’s Ultra-Low account.

*Your capital is at risk ‘75.18% of retail CFD accounts lose money’

4. FXTM: Best Trading Experience And Ease

When we dove into the trading experience and ease of use for both XM and FXTM, we couldn’t help but notice some distinct differences. From the get-go, it’s evident that both brokers have invested significantly in ensuring their platforms are user-friendly, but there are nuances that set them apart.

- XM boasts a seamless trading experience with its advanced trading tools and user-friendly interface.

- FXTM, on the other hand, has a more intuitive platform layout, making it easier for beginners to navigate.

- Our team particularly appreciated the customisability options offered by XM, allowing traders to tailor their workspace.

- FXTM’s educational resources stood out, providing traders with valuable insights to enhance their trading strategies.

Drawing from our own testing and the data we’ve gathered, it’s clear that both brokers have their strengths. However, when it comes to the overall trading experience, there’s a slight edge that one broker has over the other.

Our Best Trading Experience and Ease Verdict

In terms of the best trading experience and ease, FXTM takes the lead with its intuitive platform and comprehensive educational resources.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

5. Tie: Stronger Trust And Regulation

Stronger trust and regulation are essential for brokers, as they guarantee a secure and transparent trading environment.

XM Trust Score

FXTM Trust Score

1. Regulations

XM and FXTM are both overseen by multiple top-tier financial authorities. As regulation varies between jurisdictions, the investor protection you receive depends on the subsidiary you are signed up to.

XM Regulation

When trading forex with XM, customers can sign up to one of five different subsidiaries that are regulated by different financial authorities:

- FCA: Financial Conduct Authority (United Kingdom)

- ASIC: Australian Securities and Investments Commission (Australia)

- CySEC: Cyprus Securities and Exchange Commission (Europe)

- DFSA: Dubai Financial Services Authority (Dubai and Golf States)

- IFSC: International Financial Services Commission (Belize, Global)

FXTM Regulation

ForexTime operates four different subsidiaries around the world:

- FCA (UK)

- CySEC (Europe)

- FSCA: Financial Sector Conduct Authority (South Africa)

- FSC: Financial Services Commission of the Republic of Mauritius (International)

Investor Protection Schemes

Following FCA and CySEC regulations, traders receive investor protection up to £85,000 and €20,000, respectively. The investor protection insurance schemes ensure that in the case that XM or FXTM become insolvent, traders can receive a certain amount of compensation to cover losses. If you are trading with FXTM or XM outside of Europe and the UK, you will not receive protection via investor compensation schemes.

| XM | FXTM | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) CYSEC (Cyprus) | CYSEC (Cyprus) FCA (UK) |

| Tier 2 Regulation | DFSA (Dubai) | FSCA (South Africa) |

| Tier 3 Regulation | FSC-BZ | FSC-M (Mauritius) CMA (Kenya) |

2. Reputation

XM gets searched on Google more than FXTM. On average, XM sees around 823,000 branded searches each month, while FXTM gets about 27,100 — that’s 96% fewer.

| Country | XM | FXTM |

|---|---|---|

| Colombia | 74,000 | 1,600 |

| Jordan | 74,000 | 210 |

| Argentina | 60,500 | 2,900 |

| Turkey | 60,500 | 390 |

| Philippines | 33,100 | 390 |

| Germany | 27,100 | 880 |

| United States | 27,100 | 1,300 |

| Morocco | 18,100 | 2,900 |

| Australia | 18,100 | 170 |

| Indonesia | 18,100 | 170 |

| Bolivia | 18,100 | 390 |

| Peru | 14,800 | 210 |

| Vietnam | 14,800 | 170 |

| Malaysia | 14,800 | 260 |

| Thailand | 12,100 | 320 |

| Singapore | 12,100 | 590 |

| Saudi Arabia | 12,100 | 140 |

| Ireland | 12,100 | 30 |

| Algeria | 9,900 | 390 |

| India | 8,100 | 720 |

| Poland | 8,100 | 170 |

| United Arab Emirates | 6,600 | 390 |

| Uruguay | 6,600 | 210 |

| Italy | 6,600 | 260 |

| Cambodia | 6,600 | 110 |

| Nigeria | 5,400 | 2,900 |

| Uzbekistan | 5,400 | 210 |

| Switzerland | 5,400 | 320 |

| Mexico | 5,400 | 90 |

| Tanzania | 5,400 | 90 |

| Bangladesh | 4,400 | 210 |

| Hong Kong | 4,400 | 140 |

| Taiwan | 4,400 | 210 |

| South Africa | 4,400 | 590 |

| Brazil | 3,600 | 320 |

| Pakistan | 3,600 | 880 |

| Ethiopia | 3,600 | 110 |

| Ecuador | 3,600 | 70 |

| New Zealand | 3,600 | 90 |

| Cyprus | 2,900 | 40 |

| Sri Lanka | 2,900 | 170 |

| Austria | 2,900 | 50 |

| Sweden | 2,400 | 40 |

| Spain | 2,400 | 110 |

| Venezuela | 2,400 | 70 |

| Portugal | 2,400 | 110 |

| France | 2,400 | 10 |

| United Kingdom | 1,900 | 320 |

| Canada | 1,900 | 50 |

| Botswana | 1,900 | 140 |

| Ghana | 1,900 | 30 |

| Egypt | 1,600 | 20 |

| Costa Rica | 1,600 | 30 |

| Netherlands | 1,300 | 50 |

| Chile | 1,000 | 110 |

| Japan | 1,000 | 110 |

| Dominican Republic | 880 | 20 |

| Uganda | 720 | 10 |

| Greece | 590 | 30 |

| Kenya | 590 | 90 |

| Panama | 590 | 10 |

| Mongolia | 480 | 30 |

| Mauritius | 260 | 40 |

74,000 1st | |

590 2nd | |

74,000 3rd | |

1,600 4th | |

60,500 5th | |

5,400 6th | |

27,100 7th | |

1,300 8th |

Similarweb shows a similar story when it comes to August 2025 website visits with XM receiving 8,619,000 visits vs. 227,197 for FXTM.

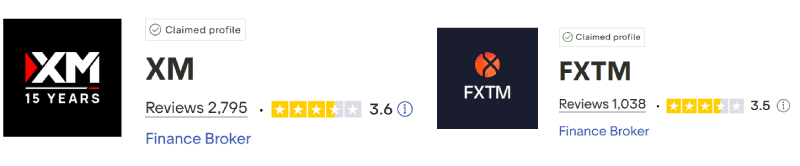

3. Reviews

As shown below, XM and FXTM have fairly different reputations on Trustpilot, reflecting varied user experiences. XM holds a rating of 3.6 out of 5 based on over 2,500 reviews. FXTM has a slightly lower rating of 3.5 out of 5 from around 1,100 reviews. XM is viewed as slightly more reliable overall, especially for beginners seeking educational support. FXTM offers solid trading tools but faces more criticism around transparency and fund access.

Our Stronger Trust and Regulation Verdict

As both XM and FXTM are overseen by multiple top-tier financial authorities, they are viewed by the forex trading community as well-respected and trusted online brokers. The level of investor protection you receive when trading with XM or FXTM depends on your country of residence and the subsidiary you are signed up to, with European and UK traders receiving the strongest protection worldwide.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

6. Tie: Top Product Range And CFD Markets

XM and FXTM are CFD brokers that provide market access to a range of asset classes in addition to forex. Both brokers offer a diverse range of trading instruments, with Share CFD trading available on MetaTrader 5 only.

XM CFD Product Range

As well as trading forex with XM, customers can develop trading strategies that include equity indices, commodities and share CFDs.

- Forex: Over 41 forex pairs, including major, minor, exotic and cross fx pairs

- Indices: Major Cash and Future indices such as US500,

- Soft commodities: Future CFDs derived from commodities such as cotton, coffee and cocoa.

- Metals: Gold and silver, precious metals, as well as palladium and platinum

- Energies: Natural gases and oil CFDs

- Shares: Over 1,281 stock CFDs from 18 countries, including the US, UK and Australia

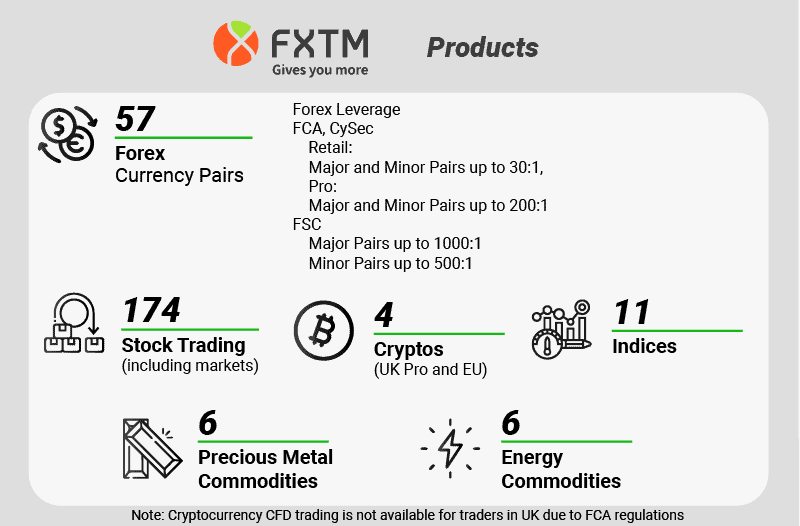

ForexTime CFDs

As an FXTM customer, you can trade CFDs on commodities, equity indices, precious metals, stocks, and cryptocurrencies.

- Forex: 57 currency pairs

- Indices: Global indices, including the AUS200 and UK100

- Shares: Over 150 stock CFDs

- Commodities: Natural gas as well as Brent and crude oil

- Metals: Gold and silver spot metal CFDs

- Cryptocurrencies: Bitcoin, Litecoin, Ripple and Ethereum (not available in the United Kingdom)

While FXTM offers cryptocurrencies, traders based in the UK and trading with the broker’s FCA-regulated subsidiary will not be able to access cryptos. The FCA recently banned UK retail traders from accessing cryptocurrency markets.

Our Top Product Range and CFD Markets Verdict

Overall, XM and FXTM tied this round. Both brokers offer a great range of CFDs, each having a key strength and weakness in regards to market access. XM customers are provided with access to over 1,000+ Share CFDs, yet fail to offer any Crypto products. On the other hand, FXTM provides access to five major Cryptocurrency markets but fewer Shares and Forex pairs than XM.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

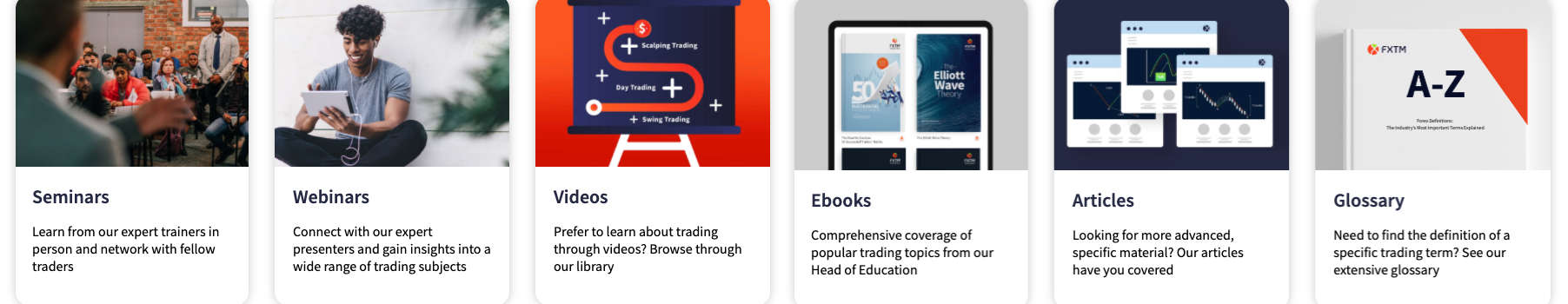

7. XM: Superior Educational Resources

When it comes to educational resources in the world of forex trading, both XM and FXTM have made significant strides to empower their traders. Our team delved deep into the offerings of both brokers and here’s what we found:

- Webinars: Both XM and FXTM offer webinars, but XM’s sessions are more frequent and cover a broader range of topics.

- Seminars: While both brokers conduct seminars, FXTM’s are more geographically diverse, reaching traders in various regions.

- E-books: XM and FXTM provide e-books, but XM’s collection is more extensive and covers advanced topics.

- Video Tutorials: Both brokers have video tutorials, but XM’s are more in-depth and cater to both beginners and advanced traders.

- Educational Articles: FXTM takes the lead here with a richer collection of articles that delve deep into trading strategies.

- Platform Tutorials: XM offers detailed platform tutorials, ensuring traders can navigate their platform with ease, while FXTM’s are more basic.

From our analysis, it’s evident that both brokers are committed to educating their traders. However, one broker slightly edges out the other in terms of depth and breadth of resources.

Our Superior Educational Resources Verdict

Based on our team’s scores and comprehensive testing, XM offers superior educational resources, making it the go-to broker for traders keen on continuous learning.

*Your capital is at risk ‘75.18% of retail CFD accounts lose money’

8. XM: Superior Customer Service

XM Customer Support

XM customers can get in touch with the online broker via live chat, phone or email. Customer support representatives are available 24 hours a day, 5 days.

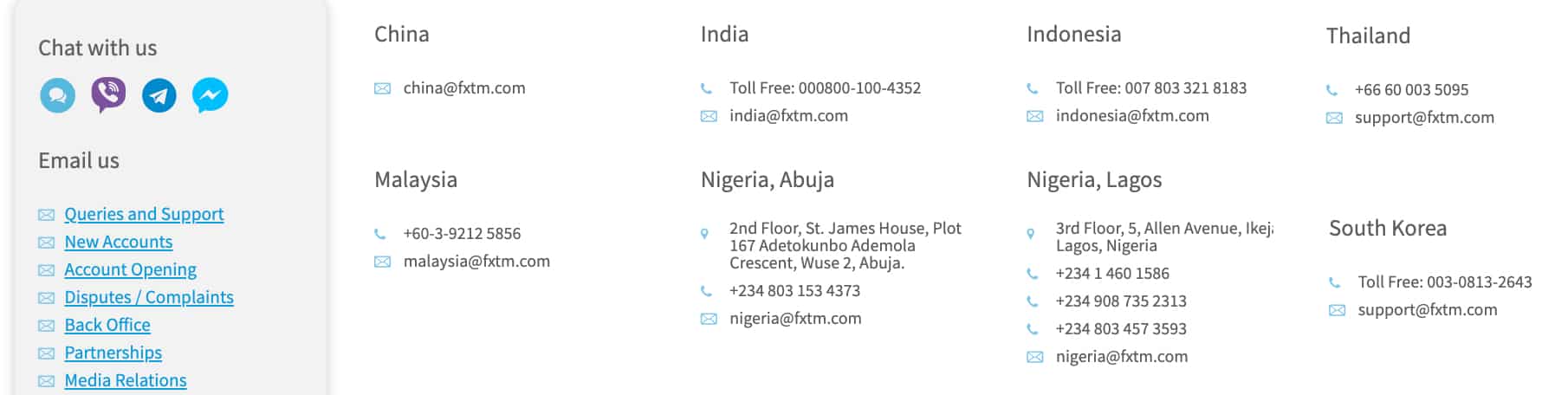

FXTM Customer Support

FXTM provides prompt service, yet customer support teams are only available 12 hours a day, 5 days a week. The broker can be contacted via live chat, phone, email and social media platforms such as Facebook and Twitter.

XM Education And Research

With a free forex education course, live webinars and a range of videos available online, XM offer excellent educational resources for beginners to advanced traders.

- A six-part course explaining the basics of forex trading.

- Video series that cover topics such as technical and fundamental analysis, trading psychology and money management.

- Webinars, Q&As and live debates hosted in 16+ languages.

XM offers a vast collection of fundamental research tools, providing a research centre with market analysis that includes:

- News

- Trade ideas

- Technical summaries

- Research

- Economic calendar

- XM TV and podcasts

FXTM Education And Research

FXTM offers educational materials suitable for all levels of experience, including e-books, webinars, tutorials and a glossary. As well as the wide range of resources available at www.forextime.com, the broker hosts live seminars in countries where FXTM has offices.

When researching financial markets, traders can use FXTM’s market outlooks, forex news, and an economic calendar to find trading opportunities.

Our Superior Customer Service Verdict

XM offers the best customer support with 24/5 customer service, excellent educational resources, and research tools. Beginner to advanced XM customers can increase their knowledge of financial markets via webinars, Q&As and courses, as well as using a range of tools to conduct market analysis.

*Your capital is at risk ‘75.18% of retail CFD accounts lose money’

9. XM: Better Funding Options

XM Payment Methods

When trading forex with XM, customers can withdraw and deposit funds using:

- Debit and credit cards: UnionPay, Mastercard and Visa

- e-Wallet: Bitcoin, Neteller, Sofort, CashU and Przelewy 24

- Bank transfer and wire transfer

Although a wide range of funding methods are offered by XM, availability varies depending on your location. The majority of payment options are fee-free, yet if you transfer less than $200 by bank transfer, you will incur a $20 fee.

When making withdrawals, XM will transfer the funds via the same methods they were deposited. For instance, if you use Bitcoin to make deposits, you are only able to withdraw funds via Bitcoin.

Depending on your XM account type, you will be able to choose one of the following base currencies when setting up your trading account:

| XM Account Type & Base Currencies | XM Micro Account | XM Standard Account | XM Ultra-Low Account | XM Zero Account |

|---|---|---|---|---|

| USD | ✅ | ✅ | ✅ | ✅ |

| EUR | ✅ | ✅ | ✅ | ✅ |

| JPY | ✅ | ✅ | ❌ | ✅ |

| GBP | ✅ | ✅ | ✅ | ❌ |

| CHF | ✅ | ✅ | ✅ | ❌ |

| AUD | ✅ | ✅ | ✅ | ❌ |

| RUB | ✅ | ✅ | ❌ | ❌ |

| PLN | ✅ | ✅ | ✅ | ❌ |

| HUF | ✅ | ✅ | ✅ | ❌ |

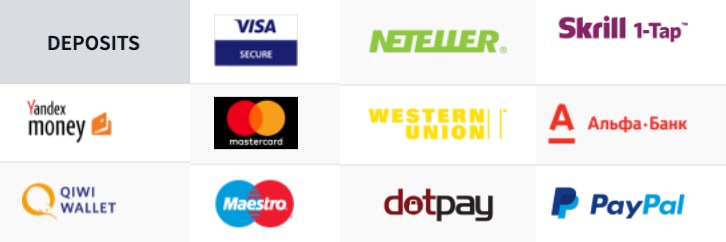

FXTM Deposit And Withdrawal Methods

To deposit and withdraw funds from your FXTM trading account, use a credit card, e-wallet or bank transfer payment method.

- Credit card: Visa, Maestro, and Mastercard

- e-wallet: Skrill/Moneybookers, Paypal, Neteller, Alfa-Click, Western Union Quick Pay, QIWI, Yandex.Money and Dotpay

- Bankwire: Deutsche Handelsbank

FXTM’s funding methods are fee-free, although third-party fees may apply. For Skrill and Neteller e-wallet options, VIP programs are available where the e-wallet providers charge reduced transaction costs.

To start trading, FXTM requires traders to choose a trading account-based currency. When based in the UK or Europe, customers can select either the EUR, USD or GBP, with Cent accounts using the US Cent, EU Cent or GBP Pence. For those residing outside of Europe and the UK, the additional option of NGN (or NGN Kobo) is offered as a base currency.

Our Better Funding Options Verdict

Both brokers offer a range of traditional and e-wallet payment options that are mostly fee-free. With a substantially larger selection of base currencies to choose from, XM offers the most convenient funding methods overall.

*Your capital is at risk ‘75.18% of retail CFD accounts lose money’

10. XM: Lower Minimum Deposit

XM has a minimum deposit requirement of $5, which is lower than FTXM’s $10 requirement. Both brokers’ amounts apply globally, and where they differ is in the payment methods available.

XM

| Minimum Deposit | GBP | USD | EUR | AUD |

|---|---|---|---|---|

| Credit Card / Debit Card | £5 | $5 | €5 | $5 |

| Bank Wire | £5 | $5 | €5 | $5 |

| Electronic Wallets | £5 | $5 | €5 | $5 |

FXTM

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £10 Minimum Deposit | $10 Minimum Deposit | €10 Minimum Deposit | $10 |

| Paypal | £10 Minimum Deposit | $10 Minimum Deposit | €10 Minimum Deposit | $10 |

| Bank Wire | £10 Minimum Deposit | $10 Minimum Deposit | €10 Minimum Deposit | $10 |

| Skrill | £10 Minimum Deposit | $10 Minimum Deposit | €10 Minimum Deposit | $10 |

Our Lower Minimum Deposit Verdict

XM offers a significantly lower minimum deposit across its account types (Standard, Micro, and Ultra Low all at $5), making it a more accessible choice for traders on a budget.

*Your capital is at risk ‘75.18% of retail CFD accounts lose money’

So Is FXTM or XM The Best Broker?

XM is the winner because of its intuitive platform, comprehensive educational resources, and overall better trading experience. The table below summarizes the key information leading to this verdict:

| Criteria | XM | FXTM |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platforms | ✅ | ✅ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience | ❌ | ✅ |

| Stronger Trust And Regulation | ✅ | ✅ |

| Most Popular Broker | ✅ | ❌ |

| CFD Product Range And Financial Markets | ✅ | ✅ |

| Superior Educational Resources | ✅ | ❌ |

| Better Customer Service | ✅ | ❌ |

| More Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ✅ | ❌ |

FXTM: Best For Beginner Traders

FXTM is better for beginner traders due to its intuitive platform and comprehensive educational resources.

XM: Best For Experienced Traders

XM is better for experienced traders because of its competitive spreads and diverse range of account types.

FAQs Comparing XM Vs FXTM

Does FXTM or XM Have Lower Costs?

FXTM generally offers lower costs when compared to XM. Both brokers have competitive spreads, but FXTM edges out with slightly tighter spreads on major pairs. For instance, the EUR/USD spread with FXTM can go as low as 0.1 pips. For a more detailed comparison on low commissions, you can check out this comprehensive guide on the lowest spread brokers.

Which Broker Is Better For MetaTrader 4?

Both FXTM and XM are excellent choices for MetaTrader 4, but XM provides a slightly enhanced experience with custom add-ons. MetaTrader 4 is a popular platform known for its user-friendly interface and advanced charting tools. If you’re keen on exploring more about the best MT4 brokers, this detailed review of top MT4 brokers might be of interest.

Which Broker Offers Social Trading?

XM offers social trading features, allowing traders to copy the strategies of experienced traders. Social trading is a great way for beginners to learn and benefit from the expertise of seasoned professionals. For those interested in diving deeper into social trading platforms, here’s a comprehensive guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither XM nor FXTM offer spread betting as a primary service. Spread betting is a unique form of trading popular in the UK, allowing traders to bet on the direction of market movements without owning the underlying asset. For those interested in brokers that do offer this service, here’s a comprehensive guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, XM is the superior choice for Australian forex traders. XM is ASIC regulated, ensuring a high level of trust and security for Australian traders. While both brokers cater to the Australian market, XM has a more established presence and offers a broader range of services tailored to the needs of Aussies. Moreover, XM, unlike FXTM, was founded overseas but has made significant inroads in the Australian market. For a deeper dive into the best brokers for Australians, you can check out this detailed review of the best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

From my perspective, FXTM stands out as the better choice for UK forex traders. FXTM is FCA regulated, ensuring that UK traders receive the highest standards of protection and security. While both brokers serve the UK market, FXTM offers a more tailored experience for UK traders, with a focus on local needs and preferences. It’s worth noting that neither broker was founded in the UK, but both have established strong footholds in the region. For more insights on the best brokers for UK traders, here’s a comprehensive guide on the Forex Brokers In UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Which XM account is best for scalping?

They are fine but there are better brokers.