Pepperstone vs Octa FX: Which One Is Best?

Pepperstone and Octa are both strong contenders in forex, but they’re built for different types of traders. In this comparison guide, I’ll discuss the key differences that actually impact your trading experience, from spreads and platforms to funding options and support.

By the end, you’ll have a clear view of how these CFD brokers stack up, and which one fits your trading style best.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Before I get into the full breakdown, here’s a quick overview of how Pepperstone and OctaFX compare across the fundamentals:

- Pepperstone offers a $0 minimum deposit, while Octa requires a minimum of $25.

- In terms of execution speed, Pepperstone ranks 3rd overall in my tests, outperforming Octa.

- Pepperstone provides a wider range of CFDs, including ETFs and bonds.

- Looking at education, Pepperstone delivers better-structured and more comprehensive learning materials.

- Pepperstone leads on customer service, offering round-the-clock weekday support in multiple languages.

1. Pepperstone: Lowest Spreads and Fees

Spreads are the difference between the bid and ask price. They’re a direct hit to your bottom line every time you enter and exit a trade.

Wider spreads mean higher trading costs, plain and simple. If you’re trading frequently or scalping, those few tenths of a pip can add up fast and quietly eat into your profit potential over time.

I ran independent spread tests across both brokers’ standard (no commission) accounts and at first glance, OctaFX looks competitive. On EUR/USD and GBP/USD, it starts strong with 0.9 pips and 1.2 pips respectively. This is slightly tighter than Pepperstone’s 1.1 pips and 1.3 pips.

However, that advantage fades quickly once you move beyond the headline pairs. Pepperstone consistently posts tighter spreads across the other popular pairs, delivering a lower average spread of 1.35 pips compared to OctaFX’s 1.65 pips.

| EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | Average Overall | |

|---|---|---|---|---|---|---|---|---|---|

| OctaFX | 0.9 | 1.8 | 1.2 | 1.5 | 1.9 | 1.7 | 1.9 | 2.3 | 1.65 |

| Pepperstone | 1.1 | 1.3 | 1.3 | 1.2 | 1.4 | 1.2 | 1.8 | 1.5 | 1.35 |

Looking at the Raw account, Pepperstone’s Razor account offers near-zero spreads on major pairs, with even more complex crosses staying razor-thin.

RAW Account Spread Comparison | |||||

|---|---|---|---|---|---|

| 0.30 | 0.30 | 0.10 | 0.30 | 0.10 |

| 0.10 | 0.20 | 0.06 | 0.10 | 0.20 |

| 0.03 | 0.04 | 0.01 | 0.27 | 0.02 |

| 0.10 | 0.20 | 0.10 | 0.70 | 0.10 |

| 0.51 | 0.57 | 0.14 | 0.39 | 0.31 |

| 0.29 | 0.50 | 0.11 | 0.40 | 0.30 |

| 0.10 | 0.20 | 0.10 | 0.40 | 0.10 |

| 0.40 | 1.30 | 0.30 | 0.80 | 0.80 |

| 0.14 | 0.18 | 0.90 | 0.14 | 0.13 |

| 0.24 | 0.70 | 0.16 | 0.54 | 0.29 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

OctaFX, by contrast, doesn’t offer a raw option at all. Every trade is commission-free, which makes things simple but it also means you’re paying through wider spreads. What they advertise as “floating spreads from 0.6 pips” isn’t in line with what you’d expect from a proper ECN setup.

Verdict

If low-cost trading is your priority, Pepperstone wins on both fronts with lower average spreads on standard accounts and far more competitive pricing on raw spreads. OctaFX might work for beginners or smaller accounts, but it’s less efficient and more expensive for serious, high-frequency trading.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

2. Pepperstone: Better Trading Platform

| Trading Platform | Pepperstone | Octa FX |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

Both brokers cover the platform basics, each offering MT4, MT5, copy trading, even proprietary options. Another common feature is the support of Capitalise.ai, a no-code automation tool for building rule-based strategies without getting into the technical side of it.

For me, Pepperstone starts to pull ahead when you get into actual execution quality and platform depth.

Take MetaTrader 4 for example. It’s a standard issue across the industry, but Pepperstone takes it a step further with its Smart Trader tools. This is a toolkit designed to make your decisions sharper and your workflow faster. It includes features like automated trade management, sentiment overlays, and risk-control tools you won’t find in a default MT4 install.

Pepperstone’s MT4 also comes preloaded with dozens of indicators and gives you access to thousands more. You’ll find them very helpful for analysing price action, spotting trends, and making more informed decisions directly from the chart.

And unlike OctaFX, Pepperstone is one of the few brokers offering cTrader and TradingView integration. With these platform options you get more flexibility with advanced order controls, faster execution, and better charting.

Verdict

Pepperstone doesn’t just offer more platforms but more complete versions of the ones that matter like we’ve seen with MT4. If you want flexibility, automation, and speed all built into your platform, Pepperstone is the stronger choice.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

3. Pepperstone: Superior Accounts and Features

Pepperstone offers two core accounts: Standard and Razor (Raw). The Standard account keeps things simple, rolling all fees into the spread with about a 1 pip markup. It’s geared toward newer traders or those who prefer a predictable cost structure.

The Razor account, on the other hand, is built for precision with raw spreads starting from 0.0 pips and a flat commission. It’s ideal if you’re scalping, day trading, or just serious about minimizing trading costs.

What Pepperstone does offer across all accounts, though, is a suite of risk management tools that are noticeably stronger. You have trailing stops, take-profits, custom alerts all built into the platform without the need for extra plugins.

On top of that, Pepperstone’s Active Trader program rewards volume with rebates, which can shave even more off your total cost if you trade consistently.

OctaFX takes a flatter approach in their pricing model, in my view. All accounts are commission-free and tied to the platform you choose (OctaTrader, MT4, or MT5).

Sure, the pricing is simple, but you don’t get the raw spreads (commission-based) option like you do with Pepperstone. Even OctaFX’s tightest spreads don’t come close to what Pepperstone offers on Razor.

And while OctaFX does run a loyalty program, it’s based on your account balance, not your trading volume. So, you unlock perks like better spreads and faster withdrawals by holding more, not trading more which I find off-putting.

Now, credit where it’s due, OctaFX makes all accounts swap-free by default, which is convenient if you hold trades for long periods. Pepperstone does offer swap-free accounts too, but you’ve got to request them.

Verdict

Pepperstone gives you more control over pricing, more tools for risk, and more benefits if you’re actually active in the market. OctaFX keeps the experience straightforward, which might suit newer traders but the tradeoff is less flexibility and weaker pricing.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

4. Tie: Best Trading Experience and Ease

When it comes to trading experience, I look at two things: how it feels to trade with a broker day to day, and how fast and reliably they move my orders. And in this case, Pepperstone and OctaFX are both producing great results.

On the speed side, Pepperstone is one of the fastest brokers globally with 77 milliseconds on average for limit orders, and 100 milliseconds for market orders. In my tests, the Australian broker ranked 3rd overall for execution, landing in the top two for limit orders and top ten for market orders.

OctaFX isn’t far behind, ranking 5th overall with average speeds of 81ms for limit orders and 91ms for market orders.

| Broker | Overall | Limit Order Speed | Limit Order Rank | Market Order Speed | Market Order Rank |

|---|---|---|---|---|---|

| Blackbull Markets | 1 | 72 | 1 | 90 | 5 |

| Fusion Markets | 2 | 79 | 3 | 77 | 1 |

| Pepperstone | 3 | 77 | 2 | 100 | 10 |

| Oanda | 4 | 86 | 5 | 84 | 2 |

| Octa | 5 | 81 | 4 | 91 | 6 |

| Exness | 6 | 92 | 10 | 88 | 3 |

| Blueberry Markets | 7 | 88 | 6 | 94 | 7 |

| Forex.com | 8 | 98 | 13 | 88 | 4 |

| Global Prime | 9 | 88 | 7 | 98 | 9 |

| Tickmill | 10 | 91 | 9 | 112 | 11 |

Both brokers run on ECN infrastructure, which is why you’re getting consistently fast fills with minimal dealing desk interference.

From a platform perspective, they’re evenly matched in terms of access. The difference comes in how each broker supports traders beyond the platform.

Pepperstone puts serious effort into creating a trader-first environment with fast support, strong third-party integrations, and a sharp focus on execution quality. You feel that whether you’re trading on desktop, mobile, or through APIs.

OctaFX has done a good job refining the user interface, especially for mobile but it still leans more toward accessibility than depth. You may start to feel the limitations once you need more advanced tools or tighter control over your trades.

Verdict

Both brokers offer a smooth, responsive trading experience with fast execution speed and no major friction. If you’re trading casually, the difference won’t be obvious. But if you care about execution precision, platform flexibility, and tool integration, Pepperstone has a slight edge.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

5. Pepperstone: Stronger Trust and Regulation

In forex trading, establishing a secure and transparent environment relies heavily on strong trust and regulation.

Pepperstone Trust Score

Octa FX Trust Score

Regulations

Pepperstone is one of the most heavily regulated brokers in the industry. It holds Tier 1 licenses from ASIC in Australia, the FCA in the UK, BaFin in Germany, and CySEC in Cyprus. These regulators enforce strict rules around client fund segregation, negative balance protection, leverage limits, and full transparency from the brokers they license.

The online broker also holds a Tier 2 license from the DFSA in Dubai, a reputable and increasingly prominent authority in the Middle East. This multi-layered regulatory framework is exactly why Pepperstone scores a 91 out of 100 on trust in my reviews.

Meanwhile, OctaFX operates under a lighter structure with CySEC as its main regulatory body. CySEC is technically Tier 1 by some standards, but it doesn’t carry the same weight as ASIC or the FCA. They also hold licences in several offshore or Tier 3 jurisdictions including MISA, FSCA, FSRA, and CMA which similarly have weaker enforcement powers.

But more importantly, OctaFX lacks any Tier 2 oversight altogether, which puts a ceiling on the level of regulatory scrutiny and client protection you’re likely to get. On the same trust scale, OctaFX scores just 43 out of 100.

| Pepperstone | Octa FX | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) | CYSEC (Cyprus) |

| Tier 2 Regulation | DFSA (Dubai) | |

| Tier 3 Regulation | SCB (Bahamas) CMA (Kenya) | MISA FSCA FSRA |

Verdict

Based on consistent positive feedback from the trading community and strong regulatory framework, Pepperstone is the more trustworthy choice.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

6. Pepperstone: Top Product Range And CFD Markets

On the subject of product range, Pepperstone blows OctaFX out of the water and it’s not even a close competition.

Across both its Standard and Razor accounts, Pepperstone offers 1,712 tradable instruments. That includes 94 forex pairs, over 1,300 individual stocks, 44 cryptos, and full access to ETFs, indices, commodities, and even bonds.

| CFD (Standard) | CFD (Razor) |

|---|---|

| Total number of instruments | 1712 |

| Forex | 94 |

| Indices | 24 |

| Commodities | 33 |

| Shares | 1384 |

| Cryptocurrencies | 44 |

| ETFs | 95 |

OctaFX’s offering is a bit more limited in comparison. Depending on the platform, you’re looking at 80 to 277 instruments, with fewer forex pairs, capped stock access, and no ETFs at all.

Even on MT5, which offers the widest OctaFX range, you’re still trading with just a fraction of the market coverage Pepperstone delivers by default.

| OctaTrader | MT5 | MT4 |

| 80 Instruments: | 277 Instruments: | 80 Instruments: |

| 35 currency pairs + gold and silver + 3 energies + 10 indices + 30 cryptocurrencies | 52 currency pairs + gold and silver + 3 energies + 10 indices + 34 cryptocurrencies + 150 stocks + 26 intraday assets | 35 currency pairs + gold and silver + 3 energies + 6 indices + 34 cryptocurrencies |

Verdict

If you’re looking for market variety or want to diversify across asset classes without switching platforms, Pepperstone gives you the firepower. OctaFX might cover the basics but for anything beyond that I just don’t think it will keep up.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

7. Pepperstone: Superior Educational Resources

I like that Pepperstone doesn’t treat education as an afterthought. It has clearly invested in helping traders level up with educational content that goes deep and wide.

They cover everything from beginner guides on forex and CFDs to advanced material on scalping, technical analysis, and even upcoming IPOs. You’ll find in-depth resources across asset classes e.g. forex, crypto, stocks, commodities plus regular webinars and strategic insights that go beyond the usual basics.

OctaFX does offer educational material, including platform tutorials, strategy explainers, and a Forex basics video course. It also hosts webinars and has a decent glossary for new traders.

I really don’t think the depth and structure are in the same league. The research side is more functional than insightful with economic calendars, rate trackers, and holiday schedules, but I didn’t come across high-level analysis.

Verdict

Pepperstone gives you the kind of content that actually levels up your trading. OctaFX lays a decent foundation, but it falls short of delivering real long-term trader development.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

8. Pepperstone: Superior Customer Service

Fast, reliable customer support is important in forex trading. When something goes wrong mid-trade, you want immediate solutions, not scripted replies and delayed help.

Pepperstone has built a reputation around fast, competent, and global support. In our testing, they consistently responded faster than most brokers and more importantly, with staff who knew what they were talking about.

Pepperstone has built a reputation around fast, competent, and global support. In our testing, they consistently responded faster than most brokers and more importantly, with staff who knew what they were talking about.

You can reach them via live chat, email, or phone, and they’re available 24 hours a day, five days a week. Add in multilingual support and you’ve got a broker that treats service as a key part of the trading experience, not an afterthought.

OctaFX holds its own in the customer service department. Support is accessible through all the main channels i.e. chat, email, phone, and they’re quick to respond. They also offer help in over seven languages and do a decent job assisting with account setup and platform basics.

| Feature | Pepperstone | Octa FX |

| Responsiveness | High | High |

| Knowledgeable Staff | Yes | Yes |

| Communication Channels | Multiple | Multiple |

| Language Support | Multilingual | Multilingual |

| Educational Support | Comprehensive | Available |

| Availability | 24/5 | Trading Hours |

Verdict

With fast, informed support across multiple channels and languages, Pepperstone has built a customer service model that actually keeps up with the pace of trading. OctaFX tries to keep up but Pepperstone’s 24/5 availability and deeper educational support makes it the clear winner.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

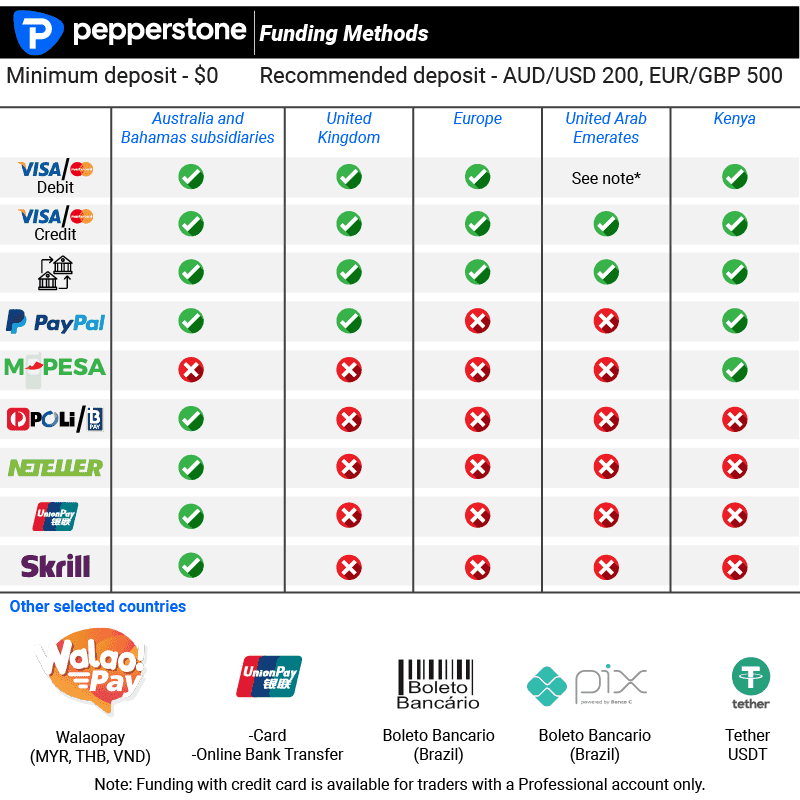

9. Pepperstone: Better Funding Options

Pepperstone offers various funding methods for trading accounts, including credit/debit cards (Visa, Mastercard), bank transfers and e-wallets such as PayPal, Neteller, and Skrill. Depending on your region, you may also have access to options like POLi, BPAY, Union Pay, MPESA, and Flutterwave.

I appreciate how fast Pepperstone processes deposits and withdrawals as it means I can fund my account or access my money without delays or friction. And with support for multiple base currencies, I can avoid unnecessary conversion fees and keep training costs low from the start.

OctaFX makes funding relatively straightforward, with no commissions on deposits or withdrawals across all methods. You can fund your account using bank cards, e-wallets or a range of crypto options like Bitcoin, Ethereum, Tether, and Litecoin.

Most bank and e-wallet deposits are processed instantly, while crypto takes 3 to 30 minutes. Withdrawals are also fee-free, and typically get approved within 1 to 3 hours, followed by a quick transfer (often within minutes).

The one drawback I found with OctaFX in this sector is that it only supports USD and EUR as base currencies. This means you’ll likely face conversion fees if your local currency isn’t one of them.

| Funding Option | Pepperstone | Octa FX |

|---|---|---|

| Credit Card | ✅ | ✅ |

| Debit Card | ✅ | ✅ |

| Bank Transfer | ✅ | ✅ |

| PayPal | ✅ | ❌ |

| Skrill | ✅ | ✅ |

| Neteller | ✅ | ✅ |

| Crypto | ✅ | ✅ |

| Rapid Pay | ❌ | ❌ |

| POLi / bPay | ✅ | ❌ |

| Klarna | ❌ | ❌ |

Verdict

Pepperstone offers better funding options with its wide range of methods, quick transaction processing, and focus on security and currency diversity.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

10. Pepperstone: Lower Minimum Deposit

Both brokers keep the entry barrier low. Pepperstone lets you open an account with no minimum deposit at all. But we all know that trading effectively means having enough capital to manage risk, cover margin, and avoid getting stopped out too early. So, I think $200 is a more practical starting point, even if you’re technically allowed to deposit less.

OctaFX sets a minimum deposit of $25, which is still very accessible, but I recommend $100 as a more realistic starting point.

| Minimum Deposit | Recommended Deposit | |

| Pepperstone | $0 | $200 |

| Octa FX | $25 | $100 |

Verdict

Pepperstone gives you more flexibility and headroom to grow. With no minimum deposit, you’re free to scale at your own pace.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

So Is Pepperstone or Octa FX The Best Broker?

Pepperstone comes out on top across every major category I’ve covered from pricing, platforms and regulation to support and product range. OctaFX is accessible, but when you put them side by side, Pepperstone is clearly the more complete, professional-grade broker.

| Criteria | Pepperstone | Octa FX |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ✅ | ❌ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ❌ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ✅ | ❌ |

| Superior Customer Service | ✅ | ❌ |

| Better Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ✅ | ❌ |

Pepperstone: Best For Beginner Traders

Pepperstone is better for beginner traders, offering extensive educational resources and a $0 minimum deposit.

Pepperstone: Best For Experienced Traders

Pepperstone stands out as the best choice for experienced traders, thanks to its advanced trading platforms and comprehensive product range.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

FAQs Comparing Pepperstone vs Octa FX

Does Octa FX or Pepperstone Have Lower Costs?

Pepperstone generally has lower costs compared to Octa FX. Pepperstone offers competitive spreads, starting from as low as 0.0 pips on major currency pairs. Their commitment to low-cost trading is further evidenced by their inclusion in the list of lowest spread forex brokers. In contrast, Octa FX, while offering reasonable spreads, typically does not match the ultra-low spread environment that Pepperstone provides.

Which Broker Is Better For MetaTrader 4?

Pepperstone is the better choice for MetaTrader 4 users. Recognised for its superior integration with MT4, Pepperstone offers enhanced features and tools that enhance the trading experience on this platform. For traders seeking the best MT4 experience, exploring best MT4 forex brokers can provide valuable insights, with Pepperstone often leading the pack.

Which Broker Offers Social Trading?

Octa FX stands out for offering social trading. They provide a platform where traders can engage in copy trading, allowing them to mimic the strategies of experienced traders. This feature particularly benefits new traders or those looking to diversify their trading strategies. For more information on social and copy trading platforms, you can visit best copy trading platforms, where Octa FX’s offerings are highlighted alongside other top brokers in this domain.

What Broker is Superior For Australian Forex Traders?

In my opinion, Pepperstone is superior for Australian Forex traders. Being an ASIC-regulated broker founded in Australia, Pepperstone offers a sense of reliability and local expertise that’s invaluable. Their deep understanding of the Australian market, combined with competitive spreads and a robust platform, makes them a top choice. For more insights into Australian Forex trading, you can check out the Forex Brokers In Australia, where Pepperstone’s features are highlighted.

What Broker is Superior For UK Forex Traders?

In my view, Pepperstone is superior for UK Forex traders. As an FCA-regulated broker, Pepperstone offers a high level of security and compliance, which is crucial in the UK market. Their global presence, combined with a strong focus on advanced trading technologies, makes them a preferred choice for UK traders. For those seeking more information on top brokers in the UK, forex brokers in UK provide a comprehensive guide, where Pepperstone’s features are prominently displayed.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.