Pepperstone vs eToro: Which Broker Is Better?

In this review, we will explore both the strengths and shortcomings of brokers, examining their features in detail. While some may lack specific functionalities, they often offer superior alternatives that effectively meet traders’ needs. Join us as we study these information gathered into our analysis of Pepperstone and eToro to uncover the insights you need. Read on to learn more.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors, but here are five key differences to get you started:

- Pepperstone offers a lower spread, making it more cost-effective for frequent traders.

- Pepperstone provides a diverse range of trading platforms including MT4, MT5, and cTrader, giving you more choices.

- Pepperstone is regulated by both ASIC and FCA, giving you that extra layer of trust and security.

- eToro’s platform is incredibly user-friendly, making it a great starting point for trading newbies.

- eToro is the go-to for social trading, offering features like CopyTrader that Pepperstone doesn’t have.

- eToro’s has lots of Youtube materials, videos and podcasts as part of their educational resource.

1. Lowest Spreads And Fees – Pepperstone

Welcome! As a team of traders, we understand the importance of finding brokers with the lowest spreads and fees. Lower spreads mean the difference between the buying and selling price of a currency pair is minimal, reducing the cost of each trade. This is especially beneficial for traders who execute numerous trades, as it helps save on transaction costs and increase overall profitability. Here, we will provide you with in-depth reviews and insights to help you make informed decisions and maximize your trading success. Let’s dive into the world of forex trading together!

Spreads are crucial when choosing a broker. Low spreads and commissions in ECN trading offer significant savings, especially for high-volume traders, as costs apply to each lot.

Spreads

Pepperstone provides competitive spreads of 1.1 for EUR/USD, whereas eToro offers an even tighter spread of 1, both of which fall within the average spread of 1.2. For AUD/USD, Pepperstone has a spread of 1.1, compared to eToro’s 1 and an average spread of 1.6. Overall, Pepperstone achieves an average spread of 1.35, significantly lower than eToro’s 1.5. Interestingly, eToro’s average spread is just shy of reaching the upper limit of 1.7, highlighting the competitive pricing between these brokers.

| Standard Account | Pepperstone Spreads | eToro Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.35 | 1.5 | 1.7 |

| EUR/USD | 1.1 | 1 | 1.2 |

| USD/JPY | 1.2 | 1 | 1.5 |

| GBP/USD | 1.2 | 2 | 1.6 |

| AUD/USD | 1.1 | 1 | 1.6 |

| USD/CAD | 1.4 | 1.5 | 1.9 |

| EUR/GBP | 1.2 | 1.5 | 1.5 |

| EUR/JPY | 2.1 | 2 | 2.1 |

| AUD/JPY | 1.9 | 2 | 2.3 |

Commission Levels

Although eToro has not disclosed any information about their commission levels, Pepperstone offers a competitive commission rate of $3.50, which aligns well with industry standards. Our team’s opinion on this matter is that a $3.50 per $100k USD side trip is generally considered affordable for traders. It truly is competitive compared to other brokers and can be manageable, especially for those who trade frequently. However, the affordability can vary depending on the trader’s volume and trading strategy.

Standard Account Fees

In this section, we see in the provided table that Pepperstone offers a standard account spread of 1.10 for EUR/USD, while eToro offers 1.00. For AUD/USD, Pepperstone’s spread is 1.20 compared to eToro’s 1.00. A lower spread, like 1.00, is better as it reduces the cost of each trade, making it more cost-effective for traders.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.10 | 1.10 | 1.30 | 1.30 | 1.30 |

| 1.00 | 1.00 | 1.50 | 2.00 | 1.00 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 1.20 | 1.41 | 1.47 | 1.47 | 1.61 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.52 | 2.08 | 1.46 | 1.87 | 1.67 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

We can surmise that when comparing Pepperstone and eToro, it’s clear that lower spreads, like eToro’s 1.00 for EUR/USD and AUD/USD, are more cost-effective for traders than Pepperstone’s higher spreads. Remember, lower spreads reduce trading costs, making it crucial to choose brokers with competitive rates for better profitability.

Our Lowest Spreads and Fees Verdict

With our team’s perspective on this matter, we can clearly say that Pepperstone has cheaper bid and ask spreads on Forex and CFDs than eToro. eToro offers lower trading costs only on Gold CFDs (0.45 BP vs. 0.50 BP on Pepperstone). These low spreads support scalping and day trading. For this portion, Pepperstone takes the lead due to their lowest spreads and fees.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

2. Better Trading Platform – Pepperstone

In this segment of our review, we will focus on brokers that offer superior trading platforms. These brokers stand out by providing advanced charting tools, real-time market data, and swift execution speeds. Their platforms are designed with user-friendliness in mind, featuring customizable options and strong security measures to benefit traders. Furthermore, they facilitate automated trading, social trading, and access to a diverse array of financial instruments. These elements significantly enrich the trading experience, empowering traders to make informed decisions and execute trades with efficiency.

| Trading Platform | Pepperstone | eToro |

|---|---|---|

| MetaTrader 4 | Yes | No |

| MetaTrader 5 | Yes | No |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

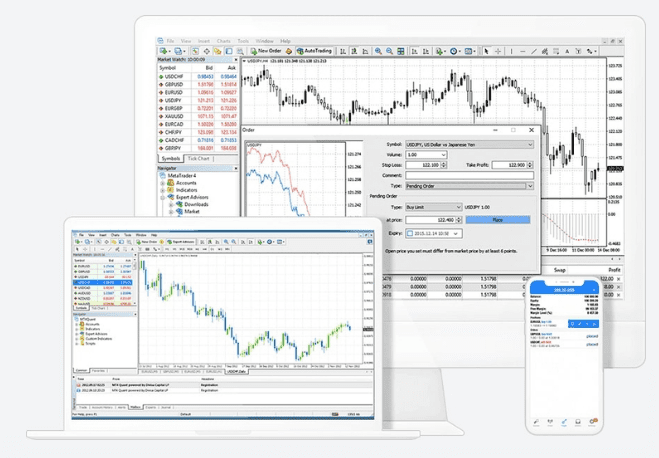

Metatrader

In this section, it’s evident that Pepperstone excels with a variety of tools that enhance the forex trading experience, outshining eToro, which offers only two trading platforms. However, eToro’s alternative platform remains impressively user-friendly. Pepperstone provides MetaTrader 4 and 5, essential for forex trading due to their advanced charting tools, real-time market data, and automated trading capabilities. Meanwhile, eToro offers proprietary platforms, a mobile trading app, and social and copy trading features, as well as automation and scalping tools, which are still valuable for traders.

Advanced Platforms

eToro offers both copy trading and their proprietary platform, similar to Pepperstone. However, Pepperstone provides additional platforms for traders, including cTrader Copy, MetaTrader Signals, EAs, and cTrader Automate, enhancing the trading experience with a wider range of tools and features.

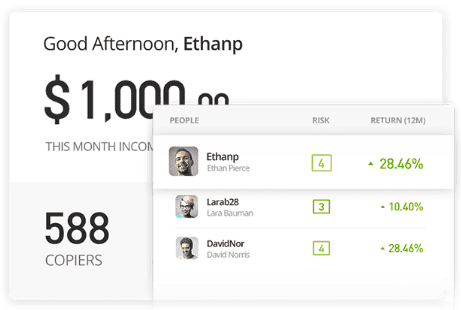

Copy Trading

Both Pepperstone and eToro offer their own versions of Copy Trading through proprietary platforms. Pepperstone provides Copy Trading by Pepperstone, cTrader Copy, and MetaTrader Signals, enhancing the trading experience with diverse tools. On the other hand, eToro offers its proprietary platform, eToro, known for its user-friendly interface and robust social trading features. Both brokers cater to traders seeking to replicate successful strategies and leverage the expertise of seasoned traders.

Pepperstone focuses on optimal trading conditions and tools for CFDs, while eToro emphasizes social trading for retail clients. eToro’s strength lies in its proprietary platform that enhances copy trading and sharing of strategies.

Specialised Trading Platforms

Pepperstone provides three powerful trading platforms, including MetaTrader 4 and 5, known for excellent CFD and Forex trading conditions, while eToro only has its social trading platform. Pepperstone’s cTrader features advanced order capabilities and customization.

Each trading platform has its own advantages, including:

MetaTrader 4 – an easily customisable trading platform that features live quotes, real-time charts, in-depth news and analytics, a variety of technical indicators and order management tools. The software also provides a good environment for automated trading (Expert Advisors)

MetaTrader 4 – an easily customisable trading platform that features live quotes, real-time charts, in-depth news and analytics, a variety of technical indicators and order management tools. The software also provides a good environment for automated trading (Expert Advisors)- MetaTrader 5 – features advanced functionality and superior analysis tools. Opportunity to hedge positions, access 38 built-in indicators and 21-time frames, advanced pending orders and exceptional order execution speed

- cTrader – advanced trading capabilities such as fast entry and execution and coding customisation as well as enhanced market transparency. An institutional trading environment with Level II pricing (depth of market), detailed order tickets and an extensive list of technical indicators

Social Trading With Pepperstone

Pepperstone, unlike eToro, only offers copy trading solution through 4 different third-party platforms:

Myfxbook – an automatic copy trading feature integrated with MetaTrader 4 and MetaTrader 5. This copy trading platform allows its users to access profile statistics and advanced analytical tools

Myfxbook – an automatic copy trading feature integrated with MetaTrader 4 and MetaTrader 5. This copy trading platform allows its users to access profile statistics and advanced analytical tools- MetaTrader Signals – follow free and paid signals without leaving the MetaTrader 4 terminal

- DupliTrade – access leading trading strategies from professional traders. On the downside, DupliTrade require a minimum deposit of AUD $5,000

- Tradency RoboX – a unique database of trading strategies packed into a diversified portfolio that traders can follow and copy in real-time

eToro Proprietary Social Trading Platform

eToro is known for offering the best social trading platforms worldwide. The software empowers retail traders to:

eToro is known for offering the best social trading platforms worldwide. The software empowers retail traders to:

- Copy-trading from a database with over 10 million users through eToro’s dedicated CopyTrader technology

- Discuss new trading ideas or follow the lead of other professional traders through the News Feed (only verified accounts are allowed to use this feature)

- Invest in CopyPortfolios which offers a diversified investment opportunity in a basket of different asset classes that follows the same strategy

- Crypto copy trading with access to +90 cryptocurrency pairs

The CopyPortfolios feature lets traders invest in Top Trader Portfolios, distributing funds across various professionals. eToro also offers CryptoPortfolios for balanced cryptocurrency investments. Clients can copy up to 100 traders, pause, or modify their investments anytime. Overall, copy trading offers a passive income opportunity for beginners with a minimum deposit of USD 200.

Our Better Trading Platform Verdict

Pepperstone offers clients flexibility with 4 third-party services, while eToro is popular for social trading. For the best Forex signals, choose Pepperstone; for general social trading, eToro is preferred. So for this section, takes the cake due to their better trading platform.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

3. Superior Accounts And Features – Pepperstone

To truly appreciate the benefits of superior accounts and features, it’s crucial to explore their advantages for both novice and experienced traders. These accounts provide customized options for various trading needs, featuring competitive spreads, low commissions, and advanced tools. They often include demo accounts, swap-free choices, and a wide range of financial instruments. Enhanced features like social trading, automated trading, and top-notch customer support ensure a smooth trading experience, fostering client satisfaction and loyalty.

We can see here that Pepperstone excels in account types, offering Standard and Razor accounts for various trading styles. The Razor account is favored for its lower spreads and commission structure, making it cost-efficient for traders.

- Pepperstone’s Razor account offers spreads as low as 0.0 pips.

- eToro offers a single account type with a focus on social trading.

- Pepperstone provides a demo account with $50,000 in virtual funds.

- eToro’s demo account comes with $100,000 in virtual money.

eToro, on the other hand, offers a one-size-fits-all account with a strong focus on social trading features like CopyTrader. While this is great for beginners or those interested in social trading, it lacks the customisability that seasoned traders often seek.

| Pepperstone | eToro | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | No |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | No |

| Spread Betting (UK) | Yes | No |

Our Superior Accounts and Features Verdict

Our team can easily surmise in this portion that Pepperstone outperforms the challenger due to their superior accounts and features which provides more options and flexibility for different types of traders.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – Pepperstone

To ensure an optimal trading experience, brokers that provide exceptional features truly stand out. These advantages stem from a blend of advanced trading platforms, rapid execution speeds, competitive spreads, and strong customer support. These factors help traders make informed decisions, execute trades easily, and manage accounts confidently. A user-friendly interface and access to educational resources enhance the trading experience, making it more enjoyable and profitable.

Pepperstone is a powerhouse when it comes to trading platforms. With options like MT4, MT5, and cTrader, you’re spoilt for choice. These platforms come with advanced charting tools and lightning-fast execution speeds, which are crucial for traders like us.

- Pepperstone’s MT4 and MT5 platforms offer advanced charting tools.

- eToro’s platform is designed for social trading and is incredibly user-friendly.

- Pepperstone offers a cTrader platform that comes with Level II pricing.

- eToro’s platform is web-based, making it accessible without any downloads.

eToro, on the other hand, offers a unique, user-friendly platform that’s perfect for beginners. It’s web-based, so no downloads are needed, and it’s designed with social trading in mind. It’s all about what fits your trading style.

Our Best Trading Experience and Ease Verdict

Evidently, Pepperstone offers the best trading experience with platforms like MT4, MT5, and cTrader, providing excellent execution speeds for performance and ease of use. For this portion, Pepperstone steals the crown due to their best trading experience and ease.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – Pepperstone

A solid framework of trust and regulation guarantees traders a secure and transparent trading environment. Regulated brokers are held to high standards, safeguarding traders against fraud and malpractice. This builds confidence, encouraging traders to invest more. Reputable brokers with strong regulation attract more clients, enhancing their reputation and market presence.

Pepperstone Trust Score

eToro Trust Score

| Pepperstone | eToro | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) | ASIC (Australia) CYSEC (Cyprus) FCA (UK) |

| Tier 2 Regulation | DFSA (Dubai) | MFSA (Europe) ADGM (UAE) GFSC (Gilbraltar) |

| Tier 3 Regulation | SCB (Bahamas) CMA (Kenya) | FSA-S (Seychelles) |

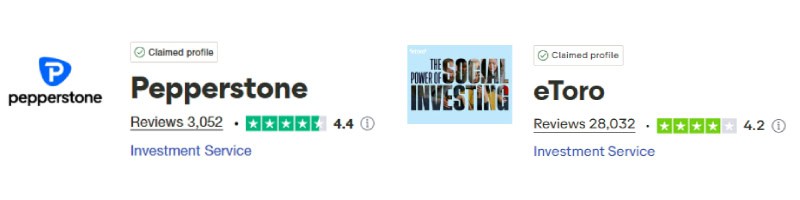

Reviews

As shown below, Pepperstone is rated 4.4 out of 5 from around 3,000 reviews, with 81% of users giving it 5 stars. eToro holds a rating of 4.2 out of 5, based on over 28,000 reviews. Pepperstone is favored by active traders for its speed and reliability, while eToro appeals to beginners and investors interested in social and copy trading. Both are well-regarded, but Pepperstone edges ahead in overall service consistency.

Our Stronger Trust and Regulation Verdict

Pepperstone and eToro are safe to trade with, licensed by top regulators. Pepperstone holds client funds in segregated accounts with NAB and Barclays UK, while eToro also uses segregated accounts with tier-1 banks. So, for this portion, we can safely say that both brokers have made a draw.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

6. Most Popular Broker – eToro

eToro gets searched on Google more than Pepperstone. On average, eToro sees around 823,000 branded searches each month, while Pepperstone gets about 110,000 — that’s 86% fewer.

| Country | Pepperstone | eToro |

|---|---|---|

| United Kingdom | 5,400 | 135,000 |

| Italy | 1,900 | 110,000 |

| France | 1,000 | 110,000 |

| Germany | 3,600 | 74,000 |

| Spain | 1,900 | 60,500 |

| United States | 4,400 | 33,100 |

| Australia | 8,100 | 27,100 |

| Netherlands | 880 | 18,100 |

| United Arab Emirates | 1,000 | 14,800 |

| Colombia | 3,600 | 14,800 |

| Switzerland | 320 | 12,100 |

| Mexico | 3,600 | 12,100 |

| India | 2,900 | 9,900 |

| Poland | 720 | 9,900 |

| Malaysia | 4,400 | 9,900 |

| Peru | 1,600 | 9,900 |

| Austria | 320 | 8,100 |

| Philippines | 880 | 8,100 |

| Ireland | 260 | 8,100 |

| Argentina | 1,300 | 8,100 |

| Taiwan | 1,000 | 8,100 |

| Portugal | 480 | 8,100 |

| Greece | 210 | 6,600 |

| Brazil | 6,600 | 5,400 |

| Chile | 1,000 | 5,400 |

| Sweden | 390 | 4,400 |

| Canada | 720 | 3,600 |

| Singapore | 1,600 | 3,600 |

| Morocco | 720 | 3,600 |

| Indonesia | 1,600 | 2,900 |

| Thailand | 4,400 | 2,900 |

| Nigeria | 1,300 | 2,900 |

| South Africa | 2,900 | 2,900 |

| Pakistan | 1,300 | 2,900 |

| Vietnam | 720 | 2,900 |

| Ecuador | 1,000 | 2,900 |

| Turkey | 1,600 | 2,400 |

| Bolivia | 1,300 | 2,400 |

| Cyprus | 480 | 1,900 |

| New Zealand | 170 | 1,900 |

| Dominican Republic | 880 | 1,900 |

| Costa Rica | 480 | 1,900 |

| Japan | 480 | 1,600 |

| Egypt | 390 | 1,600 |

| Hong Kong | 3,600 | 1,600 |

| Saudi Arabia | 260 | 1,300 |

| Algeria | 390 | 1,300 |

| Venezuela | 390 | 1,300 |

| Bangladesh | 390 | 1,000 |

| Kenya | 4,400 | 1,000 |

| Jordan | 260 | 1,000 |

| Cambodia | 320 | 880 |

| Ghana | 260 | 480 |

| Sri Lanka | 320 | 390 |

| Panama | 320 | 390 |

| Uzbekistan | 140 | 260 |

| Uganda | 390 | 260 |

| Ethiopia | 390 | 260 |

| Mauritius | 110 | 260 |

| Tanzania | 720 | 210 |

| Mongolia | 1,900 | 70 |

| Botswana | 390 | 70 |

135,000 1st | |

5,400 2nd | |

110,000 3rd | |

1,900 4th | |

74,000 5th | |

3,600 6th | |

60,500 7th | |

1,900 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with eToro receiving 51,160,000 visits vs. 1,273,000 for Pepperstone.

Our Most Popular Broker Verdict

eToro is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘51% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – Pepperstone

A comprehensive product range and access to diverse CFD markets are crucial for successful forex trading, as they enable traders to diversify their portfolios and leverage various market conditions. Brokers offering various financial instruments like forex, commodities, indices, and cryptocurrencies create numerous profit opportunities and enhance the trading environment, supporting diverse strategies.

Clearly, we can see here that Pepperstone offers over 94 forex pairs and a wide range of CFDs including indices, commodities, and cryptocurrencies. eToro isn’t far behind, offering over 55 forex pairs and a staggering range of over 2,000 stock CFDs.

| CFDs | Pepperstone | eToro |

|---|---|---|

| Forex Pairs | 94 | 55 |

| Indices | 27 | 20 |

| Commodities | 33 Commodities 7 Metals, 4 Energies, 9 Softs, 13 Hard | 26 |

| Cryptocurrencies | 44 | 114+ |

| Share CFDs | 1,200+ | 1209 NYSE 884 NASDAQ 117 FrankFurt 285 LSE 42 Madrid 49 Zurich 26 Oslo 49 Stockholm 23 Copenhagen 20 Helsingki 135 Hong Kong 3 Lisbon 15 Brussels 1 Saudi Arabia 35 Amsterdam |

| ETFs | 95 | 300 |

| Bonds | No | No |

| Futures | 42 | No |

| Treasuries | 7 | No |

| Investments | No | Yes (US only) |

Our Top Product Range and CFD Markets Verdict

Pepperstone offers a broader range of stock CFDs, making it the go-to for traders looking to diversify their portfolios. And for this section, our team confirms that eToro outshines due to their top product range and CFD markets.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

8. Superior Educational Resources – eToro

High-quality educational resources are essential in the industry of forex trading. They offer traders an extensive array of learning materials, such as webinars, articles, video tutorials, and organized courses. These resources provide traders with essential knowledge and skills for informed decision-making, strategy refinement, and confident navigation of the forex market, fostering continuous learning for long-term success.

Pepperstone offers a robust educational platform with free webinars, tutorials, and a well-structured FAQ section. eToro takes it up a notch with an education centre that offers interactive courses and webinars.

- Pepperstone’s educational resources include free webinars and tutorials.

- eToro offers an education centre complete with interactive courses.

- Pepperstone provides market analysis reports to keep you updated.

- eToro has a ‘CopyTrader’ feature that allows you to learn from successful traders.

- Pepperstone has a well-structured FAQ section for quick answers.

- eToro provides a comprehensive glossary for trading terms.

Our Superior Educational Resources Verdict

From our team’s perspective, eToro excels well in this field due to their superior educational resources.

*Your capital is at risk ‘51% of retail CFD accounts lose money’

9. Superior Customer Service – Pepperstone

For brokers that excel in providing superior customer service in forex trading truly shine by delivering timely support and guidance, which cultivates a smooth and confident trading experience. Their commitment includes responsive 24/7 live chat, phone, and email support, along with multilingual assistance. Such exceptional service enables traders to swiftly resolve issues, boosts their overall satisfaction, and fosters a strong sense of trust in their broker.

Pepperstone offers 24/5 customer support through live chat, phone, and email. eToro extends its customer service to the weekends but lacks phone support.

| Feature | Pepperstone | eToro |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

Pepperstone provides 24/5 customer support through live chat, email, and phone, with quick responses via live chat. Clients can also use an online form on their website. In contrast, eToro offers support through live chat or a ticketing system, responding via email.

eToro’s live chat link is hard to find, located below the FAQ in the “Help Center.” It often appears offline, and there’s no phone support available, which are drawbacks.

Our Superior Customer Service Verdict

Pepperstone’s customer support is professional, offering direct access to real FX experts via live chat, making it easier to connect with them. So, in this category, Pepperstone comes out on top due to their superior customer service.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

10. Better Funding Options – Pepperstone

Enhanced funding options in forex trading significantly increase flexibility and convenience for traders. These options encompass a range of methods, including bank transfers, credit and debit cards, digital wallets like PayPal, Skrill, and Neteller, as well as cryptocurrencies. Multiple low or no-fee funding methods allow traders to easily manage accounts, making deposits and withdrawals efficient, enhancing their trading experience.

Pepperstone offers a variety of funding options including credit card, PayPal, bank transfer, Skrill, and Neteller. eToro also offers multiple options but lacks Skrill and Neteller.

| Funding Option | Pepperstone | eToro |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | Yes |

| POLi / bPay | Yes | Yes |

| Klarna | No | Yes |

Our Better Funding Options Verdict

We can safely confirm that Pepperstone come up trumps in light of their better funding options and offers of a wider range of funding options, giving you more flexibility.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

11. Lower Minimum Deposit – Pepperstone

A reduced minimum deposit is crucial in the forex trading industry, as it enhances accessibility for a broader spectrum of traders, including novices and individuals with limited resources. Lowering financial barriers allows traders to enter with smaller investments, fostering inclusivity and enabling skill refinement without heavy initial costs.

Pepperstone requires a minimum deposit of $200, which might be a bit steep for some. eToro, on the other hand, only requires a $50 minimum deposit, making it more accessible for those just starting out.

| Broker | Minimum Deposit | Recommended Deposit |

|---|---|---|

| Pepperstone | $0 | $200 |

| eToro | $50 | $200 |

Our Lower Minimum Deposit Verdict

eToro truly outshines in this category owing to their lower minimum deposit, and, according to our team, is the better choice for traders looking for a lower entry point.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

Our Final Verdict If eToro Or Pepperstone Is Best?

Pepperstone come up on top here all because they offer a more comprehensive trading experience, from lower spreads to superior customer service. The table below summarises the key information leading to this verdict.

| Categories | Pepperstone | eToro |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | Yes | No |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | Yes | Yes |

| Top Product Range And CFD Markets | No | Yes |

| Superior Educational Resources | No | Yes |

| Superior Customer Service | Yes | No |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | Yes | No |

eToro: Best For Beginner Traders

For beginner traders, eToro is the better choice due to its user-friendly platform and educational resources.

Pepperstone: Best For Experienced Traders

For experienced traders, Pepperstone is the go-to for its advanced trading platforms and lower spreads.

FAQs Comparing Pepperstone vs eToro

Does eToro or Pepperstone Have Lower Costs?

Pepperstone has lower costs. They offer some of the lowest spreads in the industry. For more details, you can check out our Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Pepperstone is the better choice for MetaTrader 4 users. They offer advanced features and tools on this platform. For more information, visit our best MT4 brokers page.

Which Broker Offers Social Trading?

eToro is the standout for social or copy trading. They offer a feature-rich platform for this trading style. For those interested in exploring more about social trading platforms, here’s a comprehensive review of the best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither Pepperstone nor eToro offer spread betting. For those in the UK interested in exploring spread betting further, here’s a comprehensive guide to the best spread betting brokers.

What Broker is Superior For Australian Forex Traders?

In my opinion, Pepperstone is superior for Australian forex traders. They are ASIC regulated and were founded in Australia. For more details, visit our Forex Brokers In Australia page.

What Broker is Superior For UK Forex Traders?

For UK traders, Pepperstone is the better choice. They are FCA regulated and offer a robust trading environment. If you’re a UK trader looking for more insights, this list of Forex Brokers In UK offers a detailed breakdown.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

How risky is eToro?

CFD trading is inherently risky since you can’t predict which was your trade will go and you are using leverage. eToro arguable carries an extra level of risk should you copy trade signal providers since you just do not know how they will trade. While eToro provides filters to help you find signal providers with a good track record for reliability, the past should not be used as a pointer for the future.