Pepperstone vs City Index: Which One Is Best?

This review compares Pepperstone and City Index, highlighting their similar features and platforms as effective forex brokers. Read on to learn more.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

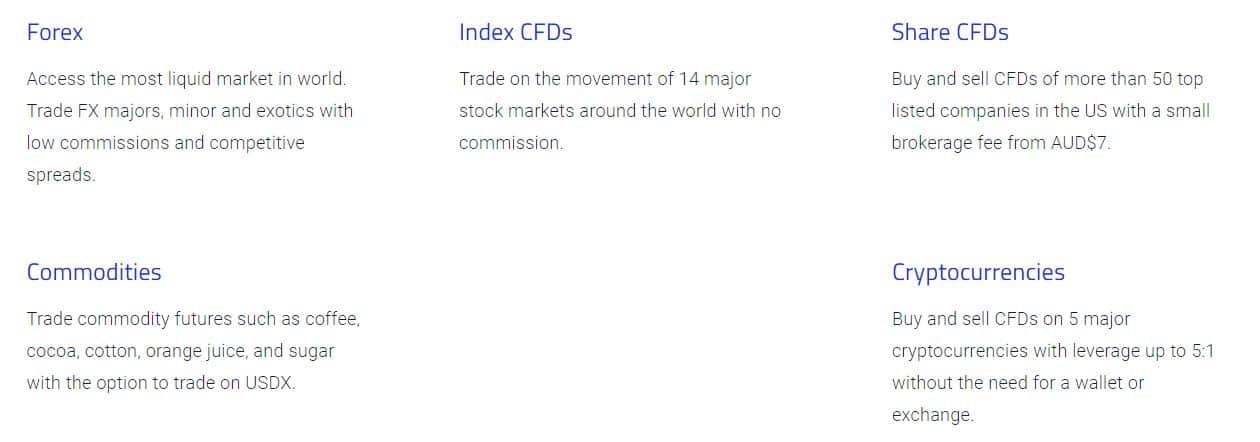

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 10:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers the 10 most important trading factors. Here are five noticeable differences between Pepperstone and City Index:

- Both brokers offer MetaTrader 4, but only Pepperstone offers MetaTrader 5.

- Pepperstone sources pricing using a deep pool of external liquidity providers, whereas City Index is a market maker.

- Pepperstone’s Razor account offers ECN-style spreads, while City Index incorporates their fees into their spreads.

- Pepperstone does not have an inactivity fee, but City Index charges a monthly $15 fee after 24 months of inactivity.

- City Index offers a Guaranteed Stop Loss Order (GSLO) option, while Pepperstone does not.

- City Index offers 21 global stock market indices and 3 Interest Rate market for speculative marketing.

1. Lowest Spreads And Fee – Pepperstone

In this segment, our team will explore the pivotal role played by brokers offering the lowest spreads and fees in the forex trading landscape. This factor is crucial as it significantly influences trading costs. When spreads are minimized, the gap between the buying and selling prices of currency pairs becomes narrower, effectively lowering the expenses associated with each trade. This advantage is particularly advantageous for traders who frequently execute multiple transactions, as it allows them to minimize transaction costs and enhance their overall profitability.

Spreads

Pepperstone presents a EUR/USD rate of 1.1, outpacing City Index’s offering of 0.7. While Pepperstone maintains a higher standard rate than City Index, it still aligns with the regional industry average spread of 1.2. However, when it comes to AUD/USD, City Index shows a less favorable rate of 2.2, which surpasses the industry average and is significantly higher than Pepperstone’s 1.2. This highlights the variability in rates across different currency pairs. Overall, the industry average spread stands at 1.35, with City Index providing a competitive rate of 1.3.

The Pepperstone Standard account spreads can be fairly compared to both City Index accounts. The Pepperstone Razor account spreads are cheaper but don’t take into account the commission that will be added to your trade.

| Standard Account | Pepperstone Spreads | City Index Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.35 | 1.3 | 1.6 |

| EUR/USD | 1.1 | 0.7 | 1.2 |

| USD/JPY | 1.30 | 0.6 | 1.4 |

| GBP/USD | 1.30 | 1.1 | 1.6 |

| AUD/USD | 1.2 | 2.2 | 1.5 |

| USD/CAD | 1.4 | 1.6 | 1.8 |

| EUR/GBP | 1.20 | 1.1 | 1.5 |

| EUR/JPY | 1.8 | 1.6 | 1.9 |

| AUD/JPY | 1.5 | 2.2 | 2.1 |

Commission Levels

When it comes to commission rates, City Index presents a competitive rate of $2.50 in USD, which is notably lower than Pepperstone’s rate of $3.50. Interestingly, when both rates are converted to AUD, they equalize at $3.50 for both brokers. However, City Index does not have offers for both GBP and EUR, whereas Pepperstone offers a £2.25 and €2.60 accordingly. This highlights a significant disparity between City Index’s commission structure in USD compared to its AUD rate, while Pepperstone maintains consistency across both currencies. Hence, traders should consider these variations when choosing between the two platforms, as the currency can greatly impact overall trading costs.

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| Pepperstone | $3.50 | $3.50 | £2.25 | €2.60 |

| City Index | $2.50 | $3.50 | N/A | N/A |

Try the Pepperstone vs City Index fee calculator below based on the most popular forex pairs and base currencies.

Standard Account Fees

In this comparison, Pepperstone charges a standard account fee of 1.10 for EUR/USD, while City Index offers a more competitive rate at 0.70, making it the lowest option available. However, when it comes to AUD/USD, City Index’s standard account fee rises to 2.20, significantly higher than Pepperstone’s 1.20. These discrepancies in rates can likely be attributed to varying local regulations, currency exchange rates, and operational costs across different countries.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.10 | 1.10 | 1.30 | 1.30 | 1.30 |

| 0.70 | 2.20 | 1.10 | 1.10 | 0.60 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 1.20 | 1.41 | 1.47 | 1.47 | 1.61 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.52 | 2.08 | 1.46 | 1.87 | 1.67 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

For the lowest spreads in forex trading, we recommend Pepperstone’s Razor account due to its ECN-style spreads, which are usually narrower than those from a market maker. If you prefer to avoid commissions, consider the City Index CFD account.

While saving $1.80 with Pepperstone’s Razor account over City Index CFD might seem small, it adds up, especially with leverage. Higher leverage means more capital to trade with, resulting in more lots traded and saving $1.20 per lot, leading to significant savings over time.

Remember to consider other costs, such as Pepperstone’s deposit charge when using a credit card.

Our Lowest Spreads and Fees Verdict

While our team’s conclusion may seem at odds with the presented data, we strongly advocate for Pepperstone’s Razor account. This recommendation stems from the fact that ECN-style spreads are generally tighter than those offered by market makers. It’s evident that Pepperstone excels in this area.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

2. Better Trading Platform – City Index

| Trading Platform | Pepperstone | City Index |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | No |

| cTrader | Yes | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

Metatrader

Pepperstone provides both MetaTrader 4 and MetaTrader 5, while City Index only offers MetaTrader 4. These platforms are vital for forex trading, boasting advanced charting tools, real-time market data, and automated trading features. MetaTrader 4 is popular for its user-friendly interface and widespread adoption, whereas MetaTrader 5 includes enhanced functionalities such as additional timeframes, advanced order types, and superior backtesting capabilities. Both platforms support Expert Advisors (EAs), making them indispensable for traders looking to optimize efficiency and precision in their trading strategies.

Advanced Platforms

This section discusses the importance of cTrader and TradingView in forex trading. cTrader offers fast execution, advanced charting, and automation for professional traders, while TradingView provides powerful charting, real-time data, and a social platform for sharing ideas. Together, they enhance trading efficiency and decision-making. For Pepperstone, the offer both cTrader and TradingView, while City Index only offers TradingView for their platform. However, both brokers have copy trading and their own proprietary platforms to offer.

Copy Trading

Pepperstone and City Index both provide unique copy trading platforms, complemented by their own versions of social and copy trading solutions. Pepperstone offers Copy Trading by Pepperstone, cTrader, and Copy MetaTrader Signals, while City Index presents MetaTrader Signals. Each broker boasts robust features, allowing traders to choose based on their individual needs and transaction preferences.

City Index Trading Platforms

Web Trader

City Index’s Web Trader, launched in late 2018, replaces Advantage Web with HTML5 for faster loading and better mobile compatibility.

Here are the following key features:

Customisation

- Creation of up to 10 personalised workspaces and the ability to switch between them with a single click. You can choose from charts, watch lists, news and position windows.

- Advanced charts, including custom indicators and drawing tools designed for precision.

- Ability to create charts that show an overlay of 2 different markets.

Charts

- Charts powered by Trading View. Choose from 10 different chart types.

- Trade tickets are available directly within charts.

- 57 indicators and studies.

Intelligent Tools

Intelligent Tools

- Search functionality – to help you find what you need

- Search Tool – Search by market name or stock code. Results will show alphabetically.

- Browse Tool – This feature allows you to browse by product type of region

- Balance bar to easily see you P&L and add funds

- Smart Trade ticket with risk management tools

- Set ticket by price, points away or P&L. When you set one of these values, the others will update in real time.

- Automatic ‘Margin required’ updating when you set your ticket price.

- Multiple stops and limits against one position via trade ticket

- Ability to hedge your trade via trade ticket.

360° Market view

- Tools to help you find trading opportunities

- Market analysis with Reuters

- The latest market prices with charts, news and pricing

- Economic Calendars

City Index AT Pro

The City Index desktop trading platform offers advanced features for spread betting, enhancing the Web Trader’s capabilities.

- Creation of custom templates using any of the following languages – .NET, C# or Visual Basic.

- Choice of custom templates

- Choice of 140 indicators which exceeds most trading platforms in the industry

- Backtesting tools that work with spreadsheets for historical analysis.

- Over 25 drawing tools, including retracements, Fibonacci and Gann lines.

- Ability to Pan over 15 timeframes

- Social Trading with ‘Connect’

City Index Apps For IOS And Android

City Index has apps for Apple and Android, featuring the same core functions as Web Trader but with fewer options. It offers 60 indicators, which is less than Web Trader but still a good selection.

MetaTrader 4 (MT4) – Pepperstone And City Index

It is safe to assume that City Index and Pepperstone provide MetaTrader 4, a popular trading platform for foreign exchange and commodities, but it’s not ideal for trading shares.

One of the big benefits of MT4 is that many brokers offer it. This means you can change brokers without needing to learn a new platform.

MT4 stands out as a platform because it allows you to trade with three types of execution modes.

Execution Modes:

- Instant Execution

- Execution on Request

- Execution by Market

In addition to the choice of execution modes, you can also place different types of order requests.

Order Request Types:

- Market Orders

- Pending Orders include

- Buy Limit

- Buy Stop

- Sell Limit

- Sell Stop

MT4 offers 2 types of stops

Stops:

- Stop Loss / Take Profit

- Trailing Stop

Other Main Features

- 30 technical indicators and 2000 free custom indicators plus 700 paid ones, meaning you can perform a market analysis to as complex a level as you wish. Indicators types include:

- Moving Averages

- Fibonacci Retracements

- Bollinger Bands

- 23 Analytical functions

- Interactive charts

- Expert Advisors for algorithmic trading, including backtesting capability

- 9 timeframes

- Hedging

- Social Trading / Copy Trading

- Access to lots of add-on tools to further enhance your trading

MetaTrader 4 – Pepperstone Or City Index

City Index spreads with MT4 are wider and offer less leverage than with Pepperstone MT4. Pepperstone also offers MT4 as a web browser (through Web Trader); City Index doesn’t offer this.

MetaTrader 5 (MT5)

This platform is only available with Pepperstone. MT5 is an improvement on MT4 in that it allows you to trade all CFDs in addition to Forex. MT5 offers the following features:

- Trading on all CFDs

- Available as download, iOS and Android and via a web browser

- 100 charts for forex and stock quotes at one time

- 6 types of pending orders (2

- 11 different minute charts and 7 hourly charts

- 21 timeframes

- over 80 technical indicators

- 22 analytical tools

- 46 graphical object

- Hedging (only with brokers outside America)

- Expert Traders with MQL5, which is superior to MQL4 on MT4

- Access to 2500 algorithmic applications

- Access to more fundamental analysis such as Economic Calendars (MT4 requires an add-on for these)

Our team previously recommended MT4 due to MT5’s initial limitations with American regulations, which restricted LIFO trading and hedging. However, MT5 has been updated to include these features for non-US brokers, making it the superior platform with all MT4 capabilities and more. MT4 remains a great choice for forex and certain CFDs due to its clean interface and ease of use. City Index’s custom platforms offer more built-in tools and have won awards, but they may lock you into their ecosystem, making it hard to switch brokers. MT4 with City Index is less appealing due to higher spreads and limited leverage.

Our Better Trading Platform Verdict

Our team has reached a definitive decision on which of the two contenders should take the lead in this category. It is evident that City Index stands out due to its diverse range of features, offerings, and platforms designed to meet the trading needs of both novice and experienced traders, all while ensuring ease of use.

City Index ReviewVisit City Index

*Your capital is at risk ‘69% of retail CFD accounts lose money’

3. Superior Accounts And Features – A Tie

It is important to understand why each broker is different and the different trading account types they offer for forex trading.

For superior accounts and features, this greatly attracts a diverse range of traders, offering flexibility, advanced tools, and improved conditions. This enhances trading experiences, increases client satisfaction and loyalty, and boosts the broker’s reputation and competitiveness.

Pepperstone Accounts

Pepperstone operates as an ECN + STP ‘style’ broker, owning the electronic systems for their products. While not a ‘true’ ECN provider, Pepperstone sources pricing from reputable external liquidity providers, offering low spreads with No Dealing Desk Brokers, no requotes, and no price manipulation.

For standard accounts, Pepperstone adds a flat one pip to spreads. For Razor accounts on MT5, there’s a $7 round-turn commission, or 7 units of the base currency on cTrader (e.g., AUD/USD costs $7 AUD per lot). This setup ensures competitive pricing and efficient trading.

Pepperstone ‘Razor’ Account – Key Features:

- ECN Pricing (no markups)

- Choice of MetaTrader 4, MetaTrader 5 or cTrader

- Commission of $3.50 side-ways, $7.00 round turn

- Scalping

- Hedging

- A $200 minimum deposit when you open an account (though not enforced)

- Expert Advisors

- No dealing desk, no requotes

- News trading available

Pepperstone ‘Standard’ Account

- ECN pricing plus 1 pip

- Choice of MetaTrader accounts

- Scalping

- Hedging

- $200 minimum opening account balance (though not enforced)

- Expert Advisors

Both trading accounts offer the following base currencies: AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD and HKD. View the Pepperstone razor vs standard accounts comparison if you need more details comparing the two most popular Pepperstone accounts.

Pepperstone Swap-Free Islamic Account

Pepperstone offers an Islamic account, not advertised on their website, to comply with Sharia Law, which forbids swaps. This account has the same spreads as the Razor account but no rollover interest or overnight fees. Instead, an administration fee is charged: under $10 for major currency pairs, under $20 for minors, and higher for exotic pairs.

City Index Accounts

City Index is a market maker. This simply means they are the counterparty to every trade you do.

As the dealing desk broker, City Index incorporates their fees into their spreads, which means there are no commissions.

Account Features Comparison

| Feature | Pepperstone | City Index |

|---|---|---|

| Lots Size | 0.01 - 100 Lots | 0.01 - 100 Lots |

| Commission | Standard Account - 1pip Razor Account - $7 Round trip for MT4 (cTrader varies) | None |

| Leverage | 30:1 | 30:1 CFD Platform 30:1 MT4 Platform |

| Minimum Account Opening | AUD $200 | No Minimum |

| Scalping Allowed | ✔ | ✔ |

| Algo Trading | ✔ | Expert Advsors (MT4 Platform) Via API interface (CFD Platform) |

| Hedging Allowed | ✔ | ✔ |

| News Trading | ✔ | ✔ |

| Social Trading | ✔ | ✘ |

| No Dealing Desk Execution | ✔ | ✘ |

| Pepperstone | City Index | |

|---|---|---|

| Standard Account | Yes | No |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | No |

| Active Traders | Yes | No |

| Spread Betting (UK) | Yes | Yes |

Our Superior Accounts and Features Verdict

Our team has just made the strategic decision to link both brokers, given their impressive offers and the robust platforms they provide for traders in the market. It’s evident that both Pepperstone and City Index belong to this category.

City Index ReviewVisit City Index

*Your capital is at risk ‘69% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – A Tie

There is nothing more gratifying for traders than the assurance that brokers can deliver an exceptional trading experience. This is achieved through a blend of state-of-the-art trading platforms, swift execution speeds, competitive spreads, and dependable customer support. Together, these components empower traders to make well-informed decisions, execute trades effortlessly, and efficiently manage their accounts. Additionally, a user-friendly interface, access to educational resources, and a diverse array of trading tools elevate the overall trading experience, resulting in greater enjoyment and increased profitability for traders.

When it comes to the best trading experience and ease of use, our team has delved deep into the nuances of both Pepperstone and City Index. Based on our findings and our own rigorous testing, here’s what we’ve discovered:

- Pepperstone stands out as the best choice for MT4 users, offering a seamless experience on this platform.

- For those who prioritise automation in their trading, Pepperstone again takes the lead with robust features.

- City Index, on the other hand, offers a diverse range of tools and resources that cater to both beginners and seasoned traders.

- The overall user interface, navigation, and responsiveness of both platforms are commendable, but nuances in their offerings can make one a better fit for certain traders over the other.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| Pepperstone | 77ms | 2/36 | 100ms | 10/36 |

| City Index | 95ms | 12/36 | 131ms | 14/36 |

Both brokers significantly improved user experience, offering unique features for both beginners and pros. It’s essential to choose the platform that suits your trading style.

Our Best Trading Experience and Ease Verdict

Once again, both Pepperstone and City Index achieve a tie, thanks to their user-friendly platforms and features that cater to both novice and experienced traders alike.

City Index ReviewVisit City Index

*Your capital is at risk ‘69% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – A Tie

This aspect is vital for traders entering the forex market. Stronger trust and regulation are essential for brokers, as they guarantee a secure and transparent trading environment. Regulated brokers comply with rigorous standards, safeguarding traders from fraud and malpractice. This creates a sense of confidence, motivating traders to invest and engage more actively. Reliable brokers with solid regulatory oversight not only attract more clients but also bolster their reputation and presence in the market.

Pepperstone Trust Score

City Index Trust Score

Both brokers are regulated by various bodies in different countries. Having regulation means that the broker will conduct their business in a fair, ethical way and operate in a way that meets the strict compliance requirements set by the regulator.

Regulators require the broker to take measures that will protect your funds. These measures include:

- Keeping your funds in a Tier-1 segregated bank account

- Requiring the broker to keep capital in reserve

- Provide a Product Disclosure Statement (PDS) so the client knows what to expect when dealing with them

- Establishing a client dispute resolution process

Pepperstone is regulated by:

- United Kingdom: Financial Conduct Authority (FCA) under FCA registration number 684312

- Australia: The Australian Securities and Investments Commission (ASIC) under the following licence number AFSL No.414530

- As well as CySEC (Eu), CMA (Kenya), DFSA (Dubai), SCB (The Bahamas) and BaFin (Germany).

City Index is regulated by:

- United Kingdom: Financial Conduct Authority (FCA) under FCA. registration number 1761813

- Australia: The Australian Securities and Investments Commission (ASIC) AFSL 345646

- MAS: Monetary Authority of Singapore (MAS) Co Reg # 200400922K

If you are in Europe or the UK, you will fall under FCA regulation rules. One benefit of FCA regulation is that retail traders will receive guaranteed Negative Balance Protection. Unfortunately, due to recent changes to FCA regulation, UK retail traders are no longer able to trade cryptocurrency products.

If you are a City Index client from Singapore, then City Index will be compliant with MAS regulations.

| Pepperstone | City Index | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) | ASIC (Australia) FCA (UK) MAS (Singapore) |

| Tier 2 Regulation | DFSA (Dubai) | |

| Tier 3 Regulation | SCB (Bahamas) CMA (Kenya) |

Our Stronger Trust and Regulation Verdict

Once again, in this critical segment of our review, it’s a draw between Pepperstone and City Index. Their notable trust and exceptional regulatory standards set them apart, earning them commendable recognition.

Reviews

As shown below, Pepperstone scores 4.5 out of 5, while City Index follows closely with a 4.2 out of 5 rating. Both brokers are well-regarded, but Pepperstone has a slight advantage in overall customer satisfaction.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

6. Most Popular Broker – Pepperstone

Pepperstone gets searched on Google more than City Index. On average, Pepperstone sees around 135,000 branded searches each month, while City Index gets about 8,100 — that’s 94% fewer.

| Country | Pepperstone | City Index |

|---|---|---|

| Malaysia | 9,900 | 30 |

| Brazil | 8,100 | 1,000 |

| India | 6,600 | 3,600 |

| South Africa | 6,600 | 20 |

| Thailand | 5,400 | 90 |

| Indonesia | 5,400 | 10 |

| Colombia | 4,400 | 260 |

| Turkey | 4,400 | 40 |

| United States | 4,400 | 70 |

| Vietnam | 4,400 | 10 |

| Argentina | 3,600 | 880 |

| United Kingdom | 3,600 | 30 |

| Germany | 2,900 | 110 |

| Philippines | 2,900 | 70 |

| Poland | 2,900 | 40 |

| United Arab Emirates | 2,400 | 50 |

| Bangladesh | 2,400 | 390 |

| Egypt | 2,400 | 10 |

| Algeria | 1,900 | 30 |

| Pakistan | 1,600 | 50 |

| Peru | 1,600 | 70 |

| Italy | 1,600 | 10 |

| Mexico | 1,600 | 10 |

| Singapore | 1,300 | 40 |

| Nigeria | 1,300 | 30 |

| Spain | 1,300 | 10 |

| Tanzania | 1,300 | 10 |

| Cyprus | 1,300 | 10 |

| Morocco | 1,000 | 30 |

| Hong Kong | 1,000 | 20 |

| Saudi Arabia | 1,000 | 20 |

| Venezuela | 1,000 | 10 |

| France | 1,000 | 10 |

| Uzbekistan | 880 | 40 |

| Ecuador | 880 | 70 |

| Australia | 720 | 10 |

| Netherlands | 720 | 40 |

| Canada | 720 | 10 |

| Portugal | 590 | 10 |

| Chile | 590 | 10 |

| Japan | 590 | 10 |

| Taiwan | 480 | 10 |

| Jordan | 480 | 90 |

| Bolivia | 480 | 20 |

| Sri Lanka | 480 | 10 |

| Kenya | 480 | 10 |

| Dominican Republic | 480 | 10 |

| Uruguay | 390 | 20 |

| Switzerland | 390 | 10 |

| Sweden | 390 | 20 |

| Ghana | 390 | 10 |

| Cambodia | 390 | 20 |

| Uganda | 390 | 10 |

| Ethiopia | 320 | 10 |

| Botswana | 320 | 10 |

| Costa Rica | 320 | 10 |

| Austria | 260 | 10 |

| Greece | 260 | 20 |

| Ireland | 210 | 10 |

| New Zealand | 210 | 10 |

| Mongolia | 210 | 10 |

| Mauritius | 170 | 10 |

| Panama | 170 | 10 |

9,900 1st | |

30 2nd | |

8,100 3rd | |

1,000 4th | |

6,600 5th | |

3,600 6th | |

5,400 7th | |

10 8th |

Similarweb shows a similar story when it comes to August 2025 website visits with Pepperstone receiving 1,474,000 visits vs. 144,523 for City Index.

Our Most Popular Broker Verdict

Pepperstone is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – City Index

This portion is truly gold for traders doing business in forex trading. A wide product range and extensive CFD markets benefit forex traders by allowing portfolio diversification and capitalizing on different market conditions. Brokers with diverse financial instruments, like forex pairs and cryptocurrencies, increase profit opportunities and enhance the trading experience.

Clearly, both brokers offer a large range of markets for trading CFDs.

Pepperstone

As a trader with Pepperstone, you can trade the following:

- Share market CFDs – Pepperstone offers 60 US shares. Surprisingly, you cannot trade ASX CFDs.

- Indices – choose from 24 different indices and all the major stock markets around the world.

- Commodities – Pepperstone offers all the major commodities available for trade.

- Hard commodities: Spreads for gold and silver average 1 and 1.56 pips. Spreads for Platinum and Palladium start at 5 pip.

- Soft Commodities: Spreads vary greatly between each commodity.

- Currency Index CFDs – you can trade the USDX, which measure 6 major currencies (mostly Euro, Yen and Pound) against the USD. Spreads start at 0.3. Lots are traded in 100 USD.

- Cryptocurrencies – 44 Cryptocurrencies.

City Index

As a trader with City Index, you will be able to trade on the following markets:

- Share Market CFDs – City Index allows you to trade over 4500 national and global shares.

- Commodities – City Index allows you to trade over 25 global commodities. Spreads start at 0.06 points or sugar but can go as high as 150 for some commodity futures.

- Indices – City Index allows you to 21 global stock market indices with the spreads being as tight as just 1 pip.

- Interest Rates – 3 Interest Rate markets are available for speculative trading. These are Short Sterling 3mnth, Eurodollar and Euribor 3 months. Spreads for each are as narrow as 0.02.

- Metals – You can trade from 5 metals, including Gold and Silver.

- Bonds – City Index allows you to take advantage of the deep liquidity available in 12 different bonds across the UK, US and European markets.

- Options – You can speculate on daily, monthly and quarterly options contracts in over 20 different markets, such as UK 100 and SP 500.

- Cryptocurrencies – With City Index, you can choose from 5 different cryptos. City Index claims to have some of the lowest spreads on the market; however, Cryptocurrencies are one of the most volatile CFDs you can trade with, so this could change very quickly. This is reflected by the wide differences in the spread for each cryptocurrency type.

Note: Futures are also available for some of these City Index CFDs. Spreads and margins will be higher if you choose to speculate on futures. Futures are great for long-term trading.

| CFDs | Pepperstone | City Index |

|---|---|---|

| Forex Pairs | 94 | 84 |

| Indices | 24 | 40+ |

| Commodities | 33 Commodities 7 Metals, 4 Energies, 9 Softs, 13 Hard | 6 Metals 8 Energies 13 Softs |

| Cryptocurrencies | 44 | 5+ |

| Shares | 1,170 | 4700+ |

| ETFs | 94 | 4 |

| Bonds/Treasuries | 7 | 11 |

| Other Products(Options,Futures) | No | No |

Our Top Product Range and CFD Markets Verdict

City Index is better than Pepperstone for trading a wide range of CFDs or futures. So, if you want to trade CFDs, it’s a good idea to compare them between different brokers. CFD terms can vary from broker to broker, so it’s important to find the one that offers you better conditions. In my opinion, City Index gives you more options for trading. So, it might be worth checking them out! So for this portion, City Index excels due to their top product range and CFD markets.

City Index ReviewVisit City Index

*Your capital is at risk ‘69% of retail CFD accounts lose money’

8. Superior Educational Resources – Pepperstone

When trading, educational resources can be a game-changer because having superior educational resources is prime in the business of trading. Quality educational resources are essential in forex trading, offering webinars, articles, and courses that equip traders with the knowledge to make informed decisions and improve strategies. Such resources support continuous learning and foster long-term success.

Both Pepperstone and City Index have invested significantly in this area, aiming to provide traders with the knowledge and tools they need to succeed. Based on our findings and our own in-depth testing, here’s a comparison of the educational resources each broker offers:

- Pepperstone:

- Offers comprehensive webinars and tutorials for both beginners and advanced traders.

- Provides a rich library of trading guides and market analysis.

- Features a dedicated section for strategy development and risk management.

- City Index:

- Boasts an extensive range of educational videos and articles.

- Provides insights through expert-led webinars and events.

- Features a dedicated section for trading strategies and market news.

We can assume that while both brokers offer a plethora of educational materials, it’s essential to choose one that aligns with your learning style and trading goals.

Our Superior Educational Resources Verdict

Standing out in this category is Pepperstone due to their plethora of superior educational resources which are webinars, online seminars, ebook and other downloadable materials, as well as available Youtube video materials, and podcasts too, which our team is giving out a score of 7 out of 10.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

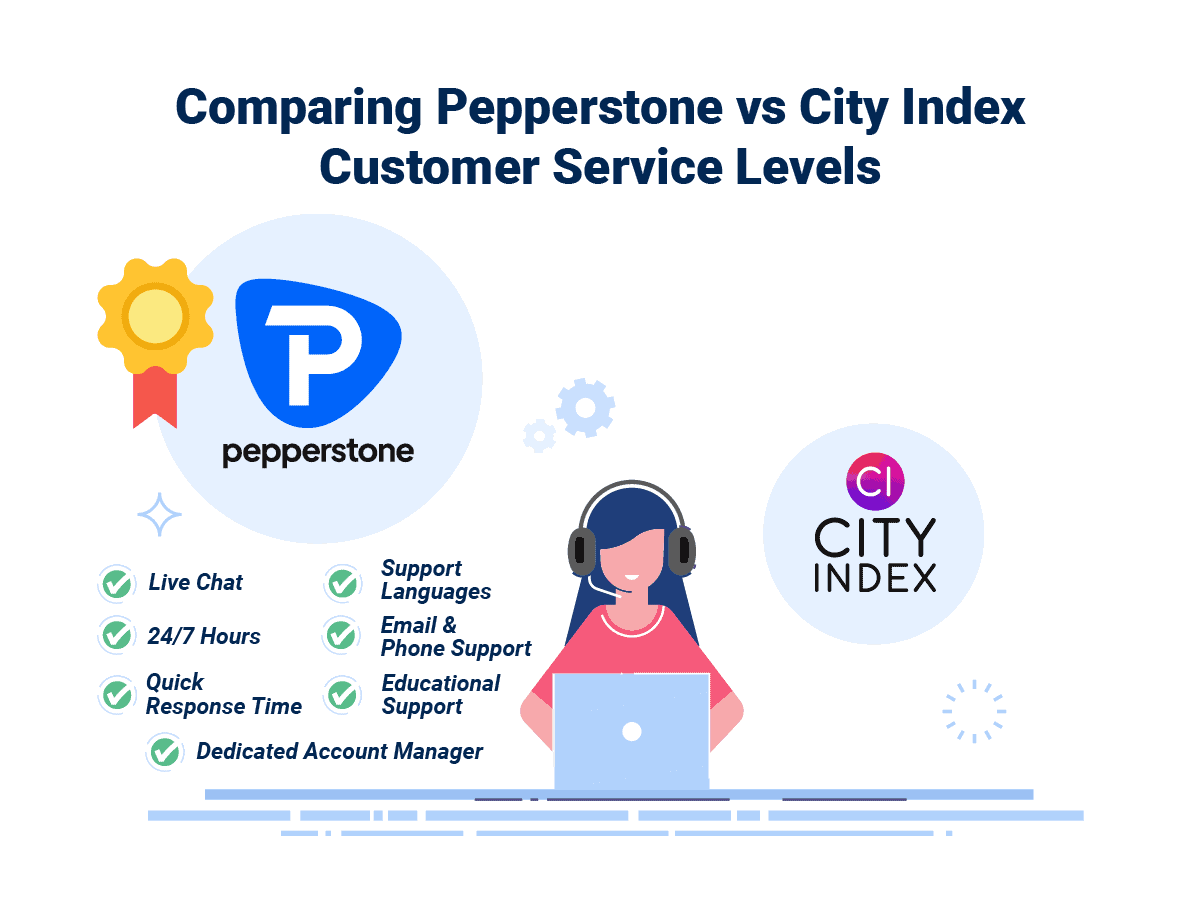

9. Superior Customer Service – Pepperstone

In the world of trading, having reliable customer service can make all the difference. For brokers offering Superior customer service in forex trading, are the star of the show as they ensure traders receive timely support and guidance, fostering a seamless and confident trading experience.

We can see here that both Pepperstone and City Index understand this and have made significant strides in ensuring their customers receive top-notch support. Based on our findings and our own meticulous testing, here’s what we’ve observed:

Pepperstone and City Index both pride themselves on offering 24/7 customer support, ensuring that traders can get the help they need whenever they need it. Whether it’s a technical glitch, a query about a trade, or just general assistance, having a responsive customer service team can be a trader’s best ally.

Pepperstone

The excellent service the Pepperstone customer service team provides was recognised in 2018 by the UK Forex Award. Customer support is available 24/5 via the usual mediums – Live Chat, Phone and email.

City Index Customer Support

Customer Service with City Index is available throughout the working week (24/5). The City Index team provides helpful and timely support for all sorts of questions you may have when it comes to trading with City Index. Support is available through Live Chat, Email and Phone.

City Index Customer Services

City Index provides a FAQ section broken by topic, which features answers to a range of commonly asked questions. This is likely to be your first stop when it comes to your support needs.

Here’s a table comparing the key customer service features of each broker:

| Feature | Pepperstone | City Index |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

Our Superior Customer Service Verdict

Based on our team’s evaluation, we have to say Pepperstone totally nailed it with a perfect score of 10/10 in this area. This is due to their superior customer service, which is just on another level compared to the competition. They really know how to treat traders right!

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

10. Better Funding Options – Pepperstone

Funding options play a pivotal role in a trader’s journey, offering flexibility and ease of transactions this is all because better funding options in forex trading offer flexibility and convenience through methods like bank transfers, cards, digital wallets (PayPal, Skrill, Neteller), and cryptocurrencies. Multiple low- or no-fee options allow efficient account management and improve the trading experience.

Evidenly, both Pepperstone and City Index have made efforts to provide a diverse range of funding options to cater to their global clientele. Based on our findings and our own detailed testing, here’s what we’ve discerned:

Pepperstone and City Index understand the importance of seamless deposits and withdrawals for traders. They’ve incorporated various funding methods, ensuring that traders can choose the one that best fits their needs. Whether it’s traditional bank transfers, credit cards, or modern e-wallets, both brokers have got traders covered.

Here’s a table comparing the key funding options of each broker:

| Funding Option | Pepperstone | City Index |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | Yes |

| Skrill | Yes | No |

| Neteller | Yes | No |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Our Better Funding Options Verdict

Based on our team’s research, Pepperstone offers a more diverse range of methods, making it the preferred and best choice for traders looking for flexibility in their transactions, clearly, this is a big win for Pepperstone due to having better funding options.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

11. Minimum Deposit Requirements – A Tie

Lower minimum deposits in forex trading enhance accessibility for beginners and individuals with limited funds. This inclusivity breaks down financial barriers, encouraging broader participation and enabling traders to acquire experience without incurring substantial upfront costs. It is commendable that brokers are providing this feature, as it fosters more opportunities for aspiring traders.

Pepperstone and City Index have the same minimum deposit requirement of $0. That said, City Index recommends traders deposit at least $150 vs $200 that Pepperstone recommended. Minimum deposit levels also depend on the funding methods, as shown in the tables below.

In summary, the table below highlights each broker’s minimum and recommended deposit amounts.

| Minimum Deposit | Minimum Via Credit Card | Minimum Via Paypal | Recommended Deposit | |

| Pepperstone | $0 | $0 | $0 | $200 |

| City Index | $0 | £100 | £50 | $100 |

Our Lower Minimum Deposit Verdict

Our team confidently concludes that both brokers are exceptional in this regard, primarily because they both have a minimum deposit requirement of $0. Therefore, this factor shouldn’t influence your comparison between the two. However, it’s worth mentioning that City Index requires a slightly higher minimum deposit if you intend to fund your account using PayPal or a credit card.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

Is City Index or Pepperstone The Best Broker?

Pepperstone outshines the contender here because it consistently offers a more diverse range of services, lower fees, and a more user-friendly experience for traders of all levels.

The table below summarises the key information leading to this verdict:

| Categories | Pepperstone | City Index |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | No | Yes |

| Superior Accounts And Features | Yes | Yes |

| Best Trading Experience And Ease | Yes | Yes |

| Stronger Trust And Regulation | Yes | Yes |

| Top Product Range And CFD Markets | No | Yes |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | Yes | No |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | Yes | No |

(Note: The ticks and crosses in the table are placeholders. You can adjust them based on your research and the data you have.)

Pepperstone: Best For Beginner Traders

Pepperstone is the ideal choice for beginner traders due to its user-friendly platform, comprehensive educational resources, and $0 minimum deposit requirement.

City Index: Best For Experienced Traders

City Index might appeal more to experienced traders who are looking for a diverse product range and advanced trading tools despite its higher minimum deposit requirement.

FAQs Comparing Pepperstone Vs City Index

Does City Index or Pepperstone Have Lower Costs?

Pepperstone generally offers lower costs when compared to City Index. This is evident from their competitive spreads and minimal commission charges. For a more detailed breakdown of spreads across various currency pairs, you can check out this comprehensive guide on Lowest Commission Brokers. It’s always a good idea for traders to be aware of all associated costs to make informed decisions.

Which Broker Is Better For MetaTrader 4?

Both City Index and Pepperstone offer MetaTrader 4, but Pepperstone is often preferred for its seamless integration and enhanced features on this platform. They provide a tailored experience for MT4 users, ensuring optimal trading conditions. If you’re keen on exploring more about the best MT4 brokers, this detailed review might be of interest.

Which Broker Offers Social Trading?

Pepperstone stands out when it comes to offering social or copy trading features. They have integrated platforms that allow traders to mimic the strategies of seasoned professionals. Social trading can be a game-changer, especially for those who are new to the forex world. For a deeper dive into the world of social trading, here’s a comprehensive guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

City Index offers spread betting, while Pepperstone does not. Spread betting is a popular form of trading in the UK and offers tax benefits for UK residents. If you’re interested in exploring more about spread betting and finding the best brokers for it, this comprehensive guide is a great place to start.

What Broker is Superior For Australian Forex Traders?

In my opinion, Pepperstone has the edge for Australian forex traders. Not only is Pepperstone ASIC regulated, but it’s also an Australian-founded company, which gives it a deep understanding of the local market. On the other hand, City Index, while also ASIC regulated, is based overseas. Both brokers offer a range of services, but there’s a certain comfort in trading with a home-grown broker. For a broader perspective on the the Forex Brokers In Australia, you might want to check out this detailed review.

What Broker is Superior For UK Forex Traders?

For UK forex traders, I personally feel City Index holds a slight advantage. Being FCA regulated and having a strong presence in the UK market gives it an edge. Pepperstone, while also FCA regulated, originated in Australia. City Index’s deep roots in the UK and its comprehensive offerings tailored to the UK market make it a top choice. For more insights on the forex brokers in UK, this guide is quite informative.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Does Pepperstone offer indices?

Yes, Pepperstone offers over 23 global indices to choose from. Indices include AUS200 (S&P/ASX 200 Index), JPN225 (Nikkei 225 Index), US30 (Dow Jones Industrial Average Index) and UK100 (FTSE 100 Index)

I’m planning some swing trades and longer-term CFD positions. Should I be concerned about differences in swap rates or overnight financing costs between Pepperstone and City Index that might affect my returns?

Being aware of swap rates can make a difference if you are concerned about longer term but spreads and commission costs should be a bigger consideration.