Pepperstone vs Blueberry Markets: Which One Is Best?

In our in-depth review comparing Pepperstone and Blueberry Markets, our team discovered that both brokers provide a variety of trading pairs and an extensive range of CFDs. Each broker has its unique strengths and weaknesses when it comes to features and trading platforms. For a deeper insight into their offerings, continue reading as we delve further into this comparison.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are five noticeable differences between Pepperstone and Blueberry Markets:

- Pepperstone offers 94 currency pairs.

- Pepperstone, traders can access 180 CFDs like stocks and crypto.

- Pepperstone provides trading platforms like MetaTrader 4, MetaTrader 5, and cTrader.

- Blueberry Markets offers only MetaTrader 4 and MetaTrader 5.

- Blueberry Markets provides 44 currency pairs.

- Blueberry Markets has 55 CFD instruments.

1. Lowest Spreads And Fees – Pepperstone

This review discusses brokers with the lowest spreads and fees, providing cost-effective trading options. Lower spreads reduce transaction costs, benefiting high-frequency traders. Competitive fees attract clients, elevating trading volumes and broker revenue, thus improving the trading experience for both parties.

Spreads

When we compare the spreads offered by different brokers, the tables clearly illustrate that Pepperstone provides a competitive spread of 1.1 for the EUR/USD currency pair. In contrast, Blueberry Markets has a slightly higher spread at 1.2 for the same pair, making Pepperstone the more cost-effective option for traders focused on this currency. Additionally, when we examine the overall industry spreads across various currencies, we can observe that Pepperstone consistently maintains spreads that are marginally lower than those of Blueberry Markets. This trend of lower spreads continues across all eight available currencies in their offerings.

| Standard Account | Pepperstone Spreads | Blueberry Markets Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.35 | 1.53 | 1.7 |

| EUR/USD | 1.1 | 1.2 | 1.2 |

| USD/JPY | 1.2 | 1.5 | 1.5 |

| GBP/USD | 1.2 | 1.4 | 1.6 |

| AUD/USD | 1.1 | 1.5 | 1.6 |

| USD/CAD | 1.4 | 1.5 | 1.9 |

| EUR/GBP | 1.2 | 1.3 | 1.5 |

| EUR/JPY | 2.1 | 2 | 2.1 |

| AUD/JPY | 1.9 | 1.8 | 2.3 |

Commission Levels

For this section, it is worth noting that both Pepperstone and Blueberry Markets provide a commission rate of $3.50, which may not be the most economical option available in the market. However, when you compare this rate to the commission fees charged by other brokers, it becomes evident that this rate is quite favorable. Although it isn’t the lowest, it strikes a balance that can be considered ideal for many traders looking for reasonable fees. Overall, this commission structure is advantageous, especially when evaluating the broader landscape of brokerage options.

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| Pepperstone | $3.50 | $3.50 | £2.25 | €2.60 |

| Blueberry Markets | $3.50 | $3.50 | N/A | N/A |

Try the Pepperstone vs Blueberry Markets fee calculator below based on the most popular forex pairs and base currencies.

Standard Account Fees

Lastly, in this particular analysis, it is notable that Blueberry Markets is offering a rate of 1.2 for EUR/USD, while for AUD/USD, their offer is significantly higher at 1.5. In contrast, when we look at Pepperstone’s figures, they present a lower offer of 1.1 for EUR/USD and 1.2 for AUD/USD. This comparison highlights that Blueberry Markets has a more advantageous rate for both currency pairs, particularly for AUD/USD, where the discrepancy is even more pronounced. Overall, these differences in offers could influence traders’ decisions based on the competitive rates available.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.10 | 1.10 | 1.30 | 1.30 | 1.30 |

| 1.20 | 1.10 | 1.70 | 1.20 | 1.60 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 1.20 | 1.41 | 1.47 | 1.47 | 1.61 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.52 | 2.08 | 1.46 | 1.87 | 1.67 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Overall, Pepperstone’s price engine technology provides lower spreads on all of its currency pairs and CFD instruments. On average, Pepperstone can save you in transaction costs up to 33% on your FX transactions and up to 200% on your index CFD dealings as compared to Blueberry Markets. Low-spread forex brokers are recommended for scalping and active traders.

Our Lowest Spreads and Fees Verdict

Pepperstone definitely wins in this category thanks to their lowest spreads and fees.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

2. Better Trading Platform – Pepperstone

When a broker claims to provide the best trading platform in the forex market, it signifies that they offer advanced charting tools, real-time market data, and lightning-fast execution speeds, all readily accessible to both novice and experienced traders. This platform boasts a user-friendly interface, customizable features, and strong security measures. Furthermore, it facilitates automated trading, social trading, and access to a diverse array of financial instruments. These attributes elevate the trading experience, empowering traders to make well-informed decisions and execute trades with remarkable efficiency.

| Trading Platform | Pepperstone | Blueberry Markets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | No |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

Pepperstone steals the spotlight as, unlike Blueberry Markets, it offers more sophisticated trading tools and features, third-party tools offer to trade with the cTrader platform, and last but not least, it has institutional quality execution speeds. Click the button below and drive a test Pepperstone suite of trading platforms.

Our Better Trading Platform Verdict

Pepperstone steals the spotlight due to their better trading platform.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

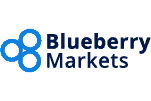

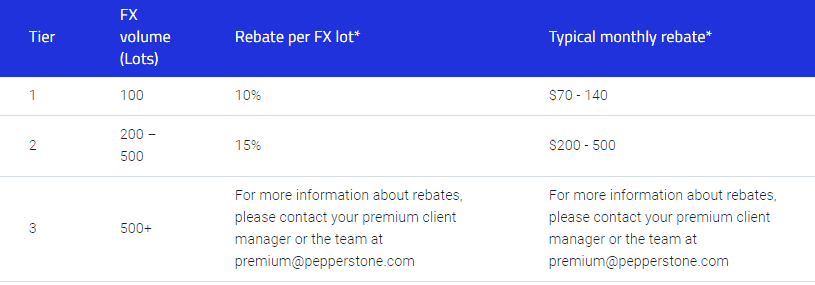

3. Superior Accounts And Features – Pepperstone

Forex brokers with superior accounts offer tailored options like competitive spreads, low commissions, and advanced tools. These include demo accounts, swap-free options, and diverse financial instruments. Enhanced features like social and automated trading, along with strong customer support, improve the trading experience and foster client loyalty.

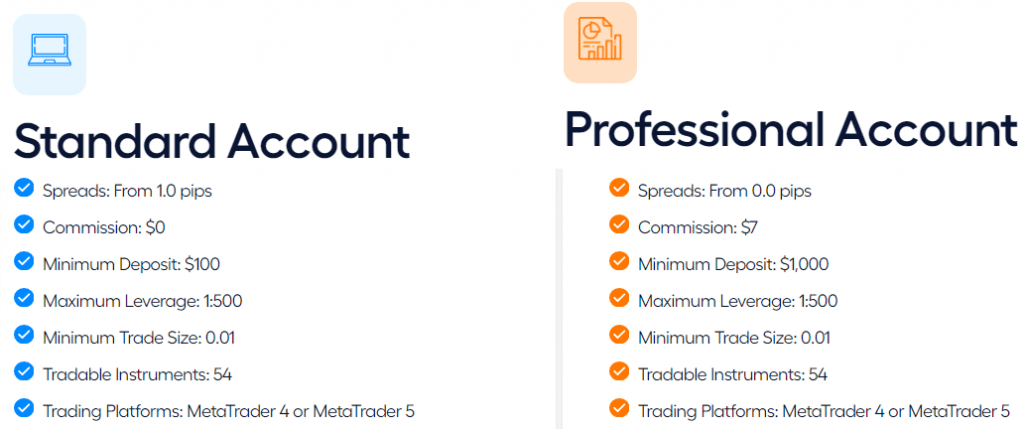

With both Pepperstone and Blueberry Markets, clients can open two core live account types:

- Standard Account – beginner-friendly with no commissions

- ECN Account (Razor Account at Pepperstone, Professional Account at Blueberry Markets)

| Pepperstone | Blueberry Markets | |

|---|---|---|

| Minimum Deposit | No minimum deposit | AUD$100 |

| EUR/USD Standard Account Spreads | 1.16 pips | 1.3 pips |

| EUR/USD Raw Account Spreads | 0.16 pips | 0.2 pips |

| Commission (Raw Account) | $3.5 per side per 100k units ($7.0 round-turn) | $3.5 per side per 100k units ($7.0 round-turn) |

| Range of Platforms | MT4,MT5 & cTrader | MT4 and MT5 |

| Maximum Leverage | 30:1 | 30:1 |

| Instruments | +180 | +65 |

| Social Trading | MyFxBook AutoTrade, MQL5 Signals, Pelican, DupliTrade, RoboX & Mirror Trader | MQL5 Signals |

Pepperstone’s Standard account is ideal for beginners, with all costs included in the bid-ask spread. It offers competitive variable spreads from 1.0 pip on major pairs, averaging 1.16 pips for EUR/USD and USD/JPY. The minimum deposit is AUD 200, and trade size starts at 0.01 lots.

Blueberry Markets’ Standard account has a wider bid-ask spread that includes all costs. A minimum deposit of $100 is required to open the account, with a minimum trade size of 0.01 lots. Spreads for major currency pairs start at 1.0 pip.

Pepperstone’s Razor account provides a true ECN trading environment with ultra-tight spreads, as low as 0.0 pips, and an average of 0.16 pips for pairs like EUR/USD and USD/JPY. A small commission is charged based on account type and platform, e.g., $7.53 per round turn for MetaTrader 4. Active traders can receive commission discounts based on their trading volume.

Blueberry Markets’ Professional account provides real-time raw pricing with tight spreads from 0.0 pips on major pairs like EUR/USD, subject to a $7.00 round turn commission per 1 Standard lot. It requires a minimum deposit of $1,000 and allows a minimum trade size of 0.01 lots.

| Pepperstone | Blueberry Markets | |

|---|---|---|

| Standard Account | ✔ | ✔ |

| ECN Account (Raw Account) | ✔ | ✔ |

| Demo Account | ✔ | ✔ |

| Active Trader Account | ✔ | ✘ |

| Swap-Free Account (Islamic Account) | ✔ | ✘ |

| MAM/PAMM | ✔ | Only MAM |

Pepperstone and Blueberry Markets both offer free demo accounts with $50,000 in virtual funds for 30 days. However, only Pepperstone provides swap-free accounts for Islamic traders, while Blueberry Markets does not. Additionally, Pepperstone offers a full MAM/PAMM solution with three allocation methods, whereas Blueberry Markets only has a MAM program.

| Pepperstone | Blueberry Markets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | No |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | Yes | No |

Evidently, The side-by-side comparison revealed Pepperstone as the trading account types category winner. Pepperstone is better than Blueberry Markets as it offers better trading conditions across its entire suite of account types, has VIP accounts for professional traders, lower spreads, a low entry barrier, and a PAMM solution and accommodates the needs of Muslim traders.

Our Superior Accounts and Features Verdict

Pepperstone dominates the category owing to their superior accounts and features.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – Pepperstone

When it comes to trading experience, both Pepperstone and Blueberry Markets have their unique features. Having personally tested both platforms, I can vouch for the seamless experience they provide. Pepperstone, for instance, is recognised as the best MT4 broker, which speaks volumes about its user-friendly interface and advanced tools. On the other hand, Blueberry Markets, while not topping our list, still offers a commendable platform that’s easy to navigate and efficient for trading.

- Pepperstone is renowned for its MT4 platform, ensuring a top-notch trading experience.

- Our tests revealed that Pepperstone also stands out for automation, with features like Capitalise.ai.

- Blueberry Markets, though not leading in our tests, still provides a reliable and user-friendly platform.

- Both brokers are committed to offering traders the tools and resources they need for successful trading.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| Pepperstone | 77ms | 2/36 | 100ms | 10/36 |

| Blueberry Markets | 88ms | 6/36 | 94ms | 7/36 |

Our Best Trading Experience and Ease Verdict

Pepperstone dominates this category over the contender due to their best trading experience.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – Pepperstone

Our research strongly advocates for brokers with solid trustworthiness and regulatory compliance. This approach guarantees a secure and transparent trading environment. Regulated brokers follow stringent standards that safeguard traders from fraud and malpractice, fostering a sense of confidence that encourages active investment and trading. Trustworthy brokers equipped with comprehensive regulatory oversight not only attract more clients but also enhance their reputation and bolster their presence in the market.

Pepperstone Trust Score

Blueberry Markets Trust Score

Pepperstone is fully compliant with the strict regulatory standards of some of the most notorious Forex authorities worldwide. Therefore, it can be considered safe. Pepperstone and its corporate arms are authorised to conduct online Forex and CFD trading business and are regulated in the following jurisdictions:

- Australia – Pepperstone Australia – by the Australian Securities and Investments Commission (ASIC)

- United Kingdom – Pepperstone UK – by the Financial Conduct Authority (FCA)

- UAE – Pepperstone AE – by the Dubai Financial Services Authority (DFSA)

Pepperstone’s operations are managed by Pepperstone Markets, regulated by the Bahamas SCB. Blueberry Markets, operated by Eightcap Pty Ltd, holds an Australian Financial Services License and is regulated by ASIC. Its international operations are managed by Eightcap Global Ltd in Vanuatu, regulated by the VFSC, but it lacks top-tier European regulatory licenses.

| Pepperstone | Blueberry Markets | |

|---|---|---|

| Tier 1 Regulators | FCA (UK) CYSEC (Cyprus) ASIC (Australia) BaFin (Germany) | ASIC (Australia) |

| Tier 2 Regulators | DFSA (Dubai) | |

| Tier 3 Regulators | CMA (Kenya) SCB (Bahamas) | SVG-FSA |

Both brokers keep client funds segregated from their corporate accounts at major Australian banks, reducing scam risks. Funds are held in a trust account with NAB, but neither brokerage offers negative balance protection. Retail clients must practice solid risk management to safeguard against Forex market fluctuations.

When we mention of regulatory status, we can see that both brokerages are regulated brokers and that Pepperstone clearly outpaces Blueberry Markets. Fully licenced by tier-one regulatory bodies across the globe, Pepperstone has more credibility. The broker’s longevity (founded in 2010) also speaks volumes for the type of trading services you’ll receive.

Reviews

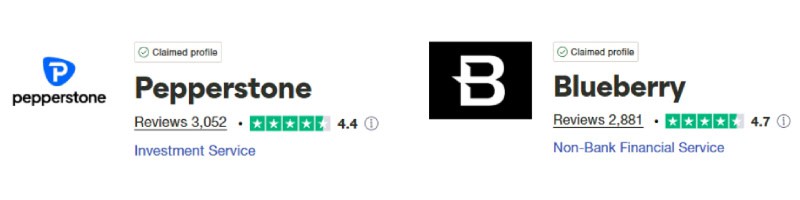

As shown below, Pepperstone has a Trustpilot rating of 4.4 out of 5, based on over 3,000 reviews. It’s consistently praised for excellent customer service. Blueberry Markets, on the other hand, holds a slightly higher Trustpilot score of 4.7 out of 5, from around 2,900 reviews. While both brokers are highly rated, Blueberry Markets edges ahead in overall score and customer satisfaction. Pepperstone, however, has a larger review base and a strong reputation for platform reliability and regulatory strength.

Our Stronger Trust and Regulation Verdict

Pepperstone clearly outperforms in this portion owing to their stronger trust and regulation.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

6. Most Popular Broker – Pepperstone

Pepperstone gets searched on Google more than Blueberry Markets. On average, Pepperstone sees around 110,000 branded searches each month, while Blueberry Markets gets about 22,200 — that’s 79% fewer.

| Country | Pepperstone | Blueberry Markets |

|---|---|---|

| Australia | 8,100 | 1,000 |

| Brazil | 6,600 | 210 |

| United Kingdom | 5,400 | 1,900 |

| United States | 4,400 | 1,300 |

| Malaysia | 4,400 | 480 |

| Thailand | 4,400 | 110 |

| Kenya | 4,400 | 110 |

| Germany | 3,600 | 1,000 |

| Colombia | 3,600 | 170 |

| Mexico | 3,600 | 90 |

| Hong Kong | 3,600 | 70 |

| India | 2,900 | 880 |

| South Africa | 2,900 | 480 |

| Spain | 1,900 | 320 |

| Italy | 1,900 | 320 |

| Mongolia | 1,900 | 10 |

| Singapore | 1,600 | 480 |

| Indonesia | 1,600 | 320 |

| Turkey | 1,600 | 210 |

| Peru | 1,600 | 30 |

| Nigeria | 1,300 | 480 |

| Pakistan | 1,300 | 320 |

| Argentina | 1,300 | 50 |

| Bolivia | 1,300 | 10 |

| France | 1,000 | 1,600 |

| United Arab Emirates | 1,000 | 170 |

| Taiwan | 1,000 | 30 |

| Ecuador | 1,000 | 30 |

| Chile | 1,000 | 20 |

| Philippines | 880 | 590 |

| Netherlands | 880 | 320 |

| Dominican Republic | 880 | 50 |

| Canada | 720 | 1,900 |

| Vietnam | 720 | 260 |

| Morocco | 720 | 210 |

| Poland | 720 | 110 |

| Tanzania | 720 | 40 |

| Portugal | 480 | 110 |

| Japan | 480 | 70 |

| Cyprus | 480 | 50 |

| Costa Rica | 480 | 10 |

| Bangladesh | 390 | 170 |

| Sweden | 390 | 140 |

| Algeria | 390 | 70 |

| Egypt | 390 | 70 |

| Uganda | 390 | 50 |

| Botswana | 390 | 50 |

| Venezuela | 390 | 30 |

| Ethiopia | 390 | 30 |

| Switzerland | 320 | 170 |

| Austria | 320 | 170 |

| Sri Lanka | 320 | 50 |

| Cambodia | 320 | 20 |

| Panama | 320 | 10 |

| Ireland | 260 | 90 |

| Ghana | 260 | 70 |

| Saudi Arabia | 260 | 50 |

| Jordan | 260 | 20 |

| Greece | 210 | 50 |

| New Zealand | 170 | 260 |

| Uzbekistan | 140 | 70 |

| Mauritius | 110 | 20 |

8,100 1st | |

1,000 2nd | |

6,600 3rd | |

210 4th | |

5,400 5th | |

1,900 6th | |

4,400 7th | |

110 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with Pepperstone receiving 1,273,000 visits vs. 265,000 for Blueberry Markets.

Our Most Popular Broker Verdict

Pepperstone is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – Pepperstone

Brokers with a diverse range of top-tier products and robust CFD markets in forex trading are highly recommended. This expansive offering enables traders to diversify their portfolios and take advantage of a variety of market conditions. Brokers that provide a comprehensive selection of financial instruments, including forex pairs, commodities, indices, and cryptocurrencies, present traders with countless opportunities for profit. Such variety not only enriches the trading experience but also makes it more dynamic and adaptable to different trading strategies.

Pepperstone offers disproportionately more tradable instruments across several asset classes compared to Blueberry Markets. With Pepperstone, clients can access over 180 financial instruments, while at Blueberry Markets, they can choose from over 50 trading instruments.

| CFDs | Pepperstone | Blueberry Markets |

|---|---|---|

| Forex Pairs | 94 | 38 |

| Indices | 27 | 19 |

| Commodities | 33 Commodities 7 Metals, 4 Energies, 9 Softs, 13 Hard | 9 Metals (Gold x 7 Currencies) (Silver x 6 Currencies) 3 Energies |

| Cryptocurrencies | 44 | 10 |

| Shares | 1,170 | 300+ |

| ETFs | 95 | 140 |

| Bonds/Treasuries | 7 | No |

| Other Products(Options,Futures) | No | No |

Pepperstone offers 94 currency pairs on three platforms, while Blueberry Markets has 44 pairs on two platforms. In CFD trading, both brokers provide similar ranges:

- Cryptocurrency CFDs: 5 coins each.

- Stock Index CFDs: 15 at Pepperstone vs. 10 at Blueberry Markets.

- Commodity CFDs: 22 contracts at Pepperstone vs. 5 at Blueberry Markets, with Platinum exclusive to Blueberry’s MetaTrader 5.

- Stock CFDs: 63 US shares and 1 ETF at Pepperstone; Blueberry offers unspecified Australian stocks.

- Currency Index CFDs: Only Pepperstone offers 3 contracts.

We should note that neither brokerage has included CFDs on Futures or Bonds in their product lists.

*NOTE: Under new FCA guidelines, UK retail traders are no longer able to trade cryptocurrencies.

Overall, Pepperstone provides +150 more CFD trading opportunities that can’t be found with Blueberry Markets. Their CFD offering surpasses many brokers, not just Blueberry’s. If you’re looking for a 1-stop shop solution for all your trading needs, you’re likely to be impressed with the diverse list of trading instruments offered by Pepperstone.

Our Top Product Range and CFD Markets Verdict

Pepperstone steals the throne here due to their top product range and CFD markets.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

8. Superior Educational Resources – Pepperstone

Pepperstone:

- Offers a comprehensive range of educational materials.

- Provides webinars and tutorials for traders of all levels.

- Features a dedicated section for beginner traders.

- Includes advanced trading strategies and insights.

- Has a user-friendly platform with educational pop-ups.

- Collaborates with professional traders for expert insights.

Blueberry Markets:

- Provides a variety of educational resources tailored for traders.

- Features regular webinars and live trading sessions.

- Offers beginner-friendly tutorials and guides.

- Includes insights from market experts and analysts.

- Has a dedicated section for advanced trading techniques.

- Collaborates with trading communities for shared knowledge.

With the data given, and based on our team’s testing, we can clearly see that Pepperstone offers the best educational resources with a score of 8.5, closely followed by Blueberry Markets with a score of 8.2.

Our Superior Educational Resources Verdict

Pepperstone outshines the competitor in light of their superior educational resources.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

9. Superior Customer Service – A Tie

Brokers that prioritize exceptional customer service in forex trading are truly worth the investment of your time and effort. They provide traders with prompt support and expert guidance, creating a seamless and reassuring trading experience. Offering responsive live chat, phone, and email support around the clock, along with multilingual assistance, these brokers ensure that any issues are swiftly addressed. This high level of service not only enhances trader satisfaction but also fosters a strong sense of trust in the broker.

In terms of customer service, both brokers can be contacted via 3 main means of communication. To get in touch with the customer service team, you can choose between the following:

- Live Chat: To start chatting with a forex specialist, you need first to fill in your name and email and choose a topic that interests you

- Email: Pepperstone’s support team include an email option, while Blueberry Markets can also be contacted via email

- Phone: Pepperstone’s trading desk can be contacted by dialling +613 9020 0155, while Blueberry Markets’ clients can call +612 8039 7480 (for Australia-based clients)

Pepperstone offers a toll-free number for Australian clients (1300 033 375) and provides support 24/5, unlike Blueberry Markets’ 24/7 service. Their live chat is efficient; we contacted a representative in under 30 seconds and received prompt, helpful responses.

| Feature | Pepperstone | Blueberry Markets |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/7 |

| Multilingual Support | Yes | Yes |

Additionally, Pepperstone has been given the top award for:

- Forex Trading Support (Europe) in the Global Forex Awards 2019

- And for Best Client Relationship Manager Service in the Professional Trader Awards 2019

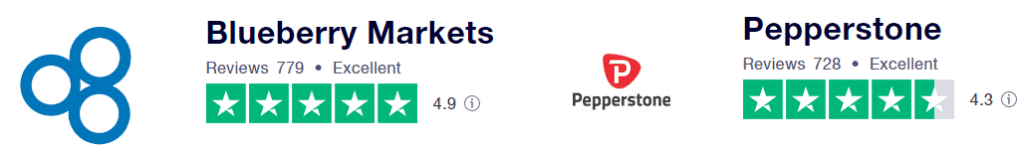

Trustpilot star rating gives 4.9 stars out of 779 reviews for Blueberry Markets compared to 4.3 stars out of 728 reviews received by Pepperstone.

Pepperstone offers extensive educational materials, while Blueberry Markets lacks trading education resources. Pepperstone’s content includes trading guides on forex basics and advanced concepts, regular webinars covering market insights, in-depth market analyses by Chris Weston, a 24/7 economic calendar, and comprehensive market analyses on various influencing factors.

In comparison, Blueberry Markets offers a subscription-based trading tips service known as the Blueberry Jam, and it also provides a well-thought-out blog featuring the latest financial news as well as FX analysis on current trends. Yet, the entire content there is with a sole informational purpose and should not be taken as investment advice.

Overall, both forex brokers offer educational material for free. However, Blueberry Markets lacks the Forex tutorials needed for beginners, but it’s fully packed with market analysis (Forex chart of the day). On the other hand, Pepperstone offers a multitude of trading services all under one roof.

Our Superior Customer Service Verdict

Both Blueberry Markets and Pepperstone are tied in this category, thanks to their superior customer service.

10. Better Funding Options – A Tie

In the industry of forex trading, brokers that prioritize flexibility and convenience are highly regarded as the best options for funding. These brokers offer a diverse range of funding methods, including bank transfers, credit and debit cards, popular digital wallets such as PayPal, Skrill, and Neteller, as well as cryptocurrencies. By providing multiple funding options with minimal or no fees, they empower traders to manage their accounts effortlessly, facilitating seamless deposits and withdrawals, and significantly enhancing the overall trading experience.

We can see here that Pepperstone requires a minimum deposit of AUD 200 or currency equivalent for all account types offered, while Blueberry Markets requires a minimum deposit of $100 for the Standard account type and a min. deposit of $1,000 for the Professional account type.

Pepperstone allows deposits in 10 currencies (AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD), while Blueberry Markets accepts 7 currencies (AUD, USD, CAD, GBP, NZD, SGD, EUR). Neither broker charges deposit/withdrawal fees or inactivity fees, even with a $0 balance.

| Funding Option | Pepperstone | Blueberry Markets |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Both Pepperstone and Blueberry Markets provide convenient account funding options for clients.

For example, Pepperstone allows the following payment options:

- Debit Card or Credit Card by MasterCard or Visa

- PayPal

- Skrill

- Neteller

- Union Pay

- POLi

- BPay

- Bank transfer

In comparison, Blueberry Markets allows clients to fund their live trading account by using the following payment options:

- Credit Card or Debit Card by Visa or MasterCard

- POLi Payment

- China UnionPay

- Skrill – there will be a platform fee of 3%-4%

- Fasapay – there will be a 0.5% fee charged by the provider

- Bank transfer – there may be fees depending on the bank

In conjecture, both forex brokers support free-fee deposits along with the most popular payment options. The process of funding your trading account works the same with both forex brokers. Even though Pepperstone supports slightly more digital wallet options, this is not a deal-breaker as both brokers equally share the most popular funding options.

Our Better Funding Options Verdict

Both Pepperstone and Blueberry Markets are again tied to this category due to their better funding option.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

11. Lower Minimum Deposit – Pepperstone

Pepperstone has a lower minimum deposit of $0 than Blueberry Markets’ $100. The minimum amounts mentioned apply to all the accounts associated with both brokers.

Here’s a breakdown of their minimum deposit amounts:

| Minimum Deposit | Recommended Deposit | |

| Pepperstone | $0 | $200 |

| Blueberry Markets | $100 | $100 |

Evidently, Pepperstone wins with its $0 minimum deposit requirement. However, the broker recommends starting with $200, making Blueberry Markets’ minimum seem reasonable.

Our Lower Minimum Deposit Verdict

Pepperstone takes the cake in this portion thanks to their lower minimum deposit.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

So is Blueberry Markets or Pepperstone Better?

Pepperstone definitely outshines in all category given because of its comprehensive offerings, competitive spreads, and robust regulatory framework. The table below summarises the key information leading to this verdict:

| Categories | Pepperstone | Blueberry Markets |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ✅ | ❌ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ❌ |

| Most Popular Broker | ✅ | ❌ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ✅ | ❌ |

| Superior Customer Service | ✅ | ✅ |

| Better Funding Options | ✅ | ✅ |

| Lower Minimum Deposit | ✅ | ❌ |

Blueberry Markets: Best For Beginner Traders

Blueberry Markets is better suited for beginner traders due to its user-friendly platform and comprehensive educational resources.

Pepperstone: Best For Experienced Traders

Pepperstone is the ideal choice for experienced traders because of its advanced trading tools, competitive spreads, and faster execution speeds.

FAQs Comparing Pepperstone Vs Blueberry Markets

Does Blueberry Markets or Pepperstone Have Lower Costs?

Pepperstone generally offers lower costs compared to Blueberry Markets. They have been recognised for their competitive spreads, especially during peak trading hours. For instance, their EUR/USD spread can start as low as 0.13 pips. For more detailed insights on low-cost brokers, you can check our guide on the Lowest Spread Forex Brokers.

Which Broker Is Better For MetaTrader 4?

Both Pepperstone and Blueberry Markets offer robust MetaTrader 4 platforms, but Pepperstone edges out with its advanced tools and faster execution speeds. Their MT4 platform is equipped with features tailored for both novice and experienced traders. If you’re keen on exploring more about MT4 brokers, our comprehensive list of the Best MT4 Brokers in Canada might be of interest.

Which Broker Offers Social Trading?

Pepperstone provides a platform for social trading, allowing traders to copy strategies from experienced traders. This feature is especially beneficial for beginners who are still finding their footing in the forex market. Social trading bridges the gap between novice and expert traders. For a deeper dive into social trading platforms, you can explore our guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

Pepperstone offers spread betting for its UK clients. This form of trading is tax-free in the UK and is a popular alternative to traditional forex trading. Spread betting allows traders to speculate on price movements without owning the underlying asset. For those interested in exploring more about spread betting, our guide on the best spread betting brokers in the UK provides comprehensive insights.

What Broker is Superior For Australian Forex Traders?

In my opinion, Pepperstone stands out as the superior choice for Australian forex traders. Founded in Melbourne, they are ASIC regulated, ensuring a high level of trust and security for their clients. Their deep roots in Australia and commitment to providing top-notch services make them a favourite among local traders. Moreover, their platform offerings and competitive spreads are hard to beat. If you’re keen on exploring more about Australian forex brokers, our detailed list of Forex Brokers In Australia is a great place to start.

What Broker is Superior For UK Forex Traders?

For UK traders, Pepperstone is my top pick. They are FCA regulated, which adds an extra layer of trust and security for UK-based clients. While they were founded overseas, their commitment to the UK market is evident in their tailored offerings and services for UK traders. Their platform is user-friendly, and they offer competitive spreads, making them a top choice for many. For a deeper dive into the best brokers for UK traders, you can check out our comprehensive guide on the Forex Brokers In UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

which broker is the most beginner friendly?

Beginners friendly can mean different things to different people. Do you mean a broker with risk management tools? Both brokers have the same risk management tools when using MetaTrader 4 or 5 platforms. Do you mean Beginner-friendly trading platforms? We would suggest sticking with MetaTrader 4 since this platform as it is very intuitive and much used by beginners across the globe. As a bonus, because the platform has such a large community, there is no shortage of online resources for help. OR maybe you mean when it comes to customer services and trading education library? if so then we suggest Pepperstone.

Does Blueberry Markets have negative balance protection?

Yes they do